Acute Intermittent Porphyria Market Size:

Acute intermittent porphyria market size is estimated to reach over USD 7,274.28 Million by 2031 from a value of USD 4,480.00 Million in 2023, growing at a CAGR of 6.3% from 2024 to 2031.

Acute Intermittent Porphyria Market Scope & Overview:

Acute intermittent porphyria (AIP) is a rare autosomal dominant disease characterized by a deficiency of hydroxymethylbilane synthase (HMBS). It presents with abdominal pain, nausea, vomiting, peripheral neuropathy, seizures, and others. It is the most common form of acute hepatic porphyria which constitutes about 80% of all cases of acute hepatic porphyria. It manifests after puberty, especially in women due to hormonal influences. Acute intermittent porphyria is diagnosed with the help of urine tests, blood tests, and genetic testing, though urine test is commonly used for the diagnosis. Treatments include gonadotropin-releasing hormone analogs, intravenous heme therapy, Ribonucleic Acid interference therapy, and others.

How is AI Impacting the Acute Intermittent Porphyria Market?

AI is significantly impacting the Acute Intermittent Porphyria (AIP) market by enhancing diagnosis, treatment, and drug discovery processes. AI-powered tools are enabling faster and more accurate diagnoses, potentially reducing diagnostic delays by over a year. Additionally, AI models, trained on electronic health records (EHR), which in turn helps to identify patients at risk of AIP and analyze patient based on condition, potentially reducing diagnostic delays.

