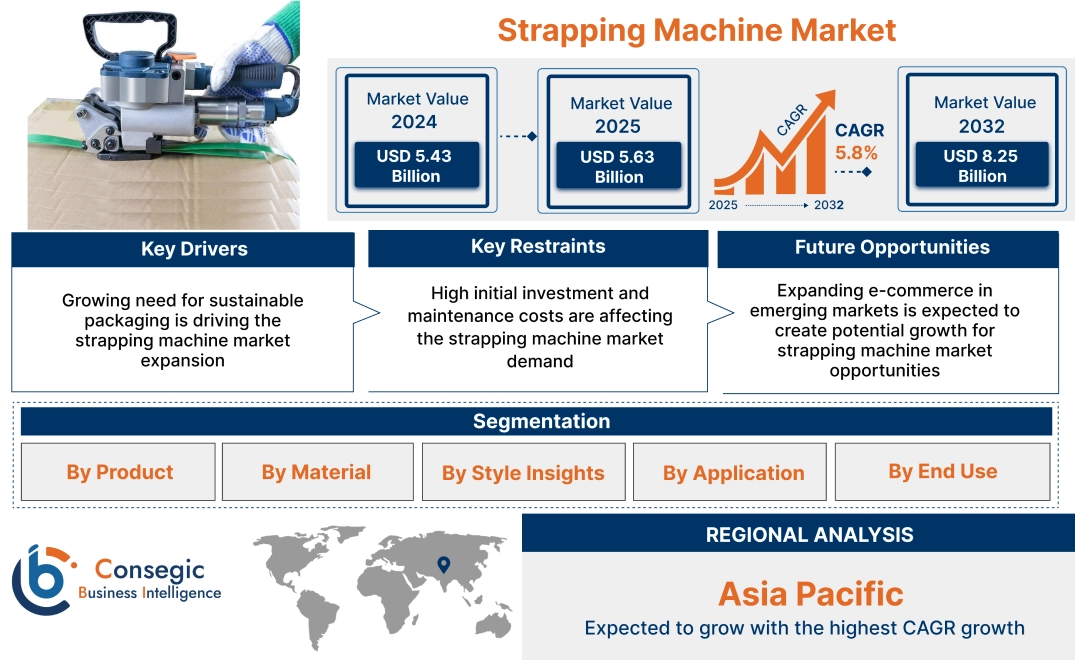

Strapping Machine Market Size:

Strapping Machine Market Size is estimated to reach over USD 8.25 Billion by 2032 from a value of USD 5.43 Billion in 2024 and is projected to grow by USD 5.63 Billion in 2025, growing at a CAGR of 5.8% from 2025 to 2032.

Strapping Machine Market Scope & Overview:

Strapping machine is an industrial machinery, which can pace up the process of wrapping pallets, while avoiding the product from breaking apart. These machines come in automated, semi-automatic, and handed versions. Further, these machines are used across various sectors, including food and beverages, pharmaceuticals, logistics, and manufacturing, ensuring that goods remain intact and protected during transit.

How is AI Transforming the Strapping Machine Market?

The integration of AI is considerably transforming the strapping machine market. AI-powered systems are being used for optimizing machine performance and reliability, facilitating predictive maintenance, enhancing operational efficiency by adapting to varying package requirements, and improving overall packaging quality through automated adjustments. AI-powered strapping machines can learn from data to optimize strap tension, positioning, and speed, which leads to reduced material waste, minimized errors, and increased throughput. AI-powered machines also facilitate seamless integration into larger automated packaging lines and support sustainability efforts through precise material use and reduced downtime. Consequently, the above factors are anticipated to drive the market growth in upcoming years.

