Uninterruptible Power Supply (UPS) Market Size:

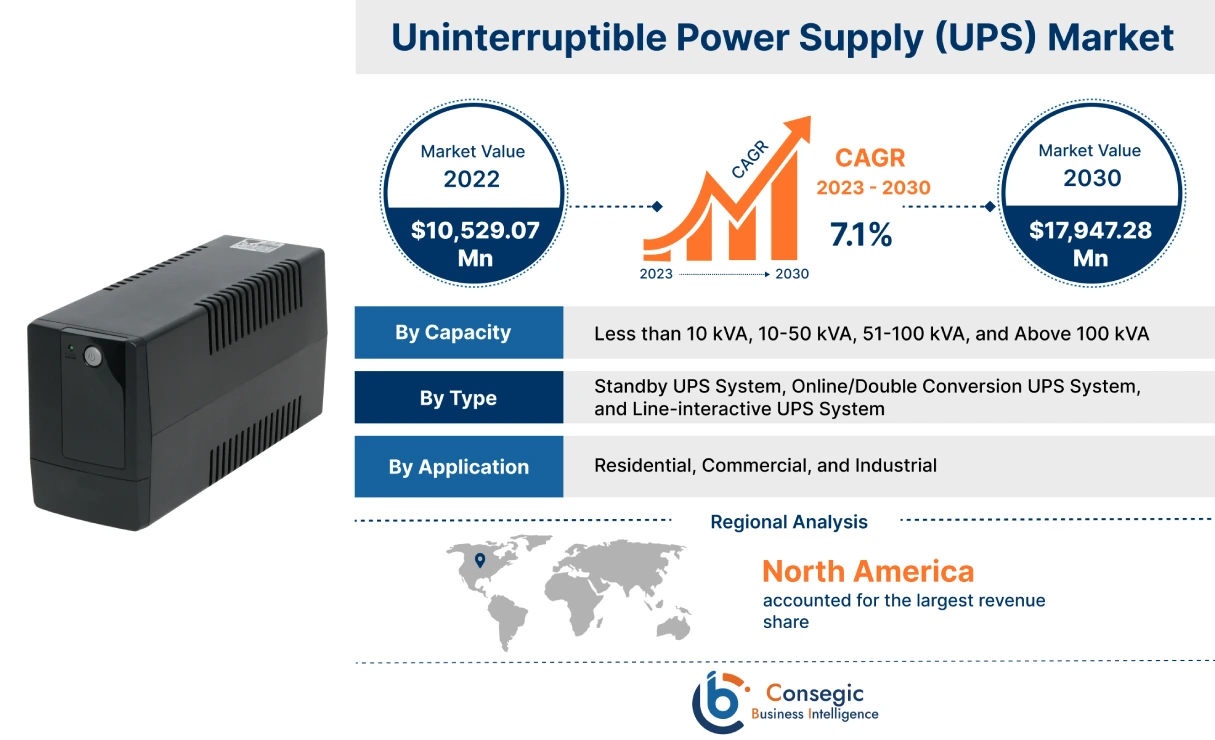

Uninterruptible Power Supply (UPS) Market size is estimated to reach over USD 21.74 Billion by 2032 from a value of USD 11.64 Billion in 2024 and is projected to grow by USD 12.36 Billion in 2025, growing at a CAGR of 7.3% from 2025 to 2032.

Uninterruptible Power Supply (UPS) Market Scope & Overview:

Uninterruptible power supply (UPS) refers to a crucial electrical device that is designed to provide a continuous and stable power source to connected equipment during sudden power outages, voltage fluctuations, or other electrical disturbances. UPS primarily consists of a battery that stores energy and an inverter that converts stored DC power to AC power, thereby ensuring that critical devices, such as computers, servers, and sensitive electronics remain operational without any disruption. This protects users and businesses from data loss, hardware damage, or downtime due to power disruptions. Moreover, UPS systems offer a wide range of benefits such as reliable backup power, protection against power disturbances, protection of electronic equipment, and others. The aforementioned benefits of UPS systems are primary determinants for increasing its utilization in residential, commercial, and industrial applications.

