Welding Equipment Market Size:

Welding Equipment Market size is estimated to reach over USD 28.96 Billion by 2032 from a value of USD 19.64 Billion in 2024 and is projected to grow by USD 20.27 Billion in 2025, growing at a CAGR of 5.3% from 2025 to 2032.

Welding Equipment Market Scope & Overview:

Welding equipment is used to join metal components by generating heat, providing filler material, and applying pressure that creates a solid bond through melting and cooling.These machines generate the necessary power (electrical current or heat) to melt and fuse metal.The welding consumables include electrode, filler metal, flux, shielding gas, and others. The equipment offers several benefits including increased efficiency, enhanced precision, and improved safety leading to higher quality welds and increased productivity.

Key Drivers:

Rising utilization of welding equipment in marine sector is driving the market growth

In marine sector, the welding equipment is used for ship construction, repair, and maintenance.Arc welding is used in shipbuilding for joining metal plates and repairing damaged parts and structures of the vessel. Moreover, gas welding is used for used for joining thinner materials or in places where precise control is needed.Furthermore, laser welding is used for manufacturing marine components that tolerate the harsh environments.

- For instance, in March 2023, Kemppi launched Master M series of portable welding machines to be used in repair shops and shipyards. It offers Master M 205 and Master M 323, both equipped with weld assist function.

Therefore, the rising utilization of welding machines in marine sector for ship construction, repair, and maintenance is driving the welding equipment market growth.

Key Restraints:

High costs associated with welding equipment are hindering the market growth

Welding equipment is expensive due to the specialized materials, advanced technology, and safety requirements needed to ensure high-quality welds and operator’s safety.Moreover, welding machines are integrated with advanced technologies including robotic welding, laser welding, and automation systems contributing to the overall cost.

Furthermore, welding machines include safety features including fume extraction, UV shielding, and ergonomic design to protect operators from potential accidents, in turn leading to higher costs.Thus, the market analysis shows that the aforementioned factors are restraining the welding equipment market demand.

Future Opportunities :

Advancements in welding automation creates new welding equipment market opportunities

Welding automation uses robots and other automated systems to increase the speed, precision, and quality of welding processes, in turn leading to improved productivity and reduced errors compared to manual welding.Moreover, automated systems perform welding tasks in dangerous and risky environments, reducing the risk to human welders.Furthermore, while the initial investment in automation is high, the long-term benefits of reduced errors, increased efficiency, and lower labor costs lead to significant cost savings.

- For instance, in June 2024, Arm Welders expanded its welding equipment and automation solutions in India. This aims to streamline production and enable its expansion into specialized welding solutions.

Thus, the ongoing advancements in welding automation are projected to drive welding equipment market opportunities during the forecast period.

Welding Equipment Market Segmental Analysis :

By Product:

Based on the product, the market is segmented into flux-core wires, rod electrodes, saw wires, solid wires, stick electrodes, and others.

Trends in the Product:

- Rising utilization of stick electrodes in industries including manufacturing and construction.

- Increasing trend in adoption of saw wires due to benefits including high efficiency, productivity, and ability to create strong and high-quality welds.

The stick electrodes segment accounted for the largest revenue share in the welding equipment market share in 2024.

- Stick welding electrodes are metal wires with a flux coating that melts during welding, providing filler metal and shielding gas for a strong and durable welding.

- They offer benefits including ease of use and affordability, making them suitable for various applications.

- For instance, Vector Welding offers stick electrodes welding machines in its product offerings. These machines are available in single-phase or three-phase alternating current.

- Therefore, the market analysis depicts that the aforementioned factors are driving the welding equipment market growth.

The solid wires segment is expected to register the fastest CAGR during the forecast period.

- Solid welding wire is a type of welding consumable, specifically a filler metal, which is used in processes including metal inert gas (MIG) and metal active gas (MAG) welding.

- Moreover, solid wires are not filled with any flux or other materials, providing clean, less spatter, precise welds, and ease of use.

