Mobile Phone Insurance Ecosystem Market Size :

Mobile Phone Insurance Ecosystem Market Size is estimated to reach over USD 64,548.30 Million by 2032 from a value of USD 29,124.26 Million in 2024, growing at a CAGR of 10.5% from 2025 to 2032.

Mobile Phone Insurance Ecosystem Market Scope & Overview:

The mobile phone insurance ecosystem involves comprehensive services provided by the mobile operators, insurance companies, and device OEMs for safeguarding smartphones. A mobile insurance offers coverage for various kinds of damage to the mobile such as physical damage, theft & loss, and others. Mobile phone insurance covers the cost of replacing or repairing mobile phones according to the terms & conditions of the policy provided by the insurer. Thus, insurance for mobile phones helps individuals to avoid financial loss in case of damage or theft of the mobile phones.

Mobile Phone Insurance Ecosystem Market Insights :

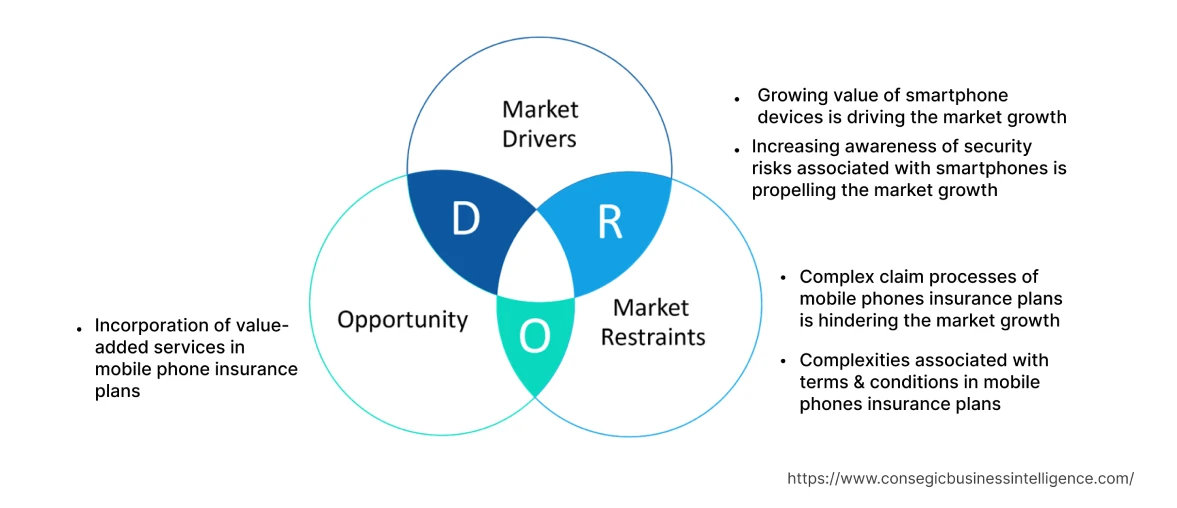

Mobile Phone Insurance Ecosystem Market Dynamics - (DRO)

Key Drivers :

Growing value of smartphone devices

The growing value of consumer electronics devices such as smartphones, laptops, and tablets are driving the demand for insurance services for high-priced devices. Smartphones are equipped with advanced functionalities such as high-quality cameras, wireless connectivity, and high speed and storage capacity. Analysis of market trends concludes that the technical development in smartphones with the aforementioned features is driving the market proliferation. The increasing value and complexity of devices allows individuals to opt for mobile phone insurance services to protect and safeguard their devices. For instance, in January 2021, Chubb collaborated with Selular Shop in Indonesia to offer gadget insurance coverage for new mobile phones against the risk of accidental damage. Thus, growing adoption of premium smartphones is accelerating the mobile phone insurance ecosystem market demand.

Increasing awareness of security risks associated with smartphones

The growing awareness among consumers about the security risks associated with smartphones such as accidental damage, theft, or loss is driving the market expansion. The rising cases of smartphone theft in countries such as India is driving the demand for mobile phone insurance plans to avoid any financial losses. Moreover, mobile phone insurance services provide protection against physical damage to the smartphones such as screen damage, poor display, or battery issues. For instance, in July 2022, FingerMotion, Inc. launched mobile device protection product providing services such as broken screen protection by accidental damage or mechanical breakdown. Analysis of market trends concludes that the growing awareness among consumers to safeguard their consumer electronics devices is proliferating the mobile phone insurance ecosystem market demand.

