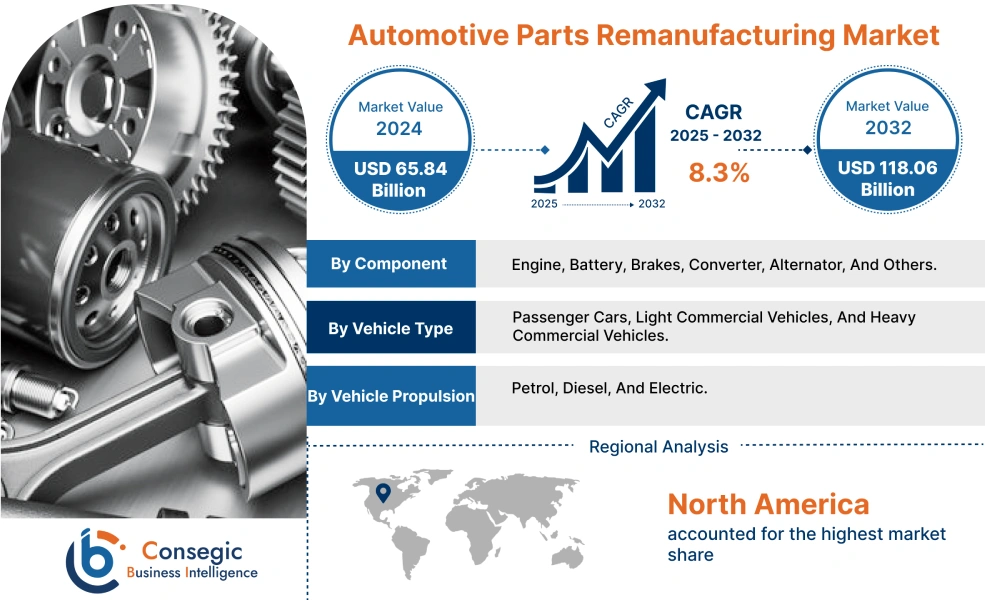

Automotive Parts Remanufacturing Market Size:

Automotive Parts Remanufacturing Market size is estimated to reach over USD 118.06 Billion by 2032 from a value of USD 65.84 Billion in 2024 and is projected to grow by USD 69.55 Billion in 2025, growing at a CAGR of 8.3% from 2025 to 2032.

Automotive Parts Remanufacturing Market Scope & Overview:

Automotive parts remanufacturing refers to the process where used or worn-out automotive parts are replaced with new-like condition and are then sold in the market. Moreover, the remanufacturing process involves various stages such as disassembly, cleaning, reassembling, testing, packaging, distribution, and others. Additionally, remanufacturing of automotive parts is less expensive than new parts, which makes it cost-effective. Automotive parts remanufacturing offers various benefits such as quality control, environmental assurance, low-cost value, design enhancements, and others.

Automotive Parts Remanufacturing Market Dynamics - (DRO) :

