3D Optical Profiler Market Size:

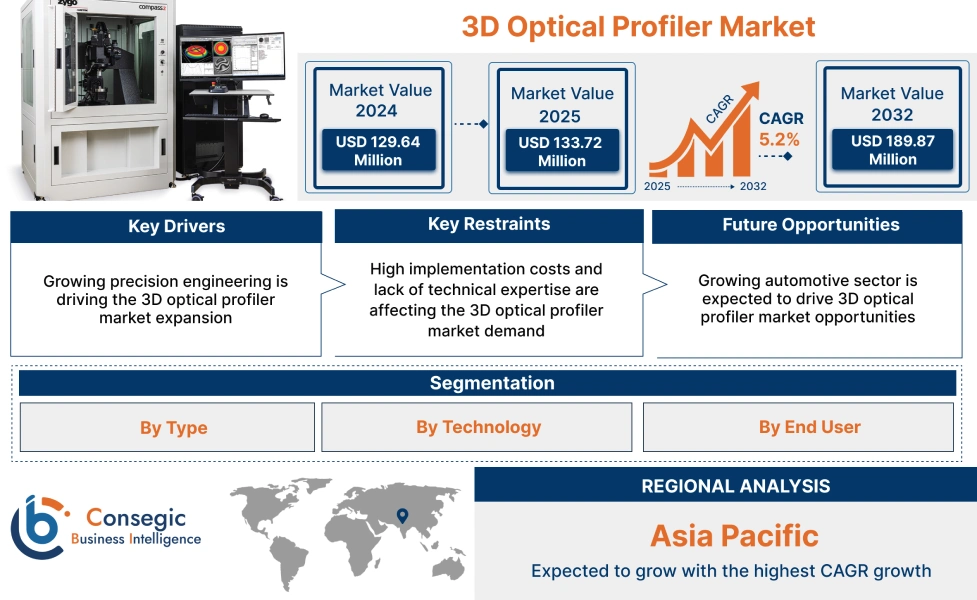

3D Optical Profiler Market Size is estimated to reach over USD 189.87 Million by 2032 from a value of USD 129.64 Million in 2024 and is projected to grow by USD 133.72 Million in 2025, growing at a CAGR of 5.2% from 2025 to 2032.

3D Optical Profiler Market Scope & Overview:

A 3D optical profiler, also known as 3D optical profilometer, is a non-contact, precision measurement tool that captures the three-dimensional topography of surfaces. It uses optical microscopy to analyze surface texture and roughness in both research and manufacturing settings. These profilers are used to measure various parameters such as step height, waviness, flatness, parallelism, roughness, and microstructures.

How is AI Transforming the 3D Optical Profiler Market?

The integration of AI is considerably transforming the 3D optical profiler market. The incorporation of AI helps in enhancing automation, data analytics, and usability of these instruments. Moreover, AI-powered systems can analyze vast amounts of data faster and more accurately, detect defects, and even predict potential issues in the equipment, which further leads to improved efficiency, reduced human intervention, and expanded applications in various industries.

Additionally, AI-powered systems minimize the need for manual operation and interpretation of results, thereby leading to faster throughput and lower labor costs. Consequently, the above factors are anticipated to drive the market growth in upcoming years.

