5G Fixed Wireless Access Market Size:

5G Fixed Wireless Access Market size is estimated to reach over USD 438.70 Billion by 2031 from a value of USD 32.61 Billion in 2023 and is projected to grow by USD 42.82 Billion in 2024, growing at a CAGR of 38.4% from 2023 to 2031.

5G Fixed Wireless Access Market Scope & Overview:

5G fixed wireless access (FWA) refers to the 5G wireless technology, which uses radio waves to send high-speed signals to connect homes and businesses to the internet and offer data transfer. Moreover, the FWA consists of a base station connected to a fixed network and several subscriber units spread out over a wide area with the help of radio waves. Additionally, the market plays a key role in interconnecting broadband technologies to manage problems with network interference and connectivity in applications such as traffic management by providing end-through-end traffic monitoring. Furthermore, the 5G fixed wireless access industry offers a range of benefits including faster speeds, easy installation, cost-effectiveness, lower latency, and greater reliability among others.

How is AI Transforming the 5G Fixed Wireless Access Market?

The use of AI is emerging in 5G fixed wireless access (FWA) market, specifically for enhancing network optimization, automating deployment, and improving efficiency. AI algorithms can analyze network data, predict potential issues, and dynamically adjust resources to ensure optimum performance and address bottlenecks. This includes optimizing spectrum allocation, managing network traffic, and predicting maintenance needs.

In addition, AI can detect and mitigate security threats in real-time, thereby enhancing the overall security posture of the 5G FWA network. Consequently, the above factors are expected to positively impact the market growth in upcoming years.

