Aircraft ACMI Leasing Market Size:

Aircraft ACMI Leasing Market size is estimated to reach over USD 8.31 Billion by 2032 from a value of USD 5.49 Billion in 2024 and is projected to grow by USD 5.72 Billion in 2025, growing at a CAGR of 5.8% from 2025 to 2032.

Aircraft ACMI Leasing Market Scope & Overview:

ACMI stands for aircraft, crew, maintenance, and insurance and aircraft ACMI leasing refers to a leasing arrangement where the lessor provides an aircraft along with crew, maintenance, and insurance coverage to the lessee. Airplane ACMI leasing offers a cost-effective solution compared to traditional ownership as the lessor provides the aircraft and its maintenance which has driven the market. Further, the leasing enables airlines to scale their fleet up without the capital expenditure associated with the purchase of a new aircraft. Moreover, the rising adoption of aircraft ACMI leasing to streamline operations by outsourcing crew and maintenance decisions is driving the market.

How is AI Impacting the Aircraft ACMI Leasing Market?

AI is significantly impacting the Aircraft, Crew, Maintenance, and Insurance (ACMI) leasing market by introducing greater efficiency and predictability. AI-powered analytics can optimize fleet utilization, matching available aircraft with demand fluctuations more effectively. Predictive maintenance, driven by AI, can anticipate potential issues with leased aircraft, reducing unexpected downtime and enhancing safety. Furthermore, AI assists in dynamic pricing models, allowing lessors to adjust rates in real-time based on market conditions, and can streamline complex contract management. This integration of AI offers ACMI lessors and airlines enhanced operational resilience, cost savings, and the ability to respond swiftly to changing market dynamics.

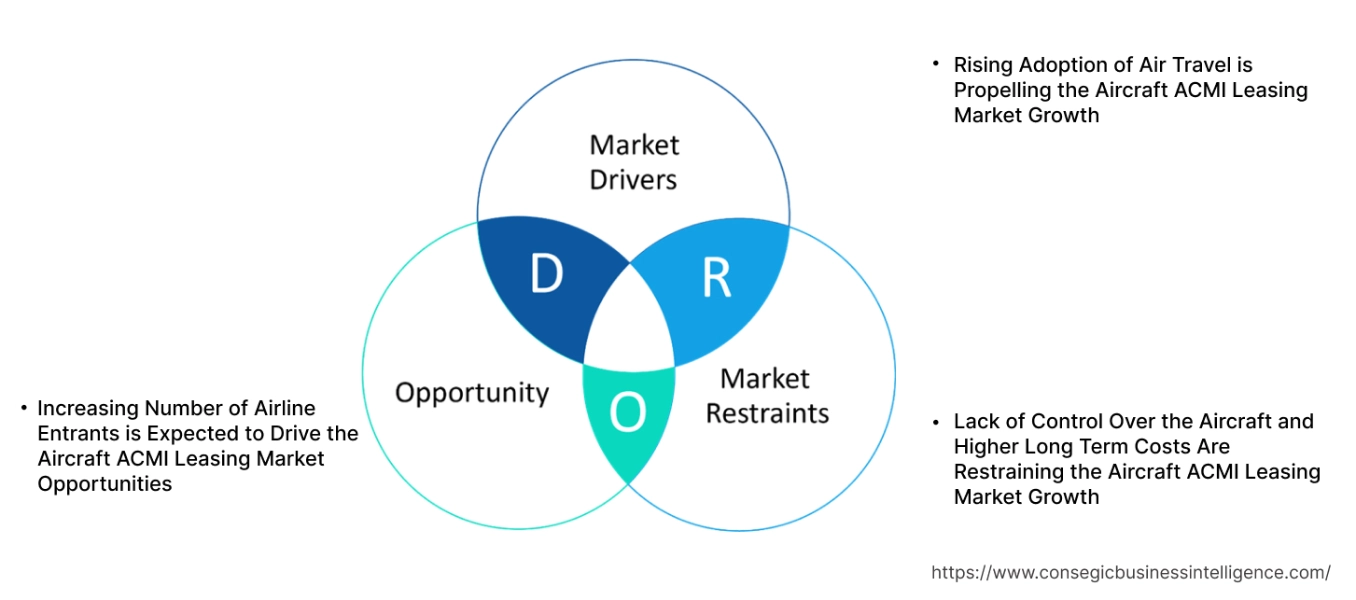

Aircraft ACMI Leasing Market Dynamics - (DRO) :

Key Drivers:

Rising Adoption of Air Travel is Propelling the Aircraft ACMI Leasing Market Growth

Air travel has experienced a rising adoption due to increasing affordability and global connectivity of airlines. Additionally, air travel is typically more convenient and safer compared to other modes of transport namely roadways. Moreover, the rising adoption of air travel has driven the market as airlines expand their fleet to serve the growing number of passengers.

