3D Time-of-Flight (TOF) Image Sensor Market Introduction :

3D Time-of-Flight (TOF) Image Sensor Market size is estimated to reach over USD 815.16 Million by 2032 from a value of USD 479.44 Million in 2024 and is projected to grow by USD 503.79 Million in 2025, growing at a CAGR of 6.90% from 2025 to 2032.

3D Time-of-Flight (TOF) Image Sensor Market Definition & Overview:

A 3D time-of-flight (TOF) image sensor measures the distance between the sensor and objects in the field of view by using the principle of time-of-flight. The sensor calculates the distance by measuring the time taken by light to travel from the sensor to the object and back to the sensor. In a 3D TOF image sensor, the sensor emits a modulated light signal, in the form of infrared rays, and then measures the time taken by the light to reflect back to the sensor. Additionally, the 3D TOF image sensor is utilized for various applications, including gesture recognition, object tracking, augmented reality, and robotics, among others.

3D Time-of-Flight (TOF) Image Sensor Market Insights :

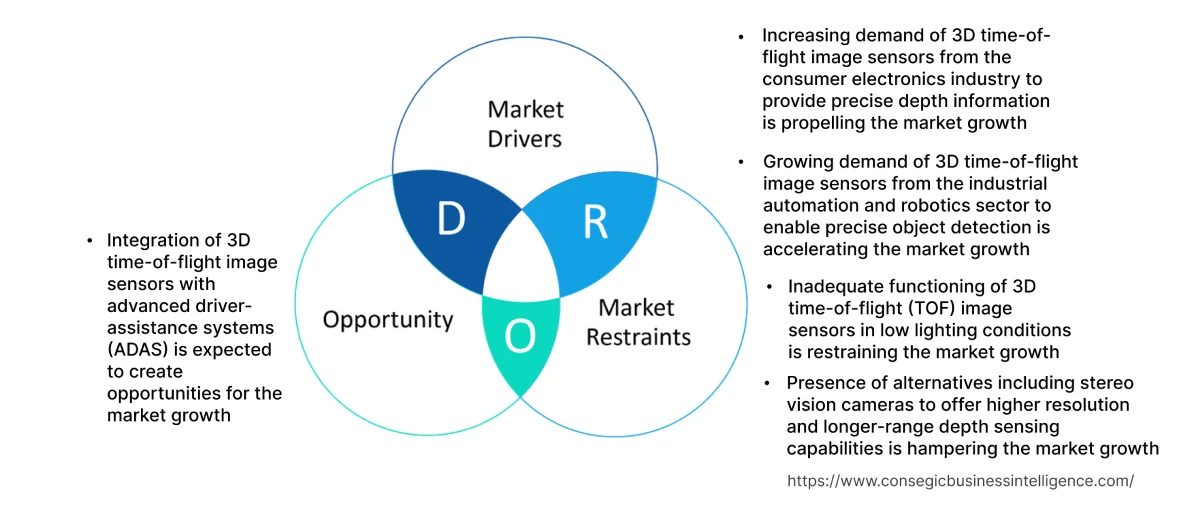

3D Time-of-Flight (TOF) Image Sensor Market Dynamics - (DRO) :

Key Drivers :

Increasing demand of 3D time-of-flight image sensors from the consumer electronics industry to provide precise depth information is propelling the market growth

Smartphones, tablets, and other consumer electronic devices incorporate high-resolution cameras and 3D time-of-flight image sensors enhances the functioning of cameras by providing depth information, enabling features including bokeh effects (blurred background), improved object tracking, and augmented reality filters. In addition, consumer electronics manufacturers are continuously striving to provide innovative and immersive user experiences. The incorporation of 3D TOF image sensors enable advanced features including facial recognition, gesture control, and 3D scanning to enhance user interactions with devices. The sensors allow for more immersive and intuitive user interfaces, leading to an increased customer base. Consequently, the expanding consumer electronics industry raises the demand for 3D time-of-flight image sensors to provide accurate depth information and also to enhance the user experience by enabling features including facial recognition and gesture control. For instance, in November 2022, according to India Brand Equity Foundation (IBEF) report, the consumer electronics market in India accounted to USD 9.84 billion in 2021 and is predicted to reach USD 21.18 billion in 2025. The expanding consumer electronics industry thus contributes significantly in driving the growth of the market.