Uninterruptible Power Supply (UPS) Market Dynamics - (DRO) :

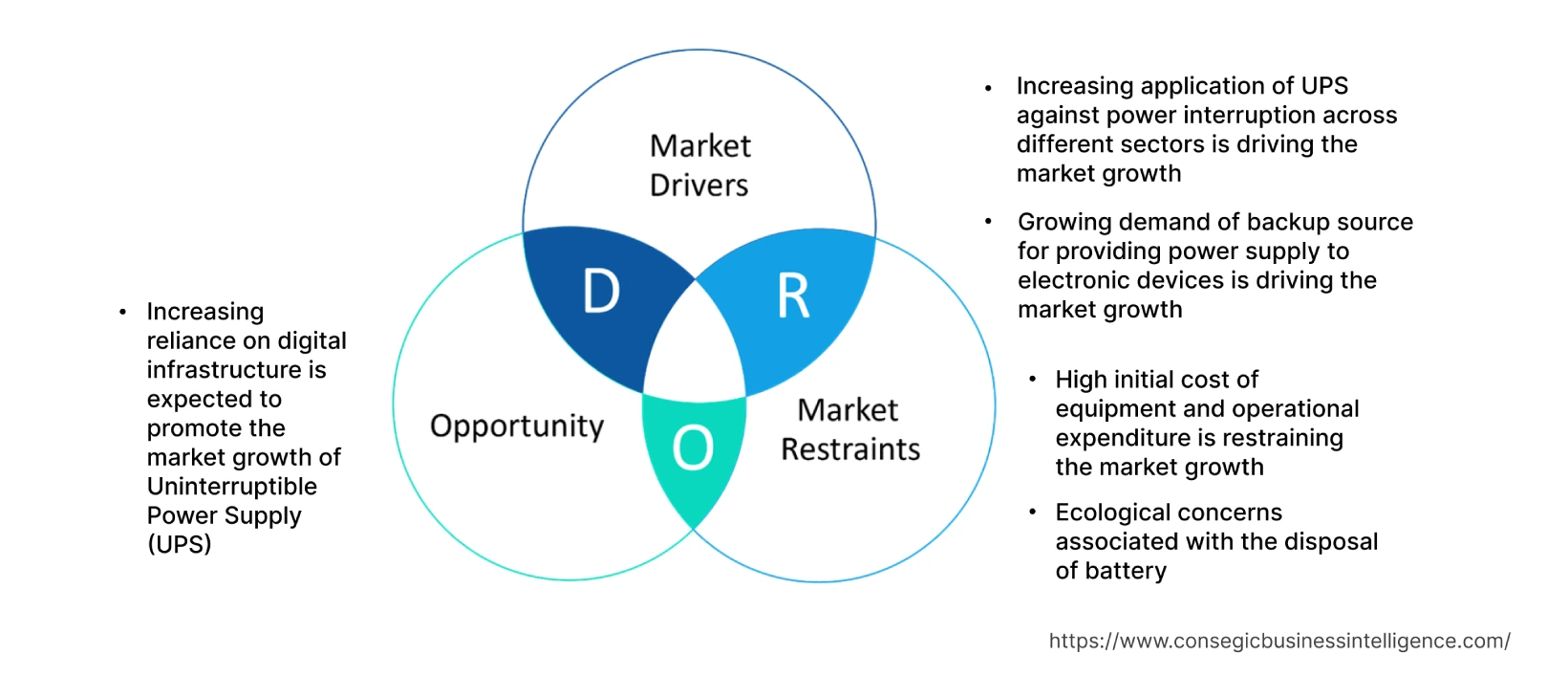

Key Drivers:

Increasing development and expansion of data centers are driving the uninterruptible power supply (UPS) market growth

Data centers are the backbone of modern businesses, which store and process vast amounts of critical data. Any disruption in power supply leads to data loss, downtime, and also financial losses. UPS systems play a vital role in data centers for ensuring continuous power supply to data centers while protecting the integrity of data and ensuring business continuity. UPS systems are designed to ensure constant operation of computer systems and network equipment used in data centers. Moreover, UPS systems are used in data centers for protecting data centers from power outages, fluctuations, and disturbances, which could potentially lead to equipment failures, downtime, or data loss. Moreover, certain modern UPS systems are also integrated with power management software that is capable of monitoring power conditions and facilitating load balancing and energy efficiency. Further, the utilization of UPS systems in data centers offers several benefits including continuous power supply, downtime prevention, improved load management, and others.

