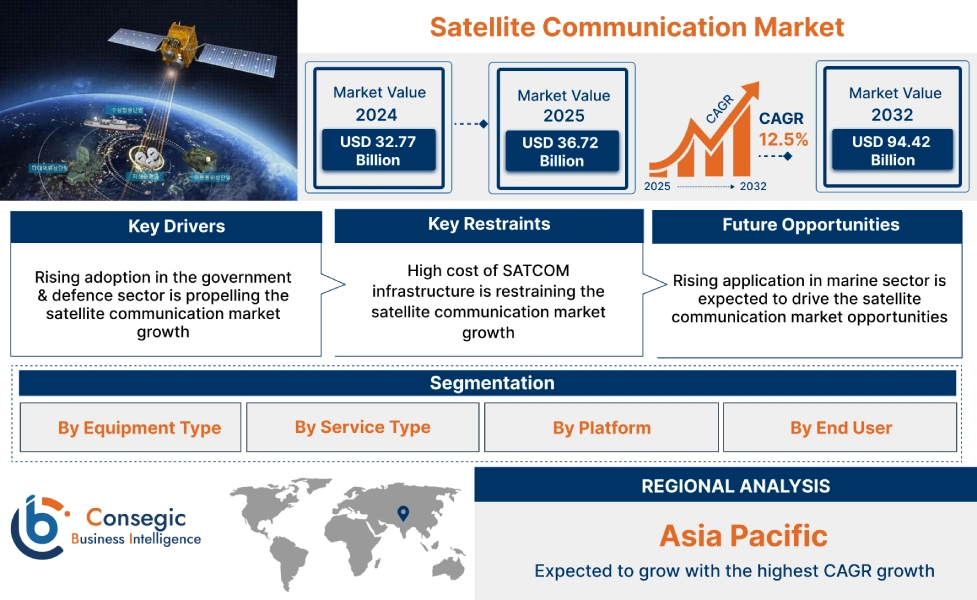

Satellite Communication Market Size:

Satellite Communication Market size is estimated to reach over USD 94.42 Billion by 2032 from a value of USD 32.77 Billion in 2024 and is projected to grow by USD 36.72 Billion in 2025, growing at a CAGR of 12.5% from 2025 to 2032.

How is AI Impacting the Satellite Communication Market?

AI is impacting the satellite communication market by automating and optimizing operations, enhancing data analysis, and improving network performance. AI algorithms are being used for real-time network management, dynamically allocating bandwidth to meet demand and prevent congestion. This technology also enables predictive maintenance by analyzing telemetry data to foresee and prevent equipment failures. Furthermore, AI-powered systems can process the massive amounts of data from satellite imagery much more efficiently than humans, making applications like climate monitoring and disaster response faster and more accurate. This leads to increased reliability, efficiency, and intelligence within the satellite ecosystem.

Satellite Communication Market Scope & Overview:

Satellite communication, also known as SATCOM, involves using satellites orbiting the Earth to relay and transmit radio signals, which enables communication between different points on the planet. SATCOM enables long-distance communication, including internet, voice, and television services. It is specifically useful in areas where traditional communication infrastructure is unavailable. Moreover, satellite communication offers several benefits, including global coverage, flexibility, high-speed connectivity, and reliability, among others.

