Automotive Lighting Market Scope & Overview:

The automotive lighting system is a combination of lighting systems attached to the vehicle that is used by drivers to illuminate the lane and recognize the road, obstacles and traffic signs. Also, lights are used for applications such as headlamp lighting systems, rear lighting systems, interior lighting systems and others.

The lighting system comes in various types such as LED and halogen to offer superior efficiency and brightness. Moreover, the key advantages of lighting systems include easy installation, energy efficiency, longer lifespan, improved colling system, waterproof, faster respond time and more.

Furter, the rising need to ensure proper visibility at night and enhances the visibility of the vehicle to other drivers drives the automotive lighting market demand. Furthermore, regulatory compliance is also propelling manufacturers to adhere to the rules and regulations which in turn is driving the automotive lighting market growth.

Automotive Lighting Market Size:

Automotive Lighting Market is estimated to reach over USD 54.88 Billion by 2032 from a value of USD 34.06 Billion in 2024 and is projected to grow by USD 35.56 Billion in 2025, growing at a CAGR of 6.7% from 2025 to 2032.

How is AI Transforming the Automotive Lighting Market?

The use of AI is emerging in automotive lighting market, specifically for enhancing safety, improving driver experience, and allowing advanced features. Moreover, intelligent automobile lighting systems, powered by AI and sensor fusion, can automatically adjust beam patterns to optimize visibility and even predict and adapt to road conditions based on navigation data. This includes features such as adaptive headlights that adjust to road curves and oncoming traffic, and systems that detect pedestrians and automatically adjust lighting to improve safety. Consequently, the above factors are expected to positively impact the market growth in upcoming years.

Automotive Lighting Market Dynamics - (DRO) :

Key Drivers:

Technological Advancement in Automotive Lighting Fuels Market Growth

The transition from traditional halogen lights to advanced LED lights, OLED lights and others is enhancing the lighting system as well as improving safety is driving the automotive lighting market growth. Moreover, the high-end luxury vehicles prefer LED lights and dynamic lighting system due to improved brightness and visibility is propelling the automotive lighting market demand. Additionally, the matrix LED automatically adjusts the brightness as per the road conditions providing illumination without blinding the driver from opposite direction.

- For instance, in July 2023, HELLA partnered with Porsche, to jointly develop high resolution matrix LED technology for automotive vehicle. The lighting system has over 32,000 individually controllable pixels per headlamp. Additionally, the space required for the light module has been reduced by up to 75 percent.

Hence, the advancement in the lighting system as well as the rising adoption of LED lights is driving the progress of automotive lighting market.

Key Restraints:

Increased Fuel Consumption and Complexity in Retrofitting Hinders The Market Growth

Daytime running lights are low-power lights which automatically starts when a vehicle's engine is turned on and DRL’s are designed to make a vehicle more visible to other drivers during the day. Also, DRLs increases fuel consumption by 1-3% compared to vehicles without them in turn hindering the automotive lighting market expansion. Moreover, DRL system incurs huge cost specially for commercial vehicles, restraining the automotive lighting market expansion.

Additionally, the retrofitting complexity starts with the electrical cables which are different in old and modern vehicles increasing the complexity of retrofitting. Moreover, modern lighting system incurs huge cost which also include customization of old vehicle to fit the modern LED lights restraining the market progress.

Therefore, increased fuel consumption due to DRL’s and increased cost of retrofitting old vehicles with modern LED lights is restraining the market growth.

Future Opportunities :

Lidar lighting system is expected to promote potential opportunities for market growth

LiDAR utilizes laser pulses to detect objects, obstruction driving the adoption of technology in autonomous vehicles for improving safety and performance of vehicles. Moreover, LiDAR integrated headlamps help in detecting obstacles, person and other in low-visibility conditions, increasing the reliability of LiDAR, which in turn, is propelling the automotive lighting market opportunities. Additionally, LiDAR enhances 360 degrees viewing with the integration with autonomous driving assistance system (ADAS) in turn fueling the automotive lighting market opportunities.

- For instance, in April 2024, Marelli collaborated with Hesai to integrate automotive grade lidar with Marelli's innovative headlamp. The lidar integrating headlamp enables object detection and ranging for advanced driver-assistance systems (ADAS) and autonomous driving functionalities.

