Bonding Wires Market Size :

Bonding Wires Market size is estimated to reach over USD 16,072.24 Million by 2030 from a value of USD 12,730.27 Million in 2022, growing at a CAGR of 3.1% from 2023 to 2030.

Bonding Wires Market Scope & Overview:

Bonding wires are metallic wires used for interconnection between various components of electronic devices. They play a crucial role in establishing electrical interconnections between semiconductor devices and integrated circuits (ICs) and their packaging during semiconductor device fabrication. Moreover, they are deployed for connecting Integrated Circuits (ICs) from one printed circuit board to another. Consequently, they consist of a wide variety of materials including gold, copper, or aluminum for efficient placement of wires at specific locations in electronic devices.

Bonding Wires Market Insights :

Key Drivers :

Increasing demand in consumer electronics is driving the bonding wires market

The rising adoption of consumer electronics devices such as smartphones, laptops, tablets, and smart wearables is driving the market. They play a crucial role in establishing interconnections between different semiconductor devices. Moreover, they are used to connect semiconductor devices such as sensors, transistors, diodes, and capacitors in consumer electronics devices. Furthermore, they are deployed to connect ICs to the printed circuit boards that serve as the backbone of consumer electronics devices. For instance, in August 2020, Heraeus Holding expanded its product portfolio by introducing the PowerCuSoft product family with a new copper bonding ribbon. Therefore, the application in connecting different components of consumer electronics devices is propelling the bonding wires market growth.

Growing adoption in the automotive industry is propelling the market

The application of bonding wires in the automotive sector for safety, connectivity, and ADAS features is driving the market. They are used to interconnect semiconductor devices within Electronic Control Units (ECUs) enabling efficient communication between different electronic devices. Moreover, they are utilized to support advanced ADAS technologies such as radar systems, LiDAR , and camera modules for the transmission of sensor data and signals. For instance, in October 2021, Inseto invested in a wedge bonder for its process development laboratory suitable for bonding hybrid circuits, semiconductor devices, sensors, and automotive power modules and battery packs. Consequently, the market analysis shows that these wires play a crucial role in ensuring reliable interconnection of electronic components, resulting in bonding wires market growth.

Key Restraints :

The presence of alternate technology including laser welding machines is hindering the market

The adoption of laser welding machines for melting and fusing semiconductor devices is hindering the market. Laser welding machines use a non-contact process where a laser beam is directed onto the target area, thereby connecting different components. Bonding wires, on the other hand, physically connect two components through wires or a ball bonding technique. Therefore, the analysis of market trends depicts that the ability of laser welding machines to provide high precision and accuracy is restraining the bonding wires market demand.

The limited current carrying capacity is hindering the market

Bonding wires are designed to withstand specific current levels due to the limited cross-sectional area. The limited diameter restricts the flow of current through them, thereby limiting the power handling capacities of electronic devices or systems. For instance, a 1 mil diameter of gold ball-bonded wire i.e., 0.001 inch tends to carry 1 Ampere of electrical current through it. Consequently, the inability of these wires to support high-power electronic devices is restraining the bonding wires market opportunities.

Future Opportunities :

The application in flexible and printed electronics presents growth opportunities for the market

The development of flexible bonding wire technologies including stretchable or bendable wires is expected to present potential bonding wires market opportunities during the forecast period. They play a crucial role in providing reliable connections between different components of electronic devices. The flexibility and conformability of these wires are well-suited for flexible and printed electronics.

Bonding Wires Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 16,072.24 Million |

| CAGR (2023-2030) | 3.1% |

| By Type | Ball Bonders, Wedge Bonders, Stud/Bump Bonders, and Peg Bonders |

| By Bonding Process Type | Thermo-compression Bonding, Thermosonic Bonding, and Ultrasonic Bonding |

| By Wire Thickness | 0μm-75μm, 75μm-150μm, 150μm-300μm, and 300μm-500μm |

| By Material | Copper, Aluminum, Gold, Silver, and Palladium-coated Copper (PCC) |

| By Application | MEMS, Memory, Sensors, Optoelectronics System, and Others |

| By End-User | Automotive, Aerospace & Defense, Consumer Electronics, Telecommunications, Healthcare, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Cirexx International Inc., Powertech Technology Inc., Alter Technology, QP Technologies, Amkor Technology Inc., NEOTech Inc., JCET Group Co. Ltd., ASE Technology Holding Co. Ltd., Tektronix Inc. |