- For instance, according to the IATA, the international full-year traffic in 2024 increased by 13.6% compared to 2024. The rising number of international and domestic air traffic is expected to boost the overall market as airlines invest in ACMI leasing.

Hence, the rising adoption of air travel and increasing investments by airlines for airplane ACMI leasing is driving the aircraft ACMI leasing market size.

Key Restraints:

Lack of Control Over the Aircraft and Higher Long Term Costs Are Restraining the Aircraft ACMI Leasing Market Growth

Airplane ACMI leasing typically involves lower upfront costs, but the long term cost of leasing may be higher than purchasing the aircraft. Further, the lease payments are an ongoing expense for the airline whereas purchasing the aircraft is a one-time expense. Moreover, operators typically have limited control over the aircraft when they lease, which can act as a restraint to the market growth as the operators may face restrictions on usage including limitations on the routes they can fly to.

Thus, lack of control over the aircraft and higher long term costs due to usage limitations and lease payments act as a restraint to the aircraft ACMI leasing market expansion.

Future Opportunities :

Increasing Number of Airline Entrants is Expected to Drive the Aircraft ACMI Leasing Market Opportunities

Airplane ACMI leasing allows new entrants to explore new markets and regions without having to spend a substantial amount in the form of upfront investment. Moreover, ACMI leasing allows the new entrants to quickly adjust their capacity to match market demand by easily leasing aircraft which is driving the market. Additionally, many providers offer extensive experience in aircraft maintenance and crew management to new entrants which is driving the overall market.

- For instance, in May 2025, Alhind Air announced the airline will begin its operations by mid-2025. The increasing number of airline entrants is expected to boost the market as ACMI leasing is especially lucrative for new entrants due to lower capital expenditure.

Thus, the increasing number of airline entrants is projected to drive the aircraft ACMI leasing market opportunities during the forecast period.

Aircraft ACMI Leasing Market Segmental Analysis :

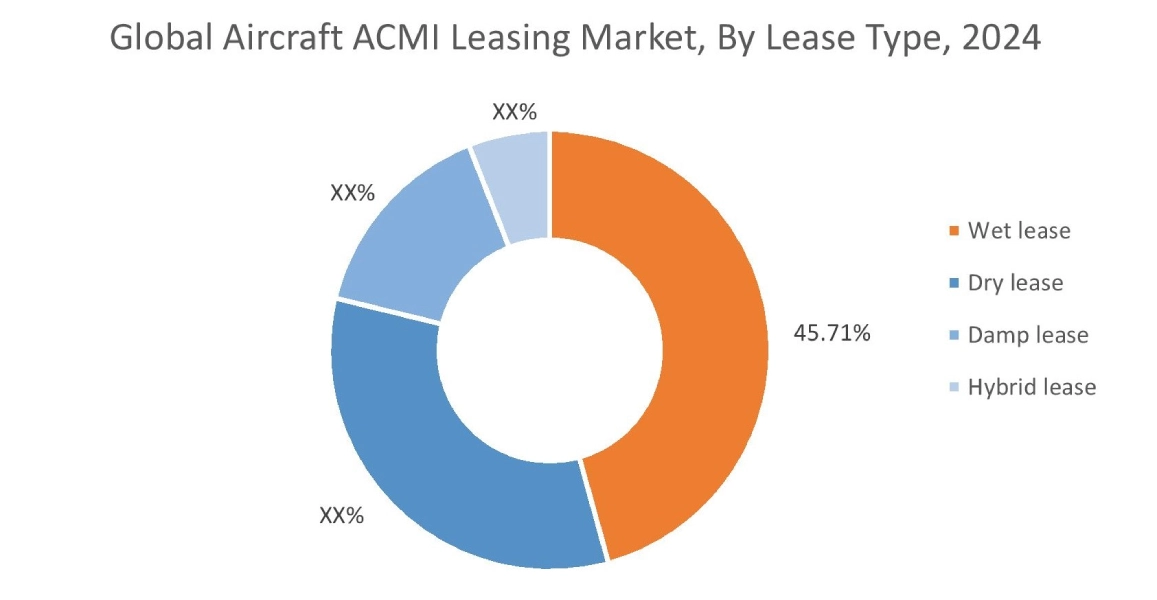

By Lease Type:

Based on the lease type, the market is segmented into wet lease, dry lease, damp lease, and hybrid lease.