Hence, the integration of LiDAR with the lighting system as well as ADAS is anticipated to increase the utilization of LiDAR lighting system in turn promoting prospect for market development during the forecast period.

Top Key Players and Market Share Insights:

The global automotive lighting market is highly competitive with major players providing automotive lighting to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the automotive lighting industry. Key players in the automotive lighting market include-

- OSRAM GmbH (Germany)

- Sumedh Automotive Industries (India)

- Ushio America, Inc. (USA)

- BrightView Technologies, Inc. (USA)

- ORACLE Lighting (USA)

- Delta Tech Industries (USA)

- Stanley Co., Inc. (USA)

- Lumileds Holding B.V. (USA)

- Koninklijke Philips N.V. (Netherlands)

- HORPOL A. Horeczy Sp. k. (Europe)

Automotive Lighting Market Segmental Analysis :

By Technology:

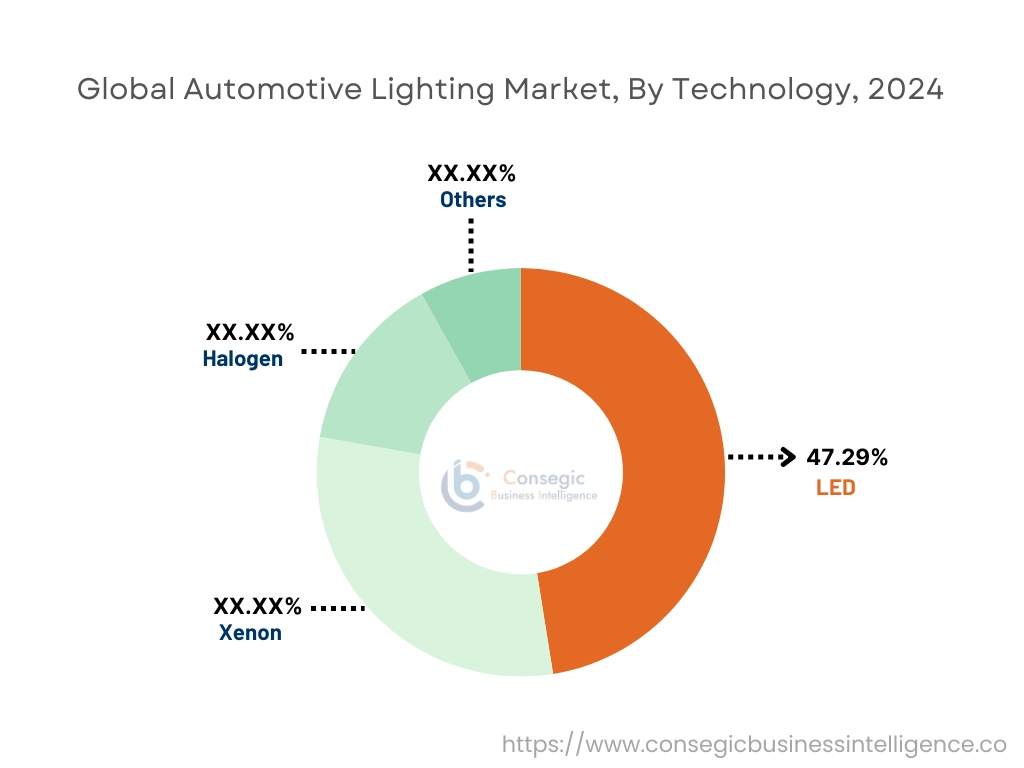

Based on the technology, the market is segmented into Led, Xenon, Halogen And Other.

Trends in Technology:

- The cost-sensitive segment of the market drives the adoption of halogen lights, which in turn propels the market.

- Xenon lights produces brighter illumination as compared to halogen driving the adoption of Xenon lights in the market.

LED accounted for the largest revenue share of 47.29% in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Automotive LED lighting systems ensure that the lighting devices mounted on different directions of the vehicle meet the highest standards for achieving performance and reliability.

