Clinical Data Management Systems Market Size:

Clinical Data Management Systems Market size is growing with a CAGR of 13.6% during the forecast period (2024-2031), and the market is projected to be valued at USD 4,490.53 Million by 2031 from USD 1,837.50 Million in 2023.

Clinical Data Management Systems Market Scope & Overview:

Clinical Data Management (CDM) systems are software platforms that are used in the collection, management, and integration of clinical trial data. CDM systems are efficient in ensuring the data collected from clinical trials are accurate and compliant with the regulatory requirements. CDMs are equipped to collect as much readily available data as possible for analysis and can streamline the procedure of data entry, validation, and storage. They also perform audit trails by tracking any change made to the given data by maintaining a detailed record of data edits and approvals. There are several benefits of CDM systems, but the primary one is the provision of acquiring high-quality and error-free data. It also speeds up the process of data collection, making it efficient in reducing time while promising compliance with global and local regulations. CDM systems are cost-effective, scalable, and offer real-time data access. The CDM systems are often employed by pharmaceutical firms, contract research organizations (CROs), the medical industry, academic institutions, and others.

Clinical Data Management Systems Market Dynamics - (DRO) :

Key Drivers:

Increase in the Volume of Clinical Trials Advances the Market

Clinical trials generate large amounts of data which clinical data management (CDM) systems manage, store, and analyze precisely and efficiently. With the advent of more pharmaceutical firms, research organizations, and medical facilities conducting clinical trials to develop novel vaccines, drugs, and devices, the need for efficient data storage and management has expanded. This has made clinical trials more complex, with multinational and multi-site research focusing on curating medicine that complies with strict regulatory requirements. The shift towards electronic data capture (EDC) and digital solutions in clinical trials has heightened the adoption of advanced CDM systems. The advanced systems offer live data access with fewer errors and faster trial timelines. The integration of artificial intelligence (AI) is also transforming the efficiency of CDM systems, driving its demand.

- In February 2023, the World Health Organization (WHO) published an article highlighting the growing number of clinical trials conducted from a period of 1999 to 2022. The high concentration of clinical trials in the Asia-Pacific region (APAC) has been on the rise in recent years. While America in the Western Pacific faces a recent rise compared to the European or Middle Eastern nations.

Thus, the growing decentralized and patient-centric clinical trials lead to clinical data management systems market growth.

Key Restraints :

Data Privacy and Security Concerns Curbs Market Growth

The data collected during clinical trials are patient-sensitive information that includes health records, medical chronologies, and genetic information. Any breach or misuse of this information can lead to major ethical, financial, and legal consequences for the companies conducting the trials. The governments and regulatory bodies impose stringent guidelines on how the collected data should be stored and shared. CDM systems that fail to maintain the standards are prone to becoming obsolete, and the firms are charged with hefty fines. There is also the vulnerability of being a target for cyberattacks from hackers who attempt to steal confidential patient data to tamper or steal for their own gain. This leads to a general distrust among patients who take part in clinical trials, hampering the CDM system's widespread adoption.

- For instance, in August 2021, Morley Companies suffered a ransomware attack leading to a breach in its systems. This cost them exposed data of over 521,000 individuals. The individuals were informed in February 2022.

Therefore, the CDM systems market growth is substantially curbed as the risk of data breach or failure to ensure data privacy is still viable within the market.

Future Opportunities :

Growing Adoption of Cloud-Based CDMS Opens New Avenues for Market Expansion

Cloud-based CDM systems are more cost-effective in the long run than conventional on-premise systems as they reduce the need for expensive IT infrastructure, hardware, and maintenance. This allows firms manufacturing CDM systems to allocate their resources more efficiently making CDM systems more accessible. This scalability allows firms to easily adjust their data storage and processing capacity based on the size and complexity of the specific clinical trials. Cloud-based CDM systems offer better collaboration among clinical stakeholders and provide the provision to partner remotely. It also supports decentralized clinical trials in which data is collected from patients outside of conventional settings, making the process flexible. It allows the integration of data from varied sources, like home health tests, offering more cloud-based solutions.

- Fountain is a software and data solution company, that provides its customers with cloud-based clinical data management systems. They have exceptional expertise in consulting services for medical, healthcare, biotech, pharma, etc. Their cloud-based CDM systems streamline clinical trials and meet the regulation guidelines of any protocol. Their CDM systems are effective for any device, drug, and diagnostic studies.

