Wheel Tractor Scrapers Market Size:

Wheel Tractor Scrapers Market size is estimated to reach over USD 11.13 Billion by 2032 from a value of USD 8.23 Billion in 2024 and is projected to grow by USD 8.40 Billion in 2025, growing at a CAGR of 3.8% from 2025 to 2032.

Wheel Tractor Scrapers Market Scope & Overview:

Wheel tractor scrapers are large earthmoving machines engineered to load, haul, and dump material across construction, mining, and land development sites. Featuring an integrated bowl, cutting-edge, and ejector system, they perform excavation and leveling tasks with high efficiency over long haul distances.

These machines combine self-loading capability with high-speed travel, allowing material to be collected and transported without additional support equipment. Most models include articulated steering, load sensors, and automatic transmission controls for improved maneuverability and operational precision.

The use of wheel tractor scrapers results in faster cycle times, reduced operating costs, and uniform surface grading. Their ability to function effectively in open, dry terrain makes them especially valuable in large-scale earthmoving applications. With high payload capacities and balanced power-to-weight ratios, they support productivity in environments demanding both speed and material control. These machines remain integral to modern earthwork operations, requiring continuous and efficient soil movement.

Key Drivers:

Rising Adoption of Mechanized Equipment in Road Construction and Railway Projects Bolsters Market Growth

With the expansion of infrastructure projects globally, there is a growing preference for mechanized equipment to enhance productivity and efficiency in earthmoving tasks. In road construction and railway projects, wheel tractor scrapers play a vital role in bulk material handling, grading, and leveling. These machines are designed for large-scale projects, offering superior productivity over manual labor and traditional methods. Their ability to move large amounts of earth quickly, even in challenging terrains, makes them indispensable for infrastructure development. As governments invest in modernizing transportation networks and addressing traffic congestion, the demand for efficient and reliable equipment continues to rise.

- For instance, in December 2021, Caterpillar relaunched their Cat® 651 Wheel Tractor Scraper with improvements to productivity, cycle times and comfort. This includes updates to powertrain, controls, hydraulics and structure. The new Advanced Productivity Electronic Control System (APECS) ensures smoother and more responsive shifts by integrating the transmission and engine drivetrain, allowing it to move faster. Additionally, the new high-pressure steering system needs less steering effort, lowering fatigue and improving productivity.

This increased adoption in road and railway construction, along with the push for faster, cost-effective solutions, is driving significant wheel tractor scrapers market expansion.

Key Restraints:

High Capital Investment and Maintenance Costs Associated with Heavy Machinery Hampers Market Expansion

Wheel tractor scrapers, while offering substantial efficiency in large-scale earthmoving applications, come with high upfront costs that limit their adoption, particularly among smaller contractors and regional operators. The initial purchase price for these machines, along with additional costs for attachments and accessories, presents a significant financial barrier. Furthermore, the maintenance and operational costs—such as fuel consumption, spare parts, and repair services—add to the total cost of ownership. These costs can be prohibitive for businesses operating on tight budgets or with limited project volumes. Despite the growing demand for mechanized equipment, the high capital and maintenance requirements continue to restrain wheel tractor scrapers market growth, particularly in emerging markets where the cost-benefit ratio remains a concern.

Future Opportunities :

Integration of Advanced Automation and GPS Systems for Improved Accuracy and Efficiency Presents Market Opportunities

The integration of automation and GPS-based control systems in wheel tractor scrapers offers significant improvements in operational precision and efficiency. These technologies enable automated grading, precise leveling, and real-time performance monitoring, reducing human error and enhancing productivity. GPS systems help operators maintain optimal paths and accurate material removal depths, while automation features allow for more efficient fleet management in large-scale construction projects. With an increasing need for smarter, more accurate equipment in the construction industry, the integration of such technologies presents a valuable opportunity. This innovation enhances the overall user experience, minimizes material waste, and optimizes machine uptime.

- For instance, Caterpillar provides Cat Load Assist for Wheel Tractor-Scrapers, which minimizes operator error and eliminates rework by automating bowl loading. Its benefits include increased productivity, less fatigue and reduced operator input.

As demand for high-efficiency machinery grows, these advancements create strong wheel tractor scrapers market opportunities, especially in large infrastructure projects and operations requiring high levels of precision.