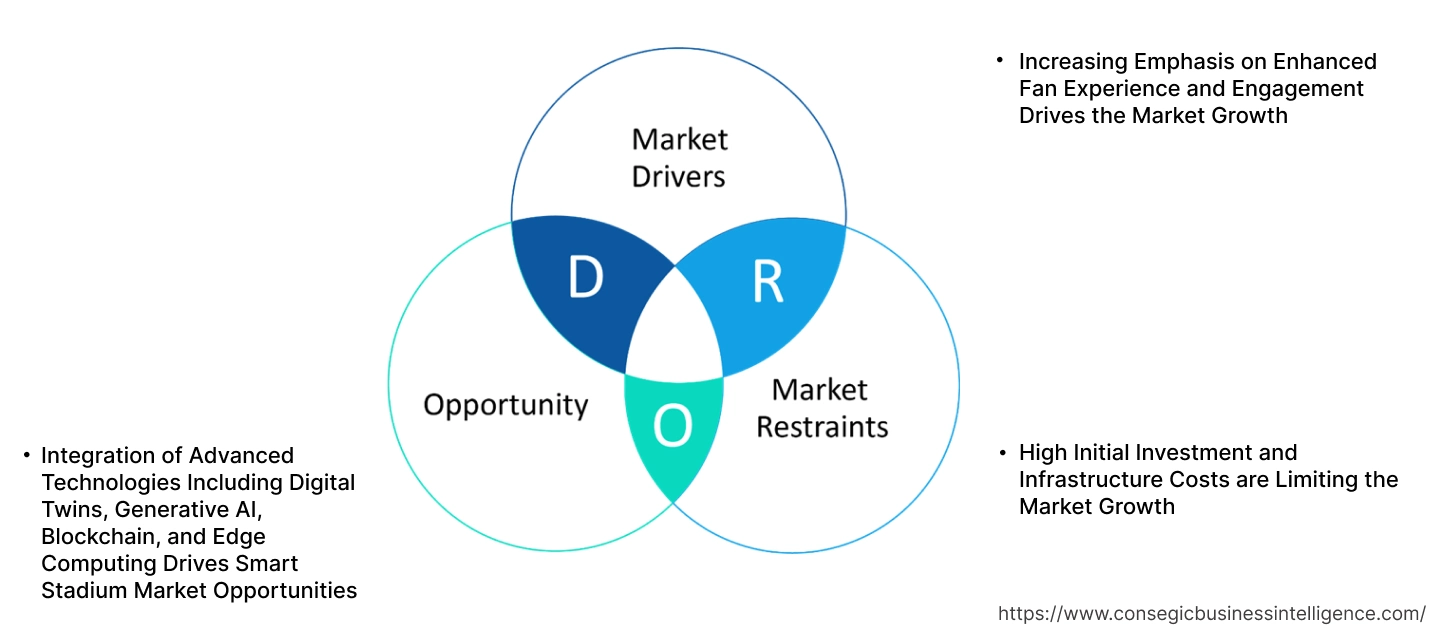

Satellite Communication Market Dynamics - (DRO) :

Key Drivers:

Rising adoption in the government & defence sector is propelling the satellite communication market growth

SATCOM is primarily used in the government & defence sector for applications involving connected aircraft, unmanned vehicles and systems, and other ground-based military vehicles, among others. SATCOM system includes various components, including a high-power amplifier, satellite data unit, and an antenna with a steerable beam, which enables defence aircraft or military vehicles to communicate with air traffic control and its operations centre through satellites. Moreover, SATCOM offers reliable and efficient connectivity at multiple frequency bands, including X, Ku, and Ka bands, even over rough terrain and the harshest environments. The aforementioned features of SATCOM are increasing its adoption in the government & defence sector.

- For instance, according to the European Defense Agency, the general budget for the European Defence Agency was valued at USD 54,095.5 million in 2024, witnessing an increase of 11.1% in comparison to USD 48,704.4 million in 2023.

Hence, the growing military & defence sector is increasing the adoption of SATCOM for transferring signals to offer reliable network connectivity and communication among connected aircraft, unmanned vehicles and systems, and ground-based military vehicles. The above factors are further driving the satellite communication market size.

Key Restraints:

High cost of SATCOM infrastructure is restraining the satellite communication market growth

The deployment of SATCOM infrastructure is usually associated with high costs, which is one of the primary factors restricting the market growth. The overall cost of building a SATCOM infrastructure is primarily dependent on the cost of production, followed by the cost of components, including antennas, receivers, transmitters, and others, required for building the SATCOM architecture.

- For instance, the cost of basic SATCOM tracking devices for utilization in aircraft ranges from USD 1,500 to USD 3,000. Likewise, the cost of high-capacity SATCOM multi-systems for aircraft ranges from USD 50,000 in most cases to USD 100,000 in specific cases, depending on the specification of the system, which is relatively very high.

Therefore, the high cost associated with the deployment of SATCOM infrastructure is hindering the satellite communication market expansion.

Future Opportunities :

Rising application in marine sector is expected to drive the satellite communication market opportunities

SATCOM is often utilized in the marine sector for connectivity, weather monitoring, and navigation applications in commercial ships, yachts, offshore support vessels, and passenger ships. Maritime SATCOM systems are dependent upon services operating on certain frequencies, including L-band, Ku-band, C-band, and Ka-band, among others. Moreover, the integration of SATCOM systems ensures effective connectivity by measuring the movement of the ship and adjusting time delays on each micro-antenna for obtaining optimal signals, which are key determinants for increasing its application in the marine sector.

