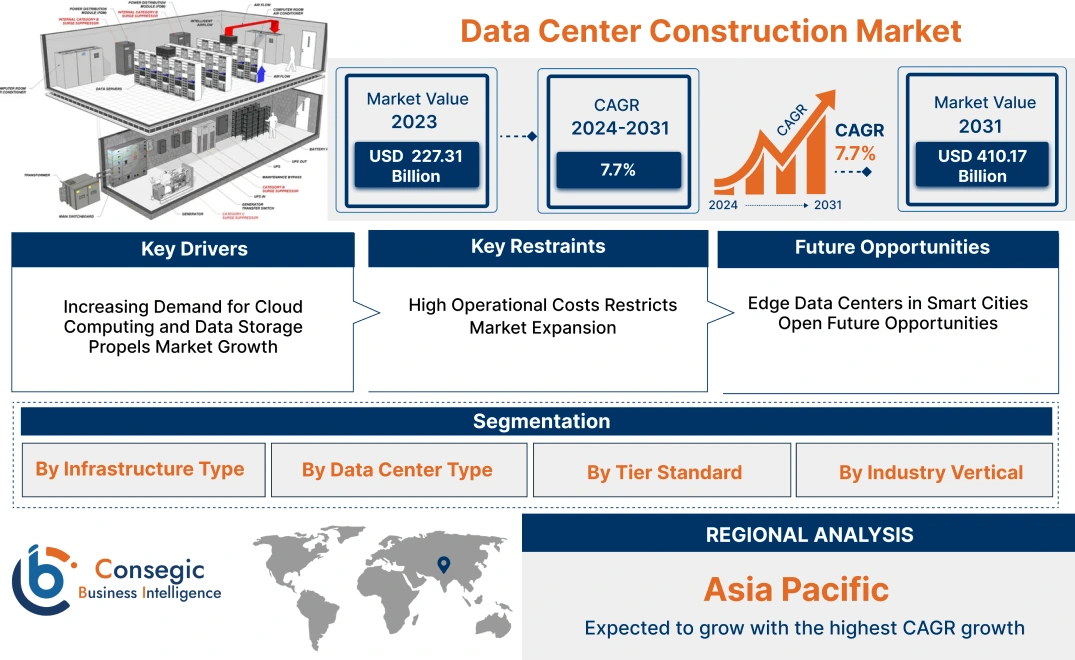

Data Center Construction Market Size:

Data Center Construction Market size is estimated to reach over USD 469.86 Billion by 2032 from a value of USD 240.67 Billion in 2024 and is projected to grow by USD 257.01 Billion in 2025, growing at a CAGR of 7.8% from 2025 to 2032.

How is AI Impacting the Data Center Construction Market?

AI is significantly impacting the data center construction market by driving unprecedented demand for new facilities and necessitating upgrades to existing ones. This is primarily due to the exponential growth of AI workloads, which require high-performance computing and substantial power and cooling resources. The rise of AI applications is fueling a surge in demand for data center capacity, leading to increased construction activity. Additionally, AI is enabling more sustainable construction practices, with a focus on using low-carbon materials such as mass timber and optimizing energy consumption through predictive maintenance. Thus, the increased demand is leading to a surge in data center construction and investments.

Data Center Construction Market Scope & Overview:

Data center construction involves planning, designing, and building data center facilities that include computer systems, servers, storage devices, and associated IT equipment required for processing, storing, and managing data. Moreover, data centers play a vital role in businesses and organizations that rely on IT infrastructure to support their operations, applications, and services. Additionally, the growing need for cloud services and rising investments in data centers are among the key factors driving the data center construction market.