Wheel Tractor Scrapers Market Segmental Analysis :

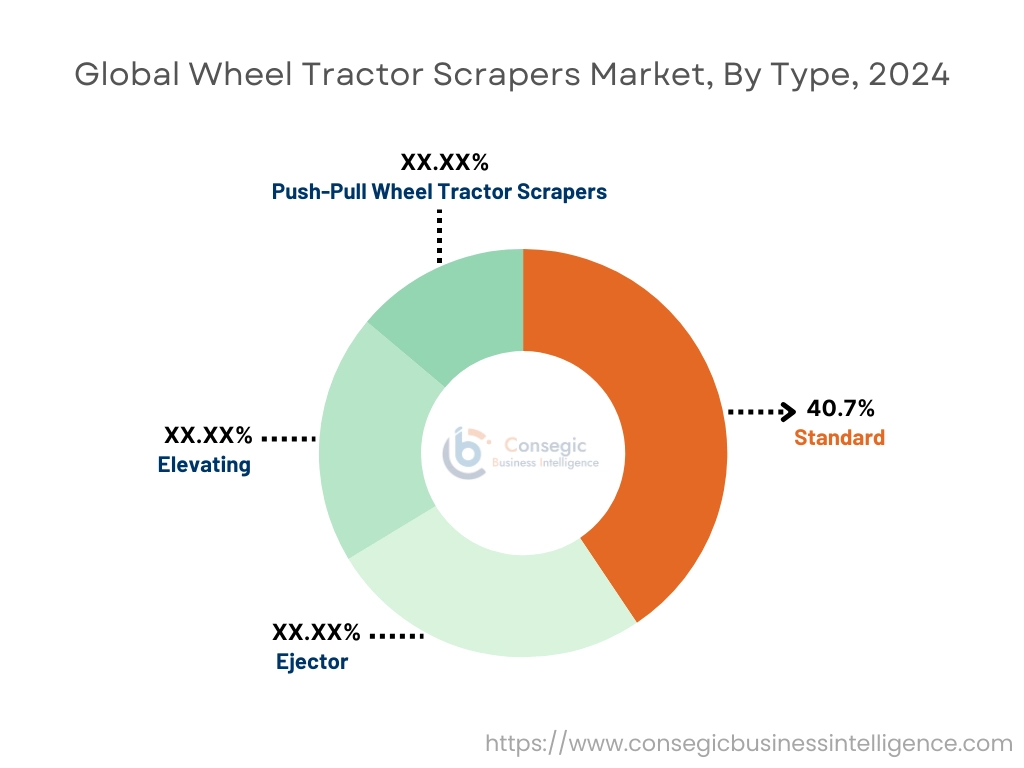

By Type:

Based on type, the wheel tractor scrapers market is segmented into standard, ejector, elevating, and push-pull wheel tractor scrapers.

The standard wheel tractor scrapers segment accounted for the largest revenue share of 40.7% in 2024.

- Standard scrapers are commonly used for general earthmoving applications, offering simplicity and efficiency in material handling and transport.

- They are ideal for applications where large amounts of earth or materials need to be moved quickly, such as in road construction and mining.

- Standard scrapers are favored for their cost-effectiveness and ease of use, making them the most common choice for small to medium-scale projects.

- As per the wheel tractor scrapers market analysis, the standard segment continues to lead due to its broad applicability and affordability in a variety of industries.

The ejector wheel tractor scrapers segment is expected to experience the fastest CAGR during the forecast period.

- Ejector scrapers are designed to unload material quickly and efficiently, providing a significant advantage in large-scale projects that require high productivity.

- They are particularly useful in construction and mining projects where rapid material unloading and high-volume capacity are essential.

- The increased need for high-performance equipment in large infrastructure and mining projects is driving the adoption of ejector scrapers.

- According to wheel tractor scrapers market trends, the need for ejector scrapers is rising due to their superior unloading capacity and efficiency in material handling.

By Power:

Based on power, the market is segmented into diesel, electric, and hybrid.

The diesel segment held the largest wheel tractor scrapers market share in 2024.

- Diesel-powered models are widely used due to their high power output, durability, and ability to perform in tough, rugged environments.

- Diesel engines provide the necessary torque and fuel efficiency required for large-scale earthmoving operations, particularly in mining, construction, and agriculture.

- The availability of diesel fuel and the proven performance of diesel engines in heavy-duty applications continue to drive the dominance of this segment.

- As per segmental analysis, the diesel-powered segment remains dominant due to its reliability, ease of refueling, and cost-effectiveness in large operations, driving the wheel tractor scrapers market demand.

The hybrid segment is projected to witness the fastest CAGR.

- Hybrid models combine the power of diesel engines with electric motors, offering enhanced fuel efficiency and reduced emissions.

