Tissue and Hygiene Market Size:

Tissue and Hygiene Market Size is estimated to reach over USD 349.26 Billion by 2032 from a value of USD 265.53 Billion in 2024 and is projected to grow by USD 270.17 Billion in 2025, growing at a CAGR of 3.3% from 2025 to 2032.

Tissue and Hygiene Market Scope & Overview:

The tissue and hygiene sector encompasses products designed for private end-users, including toilet paper, facial tissues, household paper, feminine hygiene products, baby diapers, face masks, and incontinence products. The need for convenient and easy-to-use hygiene products has surged, significantly impacting the market development. Additionally, innovations in product development and increasing urbanization contribute to the market's development, aligning with consumers' evolving preferences for high-quality hygiene products.

How is AI Transforming the Tissue and Hygiene Market?

Artificial Intelligence is reshaping the tissue and hygiene market by improving production efficiency, quality control, and consumer personalization. In manufacturing, AI-driven systems monitor machinery and raw materials in real time, optimizing production speed and reducing waste. Machine learning models detect defects in products like tissues, diapers, and sanitary items, ensuring consistent quality. AI also supports demand forecasting by analyzing market trends and consumer behavior, helping brands manage inventory more effectively. On the consumer side, AI enables personalized product recommendations and smart packaging solutions that enhance user convenience. As sustainability and hygiene standards rise globally, AI is driving innovation, operational efficiency, and product differentiation within the tissue and hygiene industry.

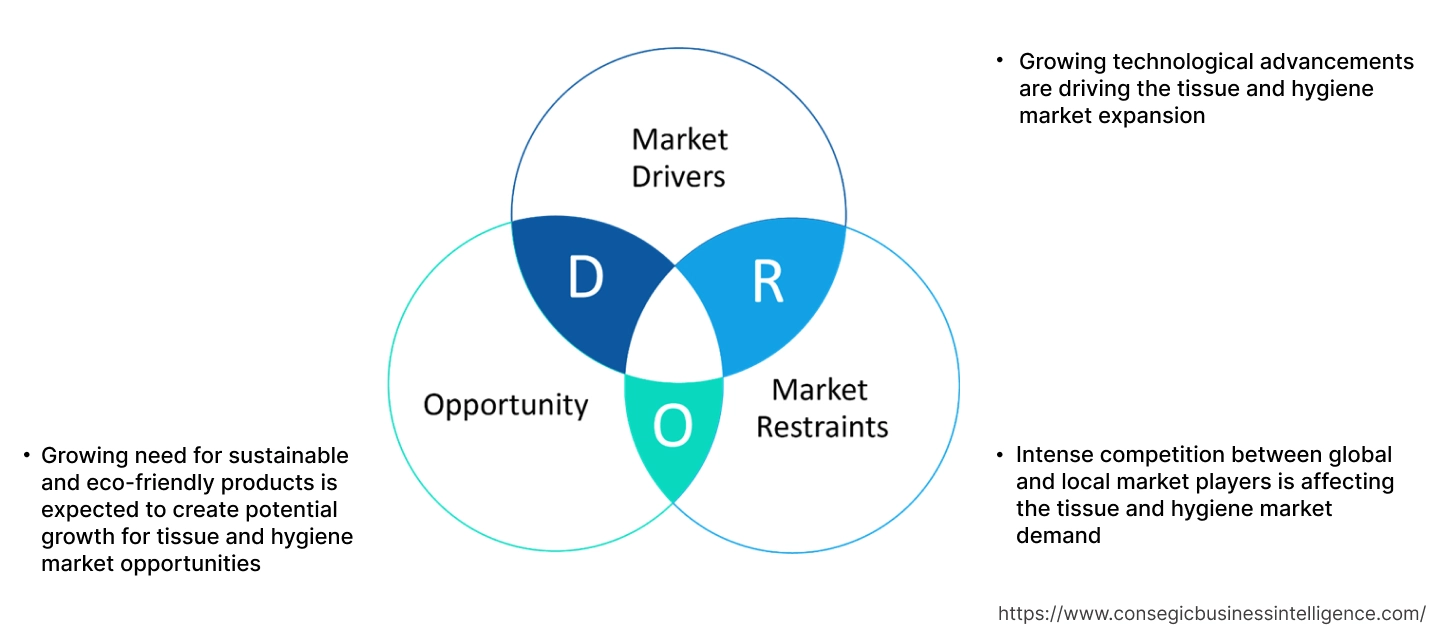

Tissue and Hygiene Market Dynamics - (DRO) :

Key Drivers:

Growing technological advancements are driving the tissue and hygiene market expansion

Technological advancements have significantly impacted the global market, revolutionizing both product offerings and manufacturing processes. One key area of innovation lies in product development, where advanced materials and designs have led to the creation of more efficient and environmentally friendly products. For instance, the introduction of biodegradable materials in the production of tissues and hygiene products has gained popularity, addressing growing concerns about sustainability and plastic pollution.

