Offshore Containers Market Size:

Offshore Containers Market size is estimated to reach over USD 2.17 Billion by 2032 from a value of USD 1.30 Billion in 2024 and is projected to grow by USD 1.36 Billion in 2025, growing at a CAGR of 7.2% from 2025 to 2032.

Offshore Containers Market Scope & Overview:

An offshore container is a portable unit specially designed to transport equipment and materials to offshore structures such as oil rigs and wind farms. Also, the containers are built to withstand harsh offshore weather conditions, which in turn is fueling the offshore containers market demand. Additionally, the key advantages of such containers include ISO-certified, resistance to harsh conditions, high durability, and reliability, among others are driving the offshore containers market growth. Further, the rapid development of marine engineering is driving the demand for containers. Furthermore, increasing offshore activities is propelling the adoption of the offshore containers industry.

Offshore Containers Market Dynamics - (DRO) :

Key Drivers:

Growth in the Offshore Energy Sector is Driving Demand for Offshore Containers

The rapidly expanding offshore energy sector, particularly in oil and gas and wind energy, is boosting the offshore containers market growth. Additionally, the containers are crucial for transporting equipment and materials to remote offshore locations. Further, the offshore wind industry is leveraging digital tools and automation to improve efficiency, reduce costs, and enhance sustainability is fueling the offshore containers market demand.

- For instance, in June 2024, the Indian Ministry of New and Renewable Energy approved the implementation of offshore wind energy projects. Additionally, the project aims to provide higher adequacy & reliability, lower storage requirements, and higher employment potential.

Therefore, the expanding offshore energy sector is driving the adoption of containers, in turn proliferating the growth of the market.

Key Restraints:

High Cost of Containers and Stringent Regulations are Restraining the Market Growth

The environmental regulations set by the International Maritime Organization (IMO) are propelling an increase in the cost of containers to comply with carbon emissions and eco-friendly practices. Additionally, procuring and maintaining offshore containers, particularly those designed for harsh marine environments, incurs huge costs and in turn hinders the offshore containers market expansion. Further, the shift toward sustainable shipping practices and cleaner maritime sectors is restraining the market process.

Therefore, the high costs of containers and stringent rules and regulations are hindering the offshore containers market expansion.

Future Opportunities :

Increasing Focus on Sustainability in Offshore Operations is Expected to Promote Potential Opportunities for Market Growth

The demand for sustainable practices and technologies is growing rapidly, which in turn is driving innovations in renewable energy, environmental monitoring, and sustainable resource management. Additionally, growing consumer and regulatory pressure for sustainability is propelling the offshore containers market opportunities. Further, the rising adoption of advanced technologies, such as digital solutions for container tracking and monitoring, is fueling the market progress. Furthermore, increasing focus on reducing missions, waste management, and efficient logistics, among others, is boosting the market development.

- For instance, in February 2025, Hanwha Ocean and Hanwha Power Systems collaborated with Baker Hughes to jointly work on a project related to achieving the world’s first completely carbon-free ship operation. The collaboration has developed an eco-friendly ammonia gas turbine that aims to accelerate the global shipbuilding and shipping sector.

Hence, the increasing focus on sustainability is anticipated to increase the utilization of containers, in turn promoting prospects for the offshore containers market opportunities during the forecast period.

Offshore Containers Market Segmental Analysis :

By Type:

Based on the type, the market is segmented into closed containers, half height containers, open top containers, baskets, waste skip/ cutting skip, mini containers, and others.

Trends in the Type:

- The integration of smart sensors for inventory tracking and monitoring of closed containers is fueling the offshore containers market trends.

- The rising demand for anti-corrosion containers is propelling the offshore containers market trends.

Closed Containers accounted for the largest revenue share in the year 2024.

- Closed containers are primarily utilized for general-purpose storage and transportation of goods and equipment’s among others.

- Additionally, the growing oil and gas sector is propelling the need for close containers, which in turn is fueling the offshore containers market share.

- Further, the harsh weather conditions fuel the need for weatherproof and secure storage solutions, which in turn boosts the offshore containers market share.

- Furthermore, the changing regulatory compliance, such as DNV2.7-1, aims to provide customers with safe containers.

- Thus, according to the offshore containers market analysis, the growing oil and gas sector, as well as need for weatherproof, is driving the adoption of closed containers.

Half Height Containers is anticipated to register the fastest CAGR during the forecast period.

