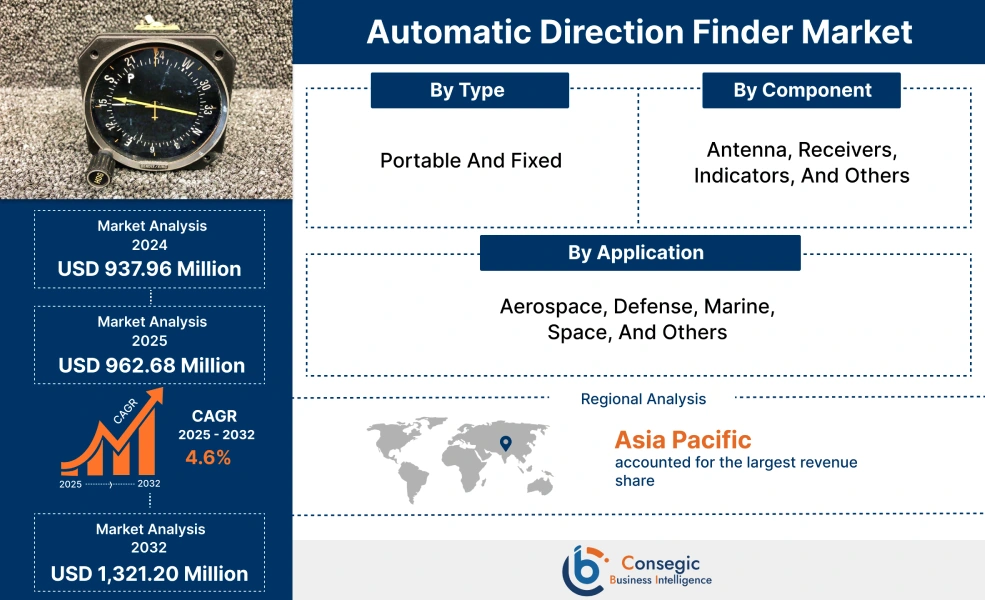

Automatic Direction Finder Market Size:

Automatic Direction Finder Market size is estimated to reach over USD 1,321.20 Million by 2032 from a value of USD 937.96 Million in 2024 and is projected to grow by USD 962.68 Million in 2025, growing at a CAGR of 4.6% from 2025 to 2032.

Automatic Direction Finder Market Scope & Overview:

Automatic direction finder is a radio navigation instrument that receives radio signals from non-directional beacons (NDB) or AM broadcast stations. The key components of an automatic direction-finding system include antenna, receivers, indicators, and others, which are for navigating or holding patterns using NBDs. Moreover, it facilitates high-performance navigational systems for a wide range of industries including aerospace, automotive, defense, marine, space, and others. Further, advancements in automatic direction finding system with improved signal processing and advanced antenna systems are prime factors driving the global automatic direction finder market.

How is AI Transforming the Automatic Direction Finder Market?:

The integration of AI is significantly transforming the automatic direction finder market. AI is increasingly used in automatic direction finders for improving signal processing, direction estimation, and overall system performance, particularly in complex and challenging environments. Moreover, AI algorithms can analyze signals with greater efficiency than traditional methods. This includes identifying patterns, filtering out noise, and predicting signal behavior, which leads to more accurate direction finding.

Additionally, the integration of AI in automatic direction finder offers a range of benefits, including enhanced signal processing, improved accuracy, multiple signal tracking, autonomous operation, real-time data sharing, and others. Consequently, the aforementioned factors are expected to drive the market growth in upcoming years.