- For instance, in February 2025, Colt Data Center Services, a global provider of hyperscale and large enterprise data center solutions, launched its new hyperscale data center in Japan. The data center is mainly developed to meet the growing demand for data center capacity and public cloud services in Japan as well as the Asia-Pacific region.

Therefore, the increasing development of data centers is driving the adoption of UPS systems for ensuring continuous power supply to data center equipment, in turn driving the uninterruptible power supply (UPS) market size.

Key Restraints:

High initial and operational costs are restraining the uninterruptible power supply (UPS) market

The utilization of uninterruptible power supply (UPS) systems is often associated with high initial costs and operational costs, which are among the primary factors limiting the market growth.

- For instance, ABB offers PowerValue 11T G2 model of single-phase uninterruptible power supply (UPS) at a price ranging from USD 2,877 per unit.

- Additionally, the price of UPS systems can range from USD 200 to USD 25,000 per unit or more, depending on the size, type, application, and specification of the UPS system, which is relatively very high.

The above factors may cause financial barriers, particularly for smaller businesses or businesses operating on tighter budgets. Therefore, high initial and operational costs associated with the implementation of UPS systems are hindering the uninterruptible power supply (UPS) market expansion.

Future Opportunities :

Increasing advancements associated with uninterruptible power supply (UPS) are expected to drive the uninterruptible power supply (UPS) market opportunities

UPS manufacturers are constantly investing in the development of new UPS systems integrated with updated features to ensure their safe and effective deployment in commercial, residential, and industrial applications. Moreover, UPS manufacturers are launching new products with advanced features and benefits, which are projected to offer lucrative aspects for market growth.

- For instance, in July 2023, Fuji Electric Co., Ltd. Launched its new UPS product featuring a single-unit capacity of 2,400 kVA. Additionally, the UPS systems are integrated with a high-efficiency mode, which enables operation with commercial power sources when the commercial power supply is stable while attaining a power conversion efficiency of 98.5%. The product also features an integrated design combining input/output cabinets and switchgears while reducing the footprint by 25% in comparison to conventional systems. The UPS system is designed for use in hyperscale data centers.

Hence, as per the analysis, the rising advancements related to UPS systems are anticipated to boost the uninterruptible power supply (UPS) market opportunities during the forecast period.

Uninterruptible Power Supply (UPS) Market Segmental Analysis :

By Capacity:

Based on capacity, the market is segmented into less than 10 kVA, 10-50 kVA, 51-100 kVA, and above 100 kVA.

Trends in the capacity:

- Rising adoption of UPS with 51-100 kVA capacity, due to its improved scalability, cost-effectiveness, and application versatility is driving the market.

- Increasing trend towards the adoption of UPS systems with capacity above 100 kVA, attributing to its several features such as high reliability, protection against power quality issues, reduced downtime, uninterrupted operations, increased efficiency, and others.

The 51-100 kVA segment accounted for the largest revenue share in the total uninterruptible power supply (UPS) market share in 2024.

- UPS with 51-100 kVA capacity provides reliable power backup for medium-sized installations including data centers, healthcare facilities, educational institutions, and others, providing protection against power outages, surges, and voltage fluctuations.

- These UPS systems are particularly used for critical applications where downtime is unacceptable.

- Moreover, UPS with 51-100 kVA offers several benefits such as improved scalability, redundancy, energy efficiency, and versatility in applications among others.

- For instance, Vertiv Group offers Liebert MTP model of online UPS systems in its product offerings. The UPS systems are available in multiple capacities including 80kVA models. Moreover, the UPS systems are also available with numerous operation modes including standby mode, line mode (AC mode), ECO mode, battery mode, bypass mode, and others.

- According to the uninterruptible power supply (UPS) market analysis, the above factors are accelerating the uninterruptible power supply (UPS) market growth.

The above 100 kVA segment is anticipated to register a significant CAGR growth during the forecast period.

- UPS systems with capacity above 100 kVA are mainly used in large data centers and industrial or commercial settings to provide reliable backup power for critical equipment.

- These high-capacity UPS systems ensure continuous operation during power outages, thereby preventing costly downtime, data loss, and potential damage to sensitive equipment.

