Pay Card Reader Market Size:

Pay Card Reader Market size is estimated to reach over USD 70,451.16 Million by 2032 from a value of USD 19,981.11 Million in 2024 and is projected to grow by USD 23,033.86 Million in 2025, growing at a CAGR of 17.10% from 2025 to 2032.

Pay Card Reader Market Scope & Overview:

A payment card reader is a device that performs the transactions by reading either a card or mobile devices and are usually used in retail outlets, restaurants, and marketplaces such as Health Care etc. These are technologically advance gadgets which has NFC and EMV chip technology to complete payments by using digital wallets such as Apple Pay, Google Pay or Samsung pay. They ensure more efficient and speedy delivery of payments, improved customer experience, increased sales volumes and revenue as well reduced exposure to frauds. It is widely used in industries such as retail, transportation, bank, hospitality, healthcare e-commerce and others. Driving the pay card reader market is application of cashless means, more secure and convenient than a manual process.

Pay Card Reader Market Insights:

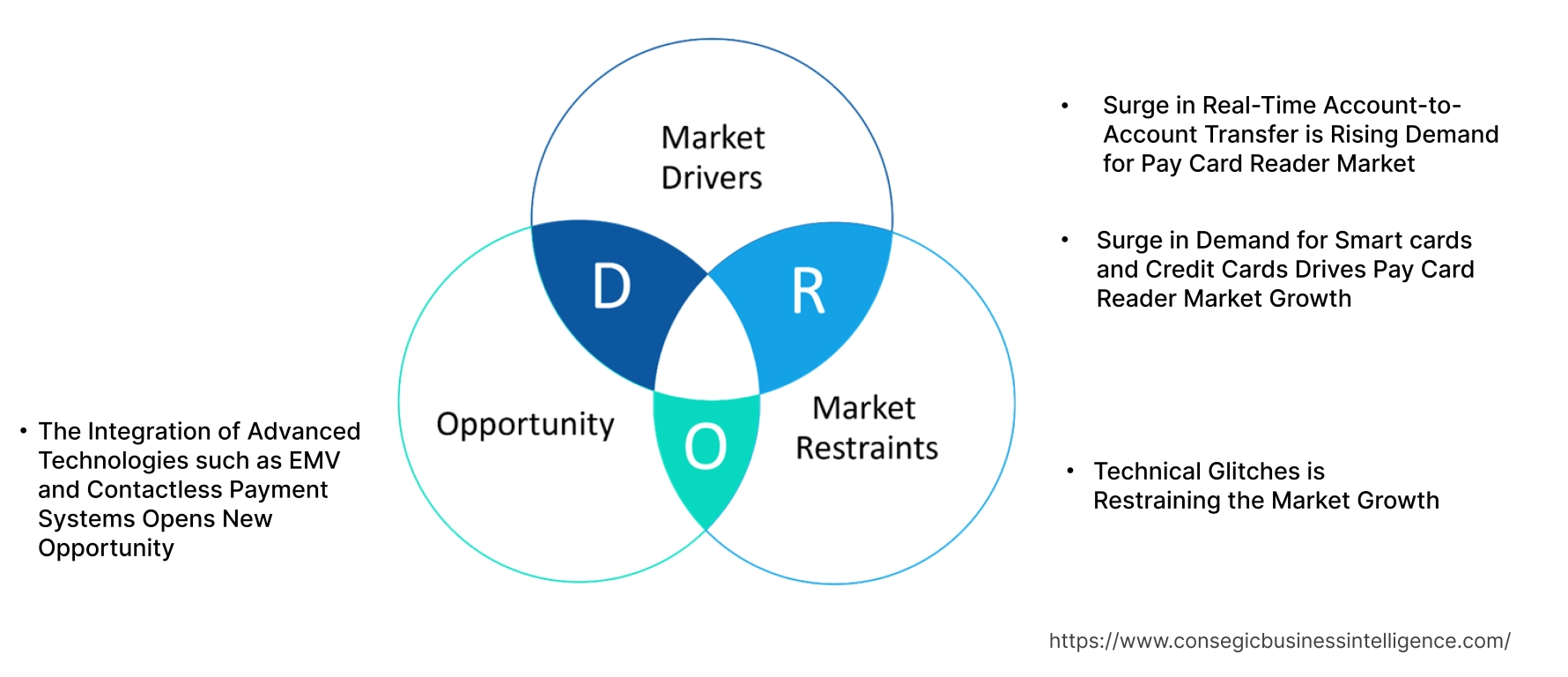

Pay Card Reader Market Dynamics - (DRO) :