- Moreover, the key advantages of LED lights include longer lifespan, energy efficiency, flexibility, easy installation and increased brightness among others. Also, LED lights reduce power consumption, increases lifecycle, offers design freedom and improves overall control which in turn boost the automotive lighting market size.

- Further, the progress of electric vehicles is propelling automakers to adopt LED lights which in turn is propelling the automotive lighting market share. Furthermore, the technological advancement in LED lights such as matric LED light, LiDAR LED lights and more is fueling the progress of LED segment.

- For instance, in November 2024, Melexis collaborated with Geely Automotive Group for adoption of Melexis’ MLX81116 Smart RGB LED driver in the new Z10 model, the first EV by Lynk & Co.

- Thus, according to the automotive lighting market analysis, development of electric vehicles and technological advancement in the LED lighting system is in turn driving the market.

By Vehicle Type:

Based on the vehicle type, the market is bifurcated into passenger vehicle and commercial vehicle.

Trends in the Vehicle Type:

- The trend towards rising need for electric vehicles with advanced LED lighting systems is driving the progress of passenger vehicle segment.

- The rising focus towards safety regulations and durability is driving the adoption of advanced lighting system into commercial vehicles.

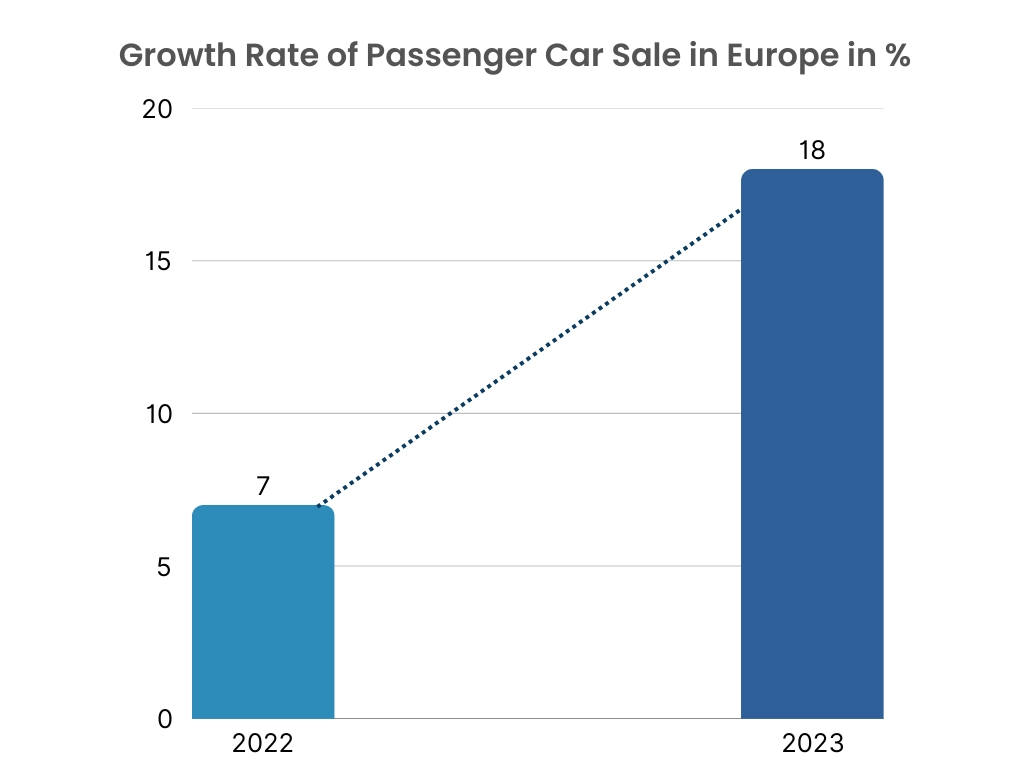

The passenger vehicle accounted for the largest revenue share in the year 2024.

- The stringent rules and regulations across the globe is propelling the adoption of DRL’s, adaptive lighting and brighter rear light to improve safety.

- Further, the proliferation of electric vehicles is propelling the progress of passenger vehicles which in turn is boosting the automotive lighting market share.