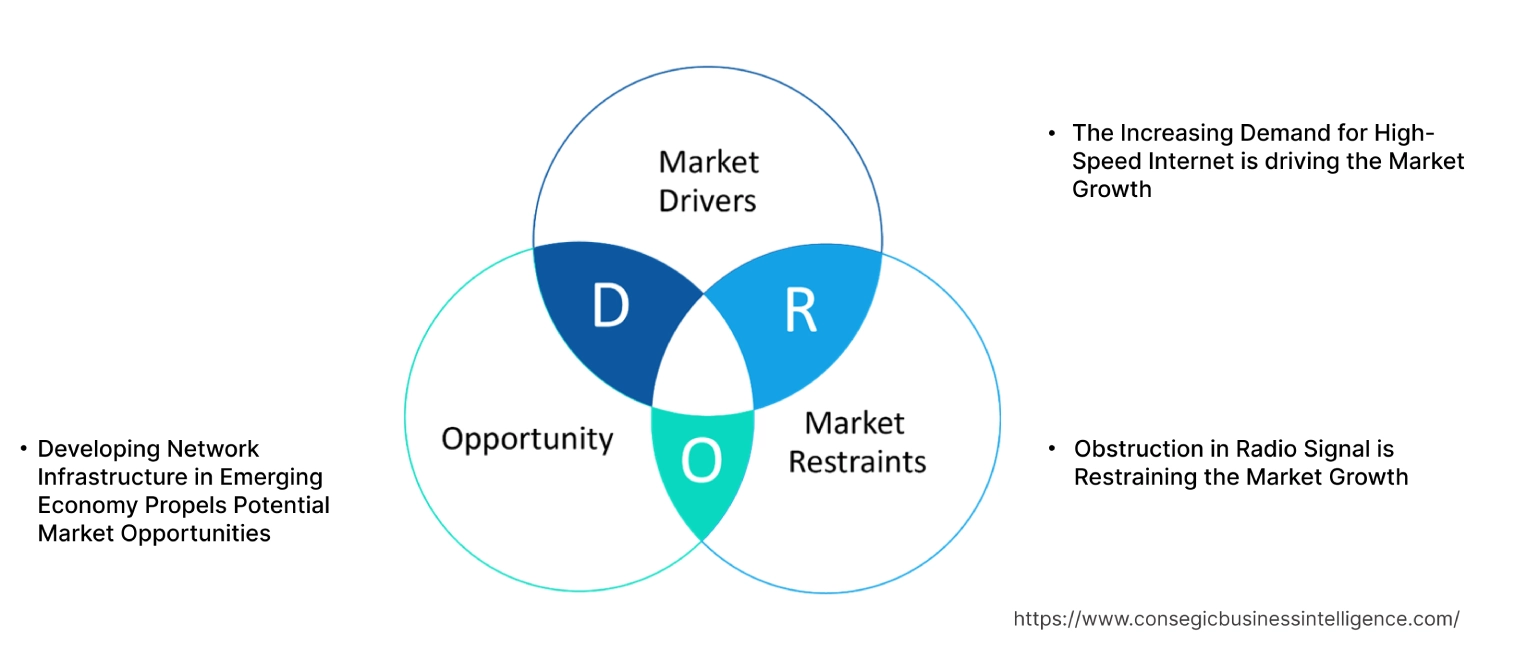

5G Fixed Wireless Access Market Dynamics - (DRO) :

Key Drivers:

The Increasing Demand for High-Speed Internet is driving the Market Growth

The proliferation of digital technologies across the industry and the growing online gaming culture are leading to a surge in data creation and consumption. Businesses are leveraging cloud computing, big data analytics, and artificial intelligence to enhance decision-making, which in turn, is driving the need for high-speed internet connectivity. Further, the rise of online working environments across the globe is also increasing the demand for virtual tools as well as high-speed internet. Moreover, the advantages of high-speed internet including faster upload speeds, better latency, greater efficiency, and improved efficiency are further contributing significantly to accelerating the 5g Fixed Wireless Access market demand.

- In June 2023, The Department of Commerce's National Telecommunications and Information Administration (NTIA) U.S. announced the development of middle mile high-speed internet infrastructure across 35 states and Puerto Rico with an investment of USD 930 Million.

Therefore, the evolution of digital technologies across industries and the growing online gaming culture is proliferating the development of the market.

Key Restraints :

Obstruction in Radio Signal is Restraining the Market Growth

The 5G FWA is dependent on radio wave frequencies to send high-speed signals to connect homes and businesses, however, factors such as rain, humidity, or fog weaken the signal due to precipitation in the air hampering the 5G Fixed Wireless Access market demand. Moreover, harsh weather conditions hamper the signal between the towers. Additionally, obstacles such as walls, buildings, or trees, lead to potential signal deprivation and interference from other wireless devices affecting performance and hindering the market evolution.

Thus, the harsh weather conditions and obstacles from walls, buildings, and others are restraining the 5G fixed wireless access market growth.

Future Opportunities :

Developing Network Infrastructure in Emerging Economy Propels Potential Market Opportunities

The rising investment in broadband networks, data centers, and connectivity projects led to the introduction of cutting-edge technologies and solutions which is in turn driving the development of network infrastructure. The growing network infrastructure is extending internet access to unserved communities, bridging the digital gap with enhanced connectivity and improved digital literacy. Also, the market is dependent on radio waves which are transmitted through network infrastructure in turn drives the 5G Fixed Wireless Access market opportunity.

- In May 2022, Qualcomm Technologies partnered with Viettel to develop a next-generation 5G Radio Unit (RU) with MIMO capabilities and others. The enhancement helps roll out of 5G network infrastructure and services across the world, especially in Vietnam.

Hence, the rising network infrastructure development is anticipated to increase the utilization, which in turn, is expected to propel 5G Fixed Wireless Access market opportunities during the forecast period.

5G Fixed Wireless Access Market Segmental Analysis :

By Offering:

Based on the offering, the market is bifurcated into hardware and service.

Trends in the offering

- The evolution of integrated antenna solutions to improve signal is driving the market trend.

- The demand for more powerful customer premises equipment is propelling the hardware segment.

