Compact Track And Multi-Terrain Loader Market Size:

Compact Track And Multi-Terrain Loader Market size is estimated to reach over USD 47.18 Billion by 2032 from a value of USD 28.40 Billion in 2024 and is projected to grow by USD 29.75 Billion in 2025, growing at a CAGR of 6.5% from 2025 to 2032.

Compact Track And Multi-Terrain Loader Market Scope & Overview:

Compact track and multi-terrain loader refers to a type of skid-steer-style construction equipment designed for earthmoving, grading, and material handling tasks across varied terrains. Equipped with rubber tracks instead of wheels, these machines offer enhanced traction, reduced ground pressure, and greater stability on soft, uneven, or delicate surfaces.

Built with a low center of gravity, suspended undercarriage, and robust hydraulic systems, they deliver excellent maneuverability and lifting capacity in confined spaces. The compatibility with a wide range of attachments—such as buckets, augers, trenchers, and landscape rakes—further expands their utility across landscaping, agriculture, site preparation, and utility installation.

The compact track and multi-terrain loader provides improved operator comfort, minimal surface disruption, and consistent performance across wet, sandy, or sloped areas. Its versatility and adaptability to challenging job site conditions make it a vital asset for contractors seeking efficiency, precision, and reliability in compact equipment operations.

Compact Track And Multi-Terrain Loader Market Dynamics - (DRO) :

Key Drivers:

Increased Demand for Versatile, All-Terrain Machinery in Construction and Landscaping Propels Market Growth

The construction and landscaping industries are increasingly relying on versatile, all-terrain machinery to meet the requirements of modern, space-constrained job sites. Compact track and multi-terrain loaders offer the flexibility to operate on rough, uneven, and soft ground surfaces, where traditional wheeled machinery would struggle. These loaders are ideal for tasks such as grading, material handling, digging, and snow removal in both urban and rural environments. Their superior mobility and ability to work in tight spaces, combined with high lifting capacities, make them highly valuable in tasks requiring maneuverability and efficiency. The increasing need for such adaptable equipment in both commercial and residential projects is propelling market growth. As urbanization and infrastructure development continue, the need for compact, reliable, and versatile equipment to complete time-sensitive jobs in varying terrains is driving the compact track and multi-terrain loader market expansion.

Key Restraints:

High Acquisition and Maintenance Costs Compared to Traditional Wheeled Loaders Hinder Market Expansion

Compact track and multi-terrain loaders, while offering enhanced capabilities, come with higher acquisition costs compared to traditional wheeled loaders. These costs are attributed to the advanced technology, specialized tracks, and increased durability required to operate on various surfaces. Additionally, ongoing maintenance for these machines—due to the wear and tear on tracks, undercarriage, and mechanical systems—adds to the overall cost of ownership. Smaller contractors or companies operating in price-sensitive markets may be deterred by these high initial investments and ongoing maintenance expenses. Although demand for versatile and high-performing machinery continues to grow, the high upfront and maintenance costs present a barrier to adoption, limiting the compact track and multi-terrain loader market growth in certain regions and among smaller operators.

Future Opportunities :

Technological Advancements in Telematics and Automation Enhancing Productivity and Safety Offer Market Opportunities

The integration of telematics and automation into compact track and multi-terrain loaders is enhancing productivity and operational safety, creating significant market opportunities. Telematics systems allow for real-time monitoring of equipment performance, location, and maintenance schedules, enabling fleet managers to optimize machine utilization and reduce downtime. Additionally, automation features such as self-leveling, remote diagnostics, and machine control systems improve efficiency, precision, and safety, particularly in hazardous environments or remote job sites. As demand for smarter, more efficient machinery grows, these technological innovations provide a competitive edge. Manufacturers are increasingly developing models with enhanced automation and telematics capabilities to meet the need for optimized operations and better fleet management.

