Procure To Pay Software Market Size:

Procure To Pay Software Market size is estimated to reach over USD 11.69 Billion by 2032 from a value of USD 6.10 Billion in 2024 and is projected to grow by USD 6.50 Billion in 2025, growing at a CAGR of 9.2% from 2025 to 2032.

Procure To Pay Software Market Scope & Overview:

Procure to pay (P2P) software refers to a comprehensive suite of tools that are designed for automating and streamlining the entire procurement process, ranging from the initial purchase decision to final payment to the suppliers. It helps business organizations in managing their spending, improving efficiency, and attaining greater control over their supply chains. Moreover, procure to pay software offers several benefits, including a streamlined procurement process, reduced invoice processing costs, enhanced visibility, increased operational efficiency, and others.

How is AI Impacting the Procure To Pay Software Market?

AI is reshaping the procure-to-pay (P2P) software market by streamlining procurement, payments, and supplier management processes. With AI-driven automation, tasks like invoice processing, purchase order approvals, and contract matching are executed faster and with greater accuracy. Machine learning models analyze spending patterns to identify cost-saving opportunities, reduce fraud risks, and improve supplier negotiations. Furthermore, AI-powered chatbots also enhance user experience by assisting employees with procurement queries in real time. On the other side, predictive analytics helps businesses anticipate supply chain disruptions and manage working capital more effectively. By reducing manual effort and improving decision-making, AI is transforming P2P software into a strategic tool that enhances efficiency, compliance, and cost control across global enterprises.

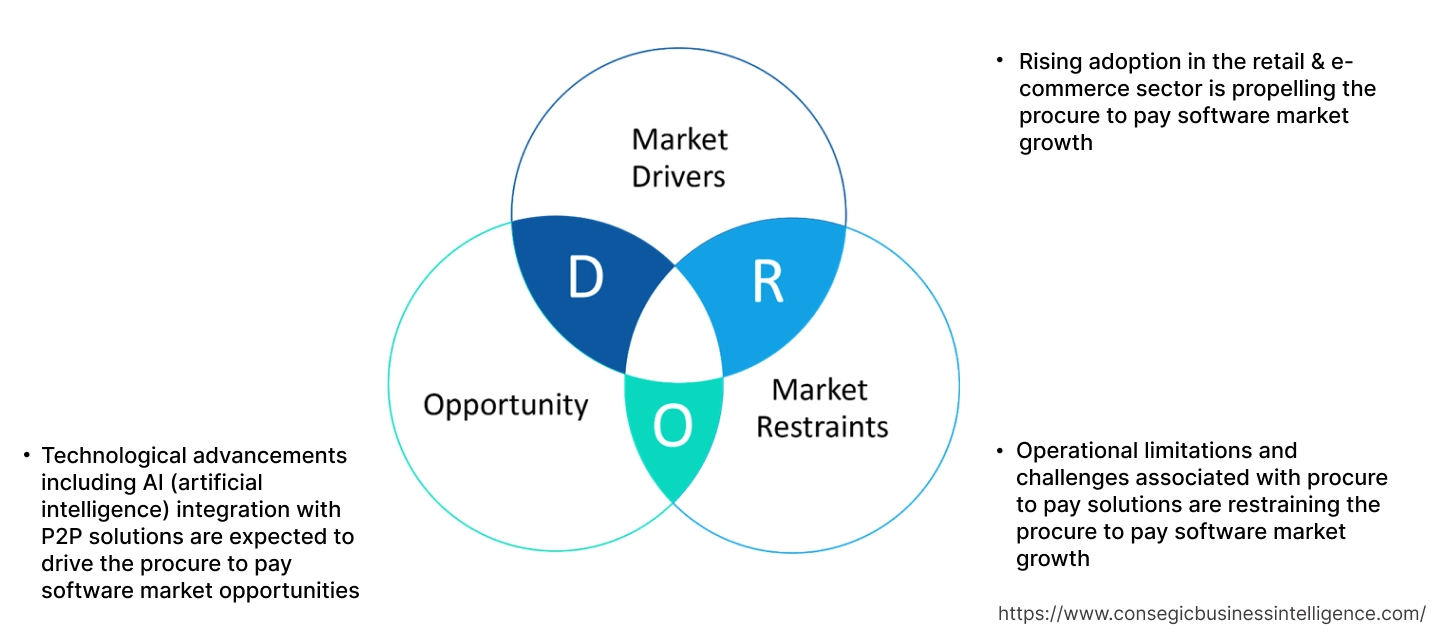

Procure To Pay Software Market Dynamics - (DRO) :

