Data Center Services Market Size:

Data Center Services Market size is estimated to reach over USD 61,871.17 Million by 2031 from a value of USD 19,729.39 Million in 2023 and is projected to grow by USD 22,407.85 Million in 2024, growing at a CAGR of 15.4% from 2024 to 2031.

Data Center Services Market Scope & Overview:

Data center services are the activities required for the maintenance of data centers, as well as their proper operation. The components included in the implementation of data centers are recovery, networking, website hosting, data management, etc. The advantages range from improved management of data, operational efficiency, and reduced downtime to solutions for disaster recovery. The key end-use industries include IT and telecommunications, healthcare, finance, retail, and government.

How is AI Transforming the Data Center Services Market?

The integration of AI is significantly transforming the data center services market. AI-powered solutions are used to optimize operations, improve efficiency, enhance security, and drive innovation in data center design and management. AI can dynamically manage resources such as power, cooling, and computing capacity based on real-time needs, thereby improving energy efficiency and reducing costs. Moreover, AI can analyze data to predict potential equipment failures, in turn facilitating proactive maintenance and reducing downtime. This helps in ensuring consistent and reliable data center services. Therefore, the aforementioned factors are expected to drive the market growth in the upcoming years.

Data Center Services Market Insights:

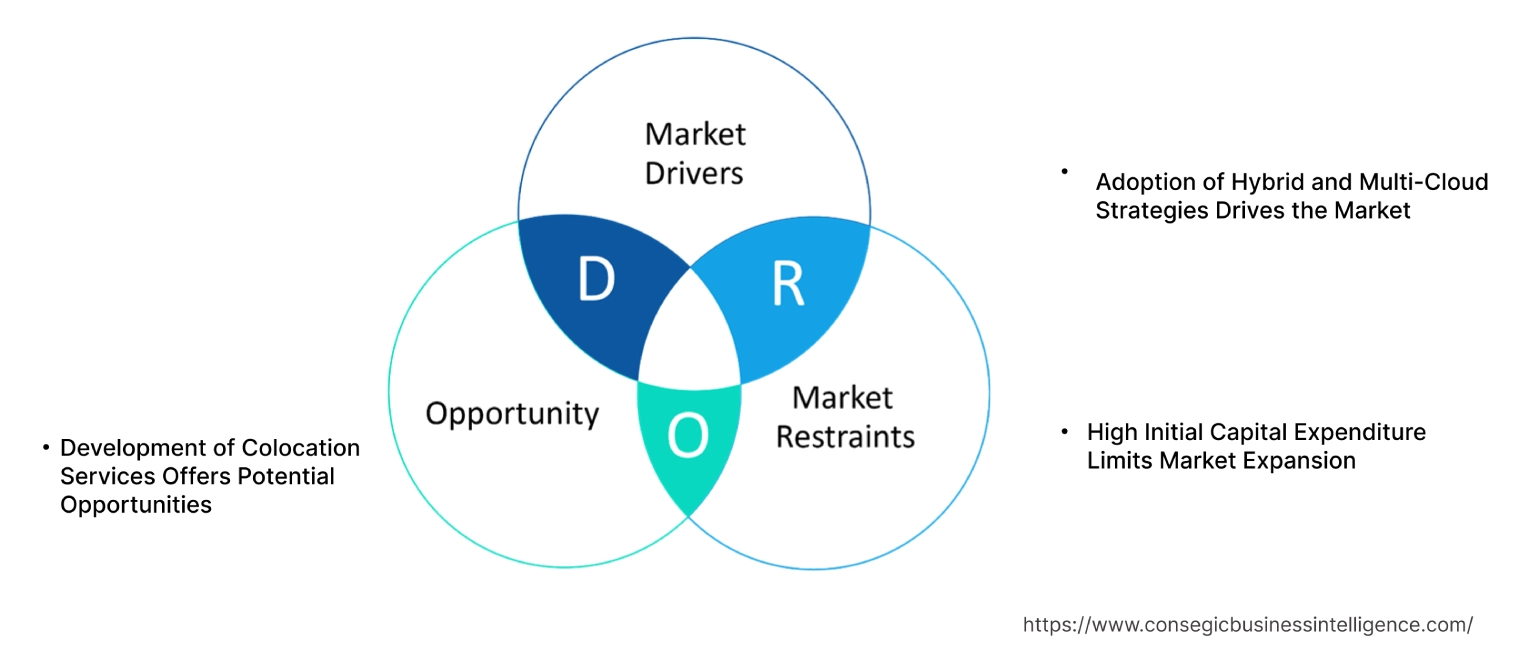

Data Center Services Market Dynamics - (DRO) :