The hardware accounted for the largest revenue share in the year 2023.

- The hardware segment including base station, customer premises equipment, antenna, and other components plays a crucial role in the smooth functioning of the 5G FWA.

- The customer premise equipment serves as the interface between wireless network infrastructure and the user device. Additionally, the Wi-Fi access point creates a local wireless network by broadcasting Wi-Fi signals. Thereby, collectively enhancing the speed, and reliability, and improving the latency issues among others.

- Innovation in customer premises equipment with the integration of advanced technologies such as network slicing, edge computing, signal processing, and others is driving the growth of hardware components.

- In November 2023, Inseego Corp launched the Inseego Wavemaker 5G indoor router FX3100 for Business customers. The router is a compact, cutting-edge device that provides ultra-fast, reliable, and secure connectivity and others.

- Thus, the hardware segment is driving the 5G fixed wireless access market trends.

The service is anticipated to register the fastest CAGR during the forecast period.

- The services segment of the market is further segmented into installation service and maintenance service which is majorly provided by the broadband service companies or firms.

- The rising latency and connectivity issues as well as the rising demand for high-speed internet are propelling the 5G fixed wireless access market growth.

- In September 2022, Nokia partnered with Telia to launch a commercial 5G standalone (SA) network. The 5G SA is embedded into Telia 5G fixed wireless access home broadband service to offer a range of packages to customers.

- Therefore, as per the analysis, the rising latency and connectivity issues are anticipated to boost the market during the forecast period.

By Connectivity:

Based on the connectivity, the market is bifurcated into cellular modem-RF and Wi-Fi.

Trends in connectivity

- In suburban and urban areas deployment uses 5G modem–RF for enhancing internet speed over long distances.

- The deployment of high-frequency mmWave bands is driving the need for advanced RF components.

The Cellular Modem-RF accounted for the largest revenue share in the year 2023 and is anticipated to register the fastest CAGR during the forecast period.

- The rising adoption of sub-6 Ghz and mm Waves which are the crucial component for cellular modem-RF is driving the segment. Additionally, the 5G cellular modem supports high bandwidth and low latency making it a preferable choice for the progress of 5G Fixed Wireless Access market share.

- The cellular modem – RF has the ability to transmit data at high speed while consuming low power and support speeds over UHF or VHF bandwidths.

- In February 2021, Qualcomm Technologies, Inc. launched the Snapdragon X65 5G Modem-RF System for the development of 5G in mobile broadband, industrial IoT, 5g private networks, and fixed wireless access.

- According to the 5G Fixed Wireless Access market analysis, the ability to transmit data at high speed and the rising adoption of sub-6 Ghz and mm Waves is driving the 5G fixed wireless access market trends.

By Operating Frequency:

Based on the operating frequency, the market is segmented into 2 – 6 GHz, 24 – 39 GHz, and above 39 GHz.

Trends in the operating frequency

- The 24-39 GHz segment can deliver ultra-high-speed broadband which is ideal for dense urban areas and is boosting the market.

- The ability to provide large bandwidth for high-speed internet services and low latency for fixed point-to-point and point-to-multipoint satellite operations is spurring the above 39 GHz segment.

The 2 – 6 GHz accounted for the largest revenue share in the year 2023.

- The 2-6 GHz operating frequency plays a key role in providing wireless services and carrying more data over the spectrum as well as reducing the chance of interference.

- Moreover, 2-6 GHz is also known as Sub-6 GHz which has the ability to cover large areas, especially in rural and suburban regions, and provide more reliable indoor and outdoor coverage due to its superior signal penetration.

- In August 2022, UScellular Collaborated with Qualcomm and Inseego to launch 5G mm-Wave high-speed internet service integrated into Home Internet+ Service by UScellular with Qualcomm 5G fixed wireless access platform gen 1 which features sub-6 GHz, mmWave, and extended-range mmWave CPE devices.