Trends in the lease type:

- Increasing adoption of dry lease due to control over crew selection is driving the aircraft ACMI leasing market share.

- Rising utilization of wet lease due to lower operational costs is driving the aircraft ACMI leasing market trends.

Wet lease accounted for the largest revenue share of 45.71% in the year 2024.

- There has been a rising adoption of wet lease by operators wanting to test new routes without committing significant capital to aircraft or crew acquisition which is driving the market.

- Moreover, the rising utilization of wet leasing to quickly increase capacity during peak periods is boosting the market.

- For instance, Hi Fly offers wet leasing that includes crew, maintenance, aircraft, and third party insurance for passenger and cargo flights.

- Thus, the increasing utilization of wet lease due to testing of new routes and increased capacity during peak periods is driving the overall market.

Dry lease is anticipated to register the fastest CAGR during the forecast period.

- In the aviation ACMI leasing market, dry lease has experienced a rising adoption by established operators as the operators already have the necessary personnel to manage their fleet, which has resulted in the aircraft ACMI leasing market expansion.

- Additionally, dry leases are cheaper and the lessee only has to make lease payments for aircraft which is driving the global aircraft ACMI leasing market.

- Moreover, the increasing number of dry lease offerings by aircraft lease providers that feature a wide selection of aircrafts is driving the market.

- For instance, Chapman Freeborn offers various leasing arrangements for operators including dry leasing. The company has access to over 50,000 aircraft worldwide, which allows them to offer a range of competitive aircraft solutions to operators.

- According to the market analysis, the rising advancements related to dry lease due to cheaper payments and wide selection of aircrafts is driving the aircraft ACMI leasing market trends.

By Aircraft Type:

Based on the aircraft type, the market is segmented into narrow body and wide body.

Trends in the aircraft type:

- Increasing adoption of ACMI leasing for narrow body aircraft to assist operators with short term fleet development is driving the market trends.

- There has been a rising utilization of ACMI leasing for wide body aircraft due to availability of newer aircrafts which is driving the aircraft ACMI leasing market demand.

Narrow body accounted for the largest revenue share in the year 2024.

- Narrow body aircrafts typically feature a single aisle and most used for short-range flights.

- Further, the rising utilization of airplane ACMI leasing for narrow body aircrafts by operators to quickly source aircrafts within weeks or months is driving the aircraft ACMI leasing market demand.

- For instance, AER Source offers wet, dry, and damp leasing solutions featuring over 50,000 narrow body aircrafts.

- Thus, as per the analysis, the rising adoption of airplane ACMI leasing due to quick sourcing of aircrafts is driving the market.

Wide body is anticipated to register the fastest CAGR during the forecast period.

- Wide body aircrafts feature two passenger aisles and are typically utilized for long haul flights.

- Moreover, rising investments by airlines to provide better travel experience to customers and expand their international footprint are driving the market.

- For instance, in February 2025, IndiGo announced that it has signed an agreement with Norse Atlantic Airways for damp leasing of a Boeing 787-9 wide body aircraft. The rising investments by airlines to lease wide body aircrafts is expected to boost the market.

- Therefore, the rising utilization of airplane ACMI leasing for wide body to expand international footprint is driving the market.

By Duration:

Based on the duration, the market is segmented into long term and short term.

Trends in the duration:

- Increasing adoption of long term lease to help with maintenance delays is driving the market trends.

- Rising adoption of short term lease for airline network development is driving the market growth.

Long term accounted for the largest revenue share in the year 2024.

- Long term lease has experienced a rising adoption due to significant cost reductions that may result due to upfront investment in aircraft which has driven the global aircraft ACMI leasing market.

- Further, rising utilization of long term leasing to avoid service disruption that may result due to crew training is driving the market.

- Moreover, the increasing utilization of long term ACMI lease to protect the aircraft from third party liability risks is driving the market

- For instance, LeBas International offers long term ACMI leasing starting from year and up to 6 years for airlines wanting to test new markets.

- Therefore, the increasing demand for long term to reduce upfront investment costs and avoid service disruptions is driving the aircraft ACMI leasing market size.

Short term is anticipated to register the fastest CAGR during the forecast period.

- Short term lease has experienced a rising adoption to help airlines dealing with delayed delivery of new aircraft which has driven the market.

