Swim Fins Market Introduction :

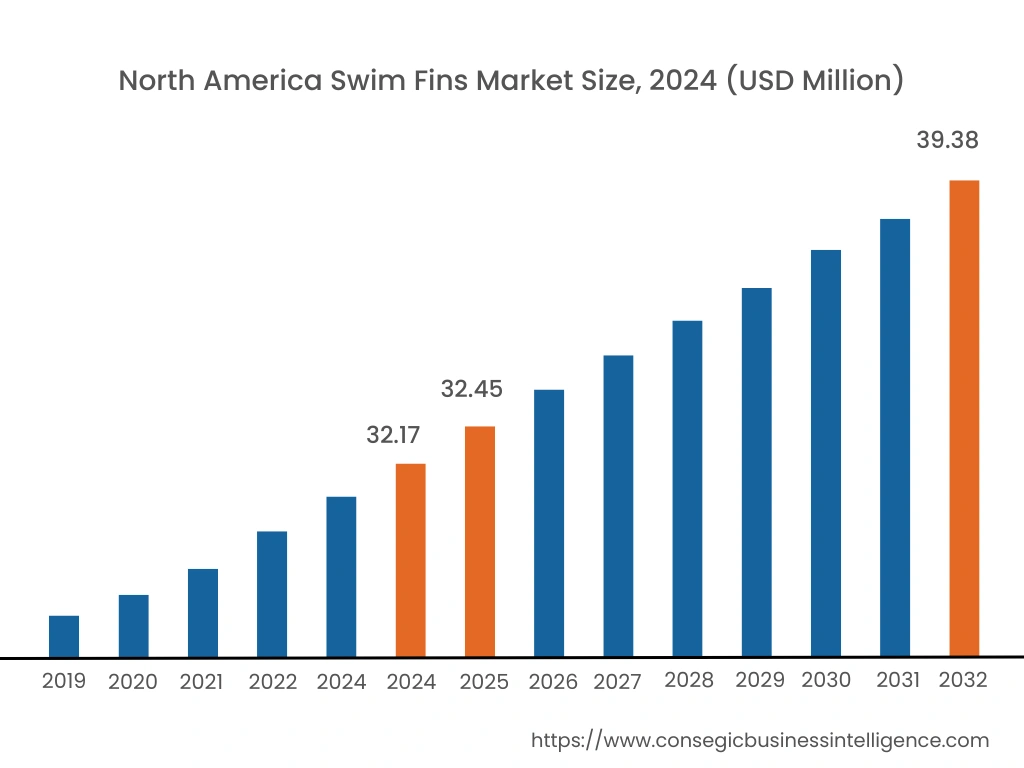

Consegic Business Intelligence analyzes that the swim fins market size is growing with a CAGR of 2.9% during the forecast period (2025-2032), and the market is projected to be valued at USD 121.5 Million by 2032 from USD 96.97 Million in 2024.

Swim Fins Market Definition & Overview:

Swim fins are considered essential accessories for swimmers as they provide a better swimming experience by enhancing propulsion and strengthening leg power. The fins are made of silicone, and they provide durability, flexibility, and comfort for all users. A swim fin is a finlike accessory worn on the feet to aid movement through water. They are typically made of rubber, plastic, or carbon fiber and have a curved, paddle-shaped blade that helps to increase the wearer's propulsion. Swim fins are also known as flippers.

Swim Fins Market Insights :

Key Drivers :

Growing adoption of swimming in the fitness and sports industry is driving the market growth

Swim fins can be used for fitness swimming. They can help consumers swim faster and more efficiently, which can help them burn more calories and improve their cardiovascular health. Swim fins can also help to improve flexibility and range of motion. Swimming is a great way to get fit and stay healthy. It is a low-impact exercise that is easy on the joints, making it a good choice for people of all ages and fitness levels. Swimming is also a great way to cool off on a hot day.

Increasing adoption of swimming is leading to greater usage of swim fins globally. Swimming is considered a low-impact, full-body workout that offers numerous health benefits. In addition, water Zumba has gained popularity among individuals and is an effective workout alternative. Moreover, many parents enroll their children in different swimming programs. Furthermore, schools, community centers, and swimming clubs have specific swim training programs, driving the adoption rate of swimming and thus influencing the growth of the swim fins market. For instance, according to a recent report by Swim England in 2023, which is the national governing body for swimming in England, swimming was considered one of the well-admired exercises in England. Furthermore, children exceeding a count of one million, learn to swim outside of school through Swim England's Learn to Swim program each year. Also, people are adopting swimming as it helps the population to stay fit. Hence, as the adoption of swimming as a fitness and training activity increases the demand for swim fins.