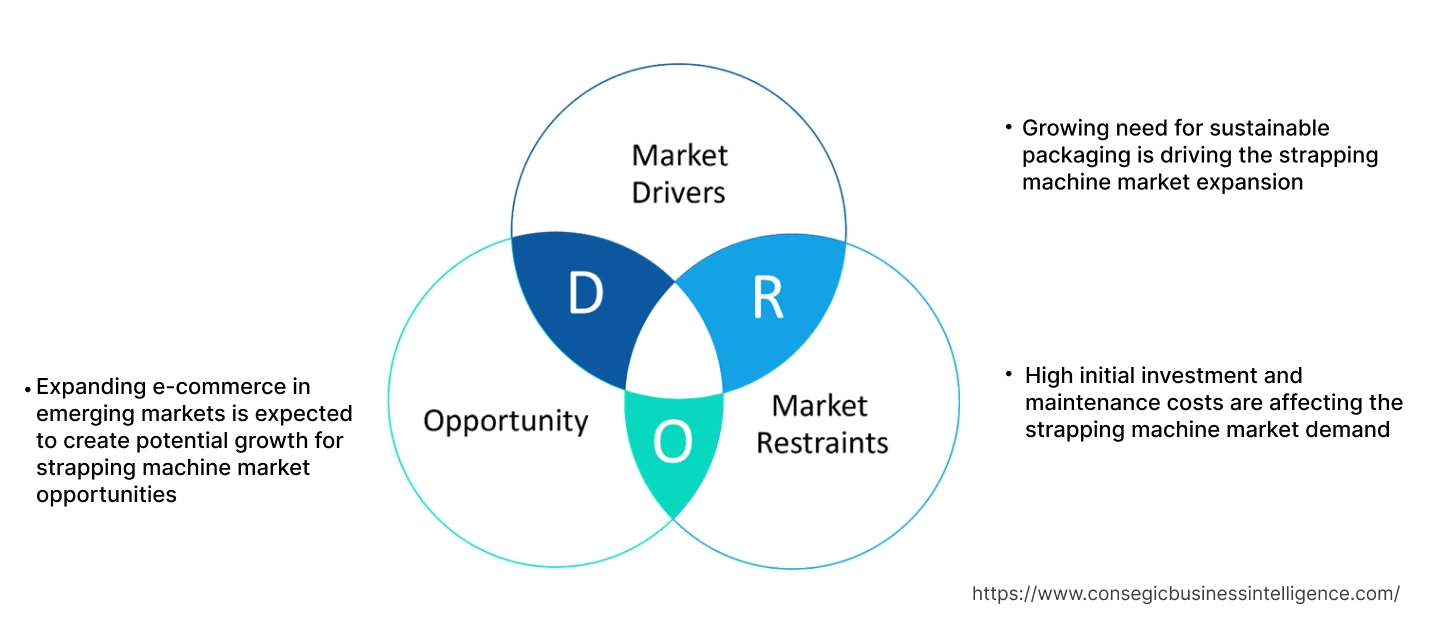

Strapping Machine Market Dynamics - (DRO) :

Key Drivers:

Growing need for sustainable packaging is driving the strapping machine market expansion

With the environmental consciousness growing globally, consumers are adopting products that are packaged in eco-friendly and sustainable materials. This shift in consumer preferences towards sustainability is driven by concerns about plastic pollution, climate change, and environmental degradation. As a result, there is a rising need for packaging solutions that minimize environmental impact, reduce waste, and are made from renewable or recyclable materials. To take advantage of this trend, manufacturers are developing machines capable of handling sustainable packaging materials effectively. This includes materials like biodegradable films, compostable plastics, recycled paper or cardboard. Additionally, integrating features that optimize material usage, reduce energy consumption, and minimize waste during the wrapping process is further enhancing the sustainability credentials of wrapping equipment.

- For instance, in July 2024, Antalis Packaging introduced a new range of cotton twine wrapping and tying machines, which use cotton and recycled cotton. The common use of machines includes bundling, strapping, retention, and aiding presentation.

Thus, according to the strapping machine market analysis, the growing need for sustainable packaging is driving the strapping machine market size and trends.

Key Restraints:

High initial investment and maintenance costs are affecting the strapping machine market demand

The machines require high initial investments for advanced strapping technologies. Fully automatic machines come with significant upfront costs, which are inaccessible to small & medium enterprises with limited budgets. Additionally, the maintenance and repair costs associated with these machines are considerably high. This financial barrier hampers the adoption of cutting-edge strapping solutions, particularly among smaller businesses, limiting strapping machine market size.