- For instance, in January 2025, Caterpillar expanded its CTL product line with the launch of Cat 275 and 285. Their next generation design includes a 50% torque increase, advanced touchscreen display, Bluetooth connectivity and Cat Product Link™ Elite, which tracks machine hours, location, and asset utilization, provides fault code details, and delivers advanced monitoring and machine health with data remotely accessible via VisionLink.

This evolution in technology is driving compact track and multi-terrain loader market opportunities, as industries look to maximize uptime and operational efficiency.

Compact Track And Multi-Terrain Loader Market Segmental Analysis :

By Product Type:

Based on product type, the market is segmented into Compact Track Loaders (CTLs) and Multi-Terrain Loaders (MTLs).

The Compact Track Loaders (CTLs) segment accounted for the largest revenue share in 2024.

- Standard CTLs are used across a wide range of industries, including construction, agriculture, and landscaping, due to their balance of power, agility, and versatility.

- High-Performance CTLs are designed for heavy-duty tasks, offering higher lifting capacities and faster operation, which are essential for large-scale construction and industrial projects.

- Vertical Lift CTLs provide better lifting heights and improved dumping capabilities, making them ideal for more complex projects that require a higher reach.

- For instance, in January 2025, Sany introduced the ST230V Compact Track Loader with exceptional maneuverability and efficiency for the North American and European markets. With a unique track differential speed system which allows 360° rotation, the ST230V is ideal for navigating tight spaces on busy job sites. Compatible with numerous attachments, the model finds application in numerous sectors.

- As per compact track and multi-terrain loader market analysis, the CTL segment continues to dominate due to the widespread use of standard and high-performance models in construction, landscaping, and other commercial applications.

The Multi-Terrain Loaders (MTLs) segment is expected to grow at the fastest CAGR during the forecast period.

- Suspension-Enhanced MTLs offer superior stability and traction, particularly on soft or uneven surfaces like mud, sand, or snow.

- Specialized MTLs are tailored for niche applications such as swampy environments or areas with uneven terrain, where the loader’s flexibility and ability to navigate are paramount.

- Compact MTLs are gaining popularity in urban areas where space is limited, providing flexibility and ease of use without sacrificing power.

- According to compact track and multi-terrain loader market trends, the MTL segment is set to experience significant growth, driven by the rising demand for specialized loaders capable of handling difficult terrain and weather conditions.

By Track Type:

Based on track type, the market is divided into rubber tracks and steel tracks.

The rubber tracks segment held the largest compact track and multi-terrain loader market share in 2024.

- Rubber tracks are more commonly used in both CTLs and MTLs due to their ability to provide better traction on a variety of surfaces, especially soft ground.

- These tracks are preferred in construction and landscaping applications because they reduce soil compaction and prevent damage to pavement or delicate ground surfaces.

- Rubber tracks offer smoother operation and better comfort for operators, which makes them more suitable for urban and residential areas.

- For instance, in October 2024, Blue Diamond launched new rubber tracks for compact equipment such as track loaders, mini-excavators, stand-on mini track loaders and multi-terrain loaders. Available in block, C-lug, multi-bar and zigzag patterns, the tracks can be used in construction, agriculture and landscaping. Furthermore, they are compatible with most manufacturers machines and carry a two-year warranty.

- As per segmental analysis, the rubber tracks segment continues to dominate, particularly in urban construction, landscaping, and agricultural applications, leading compact track and multi-terrain loader market expansion.

The steel tracks segment is projected to experience steady CAGR during the forecast period.

- Steel tracks are typically used for heavy-duty applications where enhanced durability and load-bearing capacity are necessary.

- These tracks offer greater strength and are more suited to rough or highly abrasive surfaces, such as in mining and some construction applications.

- Steel tracks are preferred for longer operational hours, particularly in industries like mining, where wear and tear are more significant.

- According to compact track and multi-terrain loader market trends, steel tracks are becoming increasingly popular in heavy-duty and industrial sectors, offering longevity and performance under harsh conditions.

