Calcium Carbide Market Size :

Consegic Business Intelligence analyzes that the Calcium Carbide Market size is estimated to reach over USD 20,322.60 Million by 2032 from a value of USD 14,225.81 Million in 2024 and is projected to grow by USD 14,621.02 Million in 2025, growing at a CAGR of 4.6 % from 2025 to 2032.

Calcium Carbide Market Scope & Overview :

Calcium carbide is a chemical compound with a formula of CaC2. It is a greyish-white crystalline solid that is primarily used in the production of acetylene gas and various chemical compounds. Applications include the manufacturing of acetylene gas for the generation of acetylene in carbide lamps, the manufacturing of chemicals for fertilizer, and steelmaking. The overall rising industries such as steel manufacturing, chemicals, and manufacturing, which use this compound in various applications drive the need for this compound globally. Furthermore, it is also used in the production of calcium hydroxide and acetylene.

Calcium Carbide Market Insights :

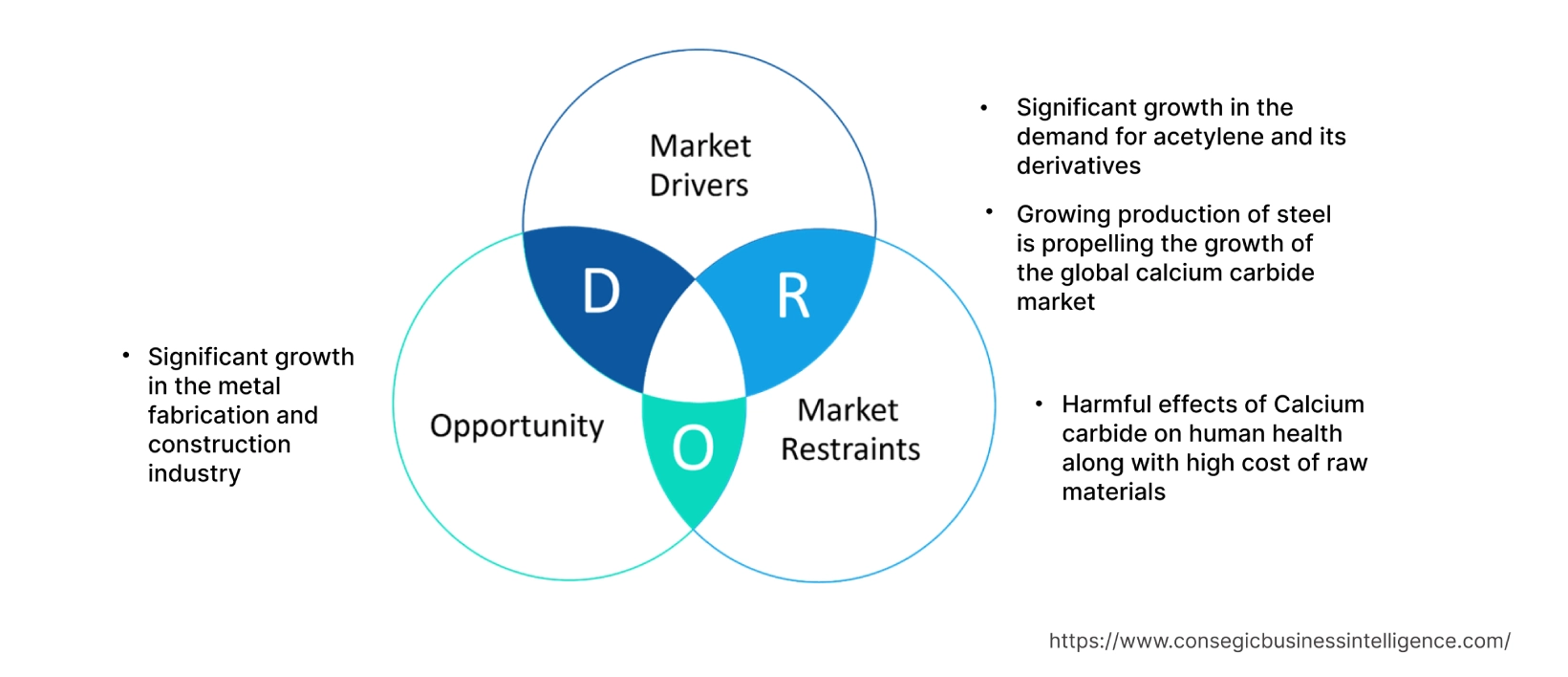

Calcium Carbide Market Dynamics - (DRO) :

Key Drivers :

Significant rise in the demand for acetylene and its derivatives impact market growth

Calcium carbide plays a pivotal role in the production of acetylene and its derivatives through a chemical reaction known as hydrolysis. It is a critical starting material in the production of acetylene gas, which is then purified and used directly or as a feedstock to manufacture a wide range of products such as chemicals, plastics, and manufacturing. Acetylene is widely used in various industrial processes such as chemical synthesis, food processing, pharmaceuticals, metal fabrication, construction, and, others. Acetylene serves as a crucial feedstock in the chemical sector, enabling the production of various chemicals and intermediates. This includes the synthesis of vinyl chloride, a key raw material for PVC production, which has been witnessing an increasing need for applications in the construction, piping, and, automotive industries. Acetylene is widely used in the metalworking and construction sectors for oxyacetylene welding and cutting. The growing production of acetylene across the globe is driving the requirements for this carbide for the production of acetylene. For instance, in March 2021, BASF SE announced the launch of its Ludwigshafen, Germany, site which includes a new production facility with the capacity to produce 90,000 mt/y of acetylene. Furthermore, in October 2022, SCG Chemicals announced a partnership with Denka Company Limited to establish and operate an acetylene black manufacturing business in the province of Rayong. The production capacity will be approximately 11,000 tons annually and is expected to commence by early 2025. Hence, the significant rise in the production of acetylene is driving the need for this carbide as a raw material, in turn, driving the calcium carbide market growth worldwide.

