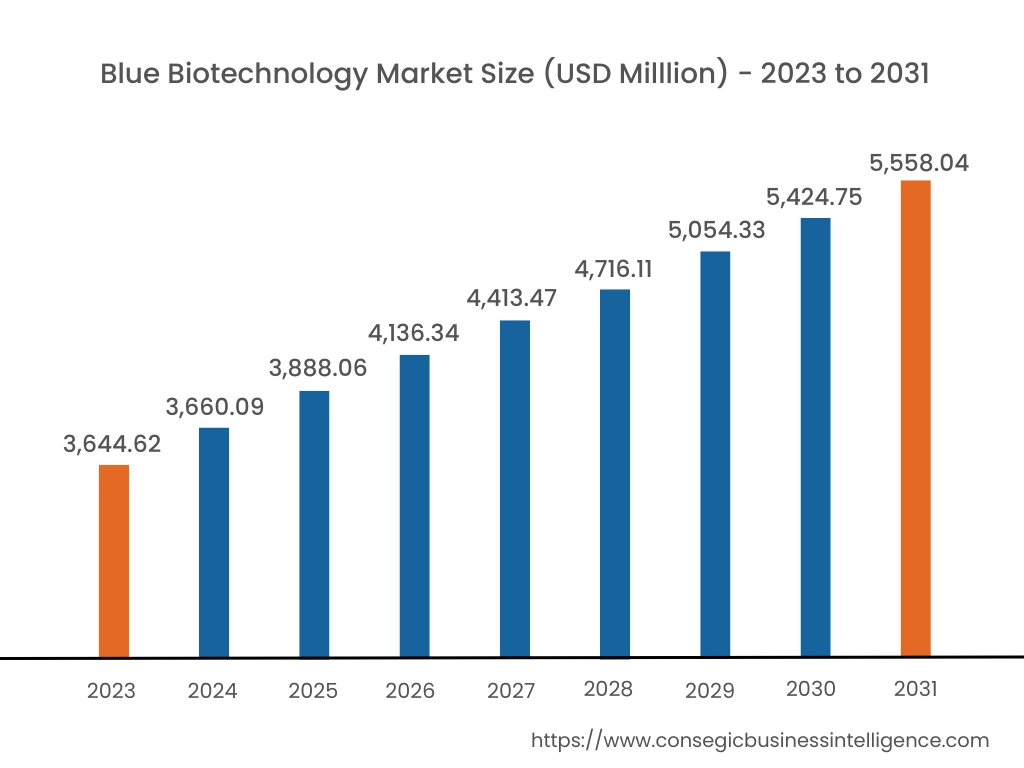

Blue Biotechnology Market Size and Growth 2023 to 2031:

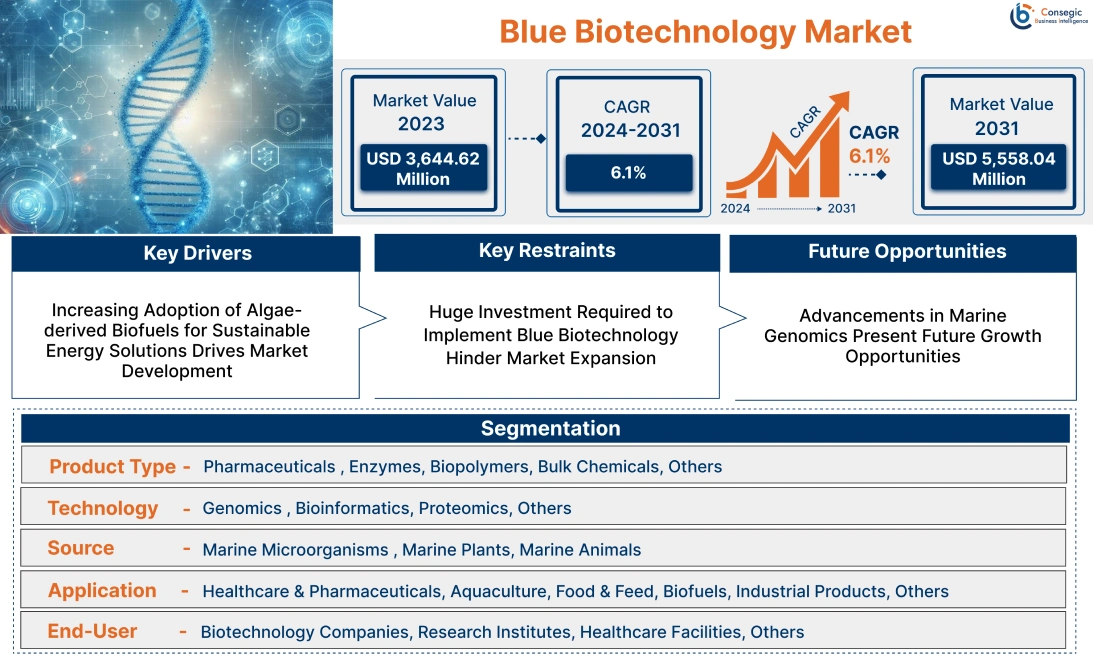

Blue Biotechnology Market size is valued at USD 3,644.62 Million in 2023. It is projected to reach USD 5,558.04 Million by 2031, growing at a CAGR of 6.1%. The Europe blue biotechnology market size reached 1,097.76 Million in 2023.

Blue Biotechnology Market Scope & Overview:

Blue biotechnology, also known as marine biotechnology, refers to the use of marine organisms, resources, and biological processes to create products and solutions. Marine life, including algae and bacteria, produces bioactive compounds with valuable properties. These compounds offer benefits like antimicrobial and antioxidant. Moreover, bio-remediation techniques based on marine biotechnology help improve aquatic ecosystems. Industries that benefit from blue biotechnology include pharmaceuticals, cosmetics, food and beverages, and environmental management. These industries are increasingly adopting marine-based innovations to improve product development and sustainability.