- For instance, in September 2024, ThyssenKrupp Marine Systems and NVL signed a cooperation agreement to facilitate the joint construction of MEKO A-400 AMD, which is a ship concept particularly developed to meet the requirements of a German Navy defense frigate. The MEKO A-400 AMD offers an improved energy supply for future weapon and command systems. The ship also features a new hull that provides more space for the installation of missiles, along with facilitating a high cruising speed for multi-national task forces.

Hence, as per the analysis, the aforementioned factors are projected to boost the satellite communication market opportunities during the forecast period.

Satellite Communication Market Segmental Analysis :

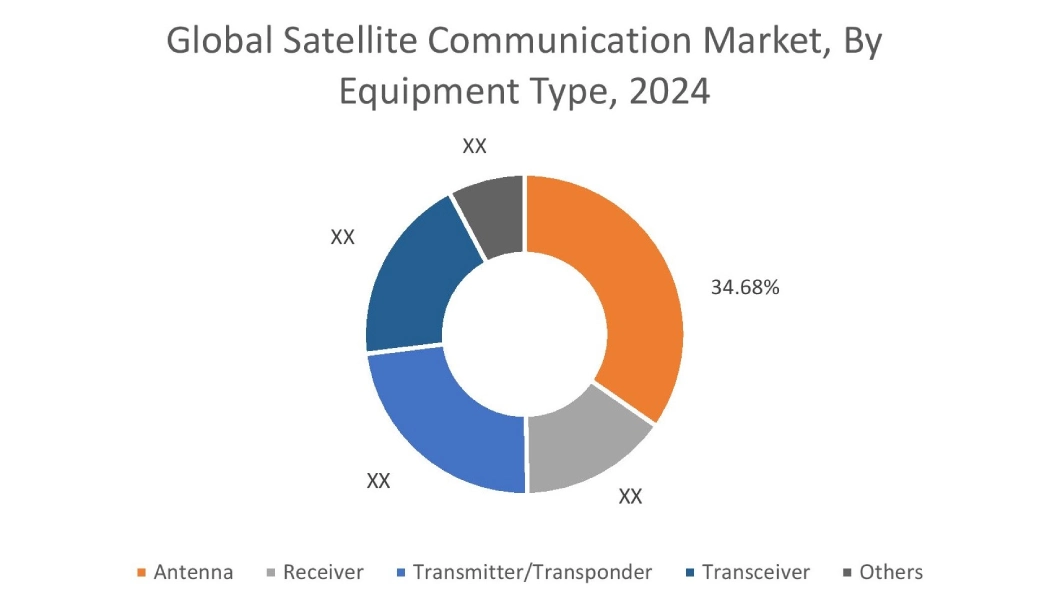

By Equipment Type:

Based on equipment type, the market is segmented into antenna, receiver, transmitter/transponder, transceiver, and others.

Trends in the equipment type:

- Rising trend towards the adoption of SATCOM antennas in the marine, military & defense, and aviation sectors is driving the market growth.

- Factors including ease of integration and implementation, higher flexibility, faster data transmission, and reduced environmental footprint are among the key prospects driving the transceiver segment.

Antenna segment accounted for the largest revenue share of 34.68% in the overall satellite communication market share in 2024.

- SATCOM antennas refer to antennas that are mainly employed to offer communication links in SATCOM applications.

- SATCOM antennas are utilized for sending and receiving signals from the satellite. SATCOM antennas support a wide range of frequency bands, including the UHF band, VHF band, C band, X band, L band, DBS band, Ku band, and Ka band.

- Moreover, antennas are also available in various polarization options such as horizontal, linear, vertical, circular, and X polarization.

- Additionally, SATCOM antennas offer multiple features such as reliable connectivity, low-profile installation options, electronic steering for low maintenance, simple power-on start-up, and auto-acquisition for easy operation.

- For instance, in August 2022, Cobham Satcom, a European manufacturer of SATCOM solutions, launched its two new Ka-band antenna systems for satellite communication services. The newly launched SATCOM antennas offer various benefits such as simplified installation, high radio frequency performance, and remote access for efficient monitoring and support to ensure seamless connectivity.

