Nutraceutical Packaging Market Size:

The Nutraceutical Packaging Market size is growing with a CAGR of 5.3% during the forecast period (2025-2032), and the market is projected to be valued at USD 6.19 Billion by 2032 from USD 4.13 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 4.33 Billion.

Nutraceutical Packaging Market Scope & Overview:

Nutraceutical packaging refers to the specialized systems and materials designed to contain, protect, and present nutraceutical products, which consists of a wide category of health-benefiting substances ranging from dietary supplements and functional foods to herbal extracts and probiotics. The sensitive nature of active ingredients within nutraceuticals, influences packaging to play an important role in the protection of product integrity, potency, and consumer safety. It primarily serves to create an important barrier against external environmental factors such as moisture, oxygen, light, and fluctuating temperatures, which leads to degradation, reduced efficacy, or spoilage of the product. Additionally, it acts as a critical medium for carrying vital information, including nutritional facts, dosage instructions, health claims, and regulatory compliance details, while simultaneously supporting brand identity and appealing to target consumers.

Nutraceutical Packaging Market Dynamics - (DRO) :

Key Drivers:

Rise in the Nutraceutical Sector to Drive the Nutraceutical Packaging Market Growth.

The nutraceutical sector is experiencing a significant global surge, driven by increasing consumer awareness regarding preventive healthcare, a growing aging population, rising disposable incomes, and a greater inclination towards functional foods and dietary supplements. Packaging for these sensitive products is important, as it must ensure product integrity, extend shelf life, protect against moisture, oxygen, and light degradation, and maintain the efficacy of active ingredients. The rise in the nutraceutical sector is influencing the use of these packaging.

For instance,

- According to the data published by NCBI, the nutraceutical sector grew by a CAGR of 8.0% from 2019 to 2023.

Thus, the rise in the use of nutraceutical for packaging applications is influencing the nutraceutical packaging market expansion.

Key Restraints:

Stringent Regulations to Hinder Nutraceutical Packaging Market Growth.

Stringent regulations are important in order to ensure safety and environmental protection. Simultaneously, they also create hurdles for businesses involved in the development of innovative technologies. The process of obtaining regulatory approvals for novel agricultural technologies is time-consuming as well as expensive. It requires testing and thorough documentation. This lengthy approval process leads to delays in the market entry of innovative products. Additionally, the dynamic nature of these regulations provides uncertainty and risk for businesses. This uncertainty hinders market entry. Moreover, stringent regulations also restrict the availability of certain technologies in specific markets, thereby limiting their widespread adoption and in turn hindering their commercial success. Therefore, the above-mentioned factors are contributing to hinderance in market.

Future Opportunities :

Growing Advancements in Recyclable Packaging to Create Nutraceutical Packaging Market Opportunities.

The packaging sector is experiencing a significant shift, influenced by advancements in recyclable packaging as sustainability becomes a core global solution. Innovations are emerging across multiple solutions, including the development of mono-material designs that simplify the recycling process by eliminating complex multi-layered plastics, and the widespread adoption of post-consumer recycled (PCR) content within new packaging, fostering a more circular economy. Manufacturers are developing novel solutions that adhere to the sustainability requirements.

For instance,

- In 2025, SÜDPACK Medica launched a new sustainable packaging concept NutriGuard, a polypropylene-based blister solution which is classified as recyclable. It is designed for dietary supplements such as vitamins, minerals, proteins, and natural additives.

Thus, the rise in the use of sustainable material for packaging creates nutraceutical packaging market opportunities.

Nutraceutical Packaging Market Segmental Analysis :

By Material Type:

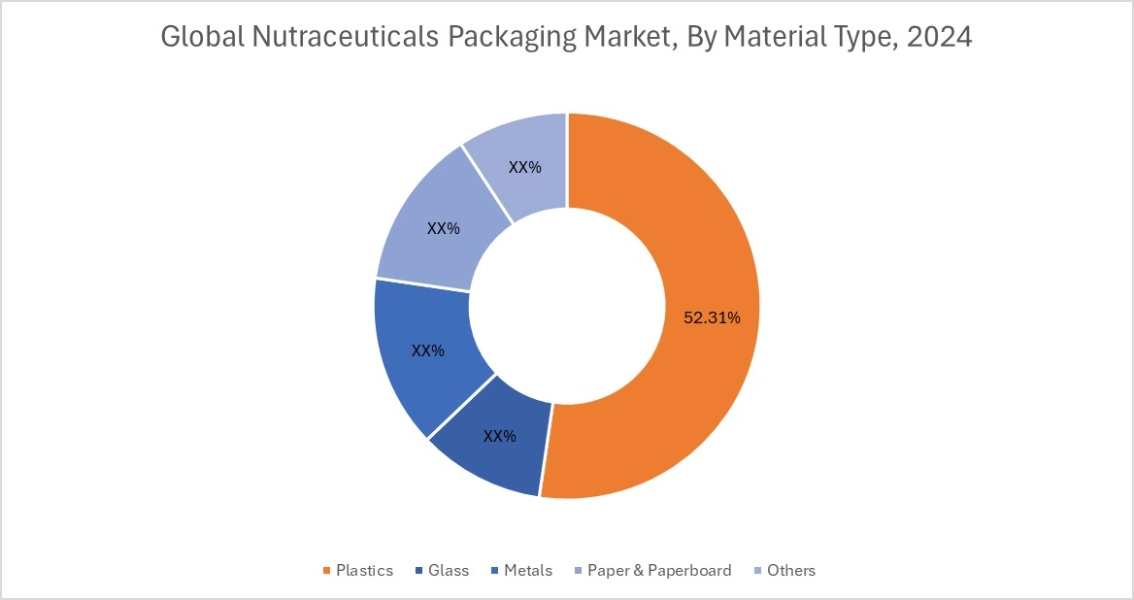

Based on the material type, the market is categorized into plastics, glass, metals, paper & paperboard, and others.

Trends in the Material Type:

- Increasing adoption of post-consumer recycled plastics and bio-based polymers to align with sustainability goals and reduce environmental impact is a trend positively impacting the market.

- Development of innovative coating technologies and advanced barrier papers to overcome moisture and gas permeability, expanding paper's use for direct nutraceutical contact.

The plastics segment accounted for the largest Nutraceutical Packaging market share of 52.31% in 2024.

- Plastics dominate nutraceutical packaging due to their versatility, lightweight nature, and cost-effectiveness.

- Materials such as PET, HDPE, and PP are extensively used for bottles, jars, and flexible pouches, offering excellent barrier properties against moisture and oxygen to preserve sensitive ingredients.

- Furthermore, plastics provide design flexibility and enable user-friendly features such as resealable closures, making them suitable for diverse nutraceutical product forms and consumer convenience.

- Additionally, the growing focus on the adoption of recyclable plastics increasingly supports the segment revenue.

- For instance, in 2025, Greiner Packaging and Orthomol have introduced a fully automated production line for packaging nutritional supplement vials. This new line utilizes recycled PET materials, aiming to enhance both product quality and manufacturing capacity.

- Thus, the aforementioned factors position plastic as the dominant market segment.

The paper & paperboard segment is expected to grow at the fastest CAGR over the forecast period.

- Paper and paperboard are increasingly vital for nutraceutical packaging, driven by a global shift towards sustainability.

- They offer renewable, recyclable, and biodegradable qualities, enhancing brand perception.

- Innovations in coatings and laminations are expanding their use beyond traditional secondary packaging.

- Their excellent printability and lightweight nature make them suitable for creating visually appealing and eco-friendly packaging that resonates with health-conscious consumers.

- As a result, owing to the aforementioned factors, the paper & paperboard segment is expected to be lucrative over the forecast period.

By Application:

Based on the application, the market is categorized into dietary supplements, functional foods, herbal products, functional beverages, and others.

Trends in the Application:

- Growing adoption of sustainable and eco-friendly packaging materials, such as paper-based canisters and recyclable plastics.

- A trend for packaging that supports clean labels, plant-based ingredients, and incorporates smart technologies for enhanced consumer information is rising.

The dietary supplements segment accounted for the largest market share in 2024.

- Dietary supplements constitute the largest segment in nutraceutical packaging, driven by increasing health awareness and an aging population.

- These products, primarily tablets, capsules, and powders, require robust protection against moisture, oxygen, and light to maintain potency.

