Pharmaceutical Manufacturing Equipment Market Size:

Pharmaceutical Manufacturing Equipment Market size is estimated to reach over USD 41.64 Billion by 2032 from a value of USD 22.73 Billion in 2024 and is projected to grow by USD 24.11 Billion in 2025, growing at a CAGR of 7.1% from 2025 to 2032.

Pharmaceutical Manufacturing Equipment Market Scope & Overview:

Pharmaceutical manufacturing equipment encompasses a wide array of machinery used in the production of drugs and other medical products. This equipment ranges from machines for powder processing, liquid filling, and tablet pressing to sterilization, packaging, and inspection systems. The equipment offers several key benefits including increased efficiency, improved quality control, reduced costs, and enhanced compliance with regulations. Advanced machinery automates processes, minimizes errors, and streamlines production, in turn leading to faster drug development and safer, more effective medications.

Pharmaceutical Manufacturing Equipment Market Dynamics - (DRO) :

Key Drivers:

Rising prevalence of chronic diseases is boosting the market growth

As chronic diseases including diabetes, cardiovascular disorders, and cancer become more widespread, the need for efficient and high-quality pharmaceutical production increases. This scaling up requires investment in advanced manufacturing equipment, including automated tablet presses, sophisticated granulators, and high-speed packaging machinery among others. The rise of biopharmaceuticals, including vaccines along with cell and gene therapies, also drives the need for specialized processing equipment with sterile and controlled environments.

- For instance, the American Cancer Society Inc. estimated more than 2 million new cancer cases in 2024. This rising number of cancer cases further drives the demand for pharmaceutical manufacturing equipment to manufacture relevant cancer treatment solutions.

Thus, the market trend analysis shows that the aforementioned factors are boosting the pharmaceutical manufacturing equipment market growth.

Key Restraints:

Regulatory compliance challenges are hindering the market growth

Pharmaceutical manufacturing equipment faces significant regulatory compliance challenges, primarily due to the highly regulated nature of the industry and the evolving standards set by regulatory bodies like the FDA. Ensuring data is accurate, complete, and reliable is crucial. Companies must adhere to principles like ALCOA+ (Attributable, Legible, Contemporaneous, Original, Accurate) and implement robust data management systems to prevent falsification or errors. Failure to meet Good Manufacturing Practices (GMP) leads to product recalls, fines, and legal actions. This includes issues with facility design, process validation, and maintaining sterility assurance.

Thus, the market analysis shows that the aforementioned factors are restraining the pharmaceutical manufacturing equipment market demand.

Future Opportunities :

Advancements in digital transformation of pharmaceutical manufacturing equipment are creating new market opportunities

Digital transformation in pharmaceutical manufacturing involves integrating digital technologies to improve efficiency, quality, and compliance within the manufacturing process. This includes solutions like automation, real-time monitoring, data analytics, and AI-driven insights, in turn accelerating drug development and production while reducing costs and improving patient outcomes. Moreover, utilizing sensors and data analytics to track key process parameters in real-time enables immediate identification and correction of issues, ensuring quality and compliance.

- For instance, MECO Incorporated offers MECO Smart Analytics solutions for pharmaceutical companies to ensure water systems are operating with optimal performance.

Thus, the market trend analysis depicts that the ongoing digital and technological advancements related to pharmaceutical manufacturing equipment are projected to drive pharmaceutical manufacturing equipment market opportunities during the forecast period.

Pharmaceutical Manufacturing Equipment Market Segmental Analysis :

By Type:

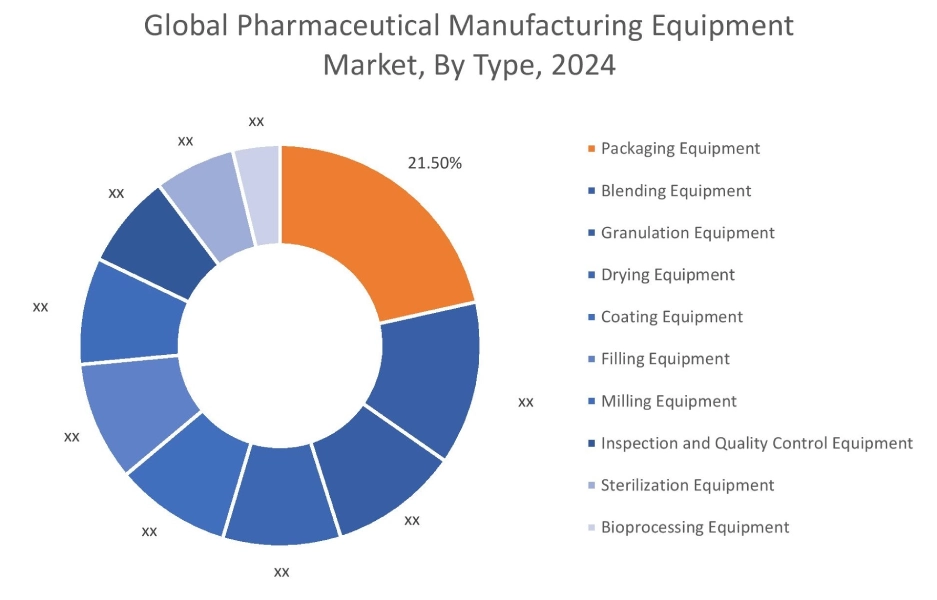

Based on the type, the market is segmented into milling equipment, blending equipment, granulation equipment, drying equipment, coating equipment, filling equipment, packaging equipment, inspection and quality control equipment, sterilization equipment, and bioprocessing equipment.