Further, automation and robotics have transformed manufacturing processes in the tissue and hygiene sector, leading to increased efficiency and cost savings. Automated systems enable faster production rates while ensuring consistent product quality, meeting the demands of a rapidly growing market. These advancements have also improved workplace safety by reducing the need for manual labor in potentially hazardous tasks.

- For instance, in April2024, ANDRITZ launched a new nonwovens production line called neXline wetlace carded-carded-pulp. This production line is designed to create nonwoven fabrics for biodegradable and plastic-free wet wipes. By integrating spun lace and wet laid techniques, the production line allows manufacturers to use natural fibers such as viscose and wood pulp. The resulting sustainable wipes offer the same quality and performance as traditional synthetic-fiber wipes, but with the added benefit of being environmentally friendly.

Thus, according to the tissue and hygiene market analysis, the growing technological advancements are driving the tissue and hygiene market size.

Key Restraints:

Intense competition between global and local market players is affecting the tissue and hygiene market demand

The increasing competition from local and international players acts as a potential threat to the market. Companies need to differentiate their products through quality, innovation, and branding to maintain a competitive edge. With the increasing awareness about hygiene and sanitation, coupled with rising disposable incomes worldwide, the need for tissue products has seen a significant surge. This heightened need has attracted numerous players, ranging from multinational corporations to local manufacturers, to stay ahead in the market. As a result, the competitive landscape is dynamic and constantly evolving, with companies employing various strategies to gain a competitive edge. Thus, the aforementioned factors would further impact the tissue and hygiene market size.

Future Opportunities :

Growing need for sustainable and eco-friendly products is expected to create potential growth for tissue and hygiene market opportunities

As consumers become more environmentally conscious, there is a growing interest in products made from recycled materials and renewable resources. This shift in consumer behavior is encouraging manufacturers to innovate and develop sustainable solutions that meet these needs. By investing in sustainable practices and materials, companies can differentiate themselves in the competitive market and capture the growing segment of eco-conscious consumers.

Further, consumers are increasingly conscious of the environmental impact of their purchasing decisions. They are actively seeking products made from sustainable materials, with reduced plastic content, and eco-friendly packaging. This is evident due to the rising demand for products labeled as biodegradable, recyclable, or made from recycled content.

- For instance, according to Fisher International, the tissue manufacturers in North America utilized a higher proportion of recycled paper in their production compared to their counterparts in Europe and Asia in 2023.Additionally, the tissue industry consumed approximately 3.9 million tons of recycled paper in 2023.

Thus, based on the above tissue and hygiene market analysis, the growing need for sustainable and eco-friendly products is expected to drive the tissue and hygiene market opportunities.

Tissue and Hygiene Market Segmental Analysis :