Growing demand of 3D time-of-flight image sensors from the industrial automation and robotics sector to enable precise object detection is accelerating the market growth

In industrial automation and robotics, accurate detection and localization of objects are crucial for safe and efficient operations. 3D TOF image sensors provide real-time depth information, enabling precise object detection, even in complex and dynamic environments. The sensors help robots to efficiently navigate and interact with the surroundings, improving productivity and safety. Additionally, industrial robots work in close proximity to humans and other objects. 3D TOF image sensors assist in collision avoidance by continuously monitoring the distance between the robot and surroundings. The sensors enable robots to react quickly and safely to dynamic changes in the environment, reducing the risk of collisions and enhancing worker safety. Subsequently, the increasing industrial automation and the rising number of robotics installations are contributing collectively in bolstering the growth of the 3D time-of-flight image sensor market. For instance, according to the International Federation of Robotics (IFR) report, 517,385 units of industrial robots have been installed in 2021 witnessing a growth of 31% in comparison to the previous year, 2020. The rising industrial robot installations, thus contribute notably in accelerating the growth of the 3D time-of-flight image sensor market.

Key Restraints :

Inadequate functioning of 3D time-of-flight (TOF) image sensors in low lighting conditions is restraining the market growth

In low lighting conditions, the amount of reflected light reaching the sensor decreases, resulting in lower signal-to-noise ratios and reduced accuracy of depth measurements. The performance of 3D TOF image sensors deteriorate, leading to inaccurate depth information and potentially affecting the performance of devices relying on precise depth sensing. In addition, various industries and applications including robotics, surveillance, and automotive, operate in indoor and low-light environments where lighting conditions are suboptimal. The inefficient functioning of 3D TOF image sensors in such scenarios hinders the adoption of sensors, thereby restraining the growth of the global 3D time-of-flight image sensor market.

Presence of alternatives including stereo vision cameras to offer higher resolution and longer-range depth sensing capabilities is hampering the market growth

Stereo vision cameras provide higher-resolution depth maps as compared to 3D time-of-flight image sensors. The utilization of multiple cameras in stereo vision allows for more detailed depth information, enabling finer depth perception and accuracy. Additionally, stereo vision cameras are less affected by lighting conditions in comparison to 3D TOF image sensors, restraining the growth of the market. Stereo vision relies on the disparity between two or more camera images to calculate the depth and is less dependent on the absolute amount of light. Moreover, stereo vision cameras achieve longer-range depth sensing by adjusting the baseline distance between the cameras to capture depth information over greater distances, hence impeding the growth of the global 3D time-of-flight image sensor.

Future Opportunities :

Integration of 3D time-of-flight image sensors with advanced driver-assistance systems (ADAS) is expected to create opportunities for the market growth

ADAS systems rely on accurate and real-time detection of objects in the surrounding environment and integrating 3D TOF image sensors with ADAS enhances the object detection capabilities. The sensors provide depth information, enabling better perception of the distance and size of objects, crucial for collision avoidance, lane-keeping, and adaptive cruise control systems. In addition, 3D time-of-flight image sensors improve detection and tracking of pedestrians and cyclists, even in challenging scenarios including low-light conditions or occlusions. ADAS provides early warnings and assists in preventing accidents by accurately capturing depth and position of vulnerable road users, leading to increased safety. In conclusion, the integration of 3D time-of-flight image sensors with advanced driver-assistance systems is anticipated to create potential opportunities for market growth.