- Consequently, the increasing advancements related to SATCOM antennas are driving the satellite communication market trends.

The transceiver segment is anticipated to register the fastest CAGR during the forecast period.

- In a satellite communication system, a transceiver refers to an electronic device that is a combination of a radio transmitter and a receiver.

- Transceivers are capable of transmitting and receiving signals and radio waves from an antenna for communication purposes.

- SATCOM systems often use full-duplex transceivers on the subscriber points based on the surface.

- Moreover, transceivers offer various benefits such as ease of integration and implementation, reduced manufacturing costs, easy upgrades, higher flexibility, and reduced environmental footprint, which are the primary determinants increasing its implementation in SATCOM system.

- For instance, Iridium Communications Inc. offers the Iridium Certus 9770 transceiver in its product offerings, which is a small form factor SATCOM transceiver that is capable of transferring IP data at a much faster rate while supporting high-quality voice connections.

- Thus, the rising advancements associated with SATCOM transceivers are expected to drive the market during the forecast period.

By Service Type:

Based on service type, the market is segmented into mobile satellite services (MSS), fixed satellite services (FSS), and broadband satellite services (BSS).

Trends in the service type:

- Increasing adoption of fixed satellite services (FSS) for supporting various applications, including television broadcasting, telephone calls, and internet connectivity, is driving the market growth.

- Rising trend in utilization of broadband satellite services (BSS), attributed to its several benefits, including rapid deployment, coverage extension, improved scalability, and enhanced service quality.

The fixed satellite services (FSS) segment accounted for the largest revenue share in the total satellite communication market share in 2024.

- Fixed satellite services (FSS) use satellites to establish communication links between earth stations at fixed locations.

- Moreover, FSS often utilizes geostationary satellites that appear stationary relative to a point on Earth.

- Fixed satellite services require fixed ground-based equipment, such as antennas, at specific locations for transmitting and receiving signals.

- Additionally, these services play a vital role in supporting various applications, including telephone calls, television broadcasting, and internet connectivity, among others.

- Therefore, the increasing adoption of fixed satellite services in telecommunication, broadcasting, and other related applications is driving the satellite communication market trends.

The broadband satellite services (BSS) segment is anticipated to register a substantial CAGR during the forecast period.

- Broadband satellite services (BSS) provide high-speed internet access through satellite, which is particularly useful in areas where traditional terrestrial broadband is unavailable.

- Moreover, BSS leverages satellite technology to deliver connectivity for several applications, including residential internet, business solutions, government services, and emergency responses, among others.

- Further, broadband satellite services offer a range of benefits, including coverage extension, rapid deployment, improved scalability, enhanced service quality, and others.

- Thus, the above benefits of broadband satellite services are expected to drive its adoption, in turn propelling the satellite communication market size during the forecast period.

By Platform:

Based on platform, the market is segmented into portable SATCOM, airborne SATCOM, land SATCOM, and maritime SATCOM.

Trends in the platform:

- Increasing adoption of airborne SATCOM for providing reliable and high-speed internet and communication services to aircraft during flight operations is driving the market.

- Rising trend in utilization of maritime SATCOM to facilitate voice, data, and video transmission for supporting various maritime applications, ranging from basic ship-to-shore communication to complex navigation and remote monitoring systems.

Airborne SATCOM segment accounted for a significant revenue in the overall market in 2024.

- Airborne SATCOM provides reliable and high-speed internet and communication services to aircraft, which enables them to connect with ground stations and other aircraft during the flight.

- Moreover, the utilization of airborne SATCOM offers various benefits, including enhanced connectivity, improved efficiency, operational flexibility, and increased safety.

- Additionally, airborne SATCOM plays a crucial role in a wide range of applications, including commercial aviation, government and defense operations, and disaster management, among others.

- According to the market analysis, the aforementioned factors are further driving the market.

The maritime SATCOM segment is anticipated to register a significant CAGR during the forecast period.

- Maritime SATCOM utilizes orbiting satellites to enable communication between sea-based vessels and land-based facilities.

- It ensures reliable communication in the maritime sector, particularly in remote or open ocean environments.

- Moreover, maritime SATCOM enables voice, data, and video transmission, in turn supporting various applications from basic ship-to-shore communication to complex navigation and remote monitoring systems, which play a crucial role in maritime safety, operations, and logistics.