- Thus, the ability to cover large areas with superior signal penetration is driving the 2-6 GHz segment.

The 24 - 39 GHz segment is anticipated to register the fastest CAGR during the forecast period.

- The mid-range which is 24-39 GHz frequency provides faster speed eliminating the need for high-speed internet connection in semi-urban and rural areas.

- The innovation in mmWaves is driving the evolution of operating frequency by offering extremely high data rates and capacity.

- The 24-39 GHz segment is ideal for augmented reality (AR), virtual reality (VR), and ultra-HD video streaming due to the ultra-high-speed connections.

- For instance, in June 2021, Qualcomm Technologies, Inc. partnered with Nokia and UScellular to achieve a milestone of extended range over 10 km with mmWaves which has the operating frequency of 24 GHz and 28 GHz spectrum bands. The achievement is bridging the gap of connectivity for communities.

- Thus, as per the analysis, the growing need in semi-urban and rural areas as well as innovation in mmWaves is driving the progress of the 24-39 GHz segment.

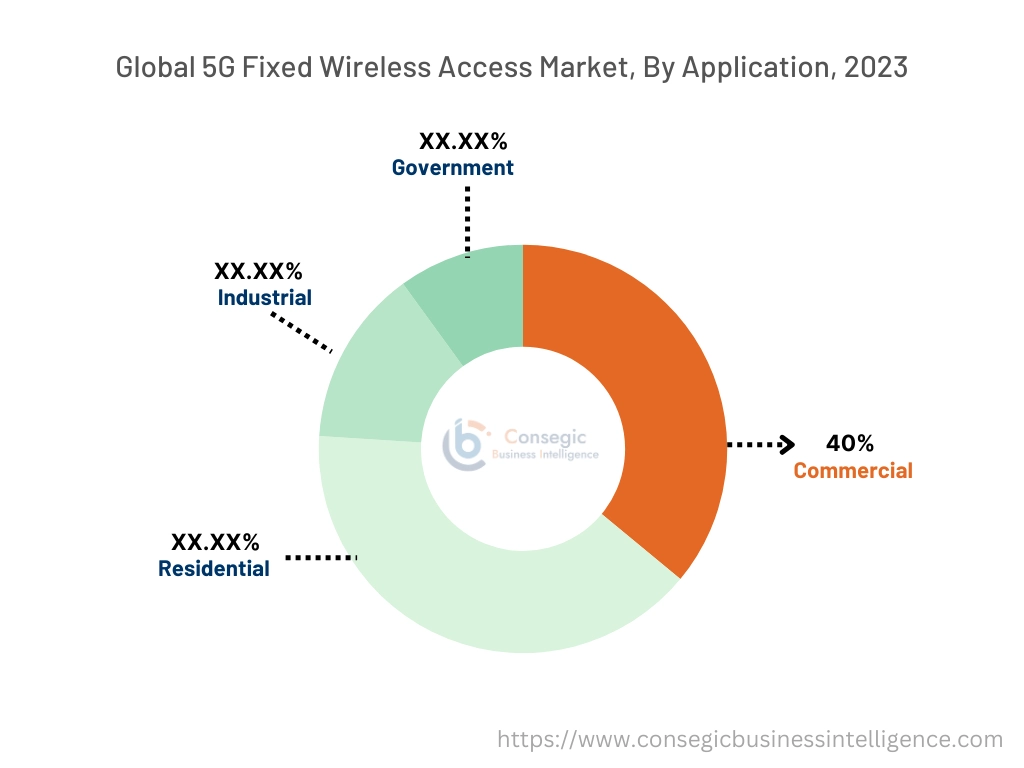

By Application:

Based on the application, the market is segmented into residential, commercial, industrial, and government.

Trends in the application

- The trend towards IoT adoption in industries is driving the need for high-speed internet is propelling the market need.