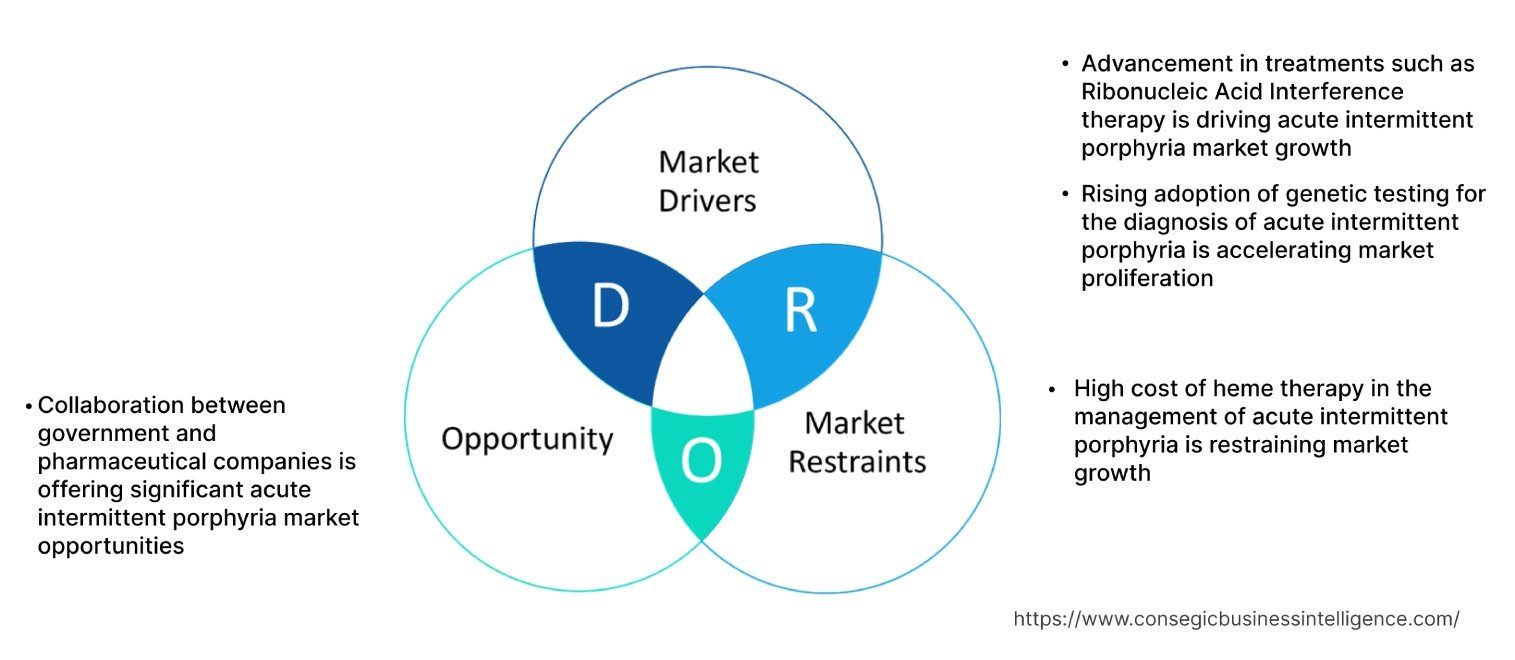

Acute Intermittent Porphyria Market Dynamics - (DRO) :

Key Drivers:

Advancement in treatments such as Ribonucleic Acid Interference therapy is driving acute intermittent porphyria market growth.

Advancements in treatments such as Ribonucleic Acid Interference therapy for acute intermittent porphyria patients have significantly influenced the industry. Givosiran is one such Ribonucleic Acid Interference therapy that works by reducing the production of heme precursors. It also reduces aminolevulinic acid synthase 1 messenger Ribonucleic Acid levels in the liver, which causes AIP.

- In 2022, according to the Journal of Internal Medicine, the results of clinical trials have shown that givosiran therapy treatment leads to a rapid and sustained reduction of aminolevulinic acid synthase 1 messenger Ribonucleic Acid. Also, it shows decreased heme precursor levels and a decreased rate of attacks in acute intermittent porphyria patients.

Thus, effective treatment options such as givosiran are driving acute intermittent porphyria market growth and acute intermittent porphyria market share.

Rising adoption of genetic testing for the diagnosis of acute intermittent porphyria is accelerating market proliferation.

Genetic testing is a precise method for diagnosis in acute intermittent porphyria patients, particularly valuable for detecting mutations in the hydroxymethylbilane synthase gene, which causes the disease. Next-generation sequencing is one of the types of genetic testing that identifies mutations in the hydroxymethylbilane synthase gene responsible for acute intermittent porphyria especially helpful when patients are asymptomatic.

- In 2022, according to a research article published in the Journal of Cancer Research and Clinical Oncology, next-generation sequencing identifies a mutation of the hydroxymethylbilan-synthase gene responsible for Acute Intermittent Porphyria. The study analyzed next-generation sequencing with an 8-gene porphyria panel plus 6 potential modifier loci to search for mutations in DNA extractions of the patients.

Thus, the use of genetic testing enables accurate diagnosis further strengthening acute intermittent porphyria market size and acute intermittent porphyria market share.

Key Restraints :

High cost of heme therapy in the management of acute intermittent porphyria is restraining market growth.

The high cost of treatment such as heme therapy for acute intermittent porphyria patients acts as a restraint for the Market. Heme therapy is used for managing acute intermittent porphyria patients and it involves administrating hemin intravenously which helps suppress the overproduction of toxic precursors that trigger symptoms in acute intermittent porphyria patients. These therapy often involve complex and costly development, which raises the final price for the patients. It also involves specialized production and administration requirements further making it expensive.

- According to the Journal of Medical Economics, total costs of care with heme therapy for acute intermittent porphyria range from USD 311,950 to USD 545,219.

Hence, the higher cost of treatments in acute intermittent porphyria patients imposes a financial burden on patients further constraining the acute intermittent porphyria market size.

Future Opportunities :

Collaboration between government and pharmaceutical companies is offering significant acute intermittent porphyria market opportunities.

