Aerospace Cold Forgings Market Size:

Aerospace Cold Forgings Market size is estimated to reach over USD 6.81 Billion by 2032 from a value of USD 3.60 Billion in 2024 and is projected to grow by USD 3.84 Billion in 2025, growing at a CAGR of 9.1% from 2025 to 2032.

Aerospace Cold Forgings Market Scope & Overview:

Aerospace cold forgings refer to shaping metal components at near-room temperature to produce durable parts for airplanes. Cold forging allows for the creation of parts with a focus on reduction in material use. Further, cold forging allows reproducibility as the process is rapid and is making it ideal for aerospace companies, looking to source large quantities of parts. Moreover, cold forging is increasingly being utilized for manufacturing crucial engine components in aircraft, such as spline shafts and gears, which is driving the market.

How is AI Transforming the Aerospace Cold Forgings Market?

AI is transforming the aerospace cold forgings market by enhancing precision, efficiency, and quality control in manufacturing processes. Cold forging requires high accuracy to produce durable components for aircraft, and AI-driven analytics optimize material flow, die design, and process parameters to achieve superior results. Machine learning models can predict defects, monitor tool wear, and recommend adjustments in real time, reducing waste and improving productivity. AI also enables predictive maintenance of forging equipment, minimizing downtime and extending operational life. In addition, AI-powered simulations accelerate product development by testing designs virtually before production. By improving reliability and reducing costs, AI is becoming a key enabler in advancing aerospace cold forging operations globally.

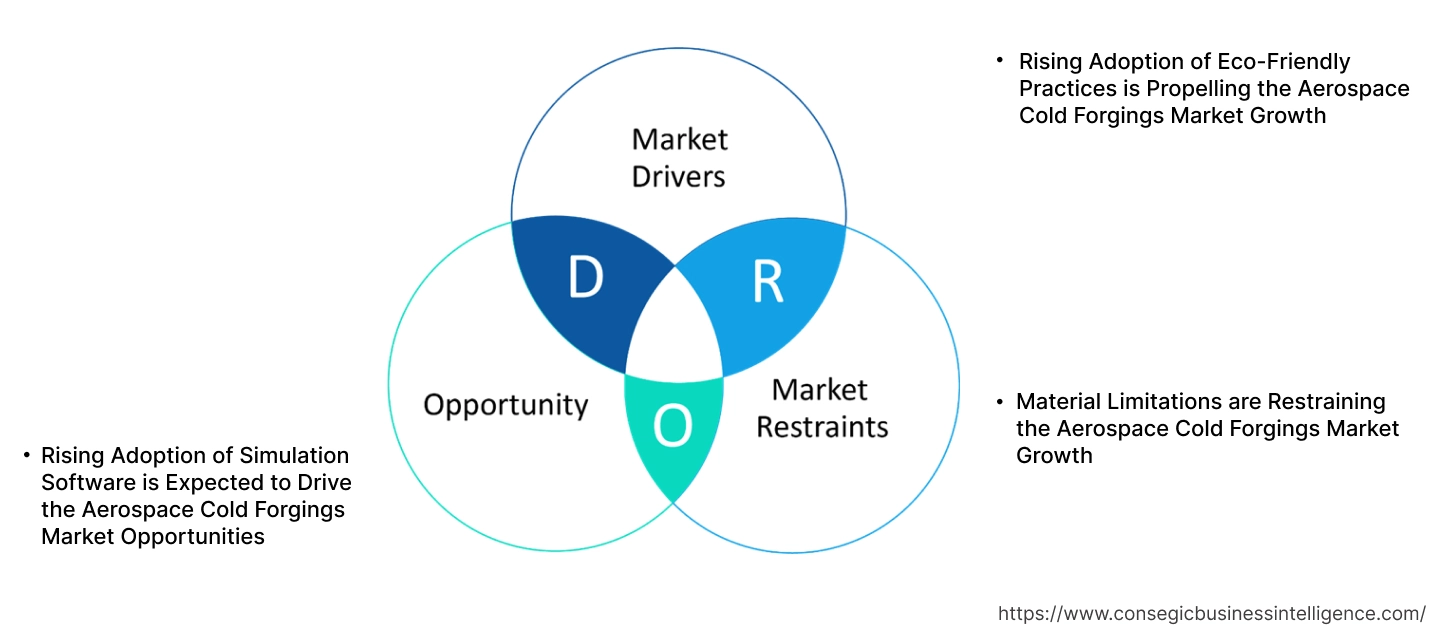

Aerospace Cold Forgings Market Dynamics - (DRO) :