3D Time-of-Flight (TOF) Image Sensor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 815.16 Million |

| CAGR (2025-2032) | 6.9% |

| By Product Type | Quarter Video Graphics Array (QVGA), Quarter QVGA (QQVGA), Half Quarter Video Graphics Array (HQVGA), Video Graphics Array (VGA), and Mega Pixel (MP) |

| By Application | Robot Navigation, Indoor Navigation, Reactive Altimeters, Obstacle Avoidance, Vehicle Monitoring, Machine Vision, Object Tracking, Augmented Reality and Virtual Reality, Gesture Control, Others |

| By End-User | Automotive, Consumer Electronics, Healthcare, Aerospace and Defense, and Entertainment |

| By Region | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Players | Teledyne e2v, Panasonic Corporation, Texas Instruments, STMicroelectronics N.V., ESPROS Photonics Corporation, PMD Technologies, Infineon Technologies, Prime Sense, Ifm Electronic, Melexis |

3D Time-of-Flight (TOF) Image Sensor Market Segmental Analysis :

Based on the Product Type :

The product type segment is classified into Quarter Video Graphics Array (QVGA), Quarter QVGA (QQVGA), Half Quarter Video Graphics Array (HQVGA), Video Graphics Array (VGA), and Mega Pixel (MP). The megapixel resolution accounted for the largest market share in 2024 and is also projected to witness the fastest CAGR during the forecast period. The growth is attributed to the ability of megapixel resolution to offer a balance between image quality and data processing requirements. Additionally, the megapixels are employed in a wide range of devices including smartphones, tablets, webcams, and entry-level surveillance cameras. For instance, LUCID Vision Labs Inc. launched a Helios Time of Flight (ToF) 3D camera with a Sony DepthSense IMX556 sensor of 0.3-megapixel resolution. The product is designed with 5 communication channels of 0.3 MP, enabling users to operate 5 Helios without interference between cameras to maintain a balance between image quality and data processing, thus contributing significantly in driving the growth of the megapixel segment.

Based on the Application :

The application segment is categorized into robot navigation, vehicle monitoring, machine vision, object detection, augmented reality and virtual reality, gesture control, liquid level measurement, 3D imaging and scanning, and others. Machine vision accounted for the largest market share in 2024 as 3D time-of-flight image sensors accurately detect and recognize objects in machine vision applications. TOF sensors enable precise identification and localization of objects, by capturing depth information in addition to color and intensity, even in complex environments. In addition, 3D time-of-flight sensors also play a significant role in robotic navigation, motion planning, and object manipulation tasks. The sensors provide real-time depth perception, allowing robots to accurately perceive the surroundings and interact with objects. 3D TOF image sensors enable robots to navigate in dynamic environments, avoid obstacles, and perform tasks with enhanced precision and efficiency, thus contributing remarkably in accelerating the growth of the machine vision segment.

Vehicle monitoring segment is anticipated to witness the fastest CAGR in the 3D time-of-flight image sensor market. 3D TOF image sensors are employed in DMS (Driver Monitoring Systems) to monitor the driver's attention and alertness levels. TOF sensors enable the accurate detection of eye movements, head position, and facial expressions by capturing the depth information of the driver's face, thus contributing significantly in driving the market growth. Additionally, 3D TOF image sensors enable gesture-based controls inside the vehicle cabin by capturing the hand movements and gestures of the driver. Moreover, TOF sensors allow for intuitive control of various functions including infotainment systems, climate control, and interior lighting to enhance the user experience. For instance, in June 2022, Infineon Technologies AG in collaboration with pmdtechnologies ag launched the second generation of 3D time-of-flight image sensor ISO26262 for automotive applications. The sensors enable the efficient functioning of driver monitoring system to detect the driver's distraction by using 3D facial recognition technology, thus contributing notably in bolstering the market growth.