Future Opportunities:

Expanding e-commerce in emerging markets is expected to create potential growth for strapping machine market opportunities

The expansion of e-commerce in emerging markets such as Asia-Pacific, Latin America, and Africa is expected to create potential demand of industrial machines in the upcoming years. As these markets are developing, there's an increasing need for advanced packaging solutions to support their expanding manufacturing, retail, and logistics sectors. This growing demand for strapping equipment is driven by the need to improve packaging efficiency, ensure product safety, and meet the rising consumer expectations for quality and presentation. Additionally, government initiatives, favorable investment policies, and infrastructure development projects in these regions further support market progression by creating a business environment for manufacturers and suppliers of wrapping equipment.

- For instance, Signode India launched MST generation strapping machine for Indian market. The machine has augmented safety features and various intelligent design attributes, such as ergonomic position of the various controls, which are convenient for operators to use.

Thus, based on the above factors and analysis, the growing need for strapping equipment in developing economies is expected to play a crucial role in shaping the future of the strapping machine market opportunities and trends.

Strapping Machine Market Segmental Analysis :

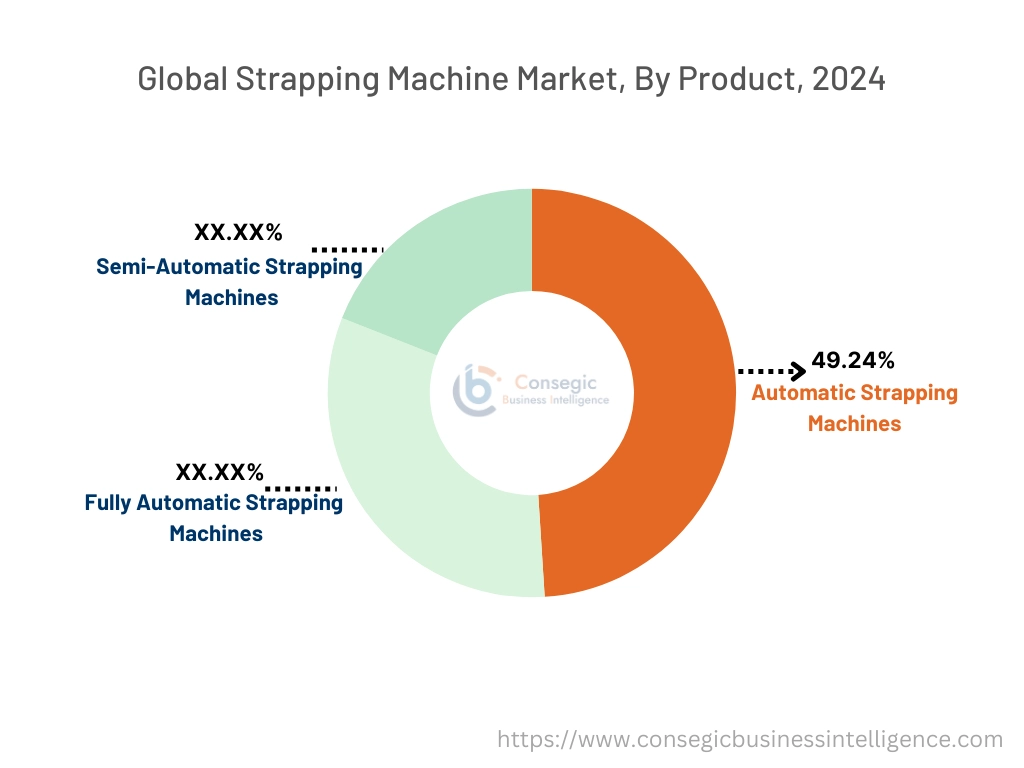

By Product:

Based on product, the strapping machine market is segmented into semi-automatic strapping machines, automatic strapping machines, and fully automatic strapping machines.

Trends in Product:

- Semi-automatic machines are designed to improve efficiency by automating processes, such as tensioning and cutting, while requiring human involvement for setup and operation. These machines are found in medium-scale operations where both speed and flexibility are important, offering a good compromise between productivity and cost.

- Automatic strapping systems are typically integrated into production lines, allowing for seamless operation without the need for manual intervention. These systems enhance efficiency and reduce the chances of human error, which is preferred choice for industries requiring continuous and high-speed packaging solutions.

The automatic strapping machines segment accounted for the largest revenue share of 49.24% in the year 2024.

- Automatic strapping machines offer a higher level of efficiency compared to semi-automatic options while still being more accessible than fully automatic models.