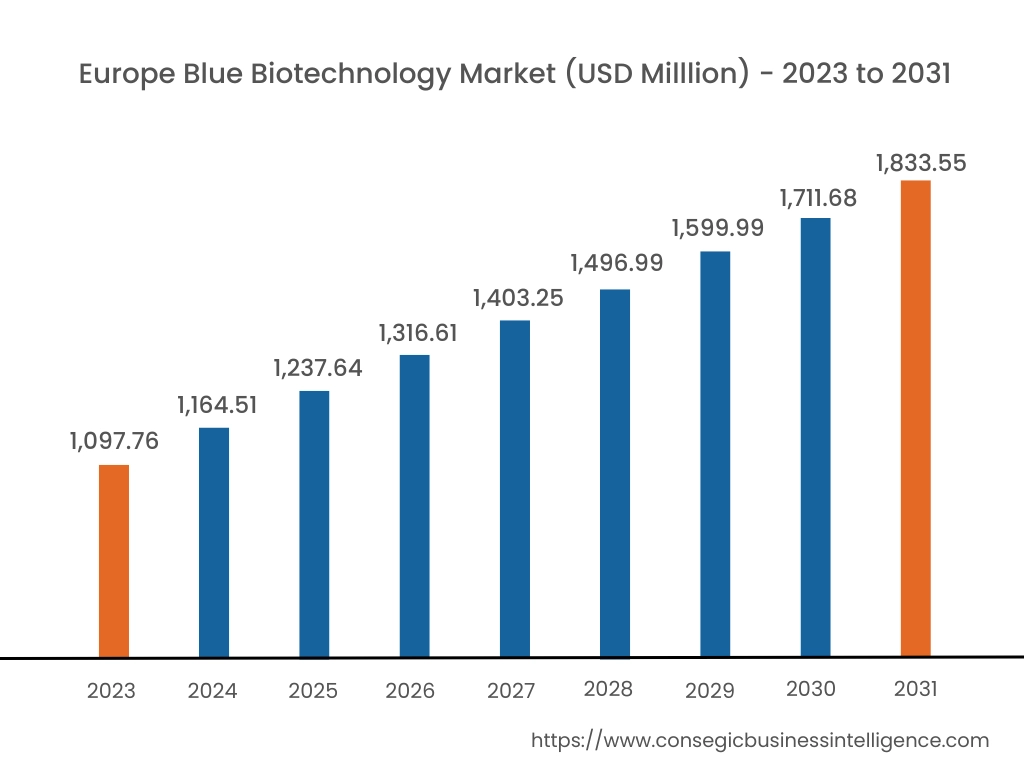

Europe Blue Biotechnology Market Size and Growth 2023 to 2031:

The Europe blue biotechnology market was valued at USD 1,097.76 Million in 2023, and it is projected to reach over USD 1,833.55 Million, at a CAGR of 6.7% from 2023 to 2031.

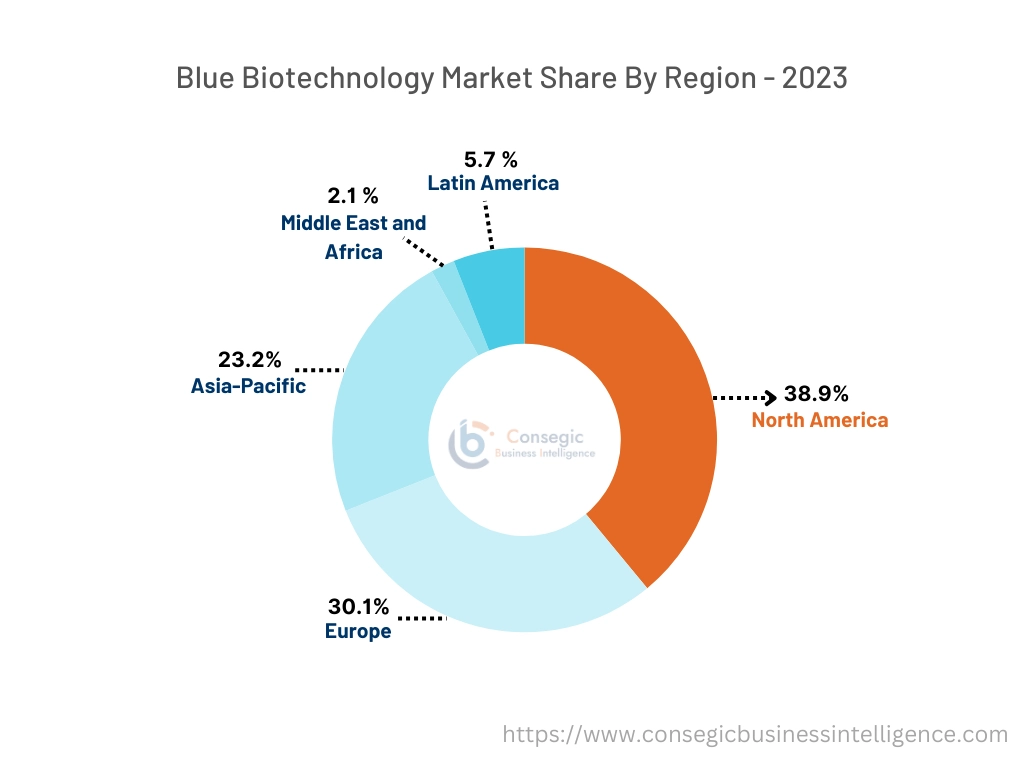

In 2023, Europe accounted revenue share of 30.1%. Europe is a leading region in terms of sustainability and innovation. Norway is a powerhouse in marine biopharmaceuticals and cold-water aquaculture, while France dominates in marine collagen for cosmetics. The EU's Blue Growth Strategy fosters sustainable exploitation of marine resources, fueling R&D in marine bioactives and bioplastics. However, strict environmental regulations and high R&D costs create barriers to commercialization. European firms are focusing on high-value segments like pharmaceuticals and cosmetics, which helps maintain competitiveness despite these challenges.