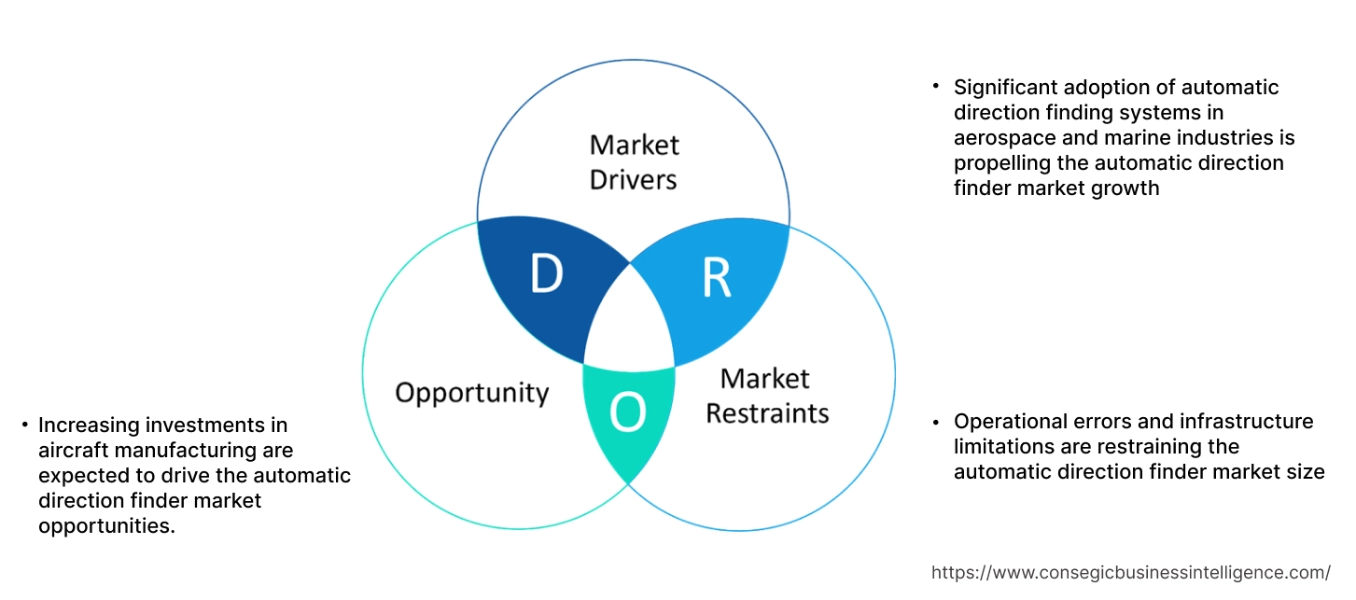

Automatic Direction Finder Market Dynamics - (DRO) :

Key Drivers:

Significant adoption of automatic direction finding systems in aerospace and marine industries is propelling the automatic direction finder market growth

The rising adoption of automatic direction finding system in aerospace and marine industries is driven by their reliance on non-directional beacons for navigation. Automatic direction finding systems are utilized in aerospace to determine the angle between the aircraft heading and the direction of the radio beacon. Moreover, in the marine industry, direction finders including emergency position-indicating radio beacons transmit signals for navigation by assisting search and rescue teams in locating vessels in distress.

- For instance, Mitsubishi Electronics, a Japanese multinational electronics manufacturing company specializing in marine electronics, offers a digital automatic radio direction finder TD-L2200 for the marine industry. The TD-L2200 direction finder consists of loop antennas to determine the direction of radio signals.

Thus, the increasing adoption of automatic direction finding systems in marine and aviation sectors is propelling the automatic direction finder market expansion.

Key Restraints:

Operational errors and infrastructure limitations are restraining the automatic direction finder market size

Automatic direction finding systems rely on radio signals to determine the direction. However, operational errors like quadrantal error, dip error, and sky wave interface cause misinterpretation of the bearing. Moreover, dip errors in direction finders are caused when the aircraft is titled on one side, which causes the ADF loop to be at a different angle from the beacon, in turn leading to a deflected needle.

Additionally, at night ionosphere reflects radio waves causing them to return to the receiver, which interferes with the direct ground signal, leading to inaccurate bearings. Therefore, operational errors and infrastructure limitations are hindering the automatic direction finder market.

Future Opportunities :

Increasing investments in aircraft manufacturing are expected to drive the automatic direction finder market opportunities.

Automatic direction finders are navigation systems used in aircraft to determine an aircraft’s bearing relative to non-directional bearing. Moreover, direction finders offer a wide range of features like continuous signal reception, bearing calculation by the receiver, and automatic tracking. Additionally, automatic direction finding system helps the pilot with precise positioning, especially in poor visibility during adverse connections.

- For instance, in March 2025, General Aerospace invested USD 88.39 Million in its European manufacturing facilities to increase its aircraft production capacity, ensuring quality for commercial and defense customers.

Therefore, increasing investments in aircraft manufacturing are projected to boost the automatic direction finder market opportunities during the forecast period.

Automatic Direction Finder Market Segmental Analysis :

By Type:

Based on type, the market is segmented into portable and fixed.

