Automotive 3D Printing Market Size:

Automotive 3D Printing Market size is estimated to reach over USD 15.58 Billion by 2032 from a value of USD 3.80 Billion in 2024 and is projected to grow by USD 4.47 Billion in 2025, growing at a CAGR of 21.6% from 2025 to 2032.

Automotive 3D Printing Market Scope & Overview:

3D Printing, also known as additive manufacturing, refers to a technique of production that involves creating 3D objects from a design file, often a Computer-Aided Design (CAD) file. 3D printing offers many advantages over traditional manufacturing in the automotive sector. It allows for the precise printing or manufacturing of complex parts that are otherwise very hard to manufacture through traditional methods. The automotive sector uses technology for the precise manufacturing of parts used in vehicles, resulting in lighter parts that use less raw material, resulting in efficiency. Automotive additive manufacturing also offers rapid prototyping, which allows engineers to see and understand how a product works in the initial stages of product development.

Automotive 3D Printing Market Dynamics - (DRO) :

Key Drivers:

Rising Adoption of Automotive 3D Printing for Reducing Development Time is Propelling the Automotive 3D Printing Market Growth

3D Printing is now being used in the automotive sector for streamlining operations by reducing the amount of time it takes for a product to be developed, as the parts are developed rapidly with a high level of customization. Automotive additive manufacturing allows for rapid prototyping, which has become useful for engineers to visualize and see how a part works before actually using it in product development. This has significantly reduced the time it takes to develop a product.

- For instance, Czinger uses 3D printing for its cars to go from the design phase to the materialization phase, resulting in reduced time in the overall process.

Hence, the growing use of additive manufacturing to reduce product development time is driving the adoption of 3D printing, in turn, proliferating the automotive 3D printing market size.

Key Restraints:

High Initial Investment Cost is Restraining the Automotive 3D Printing Market Growth

The implementation of additive manufacturing in the automotive sector is often associated with certain operational limitations and challenges, which are the primary factors restraining the market. 3D printing for the automotive sector requires high initial investment and implementation costs. The 3D printing system also requires additional ongoing costs related to maintaining and upgrading the software that integrates with the 3D printers.

Moreover, automotive 3D printers can be quite complex and challenging to implement, as the system usually requires a skilled and trained workforce to effectively utilize the technology. Furthermore, automotive 3D printers make it possible to copy any object without the knowledge of the innovator of that object, who holds a patent for the technology of the object. Infringement of intellectual property through the copying of the object without the innovator’s permission makes it challenging for manufacturers to use the technology. Thus, high initial investment costs and intellectual property infringements act as a restraint to the growth of the automotive 3D printing market.

Future Opportunities :

Adoption of 3D Printing for Electric Vehicles is Expected to Drive the Automotive 3D Printing Market Opportunities

Electric Vehicle manufacturers are frequently investing in the development of new technologies associated with automotive additive manufacturing to ensure their safe and effective utilization in their electric vehicles. Automotive 3D printing makes it possible to manufacture vehicle parts that are lighter than their traditionally manufactured counterparts, making it ideal for use in electric vehicles.

- For instance, Pix Moving announced a 3D printed automobile called the Robo-EV, which uses 3D metal printing technology to achieve one-piece molding in vehicle structures.

Thus, the rising technological advancements associated with 3D printing for electric vehicles are projected to drive the automotive 3D printing market opportunities during the forecast period.

Automotive 3D Printing Market Segmental Analysis :

By Component:

Based on the component, the market is segmented into hardware and software.

Trends in the component:

- Increasing technological advancements associated with 3D printing software, like the integration of cloud, among others.

- Rising utilization of automotive 3D printers for rapid prototyping of parts and tooling to improve operational efficiency is driving the automotive 3D printing market trends.

Hardware accounted for the largest revenue share in the market in 2024.

- Automotive additive manufacturing hardware is designed to assist manufacturers in creating parts used in vehicles with high precision.

- It helps manufacturers rapidly develop the parts and test the parts in real-world conditions, which can vastly improve the speed of moving from design to development phase.

- Additionally, automotive 3D printing is utilized in the manufacturing of other parts in the production phase with the help of custom positioning or assembling jigs.