- For instance, in June 2025, Alen Space placed the SATMAR satellite into orbit for boosting the digitalization of maritime communications. This aims at facilitating bi-directional satellite communications in the VHF band, even in remote offshore areas.

- Thus, the above factors are expected to drive the adoption of maritime SATCOM, in turn driving the market during the forecast period.

By End Use:

Based on end use, the market is segmented into commercial and government & defense.

Trends in the end use:

- Increasing adoption of SATCOM in commercial sector, including telecommunication, media & broadcasting, enterprise networks, and others, for facilitating high-speed connectivity and data transmission.

- There is a rising trend towards the utilization of SATCOM in the government & defense industry to support secure military communications, ISR (intelligence, surveillance, and reconnaissance) operations, and other related applications.

Commercial segment accounted for the largest revenue share in the overall market in 2024.

- SATCOM plays a vital role in the commercial sector, including media & broadcasting, energy & utilities, telecommunication, healthcare, oil & gas, mining, and others.

- In the telecommunication sector, satellite services are crucial for providing voice, data, and video communication, particularly in areas with limited or no terrestrial infrastructure.

- Moreover, SATCOM plays an essential role in the media & broadcasting sector for transmitting television and radio programming to affiliates and cable television headend.

- Additionally, industries such as oil & gas and mining rely significantly on SATCOM for reliable connectivity in remote locations, in turn supporting operational efficiency and safety.

- For instance, in March 2025, Cobham Satcom and Space42 launched IP NEO, which is their new satellite broadband terminal intended for commercial usage. IP NEO offers high-speed connectivity, seamless data transmission, and robust network resilience in remote locations where terrestrial networks are not available.

- According to the market analysis, the aforementioned factors are driving the market demand.

The government & defense segment is anticipated to register the fastest CAGR during the forecast period.

- SATCOM plays a vital role in modern defense and government operations, providing reliable communication, navigation, and intelligence gathering capabilities, particularly in remote or harsh environments.

- Moreover, SATCOM is primarily used in the government & defence sector for applications involving connected aircraft, unmanned vehicles and systems, and other ground-based military vehicles, among others.

- Additionally, SATCOM offers reliable and efficient connectivity at multiple frequency bands, including X, Ku, and Ka bands, even over rough terrain and the harshest environments, thereby increasing its adoption in the government & defense sector.

- Therefore, the growing government & defense sector is projected to drive market growth during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

