Platform Screen Doors Market Size :

Platform Screen Doors Market size is estimated to reach over USD 1,638.67 Million by 2030 from a value of USD 997.80 Million in 2022, growing at a CAGR of 6.5% from 2023 to 2030.

Platform Screen Doors Industry Scope & Overview:

Platform screen doors (PSDs) also known as platform edge doors or platform edge screens are safety barriers installed at subway stations. They act as a physical barrier between the platform and the tracks, enhancing passenger safety and improving the efficiency of train operations. Additionally, they consist of transparent panels made of sturdy materials namely glass and polycarbonate. The panels are installed along the platform edge and upon arrival of the train, the doors slide open simultaneously with the train doors, allowing passengers to board and exit safely.

Platform Screen Doors Market Insights :

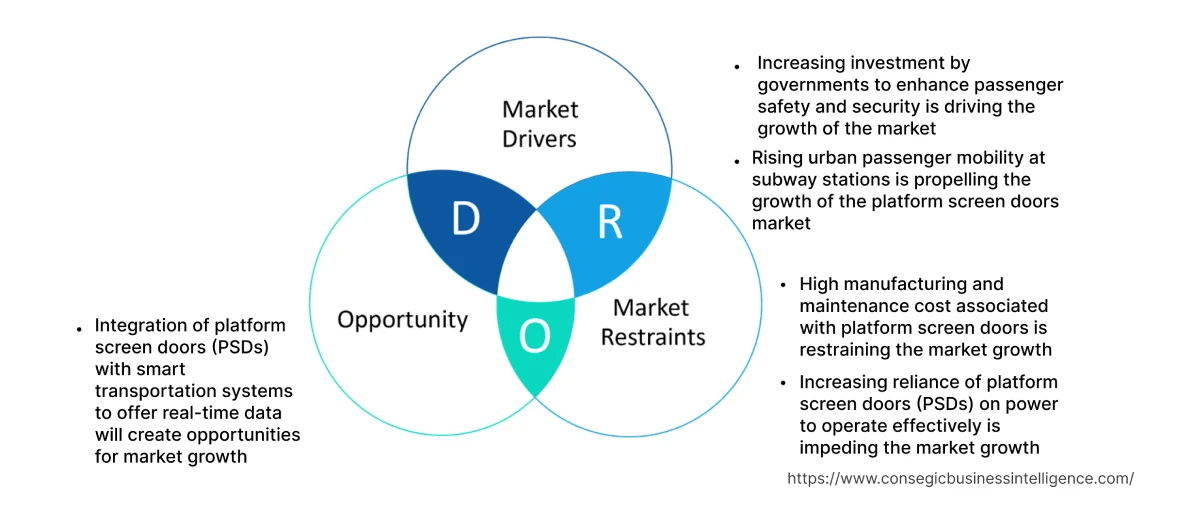

Platform Screen Doors Market Dynamics - (DRO) :

Key Drivers :

Increasing investment by governments to enhance passenger safety and security is driving the market

Governments worldwide are investing in infrastructure development projects to improve transportation systems and accommodate growing passenger volumes. Investments are being made in modernizing and upgrading the existing stations or constructing new ones. The inclusion of platform screen doors is a critical component of such projects as governments prioritize passenger safety and security. Additionally, governments are also engaged in Public-Private Partnerships (PPP) to finance and implement transportation infrastructure projects to improve the security of travelers including the installation of screen doors.

- For instance, in December 2022, the National Capital Region Transport Corporation announced that USD 1,455.5 million had been invested in the development of the Delhi Meerut regional rapid transit system project. The aim of the project is to reduce the travel time to one hour from three hours along with offering safety and security to the passengers through the installation of screen doors.

In conclusion, analysis of market trends depicts that the increasing investment by governments across the globe in upgrading the infrastructure to offer convenience and safety to passengers is driving the platform screen doors market demand.

Rising urban passenger mobility at subway stations is propelling the platform screen doors market growth.

The surge in urban passenger mobility increases the demand for efficient and safe transportation systems and PSDs provide an ideal solution to manage large crowds and improve passenger flow at busy stations. Higher passenger volumes lead to overcrowding on platforms and becomes challenging to ensure safety and maintain efficient operations. Platform screen doors help to manage the flow of passengers by providing controlled access points, facilitating smoother boarding and alighting processes, thus reducing platform congestion. Consequently, the increasing need to accommodate and handle the growing passenger volumes raises the demand for platform doors, contributing significantly to accelerating the market.

