Cardiac Output Monitoring Devices Market Size :

Consegic Business Intelligence analyzes that the Cardiac Output Monitoring Devices market size is growing with a CAGR of 4.9% during the forecast period (2024- 2031). The market accounted for USD 3,755.00 million in 2023 and is projected to be valued at USD 5,484.89 Million by 2031.

Cardiac Output Monitoring Devices Market Scope & Overview :

Cardiac output is the product of heart rate (HR) and stroke volume (SV) i.e. the amount of blood pumped by the heart into the aorta each minute. It is expressed in liters per minute. The cardiac output monitoring market involves the use of devices and techniques used to measure the amount of blood pumped by the heart per minute to assess cardiac function.

It encompasses various technologies like pulmonary artery catheters, non-invasive hemodynamic monitoring systems, transthoracic impedance, bioreactance analysis, and echocardiography. These tools aid in assessing the overall function of the heart, diagnosing and managing cardiac conditions, guiding treatments, monitoring patients in critical care settings and operating theatres, and helping healthcare providers to provide the best possible care to their patients. Advancements in technology have led to the development of minimally invasive and non-invasive methods for improving patient care.

How is AI Impacting the Cardiac Output Monitoring Devices Market?

AI is profoundly impacting the cardiac output monitoring devices market by enabling more intelligent, accurate, and non-invasive solutions. Machine learning algorithms analyze complex data from various sensors in real-time, moving beyond traditional vital signs to provide predictive analytics that can forecast hemodynamic instability, such as hypotension, minutes before it occurs. This helps clinicians intervene proactively, improving patient outcomes in critical care settings. AI also reduces the burden of false alarms, which leads to "alarm fatigue" in hospital staff, by accurately filtering and prioritizing clinically relevant alerts. Furthermore, AI-powered wearables are making continuous cardiac monitoring more accessible and less invasive for remote patient management.

Cardiac Output Monitoring Devices Market Insights :