- For instance, Toyota factories in Poland utilized 3D printers made by Zortrax to make positioning and assembling jigs tailored to the needs of Toyota.

- According to the market analysis, the rising advancements related to hardware due to increased speed and production of assembling or positioning are driving the automotive 3D printing market trends.

Software is anticipated to register the fastest CAGR during the forecast period.

- Automotive 3D printing has seen increasing use of software to design products with features like built-in templates for specific use cases in automobiles.

- The integration of cloud technologies to allow manufacturers to remotely monitor, store, and sharing of printing data has made it easier to track projects effectively.

- For instance, Cloud 3D Print offers a cloud-based SaaS that allows users to access, manage, and monitor 3D printing their projects remotely.

- Moreover, the integration of IoT sensors with software has made it possible to deliver real-time information about the 3D printers and material usage.

- Thus, the rising use of 3D printing software due to cloud-based options and integration of IoT sensors is driving the adoption of automotive 3D printing, in turn, propelling the market during the forecast period.

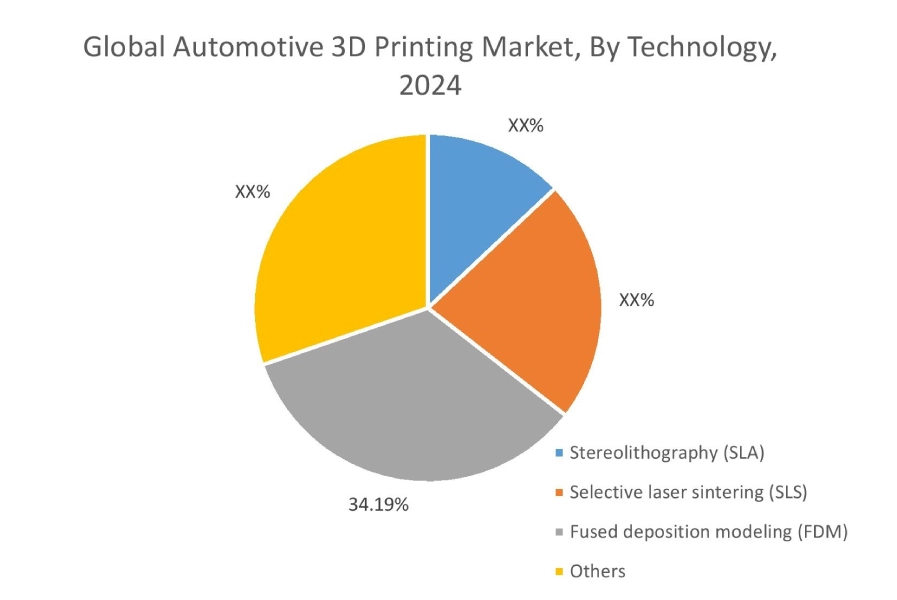

By Technology:

Based on the technology, the market is segmented into Stereolithography (SLA), Selective Laser Sintering (SLS), Fused Deposition Modeling (FDM), and others.

Trends in technology:

- Rising trend towards adoption of Stereolithography (SLA) due to the features available for design prototypes and testing of mechanical parts.

- Fused Deposition Modelling (FDM) is being used for short-run testing, creating custom vehicle interiors, creating customer assembly, and production jigs, which has resulted in its growth.

Fused Deposition Modelling (FDM) accounted for the largest revenue share of 34.19% in the year 2024.

- FDM allows cheaper prototyping of products through the use of thermoplastics, making it easier to produce parts for the automotive sector.

- Factors including affordability of FDM technology, lower training costs, and the availability of cheap replacement parts make FDM 3D printers ideal for small businesses.

- FDM makes it possible to build large models of tools and products, which isn’t possible with other types of 3D printers, making it prevalent in the automotive sector.

- For instance, Stratasys offers FDM 3D printers with powder bed technology, which can be used for high-volume production capabilities in the automotive sector.

- According to the analysis, increasing advancements associated with Fused Deposition Modelling due to its affordability and use in the printing of large models are driving the automotive 3D printing market expansion.

Stereolithography (SLA) is anticipated to register the fastest CAGR during the forecast period.

- SLA 3D printers offer more precision compared to other printing technologies, making them suitable for the automotive sector.