Thus, as cloud-based CDM systems offer better data analytics, they open up new clinical data management systems market opportunities.

Clinical Data Management Systems Market Segmental Analysis :

By Type:

The market is segmented based on type into Licensed Enterprise Software, Web-Based Software, and Cloud-Based Software.

Trends in the Type:

- Recently the drift of incorporating CDM systems with artificial intelligence (AI) and machine learning (ML) has been on the rise. It would result in the processing of large amounts of data from disparate sources.

- Real-world evidence (RWE) is trending and is utilized in making healthcare decisions more appropriate for real-world usage by taking into account a more patient-centric approach.

Cloud-based software accounted for the largest revenue of the total clinical data management systems market share and is expected to have the fastest-growing CAGR during the forecasted period.

- Cloud-based software offers healthcare organizations the provision to scale easily without upfront investments in additional infrastructure.

- With the expansion of clinical trials in scope and complexity, the flexibility of cloud-based software ensures quick adjustments to encompass larger data sets and new trial requirements.

- Cloud-based software is cost-effective as it eliminates the need for expensive on-premise hardware and offers ‘pay-as-you-go' models.

- They have a robust security protocol that includes end-to-end encryption, role-based access, and frequent updates to comply with healthcare standards.

- For instance, in March 2023, Fujitsu Limited announced the launch of a new cloud-based software for the collection of health-related data. This new platform is set to leverage AI and has automatic data conversion which is aimed at revolutionizing the medical field.

- Thus, the rising drift of decentralized clinical trials has accelerated the adoption of cloud-based CDM system software, boosting the clinical data management systems market trends.

By Component:

The market is bifurcated based on component into Software and Services.

Trends in the Component:

- Recently, a trend of leveraging blockchains for data security in services has been emerging for its ability to create immutable and tamper-proof patient records.

- In recent times, there has been a trend to attune CDM system software to support decentralized clinical trials (DCT) that can collect data from remote locations.

Software accounted for the largest revenue of the overall clinical data management systems market share in 2023.

- The advent of complex and rare diseases, the need for personalized medicines has grown, which requires accurate clinical trials. These trials necessitate the utilization of specialized software that can track, analyze, and store patient data.

- Advanced software solutions offer the provision of efficient management of large volumes of clinical data. They also offer automation capabilities, streamlining trial processes.

- These software systems increase efficiency and accelerate trial timelines by eliminating manual effort and human error, making them appealing to pharmaceutical companies, medical facilities, etc.

- The adoption of electronic data capture (EDC) systems, a type of CDM system software, to replace conventional methods in clinical trials is on the rise. They are more reliable and have a lesser risk of data loss, enhancing data accuracy.

- For instance, OpenClinica is open-source clinical data management system software that is efficient in managing clinical trial data. The software is flexible and cost-effective.

- Therefore, software solutions provide a greater degree of customization and flexibility, driving the clinical data management systems market growth.

Services are expected to have the fastest-growing CAGR in the clinical data management systems market during the forecasted period.

- The growing drift towards outsourcing clinical data management tasks to specialized service providers helps pharmaceutical firms, biotech companies, etc to reduce operational burdens and manage costs.

- Services offer curated knowledge to ensure clinical trials are meeting international regulatory standards, particularly, in terms of integrity, security, and reporting.

- Clinical trials require customization in data management based on particular therapeutic areas, research studies, and locations. Services offer perennialization through protocol design, database setup, etc.

- For instance, Quanticate, a biotech company, offers state-of-the-art clinical data management system services. They have electronic capture devices (EDC), end-to-end CDM solutions, and exceptional quality clinical trial data.

- Thus, services provide cost-effective training and technical support, boosting the clinical data management systems market expansion.

By Mode of Delivery:

The market is segmented based on the mode of delivery into On-Premise, Cloud-Based, and Web-Based.

Trends in the Mode of Delivery:

- Recently, steady growth of web-based telemedicine and remote monitoring has led to the development of integrated CDM systems that can process multiple monitoring devices into a single platform.

- Cloud-based solutions can now support interoperability which helps in proper coordination and communication between different CDM systems.

Cloud-based delivery accounted for the largest revenue and is expected to have the fastest-growing CAGR during the forecasted period.

- Cloud-based delivery offers enhanced data security measures, such as encryption, user authentication, audit trails, etc. This complies with medical requirements and regulatory guidelines.