Data Center Construction Market Insights:

Data Center Construction Market Dynamics - (DRO) :

Key Drivers:

Increasing cloud deployment is propelling the data center construction market growth

The rising trend of digitalization, growing need for scalable business infrastructure, and integration of cloud computing are increasing the demand for data centers across the world. As business enterprises increasingly adopt cloud computing to enhance flexibility, scalability, and cost-effectiveness, the need for data centers has increased significantly. Moreover, the growing adoption of cloud services and increasing enterprise shift towards cloud-based infrastructure are primary determinants for driving the data center construction market.

- For instance, according to the State of the Dutch Cloud Market 2022 published by Capgemini, 51% of the financial and professional service sector has deployed its back-end business applications to the cloud while 52% of retail and wholesale sectors deployed its back-end business applications to the cloud in Netherlands as of 2022. Similarly, 36% of government, education, and healthcare sectors deployed their back-end business applications to the cloud while 47% of government, education, and healthcare sectors deployed their front-end business applications to the cloud in Netherlands as of 2022.

Thus, as per the analysis, the increasing cloud deployment is driving the need for data centers, in turn proliferating the data center construction market size.

Key Restraints :

High initial investment and operational costs are restraining the data center construction market expansion

High initial investment associated with the data center construction is among the primary factors limiting the market. Moreover, the upfront costs associated with the construction of data centers including costs of hardware components, equipment, and others can be significantly high, which may cause financial barriers, particularly for smaller businesses or individuals operating on tighter budgets.

Additionally, the operational costs associated with data centers including maintenance costs, cooling costs, utilities costs, and others are also relatively in the higher price range. Therefore, high initial investments and operational costs associated with the data center construction and operations are restraining the market.

Future Opportunities :

Rising investments in edge data centers are expected to drive the data center construction market opportunities

Edge data centers refer to decentralized facilities that are designed to be closer to the end-users and devices that are generating data. Moreover, edge data centers offer a wide range of benefits including reduced latency, improved bandwidth optimization, higher reliability, and others. The above benefits of edge data centers improve the effectiveness and performance of applications for use cases, including industrial automation, smart cities, and autonomous cars, which require real-time processing. As a result, the above benefits of edge data centers are further increasing investments in the development of these data centers, thereby driving market growth.

- For instance, in February 2024, Azora Group launched its new European Edge data center platform. The company launched Quetta Data Centers, in collaboration with Core Capital. Azora Group further announced plans to invest over USD 538.5 million in the development of six Edge data centers in Portugal and Spain, with a total capacity of 60MW.

Hence, as per the analysis, the rising investments in edge data centers are projected to drive the data center construction market opportunities during the forecast period.

Data Center Construction Market Segmental Analysis :

By Infrastructure Type:

Based on infrastructure type, the market is segmented into electrical infrastructure and mechanical infrastructure.

Trends in the infrastructure type:

- Rising advancements associated with electrical infrastructure involving power distribution units (PDUs) and uninterruptible power supply (UPS) systems, for facilitating improved power distribution and power availability in data centers.

- Rising trend towards structural support advancements, including earthquake-resistant building technologies and improved load-bearing frameworks, to ensure safe and reliable data center operations in varied geographical locations, even in earthquake-prone areas.

The electrical infrastructure segment accounted for the largest revenue in the overall market in 2024.

- The electrical infrastructure segment primarily includes power distribution units (PDUs), uninterruptible power supply (UPS) systems, generators, switchgear, and others, which play a crucial role in facilitating power distribution and power availability in data centers.

- Power distribution units are designed to distribute electrical power to multiple outlets within a data center or server room.

- Meanwhile, uninterrupted power supply (UPS) systems play a vital role in data centers for ensuring continuous power supply to data centers while protecting the integrity of data and ensuring business continuity. UPS systems are designed to ensure constant operation of computer systems and network equipment used in data centers.

- For instance, in December 2024, Schneider Electric launched its new Galaxy VXL model of uninterruptible power supply (UPS). The UPS is highly efficient, modular, compact, scalable, and redundant. The UPS is designed to provide power protection for critical infrastructure environments, such as AI, colocation, and hyperscale data center environments, along with large-scale critical infrastructure and electrical systems.