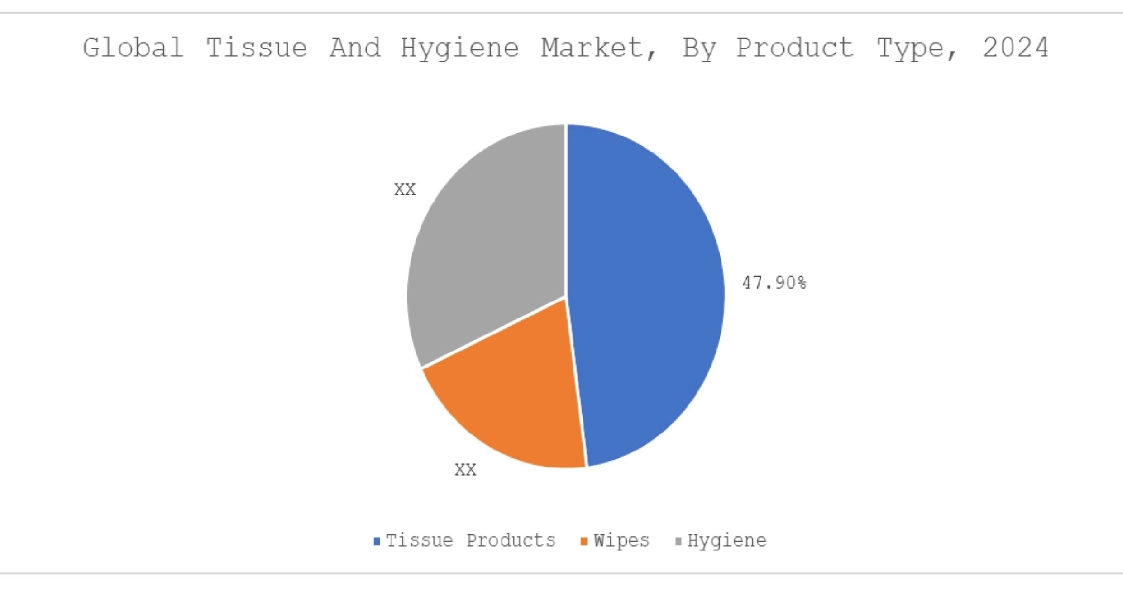

By Product Type:

Based on product type, the market is segmented into tissue products, wipes, and hygiene.

Trends in the product type:

- The increasing focus on cleanliness and hygiene has propelled the need for paper towels, particularly in public restrooms and commercial kitchens.

- Innovations in toilet paper, such as the introduction of biodegradable and septic-safe options, have become popular among environmentally conscious consumers. Additionally, the availability of premium toilet paper brands offering enhanced comfort and softness has expanded the segment.

- Thus, based on the above analysis, these factors are driving the tissue and hygiene market demand.

The tissue products segment accounted for the largest revenue share of 47.90% in the year 2024.

- The demand for eco-friendly and sustainable tissue paper products is also fueling the segment's development. Environmental concerns are pushing manufacturers to innovate and produce biodegradable and recycled tissue papers.

- Governments and environmental organizations are advocating for reduced deforestation and the use of recycled materials in tissue production. This has led to an increase in the availability of green products, which are gaining popularity among environmentally conscious consumers.

- The rising awareness of maintaining facial hygiene, particularly among women and young adults, is a key driver for this segment. Additionally, facial tissues are increasingly being used in commercial spaces such as offices, hotels, and healthcare facilities, further boosting the need for the products.

- For instance, in June 2024, Georgia-Pacific relaunched the ARIA brand of bath tissues, which are made from 100% recycled fiber. The new ARIA tissue stands out from other environmentally friendly options as it offers both the luxurious softness of a three-layer design and genuine eco-benefits through the use of recycled fibers and recyclable paper packaging.

- Thus, based on the above analysis, these factors are further driving the tissue and hygiene market growth.

The hygiene segment is anticipated to register the fastest CAGR during the forecast period.

- With increasing concerns about health and hygiene, particularly after the COVID-19 pandemic, consumers are more inclined to purchase tissue papers for both residential and commercial use. This behavior has resulted in an upsurge in need, while driving the segment.

- The increasing urban population contributes to higher consumption rates as more people move to cities, leading to greater demand in commercial establishments such as restaurants, hotels, and offices.

- The demand for high-quality, soft, and durable toilet paper is on the rise, with consumers willing to pay a premium price for better comfort and hygiene. Innovations such as scented, coloured, and textured toilet papers are also enhancing product appeal.

- Thus, based on the above analysis and developments, these factors are expected to drive the tissue and hygiene market share during the forecast period.

By Distribution Channel:

Based on the distribution channel, the market is segmented into direct and indirect.

Trends in the distribution channel:

- Manufacturers and retailers must continuously innovate and optimize their distribution strategies to capture emerging prospects and address the challenges posed by shifting market trends. The ability to effectively leverage multiple distribution channels will be a key determinant of success in the competitive market.

- Online channels enable manufacturers to reach a broader audience and gain valuable consumer insights through data analytics, supporting targeted marketing efforts and personalized shopping experiences.

The indirect segment accounted for the largest revenue share in the year 2024.

- Supermarkets and hypermarkets dominate the distribution landscape due to their wide reach and ability to offer a diverse range of products. These channels provide consumers with the convenience of purchasing multiple household items under one roof, making them the preferred choice for bulk and regular purchases of tissue and hygiene products.

- The increasing urbanization and fast-paced lifestyles are boosting sales through convenience stores, as consumers prioritize convenience and proximity.

- Additionally, the development of convenience store chains in emerging markets is providing new growth prospects for tissue and hygiene manufacturers seeking to enhance their market presence.