- Cloud-based delivery allows real-time data access which can speed up decision-making, improve trial monitoring, and minimize delays, leading to efficient trial durations and outcomes.

- They enable the integration of advanced analytics to improve trial efficiency by predicting outcomes, identifying patterns, optimizing designs, and managing complex data sets.

- For instance, Castor offers cloud-based delivery for their clinical data management systems. Their systems offer easy collection and integration of data from varied sources such as wearables, EHR devices, patients, etc.

- Thus, fast implantation and deployment of cloud-based delivery CDM systems boost the clinical data management systems market demand.

By Application:

The market is segmented based on application into Pharmacovigilance, Clinical Trial Data Management, Regulatory Compliance, and Medical Research.

Trends in the Application:

- In recent times, Clinical Trial Data Management has pressed a more patient-centric and value-based approach to achieve more efficiency in gathering analytical data.

- Medical research recently has been taking into account the implications of mental health monitoring and stress management in acquiring more accurate patient information during trials.

Clinical Trial Analysis accounted for the largest revenue share in the clinical data management systems market in 2023.

- The increase in the number of clinical trials, especially for oncology or rare diseases generates a demand for effective clinical trial data management systems.

- The data generated requires management, analysis, and compliance checks in a timely manner which clinical trial data management systems are specifically designed to offer.

- The clinical trial data are often complex and clinical trial data management systems offer features like EDC, real-time monitoring, and enhanced analytics for handling the complexities.

- The expansion of biopharmaceutical and medical tech for gene therapies, biologics, etc, has necessitated the need for unique trial designs to match regulatory needs.

- For instance, Advarra offers a clinical trial data management system that efficiently handles all aspects of clinical trials from startup to closeup. It helps in centralizing data related to codes, subjects, financials, billing, etc.

- Thus, as the importance of clinical trials rises globally, a robust clinical trial analysis ensures data consistency, driving the clinical data management systems market demand.

Pharmacovigilance is expected to have the fastest-growing CAGR during the forecasted period.

- Pharmacovigilance is imperative in monitoring the safety and efficiency of drugs during, from clinical trials to post-market inspection. With the growing frequency of clinical trials, the demand for accurate pharmacovigilance data management systems increases.

- To comply with the stringent regulations set by the global health authorities, pharmaceutical firms need to maintain high standards of pharmacovigilance reports and data management. They rely on advanced CDM systems with integrated pharmacovigilance modules to meet the standards.

- The growing demand for personalized medicine and complex therapies has made the employment of advanced pharmacovigilance systems more necessary for monitoring long-term effects.

- Patients and healthcare workers are now proactive in reporting adverse events during clinical trials which drives the demand for safe and efficient pharmacovigilance systems.

- Thus, the growing number of drug approvals and concerns about drug safety would pharmacovigilance to boost the clinical data management systems market trends.