Bonding Wires Market Segmental Analysis :

By Type :

Based on the type, the market is segregated into ball bonders, wedge bonders, stud/bump bonders, and peg bonders. The wedge bonding segment accounted for the largest revenue in the year 2022 of the global bonding wires market share. The ability of wedge bonders to offer high mechanical strength and reliability in interconnecting electronics components is driving the market. Wedge bonding involves the usage of a wedge-shaped tool to bond the wire to the bonding pad. Moreover, wedge bonders enable bonding with a large variety of wire and ribbon materials, including gold, aluminum, and silver. Consequently, the application of wedge bonders in power electronics and automotive electronics is propelling the bonding wires market trends.

The stud/bump bonders segment is anticipated to emerge as the fastest-growing segment during the forecast period. Stud bonding is a technique used for three-dimensional integrated circuits and flip-chip applications. Stud bonders require metal studs made up of gold or copper for attachment to the bonding pads of semiconductor devices. For instance, in November 2022, SET Corporation SA launched an advanced R&D flip-chip bonder called FC150 Platinum for telecom, automotive, and defense applications. Thus, stud bonders allow for high-density interconnects enabling the integration of multiple chips and components in a compact space, raising the bonding wires market demand.

By Bonding Process Type :

Based on the bonding process type, the market is trifurcated into thermo-compression bonding, thermosonic bonding, and ultrasonic bonding. Thermo-compression bonding segment accounted for the largest revenue share in the year 2022 of the bonding wires market share. Thermo-compression bonding is a technique that deploys heat and pressure to create a bond between the wire and the bonding pad. As a result, the thermo-compression bonding technique is well-suited for advanced packaging and microelectronics applications. For instance, in October 2022, Kulicke & Soffa Industries, Inc. shipped its first Fluxless Thermo-Compression Bonder (TCB) ensuring interconnect integrity through integrated fluxless delivery module to facilitate transistor-dense packaging in semiconductors to produce high levels of performance. Consequently, the application of thermos-compression techniques for Heterogeneous Integration (HI) and System-in-Package (SiP) in semiconductor devices is accelerating the market.

The ultrasonic technique is anticipated to witness the fastest CAGR during the forecast period. The ultrasonic bonding technique utilizes high-frequency mechanical vibrations to create a bond between the wire and the bonding pad. As a result, ultrasonic energy produces frictional heat that softens the wire and bonding pad, thereby fusing them. Therefore, the application of ultrasonic techniques in MEMS devices and medical applications is propelling the bonding wires market trends.

By Wire Thickness :

Based on the wire thickness, the market is segmented into 0μm-75μm, 75μm-150μm, 150μm-300μm, and 300μm-500μm. 0μm-75μm segment accounted for the largest revenue share in the year 2022. Wires of thickness 0μm-75μm provide high-density interconnects allowing for a large number of wires to be packed within a compact space. Moreover, fine wires are made up of a wide variety of materials including gold, aluminum, and copper. Thus, the application of fine wires in consumer electronics devices and other miniaturized devices is propelling the market.

The 300μm-500μm segment is expected to register the fastest CAGR during the forecast period. The wires are referred to as thick wires providing high mechanical strength and reliable connections in high-power semiconductor devices. The large diameter of 300μm-500μm wires allows for increased current-carrying capacity in comparison to fine wires. Moreover, the ability of 300μm-500μm wires to offer high thermal conductivity is accelerating the bonding wires market.

By Material :

Based on the material, the market is divided into copper, aluminum, gold, silver, and Palladium-Coated Copper (PCC). The copper segment accounted for the largest revenue share in the year 2022. The high electrical conductivity and cost-effectiveness of copper wires are driving the growth of the market. The high conductivity of wires allows for efficient transmission of current and helps minimize resistance in wire interconnects. For instance, in August 2021, QP Technologies installed two new Hesse Mechatronics ultrasonic wire bonders made up of aluminum and copper to provide advanced wedge bonding capabilities for axis recognition and pattern recognition in multichip modules (MCM), high-frequency components, chip-on-board (COB), hybrids, optical and automotive electronics. Moreover, the high availability of copper as a semiconductor material is contributing to the growth of the market.