Collaboration between government and pharmaceutical companies represents a significant opportunity for the acute intermittent porphyria industry by spreading awareness, treatment availability, and patient access. American Porphyria Foundation is a non-profit foundation dedicated to improving the health and well-being of all individuals and families impacted by acute intermittent porphyria. It partnered with Recordati Rare Diseases, a leading European pharmaceutical company in the treatment of acute intermittent porphyria.

- In 2024, the American Porphyria Foundation partnered with Recordati Rare Diseases presenting activities for National Porphyria Awareness Week from April 13-20, 2024. This association between the United States government and Recordati Rare Diseases, a leading European pharmaceutical company played a major role in the awareness of acute intermittent porphyria among the population.

Thus, this collaboration accelerated the awareness and availability of treatments for acute intermittent porphyria ultimately boosting the market.

Acute Intermittent Porphyria Market Segmental Analysis :

By Type:

By Type, the acute intermittent porphyria market is divided into treatment and diagnosis. Treatment is further classified into gonadotropin-releasing hormone analogs, ribonucleic acid interference therapy, and others. Similarly, diagnosis is further classified into urine tests, genetic testing, and others.

Trends in Type:

- In acute intermittent porphyria market trends, gonadotropin-releasing hormone analogs are sometimes used alongside more conventional treatments, like heme therapy for comprehensive management.

- Demand for Genetic testing is increasing in current acute intermittent porphyria market trends due to its ability to distinguish acute intermittent porphyria from other types of porphyria.

The treatment accounted for the largest revenue share in the year 2023.

- Acute Intermittent Porphyria (AIP) is a rare genetic disorder having no cure, but treatment is essential for managing these attacks and preventing future episodes.

- During acute attacks, treatments focus on pain management, often with strong pain relievers, and symptom relief with medications like antiemetics and sedatives.

- Hemin therapy, a key treatment, inhibits heme synthesis to reduce toxic porphyrin production. To prevent attacks, patients must identify and avoid triggers like certain medications or alcohol. Dietary modifications and regular monitoring can also help.

- Similarly, gonadotropin-releasing hormone analogs help control hormonal fluctuations, which trigger attacks in porphyria patients.

- In 2024, Kwality Pharma received approval for Leuprorelin Acetate for injectable suspension in Greece marking entry into the European Markets. This will create an opportunity for Indian pharmaceutical companies to operate in the highly regulated market of Europe where acute intermittent porphyria prevalence is higher than other regions.

- Thus, treatments for AIP are widely accepted and preferred for effective management.

The diagnosis of the type is expected to grow at the fastest CAGR over the forecast period.

- Diagnosing AIP involves a comprehensive approach, including a thorough medical history review, physical examination, and laboratory tests. Urine analysis to detect elevated PBG levels, blood tests to measure porphyrin precursors, and genetic testing to confirm specific mutations are key diagnostic tools. Early and accurate diagnosis is essential for the effective management of AIP and for preventing complications.

- One of the few diagnostic methods is genetic testing. It identifies mutations in the hydroxymethylbilane synthase gene, confirming acute intermittent porphyria diagnosis even when biological markers are not present.

- By detecting carriers early, genetic testing enables preventive care, reducing the likelihood of acute attacks by managing lifestyle factors and avoiding triggers

- In 2023, according to the Orphanet Journal of Rare Diseases, the Brazilian Porphyria Association from February 2020 until March 2022, offered genetic testing for the diagnosis of acute intermittent porphyria patients in Brazil. It helps to diagnose porphyria patients who are asymptomatic and unpredictable, supporting proactive care for these individuals.

- Thus, diagnosis such as genetic testing offers more personalized and effective care enabling preventive treatment advancing its demand in current trends.

