Vinyl Ester Resins Market Size :

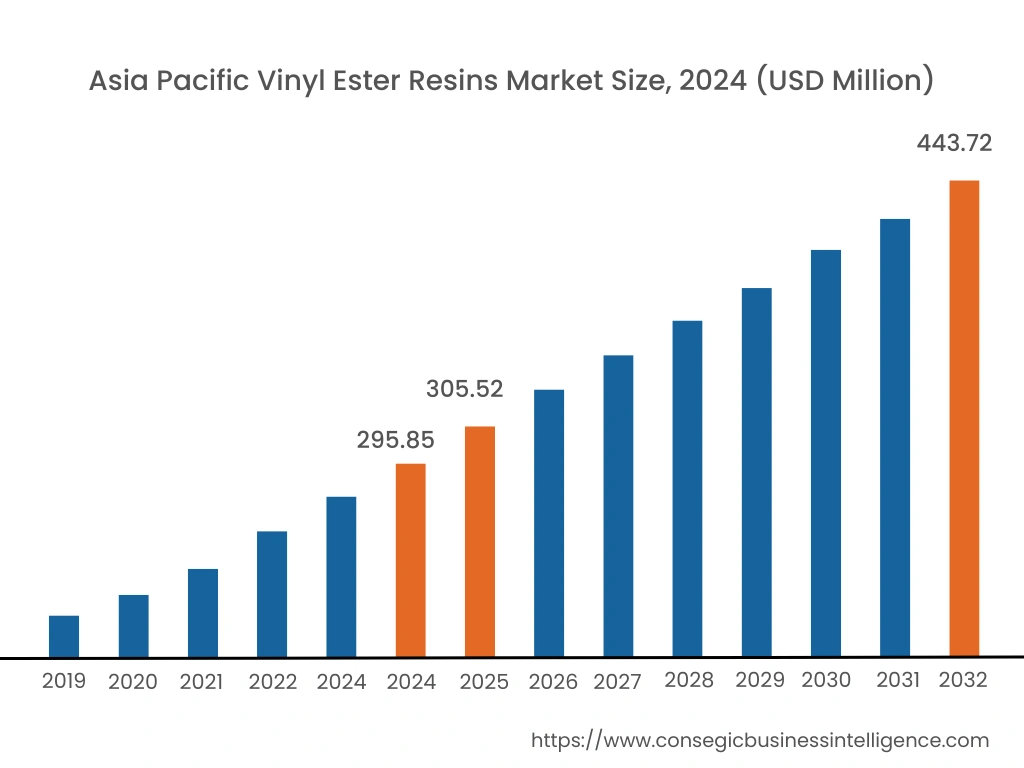

Consegic Business Intelligence analyzes that the Vinyl Ester Resins Market size is estimated to reach over USD 1,457.20 Million by 2032 from a value of USD 1,004.56 Million in 2024 and is projected to grow by USD 1,034.48 Million in 2025, growing at a CAGR of 4.80% from 2025 to 2032.

Vinyl Ester Resins Market Scope & Overview:

Vinyl ester resin is a category of resin that is produced by the esterification of an epoxy resin with methacrylic acids or acrylic. They have enhanced tensile strength and chemical resistance, which makes them an ideal solution for industrial applications. The major types of vinyl ester resin include epoxy phenol novolac (EPN), flame retardant vinyl ester resins, bisphenol A diglycidyl ether (DGEBA), and others.

The vital properties of these resins include tensile stress at a yield of 77 - 88 MPa, flexural strength of 60 - 163 MPa, elongation at 2.5 - 9%, and flexural modulus at 3,200 - 3,400 MPa, among others. Based on the analysis, these properties ensure superior flexibility and durability. As a result, vinyl ester resin is an ideal solution for applications, including pipes & tanks, paints & coatings, transportation, pulp & paper, and others.