- According to the data center construction market analysis, the rising advancements related to electrical infrastructure components used in data centers are driving the data center construction market size.

The mechanical infrastructure segment is anticipated to register the fastest CAGR growth during the forecast period.

- The mechanical infrastructure segment mainly includes cooling systems, racks, HVAC systems, and others, which are used to prevent and protect the overheating of sensitive equipment used in data centers.

- Moreover, data center cooling systems, particularly liquid cooling and free cooling technologies, are gaining significant popularity, attributed to their improved energy efficiency and effectiveness in high-density data centers..

- For instance, in May 2021, Green Revolution Cooling Inc. launched its redesigned immersion cooling solution, ICEraQ Series 10 for application in data centers. The redesigned ICEraQ Series 10 immersion cooling system offers improved performance, energy efficiency, and usability, along with additional features. The liquid immersion cooling system offers exceptional cooling capacity while reducing the overall data center energy usage by up to 50%.

- Therefore, increasing advancements associated with mechanical infrastructure components used in data centers are anticipated to propel the market during the forecast period.

By Data Center Type:

Based on data center type, the market is segmented into enterprise data centers, hyperscale data centers, colocation data centers, and edge data centers.

Trends in the Data Center Type:

- Factors including increasing enterprise shift towards deployment of cloud-based architecture, growing need for large-scale data storage and processing capabilities, and rising need for managing large-scale business processes are among the major aspects driving the hyperscale data centers segment.

- Factors including the growing need for 5G connectivity, along with the proliferation of artificial intelligence (AI), Internet of Things (IoT), big data analytics, and automation are key prospects driving the edge data centers segment.

The hyperscale data centers segment accounted for the largest revenue in the total data center construction market share in 2024.

- Hyperscale data centers refer to centralized, massive, and custom-built facilities that offer exceptional scalability capabilities. These data centers are designed for supporting large-scale workloads with a streamlined network connectivity, optimized network infrastructure, and minimized latency.

- Moreover, hyperscale data centers primarily support cloud service providers and large internet companies with huge storage, computing, and networking requirements.

- Hyperscale data centers are capable of housing thousands of racks and servers across 50,000 to over 1 million square feet.

- For instance, in February 2025, Colt Data Centre Services launched its new hyperscale data center in Tokyo, Japan. The data center is developed to fulfill the rising need for data center capacity and public cloud services in Japan as well as the Asia-Pacific region.

- Therefore, the rising development of hyperscale data centers is driving the data center construction market growth.

Edge data centers segment is anticipated to register the fastest CAGR growth during the forecast period.

- Edge data centers refer to decentralized facilities that are designed to be closer to the end-users and devices that are generating data.

- Edge data centers are often located near their intended users, which enables real-time data processing and analysis. Moreover, edge data centers are also capable of processing significant volumes of generated data at the local level.

- Additionally, edge data centers offer several benefits including reduced network latency, increased processing loads, and faster data processing among others.

- For instance, in November 2023, H5 Data Centers announced the expansion of its edge data center located in San Antonio, United States. The data center will facilitate an additional 340 cabinets along with a supplementary UPS capacity of up to 1.5 MW.

- Therefore, increasing advancements associated with edge data centers are expected to boost the market during the forecast period.