Key Restraints :

Complex claim processes of mobile phones insurance plans

The complex claim processes of mobile phone insurance policies are restraining the proliferation of the market. The customer needs to submit the required documents to the insurance company for initiating the claim process for the insured mobile phone. Moreover, customers need to undergo verification processes and wait for longer durations to claim approval, resulting in customer dissatisfaction. Analysis of market trends concludes that the lengthy and cumbersome claim procedures are restraining the expansion of the market.

Complexities associated with terms & conditions in mobile phones insurance plans

Mobile phone insurance policies have various limitations and exclusions that restrict customers from claiming smartphone insurance facilities. Moreover, customer dissatisfaction rises due to unfulfillment of customer expectation associated with insurance of their personal devices. For instance, any deliberate attempt to damage the smartphone is not considered under the smartphone insurance policies. Consequently, coverage limitations and exclusions in mobile phones insurance plans limit the adoption of mobile phones insurance plans by the customers. Analysis of market trends concludes that the complexities associated with terms & conditions in mobile phones insurance plans are hindering the proliferation of the market.

Future Opportunities :

Incorporation of value-added services in mobile phone insurance plans

The incorporation of value-added services in mobile phone insurance plans is expected to present potential opportunities for the expansion of mobile phone insurance ecosystem market. Insurance companies differentiate themselves by offering value-added services alongside insurance coverage. These services include device diagnostics, data backup solutions, malware protection, identity theft monitoring, and technical support. For instance, in March 2023, Avast Software S.R.O launched Avast One Platinum providing services such as identity monitoring and protection, identity theft resolution and reimbursement. Assessment of market trends indicates that the incorporation of value-added services in mobile insurance plans to enhance customer loyalty and satisfaction emerging as one of many mobile phone insurance ecosystem market opportunities that will drive market expansion during the forecast period.

Mobile Phone Insurance Ecosystem Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 64,548.30 Million |

| CAGR (2025-2032) | 10.5% |

| By Insurance Type | Physical Damage, Theft & Loss, and Others |

| By Sales Channel | Mobile Operators, Insurance Companies, Device OEMs, Retailers, and Others |

| By Phone Type | Budget Phones, Mid & High-end Phones, and Premium Smartphones |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Allstate Corporation, Apple, Asurion, ASUS, AT&T, Avast Software, Samsung Electronics, Vodafone Group, Worth Avenue Group, Xiaomi, Zimperium |

Mobile Phone Insurance Ecosystem Market Segmental Analysis :

