Syntactic Foam Market Size:

The Syntactic Foam Market size is growing with a CAGR of 5.2% during the forecast period (2025-2032), and the market is projected to be valued at USD 235.01 Million by 2032 from USD 157.79 Million in 2024. Additionally, the market value for 2025 is attributed to USD 165.36 Million.

Syntactic Foam Market Scope & Overview:

Syntactic foam is a specialized composite material distinguished by its unique internal structure. It is typically manufactured by uniformly dispersing pre-formed hollow particles, known as microspheres or microballoons, throughout a continuous matrix material. Matrix material is usually made of polymer, metal, or ceramic. This distinctive composition imparts a combination of desirable properties, including exceptional lightweightness, high specific strength and robust compressive strength, making it ideal for demanding applications. Additionally, this composite material exhibits low thermal expansion, excellent thermal and acoustic insulation capabilities, and ability to be precisely tailored to meet specific performance requirements across various industries.

How is AI Transforming the Syntactic Foam Market?

There is a rising adoption of AI in the syntactic foam market, mainly for accelerating material discovery through data analytics, optimizing manufacturing processes with machine learning and automation, enabling predictive performance analysis, and facilitating the development of customized, multi-functional, and sustainable foam solutions. Moreover, AI-powered tools can identify optimal foam compositions, predict material performance under various conditions, and improve real-time monitoring of production to reduce defects, waste, and downtime. This further contributes to higher quality products and more efficient, cost-effective production for use across several industries such as marine, aerospace, and others. Consequently, the above factors are expected to propel the market growth during the forecast period.

Syntactic Foam Market Dynamics - (DRO) :

Key Drivers:

Growing Adoption in Marine & Subsea Applications to Drive Syntactic Foam Market Growth.

The adoption of syntactic foam in marine and subsea applications is fueled by the material's exceptional buoyancy, high hydrostatic crush resistance, and low water absorption. These distinguishing properties make it suitable for deep-sea operations. As offshore oil and gas exploration extends into ultra-deep waters, and oceanographic research expands, the necessity for reliable buoyancy modules, subsea thermal insulation for risers, and lightweight components for remotely operated (ROVs) and autonomous underwater vehicles (AUVs) intensifies. The material's ability to maintain structural integrity and provide sustained lift in extreme underwater environments directly supports the complex and demanding requirements of modern marine and subsea activities, thereby impacting market growth.

- For instance, in 2024, Base Materials became the first syntactic foam subsea buoyancy manufacturer to achieve DNV type approval for its Subtec 11500 material and Approval of Manufacture for its full Subtec range, demonstrating the high quality and performance of its low-density syntactic buoyancy materials.

Thus, as per the analysis, the growing market for this material in marine & subsea sector is fueling significant syntactic foam market growth.

Key Restraints:

Competition from Alternative Lightweight Materials to Hinder Syntactic Foam Market Expansion.

Wide availability of alternative materials poses as a significant competition to syntactic foam market demand, impeding the market. Competition from the alternative materials such as carbon fiber composites, advanced polymers including structural foams, highly engineered plastics, and even traditional foams consisting of polyurethane, polyethylene, and expanded polystyrene poses a significant hindrance for the market. These alternatives sometimes offer comparable weight reduction, improved specific properties or more cost-effective solutions for certain applications. This ready availability and growing commercialization of substitutes create a competitive landscape and support players to adopt alternatives. As a result, the above-mentioned factors are limiting the syntactic foam market expansion.

Future Opportunities :

Growing Utilization in Electric Vehicles to Create Syntactic Foam Market Opportunities.

The growing utilization of syntactic foam in electric vehicles (EVs) presents significant market opportunities. As the automotive sector rapidly shifts towards electrification, there's an increasing need for lightweight materials that enhance vehicle range and efficiency. This composite material distinguished by its high specific strength and low density, is suitable for reducing overall vehicle weight. Furthermore, its thermal management properties are crucial for EV battery systems, where it presents potential to be used for insulation, structural components among others, making the composite material a valuable in the expanding EV market.

- For instance, new IEA report indicates that global electric car sales are projected constitute over a quarter of worldwide car sales, and are on track to surpass a 40% market share by 2030.

Henceforth, the growing adoption of EVs is creating lucrative syntactic foam market opportunities over the forecast period.

Syntactic Foam Market Segmental Analysis :

By Sphere Type:

Based on sphere type, the market is bifurcated into micro-sphere and macro-sphere.

Trends in Sphere Type:

- The preference for micro-sphere foams in ultra-deepwater applications due to their superior compressive strength and minimal water absorption is growing trend.

- Macro-spheres are increasingly combined with micro-spheres and various matrix materials to create advanced hybrid foams.