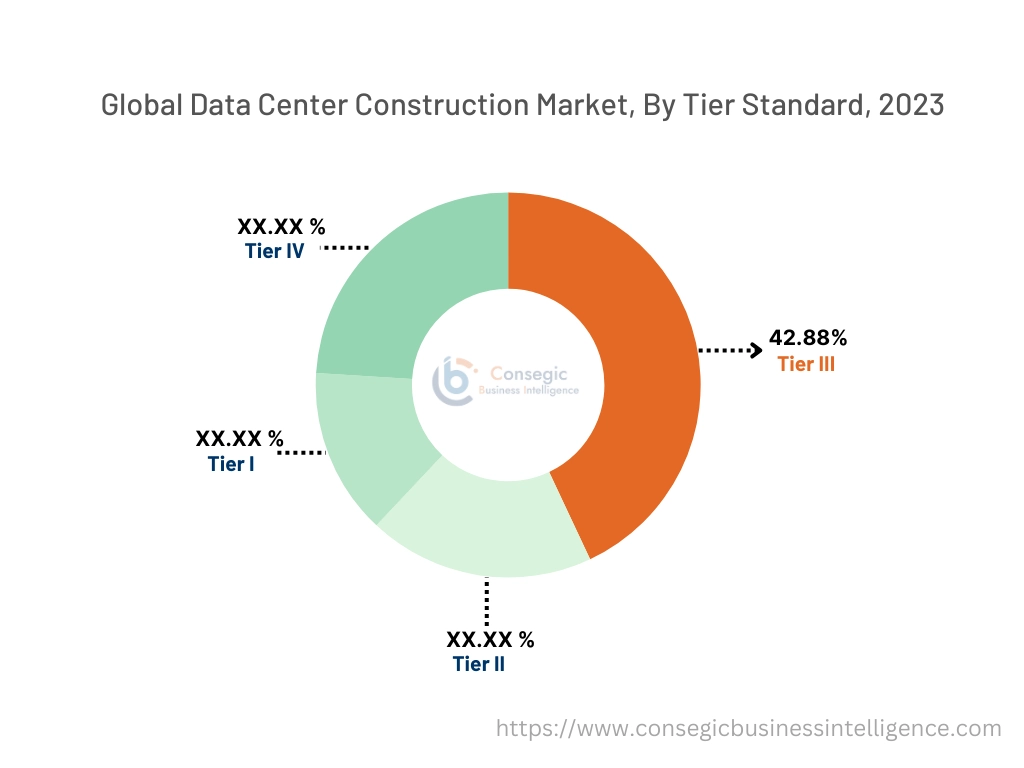

By Tier Standard:

Based on tier standard, the market is segmented into Tier I, Tier II, Tier III, and Tier IV.

Trends in the tier standard:

- Rising construction of tier III data centers, due to their reduced risk of downtime, high availability, and enhanced scalability, is driving the market.

- Rising development of tier IV data centers for IT & telecommunication, BFSI (banking, financial services, and insurance), healthcare, and government & defense applications, due to its fault-tolerant design and high level of availability and redundancy.

Tier III segment accounted for the largest revenue share of 44.42% in the overall data center construction market share in 2024.

- Tier III data centers are designed to provide a high level of availability and they often feature redundant power and cooling systems, along with multiple distribution paths for power and cooling.

- Moreover, tier III data centers offer several benefits including reduced risk of downtime, high availability, enhanced scalability, and others.

- For instance, in November 2024, the Indian Coast Guard (ICG) announced the development of the tier-III data center of Project Digital Coast Guard (DCG) at Mahipalpur, New Delhi. The data center will be equipped with the latest technology and serve as the brain center for monitoring and administering all the applications and vital IT resources, in turn offering critically vital support to the administrative functioning of ICG.

- Therefore, the rising development of tier III data centers is driving the data center construction market trends.

Tier IV segment is anticipated to register the fastest CAGR growth during the forecast period.

- Tier IV data centers typically feature fault-tolerant design, providing the highest level of availability and redundancy.

- Moreover, tier IV data centers are designed to be completely fault-tolerant, which enables continuous operations even in the event of multiple component failures.

- Further, tier IV data centers are often used in IT & telecommunication, BFSI, healthcare, and government & defense applications among others.

- Therefore, the increasing developments associated with tier IV data centers are expected to boost the market during the forecast period.

By Industry Vertical:

Based on the end user, the market is segmented into IT & telecom, BFSI, healthcare, government & defense, energy, retail, manufacturing, media & entertainment, and others.