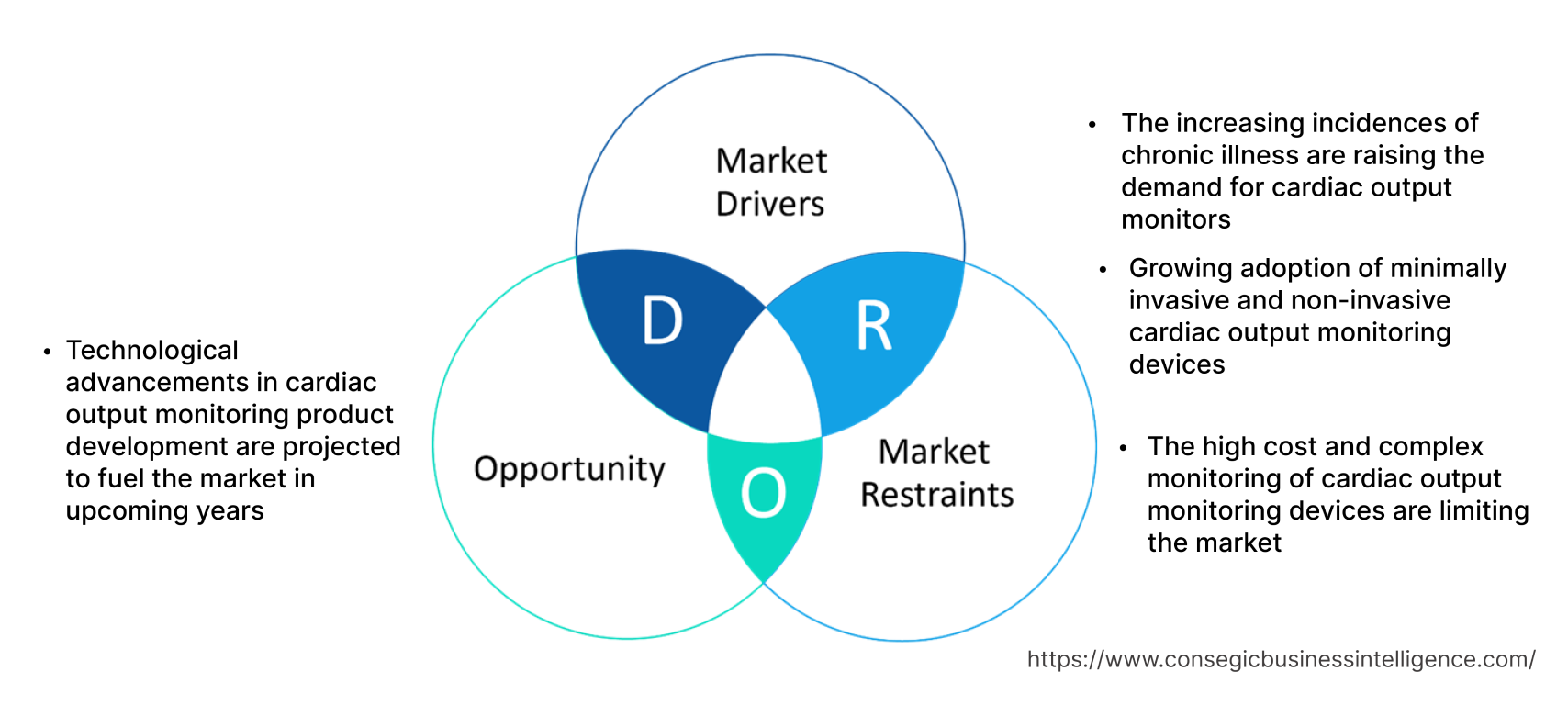

Cardiac Output Monitoring Devices Market Dynamics - (DRO) :

Key Drivers :

The increasing incidences of chronic illness are raising the demand for cardiac output monitors

The accurate quantification of cardiac output (CO) is given an important value in modern medical practice, especially in high-risk surgical and critically ill patients. These devices ensure an adequate supply of blood, improve cardiac output and thereby evaluate respiratory exchange and oxygen supply in the human body. Additionally, these devices are also used to assess the overall function of the heart, and the progression of disease, diagnose and manage cardiac conditions, and guide treatments in critical care settings and operating theatres. This helps clinicians to make informed decisions about patient care. Furthermore, these devices are used to identify individuals at high risk of developing certain cardiovascular diseases. This information is used by medical experts to develop strategies to prevent these diseases from developing. Moreover, the rising prevalence of chronic diseases such as cardiovascular diseases, is fueling the cardiac output monitoring devices market demand.

For instance, According to the report published by the World Health Organization in May 2023, deaths from cardiovascular disease have surged 60% globally over the last 30 years.

Furthermore, according to the report by the World Health Organization in June 2021, cardiovascular diseases (CVDs) are the leading cause of death globally and an estimated 17.9 million people died from CVDs in 2019, representing 32% of all global deaths. Of these deaths, 85% were due to heart attack and stroke.

As a result, the increasing prevalence of cardiovascular diseases is boosting demand for cardiac output monitoring devices market and driving market growth across the globe.

Growing adoption of minimally invasive and non-invasive cardiac output monitoring devices

Cardiac output monitoring devices are becoming increasingly non-invasive and minimally invasive, and this factor assists as the potential factor driving the market. The term minimally invasive and non-invasive cardiac output monitors collectively describe all devices that calculate cardiac output without requiring the insertion of a completely invasive pulmonary artery catheter. This makes non-invasive cardiac output monitors more appealing to patients and clinicians alike. The escalating demand for non-invasive procedures fosters the demand for these devices.

Additionally, minimally invasive and non-invasive cardiac output monitors are becoming increasingly popular because they are less risky and have shorter recovery times than traditional invasive methods. Moreover, the rising adoption of these devices in healthcare facilities is boosting the cardiac output monitoring devices market.

For instance, In November 2020, Retia Medical announced the successful installation of its Argos Cardiac Output monitors within the Duke University Health System. This provides access to Retia Medical's industry-leading hemodynamic monitoring technology to help guide clinical decisions during volume resuscitation and vasoactive therapy for critically ill patients.