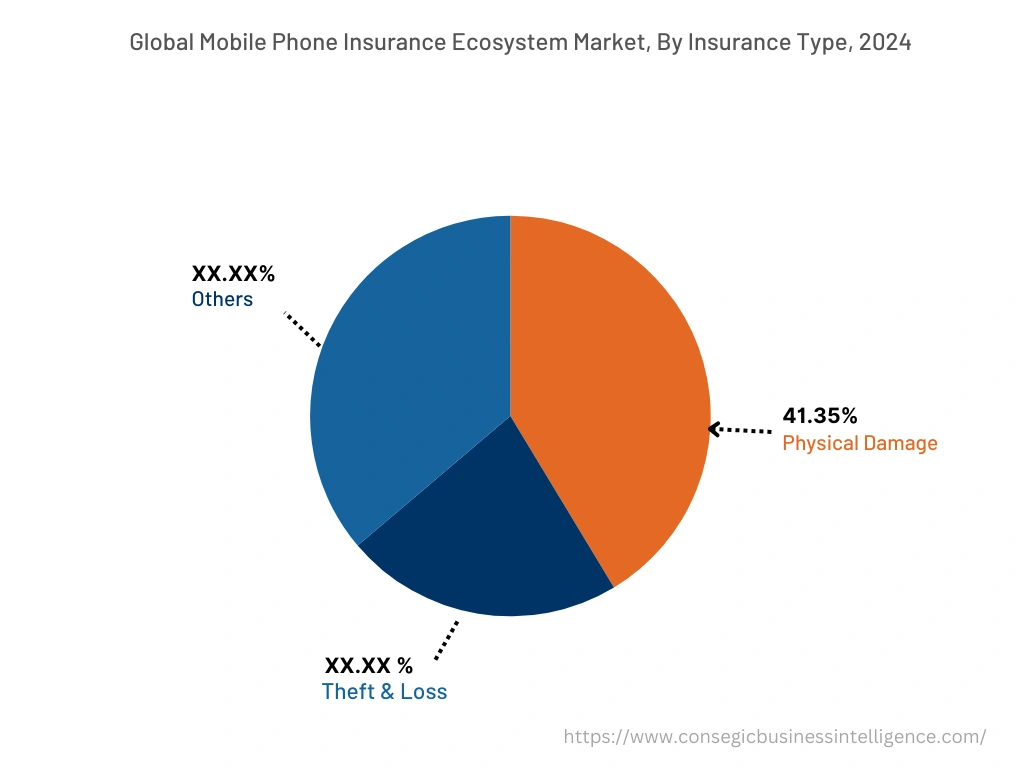

By Insurance Type :

Based on the insurance type, the market is trifurcated into physical damage, theft & loss, and others. The physical damage segment accounted for the largest revenue share of 41.35% in the year 2024. Moreover, the segment provides services such as protection against accidental damage to mobile phones. Insurance policies typically cover the cost of repairs or replacement of the damaged components, depending on the terms and conditions of the policy. Examination of market trends concludes that mobile phone insurance providers offer services in scenarios such as cracked screens, liquid damage, power surges, and hardware malfunctions, resulting in market proliferation.

The theft & loss segment is expected to witness the fastest CAGR during the forecast period. Insurance plans under this segment provide coverage against theft and loss of mobile phones. Customers file a claim to receive compensation or a replacement device if a device is stolen or lost. Analysis of mobile phone insurance ecosystem market trends concludes that the insurance companies provide services to the customers according to the terms and conditions of the policy, resulting in market expansion.

By Sales Channel :

Based on the sales channel, the market is segregated into mobile operators, insurance companies, device OEMs, retailers, and others. In 2024, the insurance companies segment accounted for the highest mobile phone insurance ecosystem market share. The companies offer smartphone insurance services to the customers for various conditions such as accidental damage, theft or loss. Thus, insurance companies assess risks, determine premiums, and manage claims and payouts. Moreover, insurance companies maintain customer records, manage coverage details, and handle policy-related queries and changes. Examination of market trends concludes that insurance companies are providing efficient customer support services leading to customer satisfaction that contributes to the proliferation of the market.

Device OEM segment is anticipated to register fastest CAGR during the forecast period. Device OEMs collaborate with insurance companies to offer insurance plans specifically designed for their devices. As a result, device OEMs provide extended services such as warranty coverage, device protection, or other insurance options bundled with the purchase of their devices. Therefore, the device OEMs ensure that customers receive adequate protection for their specific device models, resulting in mobile phone insurance ecosystem market growth.

By Phone Type :

Based on the phone type, the market is segregated into budget phones, mid & high-end phones, and premium smartphones. In 2024, the premium smartphones segment accounted for the highest mobile phone insurance ecosystem market share. The increasing production of smartphones with advanced functionalities and features is driving the expansion of mobile phone insurance ecosystem market. The growing value of consumer electronics devices drives the demand for insurance services to safeguard and protect smartphones from physical damage, theft, and loss. As a result, insurance services offer extended services for premium devices such as water damage, screen cracks, and repairing of face recognition or fingerprint sensors.

Moreover, the premium smartphones segment is anticipated to register fastest CAGR during the forecast period. The technological advancements in smartphones such as wireless connectivity are further facilitating insurance companies to provide cyber-security services such as identity monitoring and protection. For instance, in January 2021, Zimperium launched a critical zero-touch remote-code execution vulnerability called WifiDemon to protect iOS devices from network crash bugs or cyber security risks. Thus, the ability of insurance companies to provide cyber protection is further contributing to the mobile phone insurance ecosystem market growth.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022. The increasing adoption of consumer electronics devices such as smartphones, laptops, and tablets in the region is driving the expansion of mobile phone insurance ecosystem market. For instance, according to Statistics Canada, 84% of Canadians relied on a smartphone for personal use to communicate, research, or for entertainment in 2020. The mobile phone insurance ecosystem market analysis concluded that the development of smartphone devices with gradual incorporation of advanced features for safeguarding premium smartphones is fuelling the mobile phone insurance ecosystem market proliferation.