Trends in the end user:

- Factors including technological innovations including big data and IoT, rising development of telecom data centers, and increasing demand for flexible, economical, and cost-effective IT business infrastructure are among the major prospects driving the IT and telecom segment.

- Factors including the rising digitalization of banking sector, prevalence of substantial number of banking/financial firms, and increasing adoption of cloud-based infrastructure by BFSI enterprises are key determinants for driving the need for data center solutions in the BFSI industry.

The IT & telecom segment accounted for the largest revenue in the market in 2024.

- The IT & telecom sector relies significantly on data centers for supporting a range of services including cloud services, hosting services, data storage & backup, internet services, and others.

- Moreover, the rising digital transformation and increasing enterprise shift towards cloud-based infrastructure are driving significant investments in the development of data centers.

- Additionally, the rapid deployment of 5G networks and growing need for high-speed internet services are key factors driving investments construction of data centers.

- For instance, in January 2024, Telekom Malaysia, a telecommunication company, announced its plan to develop a new hyperscale data center, with the aim of expanding its capacity from the existing Iskandar Puteri Data Centre (IPDC) and Klang Valley Data Centre (KVDC) located in Malaysia. The hyperscale data center is expected to provide at least 40 Megawatts of IT power capacity, catering to large internet companies and cloud service providers.

- According to the analysis, the growing IT & telecom sector is propelling the data center construction market trends.

The healthcare segment is anticipated to register the fastest CAGR growth during the forecast period.

- The healthcare sector rely on data centers for supporting digital health solutions, including electronic health records (EHRs), telemedicine services, data storage, and others, which is further boosting the need for reliable data center infrastructure.

- Moreover, data centers play a vital role in the healthcare sector by managing, processing, and storing large volumes of data that support critical applications, enhance service delivery, and enable organizations to meet their operational demands effectively.

- For instance, HCLTech launched its shared data center as a service, which aims to help business enterprises accelerate their hybrid cloud transformation. It is ideal for several industries including, healthcare and other highly regulated industries.

- Therefore, the above factors are expected to boost the market during the forecast period.