- SLA 3D printers are faster to use and prototype a product, and they can speed up the process of producing a component from the design phase to the development phase.

- Many businesses today in the automobile industry are using SLA 3D printers to design and develop exterior and interior parts of a car, like door handles, charging ports for electric vehicles, and rear view mirrors.

- For instance, for the new Ford Explorer, the Ford team utilized SLA 3D printing to prototype many parts of the car, like assembling the rear view mirror.

- According to the automotive 3D printer market analysis, the increasing advancements related to Stereolithography (SLA) printing are anticipated to boost the automotive 3D printer market during the forecast period.

By Vehicle type:

Based on the vehicle type, the market is segmented into Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EV).

Trends in the vehicle type:

- Increasing adoption of automotive additive manufacturing in ICE vehicles for improving the durability of components and faster prototyping is driving the automotive 3D printing market demand.

- Factors including growing investments in additive manufacturing for use in electric vehicles due to printing of lighter and cheaper mechanical parts are driving the segment.

Internal Combustion Engine (ICE) vehicles accounted for the largest revenue share in the year 2024.

- ICE cars refer to cars that ignite and combust fuel in the engine, typically gasoline, diesel, or other fuels.

- ICE cars comprise the majority market in the car segment owing to the better fuel range and low cost. This makes the automotive additive manufacturing market for ICE cars dominant due to the growing need for prototyping of parts quickly and effectively.

- Many ICE manufacturers today use 3D printing technology in some capacity to assemble parts through custom jigs that are manufactured using 3D printing, driving the automotive 3D printing market expansion.

- For instance, RMC Motorsport used 3D printing technology in manufacturing their rally cars to reduce production times and manufacturing costs.

- Therefore, the increasing adoption of printing technology in the manufacturing of cars is driving the automotive 3D printing market size.

Electric vehicles is anticipated to register the fastest CAGR during the forecast period.

- Many electric car manufacturers are moving to automotive additive manufacturing for the production of parts that are lighter, making energy consumption in the cars more efficient.

- Automotive additive manufacturing requires less raw materials compared to manufacturing through traditional methods, making it environmentally friendly and the ideal choice for EV car manufacturers, resulting in growth.

- For instance, BMW for its i4 series used a 3D printed gripper for chassis construction in operation. Using this gripper, the assembly floor of the BMW i4 can be held and moved.

- Moreover, many EV manufacturers are integrating software tools with 3D printing for optimized tools or bionic structures, given the features and flexibility offered in the software tools.

- According to the automotive 3D printing market analysis, the rising number of electric vehicles is driving the adoption of additive manufacturing, in turn, propelling the market during the forecast period.

By Application:

Based on the application, the market is segmented into rapid prototyping, tooling, research & development, manufacturing of complex objects, and others.

Trends in the application:

- Rapid prototyping is one of the biggest use cases of 3D printers in the automotive industry, as it allows quick prototyping of different components compared to traditional methods.

- 3D printed tools have seen a rise in the production stage as the tools that are used are tailored to the needs of vehicles, allowing manufacturers to produce multiple parts at once.

Rapid Prototyping accounted for the largest revenue share in the year 2024.

- The dominance of rapid prototyping is attributed to the rising trend of utilizing 3D printing solutions in the design and prototyping of components, often within a day, making it easier to see and test how a component works quickly.

- Engineers had to rely on iterations that involved mockups and clay models crafted with detail, which was time-consuming before rapid prototyping became possible.

- The integration of computer-aided design (CAD) allows engineers to import the design file into their 3D printer software, which they then can use to print.

- For instance, Formlabs offers a suite of SLS and SLA 3D printers for rapid prototyping to print prototypes within a day and carry out multiple iterations of different designs and sizes from CAD to physical object quickly.

- Therefore, the increasing development of automotive additive manufacturing for utilization in rapid prototyping due to quick designing and printing of components is propelling the market.

Tooling is anticipated to register the fastest CAGR during the forecast period.

- Tooling refers to the production of functional tools used during the assembly or manufacturing phase of the production, like molds.

- 3D-printed tools offer durability and better functionality owing to the fact that they are custom-made and produced quickly, which reduces production time.