- For instance, Eaton offers UPS solutions in its product portfolio, with capacities ranging from 160-400 kVA. Moreover, the company also provides a wide range of three-phase UPS systems that are optimized to handle higher loads with improved efficiency.

- According to the market analysis, the increasing advancements related to UPS systems with capacity above 100 kVA are expected to drive the uninterruptible power supply (UPS) market size during the forecast period.

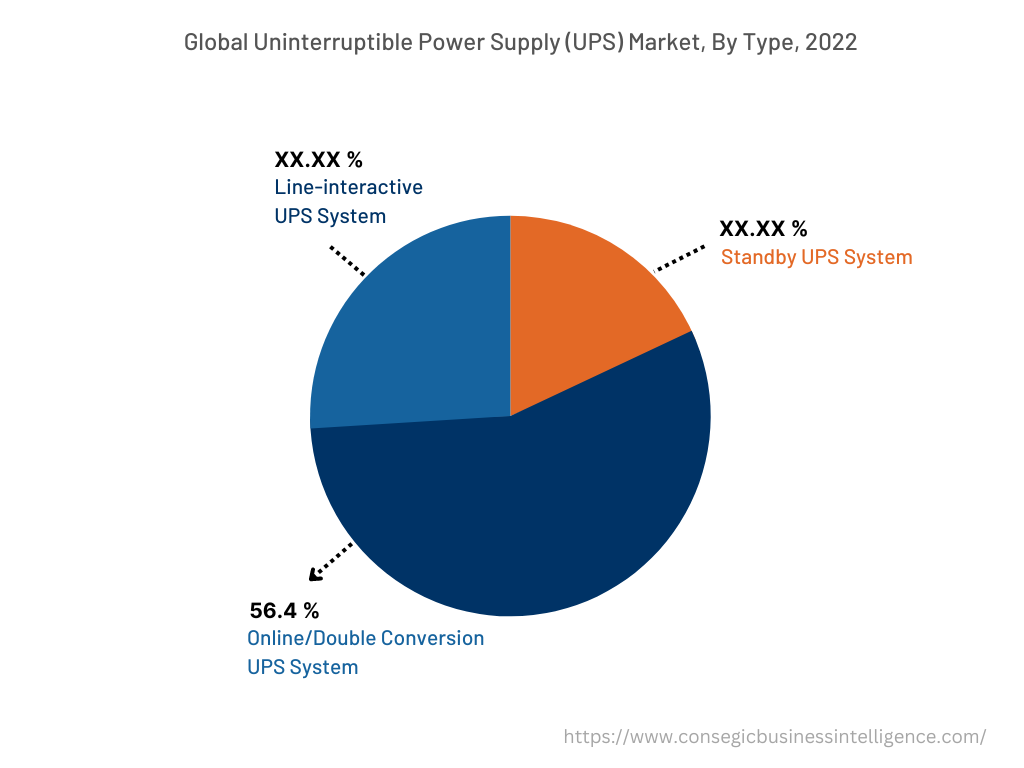

By Type:

Based on the type, the market is segmented into standby UPS system, online/double conversion UPS system, and line-interactive UPS system.

Trends in the type:

- Increasing trend in adoption of online/double conversion UPS systems due to its clean power output and higher level of protection of electronic devices against power fluctuations and power outages.

- Rising trend towards the adoption of line-interactive UPS systems, due to its lower costs, higher efficiency, good voltage regulation, and other benefits, is further driving the market.

The online/double conversion UPS system segment accounted for the largest revenue share of 56.52% in the uninterruptible power supply (UPS) market share in 2024, and it is anticipated to register substantial growth during the forecast period.

- In an online/double conversion UPS system, there is a continuous conversion of AC to DC and back to AC, which ensures a constant and steady power supply.

- The UPS systems with double conversion topology provide no interruption in power supply during a power outage or fluctuation, as the system is always running on the inverter.

- Moreover, the double conversion process filters out voltage irregularities, frequency variations, and noise from the incoming power source.

- For instance, Vertiv offers GXT5-1500LVRT2UXL model of online/double conversion UPS system in its product offerings. The UPS systems offer an operating temperature range of +32 to +104 °F, with optional communication cards, and a coloured graphic LCD display control panel. The UPS systems are capable of managing connected devices without impacting the continuity of power supply.