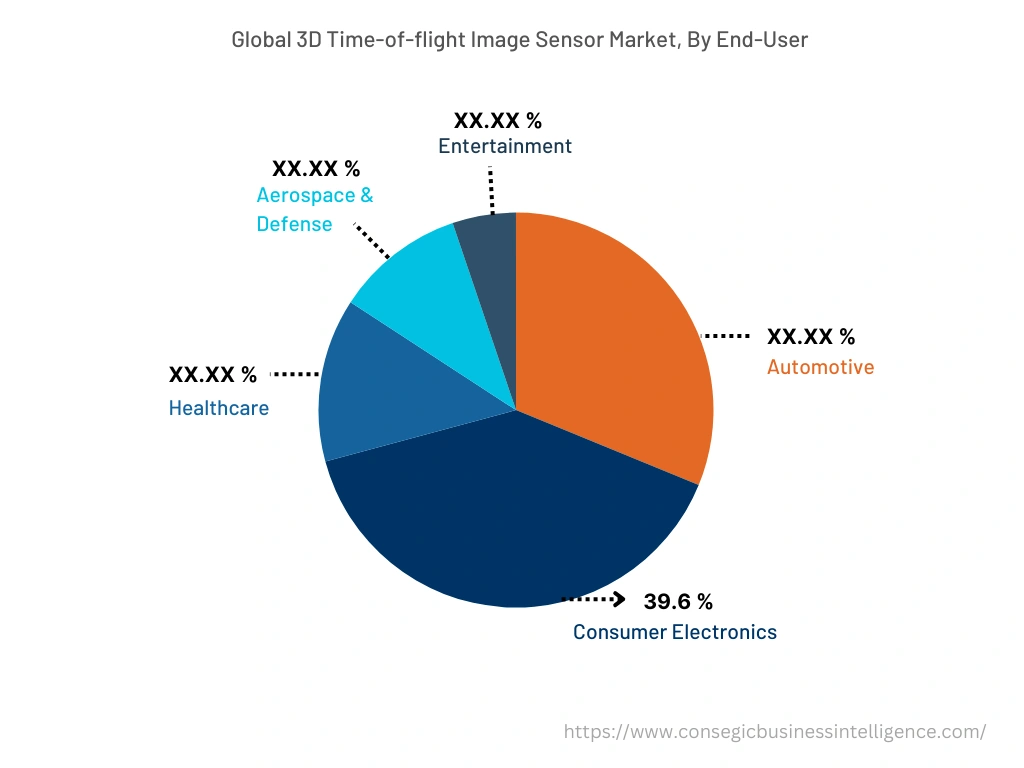

Based on the End-User :

The end-user segment is divided into automotive, consumer electronics, healthcare, aerospace and defense, and entertainment. The consumer electronics industry accounted for the largest market share of 39.6% in 2024 as 3D time-of-flight image sensors are utilized for facial recognition in consumer electronics including smartphones, tablets, and laptops. 3D TOF sensors enable accurate and secure authentication and unlocking of devices by capturing depth information of the user's face, thus enhancing user convenience, and improving device security. In addition, 3D time-of-flight image sensors are employed in AR and VR devices to provide accurate depth perception and spatial mapping. TOF sensors enable realistic and immersive AR/VR experiences by capturing depth information of the environment and are utilized in applications including virtual object placement, hand tracking, and gesture-based interactions. For instance, in February 2022, STMicroelectronics launched VD55H1, a 3D TOF image sensor with 0.5Mpixel resolution for smartphones, consumer robots, and AR/VR equipment. The sensor is designed to meet the growing demand of gaming, room mapping, and 3D avatars and also to enhance the performance of camera-system features in smartphones.

The automotive industry is projected to witness the fastest CAGR in the 3D time-of-flight image sensor market during the forecast period. The increasing adoption of 3D TOF image sensors in advanced driver-assistance systems to enable accurate object detection, pedestrian detection, and collision avoidance systems is accelerating the market growth. The integration aids in enhancing vehicle safety by providing real-time data for automatic emergency braking, lane departure warning, and adaptive cruise control systems. Additionally, TOF sensors are gaining applications in surround view systems, also termed bird's eye view systems or 360-degree camera systems. 3D TOF sensors capture depth information from multiple angles, enabling the creation of a virtual bird's eye view for vehicle parking and maneuvering, hence contributing considerably in spurring the market growth in upcoming years.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America is estimated to reach over USD 264.19 Million by 2032 from a value of USD 159.04 Million in 2024 and is projected to grow by USD 166.79 Million in 2025, owing to the early adoption of advanced technologies and a strong consumer electronics market. The expanding consumer electronics industry leads to the rapid adoption of 3D TOF image sensors in various applications, including smartphones, tablets, gaming consoles, and other consumer electronic devices. Additionally, North America has a strong presence of leading technology companies and research institutions that drive innovation in the field of 3D time-of-flight image sensors. For instance, in July 2020, LUCID Vision Labs, Inc. launched Helios 2, a 3D time-of-flight camera with Sony's DepthSense IMX556PLR TOF image sensor. The 3D time-of-flight camera with image sensor is manufactured to provide improved 3D depth data precision and accuracy and is employed in automated material handling, thus contributing remarkably in accelerating the market growth in North America.