Trends in the type:

- There is a rising trend towards the adoption of portable direction finders, due to its exceptional direction finding accuracy for a wide frequency range.

- Increasing trend in the adoption of fixed direction finders in aviation, marine, and aerospace industries, due to its ability to provide stable and accurate view of radio signals, is driving the automatic direction finder market growth.

Fixed segment accounted for the largest revenue in the overall automatic direction finder market share in 2024.

- Fixed direction finders refer to systems that determine the direction of radio signals by utilizing a stationary antenna array.

- Moreover, fixed direction finders offer a variety of key features like multi-beacon direction finders, compact antenna units, 360-degree direction ability, and others.

- Additionally, the control unit in fixed direction finder optimizes advanced beam forming technology to reduce system noise.

- For instance, HR Smith Group of Companies, a U.S.-based company offers a fixed direction-finding system for providing real-time relative bearing information, including comprehensive information on the beacon’s location.

- Hence, rising advancements associated with fixed automatic direction finders are driving the market growth.

Portable segment is anticipated to register a substantial CAGR growth during the forecast period.

- Portable direction finders are increasingly used in the aviation and marine sectors to determine the direction of incoming radio signals.

- Functions including advanced direction finding, enhanced navigation, and improved signal detection are increasing the demand for direction finders.

- For instance, Rohde & Schwarz offers R&S MP007 portable direction finding system, featuring real-time position fixing and integration capabilities.

- Hence, increasing innovations related to portable direction finders are projected to drive the automatic direction finder market size during the forecast period.

By Component:

Based on component, the market is segmented into antenna, receivers, indicators, and others.

Trends in component:

- Rising trend in the utilization of direction finders based on advanced techniques like pseudo doppler direction finding technique, correlative infometer, and others is driving the market.

- Increasing adoption of receivers, due to its advanced AI integration with other navigation systems like global positioning systems, is driving the automatic direction finder market trends.

Antenna segment accounted for the largest revenue share in the overall automatic direction finder market share in 2024.

- In an automatic direction finding system, antenna plays a crucial role in determining the relative bearing that processes signals to calculate the direction which is further displayed on the direction finder indicator.

- Moreover, automatic direction finding systems utilize two types of antennae, including a loop antenna and a sense antenna.

- Loop antennas are used to navigate the direction of radio signals while sense antennas help to settle ambiguity in the direction.

- For instance, Collins Aerospace’s ADF-900 model of direction finder utilizes DFA-901 antenna, which offers a wide range of key features like 190 to 1799 kHz tuning range, enhanced built-in test equipment, improved power interrupt, and others.

- Therefore, rising advancements related to antennas are driving the market.

Receivers segment is anticipated to register the fastest CAGR growth during the forecast period.

- In an automatic direction finding system, the receiver is one of the key components, which encompasses a tuning system, an antenna system, and a bearing indicator.

- Moreover, receivers are tuned to a particular frequency of the selected non-directional beacon that decodes the radio signals emitted by specific NBD.

- For instance, Gabbles Engineering offers a B737 Nav VHF automatic direction finding system that includes tuning control for distance measuring equipment (DME) receivers. Moreover, DME systems are specialized navigational receivers used within the automatic direction finding system to provide accurate information.

- Therefore, there is a rise in adoption of receivers in direction finders, which is projected to drive the market adoption during the forecast period.