Consequently, the increasing demand for minimally invasive and non-invasive procedures along with the rising innovations in these devices is driving the market trends.

Key Restraints :

The high cost and complex monitoring of cardiac output monitoring devices are limiting the market

Cardiac output monitoring devices are relatively expensive, especially implantable devices and advanced remote monitoring systems. This deters some patients and healthcare facilities from adopting these devices. Additionally, some devices are complex to use, requiring specialized training for clinicians and patients to use effectively. This also be a barrier to their adoption.

Moreover, the high cost of these devices places a financial burden on patients and healthcare systems. This can limit access to these devices, especially in underserved communities and developing countries. Furthermore, non-invasive monitoring devices can be more prone to errors if not used properly. This can lead to inaccurate results and create barriers to patient treatment. Thus, the high cost of these devices and the high complexity of monitoring devices are restraining the expansion of the market across the globe.

Future Opportunities :

Technological advancements in cardiac output monitoring product development are projected to fuel the market in upcoming years

Technological advancements in cardiac monitoring devices are expected to propel the market trends, as they enable more accurate, efficient, and accessible diagnosis of disease and monitoring of cardiac functions. As the prevalence of chronic disorders increases, there is a growing demand for early detection and diagnosis of the disease. Moreover, innovation in technologies such as machine learning, and dissolvable solutions for these devices is expected to bring new lucrative cardiac output monitoring devices market opportunities and trends.

For instance, According to the research published on July 5, 2023, National Science Foundation-supported biomedical researchers at Northwestern University and George Washington have developed a dissolvable cardiac device that offers real-time data collection, restores heart rhythms to normal, and simply dissolves when its job is done.

This device avoids the costs/risks of surgical extraction. As a result, increasing innovation in these devices is expected to create lucrative cardiac output monitoring devices market trends and opportunities for the expansion of the global cardiac output monitoring devices market over the forecast period.

Cardiac Output Monitoring Devices Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 5,484.89 Million |

| CAGR (2024-2031) | 4.9% |

| By Product Type | Invasive and Non-invasive |

| By Technology | Pulmonary Artery Catheterization, Transthoracic Impedance And Bioreactance Analysis, Lithium Dilution Technique, Thermodilution Pulse Contour Analysis Technique, Doppler and Others. |

| By End User | Hospitals, Ambulatory Surgical Centers, Clinics and Others |

| By Region | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Players | Koninklijke Philips N.V, Abbott, Baxter., Edwards Lifesciences Corporation., ICU Medical, Masimo., GE HealthCare., Medtronic, Retia Medical Systems, Inc. Boston Scientific Corporation, Nihon Kohden Corporation, Osypka Medical, Medizinische Messtechnik GmbH, Caretaker®, TRIHEALTH and Biotronik. |

Cardiac Output Monitoring Devices Market Segmental Analysis :

By Product Type :

By product type cardiac output monitoring device market is categorized into invasive and non-invasive devices. In 2023, the invasive segment accounted for the highest cardiac output monitoring devices market share. Invasive cardiac output monitoring device involves the use of specialized techniques such as pulmonary artery catheters, arterial pressure waveform analysis, and Doppler monitoring. These devices are typically employed in intensive care units and operating rooms to closely monitor and manage patients with complex disorders. Invasive cardiac output monitors are inserted in the body through large veins to directly measure cardiac-related functions like cardiac output, stroke volume, and heart rate. Additionally, invasive cardiac devices are safe, produce continuous cardiac output measurements, and provide accurate results. Moreover, minimally invasive cardiac output monitors provide real-time cardiac output which is potentially boosting the segment trend.