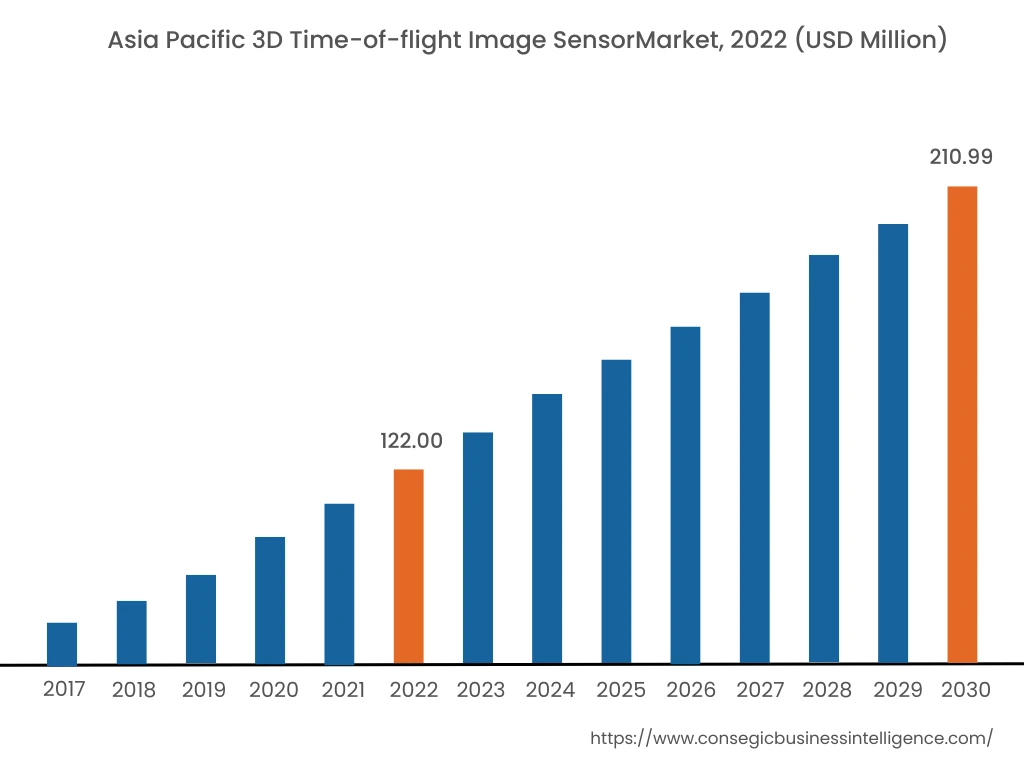

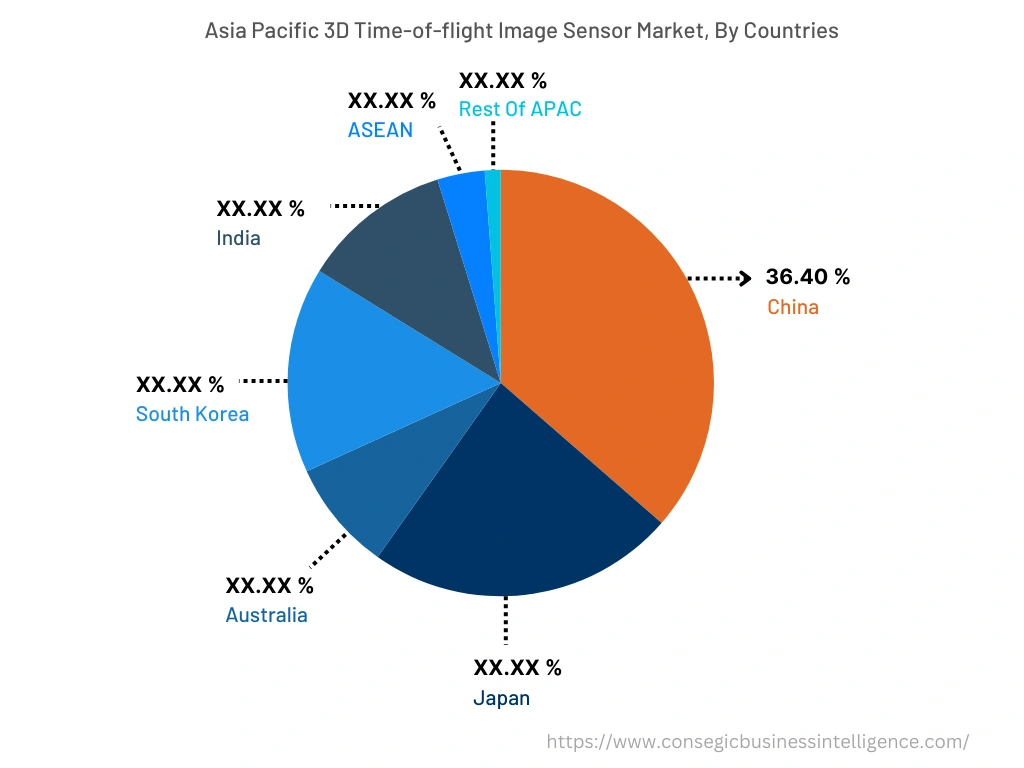

Asia Pacific accounted to USD 141.2 Million in 2024 and is predicted to register the fastest CAGR of 7.3% accounting to USD 248.22 Million in 2032 in the 3D time-of-flight image sensor market. In addition, in the region, China accounted for the maximum revenue share of 36.4.

The growth of the market is attributed to the expanding automotive industry in countries including China, Japan, and South Korea. Additionally, the region is witnessing a rise in the adoption of advanced driver-assistance systems (ADAS) in vehicles to improve safety and driving experience. TOF image sensors play a vital role in ADAS applications namely object detection, pedestrian detection, and lane departure warning. Consequently, the growing automotive industry increases the demand for advanced 3D time-of-flight image sensors, which in turn, promotes market growth in Asia Pacific countries.

Top Key Players & Market Share Insights :

The landscape of the 3D time-of-flight image sensor market is highly competitive. The key players in the market are adopting strategies for acquisitions and mergers, and product innovations to stay competitive in the market. Following are the major market players that comprise the latest market concentration -

- Teledyne Technologies

- Panasonic Corporation

- Prime Sense

- Ifm Electronic

- Melexis

- Texas Instruments

- STMicroelectronics N.V.

- ESPROS Photonics Corporation

- PMD Technologies

- Infineon Technologies

Recent Industry Developments :

- In March 2021, Teledyne e2v (UK) Ltd announced to launch Hydra3D Time-of-Flight CMOS image sensor at Vision China. The advanced sensor is ideal for distance measurement and supports the latest industrial applications, including logistics, vision-guided robotics, and automated guided vehicles.