- The presence of private labels and regular promotions in supermarkets further drives consumer interest and loyalty, contributing to the growth of this distribution channel.

- Thus, these factors would further supplement the tissue and hygiene market

The direct segment is anticipated to register the fastest CAGR during the forecast period.

- Online platforms allow tissue and hygiene manufacturers to reach consumers directly through their own websites. This trend has accelerated significantly, while offering convenience and a wider reach.

- More manufacturers are adopting D2C models to build direct relationships with consumers, gain better control over their brand image, and capture a larger share of the profit margin. This involves setting up their own online stores and managing their own marketing and sales efforts.

- Direct channels allow for greater personalization of products and offer. Manufacturers can leverage data collected directly from consumers to tailor products, bundles, and marketing messages, fostering stronger customer loyalty.

- These developments in the direct distribution channel segment are anticipated to further drive the tissue and hygienemarket trends during the forecast period.

By Application:

Based on the application, the market is segmented into household and commercial.

Trends in the application:

- Educational institutions are significant consumers of tissue products, particularly in classrooms and restrooms, where maintaining hygiene is crucial for the health and safety of students and staff.

- As the hospitality sector rebounds with the ease of travel restrictions and the resurgence of tourism, the consumption of tissue products in this application is expected to rise. Moreover, the trend toward sustainable hospitality practices has encouraged businesses to adopt eco-friendly tissue products, aligning with consumer preferences and regulatory requirements.

The household segment accounted for the largest revenue in the year 2024.

- The growing awareness of health and hygiene among households, coupled with increased purchasing power, is propelling the need for various tissue products in the residential sector.

- Toilet paper, facial tissues, and paper towels are staple items in most households, leading to steady demand in the sector.

- Additionally, the trend towards premium and eco-friendly products is becoming more prominent, as consumers are willing to invest in higher-quality options that offer greater comfort and sustainability.

- The rising awareness regarding the importance of maintaining cleanliness at home has led to increased consumption of tissues.

- Moreover, the convenience of disposable tissue products has made them a popular choice among consumers for daily use in kitchens, bathrooms, and living spaces.

- Therefore, the aforementioned factors are driving the tissue and hygiene market growth.

The commercial segment is anticipated to register the fastest CAGR during the forecast period.

- The need for tissue products in the commercial sector is driven by the need to maintain hygiene standards and provide convenience to employees, customers, and guests. For instance, offices require facial tissues and paper towels for staff use, while restaurants and hotels need napkins and toilet paper for their guests.

- The expanding hospitality and healthcare sectors have further fuelled the need for tissue products in the commercial segment.

- Restaurants, hotels, and corporate offices are major consumers of tissue products, specifically paper towels and napkins. These establishments prioritize hygiene and cleanliness to enhance customer experiences and comply with health regulations.

- These factors are anticipated to further drive the tissue and hygiene market trends during the forecast period.