The blue biotechnology market analysis shows that the U.S. leads in the North American region with innovations in marine-derived bioactive compounds and pharmaceuticals. The presence of institutions like Woods Hole and support from government agencies such as NOAA significantly boost market activities. Canada, with its vast coastlines and sustainable marine practices, is also a key player in algae-based biofuels and nutraceuticals. However, regulatory hurdles, particularly the lengthy FDA approval process for marine-derived pharmaceuticals, and environmental protection policies can slow commercialization.

Asia-Pacific region is expected to grow at a steady CAGR from 2024 to 2031. China, Japan, and South Korea lead the region, driven by large-scale aquaculture and algae-based biofuel production. China's Marine Biopharmaceutical Initiative and substantial government funding have spurred research into marine-derived health products. Japan and South Korea are at the forefront of algae cultivation for biofuels, with a focus on energy security. The region's fast development is propelled by government support and the rising adoption of marine bioactive ingredients in pharmaceuticals and nutraceuticals.

MEA is still an emerging market with a limited presence. South Africa is focusing on aquaculture and marine-derived pharmaceuticals, while the UAE is leading in desalination by-product utilization for biotechnology applications. The blue biotechnology market expansion is constrained by harsh climatic conditions and limited infrastructure, but increasing government investment, especially in aquaculture, offers future potential.

Latin America is growing, primarily driven by Chile's strong aquaculture industry, which is one of the world's largest producers of farmed salmon. Brazil's emerging interest in algae-based biofuels and bioproducts also boosts the regional market. However, the region faces challenges related to limited R&D infrastructure and strict environmental regulations, which slow the large-scale adoption of marine biotechnology. Opportunities exist in sustainable aquaculture and the production of marine-derived pharmaceuticals, especially as Brazil ramps up investments in algae cultivation.

Blue Biotechnology Market Key Players:

The blue biotechnology market is highly competitive, with leading companies serving both national and international markets. Major industry players are employing various strategies such as research and development (R&D), product innovation, and launching products for end-users to maintain a strong presence in the global blue biotechnology market. Prominent companies in the blue biotechnology industry include–

- Marinova (Australia)

- Cyanotech Corporation (USA)

- Aker BioMarine (Norway)

- CP Kelco (USA)

- New England Biolabs (USA)

- GlycoMar (UK)

- PML Applications (UK)

- Marshall Marine Products (India)

- Geomarine Biotechnologies (India)

- Sea Run Holdings Inc. (USA)

Blue Biotechnology Market Trends:

The blue biotechnology market is witnessing rapid expansion due to emerging trends across several industries. One significant factor is the increasing use of marine biomaterials like chitosan and collagen, particularly in medical, cosmetic, and environmental applications. These materials are highly valued for their biocompatibility and biodegradability, making them crucial for wound healing, drug delivery systems, and eco-friendly packaging. The rising adoption of sustainable, bio-based materials is driving the adoption of these marine-derived compounds.

Another trend is the growing use of marine biotechnology in environmental bioremediation. Marine microorganisms and enzymes are being developed to address industrial pollution issues, such as oil spills and heavy metal contamination in aquatic ecosystems. Governments and environmental organizations are increasingly turning to these biotechnological solutions to restore marine environments, creating new opportunities in this field. However, challenges such as high costs and scalability issues are hindering widespread adoption.

Marine-derived nutraceuticals represent another important trend in the market. Nutraceuticals derived from marine sources, including omega-3 fatty acids, antioxidants, and seaweed-based supplements, are gaining popularity due to their health benefits. The increasing consumer preference for natural, health-promoting products is fueling progress in this sector. Companies are focusing on marine sources to develop innovative supplements that address cardiovascular health, aging, and immune support.