- Furthermore, the consumer shift towards adoption of advanced lighting system for headlamps and rear lighting mounted on luxury and electric vehicles drives the automotive lighting market size.

- For instance, According to International organization of Motor Vehicle Manufacturers, the European region has witnessed a significant progress rate of passenger car sales in the year 2022 to 2023 which has increased from 7% to 18% driving the progress of passenger car sales.

- Thus, according to the automotive lighting market analysis, the development of electric vehicles and adoption of advanced LED lighting system is driving the passenger vehicle segment progress.

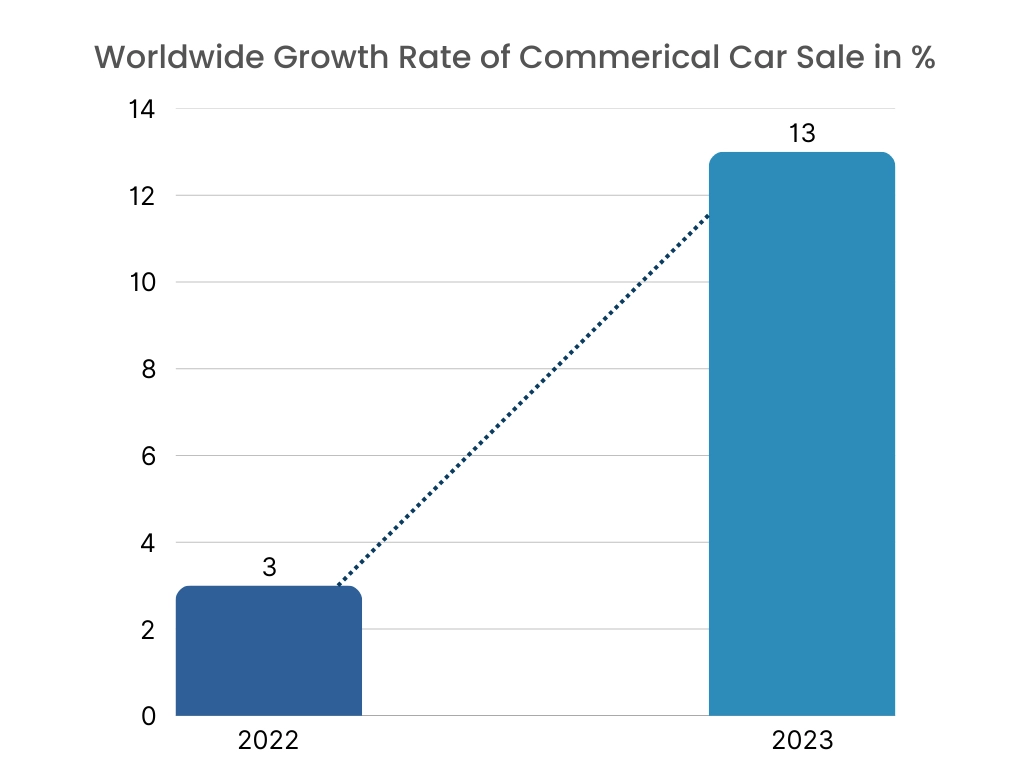

The commercial vehicle is anticipated to register the fastest CAGR during the forecast period.

- A commercial vehicle is any motor vehicle designed and primarily used for transporting goods, passengers, or services that generate income.

- Moreover, the types of commercial vehicles include cargo trucks, tippers, tractors, pickups, buses.

- Additionally, the key advantages of commercial vehicles include increased efficiency, cost effectiveness, flexibility and control, and revenue generation among others.

- Further, the key factors driving the adoption of commercial vehicles include the growing economies worldwide, expanding logistics and e-commerce business, rising safety standards and others.

- For instance, According to International Organization of Motor Vehicle Manufacturers, the commercial vehicle sale across the world has witnessed a significant growth rate which has increased from 3% to 13% in the year 2022 to 2023, driving the progress of commercial vehicle sales.

- Therefore, as per the market analysis, the expanding logistics and e-commercial business and growing economies among others is anticipated to boost the market during the forecast period.

By sales channel:

Based on the sales channel, the market is bifurcated into OEM and aftermarket.