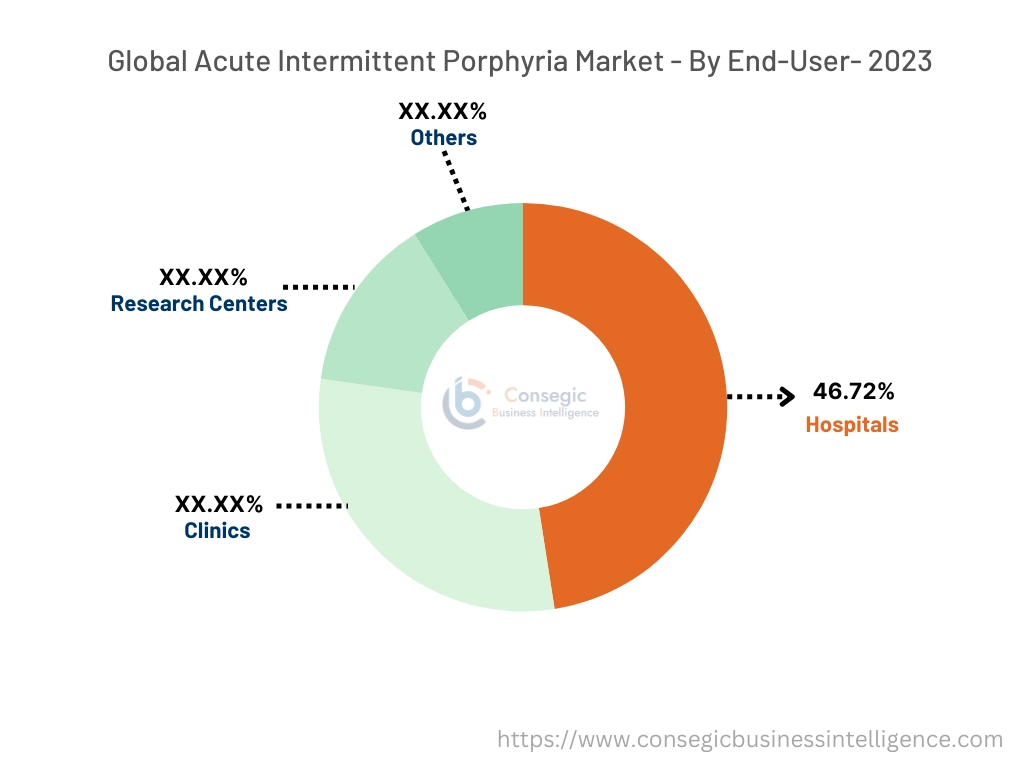

By End-User:

By end user, the acute intermittent porphyria market is divided into hospitals, clinics, research centers, and others.

Trends in End-User:

- Hospitals are providing effective treatment for acute intermittent porphyria patients supported by the availability of advanced diagnostic tools and trained healthcare professionals in current trends.

- As per the latest trends, clinics for acute intermittent porphyria are emerging rapidly offering more accessible, cost-effective options for the patients.

The hospitals accounted for the largest revenue share of 46.72% in the year 2023.

- According to current trends, hospitals remain the dominating end-users of the acute intermittent porphyria market due to the availability of advanced diagnostic tools, specialized healthcare professionals, and comprehensive treatment facilities.

- Hospitals are typically the first preference for acute intermittent porphyria cases, offering emergency care and specialized treatments such as heme therapies.

- Many leading hospitals in the United States are providing treatment for acute intermittent porphyria enabling effective care for the patients.

- For instance, Mayo Clinic in the United States is offering overall treatment for acute intermittent porphyria right from diagnosis and personalized treatment. This clinic also provides injections of hemin for the treatment of acute intermittent porphyria.

- Thus, the hospital is the dominant end-user of the acute intermittent porphyria market due to the availability of effective diagnosis and preventive care to the patients.

The clinics in the end-user are expected to grow at the fastest CAGR over the forecast period.

- As awareness of acute intermittent porphyria increases among healthcare professionals and patients, clinics are becoming more involved in the early detection and diagnosis of the disorder.

- Clinics offer more accessible, cost-effective options for managing chronic conditions like acute intermittent porphyria, reducing the need for extended hospital stays.

- As healthcare systems focus on providing more outpatient services, clinics are increasingly being utilized for regular follow-ups and disease management.