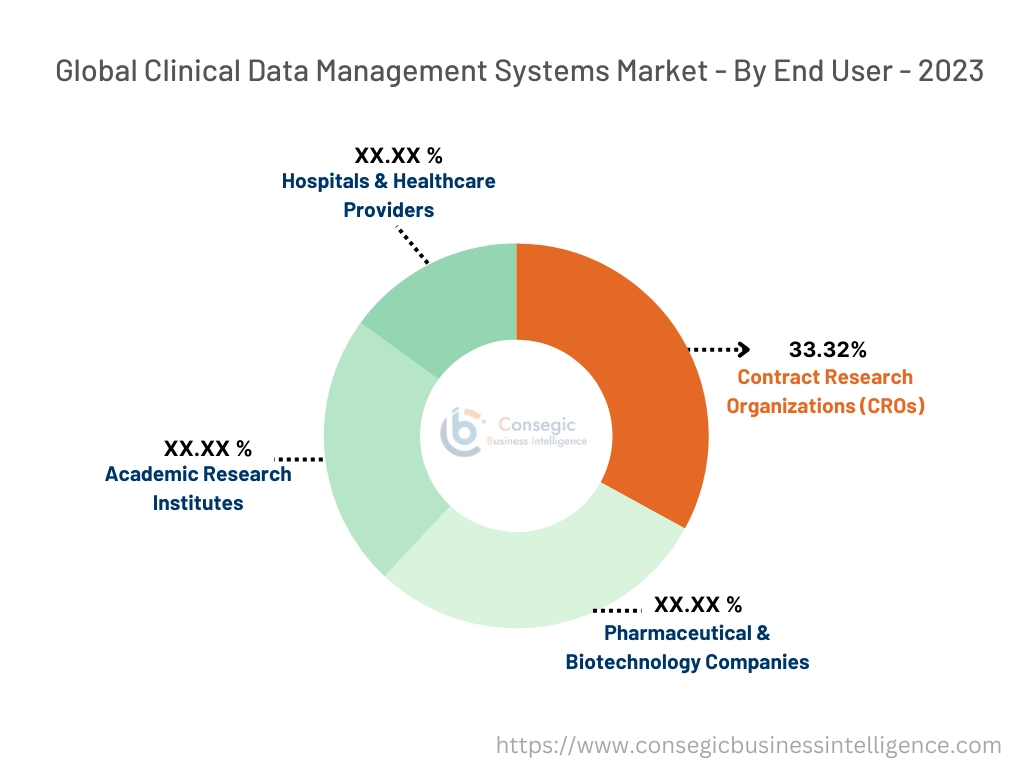

By End-User:

The market is segmented based on end-users into Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), Academic Research Institutes, and Hospitals & Healthcare Providers.

Trends in the End-User:

- Recently, biotechnology companies are integrating AI to develop new drugs using the data collected through advanced CDM systems.

- The trend of utilizing adaptive trial designs in hospitals and by healthcare providers offers a more innovative approach to clinical trials.

Contract Research Organizations (CROs) accounted for the largest revenue share of 33.32% in 2023.

- Contract Research Organizations (CROs) are becoming a reliable option to manage the complexity of clinical trials as the outsourcing of clinical activities grows.

- CROs are cost-effective alternatives to pharmaceutical and biotech companies as they provide specialized services that improve clinical trial efficiency with a reduction of errors for clinical data management.

- CROs are flexible to adopt and incorporate advanced technologies such as AI, machine learning, and enhanced analytics into their CDM management process.

- They offer decentralized and hybrid clinical trials by employing advanced CDM systems capable of remote handling, real-time data management, and integration.

- Therefore, CROs offer specialized services like biomarker analysis, precision medicine trials, and data incorporation from digital health records, boosting the clinical data management systems market expansion.

Pharmaceutical & Biotechnology Companies are expected to have the fastest-growing CAGR during the forecasted period.

- The focus on personalized medicines has led pharmaceutical and biotech companies to conduct complex and targeted clinical trials.

- Clinical trials often require the gathering and analysis of genetic and molecular data which sophisticated CDM systems are capable of handling with efficacy.

- The expansion of biologics and biosimilars in the pharmaceutical sector has driven the production of more specialized CDM system platforms that can manage complex biologics data.

- The pharmaceutical and biotech companies actively invest in research and development (R&D) for the development of new treatments and therapies, creating an adoption of CDM systems.

- For instance, Iqvia Inc. is a pharmaceutical company, offering excellent data management through clinical trials. They are adept at developing new treatments by analyzing a data-driven strategy solution.

- Thus, CDM systems are important for pharmaceutical and biotech companies tracking and managing data related to adverse events, patient-reported outcomes, etc.