- In February 2020, Panasonic Corporation launched a 3D time-of-flight image sensor by utilizing avalanche photodiode pixels to provide an accurate position of the object up to 250 m and are extensively employed in automotive range imaging and wide-area surveillance.

Key Questions Answered in the Report

What is 3D time-of-flight image sensor? +

A 3D time-of-flight (TOF) image sensor measures the distance between the sensor and objects in the field of view by using the principle of time-of-flight.

What specific segmentation details are covered in the 3D time-of-flight image sensor market report, and how is the dominating segment impacting the market growth? +

Machine vision dominates the market by application as 3D time-of-flight image sensors accurately detect and recognize objects in machine vision applications. TOF sensors enable precise identification and localization of objects, by capturing depth information in addition to color and intensity, even in complex environments.

What specific segmentation details are covered in the 3D time-of-flight image sensor market report, and how is the fastest segment anticipated to impact the market growth? +

The automotive industry is projected to register the fastest CAGR owing to the increasing adoption of 3D TOF image sensors in advanced driver-assistance systems to enable accurate object detection, pedestrian detection, and collision avoidance systems.

Based on current market trends and future predictions, which geographical region will have the largest impact on the 3D time-of-flight image sensor market’s growth in the coming years? +

Asia-Pacific is anticipated to witness the largest impact on the 3D time-of-flight image sensor market owing to the expanding automotive industry that raises the demand of 3D TOF image sensors in ADAS applications namely object detection, pedestrian detection, and lane departure warning.