Key Drivers:

Surge in Real-Time Account-to-Account Transfer is Rising Demand for Pay Card Reader Market

The increasing consumer preference for speedy and convenient transactions, and the shift away from cash towards card transactions and innovative payment solutions like real-time payments and mobile wallets. The expansion of smart devices such as NFC and EMV is driving the rapid adoption of real-time payments, which are modernizing bank account-based payments and offering added benefits such as enhanced data, and increased security.

- In December 2023, according to the, Ministry of Finance, India there has been a significant development in digital payments in recent years due to the government's coordinated efforts with all stakeholders. The total volume of digital payment transactions surged from 2,071 crore in FY 2017-18 to 13,462 crore in FY 2022-23, growing at a CAGR of 45%. Furthermore, the volume of digital payment transactions reached 11,660 crores in the current financial year 2023-24.

The growing need for real-time transactions, fueled by the use of smartphones and other connected devices, aligns with the ongoing shift towards digital, cashless, and real-time payment methods, thereby driving the pay card reader market demand.

Surge in Demand for Smart cards and Credit Cards Drives Pay Card Reader Market Growth

The global adoption of smart cards for various applications, including contactless payment transactions. Smart cards, used in transportation payments and user verification, offer secure data storage and distribution, thereby increasing their demand. The rapid digitalization and growing security concerns over user credentials further boost the adoption of smart cards.

- In December 2023, Eastern Bank PLC (EBL), a digital bank based in Bangladesh, announced the launch of a biometric metal card powered by IDEX Biometrics MasterCard certified technology, IDEX Pay. The biometric metal card has features such as security, seamless payments, and others for EBL's premium customers and is anticipated to increase card usage among this customer base.

Therefore, the rise in contactless card payments and the need for on-request payment solutions continue to fuel the payment card market, thereby driving the evolution of the pay card reader market.

Key Restraints :

Technical Glitches is Restraining the Market Growth

These devices are beneficial but susceptible to technical issues ranging from software bugs and hardware malfunctions to internet connectivity problems. Such glitches disrupt transactions, leading to transaction failures or delays, which result in customer dissatisfaction and potential loss of sales. Additionally, the costs incurred in resolving these issues further impact businesses financially.

- In December 2021, according to PayPal, the problems with payment platforms include missing out on new customers due to impeding customer experience, lack of agility in payment platforms, high chance of fraud, lost sales, compliance issues, and financial damages, especially as an enterprise handling large volumes and others are the key reasons for the issues occurring in payment platforms.

Therefore, while the market for these devices is set for substantial growth, it's crucial to address these technical challenges to maintain this growing trajectory and ensure customer satisfaction.

Future Opportunities :

The Integration of Advanced Technologies such as EMV and Contactless Payment Systems Opens New Opportunity

The integration of advanced technologies such as EMV, biometrics, and contactless payment systems enhances transaction security and convenience. EMV chip and pin offer a secure method for transactions, reducing fraud risk, while biometrics such as fingerprint or facial recognition add an extra security layer by verifying user identity. Contactless payment systems provide speed and ease, allowing a simple tap for payment, a significant benefit in a post-pandemic world favoring touchless interactions.

- In November 2023, the strategic partnership between MasterCard and NEC Corporation aims to enhance the checkout experience for merchants and consumers. This collaboration leverages the trusted facial recognition technology used to unlock phones and tablets to expedite in-store checkouts. Through a Memorandum of Understanding, the partnership incorporates NEC's face recognition and liveness verification technology with MasterCard's payment enablement and optimized user experience, aiming for global scalability.

Hence, these improvements in user experience and the expanded potential customer base present significant pay card reader market opportunities.

Pay Card Reader Market Segmental Analysis :

By Type:

Based on the type, the market is bifurcated into Mobile Card Readers and Countertop Card Readers.

Trends in the type:

- The demand for countertop card readers with contactless payment capabilities is driving the increasing preference for fast and convenient tap-and-go transactions.

- This device is integrated with advanced payment solutions that include inventory management, customer relationship management (CRM), and analytics tools.

The mobile card reader segment accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR growth during the forecast period.