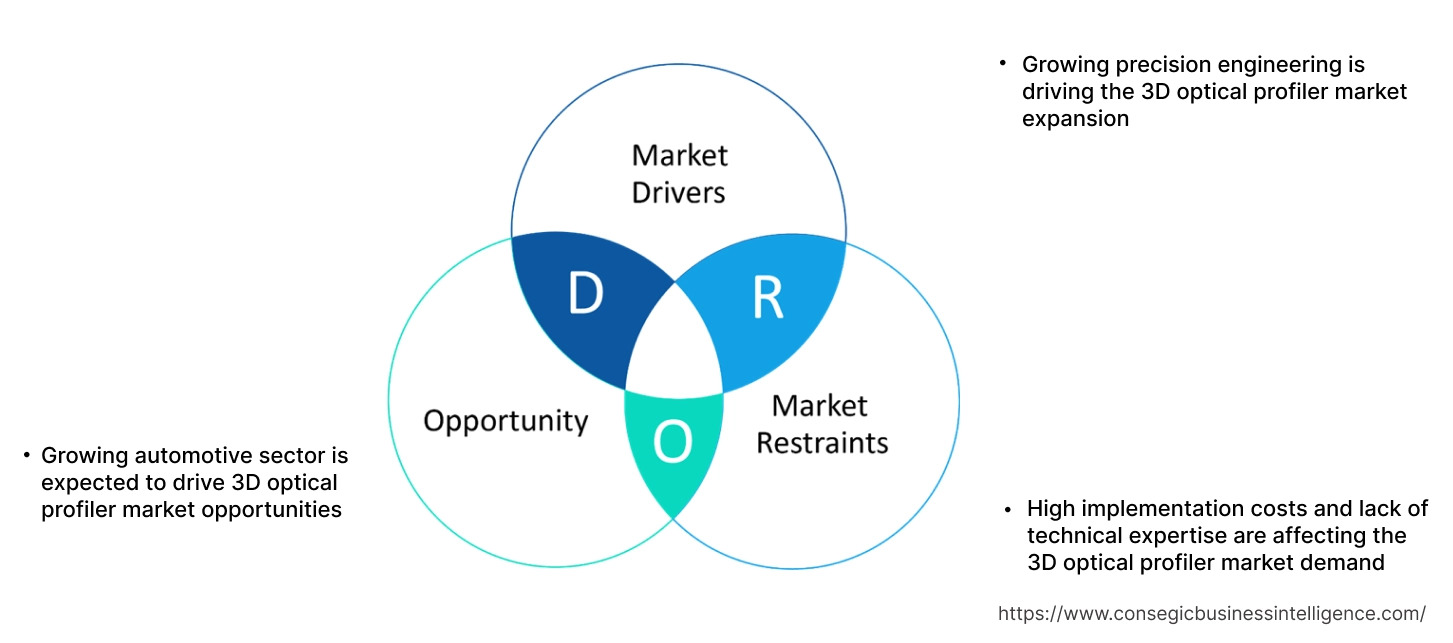

3D Optical Profiler Market Dynamics - (DRO) :

Key Drivers:

Growing precision engineering is driving the 3D optical profiler market expansion

Precision engineering involves the use of advanced technologies and meticulous processes to achieve exacting specifications in various industries such as aerospace, automotive, electronics, and healthcare among others. It is essential for components that require high reliability, performance, and durability in demanding applications. Industries rely on precision engineering to achieve consistency in quality and meet stringent regulatory standards.

Further, technological advancements play a crucial role in advancing precision engineering capabilities. Innovations in materials science, machining techniques, metrology, and automation have enabled manufacturers to provide precision and complexity in 3D optical systems. These advancements not only enhance product performance but also drive efficiency and cost-effectiveness in manufacturing processes.

- For instance, in August 2024, Zygo showcased their 3D optical profiler tools, the NewView 9000, ZeGage Pro HR, and NewView NX at the IMTS event in Chicago, U.S. These tools are critical in advanced manufacturing for obtaining highly accurate surface measurements and ensuring quality control. This precision is critical for producing reliable, high-performance components across various high-tech sectors, allowing manufacturers to meet stringent tolerance requirements.

Thus, according to the 3D optical profiler market analysis, the growing precision engineering is driving the 3D optical profiler market size.