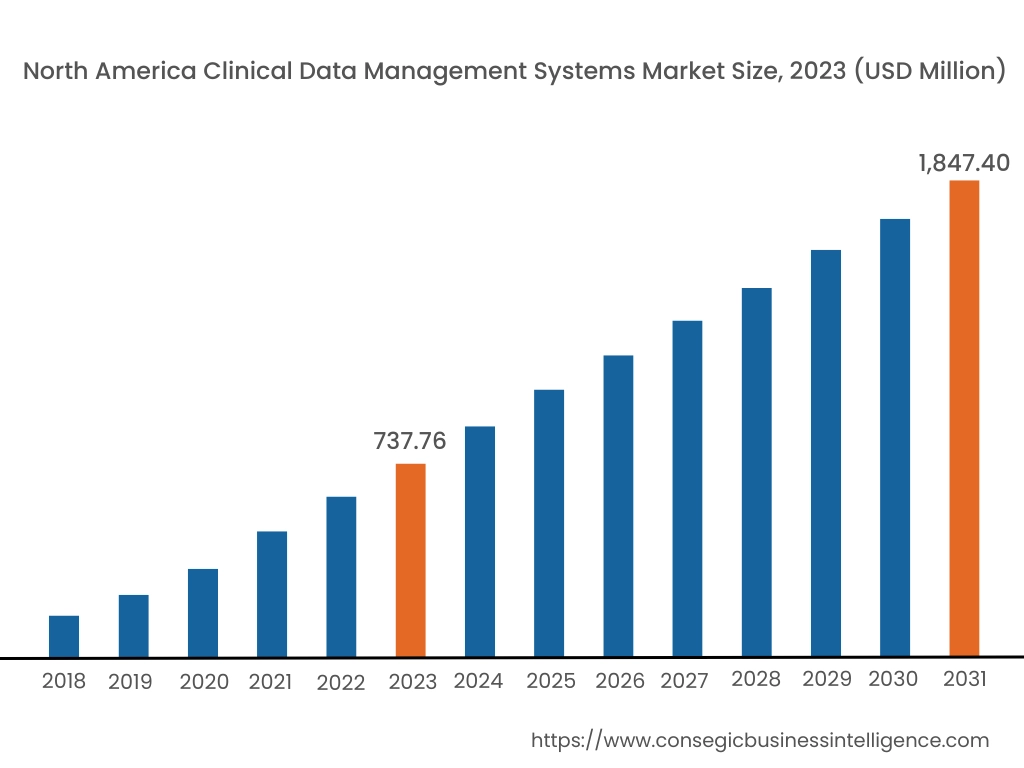

Regional Analysis:

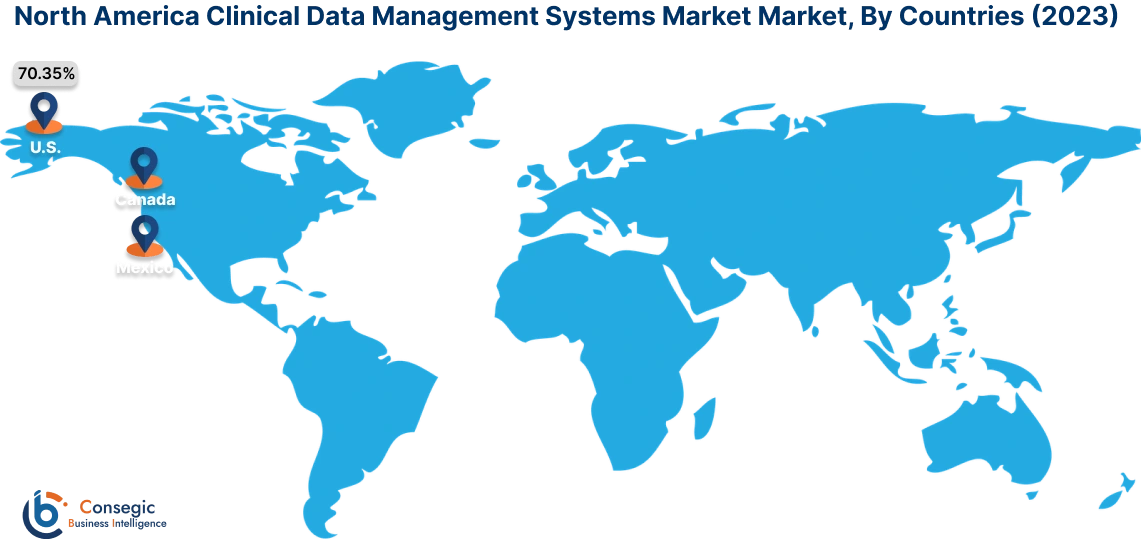

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2023, North America accounted for the highest market share at 40.15% and was valued at USD 737.76 Million, and is expected to reach USD 1,847.40 Million in 2031. In North America, the U.S. accounted for the highest market share of 70.35% during the base year of 2023. As per the clinical data management systems market analysis, in North America, especially in the U.S., the healthcare and medical sector has the most advanced infrastructure worldwide. The government here is actively concerned about the safety and integrity of clinical trials and enforces strict rules and regulations. This results in more investment in the development of state-of-the-art technology for sophisticated data management systems to ensure patient safety and traceability.

- Veeva Systems, a cloud-based software firm, in a recent press release (PR) discusses the factors that are driving clinical data innovation in New York City.

Asia Pacific is expected to witness the fastest CAGR over the forecast period of 14.6% during 2024-2031. In the Asia Pacific (APAC) region, particularly nations like China, Japan, India, South Korea, etc., there is a rapid expansion of the pharmaceuticals and biotech sectors. This has led to an increase in the number of clinical trials conducted in this region, driven by foreign investment and the availability of a wide patient base. It has made CDMs essential as they expertly manage and analyze complex clinical data.