- Half height containers are utilized to transport heavy goods in the offshore industry, as well as offer better loading and unloading capability fuels the offshore containers market size.

- Additionally, the benefits of half height containers include ease of handling, increased stability, and cost-effectiveness, among others.

- Further, the half height containers are customizable, such as removable roofs, swing doors, and hard or soft covers catering to specific requirements is propelling the adoption of half height containers, which in turn is driving the offshore containers market size.

- For instance, in June 2020, Cargostore expanded its service offerings at the Port of Taichung, which aims to support the upcoming offshore wind projects in Taiwan. The services include containers such as open top and half height offshore CCU’s.

- Therefore, according to the offshore containers market analysis, the ability to transport heavy goods is anticipated to boost the market during the forecast period.

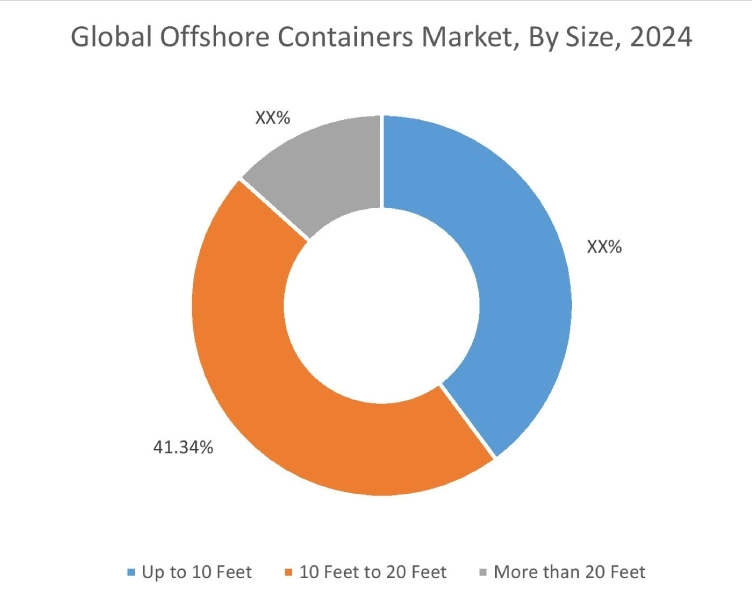

By Size:

Based on the size, the market is segmented into up to 10 feet, 10 feet to 20 feet, and more than 20 feet.

Trends in the Size:

- The trend towards growing focus on energy efficiency and reduced environmental impact is propelling the adoption of up to 10 feet.

- The trend towards growing need for transporting fresh produce, seafood, and pharmaceuticals is propelling the adoption of more than 20 feet.

10 feet to 20 feet accounted for the largest revenue share of 41.34% in the year 2024.

- Offshore containers, including 10ft and 20ft sizes, are specialized shipping containers designed to withstand the harsh conditions of the offshore environment.

- Additionally, the advantages of 10ft to 20ft containers include portability, storage, and customization, among others.

- Further, the rising adoption of closed containers, open top, and waste skips is fueling the need for 10ft to 20ft containers.

- For instance, Cargostore is a leading provider of offshore containers with a size range from 10ft to 20ft standard sizes designed to store or transport a wide variety of dry cargo to and from an offshore platform.

- Thus, as per the market analysis, the rising adoption of closed containers, open top, and waste skips is driving the market progress.

Up to 10 feet is anticipated to register the fastest CAGR during the forecast period.

- Up to 10 feet Container is perfect for the storage and transportation of offshore equipment when deck space is limited.

- Additionally, the key benefits of up to 10 ft containers include cost-effectiveness, durability, security, easy transport, and customization options.

- Further, the increasing adoption of smart technology for remote monitoring and control, such as temperature sensors and others, is fueling the adoption of up to 10ft containers.

- Therefore, as per the market analysis, the increasing adoption of smart technology is anticipated to boost the market during the forecast period.

By Application:

Based on the application, the market is segmented into equipment & goods transportation, storage solution, and others.

Trends in the Application:

- The trend towards increased digitalization is driving market adoption in equipment & goods transportation.

- The trend towards growing demand for sustainable containers is propelling market adoption for storage solutions.

The equipment & goods transportation accounted for the largest revenue share in the year 2024.

- Offshore containers are specialized shipping containers designed for transporting equipment and goods to and from offshore installations such as oil rigs and platforms.

- Additionally, the advantages of containers in equipment & goods transportation such as safety and reliability, efficiency, versatility, cost-effectiveness, and security.