Vinyl Ester Resins Market Insights :

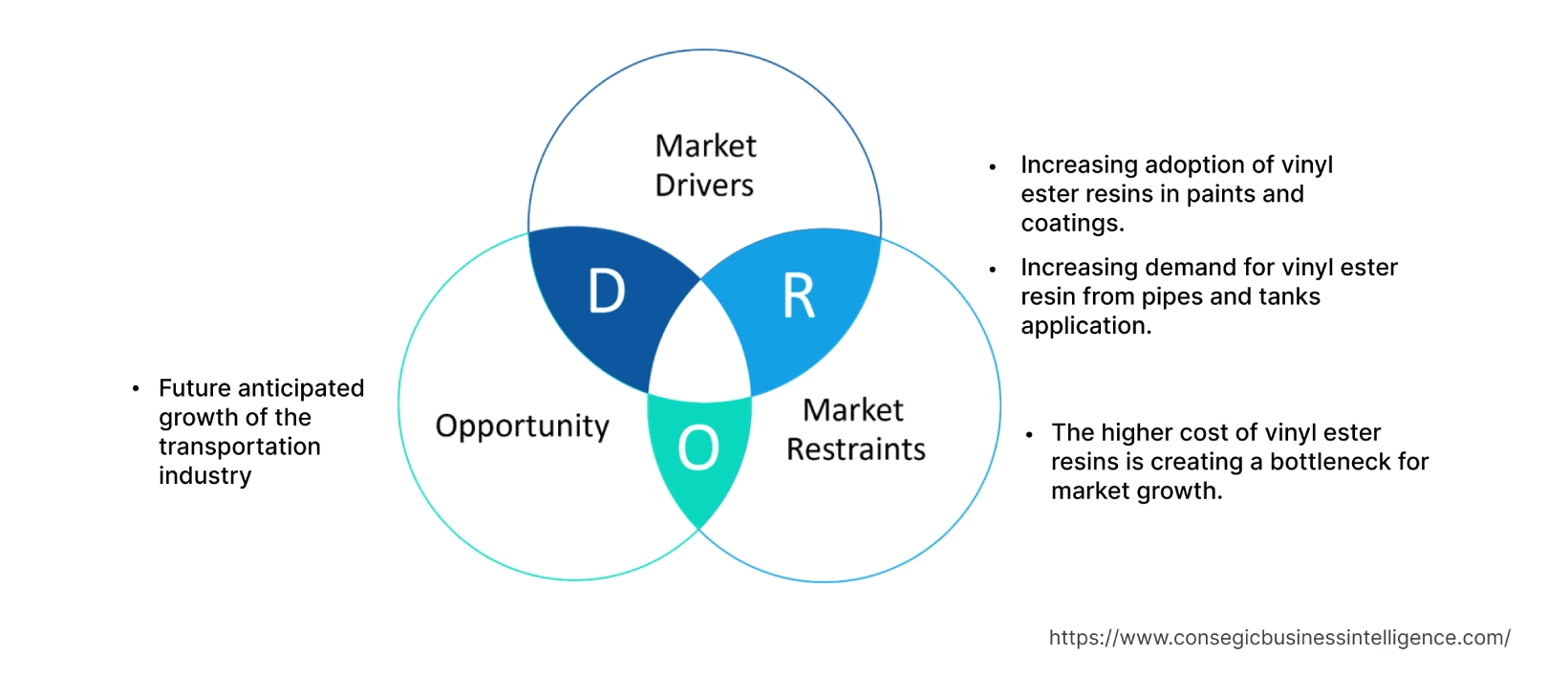

Vinyl Ester Resins Market Dynamics - (DRO) :

Key Drivers :

Increasing adoption of vinyl ester resins in paints and coatings drives market growth

Vinyl ester resins have superior chemical resistant resin that enables higher resistance against acids, alkalis, and a diverse range of chemicals. Furthermore, they are equipped with superior performance features such as good adhesion, corrosion resistance, excellent mechanical properties, and others. Thus, as per the analysis, due to the above properties, they are an ideal material for paints and coatings applications.

For instance, according to World Paint and Coatings Industry Association (WPCIA), in 2021, the paints and coatings sector at the global level was valued at USD 174.3 billion, and in 2022, it was USD 179.7 billion. In 2022, the annual growth rate of the global paints and coatings sector was 3.1%. Thus, the worldwide expansion of the paints and coatings sector is fostering the requirement for this resins to ensure superior corrosion resistance, which, in turn, is driving the expansion of the global vinyl ester resins market.

Increasing demand for vinyl ester resin from pipes and tanks application spur market growth

The corrosion impact can have a negative implication on the chemicals and materials, which may result in hazards. Thus, these resins are widely employed in the manufacturing of pipes and tanks that contain chemicals and materials. The resins are utilized in the pipes and tanks to ensure excellent resistance against chemical or environmental corrosion.