- For instance, the National Acute Porphyria Service (NAPS) at Cardiff University in the United Kingdom is a specialized clinic that provides treatment and management for acute intermittent porphyria. It is a nationally recognized service that offers expert care for patients with acute intermittent porphyria including diagnosis, crisis management, and long-term treatment plans.

- Thus, more clinics are likely to emerge contributing to the increased accessibility and quality of care for acute intermittent porphyria patients.

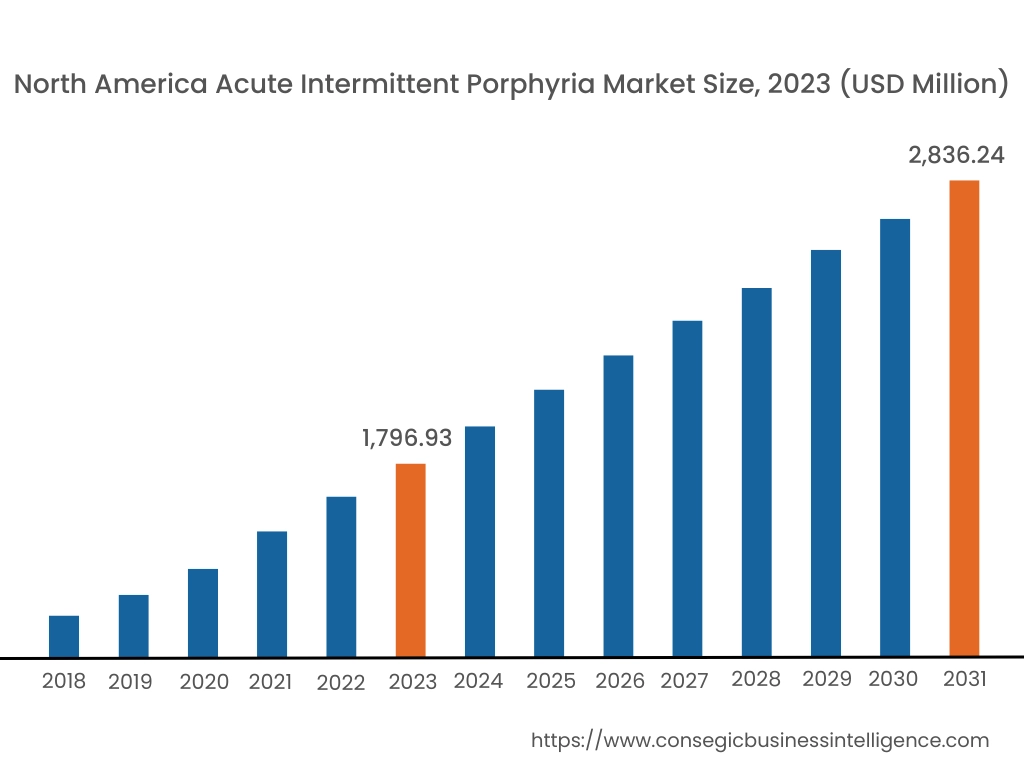

Regional Analysis:

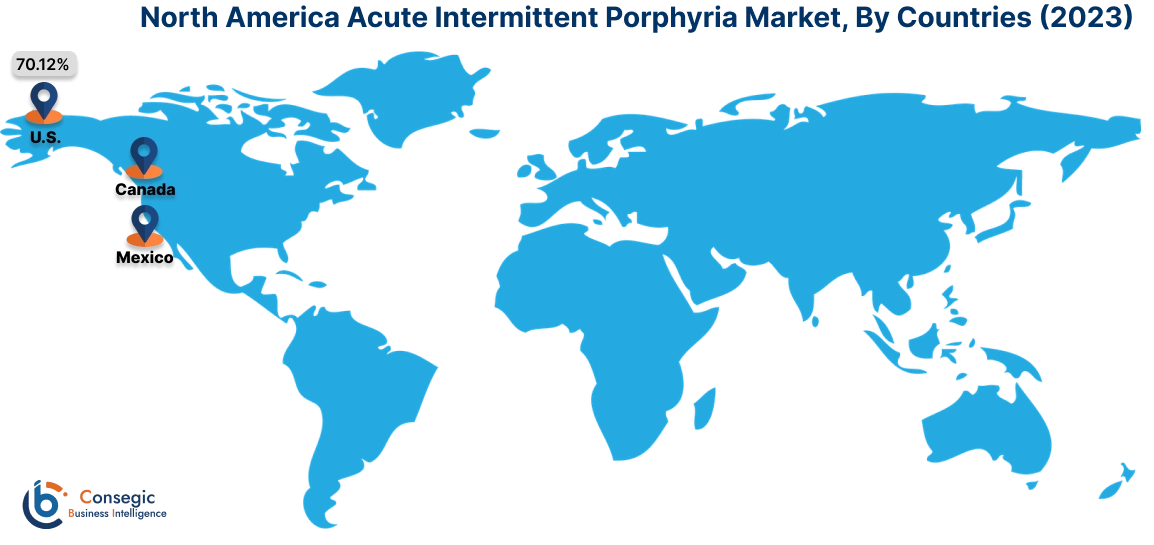

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2023, North America accounted for the highest market share at 40.11% and was valued at USD 1,796.93 Million, and is expected to reach USD 2,836.24 Million in 2031. In North America, the U.S. accounted for the highest market share of 70.12% during the base year of 2023. According to market analysis, North America has significant investments in medical research, supporting the advancement of acute intermittent porphyria treatments such as Ribonucleic Acid interference therapy. Many pharmaceutical leaders in North America such as Alnylam Pharmaceuticals, and Apellis Pharmaceuticals drive innovation and ensure accessibility to the latest treatments. The United States has improved treatment access to Panhematin® which is the first FDA-Approved hemin for injection prescription medication used to relieve repeated attacks of AIP.

- According to the American Porphyria Foundation, in the United States, affected AIP individuals are treated with Panhematin® (hemin for injection), an enzyme inhibitor derived from red blood cells that is potent in suppressing acute attacks of intermittent porphyria. Panhematin returns porphyrin and porphyrin precursor levels to normal values in the affected patients.

Thus, North America is the leading region in the Acute Intermittent Porphyria industry due to early diagnosis, cutting-edge treatments, and patient-centralized care according to market analysis.

Europe is expected to witness the fastest CAGR over the forecast period of 7.0% during 2024-2031. Europe has a relatively higher prevalence of acute intermittent porphyria patients and strong awareness programs that promote early diagnosis and treatment. Europe’s robust healthcare system enables better access to diagnostic and treatment options, including advanced therapies like Ribonucleic Acid interference therapy. Europe hosts major pharmaceutical and biotech firms actively involved in Porphyria therapies, further strengthening the market.

- According to the American Porphyria Foundation, in Europe the prevalence of Acute Intermittent Porphyria is estimated to be approximately 5.9 per million people in the general population.

Thus, as per acute intermittent porphyria market analysis, Europe is a rapidly emerging region, and acute intermittent porphyria market expansion is increasing due to higher prevalence and government support for treatment.

As per acute intermittent porphyria market analysis, the Asia-Pacific region is experiencing rapid acute intermittent porphyria market expansion fueled by expanding healthcare systems, growing awareness, and increasing availability of genetic testing. Countries like China and India are investing significantly in healthcare infrastructure and with rising economic developments, more patients are getting access to diagnostic and treatment options. Additionally, collaborations between public and private sectors are supporting research in rare diseases, and further growth in industry. Overall, the region presents significant Acute Intermittent Porphyria Market opportunities in the market with key players focusing on enhancing diagnostic accuracy and therapeutic accessibility. However, limited access to specialized treatments and low awareness among healthcare professionals persist in restricting the market demand.