Moreover, the non-invasive segment is expected to hold the highest CAGR over the forecast period. Invasive cardiac output monitoring devices are safe and produce continuous cardiac output measurement, however, the issues related to invasive devices like infections, pulmonary artery rupture, and pneumothorax are increasing the demand for non-invasive methods. Non-invasive cardiac output monitoring devices offer a less intrusive method of monitoring cardiac output with no requirement for arterial or venous access. The convenience of non-invasive monitors lowers the risk of problems and reduces patient discomfort. Additionally, non-invasive cardiac output monitors are being widely utilized in clinical settings like emergency rooms, and clinics. Moreover, newly approved product launches for non-invasive cardiac output monitoring devices are expected to fuel the market expansion in the future.

For instance, On April 25, 2023, Caretaker Medical, a digital health leader in continuous "beat by beat" wireless patient monitoring technologies, announced that it has received FDA 510(k) Clearance for four new continuous hemodynamic parameters, adding cardiac output, stroke volume, heart rate variability, and left ventricular ejection time to its VitalStream™ non-invasive patient monitoring platform.

Thus, the aforementioned factors are propelling the cardiac output monitoring devices market trend.

By Technology :

The technology segment is categorized into pulmonary artery catheterization, transthoracic electrical impedance and bioreactance analysis, thermodilution pulse contour analysis, doppler, and others. In 2023, the pulmonary artery catheterization segment accounted for the highest market share in the overall cardiac output monitoring devices market and it is expected to hold the highest CAGR over the forecast period. Pulmonary artery catheterization is an invasive technique that involves inserting a catheter into the pulmonary artery and injecting a cold fluid into the bloodstream. Pulmonary artery catheterization is used to estimate cardiac output, assess right-sided cardiac chamber filling pressures, evaluate intracardiac shunts, evaluate cardiac valves, or assess vascular resistance. Additionally, the Pulmonary artery catheterization technique is safe, produces continuous cardiac output measurement, and provides accurate results. Therefore, advantages associated with pulmonary artery catheters are driving the segment potentially.

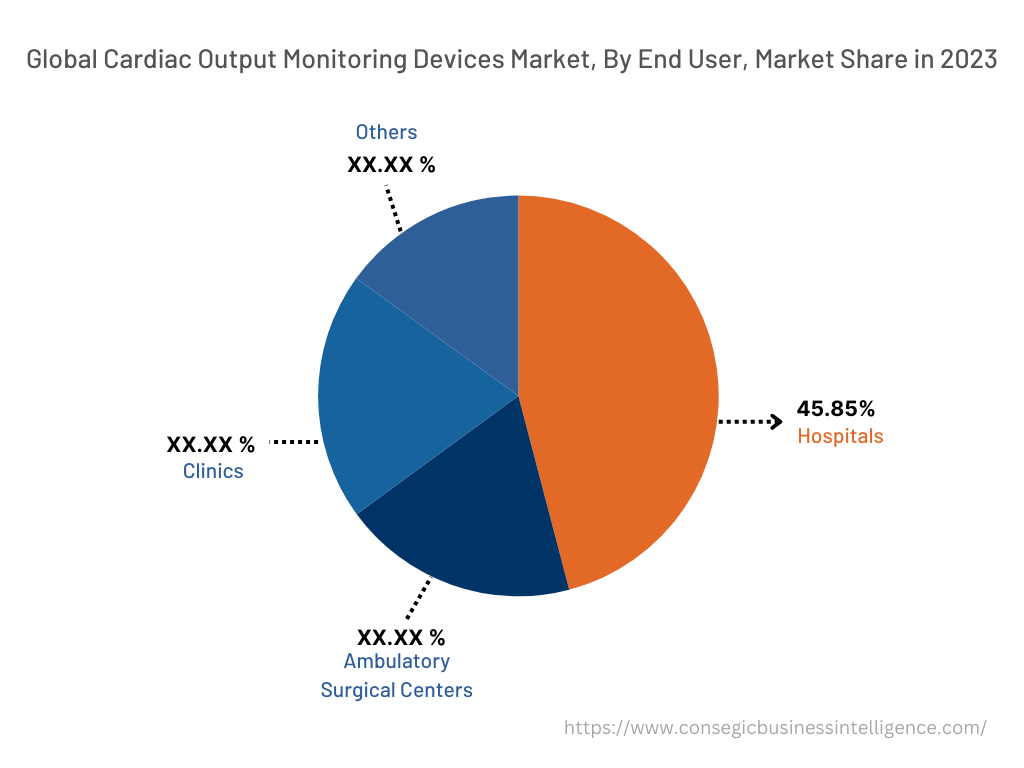

By End-User :