- These scrapers are gaining traction due to growing environmental concerns and regulations mandating lower carbon footprints in construction and mining operations.

- The ability of hybrid systems to reduce operational costs while maintaining performance makes them attractive for industries focusing on sustainability and energy efficiency.

- According to wheel tractor scrapers market trends, hybrid systems are poised for rapid growth as more industries seek to balance performance with environmental responsibility.

By Capacity:

Based on capacity, the market is segmented into below 20 cubic yards, 20–40 cubic yards, and above 40 cubic yards.

The 20–40 cubic yards segment accounted for the largest revenue share in 2024.

- Scrapers with a 20–40 cubic yards capacity are versatile and widely used across various industries, providing an ideal balance between load capacity and maneuverability.

- These scrapers are commonly used in construction, mining, and road building, where medium-to-large-scale earthmoving is required.

- The 20–40 cubic yards capacity is the most common and preferred size for most general earthmoving tasks, ensuring high efficiency and cost-effectiveness.

- As per wheel tractor scrapers market growth forecast, this segment continues to dominate due to its widespread applicability in different industries and its ability to handle a wide range of tasks.

The above 40 cubic yards segment is expected to grow at the fastest CAGR during the forecast period.

- High-capacity scrapers above 40 cubic yards are typically used for large-scale projects, such as extensive mining operations, large infrastructure projects, and earthmoving in industrial sites.

- These scrapers are designed for high productivity, capable of handling large quantities of earth and materials, making them ideal for major construction and mining projects.

- The requirement for high-capacity scrapers is increasing as construction and mining activities expand globally, particularly in regions focused on large-scale infrastructure development.

- According to wheel tractor scrapers market analysis, the large-capacity segment is growing as industries push for larger and more efficient machinery to handle massive workloads.

By End-Use Industry:

Based on end-use industry, the market is segmented into construction, mining, oil & gas, agriculture, and others.

The construction segment held the largest wheel tractor scrapers market share in 2024.

- These scrapers are heavily used in construction for tasks such as site preparation, grading, and excavation, where large quantities of materials need to be moved efficiently.

- The increasing requirement for infrastructure development, urbanization, and road construction projects is driving the adoption of scrapers in the construction industry.

- Scrapers are essential in both residential and commercial construction projects, providing the flexibility to handle various terrain types and material conditions.

- As per wheel tractor scrapers market demand, the construction sector remains the largest driver of the market due to the rising need for large-scale, efficient earthmoving solutions in urban development.

The mining segment is projected to witness the fastest CAGR during the forecast period.

- In mining, they are used for overburden removal, transporting materials, and managing large-scale excavation operations.

- As the global need for minerals and natural resources continues to rise, mining companies are increasingly investing in efficient and high-performance earthmoving equipment.

- The use of high-capacity scrapers in mining operations is expected to increase as companies seek to maximize productivity and efficiency.

- According to the market trends, the mining sector will continue to drive the adoption of advanced, high-capacity scrapers to meet the growing demand for natural resources, boosting the wheel tractor scrapers market expansion.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