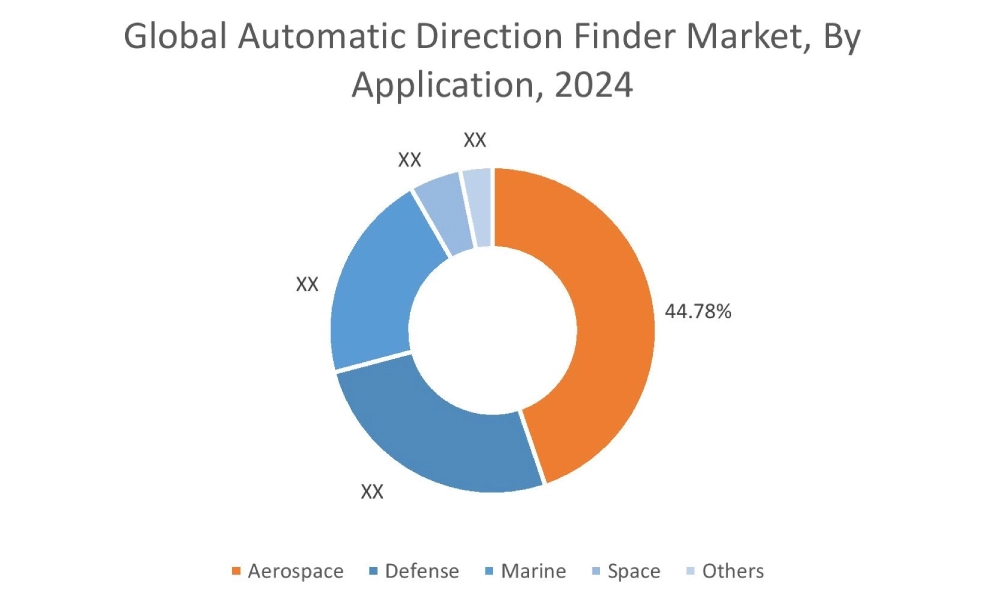

By Application:

Based on application, the market is segmented into aerospace, defense, marine, space, and others.

Trends in application:

- Increasing use of direction finders in aerospace for fixing positions, en-route navigation, and others is driving the automatic direction finder market trends.

- Features like real-time position fixing, wide frequency range, and improved direction finding accuracy are driving the utilization of automatic direction finding systems in the marine industry.

Aerospace segment accounted for the largest revenue share of 44.78% in the overall automatic direction finder market in 2024.

- Direction finder is commonly used in aerospace for en-route navigation approach procedures and backup navigation in cases of the global positioning system and very high-frequency omnidirectional range failure.

- Moreover, one of the driving factors for the utilization of detection finders in aerospace includes their ability to operate in a higher frequency range.

- For instance, Canyon’s FliteLine automatic direction finding system is an all-digital navigation aid for aircraft, which provides accurate bearing information from ground-based beacons.

- Hence, according to automatic direction finder market analysis, the rising adoption of direction finders in the aerospace sector is driving the market.

Marine segment is anticipated to register the fastest CAGR growth during the forecast period.

- In the marine industry, automatic direction finders are commonly used to tune to non-directional beacons that operate in the low-frequency band.

- Moreover, direction finders are widely used by observation ships in remote areas under challenging conditions to help ships avoid collisions and navigate in adverse weather conditions.

- For instance, Mitsubishi Electronics produces a wide range of products including automatic direction finding systems for the marine industry. Moreover, Mitsubishi Electronic’s direction finder offers several benefits like efficient scanning and searching, integration within multiple systems, and others.

- Therefore, the increasing adoption of direction finders in the marine sector is projected to boost the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