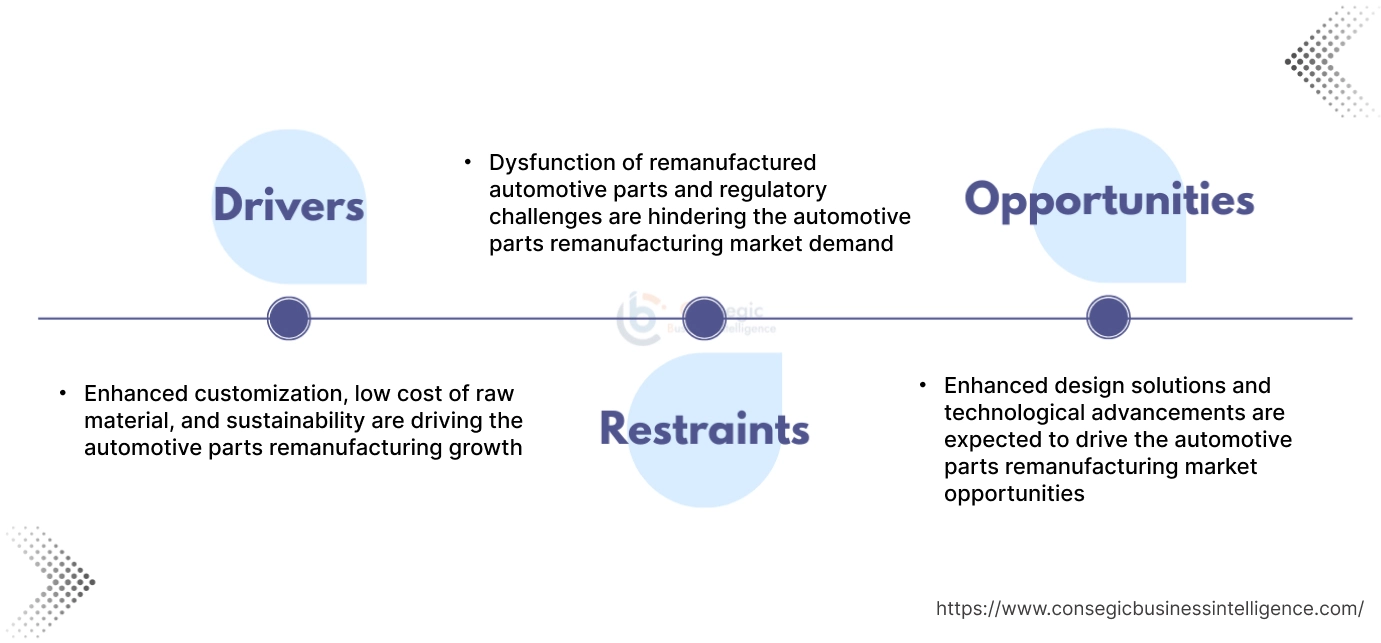

Key Drivers:

Enhanced customization, low cost of raw material, and sustainability are driving the automotive parts remanufacturing growth

Automotive parts remanufacturing refers to replacing dysfunctional components and replacing it with new products. Remanufacturing of automotive parts offers various benefits such as enhanced customization, low cost of raw materials, and sustainability. Moreover, remanufactured parts result in less environmental impact in comparison to the new automotive parts, leading to a sustainable environment. Additionally, remanufacturing allows customization as per the specific requirements, which involves modifying components and redesigning, in turn leading to reduced costs.

- For instance, Remante Group S.R.O is a European company involved in remanufacturing of automotive components. The company contributes to a sustainable environment by reducing raw material production and fuel consumption costs by 80% and 55%, respectively.

Therefore, the above factors are driving the automotive parts remanufacturing market growth.

Key Restraints:

Dysfunction of remanufactured automotive parts and regulatory challenges are hindering the automotive parts remanufacturing market demand

Automotive parts remanufacturing often includes replacing the old worn-out parts with new components. However, businesses are hesitant to remanufacture automotive parts due to various concerns such as reliability and performance of the remanufactured parts. Moreover, remanufactured automotive parts must comply with varying regulations and standards across different regions and countries.

For instance, remanufactured automotive parts must comply with standards such as ISO/TS 16949:2009, and others. ISO/TS 16949:2009, in conjunction with ISO 9001:2008, specifies the quality management system requirements for design, development, and production of automotive-related products. Further, the ISO/TS 16949:2009 standard applies to organization sites where custom automotive parts, for production or service, are manufactured. Thus, the above factors are restraining the automotive parts remanufacturing market.

Future Opportunities :

Enhanced design solutions and technological advancements are expected to drive the automotive parts remanufacturing market opportunities

In automotive parts remanufacturing market, designing plays a vital role by ensuring enhanced features for customer satisfaction. Moreover, various technological advancements such as IoT (Internet of Things) sensors, automation, advanced driver assistance system (ADAS), and others are utilized for several types of vehicle modification. Additionally, modular design, a process of breaking down a vehicle into standardized modules, significantly benefits remanufacturing of automotive parts by enabling efficient disassembly, streamlined production, enhanced flexibility, and improved efficiency.