Rising scuba diving equipment industry is fostering market growth

The scuba diving equipment industry has swim fins as their major product segment. Most of the scuba divers are recreational divers who explore underwater environments such as rivers, lakes, quarries, coral reefs, and kelp forests. Increasing scuba diving activities are fostering a rise in the scuba diving equipment industry. Furthermore, it is considered a well-known adventure sport in the world. Scuba diving equipment includes various products such as swimming fins, oxygen tanks, and diving masks among others. Hence increasing scuba diving equipment market is significantly influencing the larger demand for swim fins products. Owing to the aforementioned factors, the swim fins market is growing at a significant rate.

Key Restraints :

Increasing concerns of environmental impact is hampering the growth of swim fins market

Swim fins are typically made from rubber, plastic, or carbon fiber. Rubber and plastic are non-biodegradable materials, which means they can take hundreds or even thousands of years to break down in the environment. Rising improper disposal of swim fins is leading to the growth of the water population. Also, certain swim fin products are made up of non-biodegradable substances such as plastics which hampering the market growth of swim fins.

Future Opportunities :

Increasing international tourism is expected to fuel the market growths

Swim fins are an important part of the tourism industry, as they are used by many people who participate in water sports, such as snorkeling, scuba diving, and swimming. Swim fins can help people to move more easily and efficiently through the water, which can make these activities more enjoyable and less tiring. Swim fin products are widely incorporated in water sports across the globe. The increasing tourism industry is expected to boost the rise of water sports in different destinations globally. Hence, increasing water sports activities around the globe and rising foreign tourism are expected to influence the growth rate further. Hence, increasing international tourism in different countries is expected to fuel the market growth.

Swim Fins Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 121.5 Million |

| CAGR (2025-2032) | 2.9% |

| By Type | Short Blade Swim Fins, Fitness Swim Fins, Monofins, Breaststroke Swim Fins, and Others |

| By Material Type | Plastic, Rubber, Carbon Fiber, and Silicone |

| By Application | Training & Fitness, Diving, and Others |

| By Distribution Channel | Online (Company-Owned Website, E-commerce), Offline (Hypermarket/Supermarket, Specialty Stores, Departmental Stores, and Others) |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Speedo, IST SPORTS CORP., FINIS, INC., Aqua Lung International, Sun Tail Mermaid, LLC., Mahina-Mermaid, Kiefer Aquatics, Adolph Kiefer & Associates LLC, H2Odyssey, TYR SPORT. INC., Mares, BEUCHAT INTERNATIONAL, Scubapro (Johnson Outdoors), Huish Outdoors, Mad Wave LTD, and Zoggs International |

Swim Fins Market Segmental Analysis :

Based on the Type :

The type segment is categorized into short blade swim fins, fitness swim fins, monofins, breaststroke swim fins, and others. In 2024, the short blade swim fins segment accounted for the highest market share in the overall swim fins market. Short blade swim fins are swim fins that have short, stubby blade. The blade is typically less than 12 inches long. Short blade swim fins are designed to provide a quick and efficient kick, making them ideal for swimming, snorkeling, and other water sports. Owing to the aforementioned advantages of the short blade swim fins, there is a significant segment growth in the swim fins market.

Moreover, the fitness swim fins segment is expected to grow at the fastest CAGR in the overall swim fins market during the forecast period. This is due to certain advantages such as increased workout laps in the pool, support to level up intensity, and improvement of strong leg muscles. In addition, a large number of people of varying age groups are adopting swimming as a fitness activity, driving the segment growth during the forecast period.

Based on the Material Type :

The material type segment is categorized into plastic, rubber, carbon fiber, and silicone. In 2024, the rubber segment accounted for the highest market share and is expected to grow at the fastest CAGR in the overall swim fins market. Rubber swim fins are well-known for the durability and comfort they provide to users. Furthermore, such fins are often observed to be more flexible when compared to plastics. In addition, the key players in the market are preferring to use natural rubbers to manufacture the swim fins. Furthermore, increasing natural rubber production globally is leading to greater demand for rubber swim fins in the market. For instance, according to a recent report by the Rubber Board, in 2023, the Indian natural rubber sector registered a growth of 9.0% in consumption in 2022-23 over the year 2021-22. Rubber production also increased to 839,000 tonnes in 2022-23 from 775,000 tonnes in 2021-22. Hence, increasing natural rubber production is influencing significant segmental growth in the swim fins market.

Based on the Distribution Channel :

The distribution channel segment is categorized into online and offline. In 2024, the offline segment accounted for the highest market share in the swim fins market driven by the easy availability of swim fins in convenience stores, and specialty stores. Moreover, consumers get the chance to personally explore new products introduced into the market by accessing them in the stores so that they can choose wisely. Also, rising retail sales among other offline distribution channels is boosting the segment growth in the swim fins market. For instance, according to a report in 2023, by the Office for National Statistics, retail sales volumes rose by around 0.5% in April 2023, which cumulatively increased by around 0.8% between February to April 2023 in Great Britain.