- These machines automate certain processes, such as strap feeding and tensioning, allowing for faster packaging cycles. They are particularly beneficial for medium-sized businesses that require consistent performance and moderate production rates.

- Industries such as packaging and food processing are increasingly adopting automatic strapping machines to streamline their operations.

- For instance, in November 2024, PAC Strapping Products introduced STRAPBLASTER technology, for maintenance of automatic machines. The technology was developed to address the technological challenges in strapping equipment, such as debris buildup.

- Thus, the analysis shows that the aforementioned factors are driving the strapping machine market growth and opportunities during the forecast period.

The fully automatic strapping machines segment is anticipated to register the fastest CAGR during the forecast period.

- Fully automatic machines provides the highest level of efficiency and integration within packaging lines. These machines operate with minimal human intervention, automating the entire strapping process from start to finish.

- Due to their speed and reliability, fully automatic systems are ideal for high-volume production environments, such as manufacturing and distribution centers.

- Their advanced features, including sensors and integration with conveyor systems, enhance productivity and reduce labor costs, suitable for organizations seeking to optimize their packaging operations.

- Thus, the market analysis depicts that the aforementioned factors are driving the strapping machine market during the forecast period.

By Material:

Based on material, the market is segmented into polypropylene, polyester, steel, and others.

Trends in Material:

- The strong emphasis on sustainability is directing manufacturers towards developing and utilizing recyclable and biodegradable strapping materials.

- The growing focus on ensuring loads are stable during transportation is driving the development of robust strapping machines and materials.

The polypropylene segment accounted for the largest revenue share in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- Polypropylene strapping machines are widely adopted due to their lightweight and resistant to moisture, suitable for a variety of applications, including food and beverage, consumer goods, and logistics.

- The increasing adoption of automated packaging solutions has propelled the need for polypropylene strapping equipment, as they enhance operational efficiency while reducing labor costs.

- In addition to this, the elastic memory in polypropylene straps absorbs shock and maintains the strapping in place, while being handled and shipped, there by driving the strapping machine market trends.

- Therefore, the market analysis shows that the aforementioned factors are driving the strapping machine market share during the forecast period.

By Style Insights:

Based on style insights, the market is segmented into palette strappers, table-top strappers, and RQ-8 strappers.

Trends in Style Insights:

- Modern machines are designed with efficiency and user-friendly, which includes features such as intuitive controls, easy maintenance, and compact designs.

- The machines are being designed to handle a wide range of materials and package shapes, which is driving the progression of diverse product fulfilment.

The palette strappers segment accounted for the largest revenue share in the year 2024.

- The growing awareness among manufacturers regarding the importance of sustainable packaging practices is propelling the segment growth. As environmental concerns continue to gain traction worldwide, there is a growing preference for eco-friendly and recyclable packaging materials, driving the adoption of bio-based and biodegradable pallet strapper solutions.

- The increasing focus on reducing product damage during transit is pushing companies to adopt advanced strapping machines. These machines not only enhance packaging efficiency but also reduce labor costs and improve overall operational productivity.

- Consequently, these factors supplement the strapping machine market trends.

The RQ-8 strappers segment is anticipated to register the fastest CAGR during the forecast period.

- The desire for machines that are easy to operate and have features such as auto re-feed and loop ejection, have increased the need for RQ-8 strappers.

- A significant trend is the growing need for automated packaging solutions. This drives the need for automatic strapping solutions, such as RQ-8 series, which offer efficiency and speed.

- Logistics and distribution centers rely on RQ-8 strappers to ensure that packages are securely prepared for shipping, while contributing to the segment’s growth.

- These factors are driving the global market during the forecast period.

By Application:

Based on application, the market is segmented into bundling, binding, packaging, and others.

Trends in Application:

- The rapid progression of e-commerce and logistics is leading to an increased need for reliable packaging solutions.

- With consumer preferences leaning towards convenience and sustainability, the machines are evolving to accommodate eco-friendly materials and innovative packaging designs.

The packaging segment accounted for the largest revenue in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- In aerospace sector, strapping solutions are used to secure equipment, cargo, and parts during transportation, ensuring safety and minimizing damage during handling.