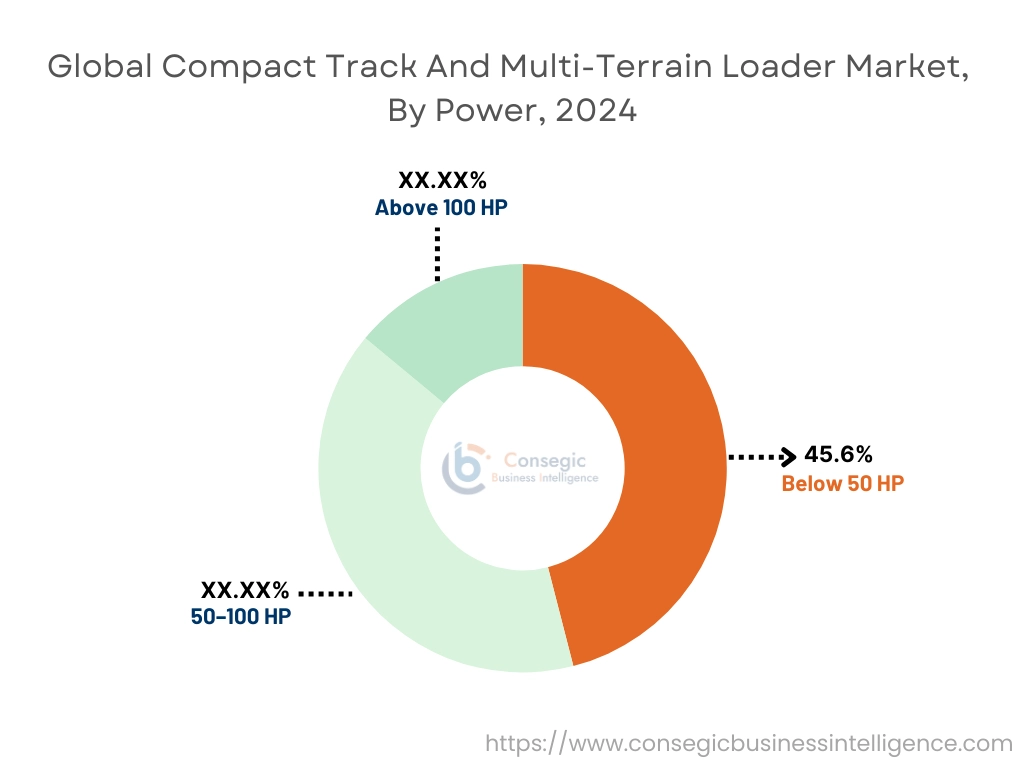

By Power:

Based on power, the market is segmented into below 50 HP, 50–100 HP, and above 100 HP.

The below 50 HP segment accounted for the largest compact track and multi-terrain loader market share of 45.6% in 2024.

- Loaders in the below 50 HP range are highly versatile and widely used in small- to medium-sized applications, making them popular for tasks like landscaping, small-scale excavation, and light construction.

- The affordability and maneuverability of these machines make them ideal for homeowners, small contractors, and municipal operations.

- Their low operational cost and ease of use in urban and residential areas, where space is limited, contribute to their dominance in the market.

- As per segmental analysis, the below 50 HP loaders continue to lead due to their applicability in smaller-scale operations and their ability to perform effectively in tight spaces, providing excellent productivity at a lower cost and driving compact track and multi-terrain loader market demand.

The above 100 HP segment is expected to experience strong CAGR during the forecast period.

- Loaders above 100 HP are designed for heavy-duty tasks in construction, mining, and industrial operations, where high power and lifting capabilities are crucial.

- These machines are ideal for tough environments requiring higher load capacities and faster operational speeds, making them highly valuable in large-scale infrastructure projects.

- For instance, in July 2024, DEVELON introduced its first compact track loader, DTL35, with a refined design featuring a powerful 115.3HP engine. The engine minimizes downtime, reduces maintenance costs and ensures consistent performance in construction sites.

- According to compact track and multi-terrain loader market analysis, the increasing use of high-power machines for large-scale construction and industrial applications is driving the growth of this segment.