- For instance, Moglix offers iBELL solid wire welding machine in its product portfolio. This machine has an efficiency of 85% and duty cycle of 60%.

- Thus, the market analysis depicts that the increasing adoption of solid wires is boosting the welding equipment market trends during the forecast period.

By Type:

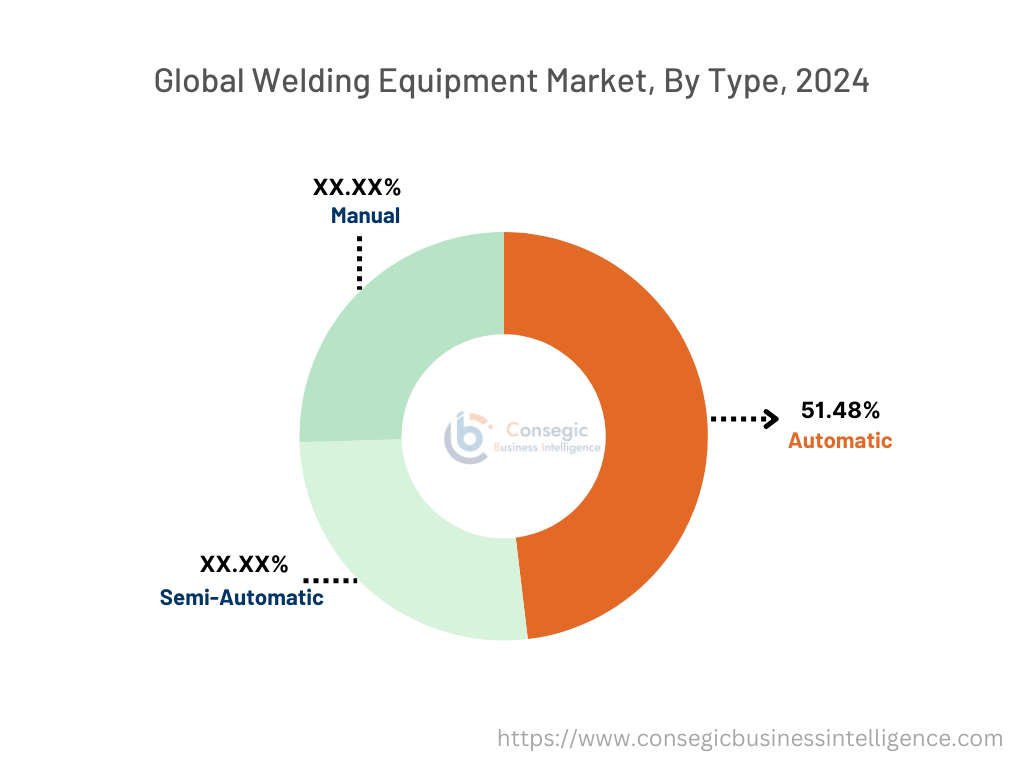

Based on the type, the market is segmented into automatic, semi-automatic, and manual.

Trends in the Type:

- Rising trend in automation of welding machines to enhance efficiency and reduce errors.

- Increasing demand and adoption for semi-automatic welding machines to have more control and precision over the welds is boosting the welding equipment market size.

The automatic segment accounted for the largest revenue share of 51.48% in the market in 2024.

- Automatic welding systems operate continuously, without breaks, leading to faster production rates and higher output.

- Automated systems ensure consistent welding parameters and produce welds with high integrity, which in turn reduces the need for rework and improved product quality.

- For instance, Polysoude offers automated welding products in its product portfolio. These equipments are used to weld difficult materials including duplex, titanium, zirconium, and aluminum, among others.

- Therefore, rising advancements associated with automatic welding machines are driving the welding equipment market demand.

The semi-automatic segment is expected to register the fastest CAGR during the forecast period.

- Semi-automatic welding is generally less expensive than robotic welding, making it a more accessible option for businesses.

- Semi-automatic welding enhances worker safety by automating some of the more dangerous tasks of the welding process.