Growing production of steel is propelling the market

In the steel manufacturing sector, calcium carbide is used as a reducing agent in the electric arc furnace for recycling scrap steel. When it is injected into the electric arc furnace along with scrap steel, it reacts with the impurities, such as iron oxides present in the scrap. Acetylene produced from it is used for heat generation, which is utilized to maintain and control the temperature within the electric arc furnace. It helps to reach the high temperatures required for the steelmaking process, ensuring efficient smelting and refining of the steel. The significant growth in steel production in developing economies drives the market. For instance, according to the report by the Ministry of Steel of India in December 2022, crude steel production expanded from 109.25 million tons in 2018 to 124.72 million tons in 2022. Crude Steel production in 2022 showed a year-on-year growth of 5.5% over 2021. For this reason, the growing production of steel is propelling the calcium carbide market growth.

Key Restraints :

Harmful effects on human health along with the high cost of raw materials bring the market down

Calcium carbide is a chemical compound that can pose several harmful effects on human health, especially when not handled or used properly. It is considered toxic to humans. Indigestion or inhaling this compound can lead to various health issues, including gastrointestinal problems, irritation of the respiratory system, and damage to internal organs. It can release acetylene gas when it comes into contact with moisture. Inhalation of acetylene gas can lead to symptoms such as dizziness, headache, nausea, vomiting, and in severe cases, it can cause unconsciousness. The use of this carbide is unregulated or improper disposal practices can have negative environmental effects. It can contaminate soil and water, potentially harming ecosystems and aquatic life. Furthermore, the production of this carbide involves a high-temperature process in electric arc furnaces, which requires a significant amount of energy. The electrically needed for this process contributes to a substantial portion of the production cost. Hence, the market analysis shows that the harmful effects of this carbide on human health and the high production cost are restraining the calcium carbide market demand worldwide.