Trends in the Type:

- Rising demand for bioprocessing equipment due to factors including reduced contamination risks, increased flexibility, faster turnaround times, and cost savings is boosting the pharmaceutical manufacturing equipment market size.

- Increasing trend in adoption of coating equipment to provide improved tablet stability, enhanced patient experience, and increased production efficiency.

The packaging equipment segment accounted for the largest revenue share of 21.50% in the pharmaceutical manufacturing equipment market share in 2024.

- Pharmaceutical packaging equipment encompasses a wide range of machinery designed to efficiently, accurately, and safely package medications and related products.

- This includes equipment for filling, sealing, labeling, and cartoning, all while adhering to strict regulatory standards like GMP.

- These machines are crucial for maintaining product integrity, ensuring patient safety, and facilitating accurate distribution.

- Modern pharmaceutical packaging equipment is designed for high-speed production and automation to meet the demands of the industry.

- Therefore, the aforementioned factors are boosting the pharmaceutical manufacturing equipment market growth.

The sterilization equipment segment is expected to register a significant CAGR during the forecast period.

- Pharmaceutical sterilization equipment is designed to eliminate or deactivate microorganisms, including bacteria, spores, and fungi, from pharmaceutical products, equipment, and environments.

- This process is crucial for ensuring the safety and efficacy of drug products and preventing contamination.

- Key types of equipment include autoclaves, dry heat sterilizers, steam sterilizers, and specialized systems including CIP/SIP (clean-in-place/sterilize-in-place).

- Moreover, sterilization processes are validated to ensure they consistently achieve the desired level of sterility.

- Thus, the aforementioned factors are expected to boost the pharmaceutical manufacturing equipment market trends during the forecast period.

By End-User:

Based on the end user, the market is segmented into pharmaceutical companies and contract manufacturing companies.

Trends in the End User:

- Rising adoption of modern pharmaceutical equipment that is designed to be flexible and adaptable to different production needs, allowing companies to easily adjust to changing market demands.

- Increasing trend in outsourcing manufacturing to allow companies to concentrate on R&D, marketing, and other strategic activities is boosting the pharmaceutical manufacturing equipment market size.

The pharmaceutical companies segment accounted for the largest revenue share in the pharmaceutical manufacturing equipment market share in 2024.

- Pharmaceutical equipment offers several key benefits to pharmaceutical companies, including increased efficiency, improved quality control, reduced costs, and enhanced regulatory compliance.

- Modern equipment automates processes, minimizing manual labor and human error, while also enabling more precise testing and analysis.

- This leads to faster production times, fewer defects, and lower overall costs, which makes medicines more accessible to patients.

- Therefore, the aforementioned factors are boosting the pharmaceutical manufacturing equipment market demand.

The contract manufacturing companies segment is expected to register the fastest CAGR during the forecast period.

- Pharmaceutical contract manufacturing offers significant benefits by leveraging specialized equipment and expertise, leading to cost savings, faster time-to-market, and increased flexibility.

- Contract manufacturers (CMOs) provide access to advanced technologies and streamlined processes, allowing companies to focus on R&D and marketing.

- CMOs possess specialized knowledge in drug manufacturing, regulatory compliance, and advanced equipment, ensuring high-quality production.

- Moreover, CMOs achieve economies of scale due to bulk purchasing and shared resources, resulting in lower production costs.

- Thus, the aforementioned factors are expected to boost the pharmaceutical manufacturing equipment market trends during the forecast period.

Regional Analysis:

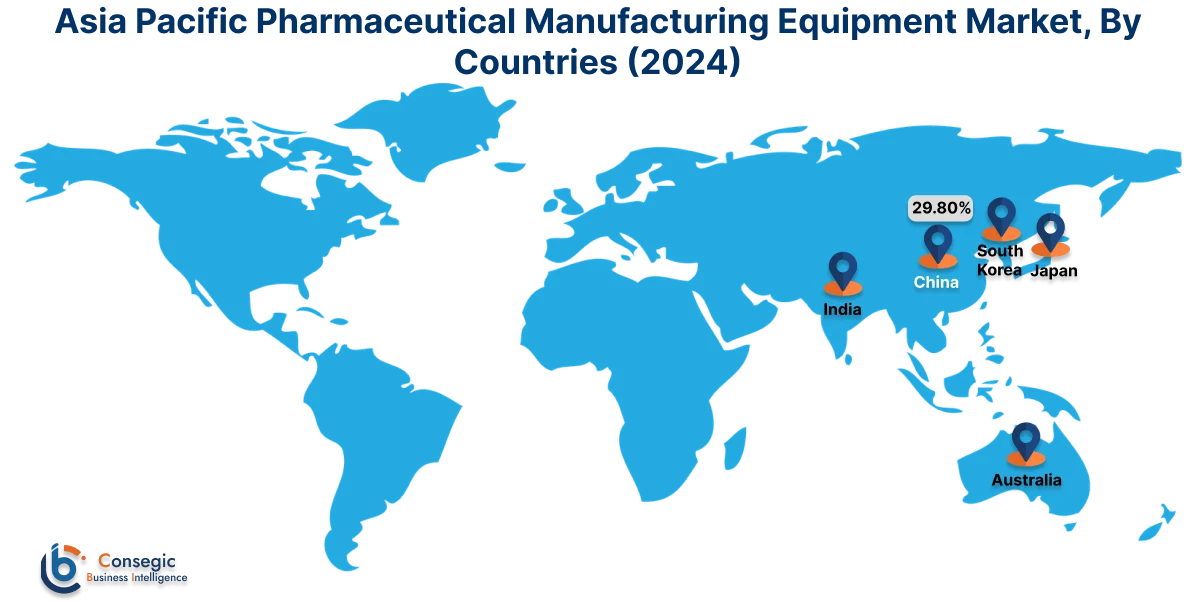

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 5.82 Billion in 2024. Moreover, it is projected to grow by USD 6.19 Billion in 2025 and reach over USD 11.08 Billion by 2032. Out of this, China accounted for the maximum revenue share of 29.80%. The pharmaceutical manufacturing equipment market analysis depicts that the market in the region is growing due to a large and expanding population, increasing healthcare access, and significant investments in the pharmaceutical sector.

- For instance, the Government of India allocated USD 11.50 Billion in the Union Budget 2025-26 for the healthcare sector. This investment is intended for development, enhancement, and maintenance of the healthcare system in the country. Thus, the aforementioned factors are driving the pharmaceutical manufacturing equipment market expansion.

North America is estimated to reach over USD 17.61 Billion by 2032 from a value of USD 9.66 Billion in 2024 and is projected to grow by USD 10.24 Billion in 2025. The market growth in the region is proliferating due to increasing demand for pharmaceuticals, technological advancements, and stringent regulatory requirements. The FDA and Health Canada impose strict quality and safety standards, requiring advanced and validated equipment. Therefore, the aforementioned factors are expected to create new pharmaceutical manufacturing equipment market opportunities in the region.

The pharmaceutical manufacturing equipment market analysis in Europe shows that the advancements in automation, process efficiency, and the adoption of Industry 4.0 principles are driving investments in pharmaceutical manufacturing equipment, in turn driving market growth. In Latin America, Middle East and Africa, the market growth is due to the increasing prevalence of chronic diseases, growing need for affordable healthcare solutions, and rising need for improved quality control and efficiency in production. Thus, the aforementioned factors are boosting the pharmaceutical manufacturing equipment market expansion.

Top Key Players and Market Share Insights:

The pharmaceutical manufacturing equipment industry is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global pharmaceutical manufacturing equipment market. Key players in the pharmaceutical manufacturing equipment industry include -

- GEA (Germany)

- SED Pharma (China)

- Paul Mueller Company (USA)

- ACG Worldwide (India)

- Bausch+Ströbel (Germany)

- Syntegon Technology (Germany)

- IMA Group (Italy)

- Glatt (Germany)

- Fette Compacting (Germany)

- Sartorius AG (Germany)

Pharmaceutical Manufacturing Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 41.64 Billion |

| CAGR (2025-2032) | 7.1% |

| By Type |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the pharmaceutical manufacturing equipment market? +

Pharmaceutical Manufacturing Equipment Market size is estimated to reach over USD 41.64 Billion by 2032 from a value of USD 22.73 Billion in 2024 and is projected to grow by USD 24.11 Billion in 2025, growing at a CAGR of 7.1% from 2025 to 2032.

What are the major segments covered in the pharmaceutical manufacturing equipment market report? +

The segments covered in the report are type, end user, and region.

Which region holds the largest revenue share in 2024 in the pharmaceutical manufacturing equipment market? +

North America holds the largest revenue share in the pharmaceutical manufacturing equipment market in 2024.

Who are the major key players in the pharmaceutical manufacturing equipment market? +

The major key players in the market are GEA (Germany), SED Pharma (China), Syntegon Technology (Germany), IMA Group (Italy), Glatt (Germany), Fette Compacting (Germany), Sartorius AG (Germany), Paul Mueller Company (USA), ACG Worldwide (India), Bausch+Ströbel (Germany), and others.