Key Drivers:

Rising Adoption of Eco-Friendly Practices is Propelling the Aerospace Cold Forgings Market Growth

In cold forging, the raw materials are used efficiently, with very few raw materials wasted during the forging process. Moreover, cold forging also reduces the environmental impact of the production process as it consumes less energy and does not require secondary treatments. Additionally, complex shapes for aircraft can be produced using cold forging with a high level of accuracy and repeatability over time.

- For instance, according to the U.S. Environmental Protection Agency, the total on-site and off-site disposal or other releases by the aircraft engine and engine parts manufacturing sector stood at 15.6 million lbs. in 2023. The increasing focus of regulators around the world to reduce emissions and the overall impact of raw material waste is driving the market.

Hence, the rising adoption of eco-friendly practices due to less raw material wastage and energy consumption is driving the aerospace cold forgings market size.

Key Restraints:

Material Limitations are Restraining the Aerospace Cold Forgings Market Growth

Cold forging is not suitable for some types of metals, including brittle alloys. Further, certain materials, including high carbon steel, are more likely to crack or break during the process. Additionally, during the forging process, the metal undergoes work hardening, which increases its strength but reduces ductility, limiting the formability of the material. Moreover, cold forging can only create certain shapes that are more basic and mass-produced, making the production of customer pieces difficult.

Thus, cracking or breaking of materials during the production process acts as a restraint to the aerospace cold forgings market expansion.

Future Opportunities :

Rising Adoption of Simulation Software is Expected to Drive the Aerospace Cold Forgings Market Opportunities

Aerospace cold forgings are increasingly witnessing automation and the use of simulation software to increase production efficiency and accuracy. Further, simulation software allows engineers to optimize the forging process, which can help ensure consistent quality of the parts. Moreover, companies have started offering features, including easy detection of cold shut areas in the part and automatic optimization to ensure defect-free die filling.

- For instance,Transvalor offers Forge software, which is a solution used for the simulation of hot and cold forging processes. The software offers features, including point tracking to identify flow-through defects.

Thus, the rising technological advancements associated with software simulations in cold forgings are projected to drive the aerospace cold forgings market opportunities during the forecast period.

Aerospace Cold Forgings Market Segmental Analysis :

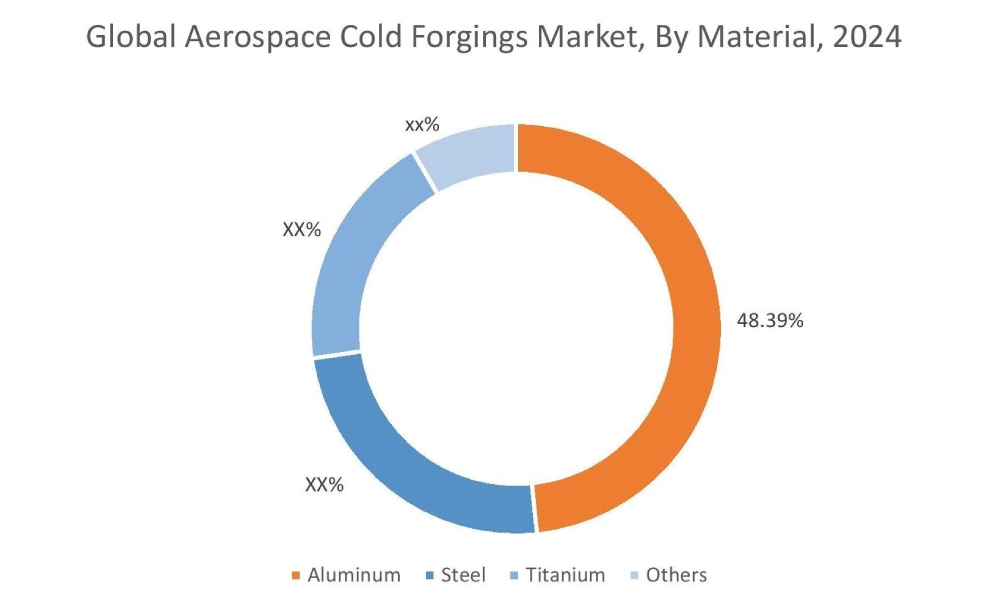

By Material:

Based on material, the market is segmented into aluminium, steel, titanium, and others.