Key Restraints:

High implementation costs and lack of technical expertise are affecting the 3D optical profiler market demand

One of the primary restraints includes high cost associated with these instruments, which can be prohibitive for small and medium-sized enterprises (SMEs). The initial investment and maintenance costs can deter potential users, limiting market penetration. Further, as 3D optical metrology systems evolve with new features, capabilities, and integration with technologies such as artificial intelligence and IoT, there is a constant need for up-to-date training and skill development among workers. The gap between traditional skill sets and emerging technological requirements poses a barrier to adopting and effectively utilizing advanced metrology solutions. Thus, the aforementioned factors would further impact the 3D optical profiler market size.

Future Opportunities :

Growing automotive sector is expected to drive 3D optical profiler market opportunities

Automotive sector relies heavily on 3D optical systems to ensure the accuracy of components, streamline manufacturing processes, and enhance overall product performance. In the automotive sector, 3D optical systems play a critical role in various stages of the production cycle, from design validation and prototyping to final inspection of vehicle components. Manufacturers use these systems to conduct detailed measurements of complex geometries, detect defects early in the production process, and verify adherence to tight tolerances. This capability not only improves product quality but also supports efforts to optimize assembly processes, reduce time-to-market, and enhance customer satisfaction with reliable, high-performance vehicles.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the passenger car production across the world reached 68,020,265 units in 2023, witnessing an increase of approximately 11% in comparison to 2022.

Thus, based on the above 3D optical profiler market analysis, the growing automotive sector is expected to drive the 3D optical profiler market opportunities.

3D Optical Profiler Market Segmental Analysis :

By Type:

Based on type, the market is segmented into desktop and portable.

Trends in the type:

- Manufacturers are increasingly focusing on developing profilers with higher accuracy, faster measurement speeds, and better integration capabilities with other digital platforms. These advancements not only enhance the performance of profilometers but also broaden their application scope across different industries, supporting the segment growth.

- The shift towards Industry 4.0 and smart manufacturing processes necessitates sophisticated measurement solutions, thereby, fueling the segment growth.

- Thus, the above factors are driving the 3D optical profiler market demand.

The desktop segment accounted for the largest revenue share in the year 2024.

- Desktop profilers are used in laboratories and manufacturing facilities where detailed, high-resolution surface measurements are required.

- These devices offer the advantage of enhanced stability and precision, making them suitable for applications that demand rigorous quality control.

- As industrial processes become increasingly sophisticated, the demand for benchtop profilometers continues to grow, driven by their ability to deliver accurate data critical for decision-making in production environments.

- Their integration into automated systems further enhances their utility, making them vital tools in quality assurance protocols.

- For instance, KLA’s 3D benchtop optical profilers provide quick, easy, and non-contact solutions for surface topography measurements. These profilers support variety of measurements, such as true color imaging, light interferometry, and confocal grid illumination.

- Thus, based on the above analysis, these factors are further driving the 3D optical profiler market growth and trends.

The portable segment is anticipated to register the fastest CAGR during the forecast period.

- Portable profilers are gaining traction due to their flexibility and convenience in field applications. These devices are particularly beneficial in scenarios where mobility is crucial, such as on-site inspections and maintenance operations.

- The portability factor enables immediate surface analysis, which can be critical in industries such as aerospace and automotive, where quick and accurate assessments are necessary to prevent downtimes.

- The growing trend towards decentralized manufacturing processes also supports the adoption of portable profilers, enabling real-time quality assessments across various production sites.

- As technology advances, portable profilers are expected to offer comparable precision to benchtop models, further boosting their adoption.

- Thus, based on the above analysis, these factors are expected to drive the 3D optical profiler market share and trends during the forecast period.

By Technology:

Based on the technology, the market is segmented into confocal microscopy, interferometry, structured light scanning, and time-of-flight.

Trends in the technology:

- As industries strive to achieve higher efficiency and accuracy, the integration of profilometers into digital ecosystems becomes essential. This evolution is supported by the growing interest in the internet of things (IoT) and smart factories, where these devices play a crucial role in providing real-time data that informs production and quality management strategies.