- The rising government regulations in the spectrum and operating frequency are fueling the 5G Fixed Wireless Access market size.

The commercial accounted for the largest revenue share of 40% in the year 2023.

- The rise of remote work and the growing need for high-speed internet is driving the need in the commercial segment. Additionally, it provides a super-fast ultra-broadband network for mobile technology which replaces fixed network Internet is propelling the commercial segment.

- Moreover, businesses leverage due to extremely effective backup connection with low-latency internet which switch over in the event of network outages.

- In December 2022, Swisscom launched its fixed wireless access 5G service for business customers. The market caters to remote buildings with network issues and temporary business locations that do not have a fixed network connection.

- Thus, the low-latency internet and growing need for high-speed internet is driving the commercial segment.

The residential is anticipated to register the fastest CAGR during the forecast period.

- The primary factor driving the growth of the 5G fixed wireless access market in the residential segment is the rising need for high-performance broadband and the evolution of IoT across the globe which is paving the way for connected devices which in turn is boosting the 5G fixed Wireless Access market size.

- The rising need to increase coverage and network performance is propelling the progress of the market in the residential segment.

- In February 2022, Nokia partnered with Zain KSA to provide network capabilities and enhance digital infrastructure across Saudi. The infrastructure includes Nokia’s AirScale Radio, Wavence Microwave, and others, to increase coverage and network performance.

- Therefore, as per the analysis, demand for improved network performance and high-performance broadband is anticipated to boost the evolution of the market during the forecast period.