- The growing need for mobile card readers that seamlessly integrate with smartphones and tablets is driven by the increasing use of mobile payments, improved customer experience, flexibility, portability, and others.

- As per the market analysis, the enhancements in technology such as chip & pin and biometrics have further improved the security and ease of use of these mobile card readers, making them popular for businesses.

- Moreover, mobile wallets and contactless payments have gained popularity, prompting the need for such readers, which offer a convenient and smooth payment experience.

- In May 2023, Stripe unveiled the Stripe Reader S700, which is a mobile pay reader based on Android. It allows businesses to accept payments and gather customer information. Equipped with pre-made features for capturing signatures and email addresses.

- Thus, the rise in mobile payments is driving the mobile pay card reader market trends.

By Technology:

Based on the technology, the market is segmented into EMV, NFC, Magnetic Stripe, Biometrics, QR and Barcodes, and Hybrid Technology Solutions.

Trends in the Technology:

- The payment processing market is increasingly adopting cloud-based solutions, providing businesses with flexibility and scalability. Real-time access to payment data and analytics enhances decision-making and operational efficiency.

- The adoption of mobile point-of-sale (mPOS) solutions has seen a notable increase. These systems enable businesses to process payments using mobile devices, offering flexibility and convenience for both merchants and customers.

The EMV segment accounted for the largest revenue share in the year 2024.

- The EMV (Europay, MasterCard, and Visa) technology offers enhanced security through chip-based cards, reducing fraud risk compared to magnetic stripe cards.

- It enables a tap-to-pay facility that is convenient and quicker.

- vIts adoption in retail and hospitality, support for contactless payments, and compatibility with other methods contribute to its dominance.

- In June 2023, Cantaloupe, Inc. observed a rise in EMV transactions at food and beverage vending machines in 2022. This trend is highlighted in their 2023 Micropayment Trends Report, driven by consumer preference for tap payments, facilitated by EMV-enabled credit cards. These cards offer a quicker and more convenient tap-to-pay experience.

- These factors collectively contributed to the EMV segment accounting for the largest revenue in the global pay card reader market share in 2023.

The QR and Barcodes are anticipated to register the fastest CAGR growth during the forecast period.

- The increasing adoption of QR code and barcode payments, particularly in emerging markets like China and India, drives QR code-enabled pay card readers market demand.

- Additionally, the factor analysis includes the rise of contactless and mobile payments further accelerates QR code-based transactions. The cost-effectiveness and ease of implementing QR code systems contribute to their widespread adoption.

- In October 2021, Samsung, introduced an innovative "Scan QR" feature for hassle-free payments. Users can make QR code payments by using their camera or selecting the "Scan QR code" option from the Quick Panel.

- Therefore, as per the analysis, the increasing adoption of QR code payments is anticipated to boost the pay card reader market trend during the forecast period.