Future Opportunities :

Significant rise in the metal fabrication and construction sector create market opportunities

Calcium carbide in the metal fabrication sector is used as a fuel in oxyacetylene welding and cutting torches. When it is mixed with water, it produces acetylene gas, which provides a high-temperature flame for welding and cutting metals. This method allows for precise and efficient metal joining and cutting. In the construction sector, it is used for the manufacturing of acetylene torches for construction, concrete building, demolition work, welding and fabrications, and others. acetylene generated from it is commonly used in the construction sector for tasks such as soldering, brazing, and heating. These processes are crucial for joining metals, especially in plumbing, HAVC systems, and structural works. Significant growing investment in the construction sector across the globe is creating lucrative calcium carbide market opportunities over the estimated period. For instance, in June 2023, the European Union announced USD 324.25 million for the construction of four new flagship infrastructure projects in Bosnia and Herzegovina. Furthermore, in April 2023, The European Climate, Infrastructure and Environment Executive Agency (CINEA) launched a call for proposals for key cross-border EU energy infrastructure projects worth USD 802.59 million from the European Union budget. Therefore, the growing investment for the construction of various infrastructure projects across the developed economies is expected to drive calcium carbide market opportunities over the forecast period.

Calcium Carbide Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 20,322.60 Million |

| CAGR (2025-2032) | 4.6% |

| By Application | Acetylene Gas, Calcium Cyanamide, Desulfurizing Agent, Reducing Agent, and Others |

| By End-user Industry | Steel Manufacturing, Chemical, Pharmaceutical, Metal Fabrication, Construction Material, Energy & Power, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Denka Company Limited, American Elements, Lonza, Mil-Spec Industries Corporation, Xiahuayuan Xuguang Chemical, Carbide Industries LLC, APH-Regency Power Group, MCB Industries Sdn. Bhd., KC Group, DCM Shriram Ltd., and AlzChemss |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Calcium Carbide Market Segmental Analysis :

By Application :

The Application is categorized into acetylene gas, calcium cyanamide, desulfurizing agent, reducing agent, and others. In 20224 the acetylene gas segment accounted for the highest market share in the global calcium carbide market share. It is a key component used in the production of acetylene. Acetylene is a colorless, flammable, hydrocarbon gas with the chemical formula C2H2. It has two carbon atoms and two hydrogen atoms. It has a distinctively sharp, pungent odor. Acetylene is produced by the decomposition of calcium carbide (CaC2) in water. While acetylene is a useful gas for many applications. Acetylene is used in various industries such as chemicals, pharmaceutical applications, agricultural industries, polymers and resins, and others. Acetylene gas is most commonly used for the production of other chemicals used in perfumes, vitamins, polymers, solvents, and other materials due to its versatility and ease of reactive control in comparison to other gases. The significant rise in the production of chemicals worldwide is driving the segment across the globe. For instance, according to the report by the European Chemical Industry Council, the global sales of chemicals in 2020 accounted for USD 3750.37 billion and increased by 15.2% in 2021 and reached, USD 4,321.41 billion in 2021. Thus, the significant rise in the chemical sector is driving the demand for ethylene for the production of various chemicals and driving the segment.

Furthermore, the calcium cyanamide segment is expected to hold the highest CAGR over the forecast period in the calcium carbide market. It is used as a precursor in the production of calcium cyanamide, which is an important nitrogen fertilizer and chemical compound. Calcium cyanamide is used in various applications, and it plays a significant role in its synthesis. It is used as a nitrogen fertilizer. It provides controlled healthy plant growth and increases crop yields. It also acts as an herbicide and helps control weeds and pests. The growing demand for fertilizers is expected to drive the calcium carbide market trends over the forecast period.