- For instance, in October 2022, according to JSA Tokyo Metro, in 2021, the Tozai Line of Tokyo Metro Station boarding accounted for 1.04 million passengers per day. Moreover, the numbers of boarding were expected to grow in recent years.

Accordingly, the market trends analysis shows that considering a surge in the number of passengers at subway stations increases the demand for platform doors to enhance the safety of passengers, thus contributing considerably to propelling the platform screen doors market expansion.

Key Restraints :

High manufacturing and maintenance costs associated with platform screen doors are restraining the market.

Setting up comprehensive platform screen doors involves large upfront costs including the retrofitting of existing transportation infrastructure and the purchase of expensive components such as vinyl-coated fiberglass. Additionally, platform doors require regular maintenance and monitoring to ensure their proper functioning including repairs, sensors, and providing technical assistance to users. Subsequently, the market trends analysis shows that the high manufacturing and maintenance costs lead to a slower adoption rate of platform doors by small enterprises, thus restraining the platform screen doors market growth.

The increasing reliance on platform screen doors (PSDs) for power to operate effectively is impeding market progress.

PSDs require a stable and reliable power supply to function properly which is a limitation in areas including India and Indonesia with inadequate power infrastructure. Transportation operators need to ensure a reliable power supply and investment in backup power systems to maintain the functionality of PSDs. The need for robust power infrastructure and backup solutions increases the overall implementation costs, thus restraining the platform screen doors market demand.

Moreover, platform doors consume a large amount of energy to operate continuously, especially in high-traffic areas. The increased energy consumption contributes to environmental concerns, particularly in terms of carbon emissions and energy efficiency. Consequently, the trends analysis depicts that the increased reliance on and consumption of power by platform doors serves as the major factor in restraining the global market.

Future Opportunities :

Integration of platform screen doors (PSDs) with smart transportation systems to offer real-time data will create opportunities for market growth.

The integration of PSDs with smart transportation systems allows to gathering of real-time data on passenger flow, platform utilization, and train schedules. The data collected is analyzed to optimize operations, improve passenger flow management, and enhance overall system efficiency. Transportation authorities and operators utilize such information to make data-driven decisions, identify bottlenecks, and implement strategies for better crowd management. Subsequently, the market trends conclude that the availability of real-time data and analytics creates opportunities for platform screen door manufacturers to offer advanced solutions, thus creating potential platform screen doors market opportunities.

Global Platform Screen Doors Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 1,638.67 Million |

| CAGR (2023-2030) | 6.5% |

| Based on the Product Type | Full-Height, Semi-Height, and Half-Height |

| Based on the Application | Airport, Metro, and Bus Stop |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | KTK Group Company Ltd., Pioneer-Fangda Metro Consortium, Fangda Group Co., Ltd., Horton Automatics Ltd, Knorr-Bremse AG, Manusa, Wabtec Corporation, Siemens, Nabtesco Corporation, Nanjing Kangni Mechanical & Electrical Co., Ltd., SHANGHAI ELECTRIC GROUP CO., LTD, ZITIN CORPORATION, Zhuzhou CRRC Times Electric Co. Ltd. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Platform Screen Doors Market Segmental Analysis :

By Product Type :

The product type segment is trifurcated into full-height, semi-height, and half-height.

Full-height platform screen doors accounted for the largest market share of the total platform screen doors market share in 2022 as full-height doors provide a complete barrier between the platform and tracks, offering the highest level of safety and security. The doors prevent accidental falls and intentional acts including suicides or trespassing. Additionally, full-height platform doors help to mitigate noise, wind, and temperature variations, improving passenger comfort, and thus contributing significantly to driving the platform screen doors market expansion. Furthermore, passenger screen doors with full height contribute to enhancing the overall operational efficiency of transportation systems by providing a controlled entry and exit point for passengers. Full-height PSDs also help to regulate passenger flow, reduce platform congestion, and minimize dwell times at stations.

- For instance, in July 2020, ENGIE Solutions and Portalp received contracts from (Régie Autonome des Transports Parisiens) RATP and Société du Grand Paris (SGP) respectively for the installation of 672 full-height platform screen doors for three metro lines by 2024. The doors are installed to improve the infrastructure of the metro stations and also to offer convenience and security to passengers in France.