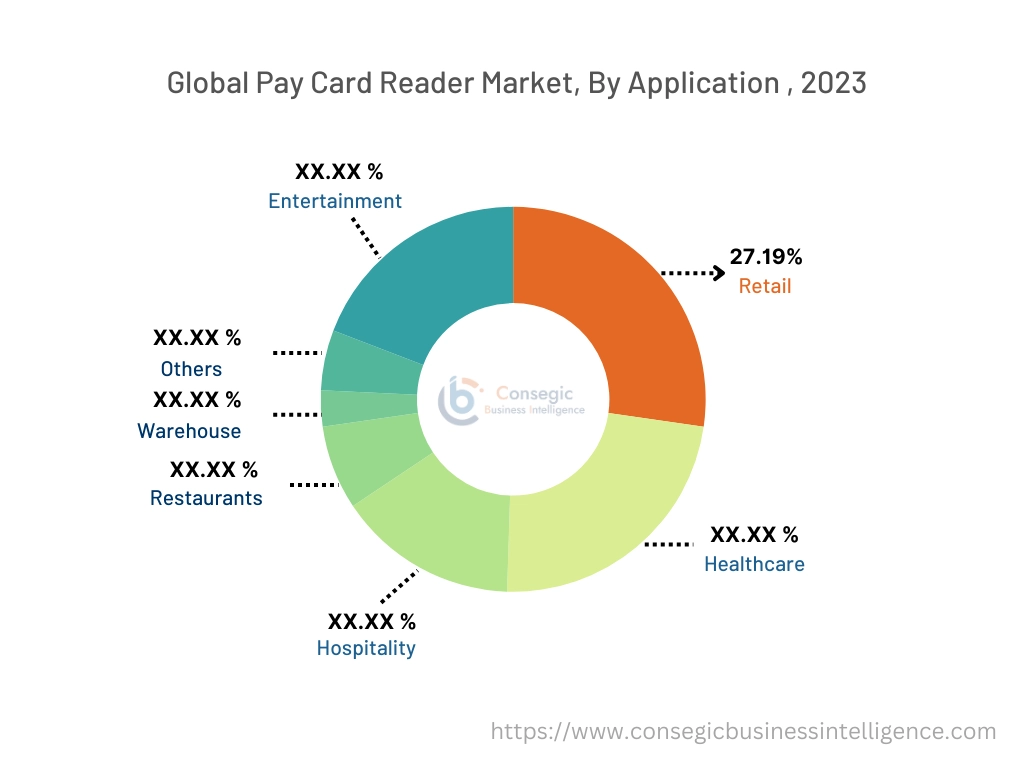

By Application:

Based on the application, the market is segmented into Entertainment, Retail, Healthcare, Hospitality, Restaurant, Warehouse and Others.

Trends in the application:

- In warehouse environments, these devices play a crucial role in streamlining inventory management processes. By seamlessly integrating card readers with inventory management systems, businesses can efficiently track transactions, manage stock levels, and minimize errors typically associated with manual data entry.

The retail segment accounted for the largest revenue share of 27.19% in the year 2024.

- The growing use of contactless payment, technological advances such as EMV chips and NFC. Therefore, there is changes in consumer preferences towards less-cash transactions and enabling rapid and secure payments for both customers and merchants show that retail is crucial in the payment process.

- In June 2023, according to Plural by Pine Labs, Contactless payments have gained significant traction in India. By 2021, NFC payments had surged to 26% from a mere 1% in 2018, reflecting growing consumer trust in this mode of payment. For the Indian retail sector, contactless payments hold immense potential. It enhances sales, reduces checkout times, and boosts customer satisfaction. These payment modes include QR codes, 'Tap and Go' debit cards, and payment links.

- These factors collectively contribute to the dominance of the retail industry in the pay card reader market, reflecting broader trends in consumer payment preferences and technological advancements in payment processing.

The healthcare segment is anticipated to register the fastest CAGR growth during the forecast period.

- The healthcare segment is increasing the adoption of electronic payments, the factors include a growing need for contactless payments (especially during the pandemic), improved efficiency, enhanced patient experience, regulatory compliance requirements, and other major aspects for the rise of pay card readers in this segment.

- In May 2024, Zelis introduced the Advanced Payments Platform (ZAPP) to simplify healthcare payments for payers. ZAPP intelligently manages communications and payments across various modalities, including ACH, virtual credit cards, and checks. By reducing complexity, enhancing efficiency, and ensuring compliance, ZAPP benefits both providers and members.

- In January 2024, MasterCard is collaborating with key partners to revolutionize B2B healthcare payments. Their innovative solution involves virtual cards for medical claim settlements. By embedding these virtual cards within health tech platforms, such as Remedinet, the process becomes seamless and efficient. When an authorized claim is submitted, a virtual card is instantly generated by MasterCard and issued to the healthcare provider, streamlining the payout process. This solution addresses challenges in India's healthcare system and enhances transparency for insurance companies.

- Hence, as per the analysis the healthcare industry continues its digital transformation and these devices are becoming an essential tool for secure and convenient transactions in hospitals, clinics, and pharmacies.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America is estimated to reach over USD 22,833.22 Million by 2032 from a value of USD 6,627.90 Million in 2024 and is projected to grow by USD 7,625.92 Million in 2025. The market is mainly driven by its deployment in retail, hospitality, and other industries.

- In December 2021, According to a MasterCard report, over 80% of consumers in the U.S. are already connecting their bank accounts to technology apps. Fintech companies and banks are leveraging this consumer-permission data to provide easier access to credit, personal financial management, digital wallets, and payment services. The adoption of online and mobile financial applications is used for tasks such as paying bills and managing banking needs.

Additionally, the implementation of smart payment solutions and an increase in contactless payments is expected to boost the North American market throughout the forecast period.