Based on the analysis, the recently developed manufacturing facilities associated with the pipes and tanks are benefiting the expansion of the market. For instance, in 2021, APLAPOLLO launched a new pipe manufacturing facility in Chhattisgarh, India. The prime focus of the company with the development of a new pipe manufacturing facility in Chhattisgarh to increase the supply of products in central and eastern parts of India. Henceforth, the development of new pipe manufacturing facilities is fostering the requirement for these resins to protect the products from rust, this, in turn, is boosting the market expansion.

Key Restraints :

The higher cost of vinyl ester resins is creating a bottleneck for market expansion

The overall cost of vinyl ester resins is dependent on the cost of production, followed by the cost of raw materials such as epoxy resin, unsaturated polycarboxylic acid, unsaturated monocarboxylic acid, and others. Furthermore, as per the analysis, the increasing transportation cost, electricity cost, labor costs, and others impact the overall pricing of vinyl resin products.

For instance, in December 2021, Interplastic Corporation, a leading manufacturer of these resins increased the prices of CoREZYN, a vinyl ester resin brand by USD 0.10 per pound. The prime factors for the increase in the prices of CoREZYN were due to supply chain constraints, shortage of raw materials, and others. Hence, the factors such as higher transportation costs, supply constraints, and others are some of the prominent determinants fostering the prices of these resins, which, in, turn, is restraining the expansion of the market.

Future Opportunities :

Future anticipated growth of the transportation sector creates market opportunities

The incorporation of vinyl resins in the transportation sector are creating lucrative vinyl ester resins market opportunities and trends in the coming years. These resins are primarily deployed in the transportation sector to enable superior resistance against corrosion and withstand water absorption. Based on the analysis, these resins are utilized in transportation products, including passenger cars, commercial vehicles, aircraft, marine ships, trains, and others.

For instance, according to the Society of Motor Manufacturers and Traders (SMMT), by the year 2024, the expansion for passenger cars in the United Kingdom will increase by 24.8%, reaching 1.951 million units in comparison with the year 2022. Hence, such an anticipated future trends will boost the vinyl ester resins market trends and opportunities to ensure superior mechanical toughness of transportation, thereby creating a potential for market expansion in the upcoming years.

Vinyl Ester Resins Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,457.20 Million |

| CAGR (2025-2032) | 4.8% |

| By Type | Epoxy Vinyl Ester Resins (Bisphenol A Diglycidyl Ether (DGEBA) and Epoxy Phenol Novolac (EPN)), Flame Retardant Vinyl Ester Resins, and Others |

| By Application | Pipes & Tanks, Paints & Coatings, Transportation, Pulp & Paper, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | AOC, DIC CORPORATION, INEOS, Interplastic Corporation, SHOWA DENKO K.K, Sino Polymer Co. Ltd, Polynt, Scott Bader Company Ltd, Poliya, and Swancor Advanced Materials Co Ltd. |

Vinyl Ester Resins Market Segmental Analysis :

By Type :

The type segment is categorized into epoxy vinyl ester resins, flame retardant vinyl ester resins, and others. In 2024, the epoxy vinyl ester resins segment accounted for the highest vinyl ester resins market share. Epoxy vinyl ester resins such as bisphenol A diglycidyl ether (DGEBA) and epoxy phenol novolac (EPN) ensure excellent durability of products. Epoxy vinyl ester resins are employed in applications such as industrial tanks & pipes. The development of tank manufacturing facilities is fostering the market growth. For instance, in March 2023, TrueNorth Steel launched a new steel tank manufacturing facility in Texas, United States. Hence, the development of new metal tank manufacturing facilities is expected to boost the demand for these resins to ensure superior strength, which, in turn, is proliferating the market growth.

Furthermore, flame-retardant vinyl ester resins are expected to be the fastest-growing segment in the market over the forecast period. This is due to the increasing demand for flame retardant vinyl ester resins from various end-use industries, including locomotive, power generation, and others. Thus, the aforementioned factors are propelling the trends of the segment.