- Hence, the rising advancements related to online/double conversion UPS systems are boosting the uninterruptible power supply (UPS) market trends.

By Application:

Based on application, the market is segmented into segmented into residential, commercial, and industrial.

Trends in the application:

- Factors such as the rising pace of urbanization, increasing investments in commercial construction, and growing demand for reliable backup power supply in commercial spaces are key prospects driving the commercial segment.

- Factors including rapid pace of industrialization, increasing development of industrial manufacturing facilities, and growing demand for constant power supply solutions in industrial buildings are driving the industrial segment.

The commercial segment accounted for the largest revenue share in the overall market in 2024, and it is anticipated to register a substantial CAGR growth during the forecast period.

- UPS systems are primarily used in the commercial sector, including offices, data centers, hospitals, and others, to provide a backup power source, allowing critical systems to continue running during power outages, preventing interruptions and minimizing downtime.

- Moreover, UPS systems facilitate a smooth transition during power outages, allowing businesses to save work and properly shut down systems, minimizing potential damage.

- Additionally, by preventing downtime, UPS systems help businesses maintain productivity and avoid financial losses associated with interruptions.

- For instance, Dale Power Solutions provides commercial UPS solutions in its product offerings. The company’s commercial UPS systems are available in multiple variants including single-phase, three-phase, modular, and others. Further, these solutions provide high efficiency, reliability, and flexibility.

- Therefore, the increasing adoption of UPS systems for commercial applications is driving the market.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 4.34 Billion in 2024. Moreover, it is projected to grow by USD 4.62 Billion in 2025 and reach over USD 8.40 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.54%. As per the uninterruptible power supply (UPS) market analysis, the adoption of UPS in the Asia-Pacific region is primarily driven by the rapid pace of digital transformation among businesses and industries along with increasing development of data centers among others. Additionally, the rising adoption of UPS systems in data centers and business enterprises for facilitating reliable and consistent power supply solutions is further accelerating the uninterruptible power supply (UPS) market expansion in the Asia-Pacific region.

- For instance, in October 2024, STACK Infrastructure launched its first data center on its new 36MW flagship Tokyo campus. The data center is situated in Inzai District of Greater Tokyo, Japan and it is developed to address the rising need for scalable critical capacity in the APAC region. Thus, the above factors are driving the industry growth in the Asia-Pacific region.