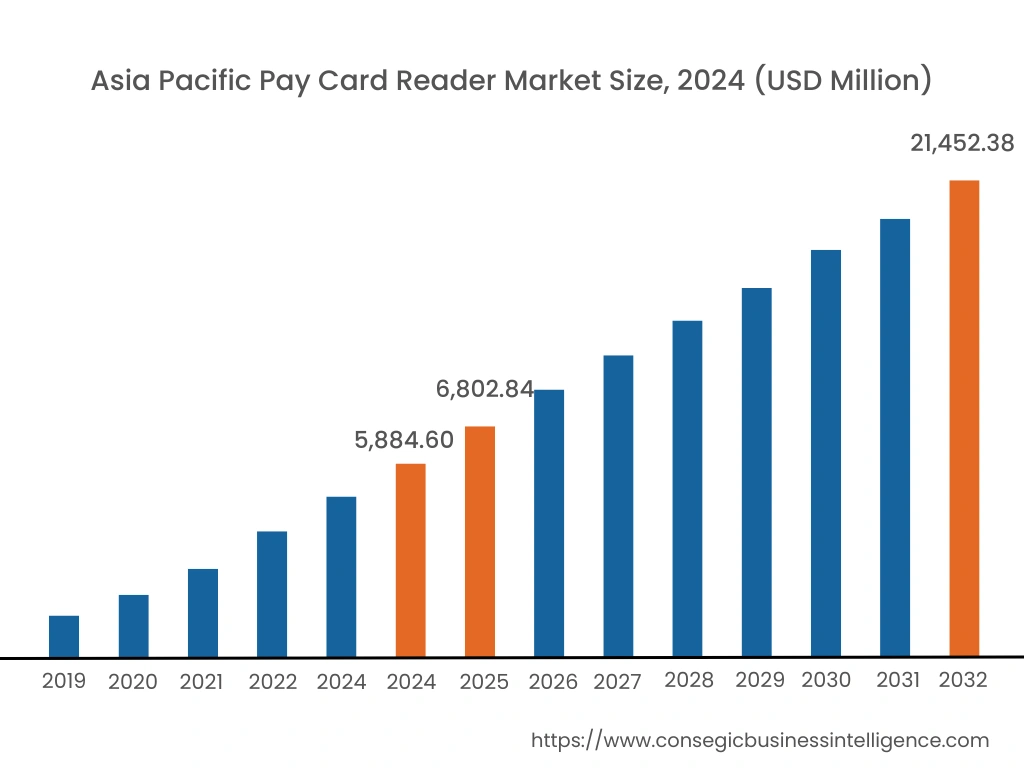

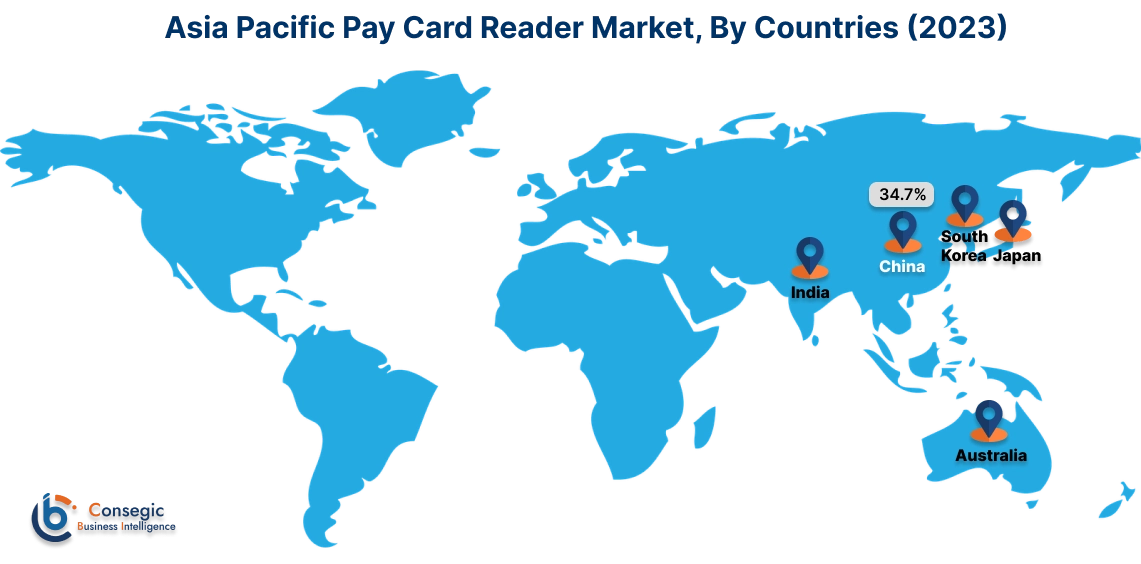

Asia Pacific region was valued at USD 5,884.60 Million in 2024. Moreover, it is projected to grow by USD 6,802.84 Million in 2025 and reach over USD 21,452.38 Million by 2032. Out of this, China accounted for the maximum revenue share of 34.7%.

The Asia Pacific region's increasing mobile payments offer lucrative growth prospects for the market. Additionally, the evolving e-commerce and the retail sector are driving the pay card reader market growth.

- In August 2022, according to MasterCard claims that consumers stand out as one of the most important drivers of digital payment acceptance in the Asia Pacific area. Digital payments such as e-wallets, QR codes, buy now pay later options (BNPLs), cryptocurrencies, and biometric authentication systems have been embraced by 88% of its population. In addition to this, over the same period, 69% of APAC consumers indicate varying degrees of evolution in the use of at least one form of electronic payment.

As per the pay card reader market analysis, Europe is anticipated to witness substantial evolution that is backed by the increasing digitalization, and adoption of contactless payments. The growing e-commerce caters to the surging demand across the region.

The pay card readers market in the Middle East & Africa is poised for moderate development, driven by factors such as the expanding retail sector, tourism, and the growing need for efficient payment solutions fueling their demand, especially in countries such as Saudi Arabia, UAE, and South Africa.

The rising adoption of advanced payment technologies, including mobile wallets and QR code payments in countries including Brazil, Argentina, and Mexico is depicting the cumulative expansion of the pay card readers market in the Latin American Region.