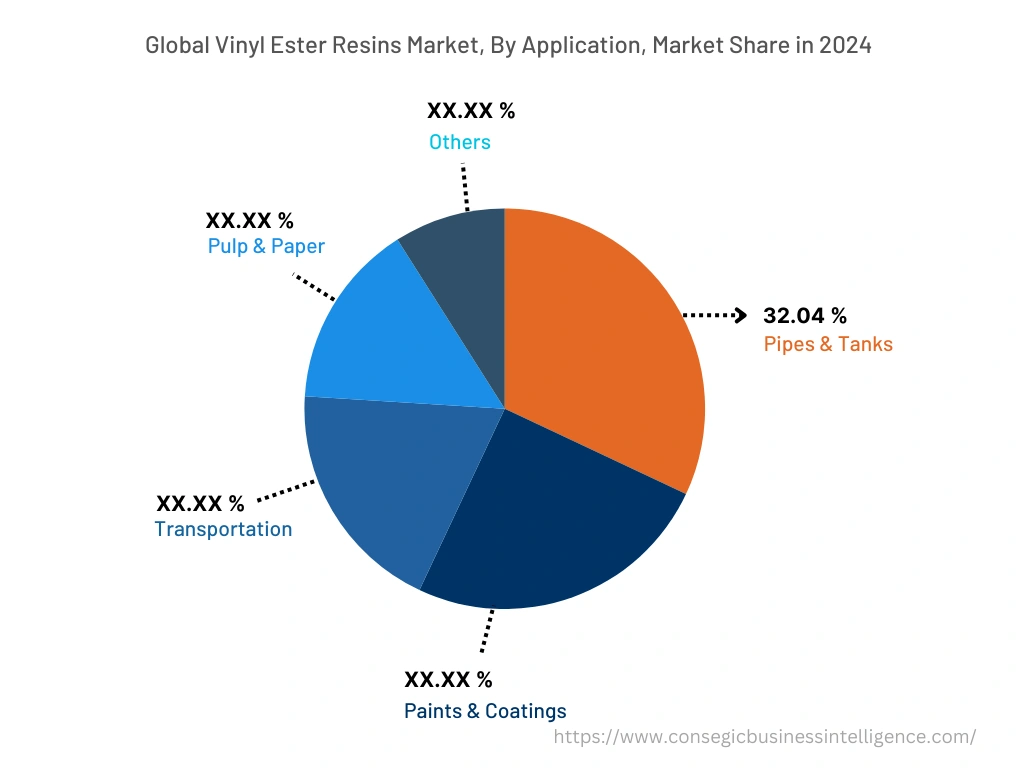

By Application :

The application segment is categorized into pipes & tanks, paints & coatings, transportation, pulp & paper, and others. In 2024, the pipes & tanks segment accounted for the highest market share of 32.04% in the overall vinyl ester resins market. The resin is utilized in the pipes and tanks applications to ensure low styrene emission, longer shelf life, improved shop efficiency, and others. These features result in enhanced secondary bonding, minimized gassing for faster consolidation, easy surface preparation, and less process time. Based on the analysis, this leads to superior durability of pipes and tanks. The expansion of industries such as power generation, chemical, industrial water and wastewater, mining and metal, pulp and paper, food processing, and others such as pipes and tanks are utilized as a material. Thus, the expansion of the above industries is favoring the demand expansion for pipes and tanks. Hence, the production activities associated with pipes and tanks are increasing, thereby fueling the demand and trends for vinyl ester resin to ensure superior environmental protection, which, in turn, is benefiting the market expansion.

However, the transportation segment is expected to be the fastest-growing segment in the vinyl ester resins market during the forecast period. For instance, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2021, the production of automotive vehicles at the global level was 80,205,102 units, and in 2022, it was 85,016,728 units. In 2022, the year-on-year growth rate for automotive production was 6%. The overall expansion of transportation production trends, including automotive, aircraft, and others is benefiting the vinyl ester resins market demand to ensure resistance against chemicals. This prime determinant is accelerating the trends of the global vinyl ester resins market growth.