The Palladium-Coated Copper (PCC) is anticipated to register the fastest CAGR during the forecast period. The palladium coating on copper wires provides a protective layer, thereby eliminating oxidation concerns associated with bare copper wires. Moreover, palladium-coated copper wires are compatible with aluminum bond pads. Subsequently, the cost-effectiveness and high compatibility of Palladium-Coated Copper (PCC) is expected to drive the market during the forecast period.

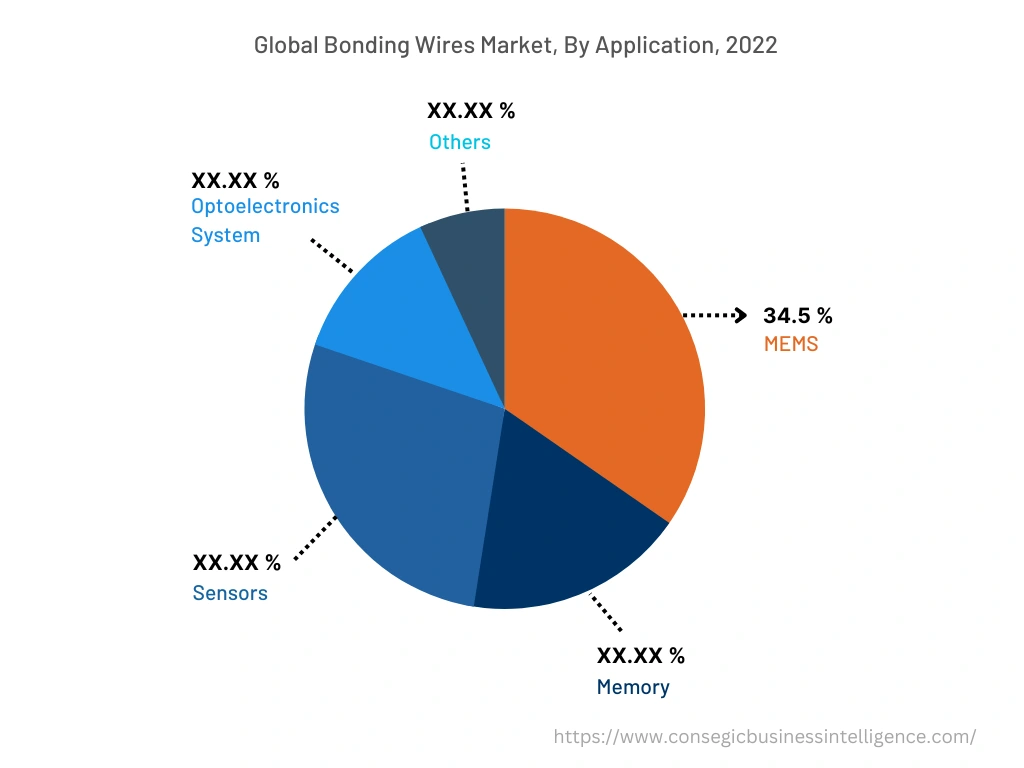

By Application :

Based on the application, the market is segregated into MEMS, memory, sensors, optoelectronics systems, and others. The MEMS systems accounted for the largest revenue of 34.5% in the year 2022. Bonding wires play a crucial role in providing electrical connectivity between different components of MEMS devices such as MEMS chips, package leads, and circuit boards. Micro-electromechanical systems (MEMS) is a process technology used to create tiny integrated devices or systems that combine mechanical and electrical components. The components are fabricated using integrated circuit (IC) batch processing techniques. Thus, these wires play a crucial role in MEMS systems, resulting in the growth of the market.

The sensor segment is expected to witness a high CAGR during the forecast period. The deployment of advanced sensors in consumer electronics and automotive industry is driving the market. Sensors play a crucial role in transmitting information between different components in semiconductor devices. As a result, wire bonders are utilized in the packaging of sensors to establish electrical connections between the sensor chip and the package leads. Thus, the growing miniaturization of consumer electronics and IoT-enabled is driving the demand for efficient wires, boosting the market.

By End-User :

Based on the end-user, the market is divided into automotive, aerospace & defense, consumer electronics, telecommunications, healthcare, and others. The consumer electronics segment accounted for the largest revenue in the year 2022. These wires are essential in IC packaging wherein semiconductor chips are enclosed within protective packages. Moreover, they play a crucial role in consumer electronics display technologies such as LCD, OLED, and AMOLED screens. Furthermore, the growing adoption of smart wearables among consumers is propelling the market.