- For instance, Bancroft offers semi-automatic welding machines in its product portfolio. These products are available in various types including robotic systems, weld control systems, and others.

- Thus, the market analysis depicts that the benefits provided by semi-automatic are projected to boost the welding equipment market trends during the forecast period.

By Welding Technology:

Based on the welding technology, the market is segmented into arc welding, gas welding, laser welding, resistance welding, and others.

Trends in the Welding Technology:

- Rising utilization of laser welding for precision and enhanced control drives the welding equipment market size.

- Increasing adoption of gas welding in small scale projects due to factors including cost effectiveness and portability.

The arc welding segment accounted for the largest revenue in the welding equipment market share in 2024.

- Arc welding is a process using an electric arc to fuse metals that is affordable, portable, in turn, making it suitable for various applications, including welding on dirty metal and in diverse weather conditions.

- Arc welding equipment includes power sources including DC rectifiers, AC transformers, inverters, electrodes, and necessary safety gear.

- For instance, in September 2022, Kemppi introduced X5 FastMig Pulse, an arc welding machine. It is used for various applications across the industries.

- Therefore, rising innovations associated with arc welding machines are driving the welding equipment market expansion.

The resistance welding segment is expected to register the fastest CAGR during the forecast period.

- Resistance welding is a method using electrical resistance to join metals for providing efficiency, speed, strong joints, while eliminating the need for filler materials, making it suitable for high-volume production.

- It is used in automotive, manufacturing of sheet metal panels, construction, thermal power plants, and others.

- For instance, Amada Weld Tech offers several products for resistance welding in its product offerings. The products are available in high frequency inverter, linear DC, capacitive discharge, AC, and others.

- Thus, the welding equipment market analysis depicts that the advantages of resistance welding are anticipated to drive the market growth during the forecast period.

By End-User:

Based on the end user, the market is segmented into automotive & transportation, building & construction, marine, oil & gas, power generation, and others.

Trends in the End User:

- Rising utilization of welding in oil and gas sector for building and maintaining pipelines.

- Increasing demand and adoption of welding in power generation for construction and maintenance of power plants, turbines, and pipelines among others.

The automotive & transportation segment accounted for the largest revenue share in the market in 2024.

- Welding equipment is used in automotive and transportation manufacturing due to benefits including flexibility, strong and durable joints, and cost-effectiveness.

- For instance, in October 2024, Laserax introduced laser welding machines to be used in automotive batteries. This machine speeds up the process of welding the current collector and busbar to the battery module.

- Therefore, the rising adoption of welding machines in automotive & transportation sector is driving the welding equipment market expansion.

The building & construction segment is expected to register the fastest CAGR during the forecast period.

- Welding creates strong, permanent joints that withstand loads and stresses, ensuring the safety and longevity of structures including bridges, buildings, and other infrastructure.

- For instance, Miller Electric Mfg. LLC offers welding solutions and products for construction sector. These machines are suitable for infrastructure, maintenance, and under roof fabrication.

- Thus, the welding equipment market analysis concludes that the wide applications of welding in building and construction sector are boosting the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