The semi-height platform screen doors are projected to witness the fastest CAGR during the forecast period. The growth of the market is credited to the ability of semi-height doors to provide a mid-level barrier between safety and comfort, suitable for transportation systems. In addition, semi-height platform doors are a cost-effective solution compared to full-height platform doors, further driving the adoption of semi-height doors. Moreover, retrofitting existing transportation infrastructure with full-height PSDs is a costly process due to space constraints. Semi-height PSDs, with partial coverage, are more easily integrated into existing platforms, requiring fewer alterations to the infrastructure. Consequently, the segmental analysis shows that the ability of semi-height PSDs to retrofit and upgrade existing stations increases their adoption in retrofit projects, thus contributing notably to propelling the platform screen doors market trends in the upcoming years.

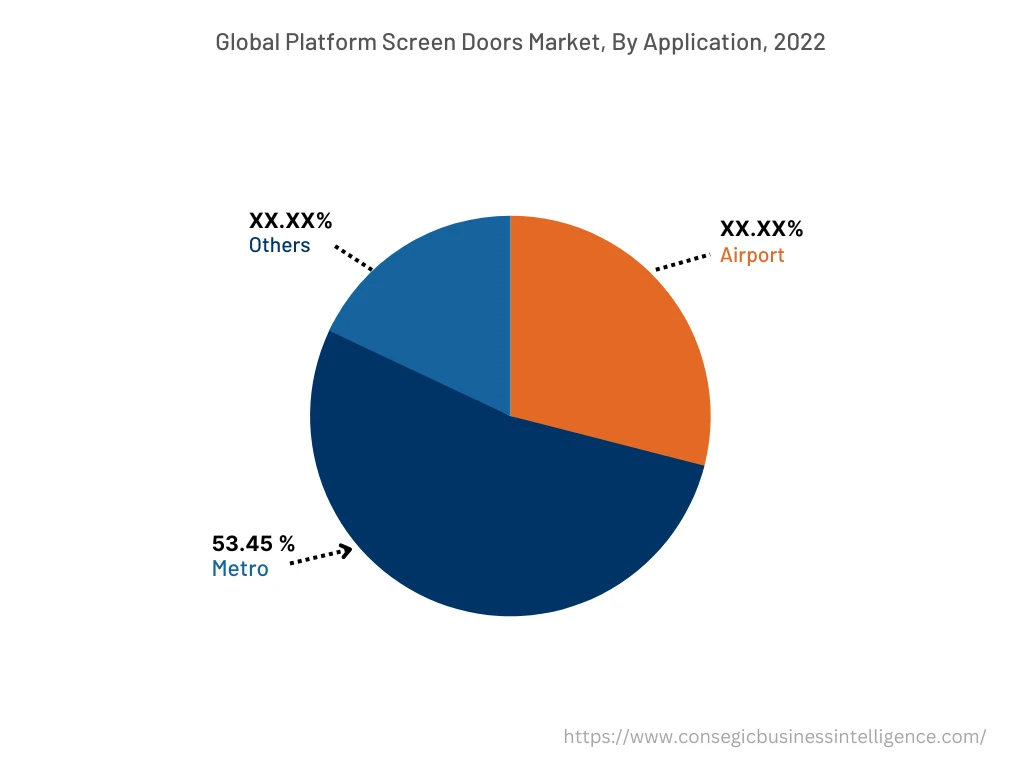

By Application :

The application segment is classified into airport, metro, and bus stops.

Metro stations accounted for the largest market share of 53.45% of the overall platform screen doors market share in 2022 as metro stations handle a significantly larger volume of passengers compared to airports and bus stops. Metro stations experience high passenger traffic during peak hours which raises the demand for the implementation of PSDs for managing the crowd and ensuring passenger safety. Additionally, the segmental trends analysis shows that the increasing investment by the government in Public-Private Partnerships (PPP) to improve the transportation infrastructure including the installation of platform doors is also contributing significantly to bolstering the market growth.

- For instance, in April 2022, Maharashtra Metro Rail Corporation Limited (MAHA-METRO) signed a contract with KTK Group Company Ltd., Janatics India Private Limited, ADS Rail Co. Ltd., and Pioneer-Fangda Metro Consortium for the manufacturing, supply, and installation of passenger screen doors for Pune Metro.