- In the healthcare industry, the machines are used for packaging pharmaceutical products, medical devices, and equipment. With the growing need for efficient and hygienic packaging solutions in healthcare, the market for strapping equipment continues to expand.

- Thus, the segmental trends analysis shows that the aforementioned factors are driving the strapping machine market growth during the forecast period.

By End-Use:

Based on the end use, the strapping machine market is consumer goods, food and beverage, newspaper and publishing, postal, and others.

Trends in the End Use:

- The newspaper and graphics sector utilizes strapping equipment to bundle printed materials, ensuring they are securely packed for delivery, critical for maintaining the integrity of printed goods.

- Consumer appliances manufacturers rely on strapping solutions to secure heavy items like refrigerators, washing machines, and microwaves.

The food and beverage segment accounted for the largest revenue in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- In the food and beverage sector, strapping machines are used to bundle products like cartons of beverages, snack items, and packaged foods, helping to maintain freshness and prevent damage during transit.

- The need for automated strapping solutions is increasing in the food and beverage sector as companies seek to enhance operational efficiency and meet high-volume packaging needs.

- For instance, in October 2024, PAC Strapping Products unveiled the latest battery-powered tools, BT3920 and BT2450, to meet the diverse need of food and beverage sector. The tools are fully compatible with both polyester strapping and polypropylene, while delivering better performance and reliability.

- Thus, as per the analysis in the food and beverage segment, the aforementioned factors are driving the trends in the global market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