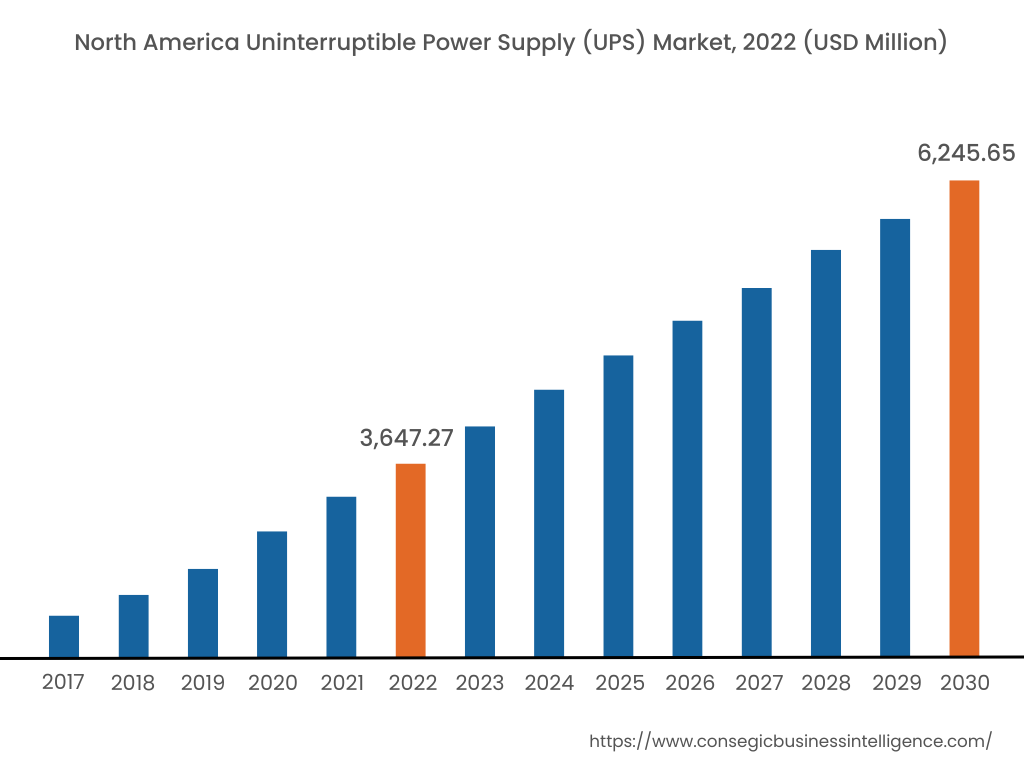

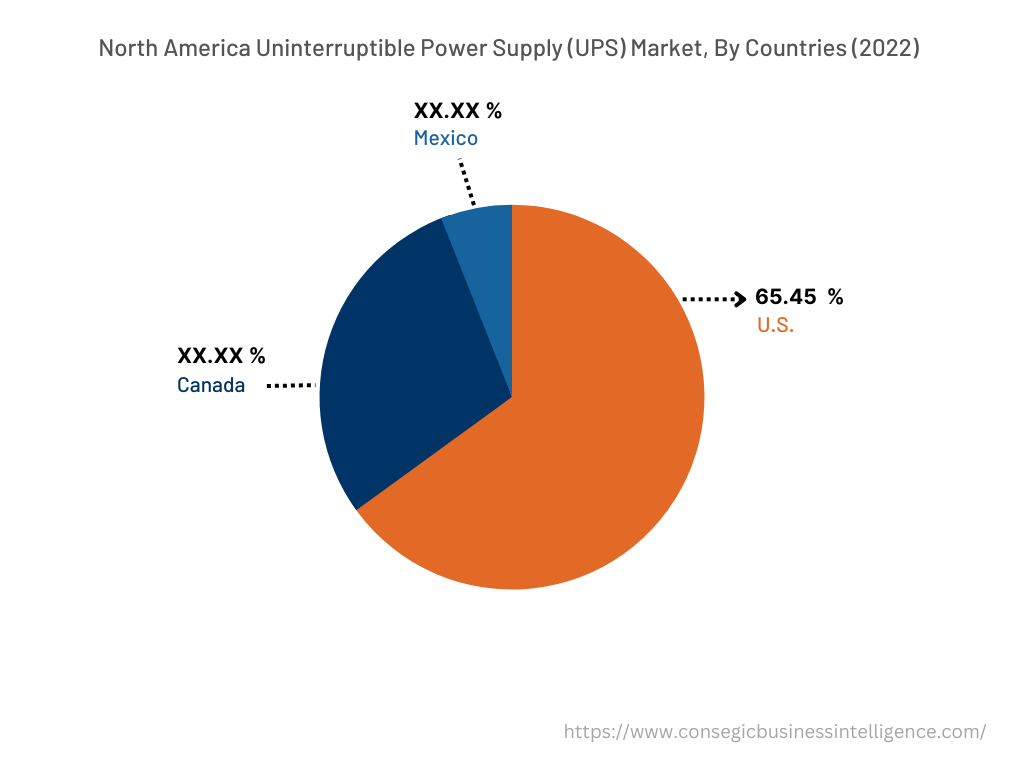

North America is estimated to reach over USD 6.04 Billion by 2032 from a value of USD 3.28 Billion in 2024 and is projected to grow by USD 3.48 Billion in 2025. In North America, the increasing development of industrial manufacturing facilities, extension of commercial spaces, along with growing need for constant power supply solutions in commercial and industrial spaces are driving the market. Similarly, the availability of large number of data centers is contributing to the uninterruptible power supply (UPS) market demand in the region.

- For instance, according to Cloudscene, the United States consists of approximately 5,427 data centers, along with 3,257 connectivity/cloud service providers. The above factors are expected to propel the uninterruptible power supply (UPS) market trends in North America during the forecast period.

Additionally, the regional analysis depicts that rising investments in data center and IT infrastructure development and growing adoption of constant power supply and backup solutions in data centers and commercial settings are driving the uninterruptible power supply (UPS) market demand in Europe. Further, according to the analysis, the market demand in Latin America, Middle East, and African regions is anticipated to increase at a significant rate due to factors including the rising demand for data center services, increasing investments in commercial development, and growing need for reliable power supply solutions in commercial spaces among others.