- A report published by CMIC Holdings, highlights the way clinical trial activity has seen expansion in the APAC region. Japan, in particular, has gained traction as a leading drug producer. Several other nations in the region offer suitable environments for oncology, rare illness, and cell and gene therapy.

The markets in Europe, especially in the UK, France, Germany, etc., have a heightened adoption of cutting-edge technologies like cloud computing, artificial intelligence (AI) algorithms, and machine learning (ML) in clinical trials. Innovative CDM systems are integrated with these technologies which enhances its ability to streamline data analysis, trial monitoring, and patient recruitment.

The clinical data management systems market analysis shows that the Middle East and Africa (MEA) region, specifically the Gulf region, is focusing on data security and compliance. This aligns them with global regulatory constrictions which helps in integrating their medical sector more firmly within the global order.

In Latin America, the cost of clinical trials is low, compared to the global standards. This facilitates the outsourcing of clinical trials to this region by pharmaceutical firms, boosting the adoption of data management systems to handle complex trial operations and data privacy.

Top Key Players & Market Share Insights:

The Clinical Data Management Systems Market is highly competitive with major players providing software and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global clinical data management systems market. Key players in the clinical data management systems industry include:

- Oracle (USA)

- Medidata (USA)

- IBM Corporation (USA)

- Parexel International Corporation (USA)

- Clario (USA)

- Veeva Systems (USA)

- DATATRAK International, Inc. (USA)

- eClinical Solutions (USA)

- Signant Health (USA)

- ICON plc (Ireland)

Recent Industry Developments :

Product Launches:

- In December 2023, Thermo Fisher Scientific announced the launching of a cloud-based data platform, CorEvidence. This new software optimizes pharmacovigilance case processing and ensures the safety of clinical data management procedures. It upgrades CorEvitas clinical research registries that are offered by the firm's PPD clinical research business. It effectively manages a wide range of data sources, streamlines coding, and reports adverse as well as safety events for post-authorization safety studies.

- In February 2024, Revvity Signals announced the launching of a software and informatics unit that can streamline clinical trial data. The novel software, Signals Clinical Solution, is a software-as-a-service (SAAS) platform that can centralize clinical data management. It is engineered to expedite important trial insights and data-based decisions to revolutionize the access and analysis of clinical trial data.

Mergers and Acquisitions:

- In November 2023, Everest Clinical Research unveiled its intention to acquire August Research. Everest is a contract research organization (CRO) that has efficient knowledge of clinical data management, biostatistics, and statistical programming. August Research is a European contract research organization (CRO) that offers Clinical Trial Services (CTS) and Pharmacovigilance (PV) services. This strategic acquisition would expand Everest's global reach and establish a beachhead in the European clinical trial markets.

- In April 2024, GE Health revealed the completion of their acquisition of MIM Software. GE Health is a medical-tech pharmaceutical diagnostics, and digital solutions innovating firm whereas MIM Software is an innovative solutions provider. Through this acquisition, GE Health gains the provision of integrating MIM Software's imaging analytics and digital workflow solutions with GE's global medical-tech portfolio. It would also bolster GE's response to provider needs.

Partnerships and Collaborations:

- In September 2024, the European Organization for Research and Treatment of Cancer (EORTC), announced a four-year extension to the partnership with Medidata. This partnership is aimed at patient's ease of accessing oncology clinical trials by offering efficient trial participation. It would result in the delivery of novel treatments to the market at a faster rate. Through this collaboration, EORTC would employ 13 Medidata solutions that would offer their researchers comprehensive access and management of clinical data in a single place.

Clinical Data Management Systems Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 4,490.53 Million |

| CAGR (2024-2031) | 13.6% |

| By Type |

|

| By Component |

|

| By Mode of Delivery |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

Who are the major players in the clinical data management systems market? +

The major players in the market include Oracle (USA), Medidata (USA), IBM Corporation (USA), Parexel International Corporation (USA), Veeva Systems (USA), Clario (USA), DATATRAK International, Inc. (USA), eClinical Solutions (USA), Signant Health (USA), and ICON plc (Ireland).

What specific segmentation details are covered in the clinical data management systems market report? +

The clinical data management systems market is segmented into type, technology, mode of delivery, application, and end-user industry.

Which is the fastest-growing region in the clinical data management systems market? +

Asia Pacific is the fastest-growing region in the clinical data management systems market.