Key Drivers:

Rising adoption in the retail & e-commerce sector is propelling the procure to pay software market growth

Procure-to-pay software plays a vital role in the retail & e-commerce sector for streamlining and automating the procurement process, ranging from the initial acquisition of goods or services to the final supplier payment. The automation capability reduces the time required for each step, in turn allowing retail businesses to manage their resources more efficiently. Moreover, P2P software enables retail businesses to have improved visibility into their spending by centralizing and automating the procurement process. Improved visibility helps retailers in identifying prospects for cost savings through bulk purchasing, negotiating better contracts, and managing supplier prices effectively.

- For instance, according to the U.S. Census Bureau (Department of Commerce), the retail e-commerce sales in the United States were valued at USD 308.91 billion during the fourth quarter of 2024, witnessing an incline of 9.4% in comparison to USD 282.49 billion during the fourth quarter of 2023.

Hence, according to the analysis, the growing retail & e-commerce sector is increasing the demand for P2P software for streamlining and automating the procurement process, in turn driving the procure to pay software market size.

Key Restraints :

Operational limitations and challenges associated with procure to pay solutions are restraining the procure to pay software market growth

The implementation of procure to pay software is often associated with certain operational limitations and challenges, which are among the key factors restraining the market. For instance, the primary limitations related to P2P software include the absence of consolidated data, slow approvals, inter-functional conflicts, and compliance issues, among others.

Moreover, different business functions in large enterprises often work with various processes and tools and maintain their own data. The absence of consolidated data can generate confusion and often lead to process inefficiencies and errors. Additionally, the procure-to-pay process mainly requires the account payable and procurement teams to work closely with each other. However, there is a high probability of internal conflicts due to a lack of proper visibility into the operations of the other team, leading to a significant impact on relationships with suppliers. Thus, the aforementioned factors are hindering the procure to pay software market expansion.

Future Opportunities :

Technological advancements including AI (artificial intelligence) integration with P2P solutions are expected to drive the procure to pay software market opportunities

Procure to pay solution providers are frequently investing in the development of new technologies associated with P2P software to ensure safe and effective application in various industries, including manufacturing, retail & e-commerce, BFSI, and others. As a result, procure to pay solution providers are launching new solutions integrated with advanced technologies and features such as artificial intelligence, and others, which are providing lucrative aspects for market development. Moreover, the integration of AI in procure to pay solutions offers several benefits, including automated invoice processing, enhanced spend visibility and control, streamlined supplier selection and management, predictive analytics for procurement planning, and others.

- For instance, Pipefy Inc. offers procure-to-pay software integrated with artificial intelligence in its solution offerings. The AI integrated procure-to-pay software offers several benefits, including automated workflows, improved efficiency, controlled spending with real-time insights, and maximized cost savings, among others.

Hence, as per the analysis, the rising technological advancements associated with procure to pay solutions are projected to boost the procure to pay software market opportunities during the forecast period.

Procure To Pay Software Market Segmental Analysis :

By Deployment Type:

Based on deployment type, the market is segmented into on-premise and cloud.

Trends in the deployment type:

- The adoption of on-premise deployment is primarily driven by factors including higher security and privacy, and more control over server hardware.

- Factors including the ease of integration, rapid deployment, and increasing consumer preference for flexible, scalable, reliable, and cost-effective procure to pay solutions are driving the cloud deployment segment.

Cloud segment accounted for the largest revenue share in the overall procure to pay software market share in 2024, and it is anticipated to register fastest CAGR growth during the forecast period.

- The cloud-based deployment offers seamless collaboration along with fast and cost-effective access to procure-to-pay software by multiple users, irrespective of the time and location of the user.

- Moreover, cloud-based deployment provides numerous benefits such as rapid implementation, minimal capital expense, ease of utilization and integration, faster processing, and higher scalability, among others.

- For instance, in June 2021, Kissflow Inc. launched its Kissflow Procurement Cloud, which is a cloud-based procure-to-pay solution that provides a unified platform for managing all procurement spends in a single place. It is designed to assist companies in streamlining their entire procurement lifecycle, along with enhancing efficiencies through data analytics.