Trends in the material:

- Increasing adoption of aluminium due to better dimensional intricacy is driving the aerospace cold forgings market share.

- Rising utilization of titanium and titanium alloys due to lighter weight is driving the aerospace cold forgings market trends.

Aluminium accounted for the largest revenue share of 48.39% in the year 2024.

- Aluminium forgings offer low density and the ability to withstand harsh conditions of space.

- Additionally, there has been a rising adoption of cold forgings for aluminium due to better design flexibility and smoother surface, which is driving the market.

- Moreover, manufacturers of aircraft have started utilizing aluminium and its alloys to make the bodies of aircraft due to their enhanced strength.

- For instance,the Boeing 747-8 utilized new-generation aluminum alloys for better durability and damage protection.

- According to the market analysis, the rising advancements related to aluminium due to its ability to withstand harsh conditions and design flexibility are driving the aerospace cold forgings market trends.

Titanium is anticipated to register the fastest CAGR during the forecast period.

- Titanium alloys have witnessed an increasing adoption in frames and joints in aircraft due to the same strength as steel but lower weight.

- Further, cold-forged titanium can help in reducing the airframe maintenance costs due to crack propagation resistance, which is driving the market.

- For instance, Philadelphia Forgings offers forged products in 6AL4V and 3AL-25V grades of Titanium for the aerospace industry.

- Thus, the rising trend in the utilization of titanium due to high strength and reduced maintenance costs is driving the aerospace cold forgings market demand during the forecast period.

By Type:

Based on the type, the market is segmented into closed die and open die.

Trends in the type:

- Rising trend towards adoption of closed die due to its ability to produce shapes with tight tolerances is driving the global aerospace cold forgings market.

- Increasing utilization of open die for large components used in aircraft engines has resulted in the growth of the market.

Closed die types accounted for the largest revenue share in the year 2024.

- Closed die forging offers improved strength and is popular for the forging of aluminium and steel due to its easy machining.

- Additionally, closed die forging offers a precise ability to reproduce any shape, driving its utilization in the production of landing gear components.

- Moreover, manufacturers have started offering closed die forging solutions for the production of structural elements, including torque tubes for better aircraft performance.

- For instance,Cantop Drop Forge offers closed die forging for structural components and landing gear components, including braces and connectors.

- According to the analysis, increasing utilization of closed die forging due to its ability to reproduce complex shapes and use in the production of structural elements is driving the aerospace cold forgings market expansion.

Open die is anticipated to register the fastest CAGR during the forecast period.

- Open die forging has witnessed increasing use to produce forgings of larger parts because of its size capability.

- Moreover, manufacturers have started utilizing open die forging to produce seamless rolled rings with exact specifications, which is driving the market.

- For instance,Ferralloy offers seamless forge-rolled rings that are lightweight and corrosion-resistant for use in jet engines and combustion systems.

- According to the market analysis, the increasing adoption of open die forging for the production of large parts and seamless rolled rings is anticipated to boost the overall market trends during the forecast period.

By Aircraft Type:

Based on the aircraft type, the market is segmented into commercial aircraft and military aircraft.

Trends in the aircraft type:

- Increasing adoption of aerospace cold forgings in commercial aircraft due to investments by commercial airline operators is driving the market.

- Rising adoption of aerospace cold forgings due to increased defense spending is driving the market growth.

Commercial aircraft accounted for the largest revenue share in the year 2024.

- Cold forged metal products have witnessed a rising adoption in commercial aircraft for the production of spline shifts.