Additionally, marine aquaculture biotechnology is advancing rapidly to support sustainable seafood production. Genetic engineering and disease resistance technologies are being implemented to improve the efficiency and yield of aquaculture practices. This trend is essential for meeting the growing global demand for seafood while minimizing environmental impacts. However, high R&D costs and regulatory challenges pose obstacles to faster market development.

These trends, encompassing biomaterials, environmental applications, nutraceuticals, and aquaculture, are shaping the future of blue biotechnology, offering promising growth opportunities while also presenting technical and financial challenges.

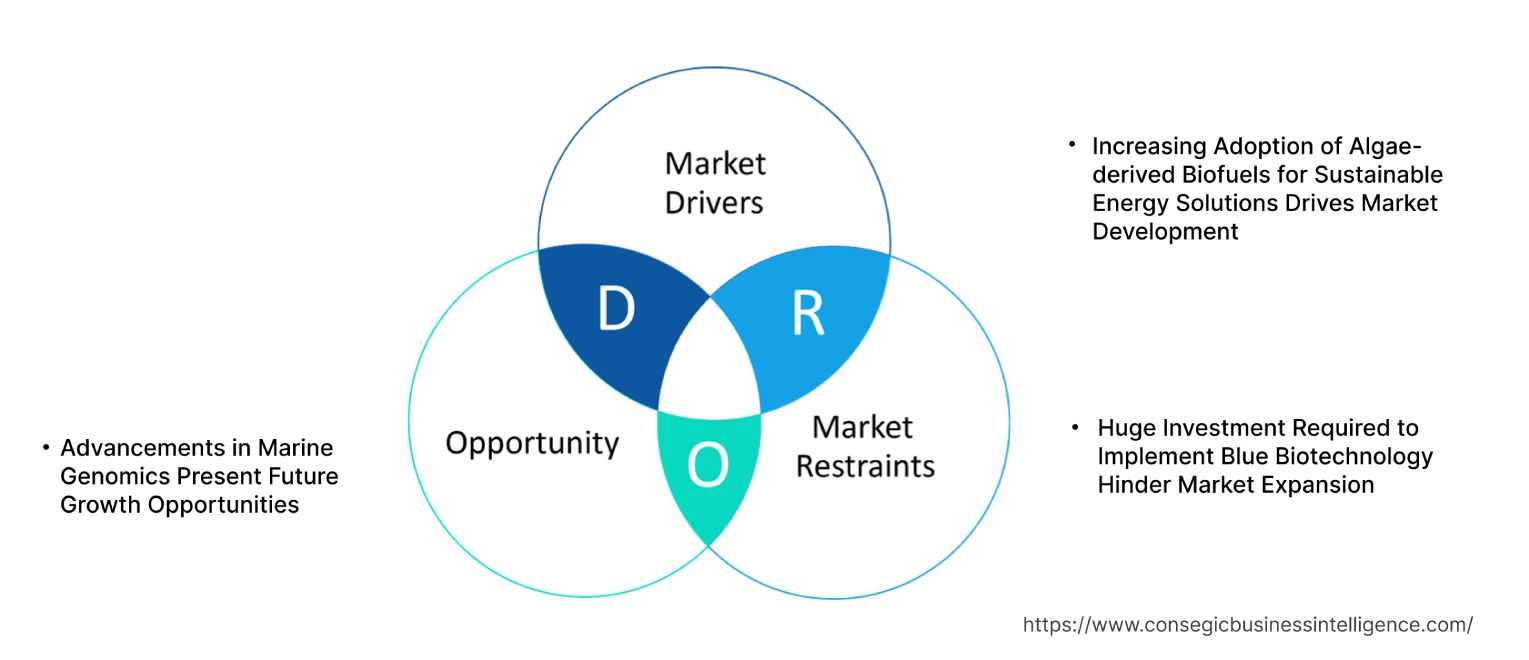

Blue Biotechnology Market Dynamics:

Key Drivers:

Increasing Adoption of Algae-derived Biofuels for Sustainable Energy Solutions Drives Market Development

Algae-based biofuels are becoming a key focus in the energy sector due to their high potential for sustainability and efficiency. Unlike traditional biofuels, marine algae can be cultivated on non-arable land and require less freshwater, making them more environmentally viable. Algae have higher photosynthetic efficiency and can be processed into biofuels such as biodiesel and bioethanol with lower carbon footprints. Marine biotechnology facilitates the genetic engineering and optimization of algae strains to maximize biofuel yield and scalability. The rising demand for cleaner energy sources and the push for carbon-neutral fuel alternatives are making algae-derived biofuels a significant driver of the blue biotechnology market growth.

Key Restraints :

Huge Investment Required to Implement Blue Biotechnology Hinder Market Expansion

Implementing blue biotechnology requires significant financial resources, especially for research and development. The processes involved in discovering and extracting bioactive compounds from marine organisms are complex and need cutting-edge technology and specialized equipment. Additionally, developing sustainable methods for cultivating and harvesting marine resources is both labor-intensive and costly. These high capital requirements present a major challenge, particularly for smaller companies that may struggle to secure funding. As a result, the high financial barriers are limiting the blue biotechnology market demand.

Future Opportunities :

Advancements in Marine Genomics Present Future Growth Opportunities

Marine genomics, which involves studying the genetic makeup of marine organisms, is opening new avenues for innovation in blue biotechnology. As advancements in sequencing technology become more accessible, scientists can better understand marine biodiversity and identify novel bioactive compounds. These genomic insights will support more precise exploration of marine organisms, leading to the discovery of new pharmaceuticals, sustainable materials, and chemicals. In the coming years, advancements in marine genomics are expected to significantly expand blue biotechnology market opportunities within the market, driving innovation and product development.

Blue Biotechnology Market Segmental Review:

Product Type Analysis:

Based on product type, the market is segmented into enzymes, biopolymers, bulk chemicals, pharmaceuticals, and others.

The pharmaceuticals segment accounted for the largest revenue share in 2023.

Bioactive compounds are crucial for developing novel drugs targeting cancer, infections, and inflammatory diseases. Notable examples include trabectedin for cancer and ziconotide for chronic pain, both sourced from marine organisms. The increasing focus on marine-derived compounds for drug development, combined with continued investment in research, drives the dominance of the pharmaceutical segment. For instance, in February 2023, KinSea Lead Discovery AS (KinSea), a new company was created by UiT The Arctic University of Norway, the University of Bergen, Norinnova, and the Lead Discovery Center (LDC). KinSea aims to develop a drug that targets FLT3 mutations to treat acute myeloid leukemia (AML) and other blood cancers. This drug is based on natural substances found in the Arctic Ocean. Growing demand for innovative therapies sourced from marine biodiversity is boosting the blue biotechnology market demand.

The enzymes segment is anticipated to register the fastest CAGR during the forecast period.

Marine-derived enzymes have unique properties that allow them to function effectively in extreme environments, such as cold and high-salinity conditions. These enzymes are becoming increasingly important in industrial applications, including biofuels, food processing, and bioremediation. The demand for more sustainable, environmentally friendly industrial processes is driving the rapid development of this segment. Technological advances in enzyme extraction methods and the expanding applications of enzymes boost the blue biotechnology market trends.

Technology Analysis:

Based on technology, the market is segmented into genomics, bioinformatics, proteomics, and others.

The genomics segment accounted for the largest revenue of the overall blue biotechnology market share in 2023.