- Therefore, the increasing advancements related to cloud-based procure-to-pay solutions are driving the procure to pay software market trends.

By Enterprise Type:

Based on enterprise type, the market is segmented into large enterprise and small and medium enterprise (SME).

Trends in the enterprise type:

- Increasing trend in adoption of procure-to-pay solution in large enterprises for streamlining the entire procurement lifecycle and improving operational efficiency.

- Factors including growing investments in the development of small and medium enterprises and rising deployment of cloud-based procure-to-pay solutions in SMEs are key trends driving the small and medium enterprise segment.

Large enterprise segment accounted for the largest revenue share in the total procure to pay software market share in 2024.

- Large enterprises refer to companies that have an above-average business size, perform large operations, and have high economies of scale.

- Large enterprises primarily comprise a larger workforce, generate a high amount of revenue, and have a greater competitive capacity in comparison to small and medium enterprises.

- Moreover, large enterprises typically deal with complex procurement processes with a high volume of transactions involving multiple departments, suppliers, and locations. Procure-to-pay software helps large enterprises in streamlining these complex processes while ensuring that orders, approvals, and payments are managed efficiently.

- For instance, Coupa offers procure-to-pay software in its solution offerings, which is designed for utilization in large enterprises, among others. The company’s procure to pay solution enables large enterprises to mitigate risk, attain complete visibility, and improve margins across direct and indirect spending.

- Therefore, increasing adoption of procure-to-pay solutions in large enterprises is driving the procure to pay software market trends.

Small and medium enterprise (SME) segment is anticipated to register substantial CAGR growth during the forecast period.

- Small and medium enterprises refer to companies that maintain revenues, workforce, and assets below a certain threshold.

- SMEs often account for the majority of the businesses that are operating across the world.

- Moreover, procure-to-pay solution is often deployed in SMEs to simplify the procurement process, improve cash flow management and supplier management, and increase operational efficiency, among others

- For instance, according to the U.S. Chamber of Commerce, the number of small businesses in the United States reached 33.2 million in 2022, representing nearly 99.9% of total businesses in the U.S.

- Thus, the rising number of small and medium enterprises is driving the adoption of procure-to-pay solutions, in turn driving the procure to pay software market size during the forecast period.

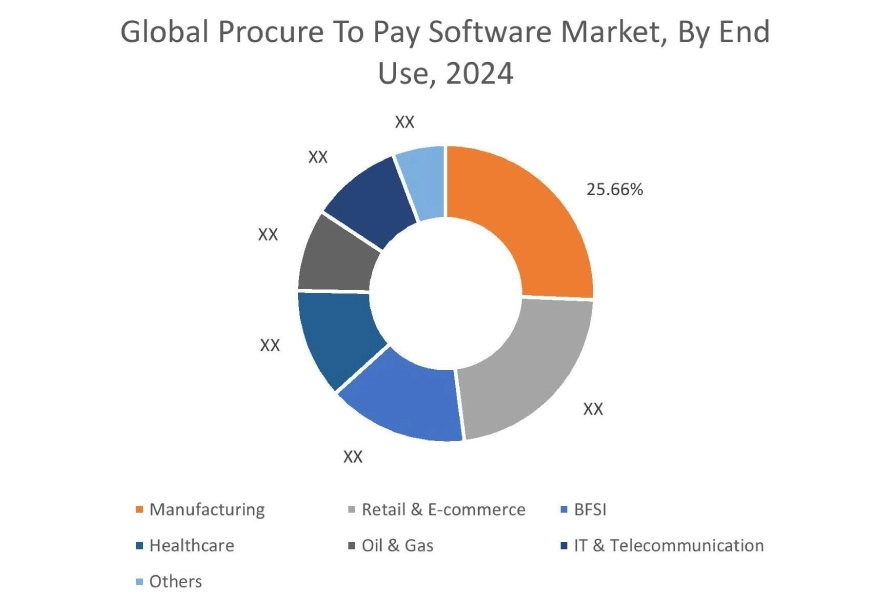

By End Use:

Based on end use, the market is segmented into manufacturing, retail & e-commerce, BFSI, healthcare, oil & gas, it & telecommunication, and others.

Trends in the end use:

- Increasing adoption of procure-to-pay solution in the manufacturing sector for streamlined procurement process, improved spend management, enhanced supplier relationships, and increased financial control.