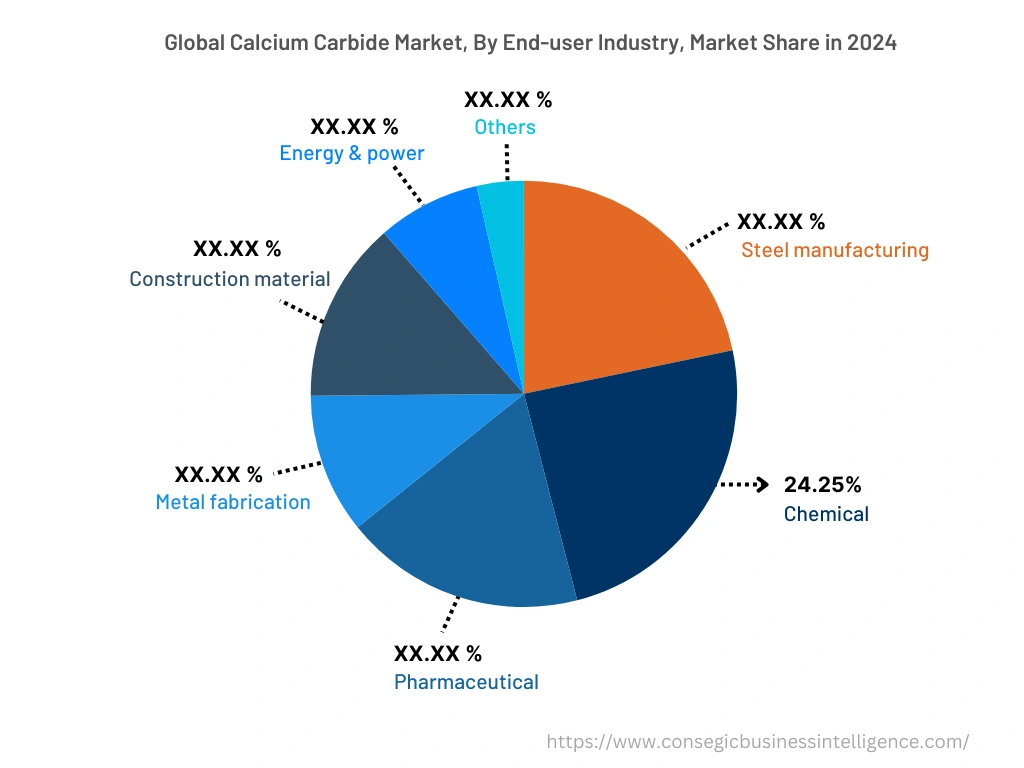

By End-User-Industry :

The end-user industry segment is categorized into steel manufacturing, chemical, pharmaceutical, metal fabrication, construction material, energy & power, and others. In 2024, the chemical segment accounted for the highest market share of 24.25% in the overall calcium carbide market share. It has several applications in the chemical sector due to its ability to produce acetylene gas when it reacts with water. Acetylene gas derived from it serves as a versatile feedstock for various chemical processes such as the synthesis of vinyl chloride monomer, acrylic acid and esters, organic compounds, acetylic black, and others. The significant rise in investment in the chemical sector is driving the segment development across the globe. For instance, according to the report by the European Chemical Industry Council, in the European Union chemicals investment reached the value of USD 28.46 billion in 2021, which is 68% above investment in 2003. Thus, the increasing investment in the chemical sector is increasing the demand in the chemical sector and driving calcium carbide market demand.

Moreover, the metal fabrication segment is expected to grow at the fastest CAGR over the forecast period in the calcium carbide market. Acetylene is used in metal fabrication and metalworking applications. Investments in infrastructure projects, such as highways, bridges, airports, and public transportation systems, are expected to drive calcium carbide market trends over the estimated period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