- Further, the rising need for real-time location tracking of containers using IoT devices enhances transparency and reduces risks of theft or damage is driving adoption in equipment & goods transportation.

- Thus, as per the market analysis, the rising need for real-time location tracking of containers is driving the market progress.

The storage solution is anticipated to register the fastest CAGR during the forecast period.

- The growing need for sustainable containers is expected to promote potential prospects for storage solutions.

- Additionally, the growing e-commerce business is propelling the adoption of storage solutions.

- Further, the rising need for eco-friendly materials and refrigerants is propelling the adoption of storage solutions.

- Therefore, as per the market analysis, the rising need for eco-friendly materials and refrigerants is anticipated to boost the market during the forecast period.

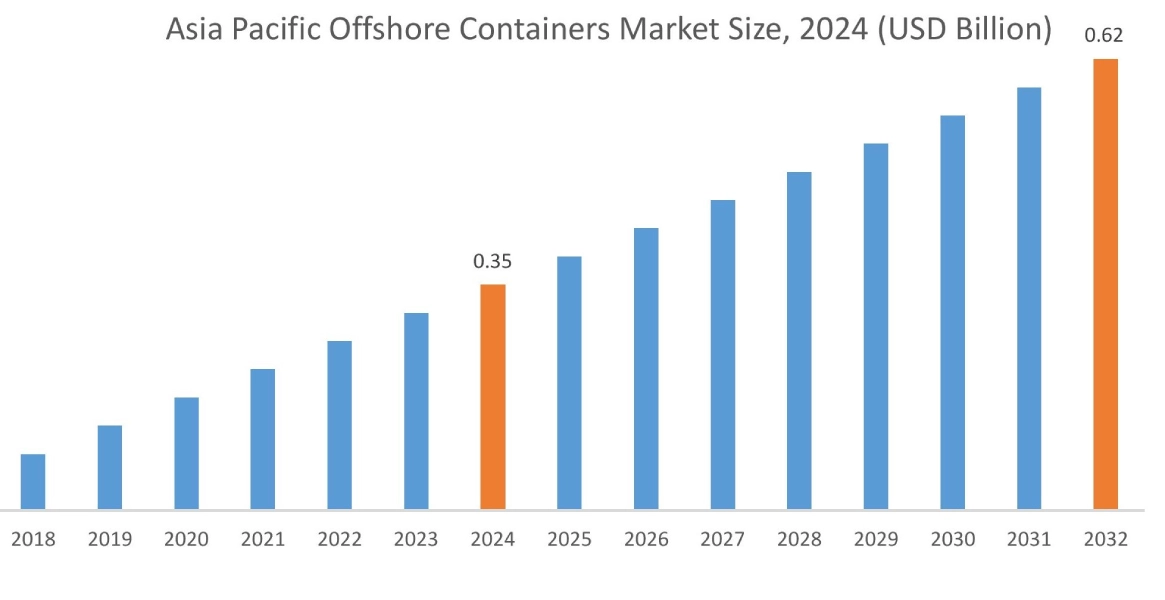

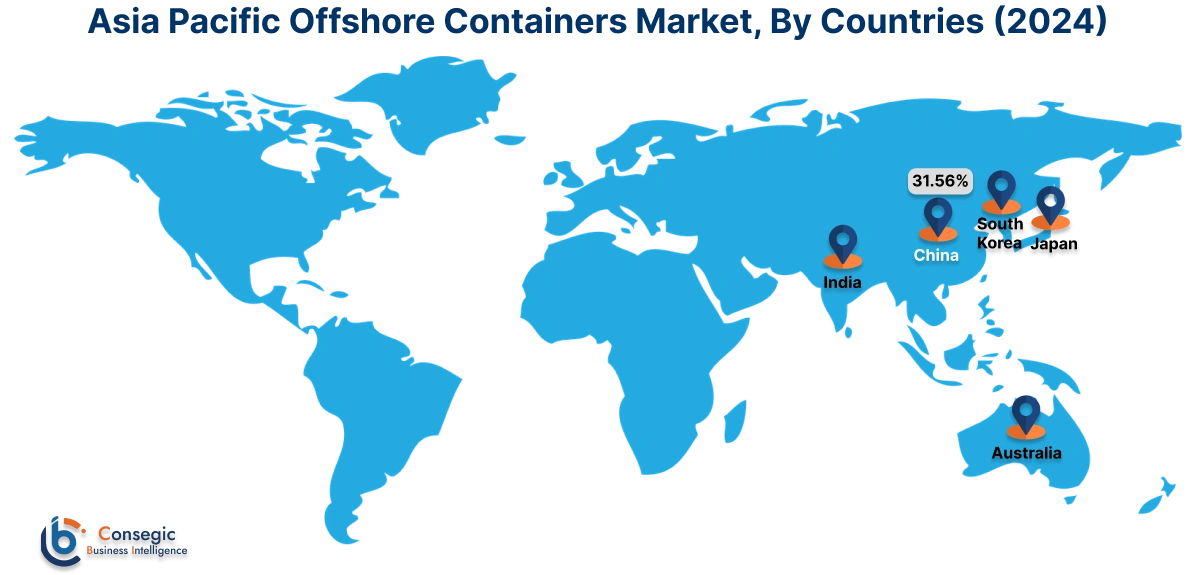

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 0.35 billion in 2024. Moreover, it is projected to grow by USD 0.37 billion in 2025 and reach over USD 0.62 billion by 2032. Out of this, China accounted for the maximum revenue share of 31.56%. The market is mainly driven by increasing import and export activities as well as urbanization and globalization. Furthermore, factors including expanding port infrastructure are projected to drive the market growth in Asia Pacific region during the forecast period.

- For instance, in June 2024, according to PIB India, the Union Cabinet approved the construction of Vadhavan port project. The total cost of the project is up to USD 762,200 million and aims to become the top 10 ports of the world.

North America is estimated to reach over USD 0.73 billion by 2032 from a value of USD 0.43 billion in 2024 and is projected to grow by USD 0.45 billion in 2025. The North American region's growing global trade as well as technological advancements, offer lucrative growth prospects for the market. Additionally, the strong presence of key players and increasing consumer spending are driving the market progress.

- For instance, in September 2024, The Port of Los Angeles handled nearly 960,597 containers, which is 16% higher than the previous year, due to holiday imports and increased consumer spending in the USA.