The micro-sphere segment accounted for the largest syntactic foam market share in 2024.

- Micro-sphere syntactic foams, featuring tiny hollow spheres (10-300 µm) in a matrix, form a fine, homogeneous material.

- Their small size enables high packing density, delivering superior compressive strength, stiffness, and excellent thermal & acoustic insulation, along with isotropic properties.

- These foams are crucial for ultra-deepwater buoyancy, lightweight aerospace & defense components, thermal management in electronics, and high-performance sporting goods.

- Additionally, its adoption of transportation equipment also supports the segment growth.

- For instance, the National Research and Innovation Agency (BRIN) is developing a lightweight hybrid syntactic foam composite polymer material, a composite combining a polymer matrix with gas or air-filled hollow microspheres, for use in drone components and transportation equipment.

- Thus, as per the syntactic foam market analysis, the micro-sphere segment is dominating the syntactic foam market demand.

Macro-sphere segment is expected to grow at the fastest CAGR over the forecast period.

- Macro-sphere syntactic foams utilize larger hollow spheres (3-50 mm), often alongside microspheres, forming three-phase composites.

- Their key advantage lies in achieving significantly lower densities than micro-sphere counterparts, providing superior buoyancy per volume.

- Applications of this sphere type of foam primarily include large-scale subsea buoyancy modules for deepwater structures up to 1,600 meters, lightweighting in large structures where extreme strength isn't critical, cryogenic insulation for LNG pipes, and lightweight concrete.

- The increasing demand for ultra-low density buoyancy solutions for deeper and larger subsea infrastructure creates potential for segment growth in future years.

- Overall, considering aforementioned factors macro-sphere segment is expected to grow over forecast period.

By End User:

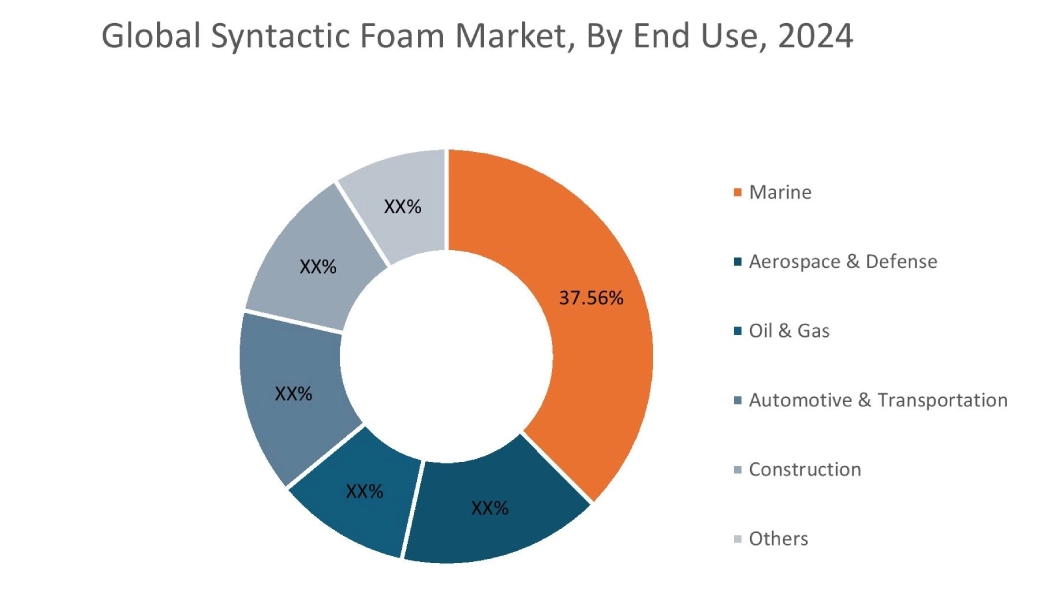

Based on end use, the market is categorized into marine, aerospace & defense, oil & gas, automotive & transportation, construction, and others.

Trends in the End Use:

- Growing focus of electric vehicles on lightweighting to extend battery range and improve energy efficiency is a key trend.

- The preference for syntactic foam in autonomous underwater vehicles and remotely operated vehicles for enhanced performance and longer endurance is growing trend.

The marine segment accounted for the largest syntactic foam market share of 37.56% in 2024.

- This segment is the largest consumer of syntactic foam as it is indispensable for deep-sea buoyancy applications in remotely operated vehicles, autonomous underwater vehicles, subsea modules, and riser floats.

- Its ability to withstand extreme hydrostatic pressures, coupled with high buoyancy and minimal water absorption, makes it critical for operations in ultra-deepwater environments.