The automotive industry is expected to witness the fastest CAGR during the forecast period. They are widely used in the assembly of ECUs to establish electrical connections between semiconductor chips, sensors, and other electronic components. Moreover, they are widely used in ADAS applications for the efficient transmission of vital information between different devices. Furthermore, the application of automotive lighting systems is accelerating the market.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

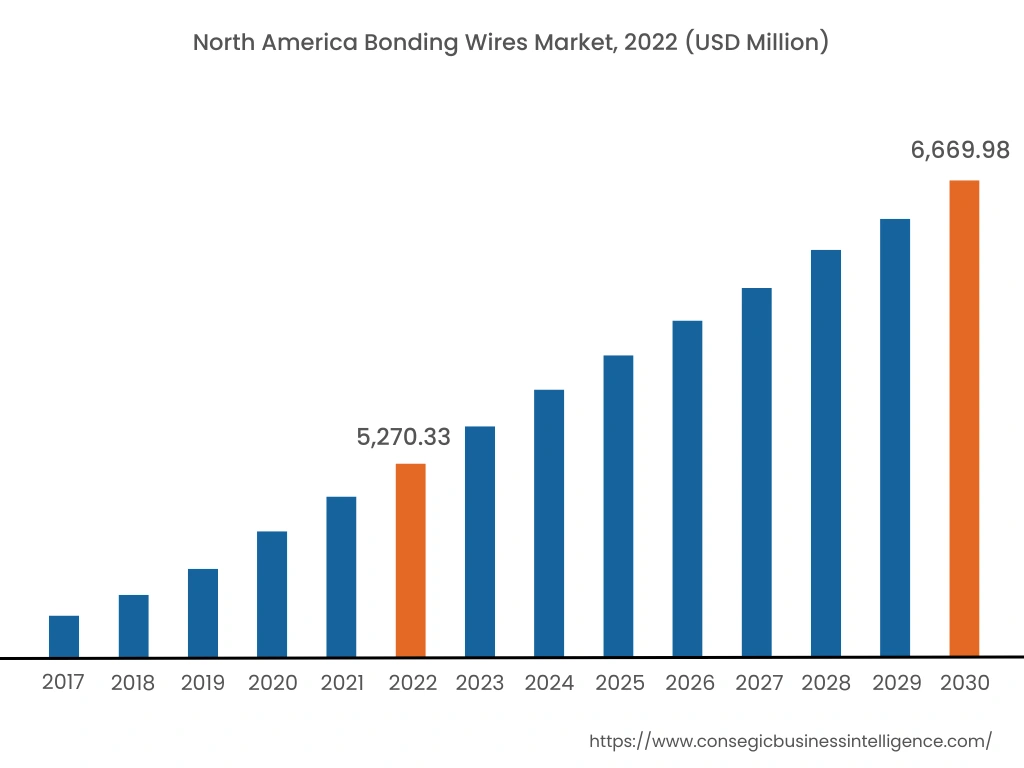

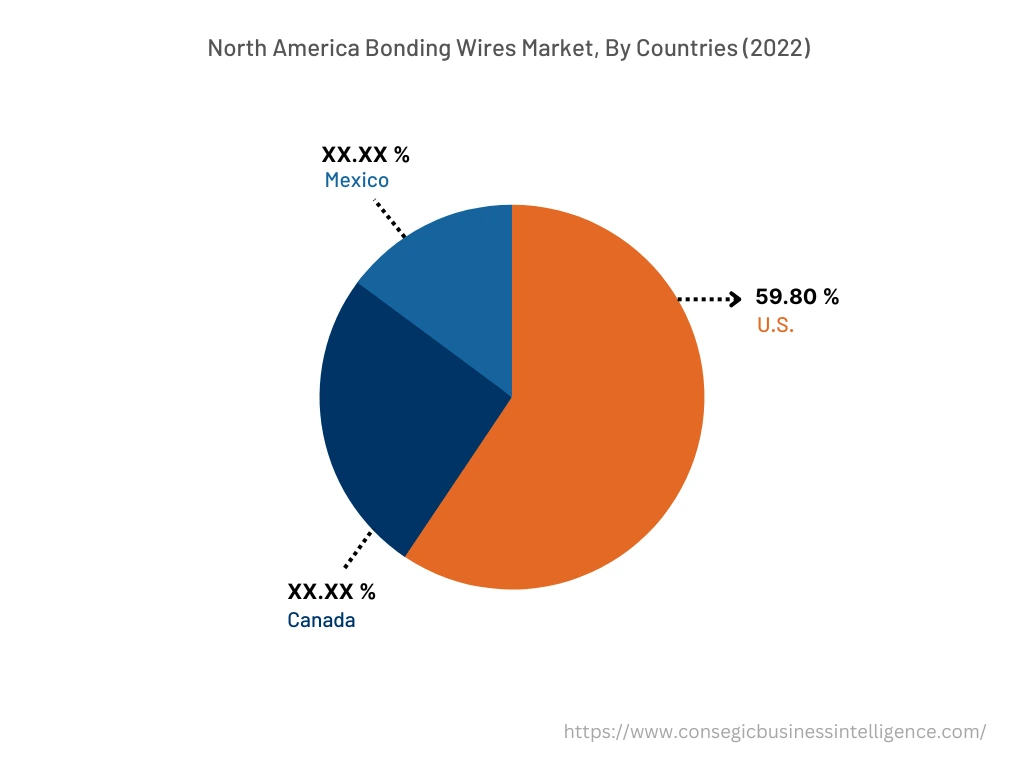

North America accounted for a revenue share of USD 5,270.33 million in 2022 and is expected to reach USD 6,669.98 million in 2030, registering a CAGR of 3.1% during the forecast period. Additionally, in the region, the U.S. accounted for the largest revenue share of 59.80% in the year 2022. As per the bonding wires market analysis, the widespread adoption of consumer electronics devices such as smartphones, laptops, and tablets is driving the growth of the market. They are essential in establishing reliable electrical connections between different semiconductor devices. For instance, in July 2021, Amkor Technology announced to offer of wire bonds and flip-chip packaging to provide reliable and cost-effective wire bonds for devices manufactured on 0.13-micron and low-k processes. Moreover, the application of these wires in medical devices is accelerating the market. They are used in the assembly of monitoring and diagnostic devices including ECG machines and ultrasound devices.

The Asia-Pacific region is anticipated to register the fastest CAGR of 3.4% during the forecast period. The bonding wires market analysis shows that the large manufacturing industries in countries such as India, China, and Japan are driving the demand for efficient and reliable wires for the manufacturing of consumer electronics and automotive parts. The growing automotive industry in the Asia-Pacific region is propelling the regional market. They are extensively used in ADAS applications for the efficient functioning of a wide variety of sensors. Therefore, the growing adoption of wire bonding techniques in the aforementioned industries is accelerating the bonding wires market expansion.