Genomics is integral to the discovery of new bioactive compounds from marine organisms. This technology helps identify valuable genetic material that can be used to develop innovative pharmaceuticals, agricultural products, and industrial enzymes. The use of advanced genomic sequencing techniques has enabled researchers to tap into the rich diversity of marine species. Increasing government funding for marine research and technological improvements are further bolstering its growth. The growing role of genomics in unlocking marine biodiversity's potential continues to drive the blue biotechnology market growth.

The bioinformatics segment is anticipated to register the fastest CAGR during the forecast period.

Bioinformatics plays a vital role in managing the vast amount of genomic data generated from marine organisms. It enables researchers to analyze complex biological data more efficiently, aiding in the discovery and development of new products. The integration of artificial intelligence (AI) and machine learning (ML) in bioinformatics is accelerating research processes and reducing the time to market for marine-derived products. The increasing adoption of computational tools for faster and more accurate data analysis is expected to drive the blue biotechnology market expansion.

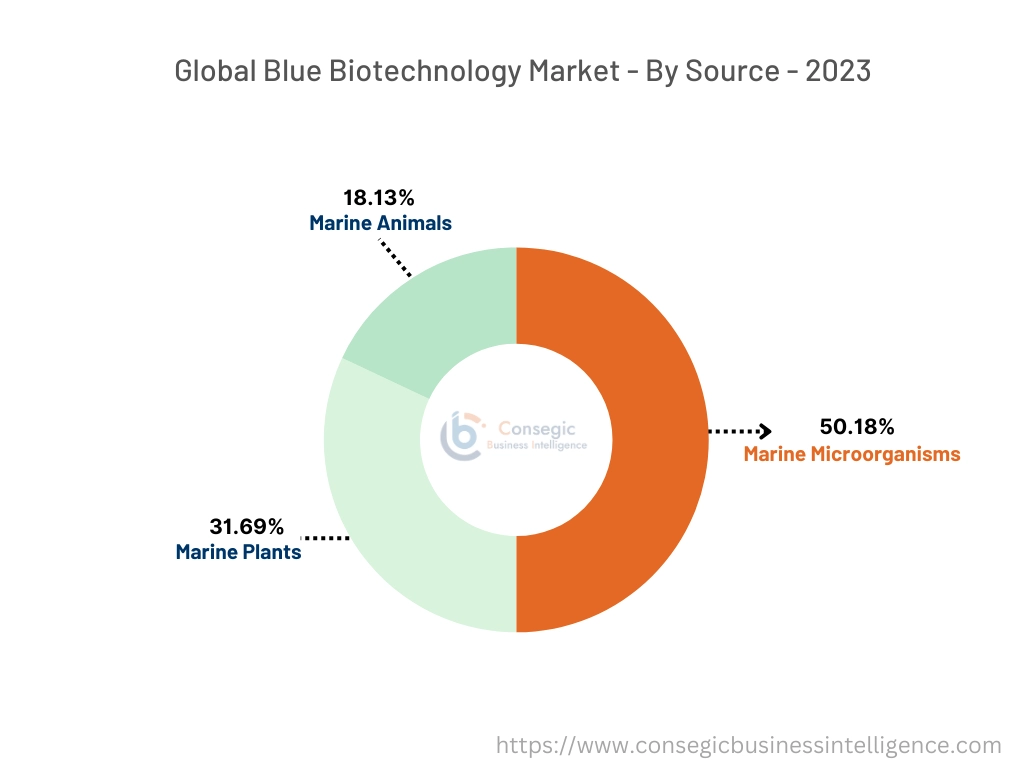

Source Analysis:

Based on the source, the market is trifurcated into marine plants, marine animals, and marine microorganisms.

The marine microorganisms segment accounted for the largest revenue share of 50.18% in 2023.

Marine microorganisms are a rich source of bioactive compounds with applications in pharmaceuticals, agriculture, and industrial biotechnology. These organisms produce antibiotics, enzymes, and anti-cancer agents that cannot be found in terrestrial organisms. With growing research focused on marine microbes, their role in developing new drugs and industrial products has expanded significantly. The ability of marine microorganisms to survive and thrive in extreme conditions makes them invaluable for discovering unique bioactive molecules, driving the dominance in the market.