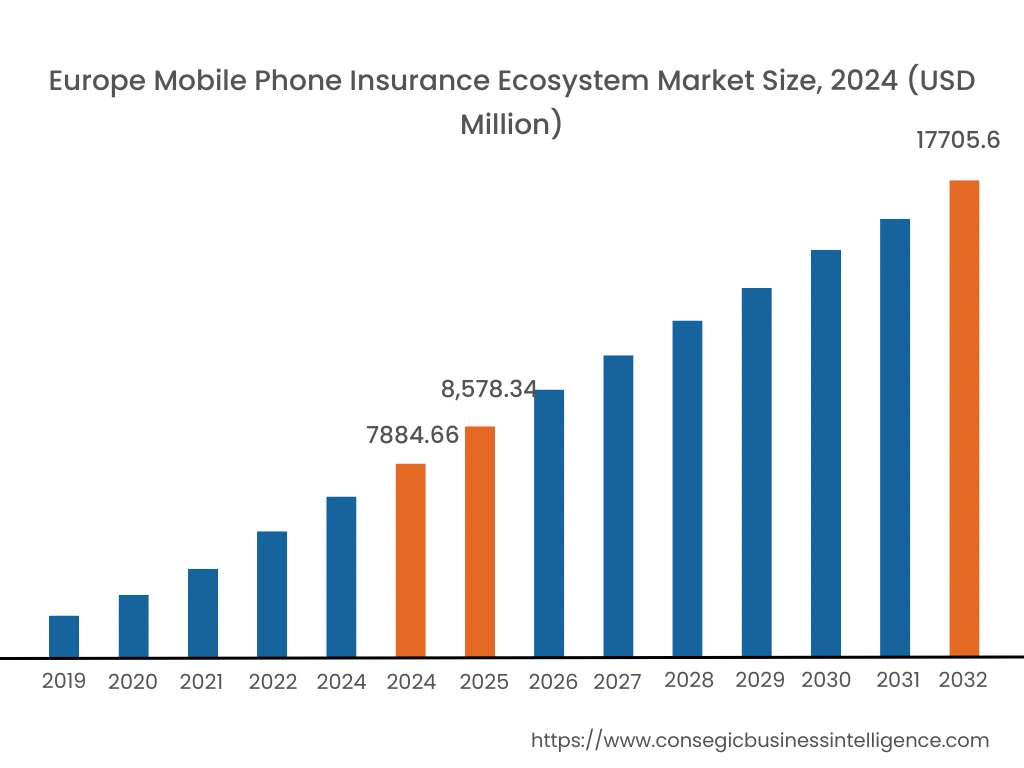

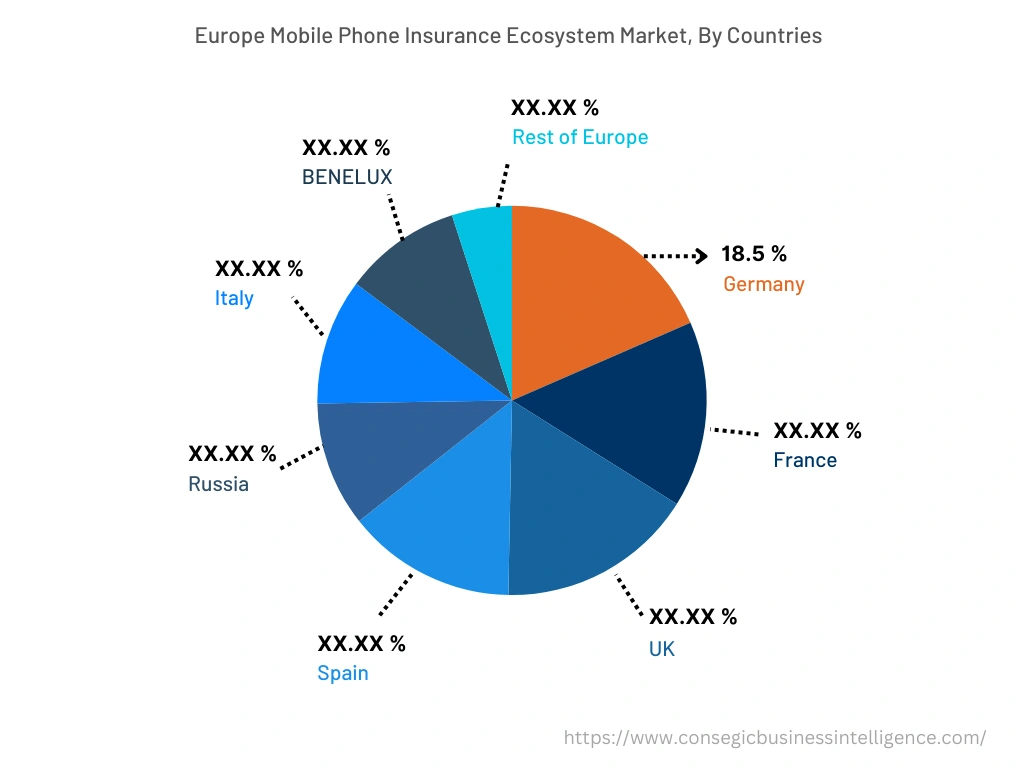

Europe accounted for a revenue share of USD 7,884.66 million in 2024 and is expected to reach USD 17,705.60 million in 2032, registering a CAGR of 10.60% during the forecast period. Additionally, in the region, Germany accounted for the largest revenue share of 18.5% in the year 2024. The rising cases of cyber security threats such as identity theft, financial loss, and others in the region is driving the expansion of mobile phone insurance ecosystem market. A large section of the population in Europe are dependent on smartphone and internet services. For instance, according to Cybercrew UK, 92% of UK population own a smartphone as of March 2021. The mobile phone insurance ecosystem market analysis concluded that the growing risks of cybersecurity threats such as ransomware, malware, and advanced persistent threats (APTs) is increasing the demand for mobile phone insurance services, resulting in the market proliferation.

Top Key Players & Market Share Insights:

The mobile phone insurance ecosystem market is characterized by the presence of major players providing insurance services for smartphones to the national and international markets. The companies operating in mobile phone insurance ecosystem industry are adopting several strategies in product innovation, research and development (R&D), and application launches have accelerated the growth of the mobile phone insurance ecosystem market. Key players in the market include-

- Allstate Corporation

- Apple

- Vodafone Group

- Worth Avenue Group

- Xiaomi

- Zimperium

- Asurion

- ASUS

- AT&T

- Avast Software

- Samsung Electronics

Recent Industry Developments :

- In December 2021, Asurion opened new electronics repair shop called Asurion Tech Repair & Solutions in Gulch at 120 11th Ave. N., Suite 101. It provides various services for electronic gadgets like providing professional fixes for consumer electronics devices such as smartphones, tablets, and computers, with its repair experts providing basic fixes in under two houses.