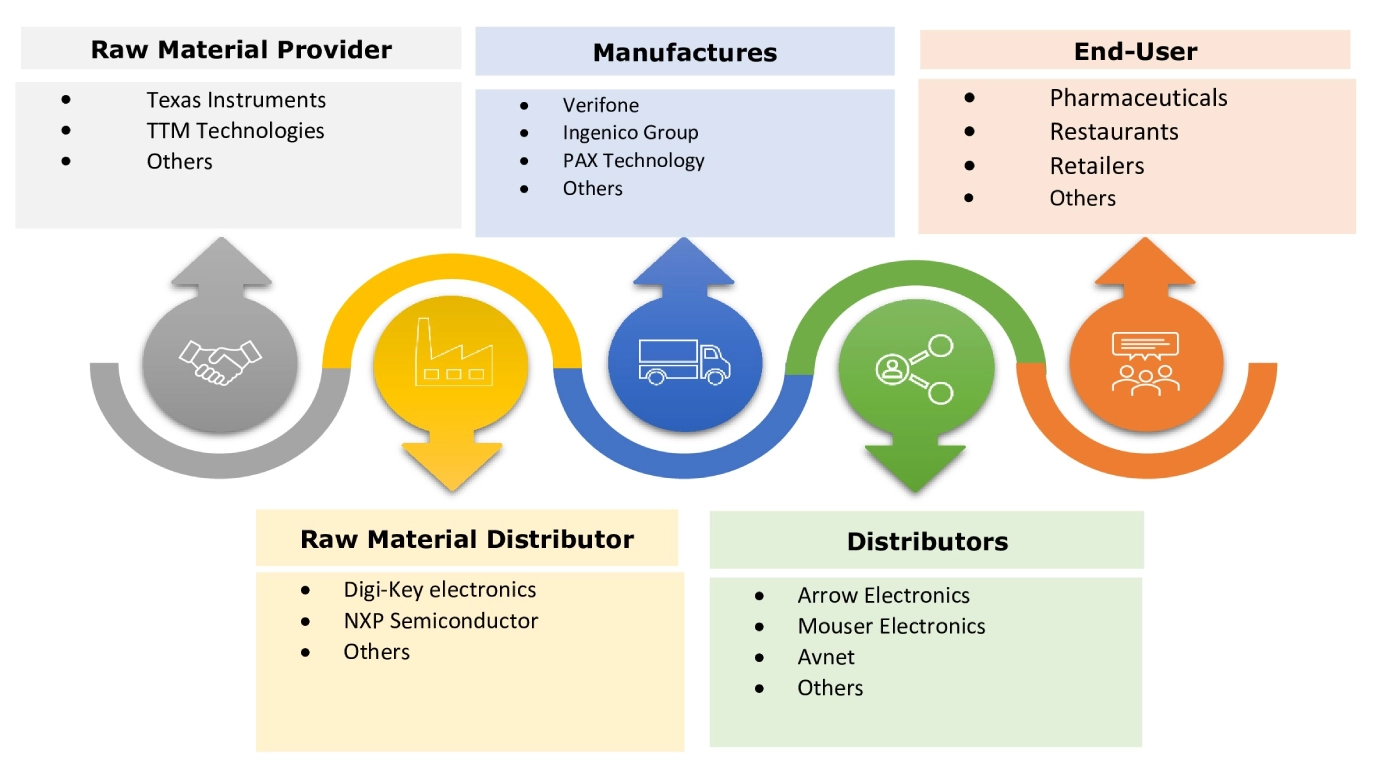

Top Key Players & Market Share Insights:

The pay card reader market is highly competitive with major players providing pay card readers to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the pay card reader market. Key players in the pay card reader industry include-

- Verifone (USA)

- Ingenico Group (France)

- Clover Network (USA)

- Square (USA)

- Elavon (USA)

- PAX Technology (China)

- Castles Technology (Taiwan)

- Newland Payment (China)

- Cayan (USA)

- Ezetap (India)

Recent Industry Developments :

Product Launches

- In April 2024, according to Shopify, 72% of consumers rely on in-store shopping. Therefore, they have introduced the POS Terminal Countertop Kit which aims at streamlined checkout experiences, and POS GO which offers flexibility on the sales floor.

- In May 2024, NMI launched the ID TECH VP3350 mobile card reader. This device connects directly to smartphones and tablets, enabling quick, seamless, and cost-effective mobile payment acceptance. Small and medium-sized businesses were previously limited to cash transactions but now accept credit cards with this user-friendly device.

- In January 2024, ACS, a prominent player in smart card technology worldwide revealed two innovative products the ACR40U Standard Contact Smart Card Reader and the ACR40U Premium Contact Smart Card Reader. These gadgets are designed to provide security and ease of use across various applications, ranging from financial services to secure identification.

Mergers & Acquisitions

- In September 2023, Razorpay acquired Mumbai-based startup BillMe which focuses on digital invoicing and customer engagement, serving over 4000 businesses and managing 15,000 retail POS. Notable clients include McDonald's, Burger King, and Decathlon. This strategic move enhances Razorpay's Omni channel ecosystem.