By End Use Industry:

Based on end-use industry, the compact track and multi-terrain loader market is segmented into construction, agriculture, mining, forestry, landscaping, and others.

The construction segment held the largest revenue share in 2024.

- Compact track and multi-terrain loaders are widely used in construction for tasks such as site preparation, excavation, material handling, and demolition.

- The versatility and maneuverability of these loaders make them ideal for construction projects in urban and suburban areas, where space is often limited.

- As per market analysis, the construction industry continues to be the dominant driver of the compact track and multi-terrain loader market growth, supported by ongoing urbanization and infrastructure projects worldwide.

The agriculture segment is expected to experience the fastest CAGR during the forecast period.

- They are increasingly used in agriculture for tasks such as plowing, harvesting, and soil preparation.

- The ability to work in wet and uneven conditions makes them essential for modern farming operations, particularly in regions where traditional wheeled tractors are less effective.

- With the rise of precision agriculture, these machines are gaining popularity due to their ability to handle a variety of tasks efficiently, enhancing productivity and operational efficiency.

- Hence, the agriculture sector is witnessing an increasing compact track and multi-terrain loader market demand as part of the broader trend toward mechanization and automation in farming.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

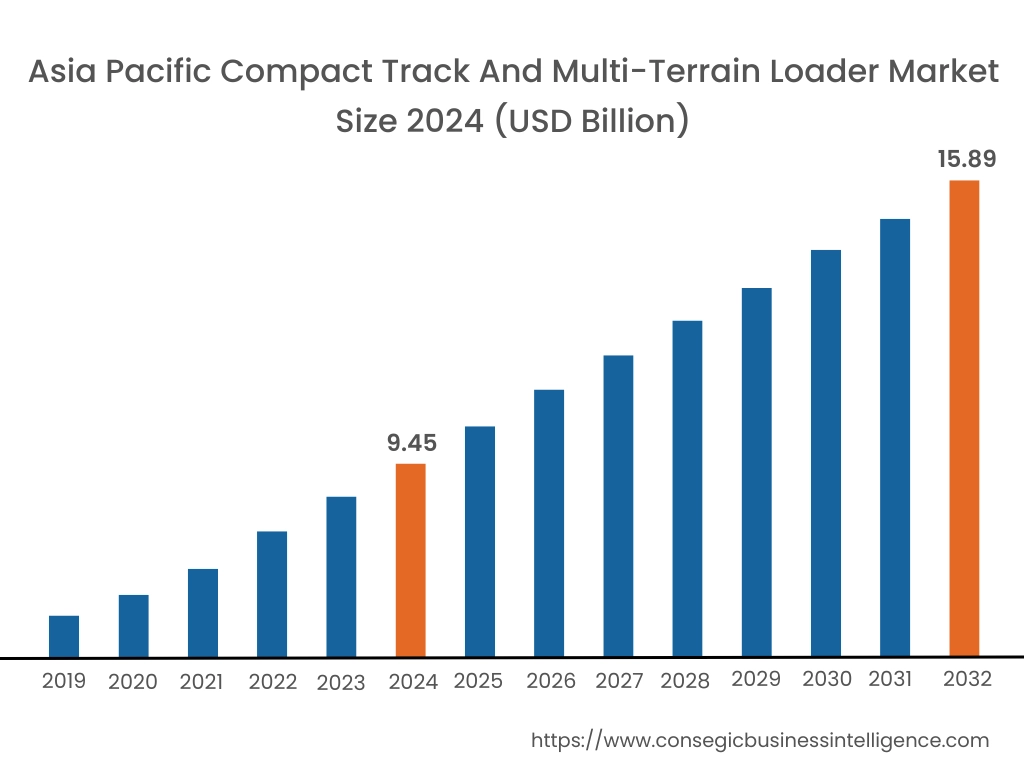

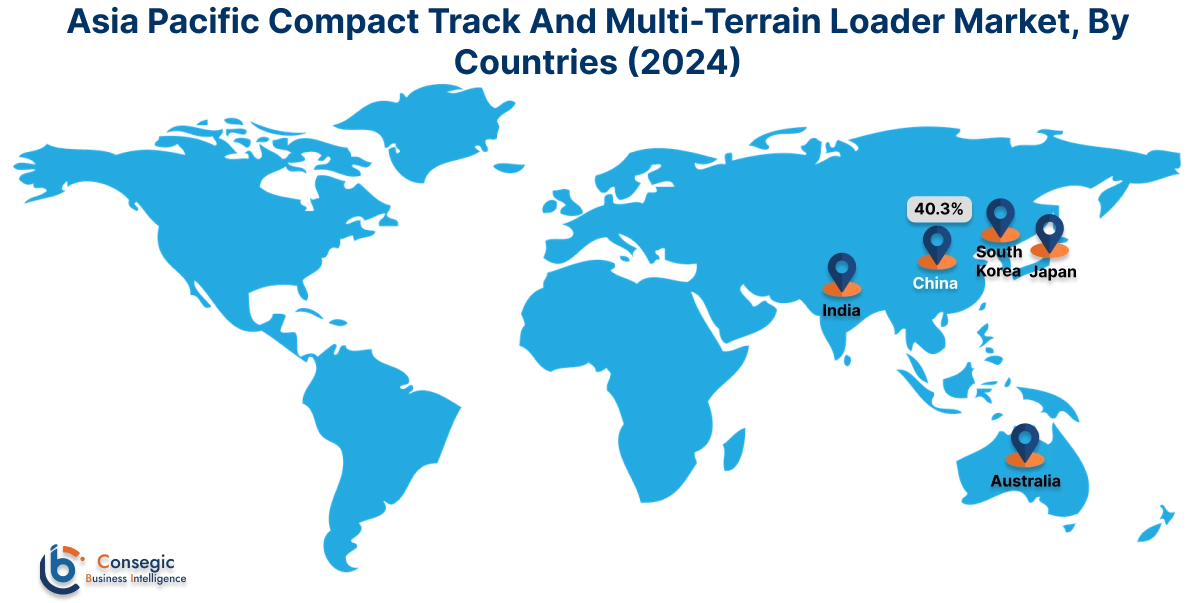