- The ongoing advancements in sensor technology and data analytics further enhance the capabilities of profilers, making them necessary tools in quality assurance and research and development environments.

- These factors would further supplement the 3D optical profiler market growth and trends.

The confocal microscopy segment accounted for the largest revenue share in the year 2024.

- Confocal microscopy provides high-resolution imaging and accurate surface characterization. This technique employs point illumination and a spatial pinhole to eliminate out-of-focus light, enhancing image quality.

- Industries such as semiconductors, where micro-scale surface details are critical, heavily rely on confocal microscopy.

- The increasing need for miniaturized and intricate components in electronics fuels the adoption of this technology.

- Additionally, advancements in laser and imaging technology further enhance the capabilities of confocal microscopy, making it crucial for high-precision applications.

- Thus, based on the above analysis, these factors would further supplement the 3D optical profiler market

The interferometry segment is anticipated to register the fastest CAGR during the forecast period.

- Interferometry provides capacity to measure surface topography with nanometer-scale resolution. This technique leverages the interference of light waves to detect minute surface variations, making it ideal for applications requiring extreme precision.

- In industries like aerospace and automotive, where component reliability is paramount, interferometry is crucial for ensuring structural integrity and performance.

- The rising focus on quality control and the need to adhere to stringent standards are propelling the demand for interferometry-based 3D optical profilers, contributing significantly to the segment growth.

- These factors are anticipated to further drive the 3D optical profiler market trends and growth during the forecast period.

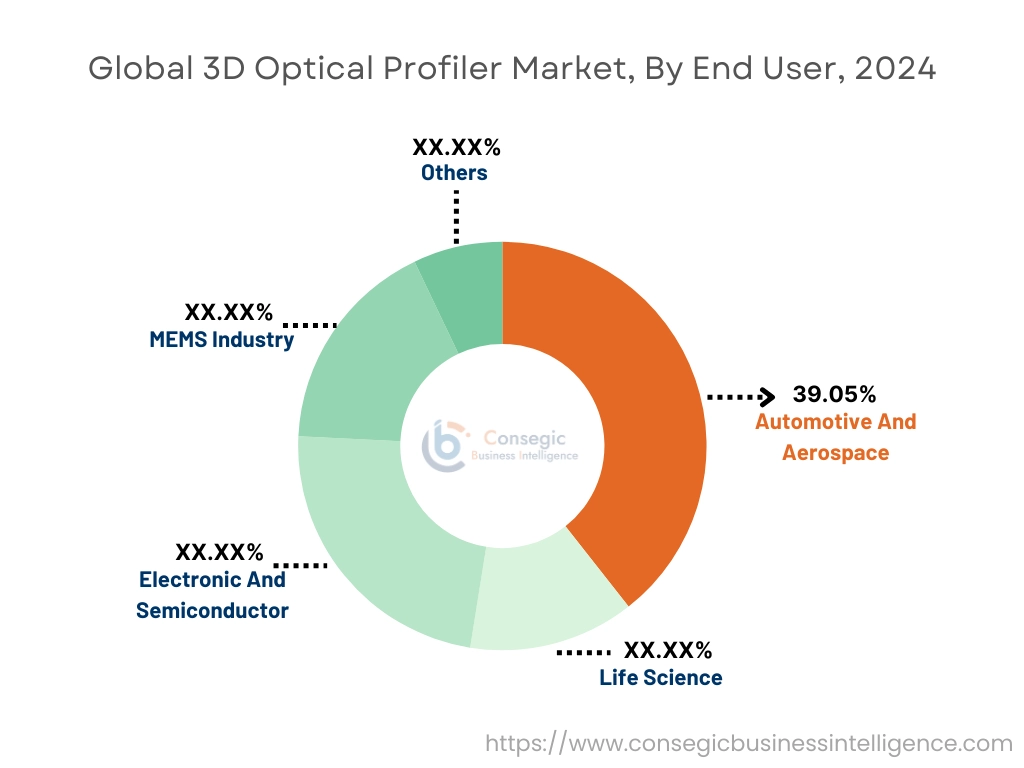

By End User:

Based on end user, the market is segmented into electronic and semiconductor,

MEMS industry, automotive and aerospace, life science, and others.