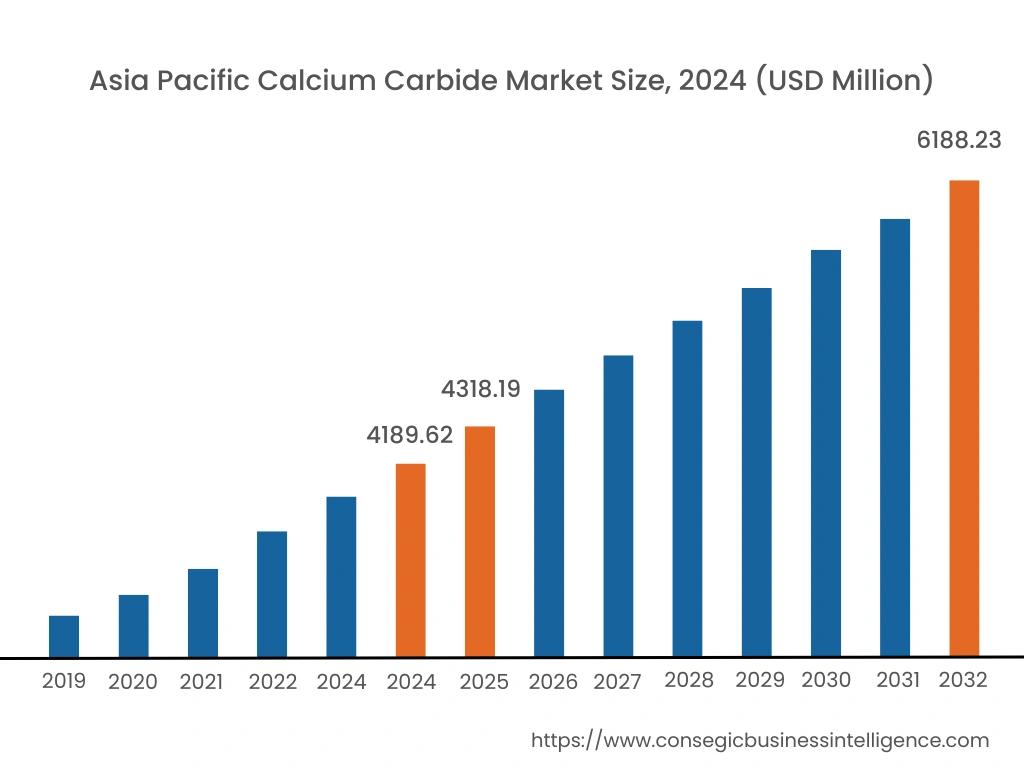

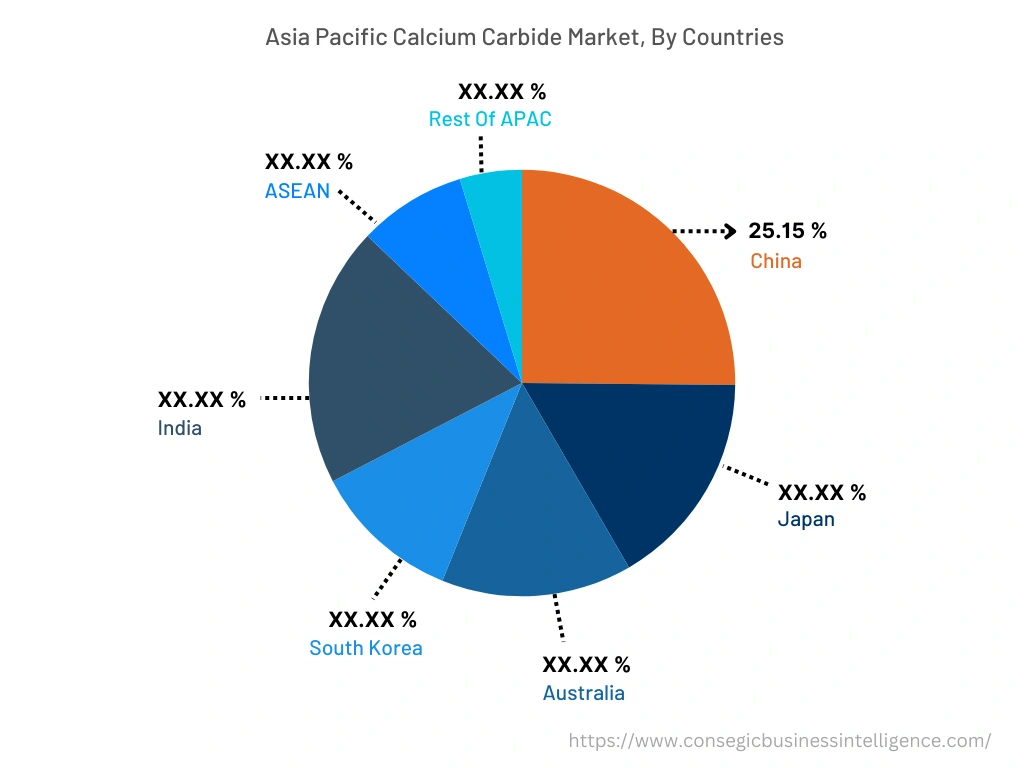

In 2024, Asia Pacific accounted for the highest market share at 38.15% valued at USD 4,189.62 Million in 2024 and USD 4,318.19 Million in 2025, it is expected to reach USD 6,188.23 Million in 2032. In Asia Pacific, China accounted for the highest market share of 25.15% during the base year of 2024. As per the calcium carbide market analysis, it is used in the production of acetylene gas, which finds application in pharmaceutical, construction, steel manufacturing, and others. Significant rise in these industries across the Asia Pacific is driving the calcium carbide market in the region. For instance, according to the report by the Indian Brand Equity Foundation in August 2023, the market size of the Indian pharmaceuticals sector is expected to reach USD 65 billion by 2024, and USD 130 billion by 2030. Furthermore, according to the report by the National Investment Promotion and Facilitation Agency in July 2023, the construction sector in India is expected to reach USD 1.4 trillion by 2025, due to the growing urban population across the country. Significant growth in steel production in the region is also driving the market growth in Asia Pacific. For instance, according to the data published by The World Steel Association in April 2023, China's steel production in 2023 increased by 5.6% from the previous year 2022.

The calcium carbide market analysis shows that the North American region is expected to witness significant growth over the forecast period, growing at a CAGR of 5.2% during 2025-2032. The significant growth in the manufacturing, energy, and power sectors across the North American region is expected to create lucrative opportunities for the calcium carbine market. The manufacturing sector such as automotive, aerospace, and metal fabrication, relies on calcium carbide-derived acetylene for various processes like welding, brazing, and heat treatment. The growing industries across North America are expected to influence the market over the estimated period.