- For instance, Steallantis and Valeo launched world’s first remanufactured front camera in 2023. Moreover, due to the increasing demand for electrification of automobiles, Valeo expanded its portfolio by adding more electric vehicles and advanced driver assistance systems (ADAS).

Thus, according to the analysis, the rising investments in enhanced design solutions and technological advancements are anticipated to drive the automotive parts remanufacturing market opportunities.

Automotive Parts Remanufacturing Market Segmental Analysis :

By Component:

Based on component, the market is segmented into engine, battery, brakes, converter, alternator, and others.

Trends in the component:

- Rising adoption of alternators due to their durability, versatility, and improved operational efficiency is driving the market.

- Factors including cost effectiveness, improved performance, sustainability, and reliability are driving the utilization of remanufactured automotive parts.

Alternator segment accounted for the largest revenue share in the overall automotive parts remanufacturing market share in 2024.

- Alternator is a component in vehicles that converts mechanical energy into alternating current electricity.

- Moreover, remanufactured alternators offer various benefits including reduced raw material consumption, reduced carbon emissions, and lower energy consumption.

- Additionally, remanufactured alternators offer comparable performance and enhanced lifespan to refurbished alternators.

- For instance, Bosch offers various remanufactured alternators as a part of its eXchnange program, providing a cost-effective alternative to new parts of the vehicle repair. Moreover, these remanufactured alternators are designed for a good price-performance ratio, ensuring enhanced quality.

- Thus, increasing advancements associated alternator segment are driving the automotive parts remanufacturing market size.

Brakes segment is anticipated to register the fastest CAGR growth during the forecast period.

- Brakes in vehicles are an essential component for safety, which allows the driver to take control of the vehicle.

- Remanufactured brakes involve refurbishing brake components such as callipers, rotors, shoes, and others to meet original equipment specifications.

- Moreover, brake remanufacturing involves various stages like dismantling, inspection, testing, and cleaning of the product to ensure its safety and functional capacity.

- For instance, Valeo offers various remanufactured brake calipers as part of its remanufacturing program, which involves an all-brands approach.

- According to the analysis, the increasing adoption of remanufactured brakes in vehicles is propelling the market.

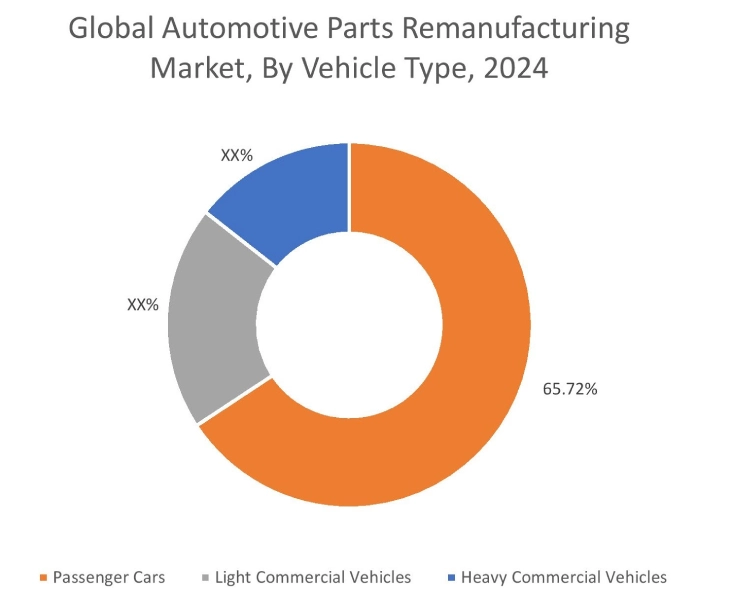

By Vehicle Type:

Based on vehicle type, the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Trends in the vehicle type:

- The rising trend in integration of advanced technologies in passenger cars, such as advanced materials and advanced driver assistance systems, is driving the automotive parts remanufacturing market growth.

- Key trends in the commercial vehicles segment include advancements in safety features, enhanced durability, flexibility, and rising adoption of advanced automobile systems.