- For instance, EOS offers tooling and mold making for building parts like tire mold inserts, which often have complex shapes.

- Hence, the growing demand for the tooling segment due to printing of molds is projected to increase the utilization of the automotive 3D printing market during the forecast period.

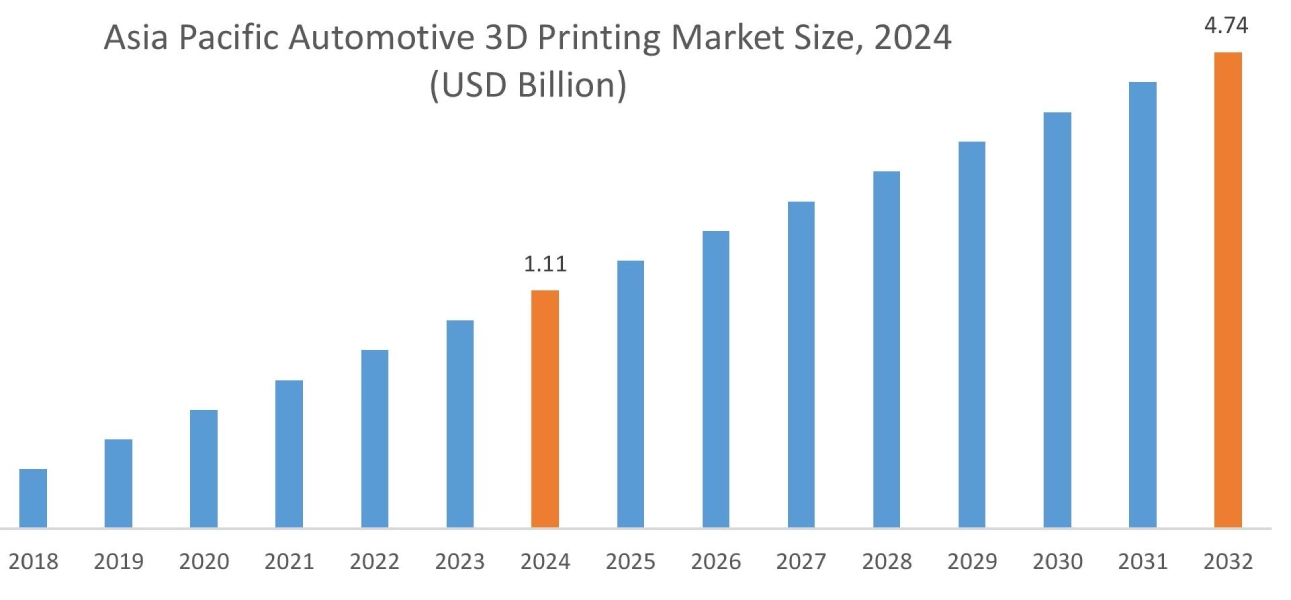

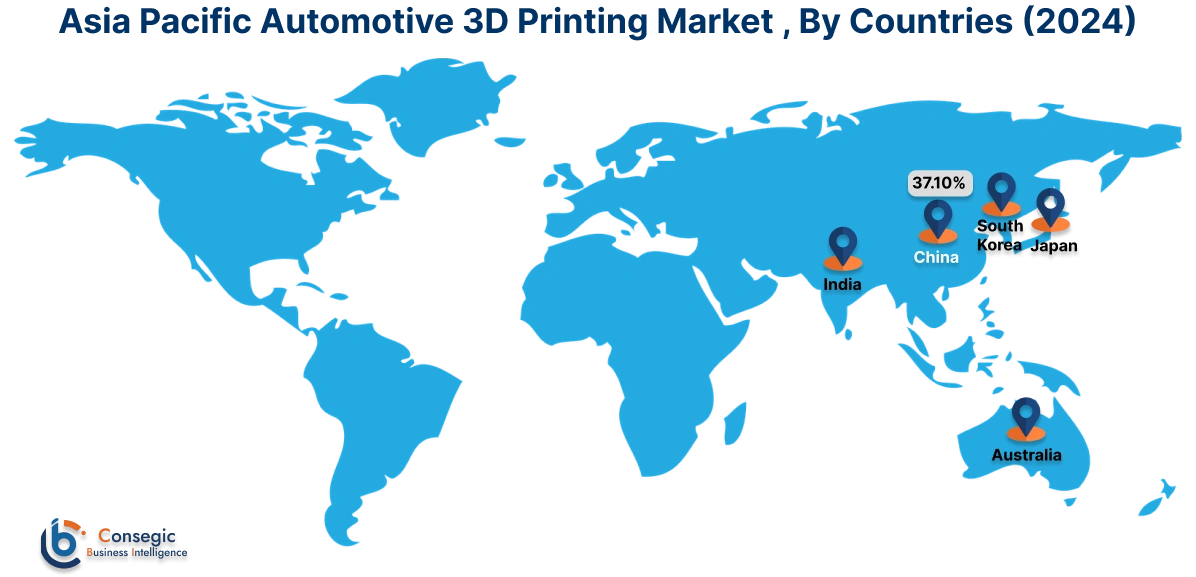

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at 1.11 Billion in 2024. Moreover, it is projected to grow by 1.31 Billion in 2025 and reach over 4.74 Billion by 2032. Out of this, China accounted for the maximum revenue share of 37.10%. As per the automotive 3D printing market analysis, the growth in adoption of 3D printing solutions in the Asia-Pacific region is primarily driven by the rising adoption of 3D printing for research and development of new parts and growing car and bike ownership in the region.

- For instance, according to Invest ASEAN, the combined vehicle sales in the 6 major ASEAN nations increased from 2.7 million units in 2021 to 3.4 million in 2022. The growing demand for vehicles is expected to boost the 3D printers market as the parts used in vehicles can be produced quickly using the 3D printers.

North America is estimated to reach over USD 5.19 Billion by 2032 from a value of USD 1.26 Billion in 2024 and is projected to grow by USD 1.49 Billion in 2025. In North America, the growth of the automotive 3D printing industry is driven by the growing investments in 3D printing technology. Moreover, the increasing adoption of 3D printing in the automotive sector for streamlining operations in the design and assembly phase has resulted in the rise of the automotive 3D printing market share.

- For instance, the United States filed the most number of patents for 3D printing technology, as per a report by OECD. The growth in the number of patents shows the increasing investments and innovation in 3D printing, which is driving the automotive 3D printing market share.