Key Drivers:

Adoption of Hybrid and Multi-Cloud Strategies Drives the Market

The growing implementation of hybrid and multi-cloud strategies has enabled organizations to optimize various tasks such as resource allocation, business continuity, and scaling of operations. The shift towards modern hybrid cloud-based solutions did increase the dependency on data centers, which work on the concept of integration of public and private clouds along with on-premise cloud infrastructure. The benefits of using this approach include greater flexibility, security, and cost efficiency.

- In February 2024, the launch of IBM® LinuxONE 4 Express, was announced by IBM, which is an expansion of the LinuxONE capabilities. This was to ensure to extend the offerings to small and medium-sized businesses, along with new data center environments.

In conclusion, the growth of hybrid and multi-cloud strategies is the driving factor in the data center services market growth.

Key Restraints :

High Initial Capital Expenditure Limits Market Expansion

A major bottleneck for the data center services market is the high capital expenditure needed for the initial setup and regular maintenance of systems. The cost includes infrastructure, cooling equipment, uninterrupted power supply, and security measures. For small and medium-sized enterprises (SMEs), it can be quite challenging to invest a huge amount of money into something new.

Moreover, regular maintenance and operational costs add further financial pressure, limiting the adoption of data center services, particularly in developing regions. Hence, the market analysis shows that high capital expenditure remains a key restraint for the data center services market demand, especially for SMEs and organizations in emerging markets.

Future Opportunities :

Development of Colocation Services Offers Potential Opportunities

Colocation allows organizations to rent out space in data centers to host their hardware, which reduces the need for on-premise infrastructure, which results in lowered operational costs. This approach is better for businesses that want to expand their IT capability without bearing the high cost of cloud services. Moreover, colocation services provide enhanced security, scalability, and reduced latency.

- In August 2023, the high-density colocation services were introduced by Digital Realty, across PlatformDIGITAL, which is a global data center platform for the company. This allows businesses to tackle processing and proximity challenges, utilizing high-performance computing (HPC) ready infrastructure configurations.

Hence, the market trends analysis depicts that the increasing demand for colocation services indicates a rise in data center services market opportunities that organizations can capitalize on by providing cost-efficient and scalable solutions.

Data Center Services Market Segmental Analysis :

By Service Type:

Based on service type, the market is segmented into data center outsourcing, data center support services, cloud services, professional services, and others.

Trends in the Service Type:

- Innovations utilizing AI in order to predict failures beforehand have been in the predictive analytics field, in the support services sector.

- In order to ensure more security, blockchain technologies have been incorporated into the security systems for safer transactions, reducing overall security threats.

The data center outsourcing segment accounted for the largest revenue share of the total data center services market share in 2023.

- Data center outsourcing refers to the process of external providers of services to take over IT infrastructure management, which includes hardware and software. This reduces the overall efficiency and cost.

- Solutions to achieve security in data storage are achieved using colocation services, which is a type of outsourcing, without any dependency on the infrastructure.

- In order to improve the performance of the system and security, IT management is provided by managed services to the organizations shifting towards digitalization.

- In 2022, Gartner recognized Kyndryl as the highest scorer in legacy data center outsourcing (DCO) in two reports that were recently published. This is due to the company's ability to provide traditional data center services to global clients.

- Therefore, the rising shift towards digital transformation and IT management by external providers is driving the data center services market growth.

The cloud services segment is anticipated to register the fastest CAGR during the forecast period.

- Cloud services provide various offerings to businesses of different sizes, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

- Organizations adopting digital infrastructures, utilize it in order to achieve scalability and reduction in cost.

- They also reduce downtime and improve agility, by optimizing data handling and storage with the help of AI and machine learning.

- In August 2021, , Cloud One data center by Trend Micro was launched in India. This is to ensure SaaS is a preferred model for Security solutions delivery, securing servers, resources, and applications in the cloud.