Trends in the end user:

- The medical device and healthcare sectors are rapidly emerging as important application areas for 3D optical systems. With the growing need for medical implants and devices, stringent quality control and validation processes are necessary to comply with regulatory standards.

- Academic institutions and research organizations utilize profilers for educational and research purposes, fostering innovation and the development of new measurement techniques. This diverse end-user landscape highlights the versatility of 3D optical systems and emphasizes their importance in various sectors.

The automotive and aerospace segment accounted for the largest revenue share of 39.05% in the year 2024.

- In the automotive sector, 3D optical profiler instruments are essential for ensuring the quality and performance of critical components.

- These instruments play a crucial role in measuring surface roughness, texture, and dimensional accuracy, which are vital for the functionality and safety of automotive parts.

- As automakers strive to enhance vehicle performance and safety, the adoption of advanced measurement technologies is also increasing.

- In aerospace sector, the precision and reliability of components are crucial to ensure safety and performance.

- These instruments are employed to inspect and measure the surface characteristics of components such as turbine blades, airframes, and avionics systems among others.

- The ability to conduct non-destructive testing and provide high-resolution measurements is critical in aerospace applications, where material integrity and surface finish directly impact performance and safety.

- Thus, based on the analysis, the above factors are driving the market development.

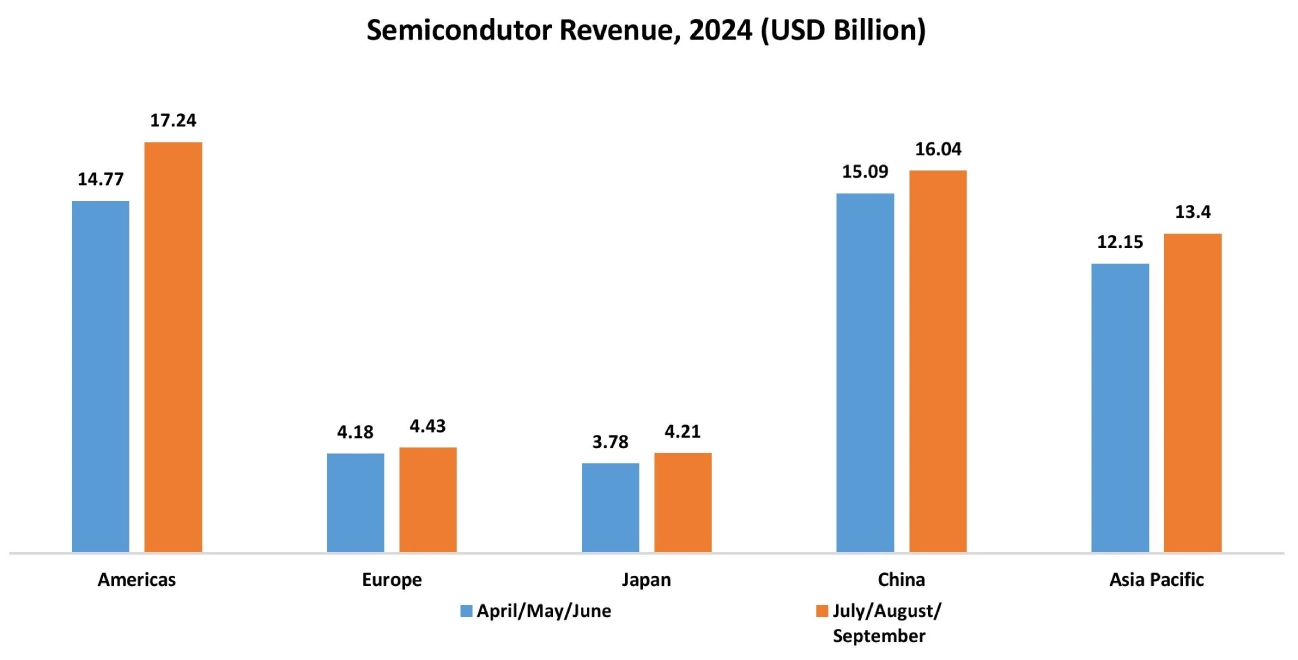

The electronic and semiconductor segment is anticipated to register the fastest CAGR during the forecast period.

- As the need for smaller, more powerful semiconductor devices increases, the requirement for accurate surface characterization becomes vital.

- 3D optical instruments enable manufacturers to identify and rectify surface defects at an early stage, ensuring product quality and reliability.

- The ongoing advancements in semiconductor technology, coupled with the increasing complexity of chip designs, are expected to sustain the need for these instruments in the semiconductor sector.

- These factors are anticipated to drive the 3D optical profiler market trends and growth during the forecast period.