Passenger cars segment accounted for the largest revenue share of 65.72% in the overall market in 2024.

- Passenger cars refer to motor vehicles that are designed for personal transportation, which primarily carry passengers rather than goods.

- In the automotive parts remanufacturing sector, various components of passenger cars are remanufactured, such as tires, brakes, suspension parts, and others which has worn out by deterioration due to constant friction and impact.

- Additionally, due to corrosion of metal parts in passenger cars, various components such as chassis and frames are replaced with new products to avoid any accidents.

- For instance, ZF Friedrichshafen AG offers hybrid and electric mobility systems for passenger cars. Moreover, ZF has a strong focus on remanufacturing car components by ensuring quality testing and customer-oriented programs.

- Therefore, the increasing utilization of remanufactured parts in the passenger car segment is driving the automotive parts remanufacturing market size.

Heavy commercial vehicles segment is anticipated to register substantial CAGR growth during the forecast period.

- Heavy commercial vehicles involve trucks, buses, and other heavy-duty vehicles, which are utilized for transporting heavy loads over long distances.

- Moreover, overloading and constant operation cause a huge impact on braking, steering, and engine of the heavy commercial vehicles, leading to frequent part replacements.

- In heavy commercial vehicles, various components like engines, transmissions, axles, and others are refurbished due to failure in the cylinder head, corrosion of metallic components, electric system failure, and others.

- For instance, Remante GmbH, a German-based remanufacturing company, offers remanufactured components for heavy commercial vehicles such as high-pressure pumps, gear actuators, brake calipers, EGR, injectors, turbochargers, and others.

- Therefore, the rising advancements in heavy commercial vehicle segment are expected to drive the automotive parts remanufacturing market trends during the forecast period.

By Vehicle Propulsion:

Based on vehicle propulsion, the market is segmented into petrol, diesel, and electric.

Trends in the vehicle propulsion:

- Increasing adoption of petrol and diesel vehicles, due to their several benefits, including increased availability of refueling stations, quicker acceleration, higher power output, and others.

- There is a rising trend towards adoption of electric vehicles, attributing to its lower emissions and eco-friendliness.

Petrol segment accounted for the largest revenue in the overall automotive parts remanufacturing market share in 2024.

- Petrol vehicle is a type of motor vehicle that utilizes a spark-ignited internal combustion engine, which is powered by petrol.

- Moreover, there are various causes of dysfunction in petrol cars, such as fuel pump failure, clogged fuel filter, clogged air filters, and engine problems.

- In petrol vehicle parts remanufacturing, core components such as engines, transmission components are disassembled, inspected, replaced, and tested, offering a cheaper alternative to new parts.

- For instance, according to the Press Information Bureau (PIB), the total registration of petrol vehicles and diesel vehicles in India in 2023 reached up to 1,80,56,749 units and 24,02,341 units respectively.

- Therefore, the above factors are driving the automotive parts remanufacturing market trends.

Electric segment is anticipated to register the fastest CAGR growth during the forecast period.

- Electric vehicles (EVs) convert electrical energy stored in batteries into mechanical energy, which further powers the wheels.

- In electric vehicle parts remanufacturing, components like electric motors, batteries, and others are remanufactured due to lower production costs and improved sustainability in manufacturing operations.

- For instance, according to the International Energy Agency, the total sales of battery electric vehicles (BEVs) in Europe reached 2.2 million units in 2023, demonstrating a substantial increase of 37.5% in comparison to 1.6 million units in 2022.

- Thus, according to the analysis, the rising adoption of electric vehicles is projected to drive the market growth during the forecast period.