- In conclusion, the integration of AI, and the scalability achieved assists the cloud services segment to boost the data center services market trends.

By Service Model:

Based on the service model, the market is bifurcated into On-Premises Data Centers and Off-Premises Data Centers (Colocation Facilities and Cloud-Based Data Centers).

Trends in the Service Model:

- The reduction in energy consumption and improvement in the efficiency of on-premises data centers, are achieved by utilizing innovations like liquid cooling technology.

- With the advancements in computational technologies, there is an increase in the adoption of quantum computing-ready infrastructure, especially in the off-premises data centers.

On-premises data centers accounted for the largest revenue of the overall data center services market share in 2023.

- On-premises data centers provide data security and control to industries like finance and healthcare, which involve sensitive data. They are physical infrastructures within the enterprise.

- Organizations involving minimal delay utilize it, in order to achieve real-time processing.

- There is also an increase in the adoption of hybrid models by organizations, ensuring cloud flexibility in order to balance on-premise control.

- In November 2023, an on-prem cloud computing rack system was launched by Startup Oxide. This includes 16, 24, or 32 Compute Sleds and 16-32 processors with x86 cores.

- Thus, the security and low latency provided place this segment as the largest in the market.

Off-premises data centers are anticipated to register the fastest CAGR during the forecast period.

- Off-premises data centers reduce the dependency of organizations on physical infrastructure, utilizing cloud-based and colocation facilities, further ensuring scalability.

- To ensure the prevention of data loss from cyberattacks or natural disasters, recovery systems for disasters are integrated into these centers.

- Data processing and reduced latency are achieved with the integration of technologies like edge computing in the off-premises facilities.

- As per the market analysis, the flexibility and integration of disaster recovery services drive the data center services market trends.

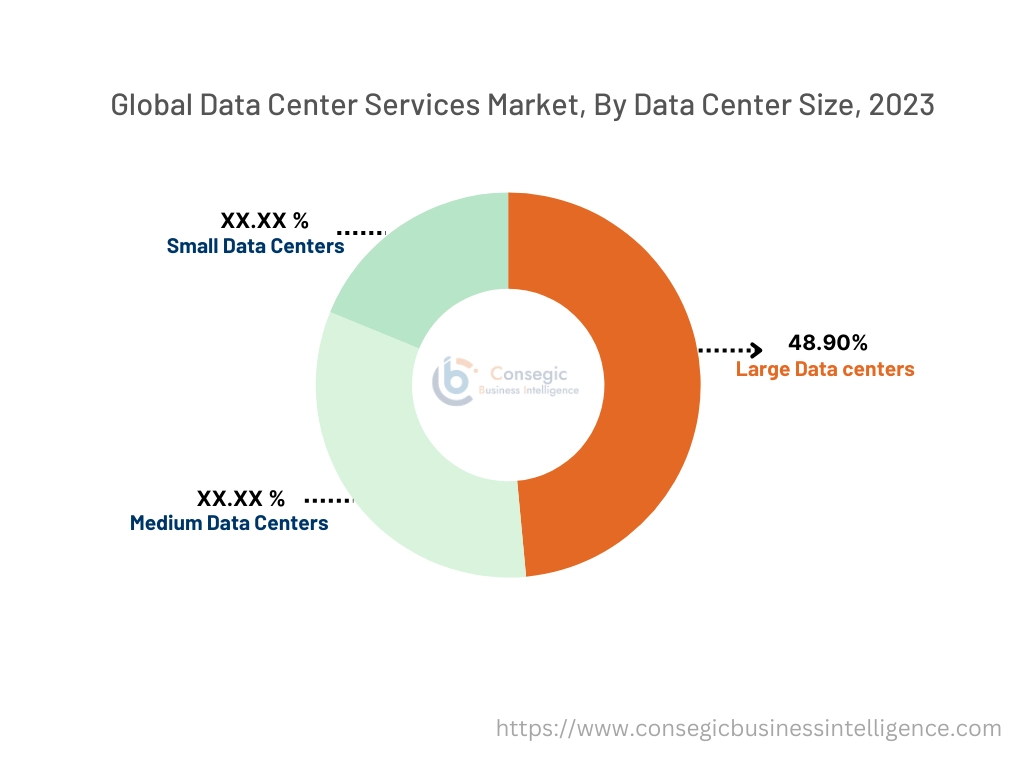

By Data Center Size:

Based on data center size, the market is trifurcated into small data centers, medium data centers, and large data centers.