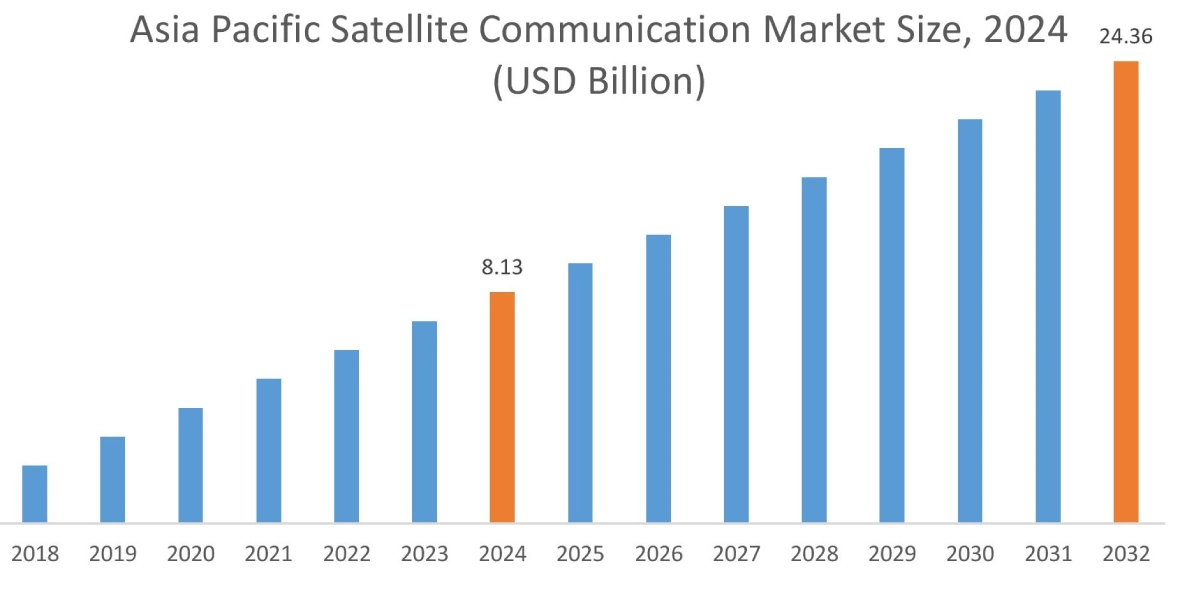

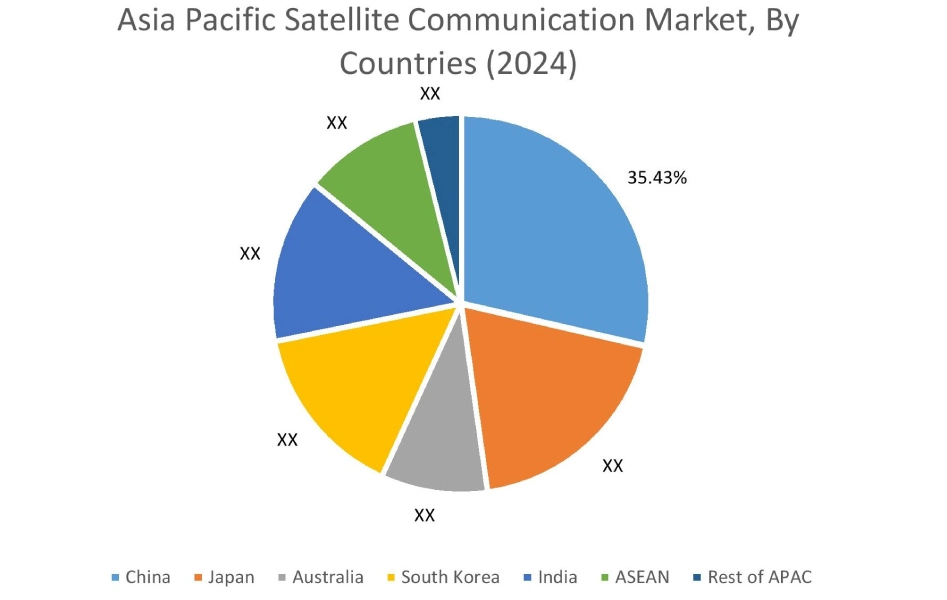

Asia Pacific region was valued at USD 8.13 Billion in 2024. Moreover, it is projected to grow by USD 9.14 Billion in 2025 and reach over USD 24.36 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.43%. As per the satellite communication market analysis, the adoption of SATCOM in the Asia-Pacific region is primarily driven by growing transportation, healthcare, and telecommunication sectors, among others. Additionally, rising investments in the government & defense sector and increasing demand for reliable and secure communication services to facilitate military operations are further accelerating the satellite communication market expansion.

- For instance, the Government of India allocated approximately USD 70.6 billion to the Ministry of Defense as part of its Union Budget 2022-23. The aforementioned factors are anticipated to drive market growth in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 33.05 Billion by 2032 from a value of USD 11.59 Billion in 2024 and is projected to grow by USD 12.97 Billion in 2025. In North America, the growth of the satellite communication industry is driven by growing investments in aviation, healthcare, telecommunication, defense, and other sectors. Moreover, the increasing adoption of SATCOM in the aviation & defense sector for providing reliable and high-speed internet and communication services to aircraft during flight operations is contributing to the satellite communication market demand.

Meanwhile, according to the regional analysis, factors including the presence of several military & defense organizations, expanding maritime fleet, along with rising demand for high-speed connectivity solutions for maritime and defense applications are driving the satellite communication market demand in Europe. In addition, according to the satellite communication market analysis, the market demand in Latin America, Middle East, and African regions is projected to rise at a significant rate due to factors such as significant investments in government & defense sector, rising oil & gas operations, expanding telecom infrastructure, and increasing adoption of SATCOM for facilitating reliable connectivity in remote locations, among others.