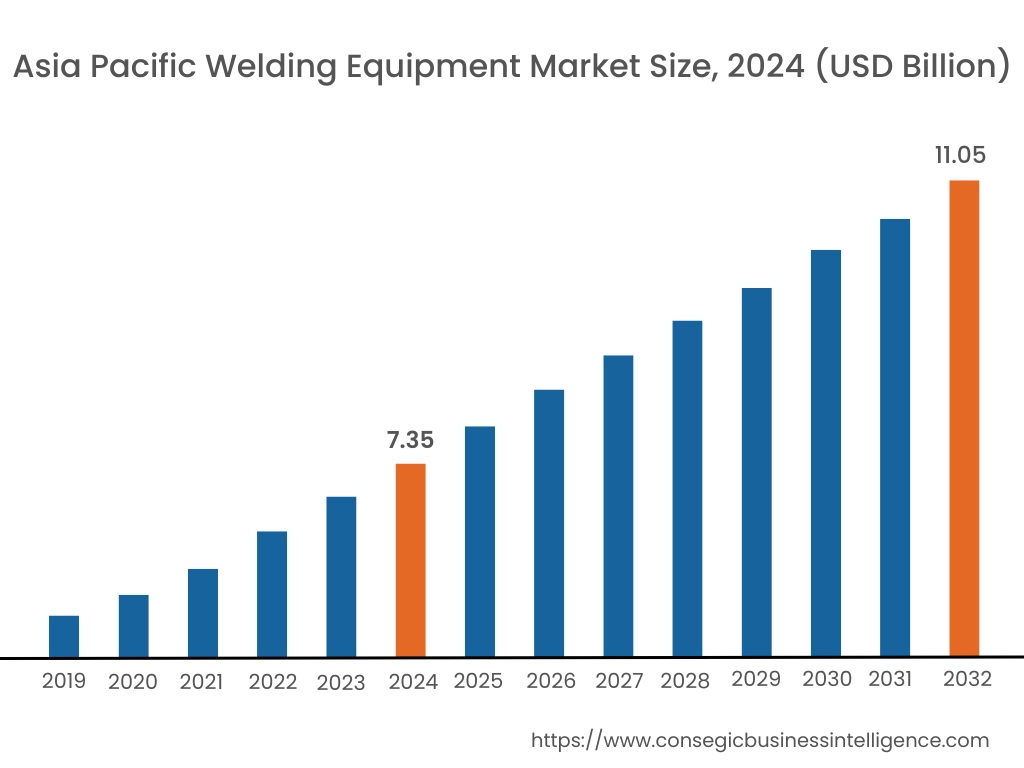

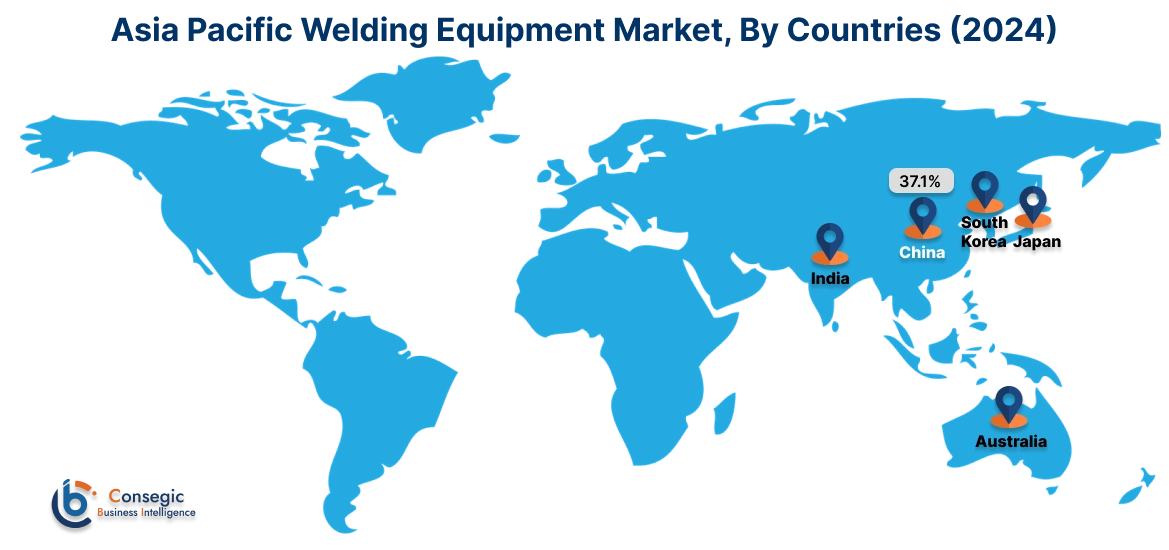

Asia Pacific region was valued at USD 7.35 Billion in 2024. Moreover, it is projected to grow by USD 7.60 Billion in 2025 and reach over USD 11.05 Billion by 2032. Out of this, China accounted for the maximum revenue share of 37.1%. The Asia-Pacific market is experiencing substantial growth, driven by factors including growth in infrastructure development, rapid industrial expansion, and the adoption of advanced welding technologies.