Top Key Players & Market Share Insights:

The Calcium Carbide market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the calcium carbide industry include-

- T&CO.

- Harry Winston, Inc.

- HStern

- GRAFF

- RENAISSANCE GLOBAL LIMITED

- De Beers Forevermark

- Pandora

- CARTIER

- Le Petit-fils de L.U. Chopard & Cie S.A.

- Swarovski

- Pomellato S.p.A.

Recent Industry Developments :

- In May 2023, Denka Company Limited announced its plant conducted joint research with Transform Materials LLC, a global microwave plasma technology provider, to establish its technology for realizing the low-carbon production of acetylene from calcium carbide.

Key Questions Answered in the Report

What was the market size of the calcium carbide market in 2024? +

In 2024, the market size of calcium carbide was USD 14,225.81 Million.

What will be the potential market valuation for the calcium carbide market by 2032? +

In 2032, the market size of calcium carbide will be expected to reach USD 20,322.60 Million.

What are the key factors driving the growth of the calcium carbide market? +

Significant growth in the demand for acetylene and its derivatives across the globe is fueling market growth at the global level.

What is the dominating segment in the calcium carbide market for the end-user industry? +

In 2024, the chemical segment accounted for the highest market share of 24.25% in the overall calcium carbide market.

What is the region which accounted for the highest market share? +

Asia Pacific accounted for the highest market share at 38.15%.