Trends in the Data Center Size:

- Reduction in cost and scalability is ensured in medium-sized facilities with the advances in modular data centers, ensuring incremental expansion of infrastructure.

- In order to optimize the consumption of power and reduction of operational costs, AI-driven cooling systems are continuously being adopted.

The large data centers segment accounted for the largest revenue share of 48.90% in 2023.

- Services like computing power, storage, and data management are provided by large data centers to industries including cloud providers and government organizations.

- Redundancy features and security systems are integrated with these centers, providing seamless services even during power outages or cyberattacks.

- Sustainable solutions like solar and wind power are combined with these centers to maintain efficiency while achieving environmental goals.

- In July 2022, cooling solutions at Corscale's Gainesville Crossing Data Campus were installed by Corscale and Airedale by Modine. Corescale's sustainability goals for hyperscale operators and enterprise clients are leveraged with Airedale's expertise in energy-efficient cooling technology in the partnership.

- Therefore, the security of infrastructure and sustainability goals drive the data center services market demand.

The small data centers are anticipated to register the fastest CAGR during the forecast period.

- Small data centers reduce the latency and enhance overall performance, utilizing the localized data processing feature with edge computing and SMEs.

- They enable real-time decision-making, reducing the overall cost of organizations, that process data closer to the source.

- With the integration of IoT, faster and more efficient processing of data is ensured within the organization.

- In December 2023, stable data center power was offered with the launch of a new UPS by Eaton, called the Eaton 93T UPS. It is integrated into Eaton Brightlayer to optimize performance management and provide data insights utilizing intelligent operational and management features.

- Therefore, the demand for IoT solutions and faster data processing, places the sector as the fastest-growing in the market.

By End User:

Based on end users, the market is segmented into Large Enterprises, Small and Medium-Sized Enterprises (SMEs), Cloud Service Providers, Telecommunication Providers, and Government and Public Sector.

Trends in the End User:

- Ensuring the flexibility and on-demand services to clients by cloud service providers, advances in serverless computing are becoming more prominent.

- The improvement in network reliability and data transmission is achieved with the integration of 5G services with data center services.

Large Enterprises accounted for the largest revenue share in 2023.

- Large enterprises, like services and healthcare, with sensitive data in a massive amount are significantly inclined towards data center services for managing the data.

- The on-premises and cloud-based solutions are often integrated in order to abide by the stringent regulations of the government.

- In order to optimize data operations and the decision-making process, AI-based data management systems are continuously being adopted.

- In August 2022, the largest vertical data center was launched by Scala Data Centers in Latin America. This is to ensure sustainable constructions and a single-tenant data center, with a modern refrigeration system.

- Therefore, the regulatory and data management needs drive the growth of the large enterprises sector in the market.

Small and Medium-Sized Enterprises (SMEs) are anticipated to register the fastest CAGR during the forecast period.

- SMEs are increasingly reducing their dependency on infrastructure which is extremely costly, by inclining more towards the adoption of data center services.

- Without significant investments in resources, the IT management needs of the SMEs are facilitated with managed services.

- There is also a move towards secure, low-cost, and scalable solutions for IT, with the rapid digitalization and dependence on e-commerce.

- As per the analysis, the cost-effectiveness and reduced capital investments, place the SME sector as the fastest-growing end user in the market.

Regional Analysis:

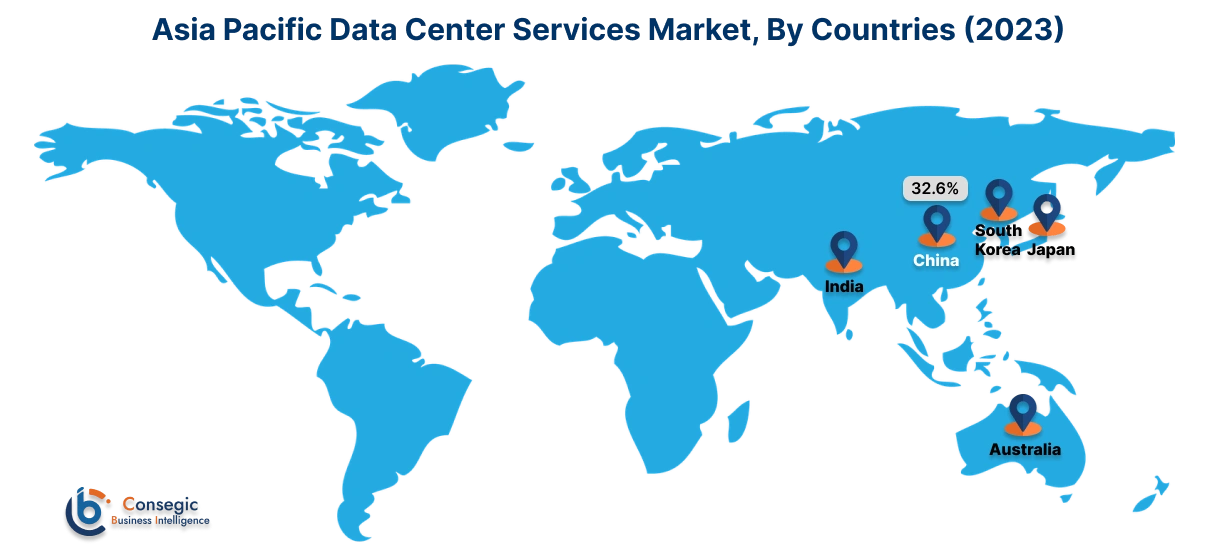

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

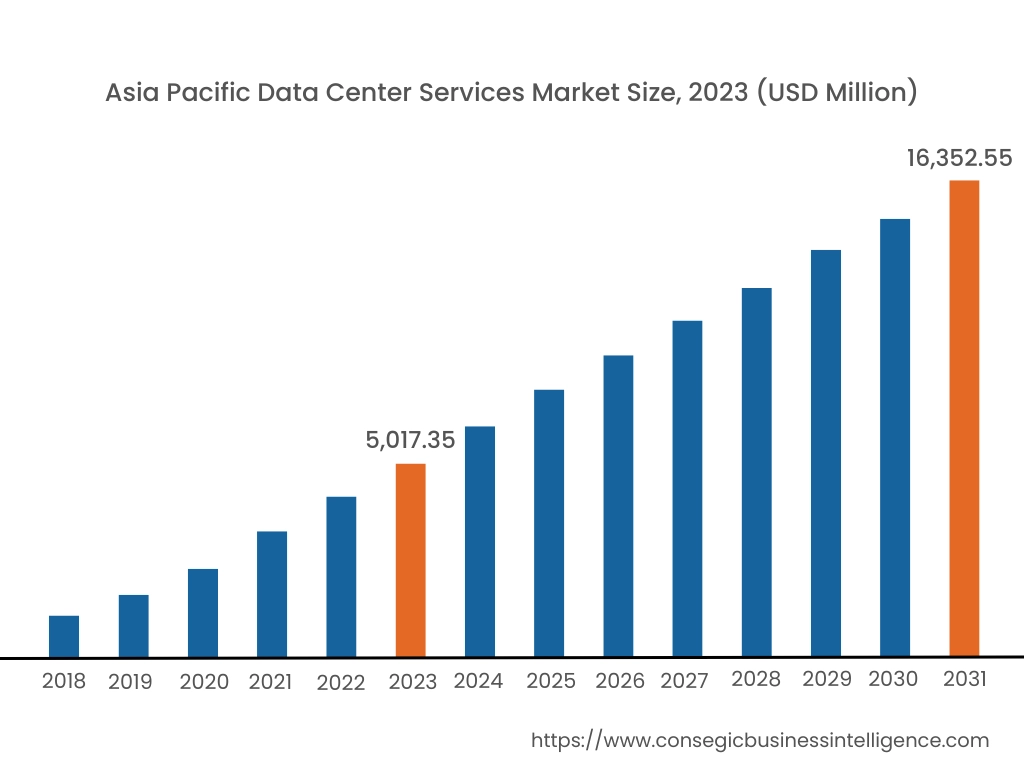

Asia Pacific region was valued at USD 5,017.35 Million in 2023. Moreover, it is projected to grow by USD 5,717.16 Million in 2024 and reach over USD 16,352.55 Million by 2031. Out of this, China accounted for the maximum revenue share of 32.6%. As per the data center services market analysis, due to the increase in the adoption of hyperscale data centers, the Internet, and digital services, especially in countries like China, India, and Singapore. The significant investment in 5G technologies, e-commerce, and mobile applications further drives the data center services market expansion.