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

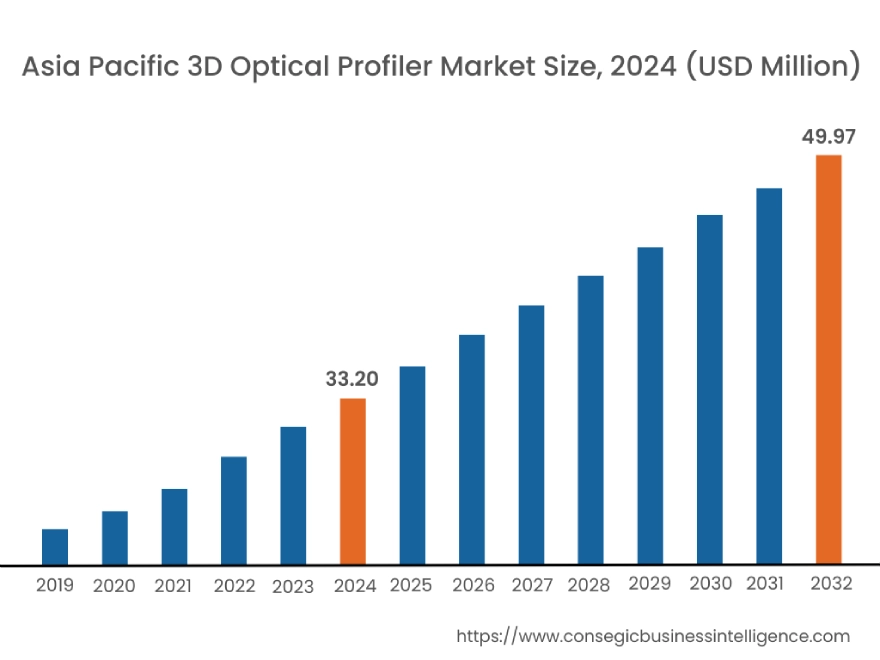

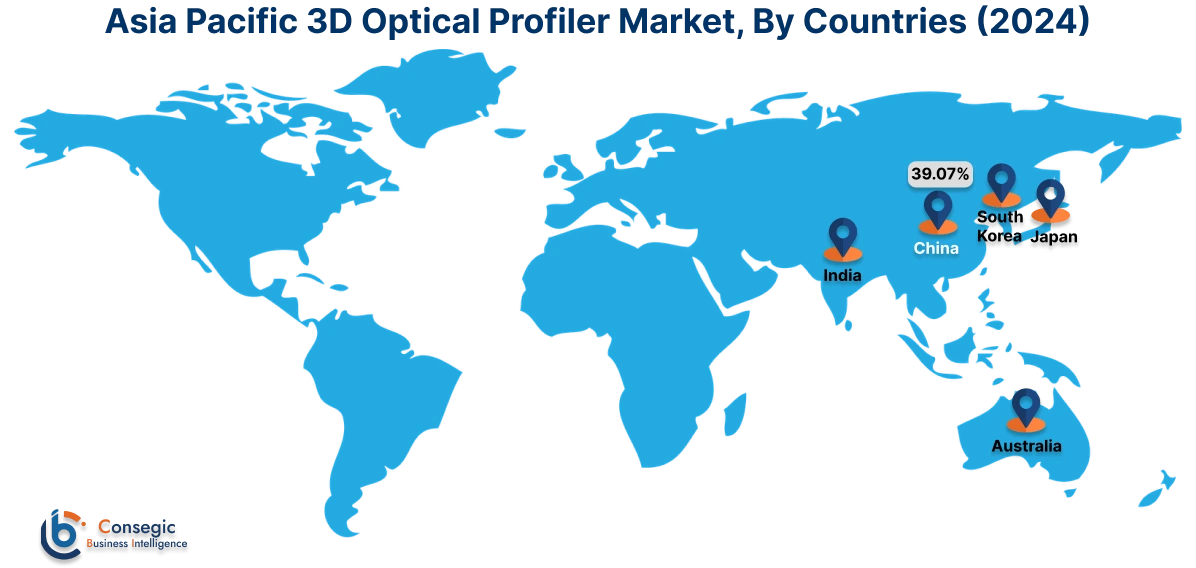

Asia Pacific 3D optical profiler market expansion is estimated to reach over USD 49.97 million by 2032 from a value of USD 33.20 million in 2024 and is projected to grow by USD 34.32 million in 2025. Out of this, the China market accounted for the maximum revenue split of 39.07%. The surge in need for miniaturized components in electronics and semiconductor sector is a primary growth driver for the regional market. As devices become smaller and more complex, the need for precision in component manufacturing and quality assurance increases. Moreover, the shift towards Industry 4.0 and smart manufacturing processes necessitates sophisticated measurement solutions, thereby, fueling the regional market. As industries increasingly incorporate automation, profilometers become integral to in-process quality control, providing precise data that enhances efficiency and product quality. These factors would further drive the regional 3D optical profiler market during the forecast period.

- For instance, in February 2024, Zygo Corporation announced the expansion of its operations of 3D optical instruments in India. Zygo's strategic move highlights its strong dedication to India's quickly expanding manufacturing sector, intending to offer better assistance to customers in the region.

North America market is estimated to reach over USD 66.11 million by 2032 from a value of USD 45.57 million in 2024 and is projected to grow by USD 46.96 million in 2025. North America holds a prominent position in the market, driven by strong technological advancements and significant investments in industries such as aerospace, automotive, and healthcare. The