- This ensures the stability and functionality of underwater equipment and structures.

- For instance, in 2025, Shell Offshore Inc. awarded CRP Subsea a contract to supply its engineered syntactic foam-based crushable foam wrap composed of thermoset resin and hollow glass microspheres, for the deepwater Whale development in the Gulf of Mexico.

- Thus, as per the aforementioned factors, the marine segment is dominating market growth.

The automotive & transportation segment is expected to grow at the fastest CAGR over the forecast period.

- The growing preference in automotive & transportation sector is due to the need for lightweight, efficient, and reliable components.

- In this sector, syntactic foam is increasingly adopted for lightweighting initiatives in vehicles, including both traditional internal combustion engine vehicles.

- Its high specific strength-to-weight ratio helps improve fuel efficiency or extend EV range.

- It is also explored for energy absorption in crash protection structures and specialized transportation components requiring high strength and low density.

- Primary driver is the growing focus of industry towards lightweighting, aimed at enhancing fuel efficiency in traditional vehicles and extending the range of rapidly expanding EVs.

- Thus, based on the market analysis, the automotive & transportation is the fastest growing segment.

Regional Analysis:

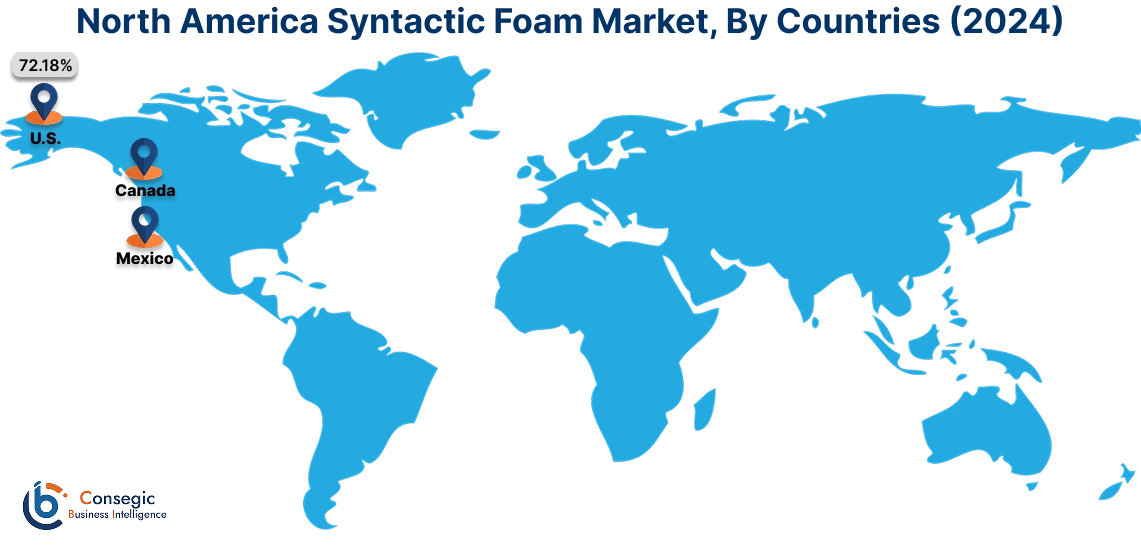

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

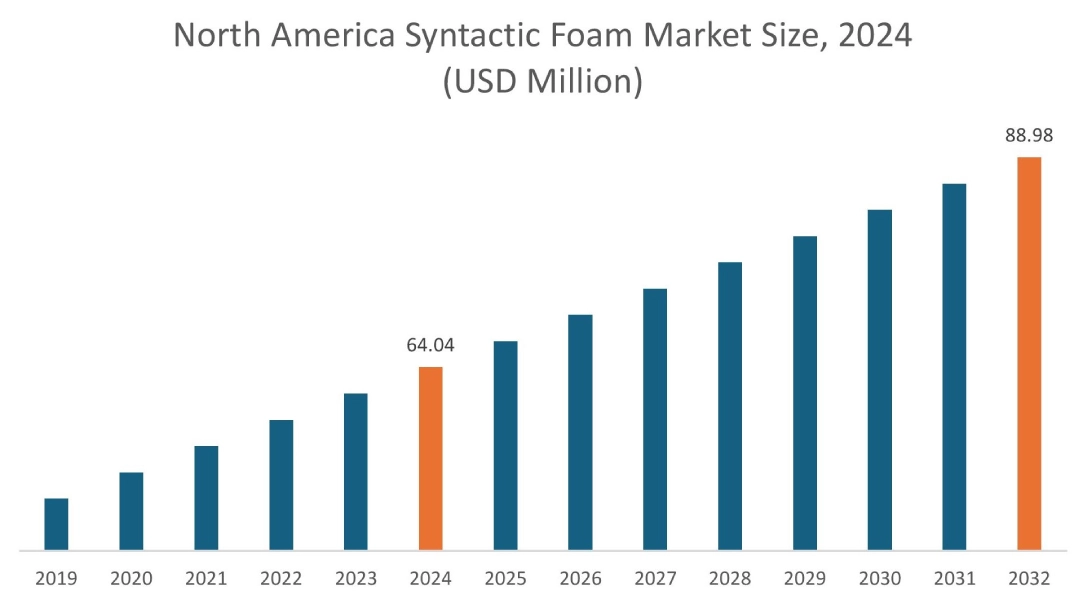

In 2024, North America accounted for the highest market share at 40.59% and was valued at USD 64.04 Million and is expected to reach USD 88.98 Million in 2032. In North America, the U.S. accounted for a market share of 72.18% during the base year of 2024. The upwards trajectory of regional share is primarily driven by well-established aerospace, defense, and marine sectors. The region also sees increasing adoption in the automotive sector, particularly for electric vehicles. Significant government-backed investments in defense and space exploration, along with extensive offshore oil and gas exploration activities, drive the demand for high-performance, lightweight, and buoyant materials.

- For instance, according to Aerospace Industry Association, the U.S. aerospace and defense sector reached an impressive milestone, generating over USD 955 billion in sales in 2023, increasing 7.1% from the previous year.

Thus, as per analysis, these factors collectively position North America as a key region for the market.

In Asia Pacific, the syntactic foam industry is experiencing the fastest growth with a CAGR of 6.9% over the forecast period owing to significant investments in marine and subsea infrastructure across the region. Furthermore, the expanding aerospace and defense sectors in key economies such as China, India, and Japan are substantially fueling demand. An increased emphasis on domestic manufacturing, coupled with rising energy demands and extensive infrastructure development, is collectively prompting a surge in the adoption of composite materials throughout the Asia Pacific. Collectively these factors fuel Asia Pacific syntactic foam market analysis.