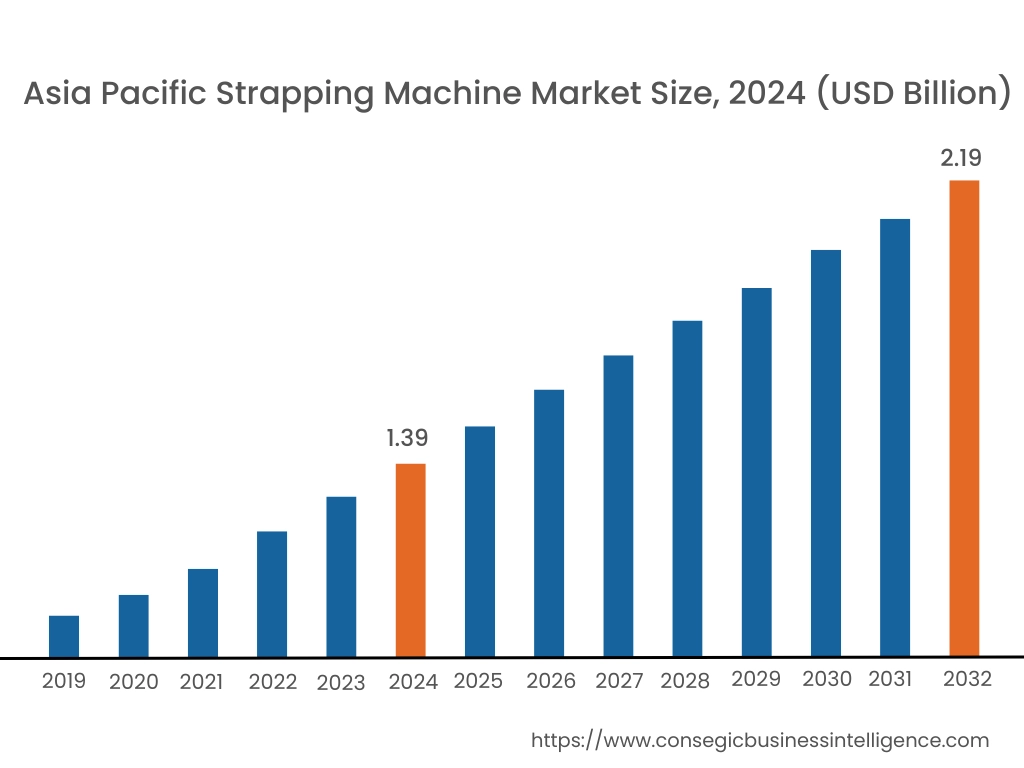

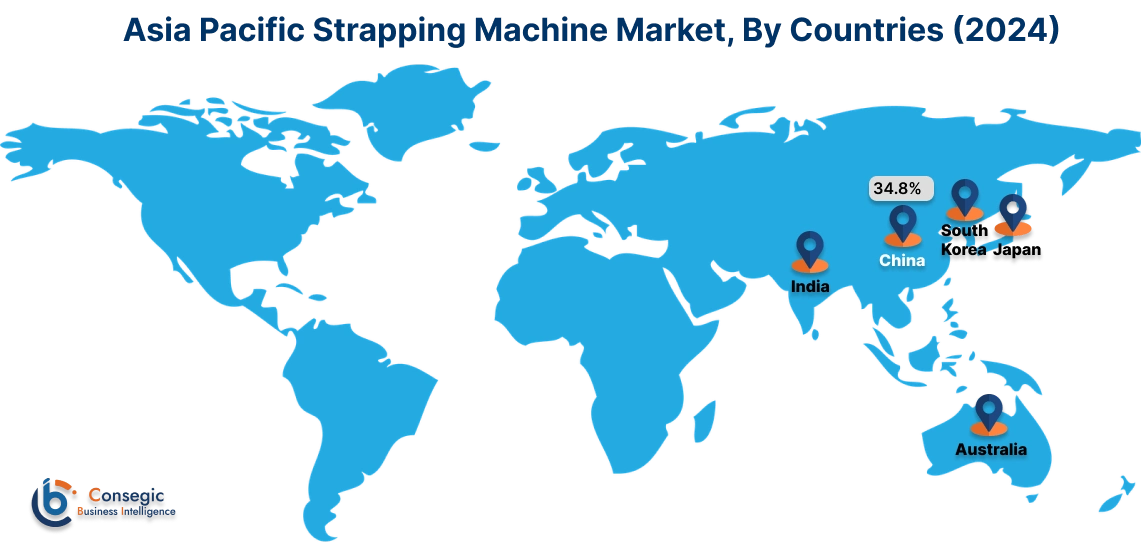

Asia Pacific strapping machine market expansion is estimated to reach over USD 2.19 billion by 2032 from a value of USD 1.39 billion in 2024 and is projected to grow by USD 1.45 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 34.8%. The rapid industrialization, expanding manufacturing sectors, and the rise of e-commerce are pivotal in driving demand. Countries such as China and India are leading this growth, with significant investments in packaging technologies. Further, with a robust manufacturing sector and growing e-commerce activities, there's an increasing need for strapping equipment to streamline packaging processes, ensure product safety, and meet the demands of a competitive market. These trends would further drive the regional strapping machine market share during the forecast period.

- For instance, in February 2022, Signode has launched its BPT steel strapping equipment. This battery-operated tool has a lightweight design and suited for a wide range of steel strapping applications, that demand high-tension force.

North America market is estimated to reach over USD 2.89 billion by 2032 from a value of USD 1.92 billion in 2024 and is projected to grow by USD 1.99 billion in 2025. The integration of smart technologies, such as IoT-enabled sensors and automation controls, is revolutionizing the wrapping equipment landscape, offering enhanced precision, efficiency, and control over packaging processes. Moreover, the increasing focus on sustainable packaging solutions is driving innovations in strapping equipment, with manufacturers developing eco-friendly and recyclable wrapping materials and machines. With these trends shaping the industry, the regional market is expected to experience continued growth, presenting prospects for market players to innovate and diversify their product offerings. These factors would further contribute to its leading position in the strapping machine market share.

- For instance, in August of 2022, TRANSPAK launched its inaugural fully automated strapping machine capable of instant packaging of any height or width of product.

According to the strapping machine industry analysis, the European market has experienced significant development in recent years. Europe represents a mature market for strapping equipment, characterized by stringent regulatory standards and a growing emphasis on sustainability. The increasing adoption of automated packaging solutions in industries such as logistics and manufacturing are expected to drive the market growth. Additionally, Latin America is gradually emerging as a viable market for strapping equipment, influenced by growing manufacturing activities and an increasing focus on packaging efficiency. Further, in the Middle East and Africa, the strapping machine market is on a growth trajectory, supported by increasing investments in infrastructure and manufacturing.