- In January 2023, in an all-cash deal, Nuvei Corporation, a fintech company from Canada, purchased Paya Holdings Inc., for a total of around $1.3 billion, paying $9.75 per stake to Paya.

Partnerships & Collaborations

- In July 2024, Paytm partnered with Axis Bank, a major private sector bank in India, the focus of this partnership is to offer POS solutions and EDC devices (card machines) to the bank's merchant network. This strategic collaboration aims to enhance merchant operations and elevate customer satisfaction through advanced technology.

Pay Card Reader Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 70,451.16 Million |

| CAGR (2025-2032) | 17.1% |

| By Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the pay card reader market? +

Pay Card Reader Market size is estimated to reach over USD 70,451.16 Million by 2032 from a value of USD 19,981.11 Million in 2024 and is projected to grow by USD 23,033.86 Million in 2025, growing at a CAGR of 17.10% from 2025 to 2032.

What specific segmentation details are covered in the pay card reader report? +

The pay card reader report includes specific segmentation details for type, technology, application, and region.

Which is the fastest segment anticipated to impact the market growth? +

In the technology segment, the QR and Barcode segment is the fastest-growing segment during the forecast period due to the rise of contactless and mobile payments.

Who are the major players in the pay card reader market? +

The key participants in the pay card reader market are Verifone (USA), Ingenico Group (France), PAX Technology (China), Clover Network (USA), Square (USA), Elavon (USA), Castles Technology (Taiwan), Newland Payment (China), Cayan (USA), Ezetap (India) and others.

What are the key trends in the pay card reader market? +

The pay card reader market is being shaped by several key trends including contactless card payment technology such as NFC, EMV, cloud-based payments, and others.