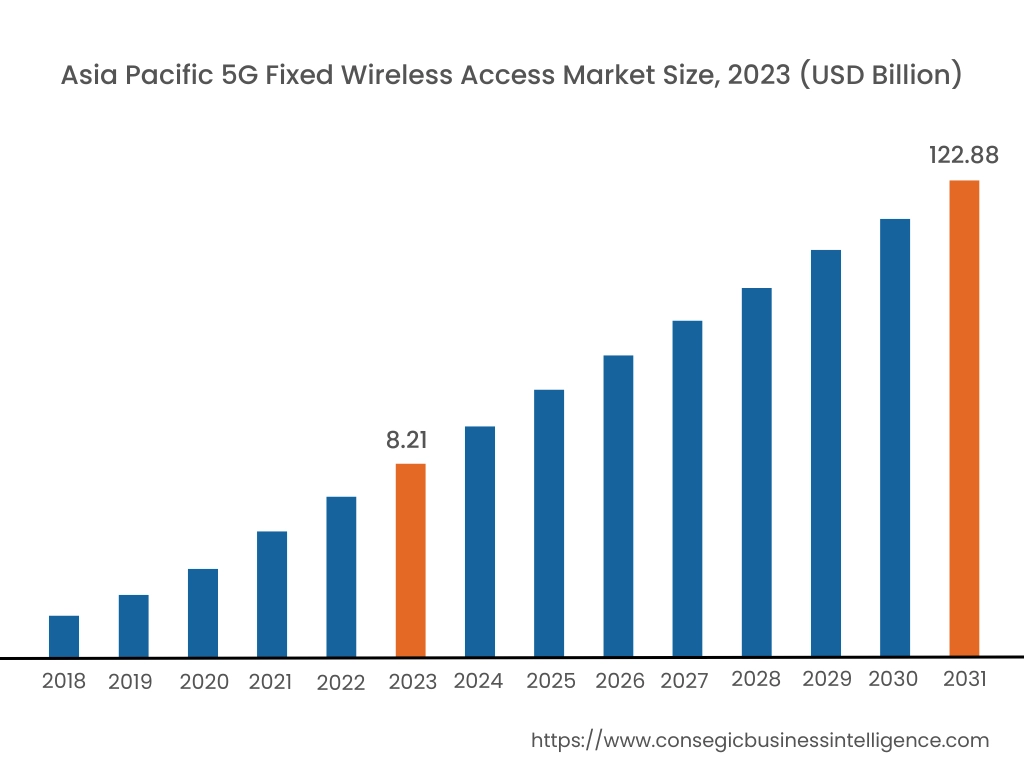

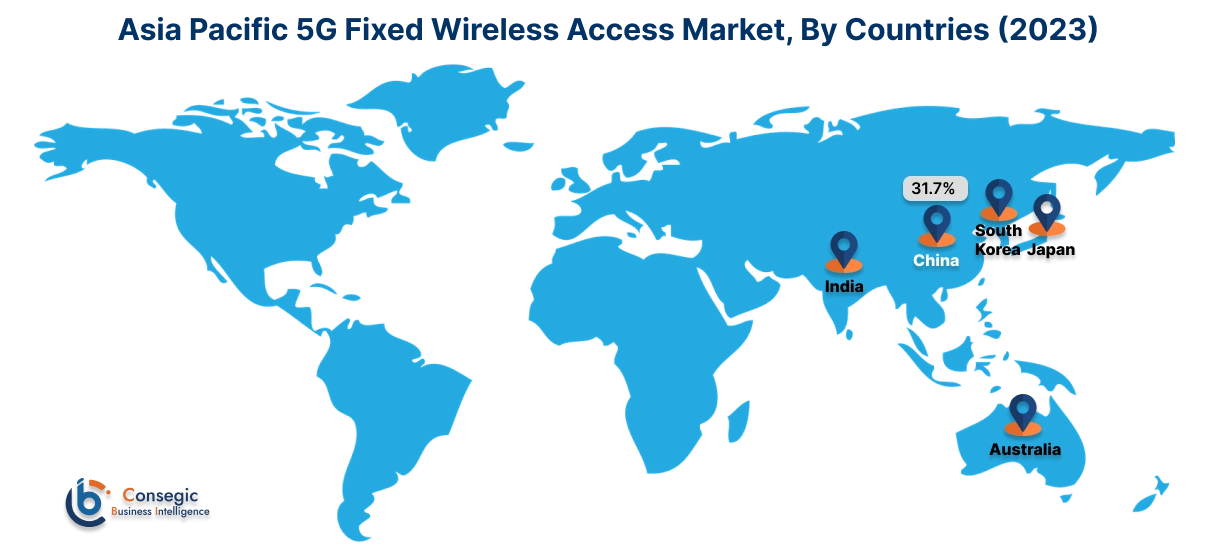

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 8.21 Billion in 2023. Moreover, it is projected to grow by USD 10.88 Billion in 2024 and reach over USD 122.88 Billion by 2031. Out of this, China accounted for the maximum revenue share of 31.7%. As per the 5G fixed wireless access market analysis, due to the increasing need for Wi-Fi at home and rising investments in data centers, network infrastructure is ensuring the growth of the digital economy in countries such as China, India, and Japan. The rapid digitalization and the rising requirement for high-internet capabilities are further accelerating the development.

- In August 2023, Bharti Airtel launched Airtel Xstream AirFiber, which is a 5G fixed wireless access in Delhi and Mumbai. The fiber is embedded with a plug-and-play feature with Wi-Fi 6 technology for connectivity up to 64 devices.

North America is estimated to reach over USD 148.72 Billion by 2031 from a value of USD 10.97 Billion in 2023 and is projected to grow by USD 14.41 Billion in 2024. The progress is driven by the increasing need for speed-based tariff plans in North America. Technological advancements such as cloud-managed eSIM technology embedded in devices are driving the 5G Fixed Wireless access market share. Additionally, wireless access market services utilize network slicing which delivers a high-performance experience such as 8K video driving the 5G Fixed Wireless Access market expansion in North America.

- In May 2024, Cisco partnered with AT&T to enhance the new digital buying experience for Cisco’s 5G fixed wireless access devices with the integration of AT&T’s wireless WAN service.