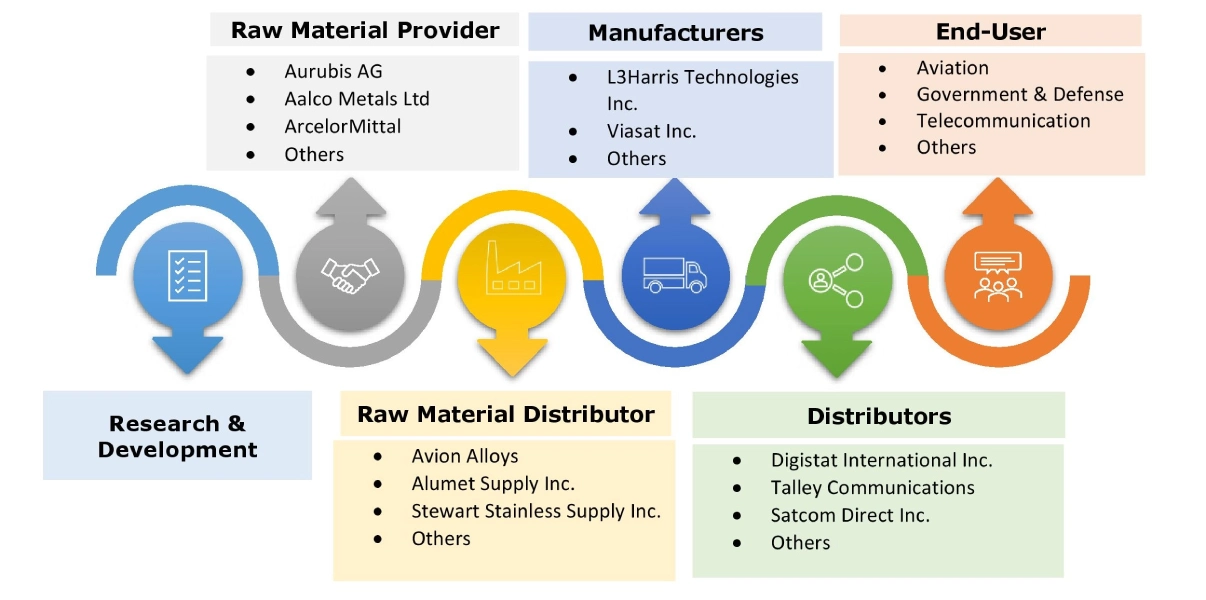

Top Key Players and Market Share Insights:

The global satellite communication market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the satellite communication market. Key players in the satellite communication industry include-

- Iridium Communications Inc. (U.S)

- L3Harris Technologies Inc. (U.S)

- Qualcomm Technologies Inc. (U.S)

- Boeing (U.S)

- SES S.A. (Luxembourg)

- Viasat Inc. (U.S)

- Sky Perfect JSAT Group (Japan)

- Thuraya Telecommunications Company (UAE)

- Inmarsat Global Limited (United Kingdom)

- EchoStar Corporation (U.S)

- Intelsat (U.S)

Recent Industry Developments :

Product Launch:

- In March 2025, Orbit Communication Systems Ltd. introduced its new MPT30Ka model of deployable SATCOM system, which is designed for quick deployment in the field. The SATCOM system offers secure and uninterrupted connectivity for military & defense forces operating in complex and dynamic environments.

Agreement:

- In April 2025, Intelsat won a U.S. Space Force contract for providing commercial SATCOM equipment and services to the U.S. Defense Department to facilitate global maritime coverage.

Satellite Communication Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 94.42 Billion |

| CAGR (2025-2032) | 12.5% |

| By Equipment Type |

|

| By Service Type |

|

| By Platform |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the satellite communication market? +

The satellite communication market was valued at USD 32.77 Billion in 2024 and is projected to grow to USD 94.42 Billion by 2032.

Which is the fastest-growing region in the satellite communication market? +

Asia-Pacific is the region experiencing the most rapid growth in the satellite communication market.

What specific segmentation details are covered in the satellite communication report? +

The satellite communication report includes specific segmentation details for equipment type, service type, platform, end use, and region.

Who are the major players in the satellite communication market? +

The key participants in the satellite communication market are Iridium Communications Inc. (U.S), L3Harris Technologies Inc. (U.S), Viasat Inc. (U.S), Sky Perfect JSAT Group (Japan), Thuraya Telecommunications Company (UAE), Inmarsat Global Limited (United Kingdom), EchoStar Corporation (U.S), Intelsat (U.S), Qualcomm Technologies Inc. (U.S), Boeing (U.S), SES S.A. (Luxembourg), and others.