region benefits from a strong presence of key market players, research institutions, and manufacturing facilities that drive innovation and adoption of advanced metrology solutions. Furthermore, the increasing focus on quality assurance and efficiency across industries further propels the need for 3D optical systems in the region. These factors would further drive the market in North America.

- For instance, in September 2024, KLA Instruments developed a portfolio of advanced meteorology solutions, Zeta-20HR and Zeta-Solar optical profilers. Using high optical resolution, these systems rapidly assess both height and width of the solar cell's surface pattern. These measurements can be taken across the entire solar cell, allowing factories to ensure consistent texture quality across the entire wafer.

According to the analysis, the 3D optical profiler industry in Europe is anticipated to witness significant development during the forecast period. The presence of a well-established manufacturing sector, significant investments in research and development, and the increasing focus on quality assurance and process optimization are driving the need for optical profilers in Europe.

Additionally, the growing automotive and aerospace sectors contribute to the need for profilometers in Latin America, where precision and innovation are highly valued. As Latin American industries continue to prioritize quality and efficiency, the need for 3D optical instruments is expected to grow. Further, the adoption of 3D optical systems in Middle East & Africa region is driven by sectors such as oil and gas, construction, and healthcare, where precise measurement and inspection capabilities are crucial for ensuring safety, reliability, and compliance with international standards.