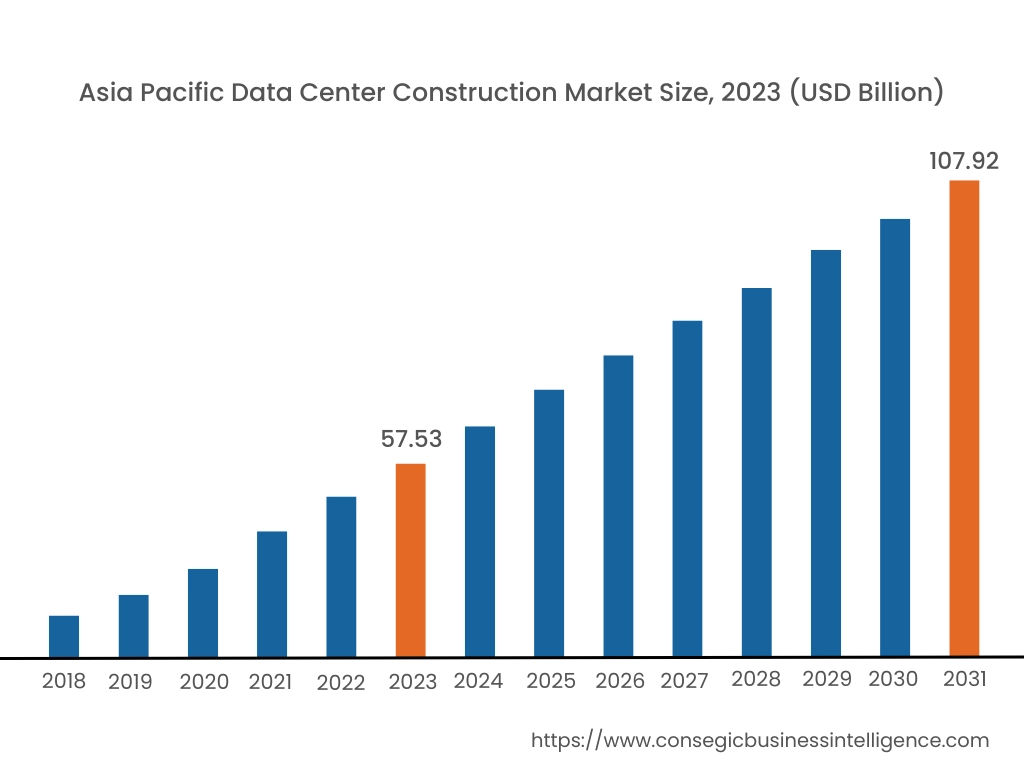

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

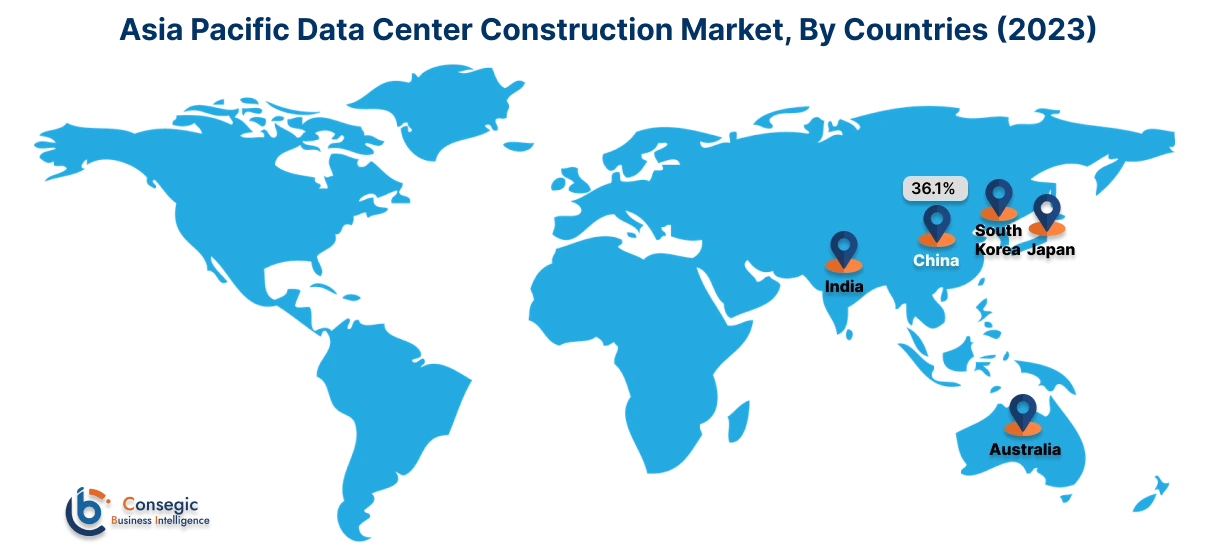

Asia Pacific region was valued at USD 61.77 Billion in 2024. Moreover, it is projected to grow by USD 66.20 Billion in 2025 and reach over USD 125.69 Billion by 2032. Out of this, China accounted for the maximum revenue share of 36.25%. As per the data center construction market analysis, the construction of data centers the Asia-Pacific region is primarily driven by growing IT & telecom, BFSI, healthcare, and other sectors, along with increasing adoption of cloud services in the region. Additionally, the rising pace of digitalization and increasing adoption of internet services and cloud-based infrastructure among business enterprises are further accelerating the data center construction market expansion.

- For instance, in February 2023, CapitaLand Investment Limited established a China data center development fund with approximately USD 741.43 million in investment, in order to build two hyperscale data centers in Beijing, China. The data center development projects will deliver over 100 megawatts of power and are scheduled to be completed in 2025. The above factors are further propelling the market demand in the Asia-Pacific region.