Trends in the Sales Channel:

- The trend towards adoption of OLED lighting is propelling OEM to advance the lighting system to offer enhanced energy efficiency, longevity, flexibility and other benefits.

- The trend towards customization of vehicles and growing e-commerce business is driving the progress of aftermarket segment.

OEM accounted for the largest revenue share in the year 2024.

- OEM stands for original equipment manufacturer which produces components for other companies integration into their products.

- The advantages of OEM in the market include reduced development time, availability, cost effective, enhanced quality, reliability and others driving the adoption of OEM for lighting system in automotive.

- Further, the key role of OEM in the lighting market is to provide high quality lighting systems to the automotive industry as well as drive innovation in the lighting system such as Matrix LED light and others.

- For instance, in September 2024, Orion Energy Systems, Inc. secured a USD 2 Million contract for management, installation, and contracting of LED lighting systems across multiple manufacturing facilities in the United States.

- Thus, as per the market analysis, the rising demand for high quality lighting systems as well as driving innovation in the lighting system is boosting the OEM segment progress.

Aftermarket is anticipated to register the fastest CAGR during the forecast period.

- The aftermarket segment is a secondary market for automotive parts such as accessories, spare parts, lighting systems, music systems and more as well as providing service of mounting the parts as per the requirement.

- Moreover, the expanding e-commerce business is propelling the aftermarket segment to cater to a larger customer base as well as providing affordable lighting solution.

- Further, the growing culture towards retrofitting or customizing or tuning the old vehicles with advanced features drives the adoption of aftermarket parts which are cost effective and are durable.

- For instance, in July 2023, Continental which is a provider of OE-engineered aftermarket parts launched NightViu Lighting Solutions line designed for automobile, truck, and agriculture/construction equipment manufacturers. Also, the lighting system aims to help improve operational safety by dramatically increasing nighttime visibility.

- Therefore, as per the marker analysis, the growing culture towards retrofitting or customizing or tuning as well as expanding e-commerce business is anticipated to boost the market during the forecast period.

By Application:

Based on the application, the market is segmented into headlamp light, rear light, side light and interior light.

Trends in the Application:

- The trend towards adoption of ambient lighting system in the interior of vehicles is driving the automotive lighting market trend.

- The increasing adoption of daytime running lights which utilizes LED technology used for improving vehicle visibility is driving the automotive lighting market trend.

Headlamp light accounted for the largest revenue share in the year 2024.

- The headlamp lights are positioned at the front of the vehicle, playing a primary role of enhancing visibility and ensuring safety as well as helping drivers navigate safely.

- The primary role of headlamp lights includes enhanced illumination, increased vehicle visibility, enhanced aesthetics and communication with other drivers among others.

- Further, the growing demand for high quality advanced LED lighting systems as well as expanding electric vehicles and luxury vehicles sales is propelling the progress of headlamp light segment in automotive lighting industry.

- For instance, in July 2023, Marelli launched h-Digi microLED designed for digital front lighting for automotive vehicles. The lighting system includes 40,000 LED pixels to create flexible light distribution of low-beam and high-beam, which adapt to driving situations.

- Thus, as per the market analysis, the advancement in the LED lighting system as well as growing popularity of electric vehicles is driving the headlamp light segment.

Rear light is anticipated to register the fastest CAGR during the forecast period.

- Automobile rear lights include turn signal lights, brake lights, position light, rear fog light, reversing light and others. Also, rear lights provide vital data to other drivers by indicating movements such as slowing down.

- Further, the rising adoption of OLED lights as rear lights in electric vehicles and luxury vehicles is driving the market progress for rear lighting system.

- Furthermore, the evolution of connected vehicles and autonomous vehicles is propelling the adoption of rear lighting system which in turn is driving market progress.

- For instance, in October 2024, OLEDWorks supplies Atala OLED rear light panels to upgraded 2024 Audi Q7 SUV. The Q7 model provides options to select digital OLED rear lights.

- Therefore, as per the market analysis, the evolution of connected vehicles and autonomous vehicles as well as rising adoption of OLED lights is anticipated to boost the market during the forecast period.

