Managed Services Market Size:

Managed Services Market size is estimated to reach over USD 516.22 Billion by 2032 from a value of USD 298.53 Billion in 2024 and is projected to grow by USD 314.49 Billion in 2025, growing at a CAGR of 7.7% from 2025 to 2032.

Managed Services Market Scope & Overview:

Managed services refer to a type of outsourcing service where a company contracts with a managed service provider (MSP) to handle specific tasks or functions, rather than managing them in-house. The services offer benefits including increased availability of internal resources, reduced costs, and improved quality and efficiency of managed services. The managed services are available in various types including infrastructure management services, security management services, data management services, network management services, application management services, cloud management services, and others.

How is AI Impacting the Managed Services Market?

AI is revolutionizing the managed services market by automating routine IT tasks, such as system monitoring, ticket resolution, and patch management. This automation boosts operational efficiency, reduces human error, and allows service providers to handle a larger volume of clients with existing staff. Furthermore, AI-powered predictive analytics enables proactive maintenance, allowing providers to identify and resolve potential issues before they cause downtime. It is also enhancing cybersecurity by providing more sophisticated threat detection and faster incident response. This shift from a reactive to a proactive service model is making managed services more valuable and scalable.

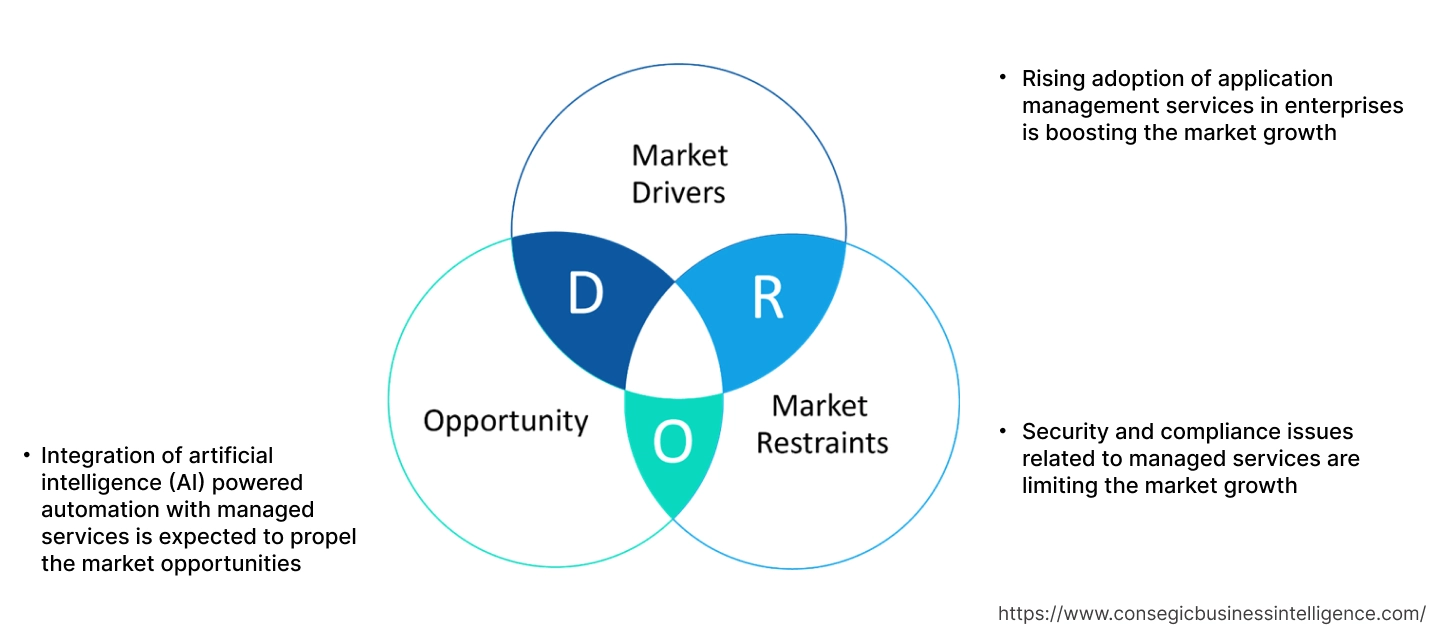

Key Drivers:

Rising adoption of application management services in enterprises is boosting the market growth

Application management services (AMS) for enterprises involves outsourcing the management and support of their applications to a third-party provider, covering development, deployment, maintenance, and optimization. AMS help reduce IT costs by leveraging economies of scale and specialized expertise, potentially lowering operational expenses. AMS providers offer specialized expertise and tools, leading to faster application development, deployment, and maintenance, ultimately improving efficiency. AMS providers optimize applications for performance, ensuring they run smoothly and efficiently, which improves user experience and business outcomes.

- For instance, in March 2025, Rimini Street launched Rimini Manage for Workday AMS. The solution provides efficient day-to-day operation of workday human capital management (HCM), workday financial management, and workday adaptive planning.

Thus, the market analysis shows that the aforementioned factors are boosting the usage of AMS in enterprises, in turn, driving the managed services market growth.

Key Restraints:

Security and compliance issues related to managed services are limiting the market growth

As businesses highly rely on digital platforms and outsource IT functions, the risk of cyberattacks and data breaches increases, requiring strict security measures. MSPs follow relevant industry regulations and compliance standards, which is complex and vary depending on the industry and location.

Moreover, outsourcing IT management extends the attack field, making it crucial to thoroughly evaluate MSPs' security protocols and ensure they are adequately protected against cyber threats. Thus, the market analysis shows that the aforementioned factors are restraining the managed services market demand.

Future Opportunities:

Integration of artificial intelligence (AI) powered automation with managed services is expected to propel the market opportunities

AI-powered automation in managed services uses AI to automate and enhance IT operations, security, and customer support, leading to reduced costs, increased efficiency, and proactive error detection. AI continuously monitors systems and networks, identifying potential issues and alerting IT staff. AI analyzes logs and data to diagnose and resolve common IT problems, reducing the need for manual intervention. AI automates security tasks including updating security software and enforcing security policies.

- For instance, in March 2025, ESSPL collaborated with Automation Anywhere Inc. to provide end-to-end AI automation services to help businesses enhance customer personalization, optimize their operations, and achieve increased efficiency.

Thus, the market analysis depicts that the ongoing technological advancements and their integration with managed services are projected to drive managed services market opportunities during the forecast period.

Managed Services Market Segmental Analysis :

By Service Type:

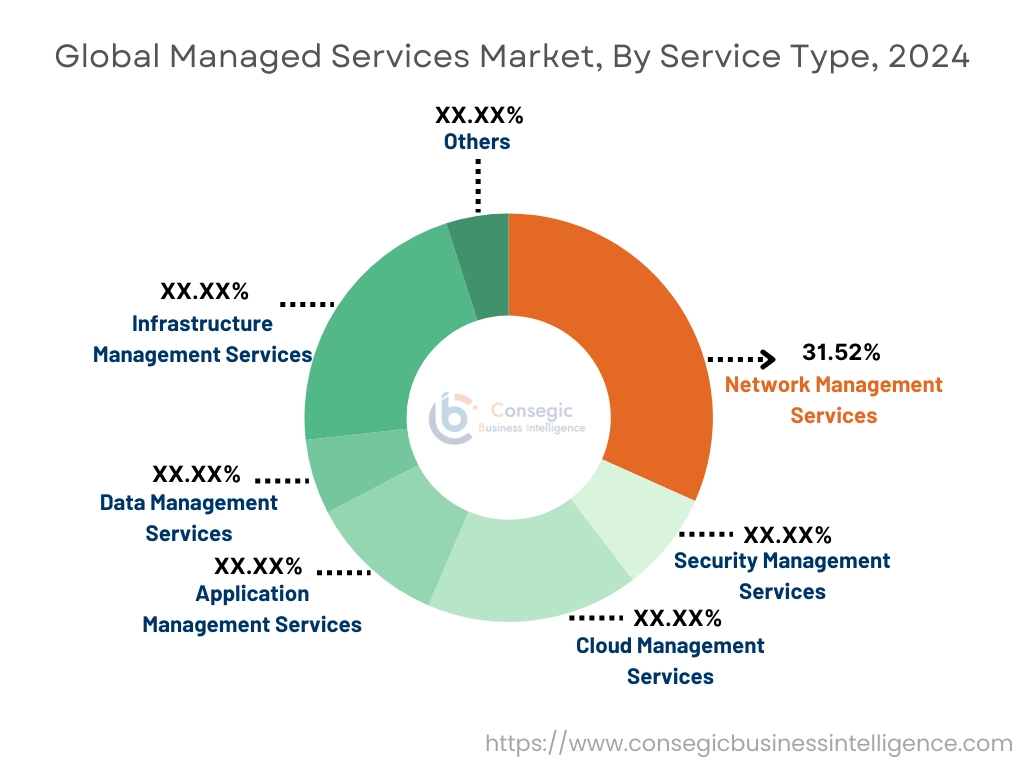

Based on the service type, the market is segmented into infrastructure management services, network management services, security management services, cloud management services, application management services, data management services, and others.

Trends in the Service Type:

- Rising demand for data management services to efficiently handle data assets, ensuring accuracy and accessibility for informed decision-making.

- Increasing trend in adoption of security management services to implement and maintain security measures to protect assets from various threats.

The network management services segment accounted for the largest revenue share of 31.52% in the market in 2024.

- Managed network services are a type of IT outsourcing service where a third-party provider takes responsibility for managing and maintaining a company's network infrastructure.

- MSPs monitor network performance, identify potential issues, and implement preventative measures to minimize downtime and ensure optimal network performance.

- For instance, in February 2025, Extreme launched platform One for MSPs. The platform allows MSPs to offer innovative security, networking, and AI solutions that scale operations.

- Therefore, the wide spread adoption of network management services is boosting the managed services market growth.

The cloud management services segment is expected to register the significant CAGR during the forecast period.

- The managed cloud service provider (MCSP) is a vendor or cloud platform that offers managed cloud services. MCSP can be directly connected to the cloud resource provider or a third-party server.

- MCSPs optimize cloud resources and ensure efficient operations. This leads to lower operational costs by utilizing the provider's expertise and economies of scale.

- For instance, in February 2025, Atos launched Google Cloud managed security services portfolio. The services offer cybersecurity solutions ensuring the organizations stay protected against cyber threats.

- Thus, the managed services market analysis depicts that the rising demand for cloud management services is expected to boost the managed services market trends during the forecast period.

By Enterprise Size:

Based on the enterprise size, the market is segmented into small and medium enterprises and large enterprises.

Trends in the Enterprise Size:

- Rising demand for managed services in small and medium enterprises to reduce costs and improve resource utilization is boosting the managed services market size.

- Increasing trend in adoption of cloud management services in large enterprises to optimize performance, and ensure security and scalability.

The large enterprises segment accounted for the largest revenue share in the managed services market share in 2024.

- MSPs have specialized expertise in areas including cybersecurity, cloud computing, and network management, which are valuable for large enterprises.

- Moreover, MSPs help organizations fill IT skills gaps by providing access to specialized talent that is not available within the enterprise.

- Additionally, MSPs continuously monitor and maintain IT systems, minimizing the risk of downtime and its associated costs, leading to enhanced operational efficiency.

- For instance, in November 2024, Farmers Edge launched managed technology services to large scale agri-businesses and crop insurers. The services addresses issues including cost management, disconnected tech stacks, and change management.

- Therefore, the aforementioned factors are responsible for wide usage of management services in large enterprises, in turn boosting the managed services market demand.