- Rising global health awareness, emphasizing preventive healthcare and immunity boosting, significantly drives requirement for nutraceutical products.

- For instance, according to Council for Responsible Nutrition, consumer survey on dietary supplements indicates that dietary supplements have achieved mainstream acceptance, with 74% of U.S. adults reporting usage and 55% being regular consumers.

- Furthermore, consumer preference for convenience propels the requirement for easy-to-use, portable, and single-serve packaging formats.

- Thus, as per the nutraceuticals packaging market analysis, the continuous innovation in nutraceutical formulations is driving the segment growth.

The herbal products segment is expected to grow at the fastest CAGR over the forecast period.

- Herbal products encompass a wide range of plant-based remedies, traditional medicines, and botanical extracts. Their packaging is often designed to convey a natural and holistic brand image while ensuring the stability of sensitive natural compounds.

- Amber glass bottles and jars are favored for liquids and oils due to their inertness and UV protection, while biodegradable pouches are gaining traction for dried herbs.

- This sector's growth is driven by rising consumer health consciousness, a strong shift towards natural remedies, and the increasing adoption of herbal products for preventive healthcare, which also fuels the requirement for sustainable packaging solutions aligning with their natural branding.

- As a result, as per the market analysis, owing to the aforementioned factors, the herbal products segment is expected to be lucrative over the forecast period.

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

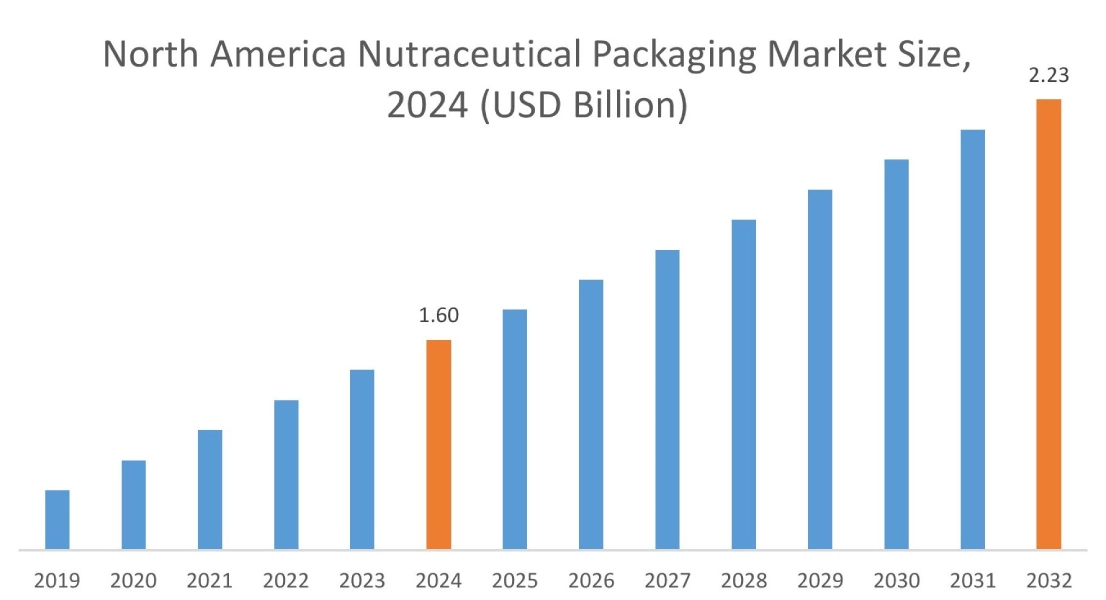

In 2024, North America accounted for the highest market share at 38.78% and was valued at USD 1.60 Billion and is expected to reach USD 2.23 Billion in 2032. In North America, U.S. accounted for the market share of 73.11% during the base year of 2024.

North America nutraceutical packaging market share for is primarily influenced due to its ingrained health and wellness focus, which translates into high adoption rates for dietary supplements and functional foods. The region benefits from a robust nutraceutical industry and the presence of key packaging companies that drive continuous innovation. Stringent FDA regulations enforce high safety standards, mandating features such as child-resistant closures and tamper-evident seals. The rapid growth of e-commerce necessitates durable, protective, and lightweight packaging for efficient shipping. Furthermore, growing emphasis on sustainable and technologically advanced packaging solutions, including smart packaging for product authentication also supports the market across the region.