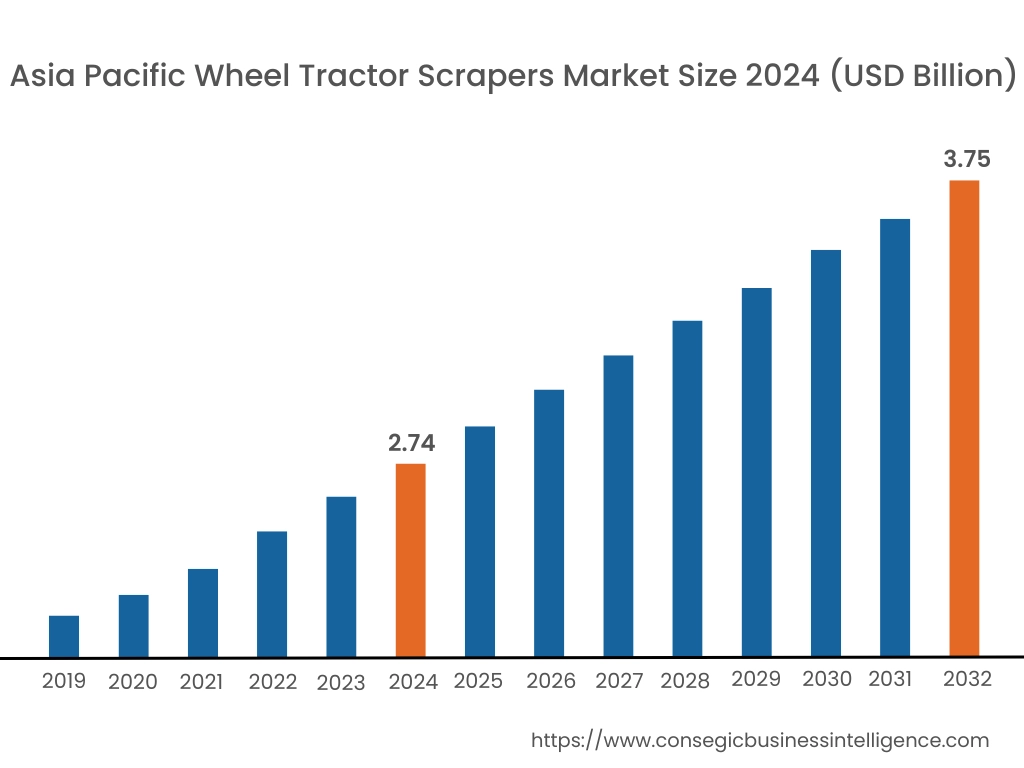

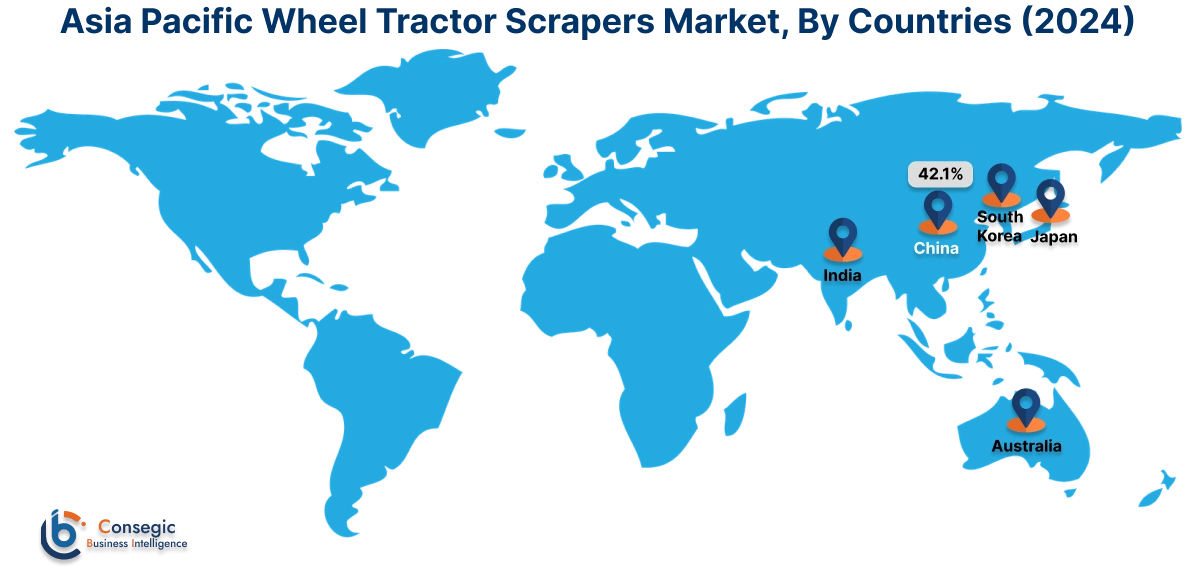

Asia Pacific region was valued at USD 2.74 Billion in 2024. Moreover, it is projected to grow by USD 2.80 Billion in 2025 and reach over USD 3.75 Billion by 2032. Out of this, China accounted for the maximum revenue share of 42.1%. Asia-Pacific represents a rapidly expanding market, driven by expansive infrastructure projects and the need for high-volume earthmoving capabilities. In China, India, and Australia, wheel tractor scrapers are deployed in mining overburden removal, irrigation system development, and highway expansion. Market analysis shows that government-led development schemes and private infrastructure investments are fueling procurement, particularly of machines offering high haul speeds and durable drivetrain components. Australia’s mining sector, in particular, benefits from the use of scrapers in overburden handling and haul road construction. Regional growth is also supported by increasing local manufacturing and favorable equipment financing models.