- For instance, a 12.7 % increase in China's data center services market was seen during the year 2022, with a market size of $17.8 billion. The strengthening of policy can be attributed to the production of a significant number of new racks.

North America is estimated to reach over USD 20,931.02 Million by 2031 from a value of USD 6,620.20 Million in 2023 and is projected to grow by USD 7,524.09 Million in 2024. The growth is primarily driven by the increasing adoption of technologies like AI, machine learning, and IoT, especially in data-intensive fields like finance, the healthcare industry, and retail, for data storage and management. The shift towards cloud technologies and rapid digitalization further accelerates the data center services market expansion.

- In October 2023, Element Critical and Alcatex entered into an exclusive partnership, to innovate and customize, sustainable data center solutions. This allows a transition from on-premise data centers to hybrid infrastructure solutions in a seamless manner.

The stringent regulations related to data privacy and the rapid shift towards technologies like edge computing, a primary growth factors in the market for the region of Europe. Additionally, the expansion of digital cities and infrastructures contributes to the market. The data center services market analysis shows that the growing adoption of strategies for digital transformation, by governments and multiple organizations, accelerates the market in the Middle East and Africa. In Latin America, the expansion of the fintech and e-commerce industry, along with the adoption of cloud-based technologies drives the data center services market expansion.

Top Key Players & Market Share Insights:

The data center services market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global data center services market. Key players in the data center services industry include-

- Amazon Web Services, Inc. (USA)

- Microsoft (USA)

- IBM Corporation (USA)

- Oracle (USA)

- Equinix, Inc. (USA)

- Google LLC (USA)

- Digital Realty Trust (USA)

- Alibaba Cloud (China)

- NTT Communications Corporation (Japan)

Recent Industry Developments :

Product Launches:

- In September 2023, Shared Data Center as a Service was launched by HCL, ensuring the expansion of hybrid cloud technologies. They mitigate the overall workload by offering services like shared and dedicated data centers.

- In June 2023, a state-owned oil and gas company in Brazil called the Petrobus, launched a tender of $17.2 million. This is to ensure the support for IT infrastructure, Structured cabling, data storage, and virtualization services.

- In February 2023, the Data Center DR Service Solution 2.0 by Huawei during the Mobile World Congress (MWC) 2023. This technology utilizes iDRP intelligent DR management to ensure data security and resilience towards service.

Mergers & Acquisitions:

- In August 2024, Service Express a data center service company was acquired by Warburg Pincus, to expand their portfolio and service offerings.

Partnerships & Collaborations:

- In August 2024, Singtel and Hitachi announce the expansion of their partnership, in order to develop GPU cloud services and data centers in Japan.

- In April 2024, Nepal's BLC enters into a partnership with India's Yotta Data Services, to build the first Supercloud Data Center in Nepal. Yotta's global expertise and BLC's network of enterprise customers, accelerate the data center portfolio of the prior.

Data Center Services Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 61,871.17 Million |

| CAGR (2024-2031) | 15.4% |

| By Service Type |

|

| By Service Model |

|

| By End User |

|

| By Data Center Size |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Data Center Services Market? +

Data Center Services Market size is estimated to reach over USD 61,871.17 Million by 2031 from a value of USD 19,729.39 Million in 2023 and is projected to grow by USD 22,407.85 Million in 2024, growing at a CAGR of 15.4% from 2024 to 2031.

What specific segmentation details are covered in the data center services market report? +

The data center services market report includes specific segmentation details for service type, service model, end user, data center size, and region.

Which is the fastest segment anticipated to impact the market growth? +

In the data center size segment, small data centers are the fastest-growing segment during the forecast period due to the advancement in technology and increasing demand for IoT and data processing.

Who are the major players in the data center services market? +

The key participants in the data center services market are Amazon Web Services, Inc. or its affiliates (USA), Microsoft (USA), Google LLC (USA), IBM Corporation (USA), Oracle (USA), Equinix, Inc. (USA), Digital Realty Trust (USA), Alibaba Cloud (China), NTT Communications Corporation (Japan).