The regional trends analysis depicts that the rising need for high-speed internet and growing remote work, online learning, and content streaming in Europe is driving the 5G fixed wireless access market expansion. The primary factor driving the market in the Middle East and African region is the rising need for network connectivity solutions across urban, suburban, and rural areas as well as enterprises of all types are dependent on fixed broadband connectivity solutions for market expansion. Further, the rollout of 5G in countries such as Colombia, Brazil, Peru, and Puerto Rico is paving the way for the growth of the 5G fixed wireless access market in the Latin America region.

Top Key Players & Market Share Insights:

The global 5G fixed wireless access market is highly competitive with major players providing FWA to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the 5G fixed wireless access market. Key players in the 5G fixed wireless access industry include-

- Mavenir (U.S)

- Qualcomm Technologies, Inc. (U.S)

- Huawei Technologies Co., Ltd (China)

- Zyxel (China)

- Ericsson (Sweden)

- Nokia (Finland)

- Siklu Communication, Ltd (U.S)

- Mimosa Networks, Inc. (U.S)

- Samsung Electronics (South Korea)

- AT&T Inc. (U.S)

Recent Industry Developments :

Product launches:

- In July 2024, Nokia announced an advancement in its portfolio of FWA broadband access products with the addition of an outdoor receiver and indoor gateway with Wi-Fi 7 into broadband access products.

- In December 2023, HFCL Limited (HFCL) launched a 5G Fixed Wireless Access Customer Premise Equipment solution. The launch aims to bridge the gap between broadband served and unserved areas with continued wireless broadband connectivity.

Partnerships & Collaborations:

- In October 2024, Nokia partnered with RACSA to deploy a 5G standalone (SA) network in Costa Rica. The network provides high-speed fixed wireless access services to businesses, including small and medium enterprises, public sector organizations, and consumers.

- In August 2024, GCT Semiconductor Holding Inc. collaborated with Tier One Supplier by signing a memorandum of understanding to develop fixed wireless access technology with 5G solutions by GCT including modem chipset and RFIC. The Company expects to close a definitive agreement before the end of 2024.

- In February 2024, Ericsson partnered with Bharti Airtel to successfully exhibit mm-Wave 5G functionality on the Airtel network for market application. The high band, above 24 GHz creates a prospect for Airtel to offer peak rates, low latency, and high capacity.

5G Fixed Wireless Access Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 438.70 Billion |

| CAGR (2024-2031) | 38.4% |

| By Offering |

|

| By Connectivity |

|

| By Operating Frequency |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the 5G fixed wireless access market? +

The 5G Fixed Wireless Access Market size is estimated to reach over USD 438.70 Billion by 2031 from a value of USD 32.61 Billion in 2023 and is projected to grow by USD 42.82 Billion in 2024, growing at a CAGR of 38.4% from 2023 to 2031.

What specific segmentation details are covered in the 5G fixed wireless access report? +

The 5G fixed wireless access report includes specific segmentation details for offering, connectivity, operating frequency, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the 5G fixed wireless access market, the service segment is the fastest-growing segment during the forecast period due to rising latency and connectivity issues as well as the rising demand for high-speed internet is driving the services segment.

Who are the major players in the 5G fixed wireless access market? +

The key participants in the 5G fixed wireless access market are Mavenir (U.S), Qualcomm Technologies, Inc. (U.S), Nokia (Finland), Siklu Communication, Ltd (U.S), Mimosa Networks, Inc. (U.S), Samsung Electronics (South Korea), AT&T Inc. (U.S), Huawei Technologies Co., Ltd (China), Zyxel (China), Ericsson (Sweden) and others.

What are the key trends in the 5G fixed wireless access Market? +

The 5G fixed wireless access market is being shaped by several key trends including the rise high high-speed internet, rising government regulations in the spectrum and operating frequency, ability to deliver ultra-high-speed broadband which is ideal for dense urban areas the key trends driving the market.