The end user segment is categorized into hospitals, ambulatory surgical centers, clinics, and others. In 2023, the hospital's segment accounted for the highest market share of 45.85% in the overall cardiac output monitoring devices market. Cardiac output monitoring devices are essential tools for patients in critical care settings and operating theatres. Additionally, hospitals provide the availability of cutting-edge healthcare infrastructure and medical personnel to their patients. Cardiac output monitoring devices play a vital role in helping healthcare providers to provide the best possible care to their patients. Moreover, the growing hospital expenditures to provide patients with the best treatment are driving the segment expansion across the globe.

For instance, According to the report by the American Medical Association in March 2023, Hospital expenditures grew 4.4% to USD 1,323.9 billion in 2021, slower than the 6.2% growth in 2020.

The growing healthcare expenditure across the globe is creating lucrative trends and cardiac output monitoring devices market opportunities over the forecast period.

Moreover, the ambulatory surgical centers segment is expected to hold the highest CAGR over the forecast period. Ambulatory surgery centers, or ASCs, are modern healthcare facilities focused on providing same-day emergency surgical care, including diagnostic and preventive procedures, avoiding hospital admissions. Additionally, the surgical solutions provided by ambulatory surgical centers are cost-effective. Increasing access, improving quality, and lowering the cost of healthcare delivery are driving the segment growth over the forecast period. Furthermore, new ambulatory surgical setups launched by medical device companies are expected to boost the segment in the future.

For instance, On June 21, 2023, Royal Philips, a global leader in health technology, announced collaboration with BIOTRONIK a leading global medical device company with products and services that improve the lives of patients suffering from cardiovascular and endovascular diseases, to expand the range of cardiovascular devices available for Philips SymphonySuite customers.

This alliance further strengthens Philips' industry leading SymphonySuite solution, a complete, integrated offering to support clinicians or hospitals to open and operate ambulatory surgery centres, hence it is expected to bring lucrative growth in the ambulatory surgical centres segment.