North America is estimated to reach over USD 3.27 Billion by 2032 from a value of USD 2.42 Billion in 2024 and is projected to grow by USD 2.47 Billion in 2025. North America remains a key region for their deployment, particularly in the United States, where highway construction, dam rehabilitation, and large-scale site preparation are major sectors. Market analysis indicates that contractors in this region favor self-loading and push-pull models to maximize productivity on expansive sites. Investments in public infrastructure renewal and mining operations support the demand. Growth in this region is also influenced by advancements in machine automation and grade control technologies that enable better load consistency and faster cycle times. Furthermore, fleet managers are increasingly integrating scrapers into mixed equipment operations for faster mass excavation with reduced haul distance constraints.

In Europe, adoption is more selective and influenced by regional terrain and regulatory frameworks. Countries such as Germany, France, and Spain utilize them in large civil engineering projects, especially in rural development, flood control, and landfill operations. Market analysis reveals a shift toward emission-compliant engines and operator comfort features in line with EU machinery directives. The wheel tractor scrapers market opportunity in Europe is shaped by a growing need for equipment that balances high material handling capacity with reduced environmental impact. Though compact alternatives often dominate urban projects, these machines remain valuable in vast, open-site developments and agricultural engineering works.

Latin America is showing a rising interest for use in terrain grading, road building, and resource extraction support. Brazil, Chile, and Peru are key countries where such equipment is used for clearing, site leveling, and mine reclamation. Market research suggests a growing need for reliable, low-maintenance machines capable of handling semi-arid and hilly conditions. Although acquisition budgets remain limited in some markets, the increasing availability of used equipment and aftermarket support services is encouraging adoption. The market opportunity here is enhanced by planned infrastructure corridor developments and broader industrial land preparation efforts.

In the Middle East and Africa, the wheel tractor scrapers market is emerging, with applications in desert infrastructure, energy corridor excavation, and flood mitigation projects. The UAE, Saudi Arabia, and South Africa are leading adopters, particularly for bulk earthmoving tasks in large-scale construction and utility trenching. Market analysis highlights a preference for machines with enhanced cooling systems, extended service intervals, and strong undercarriage resilience suited to harsh terrain. While the use of scrapers is still developing in several African nations, international infrastructure funding and regional mining expansion are expected to contribute to long-term growth.

Top Key Players and Market Share Insights:

The wheel tractor scrapers market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global wheel tractor scrapers market. Key players in the wheel tractor scrapers industry include -

- Caterpillar Inc. (USA)

- Komatsu Ltd. (Japan)

- XCMG Group (China)

- SANY Group (China)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- Volvo Construction Equipment (Sweden)

- John Deere (Deere & Company) (USA)

- Terex Corporation (USA)

- Bell Equipment (South Africa)

- CNH Industrial N.V. (CASE Construction) (United Kingdom)

Recent Industry Developments :

Product Launches:

- In March 2025, John Deere launched new scrapers, the 3012 Direct Hitch (DH) Scraper and the 3812 Direct Hitch (DH) Scraper, designed to boost productivity and efficiency on earthmoving projects. Its 30 cubic yard single pan enables self-loading, transport and spreading with a single operator, making it an ideal solution where multiple pans are not practical.

Acquisitions:

- In January 2022, Kinperium Industries acquired K.A. Group, consisting of K-Tec Earthmovers & Ashland Industries, the industry-leading manufacturers of pull-pan earthmoving scrapers and implements for the construction, mining, and agriculture sectors.

Wheel Tractor Scrapers Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 11.13 Billion |

| CAGR (2025-2032) | 3.8% |

| By Type |

|

| By Power |

|

| By Capacity |

|

| By End-Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Wheel Tractor Scrapers Market? +

Wheel Tractor Scrapers Market size is estimated to reach over USD 11.13 Billion by 2032 from a value of USD 8.23 Billion in 2024 and is projected to grow by USD 8.40 Billion in 2025, growing at a CAGR of 3.8% from 2025 to 2032.

What specific segmentation details are covered in the Wheel Tractor Scrapers Market report? +

The Wheel Tractor Scrapers market report includes specific segmentation details for type, power, capacity and end-use industry.

What are the end-use industries of the Wheel Tractor Scrapers Market? +

The end-use industries of the Wheel Tractor Scrapers Market are construction, mining, oil & gas, agriculture, and others.

Who are the major players in the Wheel Tractor Scrapers Market? +

The key participants in the Wheel Tractor Scrapers market are Caterpillar Inc. (USA), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), John Deere (Deere & Company) (USA), Terex Corporation (USA), Bell Equipment (South Africa), CNH Industrial N.V. (CASE Construction) (United Kingdom), XCMG Group (China), SANY Group (China) and Zoomlion Heavy Industry Science & Technology Co., Ltd. (China).