The marine plants segment is anticipated to register the fastest CAGR during the forecast period.

Marine plants, particularly algae and seaweed, are gaining traction for their wide range of applications, including biofuel production, nutraceuticals, and sustainable food products. Algae are rich in essential fatty acids, proteins, and vitamins, making them valuable in the food and feed industries. Their potential to produce biofuels as a sustainable energy source also supports the fast development of this segment. The increasing focus on renewable energy and the expanding use of algae in food products are key factors expected to drive the segment's rapid growth.

Application Analysis:

Based on application, the market is segmented into aquaculture, healthcare & pharmaceuticals, food & feed, biofuels, industrial products, and others.

The healthcare & pharmaceuticals segment accounted for the largest revenue share in 2023.

Marine-derived compounds play a critical role in healthcare, particularly in the development of new drugs for treating cancer, infections, and inflammatory conditions. Pharmaceutical companies are increasingly investing in marine biotechnology to discover novel therapeutic agents. Clinical trials exploring marine-based compounds for drug development are expanding globally, further contributing to the segment's dominance. The need for innovative therapies drives the progress of the healthcare & pharmaceuticals segment in the market.

The biofuels segment is anticipated to register the fastest CAGR during the forecast period.

The biofuels segment is gaining momentum as marine organisms, especially algae, emerge as a sustainable alternative to fossil fuels. Algae-based biofuels offer low carbon emissions and higher energy efficiency, aligning with global efforts to reduce reliance on traditional energy sources. Increased government funding and investment in biofuel research, along with technological advancements in algal cultivation and harvesting, are driving the rapid growth of this segment. Thus, as per the blue biotechnology market analysis, As demand for renewable energy sources increases, the biofuels segment is poised for significant expansion.

End-User Analysis:

Based on the end-user, the market is segmented into biotechnology companies, research institutes, healthcare facilities, and others.

The biotechnology companies segment accounted for the largest revenue share in 2023.

Biotechnology companies are at the forefront of developing and commercializing marine-derived products. These companies collaborate with research institutes to bring marine bioactive compounds to market, especially in the pharmaceutical, biofuel, and industrial sectors. Increasing investments in marine biotechnology and the rising commercialization of marine-based products have solidified the role of biotechnology companies as key players in the market. The ongoing trend of mergers and acquisitions within the industry is further strengthening their market position.

The research institutes segment is anticipated to register the fastest CAGR during the forecast period.

Research institutes conduct exploratory research on marine organisms, leading to the discovery of new bioactive compounds with significant industrial and pharmaceutical applications. As governments and private organizations increase funding for marine research, these institutes play an increasingly important role in advancing blue biotechnology. The rising number of public-private partnerships and international collaborations is expected to accelerate the development of the research institutes segment.

Blue Biotechnology Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 5,558.04 Million |

| CAGR (2024-2031) | 6.1% |

| By Product Type |

|

| By Technology |

|

| By Source |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the blue biotechnology market? +

Blue Biotechnology Market size is valued at USD 3,644.62 Million in 2023. It is projected to reach USD 5,558.04 Million by 2031, growing at a CAGR of 6.1%.

What are the emerging trends in the blue biotechnology market? +

Emerging trends include the growing use of blue biotechnology in drug discovery, increasing research on marine organisms for environmental sustainability, and the development of biofuels and biopolymers derived from marine resources.

What challenges does the blue biotechnology market face? +

Challenges include high research and development costs, regulatory hurdles, limited availability of marine resources, and potential environmental concerns related to the exploitation of marine ecosystems.

What investment opportunities are available in the blue biotechnology market? +

The report highlights key investment opportunities in blue biotechnology research, product development, and commercialization across various segments such as pharmaceuticals, biofuels, and aquaculture.