The regional evaluation depicts that the advancements in container technology, as well as the rising adoption of high-strength weathering steel for the manufacturing of containers, are driving the market in Europe. Additionally, the key factor driving the market is expansion of offshore energy projects in Gulf countries, as well as the adoption of digital technologies in container tracking is propelling the market progress in the Middle East and African region. Further, the increasing investing in infrastructure and technology as well as the increasing focus on digitalization and industrial automation is paving the way for the progress of market in Latin America region.

Top Key Players and Market Share Insights:

The global offshore containers market is highly competitive with major players providing containers to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the offshore containers industry. Key players in the offshore containers market include-

- OEG Offshore (UK)

- TLS Offshore Containers (China)

- Modex (Norway)

- CARU Containers (USA)

- Suretank (Ireland)

- MGS Offshore (Malaysia)

- Hoover Ferguson (USA)

- Almar (South Africa)

- SINGAMAS (Hong Kong)

- BSL Containers (China)

Recent Industry Developments :

Mergers & Acquisitions:

- In March 2025, Triton International Limited acquired Global Container International LLC. The acquisition aims to create an impressive business with a well-structured long-term lease portfolio as well as strengthen best-in-class service and support.

Offshore Containers Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2.17 Billion |

| CAGR (2025-2032) | 7.2% |

| By Type |

|

| By Size |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the offshore containers market? +

The offshore containers market size is estimated to reach over USD 2.17 billion by 2032 from a value of USD 1.30 billion in 2024 and is projected to grow by USD 1.36 billion in 2025, growing at a CAGR of 7.2% from 2025 to 2032.

Which segmentation details are covered in the offshore containers report? +

The offshore containers report includes specific segmentation details for type, size, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the offshore containers market, the half height containers are the fastest-growing segment during the forecast period due to their ability to transport heavy goods.

Who are the major players in the offshore containers market? +

The key participants in the offshore containers market are OEG Offshore (UK), TLS Offshore Containers (China), MGS Offshore (Malaysia), Hoover Ferguson (USA), Almar (South Africa), SINGAMAS (Hong Kong), BSL Containers (China), Modex (Norway), CARU Containers (USA), Suretank (Ireland), and others.

What are the key trends in the offshore containers market? +

The offshore containers market is being shaped by several key trends, including increased digitalization, as well as growing demand for sustainable containers other are key trends driving the market.