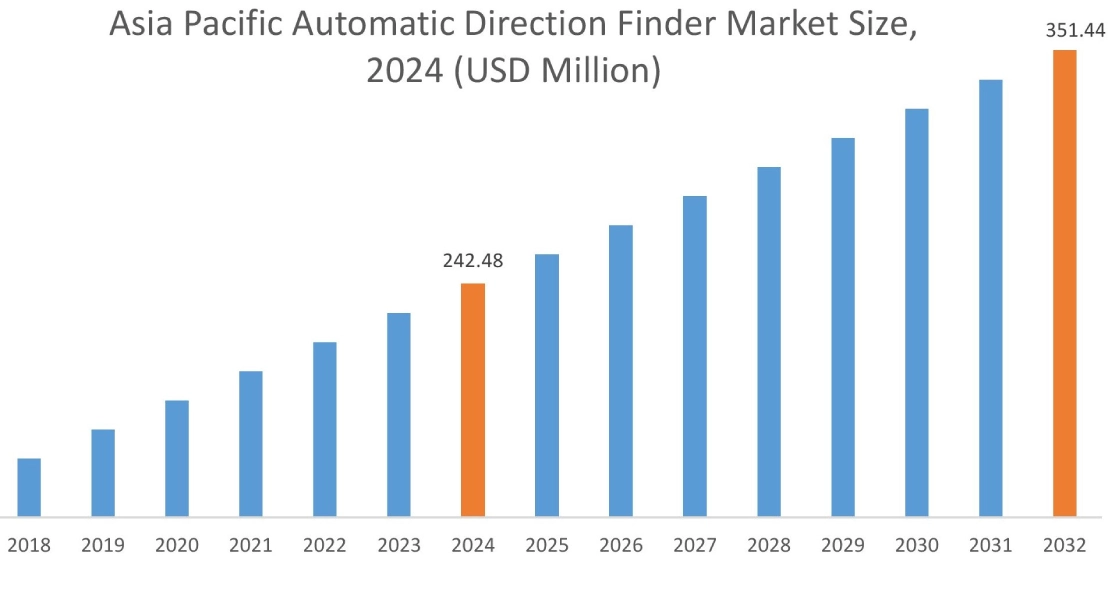

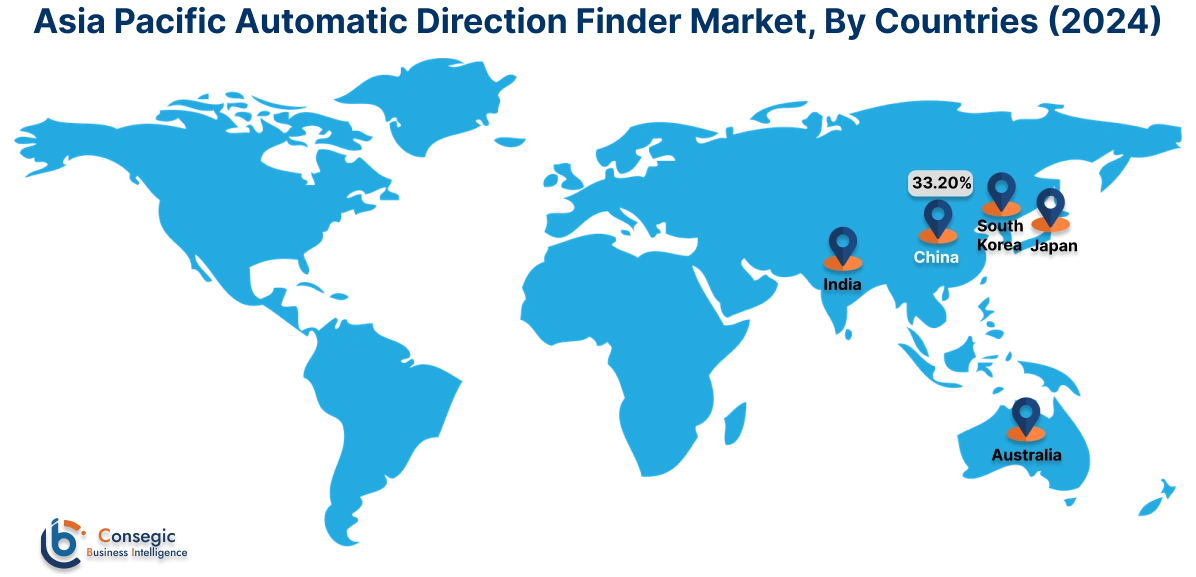

Asia Pacific region was valued at USD 242.48 Million in 2024. Moreover, it is projected to grow by USD 249.47 Million in 2025 and reach over USD 351.44 Million by 2032. Out of this, China accounted for the maximum revenue share of 33.20%. As per automatic direction finder market analysis, the adoption of automatic direction finding systems in the Asia-Pacific region are primarily driven by its ability to operate in low and medium frequency bands. Additionally, the rising adoption of automatic direction finding systems in aerospace and marine sectors is further accelerating the automatic direction finder market expansion.

- For instance, Shoghi Communications, an Indian defense technology company based in Shimla, India offers very high frequency (VHF) and ultra-high frequency (UHF) direction finders within the range of 20MHz to 8GHhz. The above factors are driving the market in the Asia-Pacific region.

North America is estimated to reach over USD 444.98 Million by 2032 from a value of USD 316.69 Million in 2024 and is projected to grow by USD 324.97 Million in 2025. In North America, the adoption of direction finders is driven by their reliability in providing navigational guidance and their ability to integrate with other navigation systems. Moreover, the increasing integration of automatic direction finders in the aerospace and defense sectors is contributing to the automatic direction finder market demand.

- For instance, Collins Aerospace, a U.S.-based aerospace company, generated a revenue of USD 80,738 Million in 2024. Moreover, Collins Aerospace provides automatic direction finders for multiple industries like aerospace, defense, marine, and others.