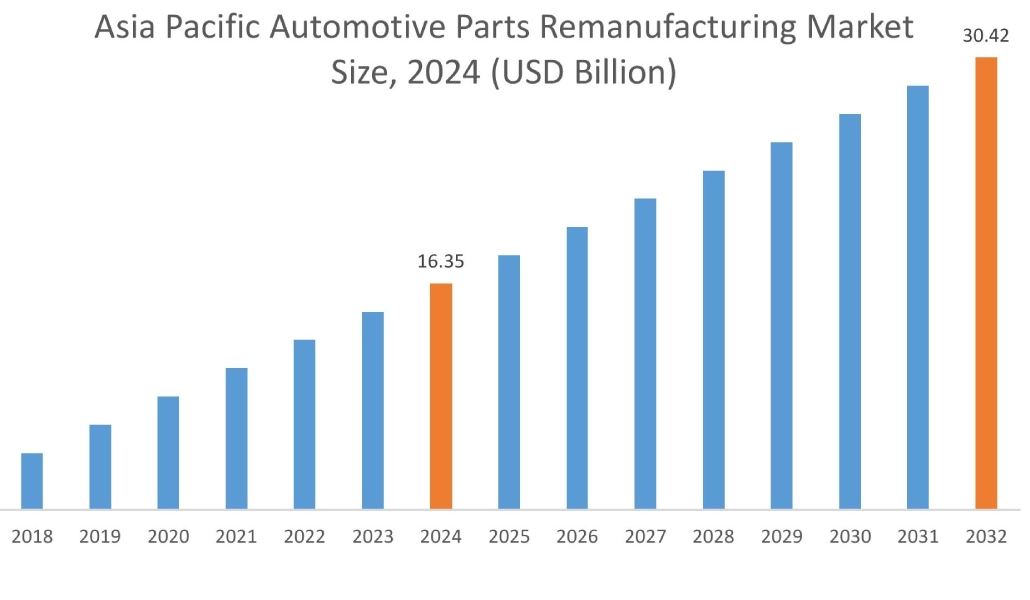

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

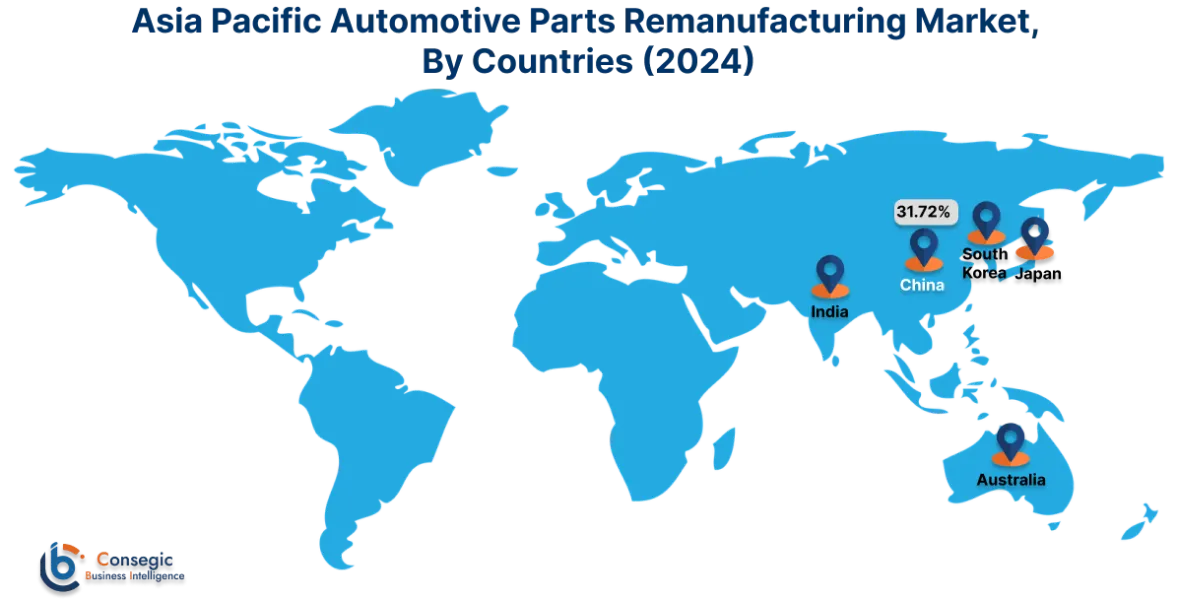

Asia Pacific region was valued at USD 16.35 Billion in 2024. Moreover, it is projected to grow by USD 17.32 Billion in 2025 and reach over USD 30.42 Billion by 2032. Out of this, China accounted for the maximum revenue share of 31.72%. As per the automotive parts remanufacturing market analysis, there is an increasing adoption of remanufactured automotive parts in the Asia-Pacific region, particularly in China and India, due to factors such as increased reliability, reduced cost, and improved part performance, among others. Additionally, the rising sustainability trends, growing EV industry, and favourable government measures for adoption of remanufactured automotive parts are further accelerating the automotive parts remanufacturing market expansion.

- For instance, Tata Motors, an Indian automobile manufacturer, remanufactured 25,807 units of commercial vehicle engines and 33,975 units of remanufactured clutch plates and clutch discs in the year 2023. Tata Motor’s ProLife initiative offers remanufactured engines, clutches, pressure plates, and truck cabins to improve fuel efficiency, enhance performance, and extend the engine’s lifespan.

North America is estimated to reach over USD 42.03 Billion by 2032 from a value of USD 23.67 Billion in 2024 and is projected to grow by USD 24.98 Billion in 2025. In North America, the development of the automotive parts remanufacturing industry is driven by rising vehicle demand, increasing automotive production, and growing need for advanced automobile components. Similarly, rising advancements related to enhanced modifications in passenger cars and increasing adoption of remanufactured battery components in electric vehicles are contributing to the automotive parts remanufacturing market demand.

- For instance, LKQ Corporation, a U.S. based remanufacturing company generated a total revenue of USD 14,355 Millions in the year 2024. Moreover, LKQ Corporation distributes a variety of remanufactured components such as transmissions, wheels, bumpers, and others.