European market is defined by its robust automotive sector, particularly the strong drive toward lightweighting in EVs. This is significantly fuels requirement for advanced materials such as syntactic foam to enhance efficiency and range. The region's well-established aerospace sector also remains a substantial consumer. Furthermore, ongoing marine and offshore activities necessitate the use of this material for buoyancy modules and insulation in challenging deepwater environments. Europe's strong emphasis on technological innovation and sustainability further underpins the adoption of cutting-edge solutions across these vital sectors. Hence, as per analysis, these factors collectively present a positive impact on the European syntactic foam market trends.

The market in Latin America is defined by expanding offshore oil and gas exploration projects. The need for specialized buoyancy modules and thermal insulation in challenging deepwater environments is a key demand driver. Furthermore, increasing investments in defense and infrastructure development across parts of this region also contribute to the upward syntactic foam market trend.

The market in Middle East and Africa is characterized by the region's expansive offshore oil and gas sector. As countries increase investments in deepwater and ultra-deepwater exploration, the need for high-performance buoyancy modules, subsea thermal insulation, and robust equipment for harsh environments is intensifying. The region's increasing focus on industrialization and infrastructure development, coupled with a rising emphasis on lightweighting and energy efficiency trends across various emerging sectors, further fuels the adoption of syntactic foam.

Top Key Players and Market Share Insights:

The Global Syntactic Foam Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Syntactic Foam market. Key players in the Syntactic Foam industry include

- Trelleborg (Sweden)

- ALCEN (France)

- Acoustic Polymers Ltd (United Kingdom)

- Oriental Ocean Tech. (China)

- Taizhou Cbm-future New Materials S&T Co.,Ltd. (China)

- Tooling Tech Group (U.S.)

- Matrix Composites & Engineering (Australia)

- RESINEX TRADING S.r.l. (Italy)

- Engineered Syntactic Systems (U.S.)

- SynFoam (U.S.)

Syntactic Foam Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 235.01 Million |

| CAGR (2025-2032) | 5.2% |

| By Sphere Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Syntactic Foam market? +

In 2024, the Syntactic Foam market is USD 157.79 Million.

Which is the fastest-growing region in the Syntactic Foam market? +

Asia Pacific is the fastest-growing region in the Syntactic Foam market.

What specific segmentation details are covered in the Syntactic Foam market? +

By Sphere Type and End Use segmentation details are covered in the Syntactic Foam market.

Who are the major players in the Syntactic Foam market? +

Trelleborg (Sweden), ALCEN (France), Tooling Tech Group (U.S.) are some of the major players in the market.