Automotive Lighting Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 54.88 Billion |

| CAGR (2025-2032) | 6.7% |

| By Technology |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

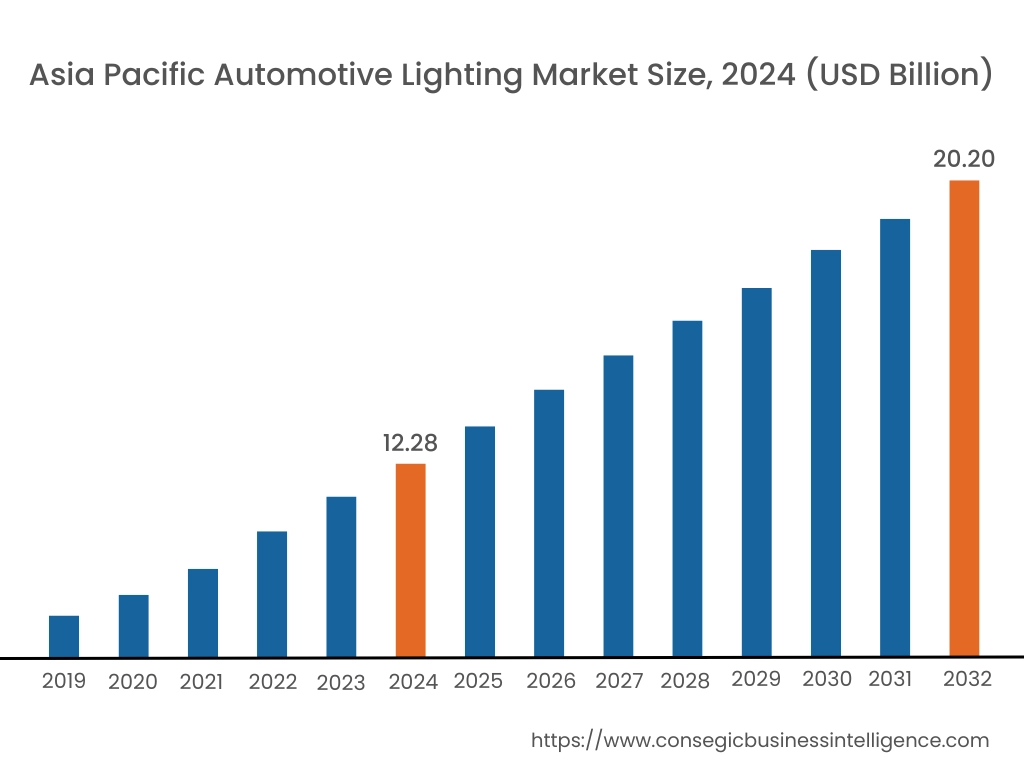

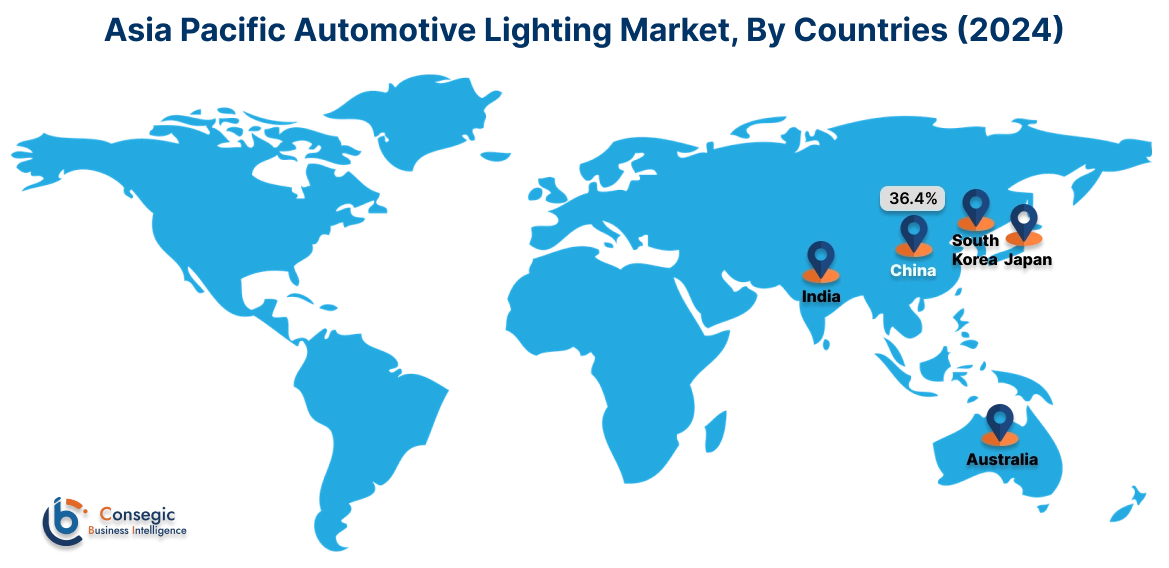

Asia Pacific region was valued at USD 12.28 Billion in 2024. Moreover, it is projected to grow by USD 12.85 Billion in 2025 and reach over USD 20.20 Billion by 2032. Out of this, China accounted for the maximum revenue share of 36.4%. The market is mainly driven by its rising adoption in electric vehicles and luxury vehicles as well as increasing sales and production of passenger and commercial vehicles among others. Furthermore, factors including technological advancement in the LED and OLED lighting system are projected to drive the market in Asia Pacific during the forecast period.

- For instance, in January 2025, according to IBEF, India automotive industry achieved a significant milestone in the year 2024 for the sale of 13,25,112 EVs. Also, total production of automotive vehicles reached 1,56,22,388 units.

North America is estimated to reach over USD 16.47 Billion by 2032 from a value of USD 10.30 Billion in 2024 and is projected to grow by USD 10.74 Billion in 2025. The North American region's growing adoption of adaptive lighting system as well as advanced LED lighting system offer lucrative growth prospects for the market. Additionally, the evolution of high-end vehicles and electric vehicles is driving market.

- For instance, according to International Organization of Motor Vehicle Manufacturers, the automotive production reached 19,136,891 units in the year 2023 which has increased by 22% from the year 2020.

The regional evaluation depicts that the European region is the manufacturing hub for various automotive manufacturers which in turn is driving the market Progress. Additionally, the market in the Middle East and African region is driven by rising demand for luxury and sports vehicles due to rapidly changing infrastructure. Further, the progress of aftermarket sales and retrofitting of old vehicles is paving the way for the progress of market in Latin America region.