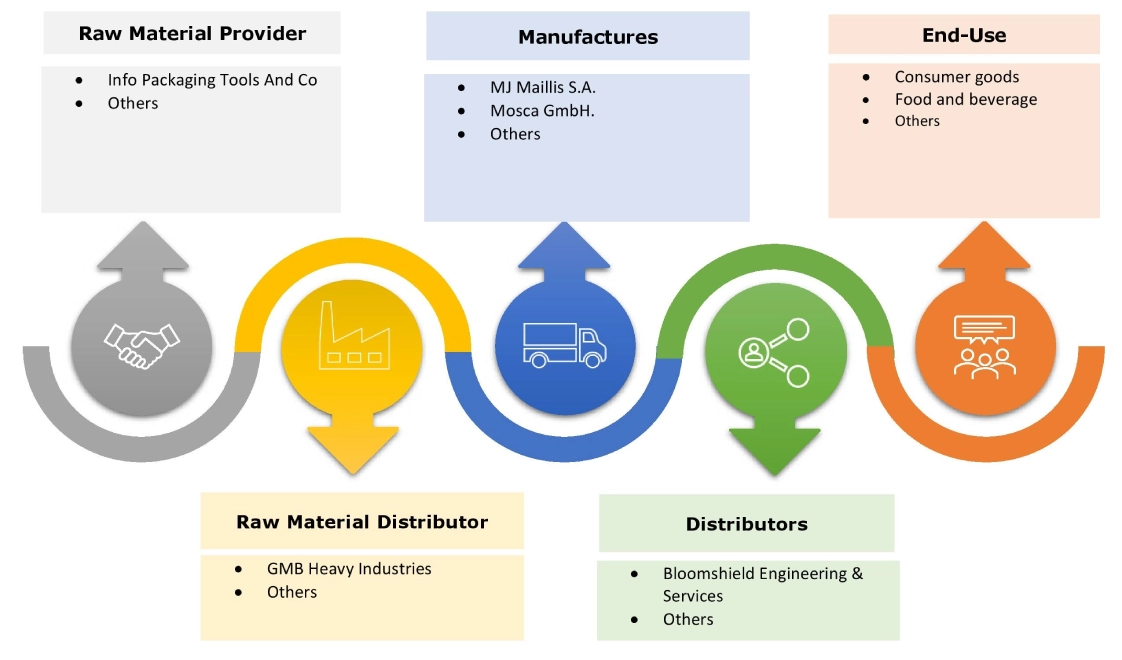

Top Key Players and Market Share Insights:

The global strapping machine market is highly competitive with major players providing strapping solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the strapping machine industry include-

- ASN Packaging Pvt. Ltd (India)

- Fromm Holdings AG (Switzerland)

- Messersi Packaging S.r.l. (Italy)

- MJ Maillis S.A. (Greece)

- Mosca GmbH (Germany)

- Polychem Corporation (India)

- Samuel Strapping Systems (Canada)

- StraPack Inc. (U.S.)

- Strapex Group (Switzerland)

- Transpak Equipment Corp. (U.S.)

- Signode Packaging Systems Corporation (U.S.)

Strapping Machine Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 8.25 Billion |

| CAGR (2025-2032) | 5.8% |

| By Product |

|

| By Material |

|

| By Style Insights |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Strapping Machine market? +

Strapping machine market size is estimated to reach over USD 8.25 Billion by 2032 from a value of USD 5.43 Billion in 2024 and is projected to grow by USD 5.63 Billion in 2025, growing at a CAGR of 5.8% from 2025 to 2032.

Which is the fastest-growing region in the Strapping Machine market? +

Asia-Pacific is the region experiencing the most rapid growth in the market. The region's expanding logistics and warehousing sectors, coupled with the growing FMCG and retail industries, drive the demand for wrapping equipment to ensure efficient and secure packaging.

What specific segmentation details are covered in the Strapping Machine report? +

The strapping machine report includes specific segmentation details for product, material, style insights, application, end use, and region.

Who are the major players in the Strapping Machine market? +

The key participants in the market are ASN Packaging Pvt. Ltd (India), Fromm Holdings AG (Switzerland), Messersi Packaging S.r.l. (Italy), MJ Maillis S.A. (Greece), Mosca GmbH (Germany), Polychem Corporation (India), Samuel Strapping Systems (Canada), StraPack Inc. (U.S.), Strapex Group (Switzerland), Transpak Equipment Corp. (U.S.), Signode Packaging Systems Corporation (U.S.), and others.