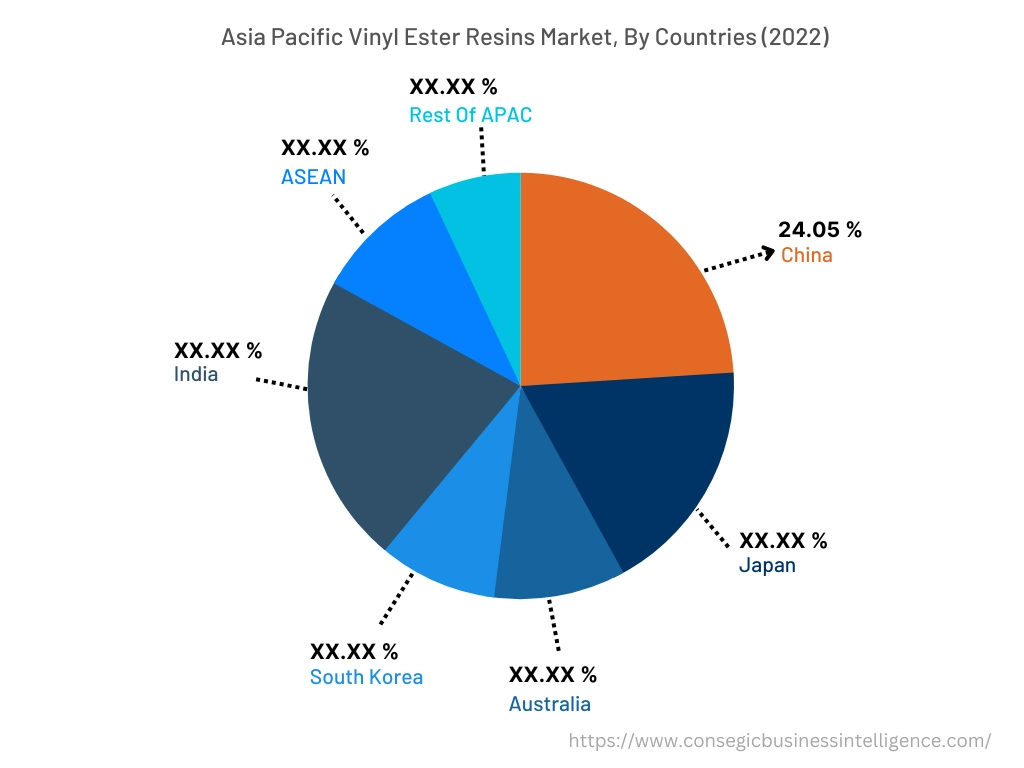

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest market share at 35.08% was valued at USD 295.85 million, and is expected to reach USD 443.72 million in 2032. In Asia Pacific, China accounted for the highest market share of 24.05% during the base year of 2024. Based on the vinyl ester resins market analysis, this is due to the expansion of the end-use industries, including paints & coatings, pipes & tanks, and others in the region. For instance, according to recent statistics World Paint and Coatings sector Association (WPCIA), in 2022, the Asia-Pacific region was the dominant region in the paints and coatings market valued at USD 63 billion, representing a share of 35.10% of the global paints and coatings sector. The East Asia region was the prominent market in the global paints and coatings industry. In 2022, the China paints and coatings market held a strong share in the regional market and increased by 5.7% as compared with the year 2021. Hence, the expansion of the Asia Pacific industries such as paints & coatings, pipes & tanks, and other industries is driving the regional demand for these resins to ensure the long shelf life of products, thereby accelerating market trends.

Furthermore, Europe is expected to witness significant expansion over the forecast period, growing at a CAGR of 4.9% during 2025-2032. This is attributed to the growing demand for these resins for the efficient durability of products. Therefore, the adoption of these resins is increasing in the European region for applications, including tanks & pipes, transportation, and others. This factor is proliferating the vinyl ester resins market growth in the region.

Top Key Players & Market Share Insights :

The vinyl ester resins market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- AOC

- DIC CORPORATION

- Scott Bader Company Ltd

- Poliya

- Swancor Advanced Materials Co Ltd

- INEOS

- Interplastic Corporation

- SHOWA DENKO K.K

- Sino Polymer Co. Ltd

- Polynt

Recent Industry Developments :

- In October 2021, Lone Star, a global private equity firm acquired AOC, a leading player in the global vinyl ester resins. The prime aim of the acquisition was to increase the market position in the global vinyl ester resins industry.

- In April 2021, SIR INDUSTRIALE S.P.A., headquartered in Italy which is involved in the manufacturing of resins launched SIRESTER VE 64-M-140, a new range of epoxy novolac vinyl ester resin. The primary focus of SIR INDUSTRIALE S.P.A. was to increase the product offering of vinyl ester resin in the global market.

Key Questions Answered in the Report

What was the market size of the vinyl ester resins industry in 2024? +

In 2024, the market size of vinyl ester resins was USD 1,004.56 million.

What will be the potential market valuation for the vinyl ester resins industry by 2032? +

In 2032, the market size of vinyl ester resins will be expected to reach USD 1,457.20 million.

What are the key factors driving the growth of the vinyl ester resins market? +

Increasing demand for vinyl ester resin from pipes and tanks application is spurring the growth of the market.

What is the dominating segment in the vinyl ester resins market by application? +

In 2024, the pipes and tanks segment accounted for the highest market share of 32.04% in the overall vinyl ester resins market.

Based on current market trends and future predictions, which geographical region is a domination region in the Vinyl Ester Resins market? +

Asia Pacific accounted for the highest market share in the overall vinyl ester resins market.