Recent Industry Developments :

Product Launch:

- In July 2024, FUJIFILM Healthcare announced the U.S. launch of APERTO Lucent, a powerful open 0.4T MRI system. This new MRI system, with its RADAR motion compensating technology, enhances image quality by reducing the need for rescans, ultimately improving diagnostic accuracy and efficiency.

Key Questions Answered in the Report

How big is the automotive lighting market? +

The Automotive Lighting Market is estimated to reach over USD 54.88 Billion by 2032 from a value of USD 34.06 Billion in 2024 and is projected to grow by USD 35.56 Billion in 2025, growing at a CAGR of 6.7% from 2025 to 2032.

What specific segmentation details are covered in the automotive lighting report? +

The automotive lighting report includes specific segmentation details for technology, vehicle type, sales channel, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the automotive lighting market, the rear light is the fastest-growing segment during the forecast period due to the growth of connected vehicles and autonomous vehicles as well as rising adoption of OLED lights.

Who are the major players in the automotive lighting market? +

The key participants in the automotive lighting market are OSRAM GmbH (Germany), Sumedh Automotive Industries (India), Delta Tech Industries (USA), Stanley Co., Inc. (USA), Lumileds Holding B.V. (USA), Koninklijke Philips N.V. (Netherlands), HORPOL A. Horeczy Sp. k. (Europe), Ushio America, Inc. (USA), BrightView Technologies, Inc. (USA), ORACLE Lighting (USA) and others.

What are the key trends in the automotive lighting market? +

The several key trends in the automotive lighting market including trend towards adoption of ambient lighting system in the interior of the vehicles as well as rising adoption of OLED lighting is propelling OEM to advance the lighting system to offer enhanced energy efficiency, longevity, flexibility and other benefits are the key trends driving the market.