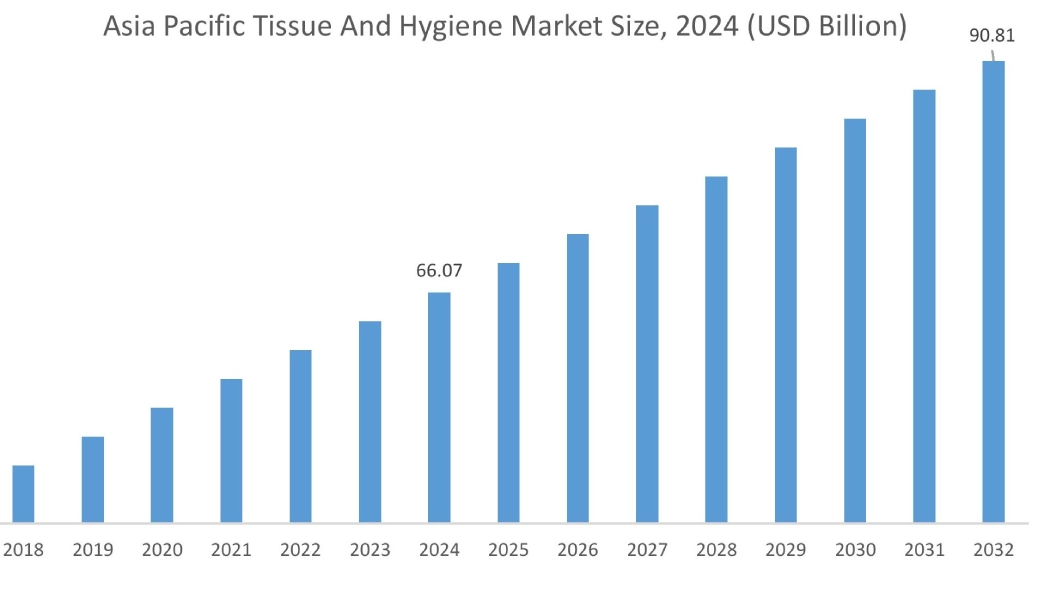

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

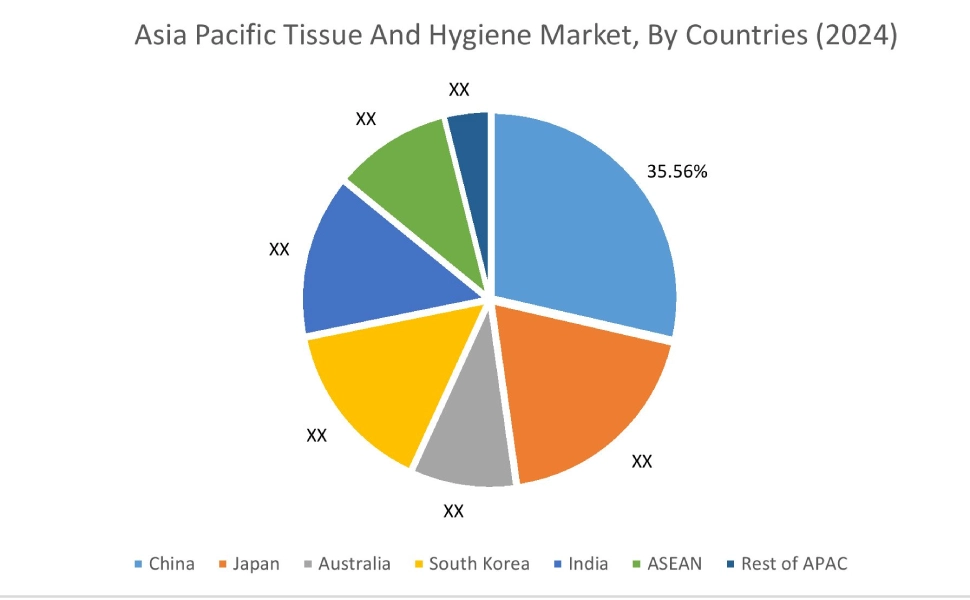

Asia Pacific tissue and hygiene market expansion is estimated to reach over USD 90.81 billion by 2032 from a value of USD 66.07 billion in 2024 and is projected to grow by USD 67.48 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 35.56%. The region's large population base, particularly in countries like China and India, and growing sustainability, presents significant opportunities for market development. Further, the increasing adoption of modern hygiene practices and the growing middle class are fueling the need for tissue and hygiene products. Moreover, the expanding hospitality and healthcare sectors in Asia Pacific further amplify the need for tissue products, positioning the region as a key growth area in the global market. These factors would further drive the regional tissue and hygiene market during the forecast period.

- For instance, in May 2022, Kimberly-Clark brands such as Huggies, Depend, and Kotex have taken the initiative to lower their carbon footprint by more than 50% by 2030. This initiative aligns with the Indian government's goals of decreasing carbon emissions and encouraging environmentally sustainable practices worldwide.

North America market is estimated to reach over USD 112.81 billion by 2032 from a value of USD 86.10 billion in 2024 and is projected to grow by USD 87.58 billion in 2025. North America is a mature market characterized by high consumer awareness and an established need for tissue products. The region's market growth is driven by product innovation, premium offerings, and the increasing preference for eco-friendly products. The United States is a major contributor to the market, with a strong emphasis on sustainability and environmental responsibility. The region is expected to maintain steady growth, with manufacturers focusing on enhancing product quality and expanding their sustainable product lines. These factors would further drive the market in North America.

- For instance, in December 2024, Georgia Pacific invested USD 90 million in its Crossett, Arkansas, plant to expand its consumer retail tissue business. This investment will create 50 new jobs and increase the plant's ability to produce more high-quality bath tissue, including its Angel Soft brand.

According to the analysis, the tissue and hygiene industry in Europe is witnessing significant development. The consumers in the region are increasingly opting for products made from recycled materials and renewable resources, driving the need for eco-friendly options. The region's stringent environmental regulations and standards are influencing manufacturers to adopt sustainable practices and innovate in product development.