North America is estimated to reach over USD 8.14 Billion by 2032 from a value of USD 5.56 Billion in 2024 and is projected to grow by USD 5.74 Billion in 2025. In North America, the market is driven by rising demand from infrastructure, construction, and automotive industries due to factors such as automotive manufacturing, infrastructure projects, and the adoption of advanced welding technologies.

- For instance, in February 2025, Maine Oxy acquired Strate welding supply in US. Strate is a welding equipment distributor in 13 locations across Florida, Pennsylvania, Georgia, and New York.

In Europe, the market is driven due to technological advancements, increasing demand for welding solutions from multiple industries, and a focus on safety and quality.In Latin America, the market is growing due to factors including significant infrastructure development and industrial expansion. Moreover, in Middle East and Africa, the market is booming due to rising infrastructure development, industrialization, and growing demand in sectors like construction, manufacturing, and automotive, among others.

Top Key Players and Market Share Insights:

The welding equipment industry is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global welding equipment market. Key players in the welding equipment industry include -

- ACRO Automation Systems Inc. (US)

- Ador Welding Limited (India)

- Carl Cloos Schweisstechnik GmbH (Germany)

- Coherent, Inc. (US)

- Cruxweld Industrial Equipments Pvt. Ltd. (India)

- ESAB (US)

- Illinois Tool Works Inc. (US)

- Kemppi Oy. (Finland)

- Miller Electric Mfg. LLC (US)

- Mitco Weld Products Pvt. Ltd. (India)

- OTC DAIHEN Inc. (US)

- Panasonic Industry Co., Ltd. (Japan)

- Polysoude S.A.S. (France)

- The Lincoln Electric Company (US)

- Voestalpine Böhler Welding Group GmbH (Germany)

Recent Industry Developments :

Business Expansions:

- In April 2022, Alexander Battery Technologies, a UK battery manufacturer commissioned the advanced laser welding machine. It enhances the overall productivity and production quality.

- In November 2022, American Friction Welding installed a new Thompson 50-ton rotary friction welding center. This aims to expand capacity and provide scheduling flexibility and manufacturing redundancy.

Product Launches:

- In August 2024, YesWelder has launched the Firstess DP200 welding machine, designed for professionals and new learners. This machine has a color display with built-in intelligent parameter recommendation system.

Welding Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 28.96 Billion |

| CAGR (2025-2032) | 5.3% |

| By Product |

|

| By Type |

|

| By Welding Technology |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the welding equipment market? +

Welding Equipment Market size is estimated to reach over USD 28.96 Billion by 2032 from a value of USD 19.64 Billion in 2024 and is projected to grow by USD 20.27 Billion in 2025, growing at a CAGR of 5.3% from 2025 to 2032.

What are the major segments covered in the welding equipment market report? +

The segments covered in the report are product, type, welding technology, end user, and region.

Which region holds the largest revenue share in 2024 in the welding equipment market? +

Asia Pacific holds the largest revenue share in the welding equipment market in 2024.

Who are the major key players in the welding equipment market? +

The major key players in the market are ACRO Automation Systems, Inc (US), Ador Welding Limited (India), Carl Cloos Schweisstechnik GmbH (Germany), Coherent, Inc. (US), Cruxweld Industrial Equipments Pvt. Ltd. (India), ESAB (US), Illinois Tool Works Inc. (US), Kemppi Oy. (Finland), Miller Electric Mfg. LLC (US), Mitco Weld Products Pvt. Ltd. (India), OTC DAIHEN Inc. (US), Panasonic Industry Co., Ltd. (Japan), Polysoude S.A.S. (France), The Lincoln Electric Company (US), and Voestalpine Böhler Welding Group GmbH (Germany).