Additionally, the regional analysis depicts that the prevalence of favourable government measures such as financial incentives, regulatory support, and environmental regulation for facilitating the adoption of electric vehicles is driving the automotive parts remanufacturing market expansion in Europe. Further, as per the automotive parts remanufacturing market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to growing automotive industry and increasing investments in electric vehicles and automotive part production, among others.

Top Key Players and Market Share Insights:

The global automotive parts remanufacturing market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the automotive parts remanufacturing market. Key players in the automotive parts remanufacturing include –

- Remante GmbH (Germany)

- ZF Friedrichshafen AG (Germany)

- Meritor Inc. (U.S.)

- BorgWarner Inc. (U.S.)

- Caterpillar (U.S.)

- Denso Corporation (Japan)

- AER Technologies, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Valeo SA (France)

- Hyundai Motor Group (Korea)

Recent Industry Developments :

Product Launch:

- In January 2024, Rolls-Royce announced its launch of remanufacturing and overhaul centres in the U.S. Moreover, this new centre integrates previously outsourced operations and aims to increase the availability of remanufactured engines and parts.

Automotive Parts Remanufacturing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 118.06 Billion |

| CAGR (2025-2032) | 8.3% |

| By Component |

|

| By Vehicle Type |

|

| By Vehicle Propulsion |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the automotive parts remanufacturing market? +

The automotive parts remanufacturing market was valued at USD 65.84 Billion in 2024 and is projected to grow to USD 118.06 Billion by 2032.

Which is the fastest-growing region in the automotive parts remanufacturing market? +

Asia-Pacific is the region experiencing the most rapid growth in the automotive parts remanufacturing market.

What specific segmentation details are covered in the automotive parts remanufacturing report? +

The automotive parts remanufacturing report includes specific segmentation details for component, vehicle type, vehicle propulsion, and region.

Who are the major players in the automotive parts remanufacturing market? +

The key participants in the automotive parts remanufacturing market are, Remante GmbH (Germany), ZF Friedrichshafen AG (Germany), Denso Corporation (Japan), AER Technologies, Inc. (U.S.), Robert Bosch GmbH (Germany), Valeo SA (France), Hyundai Motor Group (Korea), Meritor Inc. (U.S.), BorgWarner Inc. (U.S.), Caterpillar (U.S.) and others.