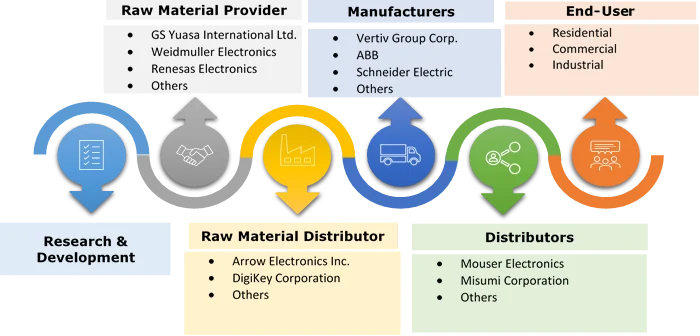

Top Key Players and Market Share Insights:

The global uninterruptible power supply (UPS) market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the uninterruptible power supply (UPS) industry. Key players in the uninterruptible power supply (UPS) industry include-

- Vertiv Group Corp. (U.S)

- ABB (Switzerland)

- Schneider Electric (France)

- Emerson Electric Co. (U.S)

- Baykee (Guangdong) Technology Co., Ltd. (China)

- Cyber Power Systems Inc. (U.S)

- Infineon Technologies AG (Germany)

- Toshiba Corporation (Japan)

- Shenzhen INVT Electric Co. Ltd. (China)

- Active Power (U.S)

- Delta Power Solutions (Taiwan)

- HONGBAO Power Supply Co., Ltd. (China)

- Guangdong Zhicheng Champion Group Co. Ltd. (China)

- Sendon Electronics Co. Ltd. (China)

- EAST Group Co. Ltd. (China)

- Eaton (Ireland)

- Shenzhen Jeidar Electronics Co. Ltd. (China)

- AEG Power Solutions (Netherlands)

- Shenzhen Kstar Science & Technology Co., Ltd. (China)

Recent Industry Developments :

Product Launches:

- In December 2024, Schneider Electric launched its new Galaxy VXL model of three-phase UPS. The UPS is highly efficient, modular, compact, scalable, and redundant. The UPS is designed to provide power protection for critical infrastructure environments, such as AI ready data centers, commercial, semiconductors, and industrial manufacturing facilities.

- In May 2024, Eaton introduced its new 9395X model of UPS system. Eaton 9395X UPS system has a 30 percent smaller footprint in comparison to similar UPS models while offering improved energy efficiency. The UPS system is ideal for application in data centers among others.

Uninterruptible Power Supply (UPS) Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 21.74 Billion |

| CAGR (2025-2032) | 7.3% |

| By Capacity |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the uninterruptible power supply (UPS) market? +

The uninterruptible power supply (UPS) market was valued at USD 11.64 Billion in 2024 and is projected to grow to USD 21.74 Billion by 2032.

Which is the fastest-growing region in the uninterruptible power supply (UPS) market? +

Asia-Pacific is the region experiencing the most rapid growth in the uninterruptible power supply (UPS) market.

What specific segmentation details are covered in the uninterruptible power supply (UPS) report? +

The uninterruptible power supply (UPS) report includes specific segmentation details for capacity, type, application, and region.

Who are the major players in the uninterruptible power supply (UPS) market? +

The key participants in the uninterruptible power supply (UPS) market are Vertiv Group Corp. (U.S), ABB (Switzerland), Schneider Electric (France), Emerson Electric Co. (U.S), Baykee (Guangdong) Technology Co., Ltd. (China), Cyber Power Systems Inc. (U.S), Infineon Technologies AG (Germany), Toshiba Corporation (Japan), Shenzhen INVT Electric Co. Ltd. (China), Active Power (U.S), Delta Power Solutions (Taiwan), HONGBAO Power Supply Co., Ltd. (China), Guangdong Zhicheng Champion Group Co. Ltd. (China), Sendon Electronics Co. Ltd. (China), EAST Group Co. Ltd. (China), Eaton (Ireland), Shenzhen Jeidar Electronics Co. Ltd. (China), AEG Power Solutions (Netherlands), Shenzhen Kstar Science & Technology Co., Ltd. (China), and others.