Additionally, the regional analysis depicts that the growing adoption of automatic direction-finding systems in marine and aerospace sectors, due to their wide frequency range, is driving the automatic direction finder market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as rising investments in aerospace and defense sectors and the growing need for reliable direction identification solutions in aforementioned industries among others.

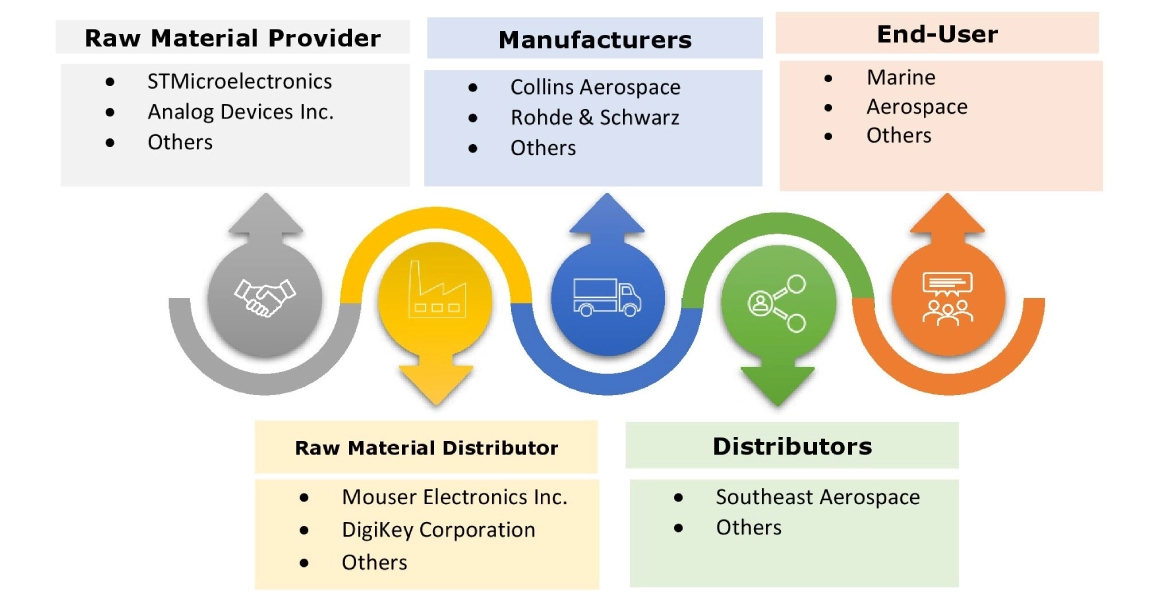

Top Key Players and Market Share Insights:

The automatic direction finder market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the automatic direction finder industry. Key players in the automatic direction finder industry include-

- Collins Aerospace (U.S.)

- Rohde & Schwarz (Germany)

- Narda (Germany)

- Aeroexpo (France)

- Gables Engineering (U.S.)

- Mid-Continent Instrument Co, Inc. (U.S.)

- Northrop Grumman (U.S.)

- Honeywell International Inc. (U.S.)

- Rhotheta (Germany)

- Thales (France)

Recent Industry Developments :

Product Launch:

- In February 2022, Rohde & Schwarz announced the launch of a direction finding and monitoring system R&S ADD557SR, which features a bandwidth range of 20 MHz to 6 GHz. The system also integrates a separate antenna output that can be utilized independently of direction finding.

Automatic Direction Finder Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,321.20 Million |

| CAGR (2025-2032) | 4.6% |

| By Type |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the automatic direction finder market? +

The automatic direction finder market was valued at USD 937.96 Million in 2024 and is projected to grow to USD 1,321.20 Million by 2032.

Which is the fastest-growing region in the automatic direction finder market? +

Asia-Pacific is the region experiencing the most rapid growth in the automatic direction finder market.

What specific segmentation details are covered in the automatic direction finders report? +

The automatic direction finders report includes specific segmentation details for type, component, application, and region.

Who are the major players in the automatic direction finder market? +

The key participants in the automatic direction finder market are Collins Aerospace (U.S.), Rohde & Schwarz (Germany), Mid-Continent Instrument Co, Inc. (U.S.), Northrop Grumman (U.S.), Honeywell International Inc. (U.S.), Rhotheta (Germany), Thales (France), Narda (Germany), Aeroexpo (France), Gables Engineering (U.S.), and others.