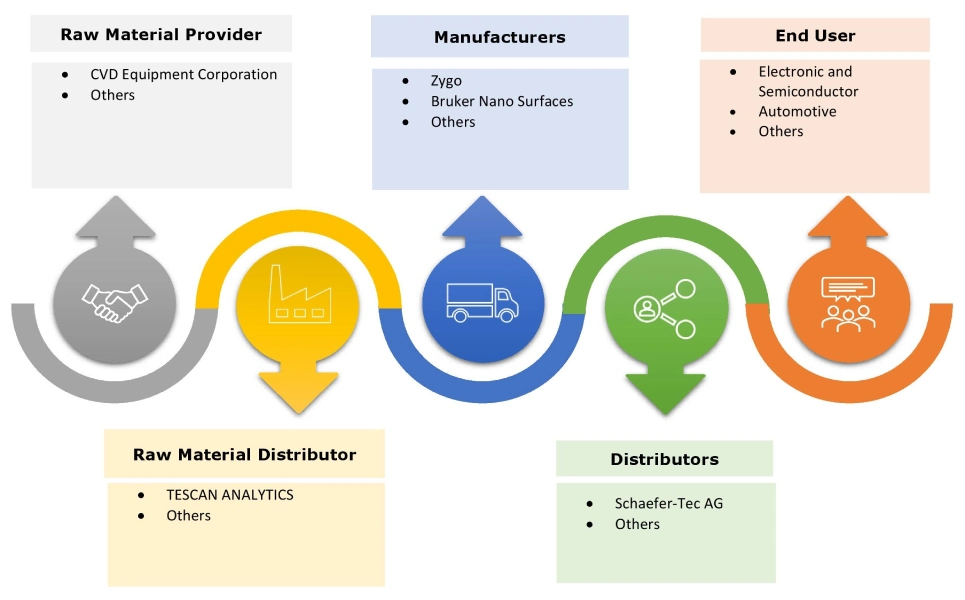

Top Key Players and Market Share Insights:

The global 3D optical profiler market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the 3D optical profiler industry include-

- Zygo (U.S.)

- Sensofar (Spain)

- Cyber Technologies (Germany)

- Nanovea (U.S.)

- Mahr (Germany)

- Zeta Instruments (U.S.)

- KLA-Tencor (U.S)

- Bruker Nano Surfaces (U.S.)

- Taylor Hobson (U.K.)

- AEP Technology (U.S.)

- Alicona (Austria)

- 4D Technology (U.S.)

Recent Industry Developments :

Product Launch:

- In September 2024, Bruker launched its Dektak ProTM stylus 3D optical profilometer, a new benchtop system designed for semiconductor sector. This system can handle measurements across a larger area, up to 200 mm, giving full access to the sample.

3D Optical Profiler Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 189.87 Million |

| CAGR (2025-2032) | 5.2% |

| By Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the 3D Optical Profiler Market? +

3D Optical Profiler market size is estimated to reach over USD 189.87 Million by 2032 from a value of USD 129.64 Million in 2024 and is projected to grow by USD 133.72 Million in 2025, growing at a CAGR of 5.2% from 2025 to 2032.

Which is the fastest-growing region in the 3D Optical Profiler Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the 3D Optical Profiler report? +

The 3D optical profiler report includes specific segmentation details for type, technology, end user, and region.

Who are the major players in the 3D Optical Profiler Market? +

The key participants in the market are Zygo (U.S.), Sensofar (Spain), KLA-Tencor (U.S), Bruker Nano Surfaces (U.S.), Taylor Hobson (U.K.), Alicona (Austria), 4D Technology (U.S.), Cyber Technologies (Germany), Nanovea (U.S.), Mahr (Germany), Zeta Instruments (U.S.), AEP Technology (U.S.), and others.