For instance,

- In October, 2024, Berry Global, has introduced a new line of clarified polypropylene (PP) bottles specifically designed for health-related applications. These bottles reportedly offer enhanced sustainability and superior product protection when compared to conventional colored PET pill bottles. They are beneficial for various products including nutraceuticals.

Thus, as per the market analysis, the rise in the nutraceutical sector and the use of novel packaging is driving expansion and nutraceutical packaging market demand.

In Asia Pacific, the Nutraceutical Packaging industry is experiencing the fastest growth with a CAGR of 7.0% over the forecast period. The growing focus of manufacturers towards the utilization of sustainable packaging materials is aligning with the Asia Pacific’s goals. A surging middle class with heightened health awareness fuels the demand for dietary supplements and functional foods. The strong cultural ties to traditional herbal medicines, particularly in China and India, further boost the herbal product segment. Rapid economic growth, increased healthcare spending, and expanding local manufacturing capabilities collectively propel market growth, catering to diverse needs ranging from sophisticated high-barrier packaging in Japan to affordable mass-market solutions in India. Thus, as per the nutraceutical packaging market analysis, these above-mentioned factors are contributing to the nutraceutical packaging market trends in this region

The European nutraceutical packaging market is defined by a growing health-conscious population prioritizing preventive healthcare. This region is characterized in demanding eco-friendly and circular packaging solutions, propelled by both strong consumer preference and stringent EU environmental regulations. A pronounced clean label trend also drives demand for transparent packaging of natural ingredients. Furthermore, Europe's diverse product landscape, encompassing traditional herbal items and innovative functional foods and beverages, necessitates strict adherence to comprehensive EU packaging and food contact material regulations. Thus, as per the market analysis, these factors are having a positive impact on the nutraceutical packaging market demand in this region.

The Latin American nutraceutical packaging market is significantly influenced by a growing health consciousness and the rising prevalence of lifestyle diseases across the region. This fuels the requirement for effective nutraceuticals, prompting a need for cost-effective yet reliable packaging solutions. Furthermore, growing disposable incomes are changing consumer habits are driving the market. Thus, as per the Nutraceutical Packaging market analysis, the growing trend of sustainable packaging is driving the Nutraceutical Packaging market expansion in this region.

The market in Middle East and Africa is characterized by increasing health awareness, rising disposable incomes, and government initiatives promoting public health, particularly in GCC countries. A growing focus on Western-style and high-quality nutraceutical products, coupled with evolving consumer behavior prioritizing health and well-being, further propels market development in key countries like UAE, Saudi Arabia, and South Africa. The government in this region is promoting circular economic practices and the participation of global companies is thus accelerating the Nutraceutical Packaging market trends in this region.

Top Key Players and Market Share Insights:

The Global Nutraceutical Packaging Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Nutraceutical Packaging market. Key players in the Nutraceutical Packaging industry include

- Amcor PLC (Switzerland)

- Gerresheimer AG (Germany)

- Graham Packaging Company (U.S.)

- Stoelzle Glass Group (Poland)

- Tecnocap Group (Italy)

- MRP Solutions (U.S.)

- Glenroy, Inc. (U.S.)

- Mondi Group (United Kingdom)

- MJS Packaging (U.S.)

- Comar Packaging Solutions (U.S.)

- Syntegon Packaging Technology GmbH (Germany)

Nutraceutical Packaging Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 6.19 Billion |

| CAGR (2025-2032) | 5.3% |

| By Material Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Nutraceutical Packaging market? +

In 2024, the Nutraceutical Packaging market is USD 4.13 Billion.

Which is the fastest-growing region in the Nutraceutical Packaging market? +

Asia Pacific is the fastest-growing region in the Nutraceutical Packaging market.

What specific segmentation details are covered in the Nutraceutical Packaging market? +

By Material Type, and Application segmentation details are covered in the Nutraceutical Packaging market.

Who are the major players in the Nutraceutical Packaging market? +

Amcor PLC (Switzerland), Gerresheimer AG (Germany), Mondi Group (United Kingdom) are some of the major players in the market.