Moreover, the online segment is expected to grow at the fastest CAGR in the overall swim fins market during the forecast period due to the increasing adoption of online shopping trends owing to rising e-commerce platforms. Various key players in the market are selling their products directly through their company owned websites and other e-commerce platforms. Furthermore, different companies are also offering the products with additional offers and discounts over online platforms, resulting in the consumers getting attracted towards online shopping. Hence, the online distribution channel is attributed to witness significant market growth during the forecast period.

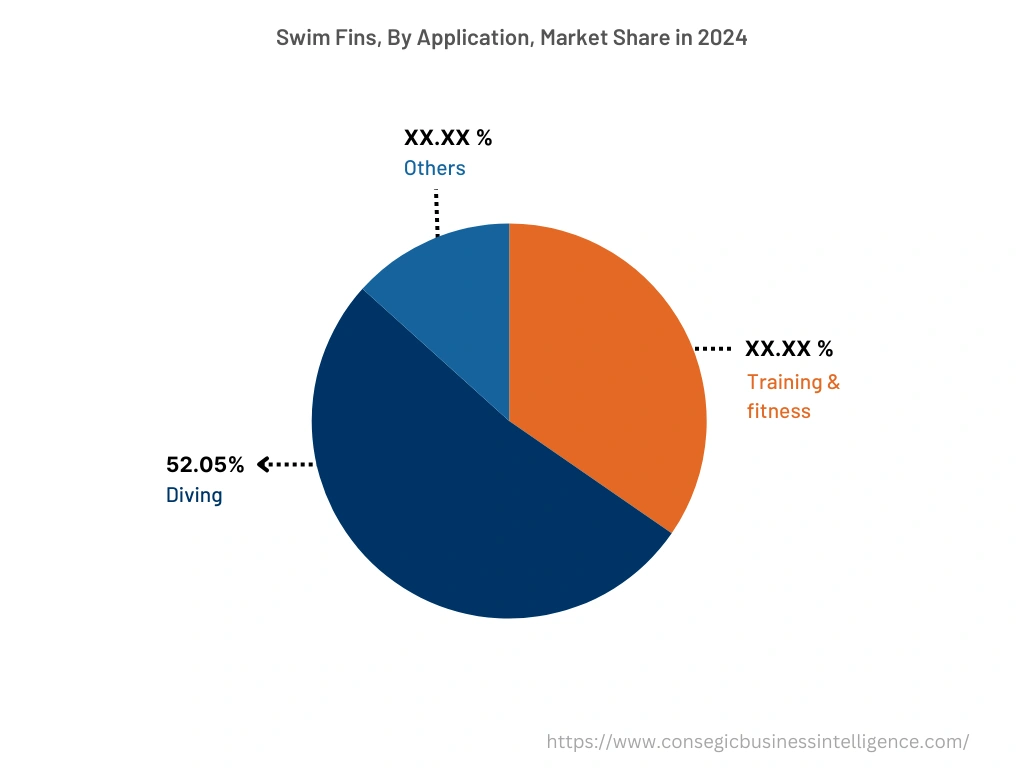

Based on the Application :

The application segment is categorized into training & fitness, diving, and others. In 2024, the diving segment accounted for the highest market share of 52.05% driven by the rising popularity of diving among the population and considering it to be an adventure activity globally. Moreover, different diving types ranging from beginner to professional have been increasing, leading to the larger application of swim fins for diving purposes. For instance, according to a recent article by the Centers for Disease Control and Prevention, in 2023, 0.5 million to 4 million people in the United States participate in recreational diving in 2022. Hence, due to rising diving activities, the segment is experiencing significant growth in the swim fins market.

Moreover, the training & fitness segment is expected to grow at the fastest CAGR in the overall swim fins market during the forecast period due to the rising awareness of living a healthy lifestyle, improvement in stress management, boosting the heart health, and others. In addition, swimming can help burn out up to around 40% more calories than biking and other exercises, leading to larger demand for swim fins in training and fitness purposes. Thus, due to the aforementioned factors, the training & fitness segment is expected to foresee significant growth during the forecast period.