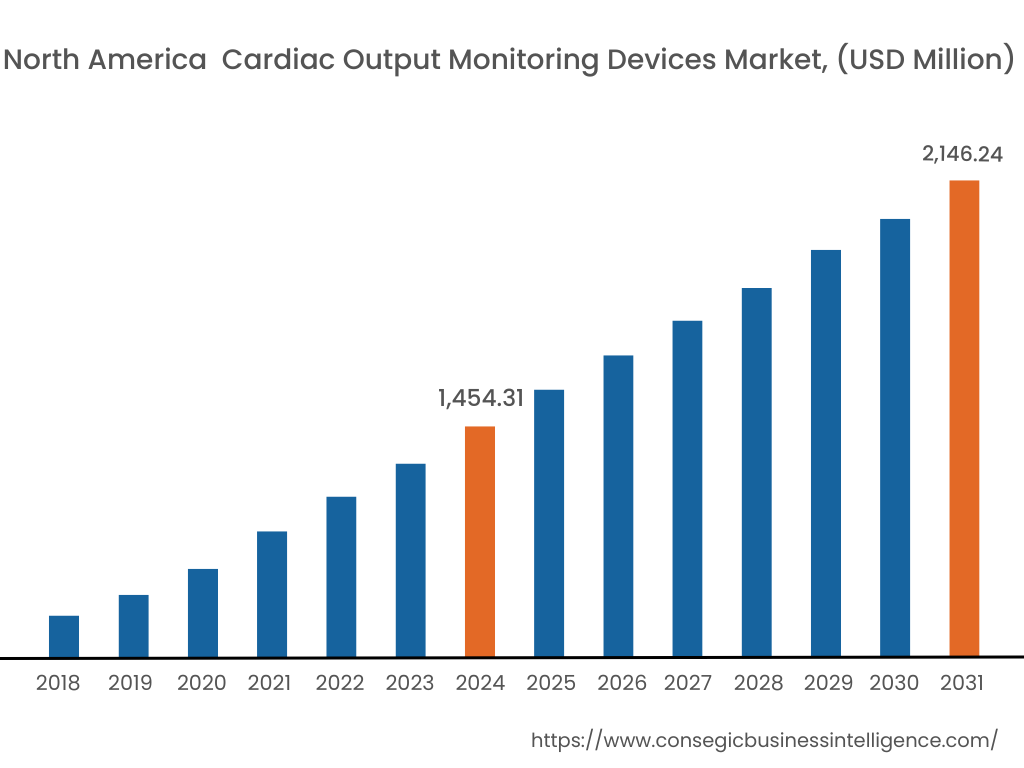

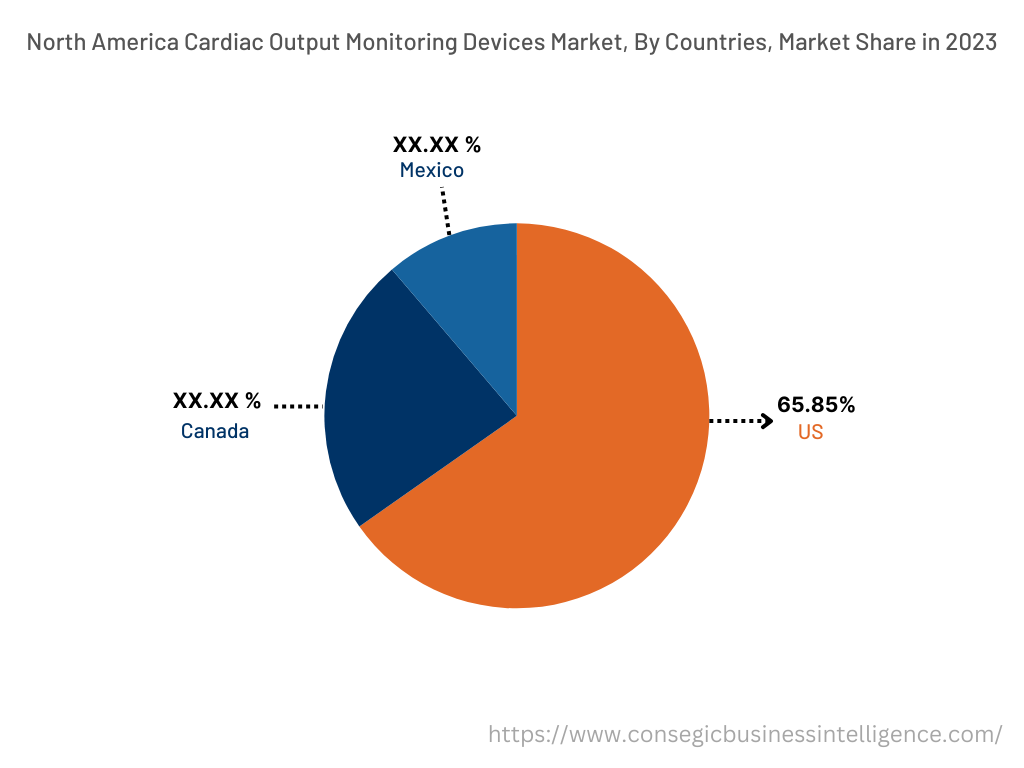

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2023, North America accounted for the highest market share of 38.73% valued at USD 1,454.31 Million in 2023, it is expected to reach USD 2,146.24 Million in 2031. In North America, the U.S. accounted for the highest market share of 65.85% during the base year of 2023. Based on the cardiac output monitoring devices market analysis, this is due to several factors including the high prevalence of chronic diseases in the region, the presence of key manufacturers, the presence of well-developed healthcare systems, the accessibility of advanced medical systems, and the high adoption rate of new technologies. Moreover, increasing investments in the development of cardiac output monitoring devices across the region are also driving the cardiac output monitoring devices market growth.