According to analysis, in the Middle East and Africa, acute intermittent porphyria market demand is in a nascent stage, with growth driven by increasing awareness of rare diseases and gradual improvements in healthcare infrastructure. Although diagnostic access remains limited in some areas, governments and health organizations are gradually investing in rare disease programs, facilitating improved patient support. Despite the challenges such as lower healthcare funding and lack of specialized resources, the market in the Middle East and Africa region shows potential for development. Along with that, this region presents potential for pharmaceutical companies to introduce affordable diagnostic tools and therapeutic solutions tailored to regional needs.

Latin America is expanding moderately, with countries like Brazil and Mexico leading in terms of healthcare access, awareness, diagnosis, and treatment of rare diseases. Government initiatives and partnerships with international health organizations are helping improve diagnosis and treatment availability, though challenges remain. Problems like high treatment costs, limited specialized centers, and economic disparities hinder broader market penetration. However, the development of diagnostic facilities, collaboration between government and non-profit organizations, and government initiatives like rare disease programs are gradually enhancing patient access to specialized care. These factors are supporting market growth and acute intermittent porphyria market demand in Latin America as per the analysis.

Top Key Players & Market Share Insights:

The Global acute intermittent porphyria market includes several key players known for their significant contributions.

- Alnylam Pharmaceuticals, Inc. (United States)

- Recordati Rare Diseases(Italy)

- Bachem (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Ipsen Pharma (France)

- Sanofi (France)

- Clinuvel Pharmaceuticals Ltd (Australia)

- Apellis Pharmaceuticals (United States)

- Quest Diagnostics (United States)

- Mayo Clinic Laboratories (United States)

Recent Industry Developments :

Research and Development:

- In March 2024, Sun Pharma gets approval from the Central Drug Standard Control Organization to conduct the study of Leuprolide Acetate. Leuprolide Acetate is a Gonadotropin-releasing hormone analog used in the treatment of AIP which reduces estrogen production- a known trigger of acute intermittent porphyria attacks.

- In April 2021, elevate is started which is an international, prospective, observational registry. The primary objective of this registry is to study the long-term real-world safety of givosiran (Ribonucleic Acid interference therapy) in acute intermittent porphyric patients. The secondary objectives of the registry focus on characterizing the long-term real-world effectiveness of givosiran treatment and describing the natural history and clinical management of affected patients.

Business expansion:

- In September 2021, initially reserved for hospital use, givlaari 189 mg/ml injectable solution (givosiran) is dispensed in the community on hospital prescription. It is used in the treatment of Acute Intermittent Porphyric patients as a ribonucleic acid interference therapy which works by reducing the production of heme precursors and aminolevulinic acid synthase 1 messenger Ribonucleic Acid levels in the liver, which causes symptoms.

Acute Intermittent Porphyria Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 7,274.28 Million |

| CAGR (2024-2031) | 6.3% |

| By Type |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Acute Intermittent Porphyria Market? +

The acute intermittent porphyria market size is estimated to reach over USD 7,274.28 Million by 2031 from a value of USD 4,480.00 Million in 2023, growing at a CAGR of 6.3% from 2024 to 2031.

What specific segmentation details are covered in the Acute Intermittent Porphyria Market report? +

The Acute Intermittent Porphyria Market report includes specific segmentation details for type and end-user.

Which is the fastest-growing region in the Acute Intermittent Porphyria Market? +

North America is the fastest-growing region in the Acute Intermittent Porphyria Market.

Who are the major players in the Acute Intermittent Porphyria Market? +

The key participants in the Acute Intermittent Porphyria market are Alnylam Pharmaceuticals, Inc. (United States), Recordati Rare Diseases (Italy), Sanofi (France), Clinuvel Pharmaceuticals Ltd (Australia), Apellis Pharmaceuticals (United States), Quest Diagnostics (United States), Mayo clinic laboratories (United States), Bachem (Switzerland), Takeda Pharmaceutical Company Limited (Japan), Ipsen Pharma (France).