- There is a rising trend towards the utilization of procure-to-pay solution in the retail & e-commerce industry for streamlining and automating the procurement process, ranging from the initial acquisition of goods to the final supplier payment.

The manufacturing segment accounted for the largest revenue share of 25.66% in the overall market in 2024.

- Procure-to-pay software plays a vital role in manufacturing sector where efficient procurement and supply chain management are crucial for maintaining production schedules, controlling costs, and ensuring product quality.

- The use of procure to pay solution in manufacturing sector provides several benefits, including streamlined procurement processes, improved supplier relationship management, enhanced workflow and approval processes, quality assurance, and others.

- For instance,ProcurePort offers procure-to-pay software for utilization in manufacturing sector, among others. The software is integrated with advanced automation features and analytics, which can streamline the entire procurement process, ranging from managing suppliers to processing invoices and making payments.

- According to the procure to pay software market analysis, rising utilization of procure to pay solutions in manufacturing sector is driving the market demand.

Retail & e-commerce segment is anticipated to register substantial CAGR growth during the forecast period.

- Procure-to-pay software is primarily used in retail & e-commerce industry for streamlining and automating the procurement process, ranging from the initial acquisition of goods or services to the final supplier payment.

- Moreover, procure to pay solution enables retail businesses to have improved visibility into their spending by centralizing and automating procurement process.

- For instance, according to India Brand Equity Foundation, the retail sector in India was valued at USD 1,200 billion in 2023, and it is projected to grow to USD 2,500 billion by 2035.

- Therefore, the growing retail & e-commerce sector is projected to drive the market growth during the forecast period.