For instance, In November 2021, Philips a global leader in health technology, announced the agreement to acquire Cardiologs, a France-based medical technology company focused on transforming cardiac diagnostics using artificial intelligence (AI) and cloud technology.

Moreover, rising healthcare expenditures are also propelling the market in this region. For instance, according to the data published by the Centers for Medicare & Medicaid Services in June 2023, total national health expenditures grew 2.7% to USD 4.3 trillion in 2021, or USD 12,914 per person, and accounted for 18.3% of Gross Domestic Product.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 5.8% during 2023- 2031. The increasing prevalence of cardiovascular diseases in the region, the rising geriatric population in regions like Japan and China, and the growing medical device industry in the Asia Pacific are driving the market growth. Additionally, increasing government funds and initiatives for better healthcare are expected to boost the market in this region.

For instance, According to the data published by the Investment Information and Credit Rating Agency, in October 2023, the Indian government is planning to introduce a credit incentive program worth USD 6.8 billion to boost the country's healthcare infrastructure.

Moreover, increasing government initiatives to develop the medical devices sector are expected to substantially grow the cardiac output monitoring devices market in this region.

For instance, According to the data published by India Brand Equity Foundation, in August 2023, in FY20, foreign investments in the medical devices sector increased 98% year over year to USD 301.01 million, as against USD 151.87 million in FY19 and foreign direct investment inflow in the medical and surgical appliances sector stood at USD 2.80 billion between April 2000-March 2023.

Overall, above mentioned factors are collectively expected to propel the market growth in the Asia Pacific region in upcoming years.

Top Key Players & Market Share Insights :

The global cardiac output monitoring devices market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The cardiac output monitor industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

The key players in the market include-

- Koninklijke Philips N.V

- Abbott

- Baxter

- Edwards Lifesciences Corporation

- ICU Medical

- Masimo

- Osypka Medical

- TRIHEALTH

- GE HealthCare

- Medtronic

- Retia Medical Systems, Inc

- Boston Scientific Corporation

- Nihon Kohden Corporation

- Medizinische Messtechnik GmbH

- Caretaker®

- Biotronik

Recent Industry Developments :

- In October 2023, Boston Scientific announced the launch of the LUX-Dx II+ Insertable Cardiac Monitor (ICM) System which is a small, leadless electronic device that monitors for arrhythmias. It's inserted under the skin in the left pectoral region.

- On Feb 09, 2023, Royal Philips, a global leader in health technology, announced a long-term strategic partnership with TriHealth, a leading Cincinnati-based integrated healthcare delivery system, to adopt Philips' integrated portfolio of cardiology solutions for its new TriHealth Heart & Vascular Institute on the campus of Bethesda North Hospital and the Harold and Eugenia Thomas Comprehensive Care Center. The agreement allows TriHealth to expand cardiac care and deliver on its promise to the community: provide high-quality care, act for the benefit of the community, cooperate with physicians and other providers to coordinate health services and educate the next generation of healthcare providers.

Key Questions Answered in the Report

What was the market size of the cardiac output monitoring devices market in 2023? +

In 2023, the market size of cardiac output monitoring devices was USD 3,755.00 million.

What will be the potential market valuation for the cardiac output monitoring devices industry by 2031? +

In 2031, the market size of cardiac output monitoring devices will be expected to reach USD 5,484.89 million.

What are the key factors driving the growth of the cardiac output monitoring devices market? +

The increasing incidences of chronic illness raising the demand for cardiac output monitors is fueling market growth at the global level.

What is the dominant segment in the cardiac output monitoring devices market for the end user? +

In 2023, the hospitals segment accounted for the highest market share of 45.85% in the overall Cardiac Output Monitoring Devices market.

Based on current market trends and future predictions, which geographical region is the dominating region in the cardiac output monitoring devices Market? +

North America accounted for the highest market share in the overall market.