In addition, there is a growing consumer preference for sustainable and eco-friendly products, including those made from recycled materials or that are biodegradable. This is pushing Latin American manufacturers to innovate in sustainable production methods. Further, the adoption of digital marketing strategies and e-commerce platforms can help companies in the Middle East & Africa reach a broader audience and enter into the growing trend of online shopping. These prospects would further drive the regional market reach for tissue & hygiene products during the forecast period.

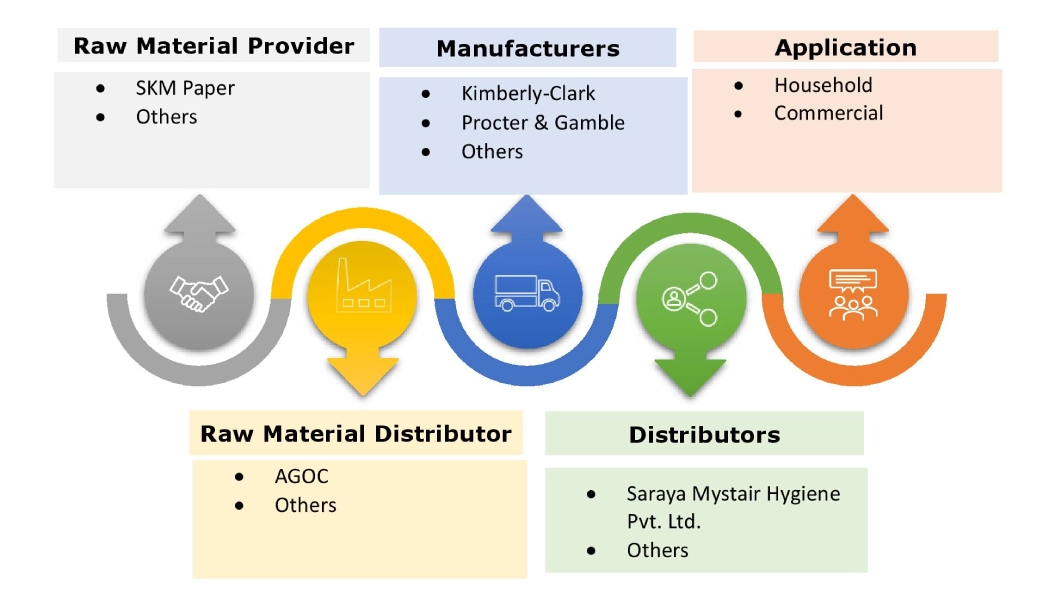

Top Key Players and Market Share Insights:

The global tissue and hygiene market is highly competitive, with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the tissue and hygiene industry include-

- Kimberly-Clark (U.S.)

- Tork (Essity Hygiene and Health AB)(Sweden)

- St CROIX TISSUE INC (U.S.)

- AbitibiBowater Inc. (Canada)

- Kruger Inc. (Canada)

- Procter & Gamble (U.S.)

- Georgia-Pacific (U.S.)

- Sofidel (Italy)

- Empresas CMPC (Chile)

- Hengan International (China)

Recent Industry Developments :

Merger & Acquisition:

- In May 2024, APRIL Group announced the acquisition of Origami, an Indian company that makes consumer tissue products. This acquisition of a majority stake in Origami is part of APRIL's plan to grow its worldwide presence in the world's most populated markets, building on recent investments in the tissue industries of China, Southeast Asia, and Brazil.

Tissue and Hygiene Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 349.26 Billion |

| CAGR (2025-2032) | 3.3% |

| By Product Type |

|

| By Distribution Channel |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Tissue and Hygiene Market? +

Tissue and Hygiene market size is estimated to reach over USD 349.26 Billion by 2032 from a value of USD 265.53 Billion in 2024 and is projected to grow by USD 270.17 Billion in 2025, growing at a CAGR of 3.3% from 2025 to 2032.

Which is the fastest-growing region in the Tissue and Hygiene Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Tissue and Hygiene report? +

The tissue and hygiene report includes specific segmentation details for product type, distribution channel, application, and region.

Who are the major players in the Tissue and Hygiene Market? +

The key participants in the market are Kimberly-Clark (U.S.), Tork (Essity Hygiene and Health AB) (Sweden), Procter & Gamble (U.S.), Georgia-Pacific (U.S.), Sofidel (Italy), Empresas CMPC (Chile), Hengan International (China), St CROIX TISSUE INC (U.S.), AbitibiBowater Inc. (Canada), Kruger Inc. (Canada), and others.