Asia Pacific region was valued at USD 9.45 Billion in 2024. Moreover, it is projected to grow by USD 9.91 Billion in 2025 and reach over USD 15.89 Billion by 2032. Out of this, China accounted for the maximum revenue share of 40.3%. Asia-Pacific is experiencing rapid growth in the compact track and multi-terrain loader industry, especially in countries like China, Australia, South Korea, and India, where expanding construction and mining activities require compact and adaptable machinery. Market analysis indicates increasing demand in roadwork, agriculture, and municipal maintenance, with users favoring models that offer enhanced flotation on soft soil and high hydraulic flow capacity for multiple attachments. In Australia, for example, the loaders are used extensively for site prep in residential zones and agricultural land management. The region’s construction boom and emphasis on machine efficiency continue to drive adoption, supported by local production and increased availability of parts and servicing.

North America is estimated to reach over USD 13.87 Billion by 2032 from a value of USD 8.34 Billion in 2024 and is projected to grow by USD 8.74 Billion in 2025. North America remains the leading region in terms of usage and equipment innovation. Contractors in the United States and Canada prefer them for grading, site preparation, snow removal, and landscaping due to their stability on uneven or muddy terrain. Market analysis highlights rising interest in models with advanced joystick controls, telematics, and low-ground-pressure undercarriages. Growth in this region is supported by suburban construction, infrastructure renewal, and a strong rental market that promotes fleet diversity and equipment availability. End-users value machines that reduce ground disturbance while offering powerful lift capacity.