North America is estimated to reach over USD 166.61 Billion by 2032 from a value of USD 85.32 Billion in 2024 and is projected to grow by USD 91.12 Billion in 2025.

In North America, the growth of data center construction industry is driven by factors including the growing digitalization of retail, BFSI, and healthcare sectors in the region and rising deployment of cloud-based delivery model among others. Similarly, rising advancements associated with big data, IoT, edge computing, and others are further contributing to the data center construction market demand.

- For instance, in March 2023, H5 Data Centers announced the launch of a new data center in Northern Virginia, United States. The data center is spread across 255,000 square feet area and will support 42 MW of critical load upon its completion. The above factors are projected to boost the market demand in North America during the forecast period.

Moreover, the regional analysis depicts that growing manufacturing, IT & telecommunication, retail, and BFSI sectors along with increasing cloud deployment among enterprises are key determinants for propelling the data center construction market demand in Europe. Further, according to the analysis, the market in Latin America, Middle East, and African regions is anticipated to grow at a considerable rate due to factors including the rising trend of digital transformation and prevalence of multiple government initiatives to stimulate the deployment of cloud infrastructure among others.

Top Key Players & Market Share Insights:

The global data center construction market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the data center construction market. Key players in the data center construction industry include-

- Turner Construction Company (USA)

- DPR Construction (USA)

- Jacobs (USA)

- ISG (UK)

- Legrand SA (France)

- AECOM (USA)

- Holder Construction Group, LLC (USA)

- Schneider Electric (France)

- Huawei Technologies Co., Ltd. (China)

- Fujitsu (Japan)

Recent Industry Developments :

Product Launches:

- In February 2024, Datacenter One GmbH offers announced the launch of the new Hamburg data center, HAM1 in Germany to fulfil the growing need for customers across the country. The HAM1 data center complements the company’s existing carrier neutral data center in Hamburg while sustaining the rising customer need for regional infrastructure deployments closer to end users

- In August 2023, STACK Infrastructure launched its new data center in Melbourne, Australia for cloud service providers and large enterprises that require robust power, scalability, and reliability in the region. The data center is located on 3.6 hectares and powered by a 105 MW on-site substation. The 72MW campus features two 36 MW data center facilities with distinct access points and diverse fiber entry points for accommodating several users with separation of security and services.

- In April 2023, Datadog Inc. launched its new data center situated in Tokyo, Japan. The new data center in Japan is responsible for storing and processing data locally while assisting Datadog and its customers comply with local data security and privacy regulations.

Partnerships & Collaborations:

- In August 2024, Blue Owl Capital announced a partnership with Chirisa Technology Parks and PowerHouse Data Centers for up to USD 5 billion joint venture in order to develop large-scale HPC (high-performance computing) and AI data centers for CoreWeave and potentially other clients.

Data Center Construction Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 469.86 Billion |

| CAGR (2024-2031) | 7.8% |

| By Infrastructure Type |

|

| By Data Center Type |

|

| By Tier Standard |

|

| By Industry Vertical |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the data center construction market? +

The data center construction market was valued at USD 240.67 Billion in 2024 and is projected to grow to USD 469.86 Billion by 2032.

Which is the fastest-growing region in the data center construction market? +

Asia-Pacific is the region experiencing the most rapid growth in the data center construction market.

What specific segmentation details are covered in the data center construction report? +

The data center construction report includes specific segmentation details for infrastructure type, data center type, tier standard, end user, and region.

Who are the major players in the data center construction market? +

The key participants in the data center construction market are Turner Construction Company (USA), DPR Construction (USA), AECOM (USA), Holder Construction Group, LLC (USA), Schneider Electric (France), Huawei Technologies Co., Ltd. (China), Fujitsu (Japan), Jacobs (USA), ISG (UK), Legrand SA (France), and others.