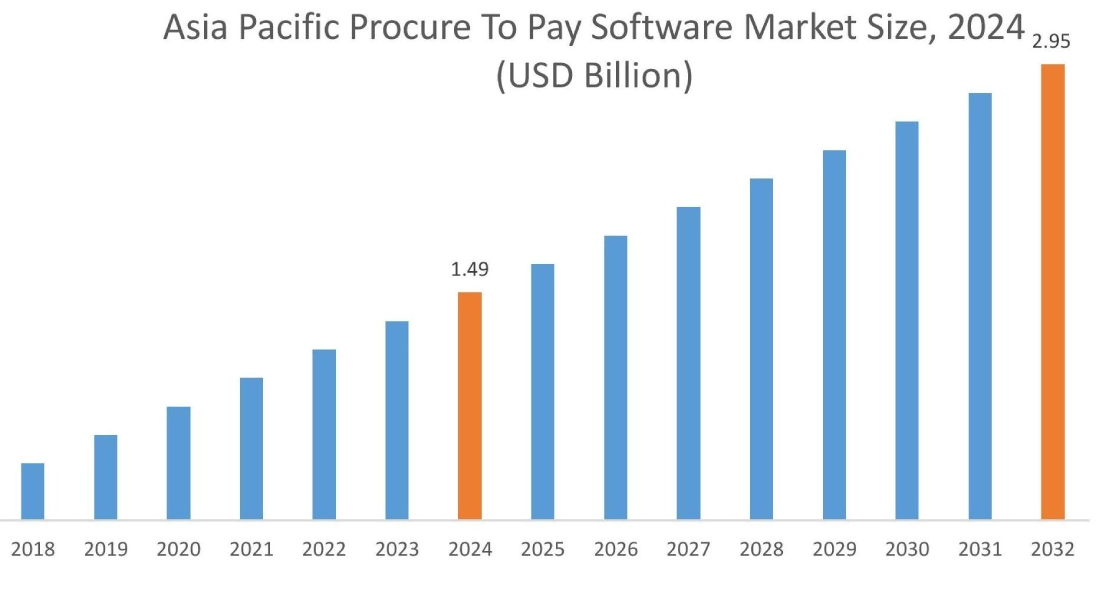

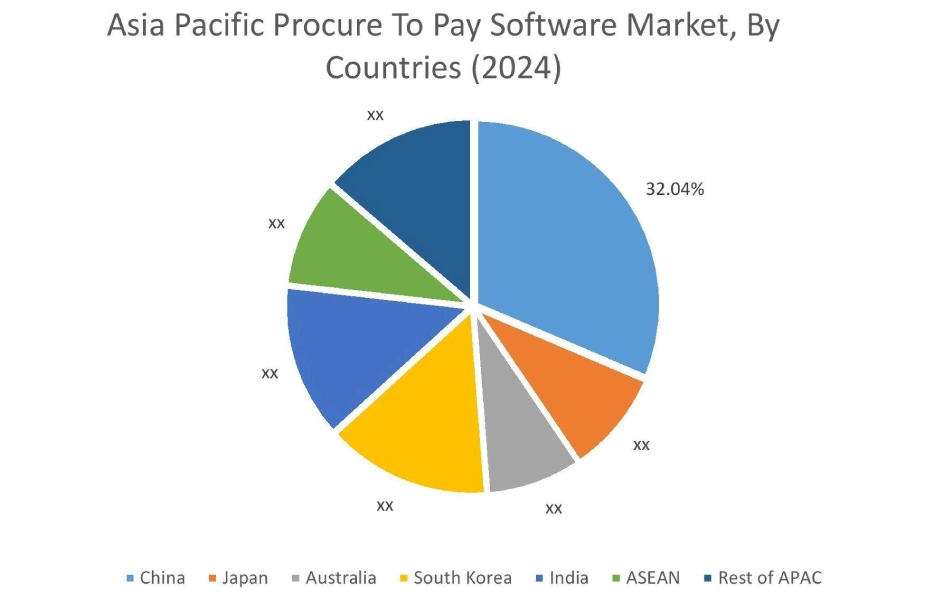

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 1.49 Billion in 2024. Moreover, it is projected to grow by USD 1.59 Billion in 2025 and reach over USD 2.95 Billion by 2032. Out of this, China accounted for the maximum revenue share of 32.04%. As per the procure to pay software market analysis, the adoption of procure to pay solutions in the Asia-Pacific region is primarily driven by the growing manufacturing, healthcare, and telecommunication sectors, among others. Additionally, the growing retail & e-commerce sector is further accelerating the procure to pay software market expansion.

- For instance, according to India Brand Equity Foundation, the e-commerce sector in India was valued at USD 93 billion in 2023, and it is projected to grow to USD 550 billion by 2035.The aforementioned factors are anticipated to drive the market growth in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 4.13 Billion by 2032 from a value of USD 2.17 Billion in 2024 and is projected to grow by USD 2.31 Billion in 2025. In North America, the growth of procure to pay software industry is driven by growing investments in manufacturing, healthcare, retail & e-commerce, and other sectors. Moreover, the increasing adoption of procure-to-pay solutions in manufacturing sector for streamlining procurement processes, improving supplier relationship management, and enhancing workflow and operational efficiency are contributing to the procure to pay software market demand.

Additionally, the regional analysis depicts that the growing manufacturing, BFSI, and healthcare sectors and increasing need for efficient procurement solutions are driving the procure to pay software market demand in Europe. Further, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a substantial rate due to several factors such as increasing development of retail & e-commerce business, expansion of oil & gas operations, and growing manufacturing sector, among others.

Top Key Players & Market Share Insights:

The global procure to pay software market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the procure to pay software market. Key players in the procure to pay software industry include-

- Coupa Software (U.S)

- Vroozi (U.S)

- ProcurePort (U.S)

- BirchStreet Systems (U.S)

- Basware Oy (Finland)

- Tradeshift Holdings Inc. (U.S)

- SAP SE (Germany)

- Oracle (U.S)

- Xeeva (U.S)

- Precoro Inc. (U.S)

Procure To Pay Software Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 11.69 Billion |

| CAGR (2025-2032) | 9.2% |

| By Deployment Type |

|

| By Enterprise Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the procure to pay software market? +

The procure to pay software market was valued at USD 6.10 Billion in 2024 and is projected to grow to USD 11.69 Billion by 2032.

Which is the fastest-growing region in the procure to pay software market? +

Asia-Pacific is the region experiencing the most rapid growth in the procure to pay software market.

What specific segmentation details are covered in the procure to pay software report? +

The procure to pay software report includes specific segmentation details for deployment type, enterprise type, end use, and region.

Who are the major players in the procure to pay software market? +

The key participants in the procure to pay software market are Coupa Software (U.S), Tradeshift Holdings Inc. (U.S), SAP SE (Germany), Oracle (U.S), Xeeva (U.S), Precoro Inc. (U.S), Vroozi (U.S), ProcurePort (U.S), BirchStreet Systems (U.S), Basware Oy (Finland), and others.