- Further, cold forging presses have witnessed a growing adoption to form, stretch, and extrude materials at room temperature, which is driving the commercial aircraft segment.

- Moreover, there has been a rise in the number of passengers traveling through commercial aircraft, which is driving the market.

- For instance, according to the PIB, the number of operational airports in India has increased from 74 in 2014 to 157 in the year 2024. The increase in the number of airports represents the growing number of people travelling by airplane.

- Therefore, the increasing demand for cold forging in commercial aircraft due to the production of spline shifts and the rising number of passengers is driving the aerospace cold forgings market size.

Military aircraft is anticipated to register the fastest CAGR during the forecast period.

- Military aircraft have experienced growing demand for cold forging due to its ability to produce gears and bearings.

- Moreover, global military expenditure has seen an upward trend, which is driving the military aircraft segment.

- For instance, according to the Stockholm International Peace Research Institute, the global military expenditure increased to approximately USD 2,718 billion in the year 2024. The military spending by governments around the world also includes investments in military aircraft, which is driving the market.

- According to the aerospace cold forgings market analysis, the growth in cold forging for military aircraft due to the production of gears and bearings and rise in military expenditure is propelling the aerospace cold forgings industry during the forecast period.

By Application:

Based on the application, the market is segmented into engine components, landing gear components, fasteners, airframes, and others.

Trends in the application:

- Increasing adoption of aerospace cold forgings in airframes to produce parts that can help in maintaining the structural integrity of the aircraft.

- Rising adoption of cold forgings in engine components, including turbine blades and connecting rods, is driving the market growth.

Airframes accounted for the largest revenue share in the year 2024.

- Airframes have witnessed a growing adoption of cold forgings due to reduced porosity, which makes parts in the airframes resistant to failure modes caused by porosity.

- Further, the rising number of new entrants in the airline sector has also driven the adoption of airframes.

- For instance, Alhind Air announced its plans to enter the aviation market in India in the year 2025, with a focus on regional routes initially.

- Thus, the increasing adoption of cold forgings due to reduced porosity and the rising number of entrants in aviation is driving the overall market.

Engine components is anticipated to register the fastest CAGR during the forecast period.

- Cold forgings for engine components have experienced a rising adoption, particularly for compressor rotors.

- Further, aircraft companies have started integrating cold forged metal parts in the rotating parts of the engine to withstand high temperatures.

- Moreover, manufacturers have started offering forged components that use titanium and aluminium alloys for turbine blades.

- For instance, Farinia Group offers forged components, including turbine blades, that undergo severe quality control checks to ensure regulatory compliance.

- Thus, the rising adoption of cold forgings in engine components due to their use in compressor rotors is driving the market.