The small and medium enterprises segment is expected to register the fastest CAGR during the forecast period.

- The managed services offer cost savings, access to specialized expertise, enhanced security, and scalability.

- Moreover, small businesses experience fluctuations in their IT needs, and MSPs provide the flexibility to scale up or down as needed.

- Additionally, these services are more cost-effective than maintaining an in-house IT team, as it reduces costs associated with employees, infrastructure, and software expenses.

- For instance, companies including Microsoft Azure, AWS, Google Cloud, Rackspace, Zoho, and others offer managed services for SMEs. These companies require scalable and cost-effective managed cloud services for ensuring security and compliance.

- Thus, the market analysis states that the rising adoption of management services in small and medium enterprises is anticipated to boost the managed services market trends during the forecast period.

By End User:

Based on the end user, the market is segmented into IT & telecommunications, BFSI, healthcare, manufacturing, energy & utilities, retail, and others.

Trends in the End User:

- Rising demand for management services in retail sector to manage inventory levels, optimize stock, and manage customer data is boosting the market growth.

- Increasing trend in adoption of management services in healthcare sector to track medical billing, claims processing, security measures, and others is driving the managed services market size.

The IT & telecommunications segment accounted for the largest revenue in the managed services market share in 2024.

- MSPs provide various services in IT & telecommunications sector including monitoring and maintenance of network infrastructure, virtualization and cloud infrastructure management.

- Additionally, MSPs also offer security management, network performance optimization and troubleshooting, including firewall configuration and intrusion detection, and data backup and recovery solutions.

- For instance, in March 2025, Wipro launched AI-first managed services platform TelcoAI360. The platform offers features to enhance network performance, streamline operations, and strengthen security for telecom providers.

- Therefore, the wide applications of management services in IT & telecommunications sector are boosting the managed services market expansion.

The BFSI segment is expected to register the fastest CAGR during the forecast period.

- Managed services allow BFSI institutions to navigate the complexities of digital transformation and adopt new technologies. MSPs help institutions stay compliant with regulations.

- Moreover, MSPs help institutions protect their data and systems from cyberattacks.

- For instance, in December 2024, NeoXam, a financial data technology solution provider, in collaboration with BNP Paribas’ Securities Services, launched a data management service. The solution offers features including holistic fund view, self-service capability through interactive screens, data privacy, security, flexibility, and resiliency.

- Thus, the managed services market analysis depicts that the aforementioned factors are expected to drive the managed services market opportunities during the forecast period.

Regional Analysis:

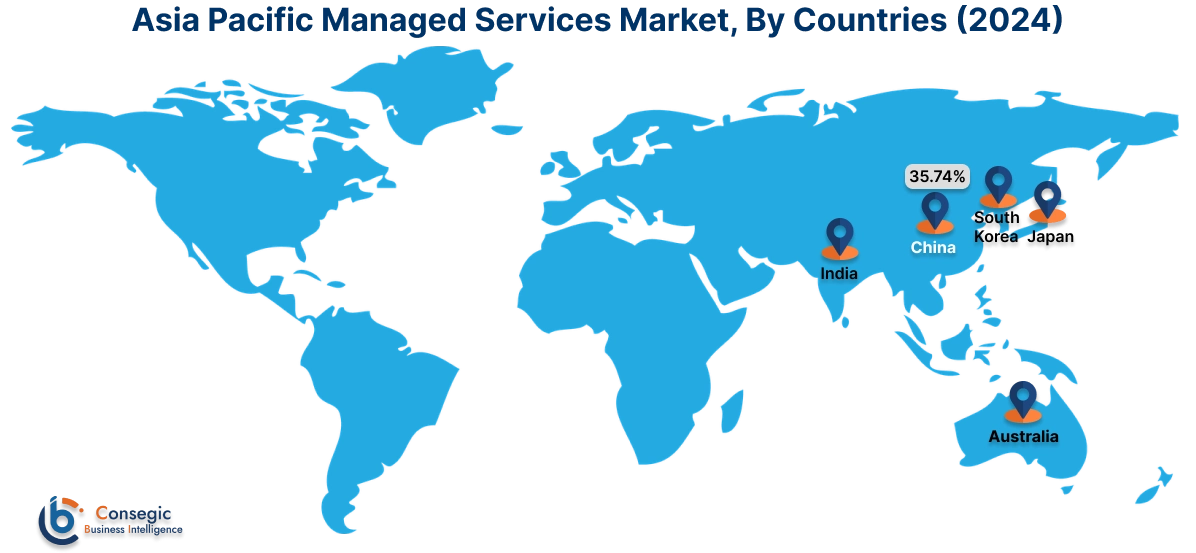

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 74.87 Billion in 2024. Moreover, it is projected to grow by USD 79.14 Billion in 2025 and reach over USD 134.63 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.74%. The market in the region is growing due to large number of small and medium enterprises operating in IT & telecommunications, BFSI, and healthcare sectors. Moreover, the rising retail sector along with the boom in ecommerce requires the use of managed services to manage infrastructure, data, network and application.

- For instance, in May 2024, IBM acquired SKYARCH NETWORKS INC. to strengthen Amazon Web Services consulting capabilities in Japan. The company offers AWS-focused cloud development and managed services.

North America is estimated to reach over USD 192.45 Billion by 2032 from a value of USD 113.35 Billion in 2024 and is projected to grow by USD 119.23 Billion in 2025. The market analysis depicts that in the North American region, the market is primarily growing due to well-established IT & telecommunications, healthcare, and BFSI sector. The presence of large and medium enterprises in the region is also boosting the market growth.

- For instance, in November 2024, HPE (Hewlett Packard Enterprise) introduced enhancement in its HPE Greenlake cloud platform. Managed Services Center of Expertise enables partners to leverage HPE GreenLake to promote their service offerings. Thus, the rising advancement related to managed services is boosting the managed services market expansion in the region.

In Europe, the market is growing due to digital transformation and adoption of advanced technologies including cloud, blockchain, and others. This requires businesses to adopt management services to effectively handle and optimize the processes. Further, in Latin America, Middle East and Africa, the market is experiencing a steady growth primarily due to factors including rising number of business enterprises and demand of managed services in oil and gas, retail, and energy sectors among others.

Top Key Players & Market Share Insights:

The managed services industry is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global managed services market. Key players in the managed services industry include -

- PwC (UK)

- HP Development Company (US)

- Cloudian (US)

- Accenture (Ireland)

- KPMG (Netherlands)

- Amazon (US)

- SAP SE (Germany)

- Deloitte (UK)

- Ericsson (Sweden)

- HCL Technologies (India)

Recent Industry Developments :

Partnerships and Collaborations:

- In March 2025, Ericsson and Zain Bahrain expanded their managed services partnership for 3 years. This aims to elevate customer experiences and optimize network efficiency.

Managed Services Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 516.22 Billion |

| CAGR (2025-2032) | 7.7% |

| By Service Type |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the managed services market? +

Managed Services Market size is estimated to reach over USD 516.22 Billion by 2032 from a value of USD 298.53 Billion in 2024 and is projected to grow by USD 314.49 Billion in 2025, growing at a CAGR of 7.7% from 2025 to 2032.

What are the major segments covered in the managed services market report? +

The segments covered in the report are service type, enterprise size, end user, and region.

Which region holds the largest revenue share in 2024 in the managed services market? +

North America holds the largest revenue share in the managed services market in 2024.

Who are the major key players in the managed services market? +

The major key players in the market are PwC (UK), HP Development Company (US), Amazon (US), SAP SE (Germany), Deloitte (UK), Ericsson (Sweden), HCL Technologies (India), Cloudian (US), Accenture (Ireland), KPMG (Netherlands), and others.