Based on the Region :

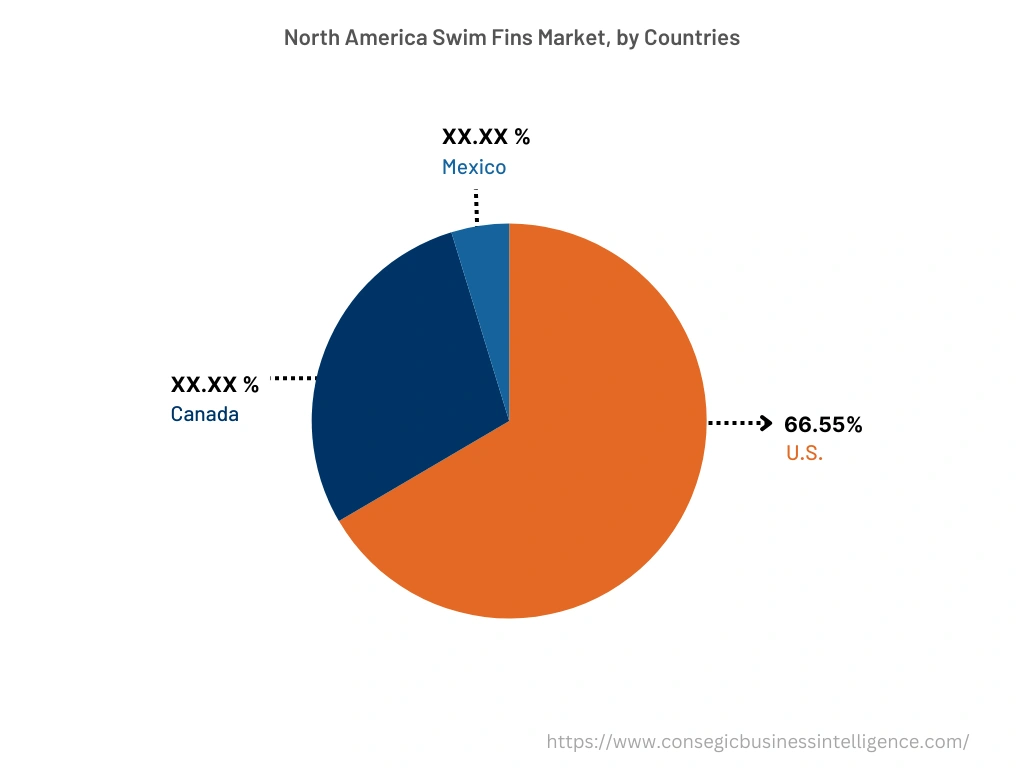

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

In 2024, North America accounted for the highest market share at 35.45% and was valued at USD 32.17 million and is expected to reach USD 39.38 million in 2032. In North America, the U.S. accounted for the highest market share of 66.55% during the base year of 2024. The growth in the North America region is attributed to the presence of key players located in this region. Also, rising numbers of health-conscious people undertaking several physical sports including swimming is driving the growth of the region in the swim fins market.

Moreover, Europe is expected to grow at the fastest CAGR of 3.0% in the overall swim fins market during the forecast period due to the increasing adoption of swimming as a recreational and leisure activity in this region. Furthermore, increasing water sports and fitness activities in this region is driving the growth of swim fins during the forecast period. Hence, due to the aforementioned factors, the swim fins market is foreseeing high growth in Europe during the forecast period.

Top Key Players & Market Share Insights:

The swim fins market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Speedo

- IST SPORTS CORP.

- Mares

- BEUCHAT INTERNATIONAL

- Scubapro (Johnson Outdoors)

- Huish Outdoors

- Mad Wave LTD

- Zoggs International

- FINIS, INC.

- Aqua Lung International

- Sun Tail Mermaid, LLC.

- Mahina-Mermaid

- Kiefer Aquatics

- Adolph Kiefer & Associates LLC

- H2Odyssey

- TYR SPORT. INC.

Recent Industry Developments :

- In July 2023, Speedo entered into a collaboration with Alwayth and Beams to launch a refreshing Summer 2023 collection. This collaboration is expected to expand their customer base across both fashion enthusiasts and swimwear aficionados.

- In April 2021, Aqua Lung International launched a new collection, named XSCAPE Collection. The product is a 100 percent neoprene-free wetsuit and proves to be a sustainable approach for a variety of water activities.

Key Questions Answered in the Report

What was the market size of the swim fins industry in 2024? +

In 2024, the market size of swim fins was USD 96.97 million.

What will be the potential market valuation for the swim fins industry by 2032? +

In 2032, the market size of swim fins will be expected to reach USD 121.5 million.

What are the key factors driving the growth of the swim fins market? +

Growing adoption of swimming in the fitness and sports industry is driving the growth of the market.

What is the dominating segment in the swim fins market by application? +

In 2024, the diving segment accounted for the highest market share of 52.05% in the overall swim fins market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the swim fins market's growth in the coming years? +

Europe is expected to be the fastest-growing region in the market during the forecast period.