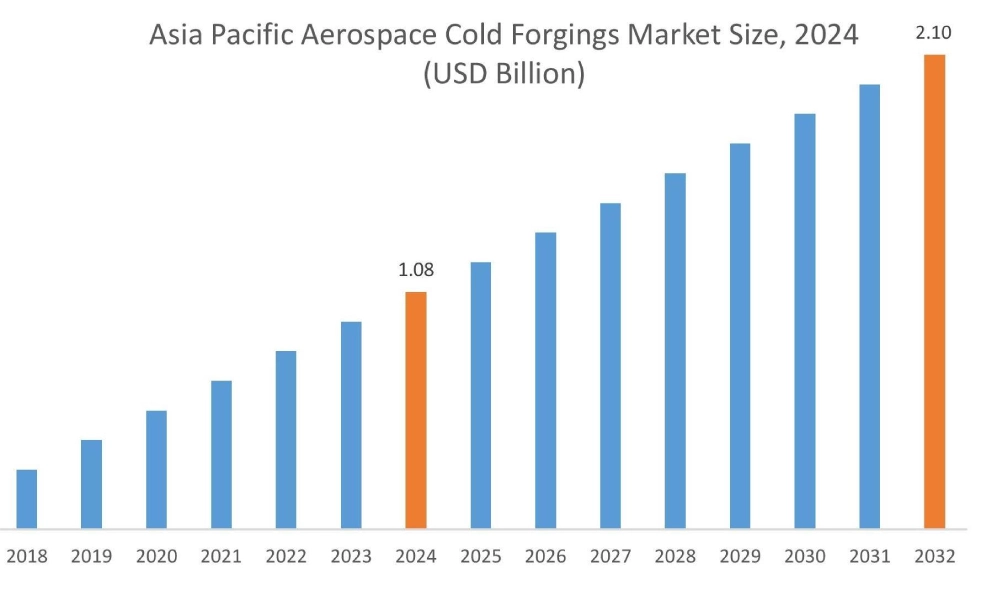

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

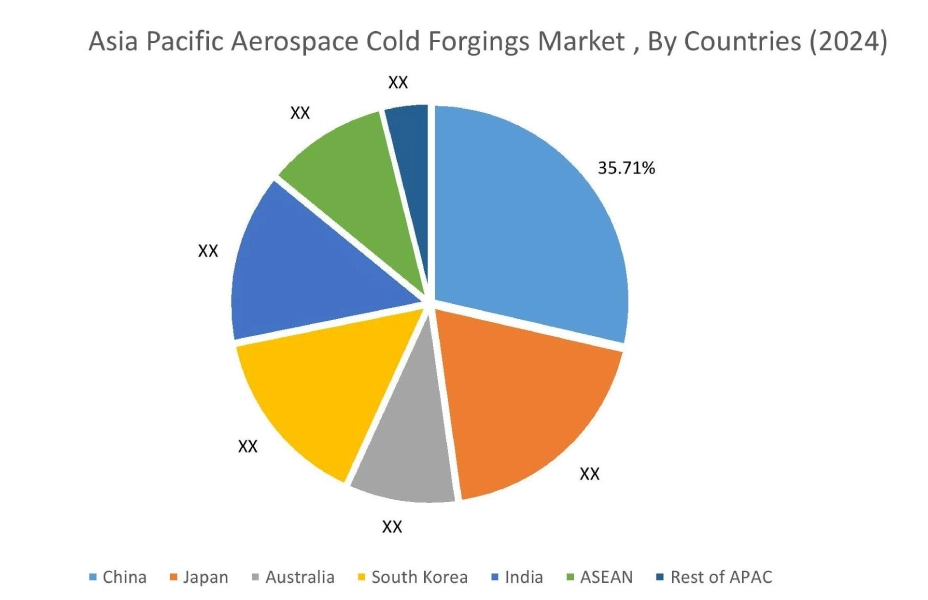

Asia Pacific region was valued at 1.08 Billion in 2024. Moreover, it is projected to grow by 1.16 Billion in 2025 and reach over 2.10 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.71%. As per the aerospace cold forgings market analysis, the growth in the Asia-Pacific region is primarily driven by the rising aviation market and increasing reliance on aircraft for domestic travel.

- For instance,according to Boeing, the South Asia region is poised to become the fastest-growing commercial aviation market over the next 20 years. The growing aviation market is expected to boost the cold forgings market in aerospace, as airplanes use cold forged steel and titanium alloys in the airframes.

North America is estimated to reach over USD 2.25 Billion by 2032 from a value of USD 1.19 Billion in 2024 and is projected to grow by USD 1.26 Billion in 2025. In North America, the growth of the aerospace cold forgings industry is driven by the growing investments to make aircraft lighter. Moreover, the increasing number of investments in airport infrastructure to improve passenger experience has resulted in the rise of the aerospace sector, in turn driving the cold forgings market share.

- For instance,in September 2024, the U.S. Department of Transportation’s Federal Aviation Administration announced approximately USD 2 billion in grants to improve the airport infrastructure in the country. The investment in airport infrastructure is expected to boost the overall market as more passengers travel via airplanes due to better airport facilities.

Additionally, the regional analysis depicts that the growing adoption of cold-forged aluminum is driving the aerospace cold forgings market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to rising income levels. Middle East and African regions are expected to grow at a considerable rate due to factors such as rising urbanization levels and increasing disposable income, among others.