In Europe, the market is growing steadily with emphasis on emission compliance and compactness for urban job sites. Germany, France, and the UK are key adopters, particularly in utility installation, estate maintenance, and landscape construction. Market analysis reveals a preference for models with low noise levels, eco-friendly engines, and compatibility with a wide range of hydraulic attachments. The compact track and multi-terrain loader market opportunity in Europe is tied to the region’s focus on sustainable infrastructure, limited-space construction environments, and the gradual replacement of older, less efficient compact equipment with newer, more maneuverable alternatives.

Latin America is gradually increasing its adoption, primarily in Brazil, Mexico, and Chile. The region uses compact track and multi-terrain loaders in agricultural operations, forestry access, and infrastructure maintenance in remote or sloped terrains. Market analysis suggests growing demand for robust machines with low-maintenance designs and cost-effective performance. Contractors in both rural and semi-urban zones appreciate the ability of these machines to operate across rough ground without damaging soil structures. The market opportunity here is enhanced by improved access to financing options, dealer networks, and rental fleet growth in medium-sized cities.

The Middle East and Africa are showing an emerging requirement for compact loaders, especially in the UAE, Saudi Arabia, and South Africa. Applications include landscaping in commercial development zones, sand handling, and construction on unstable ground. Market analysis highlights a growing preference for equipment with sealed cabs, efficient cooling systems, and strong lifting arms for tough terrain operations. While the market is still developing in some areas, growth is supported by large-scale construction projects, infrastructure investment, and increasing awareness of the equipment’s versatility. The compact track and multi-terrain loader industry in this region benefits from urbanization and expanding equipment leasing services.

Top Key Players and Market Share Insights:

The compact track and multi-terrain loader market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global compact track and multi-terrain loader market. Key players in the compact track and multi-terrain loader industry include -

- Caterpillar Inc. (USA)

- Deere & Company (John Deere) (USA)

- JCB Ltd. (United Kingdom)

- Doosan Infracore (South Korea)

- Wacker Neuson SE (Germany)

- CNH Industrial N.V. (CASE Construction) (United Kingdom)

- Komatsu Ltd. (Japan)

- Kubota Corporation (Japan)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Volvo Construction Equipment (Sweden)

Recent Industry Developments :

Partnerships:

- In February 2024, John Deere partnered with Leica Geosystems, a subsidiary of Hexagon, to accelerate the digital transformation of the heavy construction industry. This combines the manufacturing expertise of John Deere with Leica Geosystems' leadership in positioning and sensor technology, to develop and deliver solutions that improve productivity, reduce material costs and the number of passes required, thus improving safety by minimizing traffic on construction sites.

Compact Track And Multi-Terrain Loader Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 47.18 Billion |

| CAGR (2025-2032) | 6.5% |

| By Product Type |

|

| By Track Type |

|

| By Power |

|

| By End Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Compact Track And Multi-Terrain Loader Market? +

Compact Track And Multi-Terrain Loader Market size is estimated to reach over USD 47.18 Billion by 2032 from a value of USD 28.40 Billion in 2024 and is projected to grow by USD 29.75 Billion in 2025, growing at a CAGR of 6.5% from 2025 to 2032.

What specific segmentation details are covered in the Compact Track And Multi-Terrain Loader Market report? +

The Compact Track And Multi-Terrain Loader market report includes specific segmentation details for product type, track type, power and end-use industry.

What are the end-use industries of the Compact Track And Multi-Terrain Loader Market? +

The end-use industries of the Compact Track And Multi-Terrain Loader Market are construction, agriculture, mining, forestry, landscaping, and others.

Who are the major players in the Compact Track And Multi-Terrain Loader Market? +

The key participants in the Compact Track And Multi-Terrain Loader market are Caterpillar Inc. (USA), Deere & Company (John Deere) (USA), CNH Industrial N.V. (CASE Construction) (United Kingdom), Komatsu Ltd. (Japan), Kubota Corporation (Japan), Hitachi Construction Machinery Co., Ltd. (Japan), Volvo Construction Equipment (Sweden), JCB Ltd. (United Kingdom), Doosan Infracore (South Korea) and Wacker Neuson SE (Germany).