Airports are projected to witness the fastest CAGR in the platform screen doors market during the forecast period. The growth of the market is attributed to the increasing air passenger traffic that raises the demand for passenger screen doors for enhanced safety measures and improved passenger flow management. Additionally, the government is also investing heavily in improving the infrastructure of the airports by initiating several projects to accommodate growing passenger numbers and improve operational efficiency. Passenger safety doors are ideal for ensuring passenger safety and facilitating a smoother flow of passengers through the terminal, thus contributing notably to spurring the growth of the market. For instance, in May 2023, the Government of the Bahamas invested USD 400 Million for the redevelopment of the Grand Bahama International Airport. The investment is made to upgrade the existing infrastructure including the installation of passenger screen doors and also to improve the security of the travelers, thus contributing considerably to propelling the platform screen doors market trends.

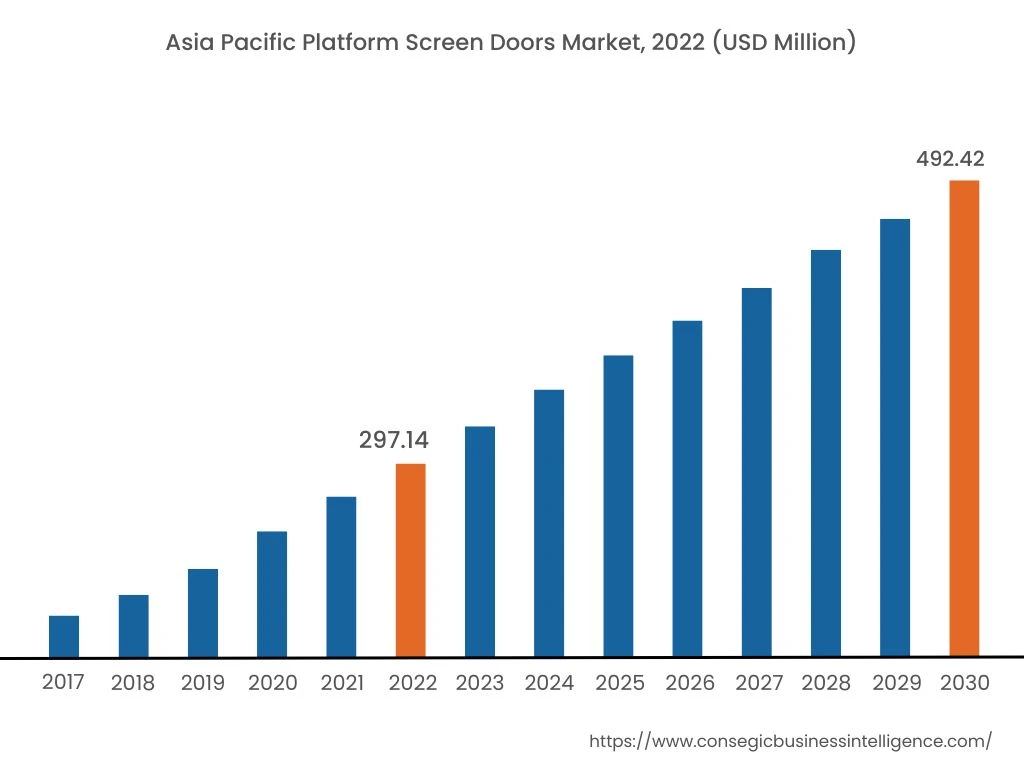

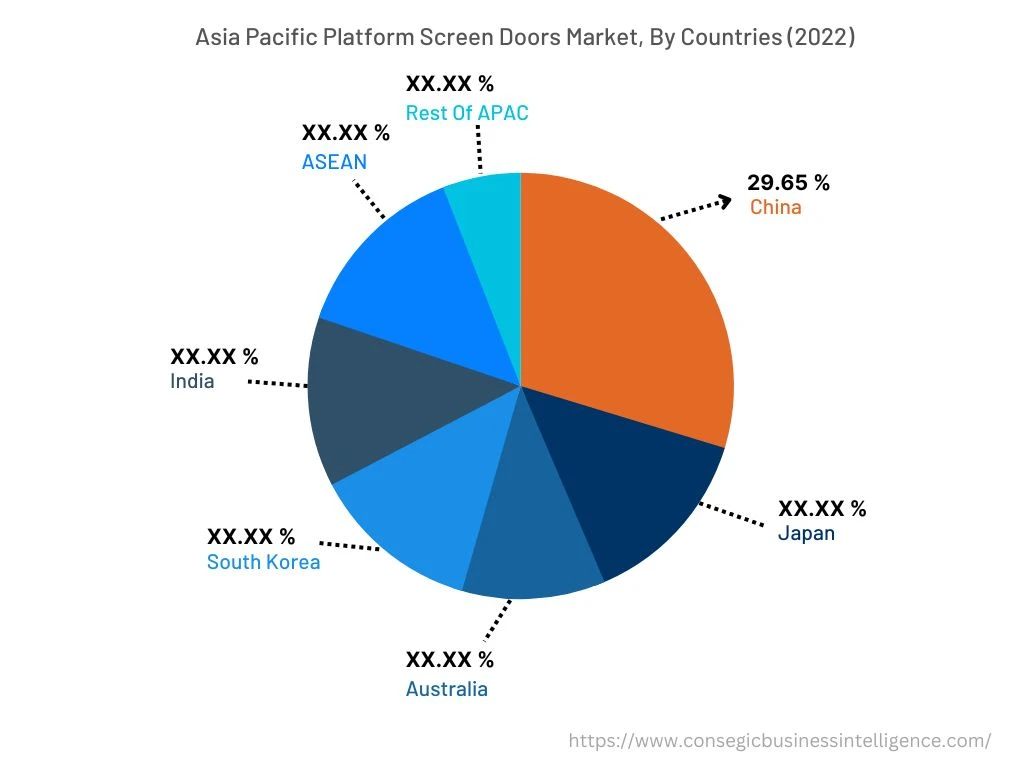

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific accounted for the largest market share of USD 297.14 million in 2022 and is expected to register the fastest CAGR of 6.7% accounting for USD 492.42 million in 2030 in the platform screen doors market. In addition, in the region, China accounted for the maximum revenue share of 29.65% in the year 2022. As per the platform screen doors market analysis, the growth in the region is attributed to the increasing investment by the government in transportation infrastructure projects. Governments are focusing on improving public transportation systems, including metro networks, to cater to the rising demand for efficient and sustainable transportation. The infrastructure investments create opportunities for the installation of platform doors that are essential for enhancing passenger safety, security, and operational efficiency.

- For instance, in May 2023, the Hitachi Toshiba supreme consortium received an order for the development of 12 sets of advanced high-speed trains from the Taiwan high-speed rail corporation. The government invested 124 billion Japanese Yen to improve the infrastructure including the installation of platform doors.

Top Key Players & Market Share Insights:

The competitive landscape of the global platform screen doors market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and application launches have accelerated the market. Key players in the platform screen doors industry include-

- KTK Group Company Ltd.

- Pioneer-Fangda Metro Consortium

- Nabtesco Corporation

- Nanjing Kangni Mechanical & Electrical Co., Ltd.

- SHANGHAI ELECTRIC GROUP CO., LTD

- ZITIN CORPORATION

- Zhuzhou CRRC Times Electric Co. Ltd.

- Fangda Group Co., Ltd.

- Horton Automatics Ltd

- Knorr-Bremse AG

- Manusa

- Wabtec Corporation

- Siemens

Recent Industry Developments :

- In April 2023, Chennai Metro Rail Ltd signed a contract with Zhuzhou CRRC Times Electric Co. Ltd. worth USD 12.14 million for the installation of passenger screen doors at Chennai Metro. The installation of half-height PSDs will be at 36 platforms whereas full-height PSDs will be installed at 18 platforms.

- In September 2020, the National Capital Region Transport Corporation (NCRTC) collaborated with Bharat Electronics Limited (BEL) for the development of platform screen doors. The doors are designed to improve the safety of the passengers under the ‘Atmanirbhar Bharat' scheme and also to improve the operational efficiency of the metros.

Key Questions Answered in the Report

What are platform screen doors? +

Platform screen doors (PSDs) also termed as platform edge doors are safety barriers installed at subway stations responsible for enhancing passenger safety and improving the efficiency of train operations.

What specific segmentation details are covered in the platform screen doors market report, and how is the dominating segment impacting the market growth? +

Full-height platform screen doors (PSDs) dominate the market as the doors prevent accidental falls and intentional acts including suicides or trespassing. Additionally, full-height platform screen doors help to mitigate noise, wind, and temperature variations, improving passenger comfort, thus contributing significantly in driving the growth of the market.

What specific segmentation details are covered in the platform screen doors market report, and how is the fastest segment anticipated to impact the market growth? +

Airports are expected to witness the fastest CAGR owing to the increasing air passenger traffic that raises the demand of passenger screen doors for enhanced safety measures and improved passenger flow management.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is expected to witness the fastest CAGR during the forecast period in the platform screen doors owing to the increasing investments by the government to enhance the metro infrastructure.