- Moreover, the rise in short term ACMI leasing to help with various emergency situations including grounded aircraft and crew sickness is driving the growth of the market.

- For instance, GetJet Airlines offer short term ACMI leasing with periods ranging from a few hours to several days to help airlines deal with unexpected demands or temporary capacity shortages.

- According to the aircraft ACMI leasing market analysis, the rising trend in the adoption of short term to deal with delayed delivery of new aircraft and emergency situations is propelling the aircraft ACMI leasing industry during the forecast period.

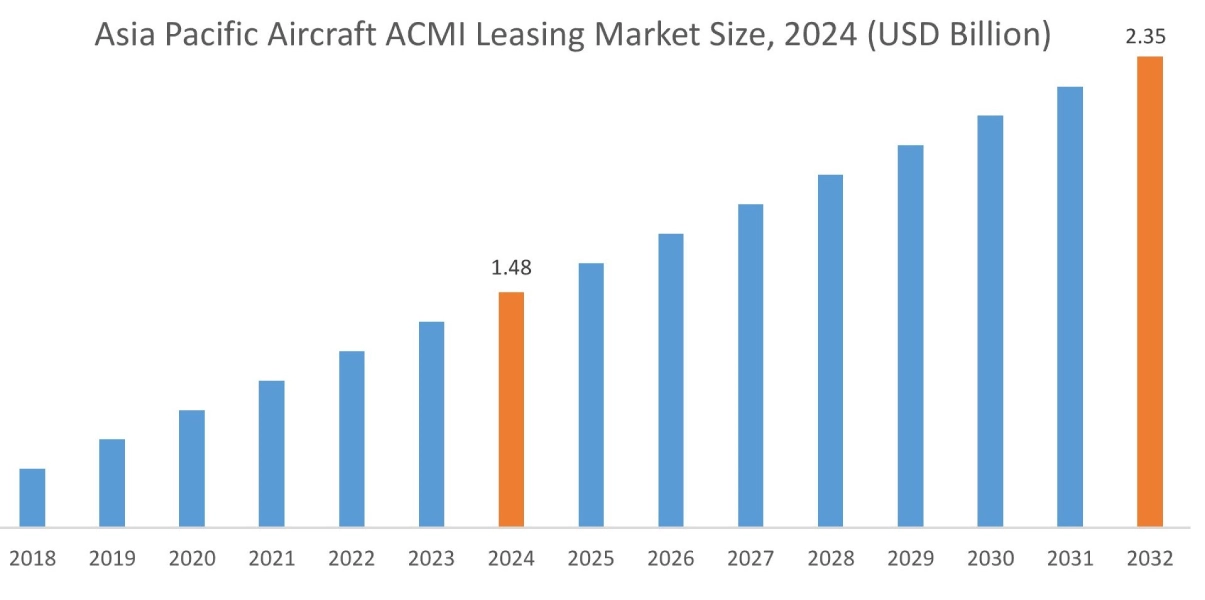

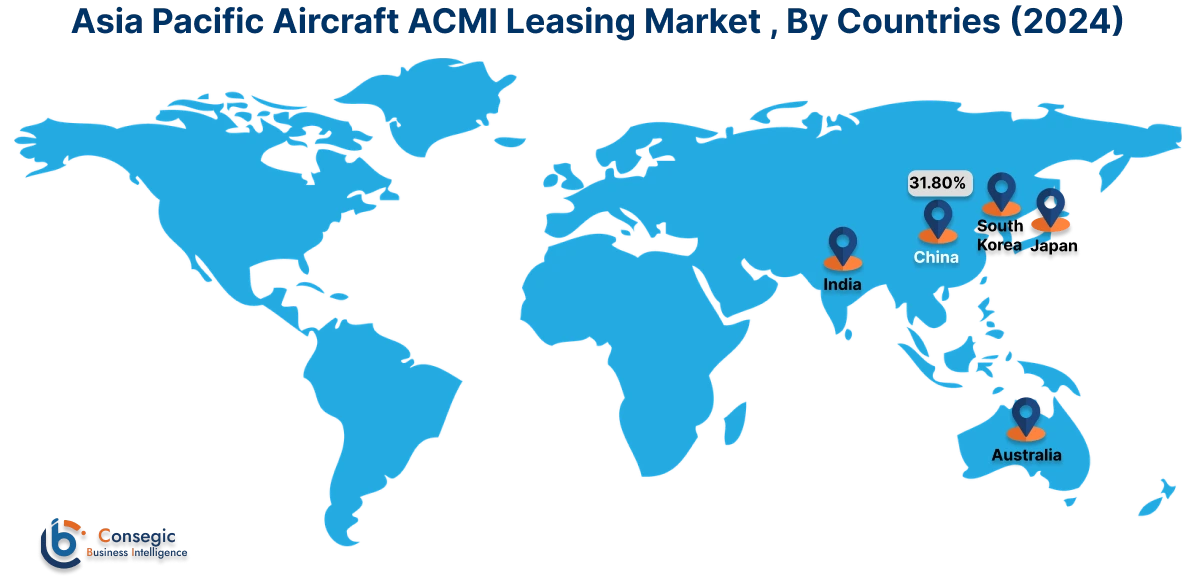

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at 1.48 Billion in 2024. Moreover, it is projected to grow by 1.55 Billion in 2025 and reach over 2.35 Billion by 2032. Out of this, China accounted for the maximum revenue share of 31.80%. As per the aircraft ACMI leasing market analysis, the growth in the Asia-Pacific region is primarily driven by the increasing utilization of ACMI leasing for wide body aircraft and increasing investments by new entrants.

- For instance, in August 2022, Akasa Air inaugurated its first flights on the Benglaru-Mumbai route. The rising investments by new entrants is expected to boost the Asia Pacific market as the new airlines typically prefer leasing over buying due to lower operational costs and quick sourcing of crews.

North America is estimated to reach over USD 2.82 Billion by 2032 from a value of USD 1.86 Billion in 2024 and is projected to grow by USD 1.93 Billion in 2025. In North America, the growth of aircraft ACMI leasing industry is driven by the increasing adoption of wet and damp leasing. Moreover, the increasing air passenger traffic has resulted in the rise of aircraft ACMI leasing market share.

- For instance, according to a report by the Airports Council International, North American airports saw an increase in passenger traffic of 11.9% in 2023 compared to 2022. The rise in passenger traffic is expected to boost the market as airlines invest in airplane ACMI leasing to deal with long term increase in passenger traffic.

Additionally, the regional analysis depicts that the rising utilization of airplane ACMI leasing for narrow body aircraft and stringent regulation in the region are driving the market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to rising investments by airlines. Middle East and African regions are expected to grow at a considerable rate due to factors such as increasing technological advancement in aircrafts and rising GDP among others.