Additionally, the regional analysis depicts that the growing adoption of 3D printing in the electric vehicle segment is driving the automotive 3D printing market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to the rising adoption of 3D printers for use in the production of passenger cars. Middle East and African regions are expected to grow at a considerable rate due to factors such as growing ownership of automobiles and the rising automotive manufacturing sector, among others.

Top Key Players and Market Share Insights:

The global automotive 3D printing market is highly competitive, with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the automotive 3D printing market. Key players in the automotive 3D printing industry include-

Recent Industry Developments :

Collaboration:

- In January 2025, 3D Systems announced a collaboration with Daimler to facilitate remote printing of spare parts. The collaboration aims to combine Daimler’s expertise in the production and maintenance of buses and trucks with 3D Systems’ expertise in 3D printing to manufacture spare parts.

Automotive 3D Printing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 15.58 Billion |

| CAGR (2025-2032) | 21.6% |

| By Component |

|

| By Technology |

|

| By Vehicle type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Automotive 3D Printing market? +

The automotive 3D printing market is estimated to reach over USD 15.58 Billion by 2032 from a value of USD 3.80 Billion in 2024 and is projected to grow by USD 4.47 Billion in 2025, growing at a CAGR of 21.6% from 2025 to 2032.

Which is the fastest-growing region in the automotive 3D printing? +

Asia-Pacific region is experiencing the most rapid growth in the automotive 3D printing market.

What specific segmentation details are covered in the automotive 3D printing market report? +

The automotive 3D printing market report includes component, technology, vehicle type, application, and region.

Who are the major players in the automotive 3D printing market? +

The key participants in the automotive 3D printing market are Zortrax (Poland), 3Dgence (U.S), Stratasys (U.S.), ExOne (U.S), Dassualt Systemes (France), EOS GMBH (Germany), Autodesk Inc. (U.S.), Raise 3D Technologies Inc. (U.S.), Aurum 3D (India), Zongheng 3D (China), and Others.