- In April 2021, V-Key Inc. a prominent software-based security company launched Digital Trust Platform. It aims to deliver a range of services such as IoT tracking, energy monitoring, cyber-physical security, and telecommunications that permit businesses to produce and distribute trusted software solutions to their consumers with the digital trust platform.

- In May 2023, Switched On Insurance, a United Kingdom based gadget insurance company has launched its Mobile Phone Insurance in Australian region. The company has also appointed a specialist team to process claims and policy queries while providing standard and premium policy insurance covers.

Key Questions Answered in the Report

What is Mobile Phone Insurance Ecosystem? +

Mobile Phone Insurance Ecosystems involves the mobile services that are provided to the customers due to accidental damage, theft or loss of smartphones.

What specific segmentation details are covered in the mobile phone insurance ecosystem report, and how is the dominating segment impacting the market growth? +

The report consists of segments including product type, category and application. Each segment has key dominating sub-segment being driven by the industry trends and market dynamics. For instance, by phone type has witnessed premium smartphones as the dominating segment in the year 2024, due to the advanced functionalities and features equipped in smartphones devices.

What specific segmentation details are covered in the mobile phone insurance ecosystem market report, and how is the fastest segment anticipated to impact the market growth? +

By sales segment has witnessed device OEMs as the fastest-growing segment during the forecast period as they collaborate with the service providers to provide repair and replacement services to the customers.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Europe is expected to register fastest CAGR growth during the forecast period due to the increasing adoption of consumer electronics devices such as smartphones, laptops, and smart wearables.