Top Key Players & Market Share Insights:

The Bonding Wires market is characterized by the presence of major players providing advanced sensing technologies for sensing parameters such as temperature, pressure, torque, and humidity. Key players operating in the market are adopting several business strategies such as research and development (R&D), product innovation, and application launches have accelerated the growth of the Bonding Wires market. Key players in the bonding wires industry include-

- Cirexx International Inc.

- Powertech Technology Inc.

- ASE Technology Holding Co. Ltd.

- Tektronix Inc.

- Alter Technology

- QP Technologies

- Amkor Technology Inc.

- NEOTech Inc.

- JCET Group Co. Ltd.

Recent Industry Developments :

- In September 2022, Kulicke & Soffa Industries, Inc. collaborated with LeYu Precision Co., Ltd. to offer automated ball-bonder production line solutions utilizing Rail-Guided Vehicle (RGV) material handling systems.

- In June 2022, West Bond, Inc. developed the 7KF Bonder Series featuring primary and secondary ball sizes, programmable force, and radiant tool heat to meet the bonding applications in microwave, RF, semiconductor, hybrid, and medical device fields.

Key Questions Answered in the Report

What are bonding wires? +

Bonding wires are small metallic wires used for establishing reliable connections between various components of electronic devices.

What specific segmentation details are covered in the bonding wires report, and how is the dominating segment impacting the market growth? +

By bonding process type segment has witnessed thermo-compression as the dominating segment in the year 2022, as it uses heat and pressure to create a bond between the wire and the bonding pad.

What specific segmentation details are covered in the bonding wires market report, and how is the fastest segment anticipated to impact the market growth? +

By end-user segment has witnessed automotive as the fastest-growing segment during the forecast period due to the increasing adoption of ADAS systems in automotive vehicles.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia-Pacific region is expected to register fastest CAGR growth during the forecast period due to the growing manufacturing and automotive industry in the region.