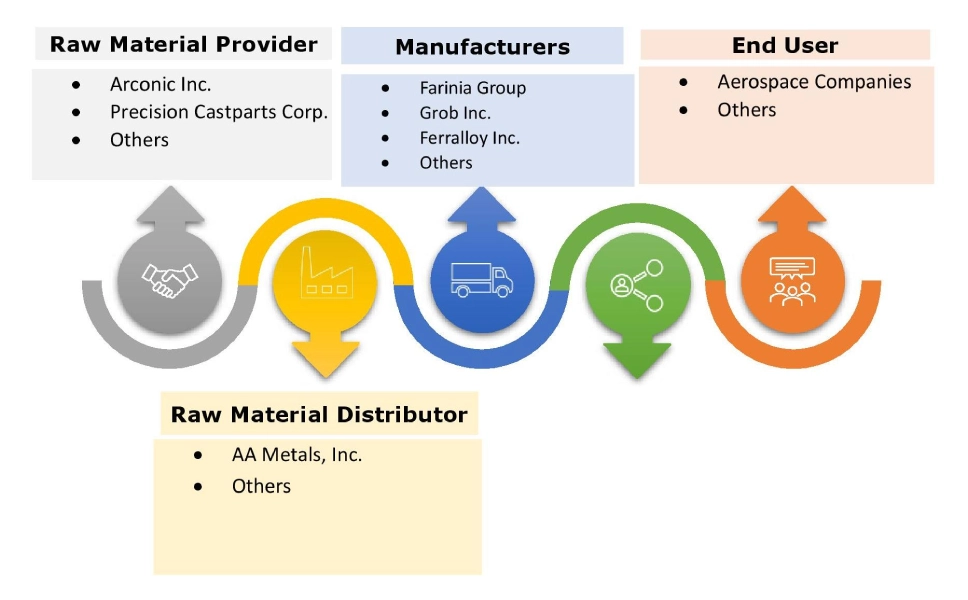

Top Key Players and Market Share Insights:

The global aerospace cold forgings market is highly competitive, with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the aerospace cold forgings market. Key players in the aerospace cold forgings industry include-

- Farinia Group (France)

- VSMPO-AVIMSA Corporation (Russia)

- ATI (U.S.)

- Scot Forge Company (U.S.)

- ACE Forge Pvt. Ltd. (India)

- Grob Inc. (U.S.)

- Ferralloy Inc. (U.S.)

- FINECS CO. LTD. (Japan)

- Bharat Forge (India)

- FORCEBEYOND (U.S.)

Recent Industry Developments :

- In February 2025,Bharat Forge Ltd. and Liebherr-Aerospace & Transportation SAS announced their collaboration to establish a manufacturing facility in India. The new facility will incorporate advanced forging techniques for the production of aircraft components.

- In April 2025,Omni-Lite Industries, a designer and manufacturer of aerospace components using hot and cold forming, announced the acquisition of Electronic Components, Inc. The acquisition was valued at approximately USD 350,000 and was an all-cash transaction. Further, the acquisition aims to boost Omni-Lite’s visibility within the high-performance electronics space in the Aerospace sector.

Aerospace Cold Forgings Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 6.81 Billion |

| CAGR (2025-2032) | 9.1% |

| By Material |

|

| By Type |

|

| By Aircraft Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the aerospace cold forgings market? +

The aerospace cold forgings market is estimated to reach over USD 6.81 Billion by 2032 from a value of USD 3.60 Billion in 2024 and is projected to grow by USD 3.84 Billion in 2025, growing at a CAGR of 9.1% from 2025 to 2032.

Which is the fastest-growing region in the aerospace cold forgings market? +

Asia-Pacific region is experiencing the most rapid growth in the aerospace cold forgings market.

What specific segmentation details are covered in the aerospace cold forgings market report? +

The aerospace cold forgings market report includes material, type, aircraft type, application, and region.

Who are the major players in the aerospace cold forgings market? +

The key participants in the aerospace cold forgings market are Farinia Group (France), Grob Inc. (U.S.), Ferralloy Inc. (U.S.), FINECS CO. LTD. (Japan), Bharat Forge (India), FORCEBEYOND (U.S.), VSMPO-AVIMSA Corporation (Russia), ATI (U.S.), Scot Forge Company (U.S.), ACE Forge Pvt. Ltd. (India), and Others.