Top Key Players and Market Share Insights:

The global aircraft ACMI leasing market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the aircraft ACMI leasing market. Key players in the aircraft ACMI leasing industry include-

- Avolon (Ireland)

- BOC Aviation (Singapore)

- Chapman Freeborn Airchartering (U.K.)

- AVICO (France)

- Delta World Charter (UAE)

- AerCap Holdings N.V. (Ireland)

- Nordic Aviation Capital (Ireland)

- BBAM US LP (U.S.)

- ACC Aviation (U.K.)

- Avia Solutions Group (Ireland)

Recent Industry Developments :

Partnerships:

- In October 2024, Thai SmartLynx, a partner of the Avia Solutions Group, announced that the company will start providing ACMI leasing from early 2025. The company will begin its operations with Airbus A320s and is in the last stages of getting approval for its Air Operator’s Certificate.

Business Expansion:

- In November 2024, Avion Express, a key ACMI player, announced its expansion into the South American market with a collaboration with Flybondi. Avion Express will provide two Airbus A320 aircrafts as part of the collaboration and aims to start operations in November 2024 till March 2025.

Aircraft ACMI Leasing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 8.31 Billion |

| CAGR (2025-2032) | 5.8% |

| By Lease Type |

|

| By Aircraft Type |

|

| By Duration |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the aircraft ACMI leasing market? +

The aircraft ACMI leasing market was valued at USD 5.49 Billion in 2024 and is projected to grow to USD 8.31 Billion by 2032.

Which is the fastest-growing region in the aircraft ACMI leasing market? +

Asia-Pacific region is experiencing the most rapid growth in the aircraft ACMI leasing market.

What specific segmentation details are covered in the aircraft ACMI leasing market report? +

The aircraft ACMI leasing market report includes lease type, aircraft type, duration, and region.

Who are the major players in the aircraft ACMI leasing market? +

The key participants in the aircraft ACMI leasing market are Avolon (Ireland), BOC Aviation (Singapore), AerCap Holdings N.V. (Ireland), Nordic Aviation Capital (Ireland), BBAM US LP (U.S.), ACC Aviation (U.K.), Avia Solutions Group (Ireland), Chapman Freeborn Airchartering (U.K.), AVICO (France), Delta World Charter (UAE), and Others.