Heavy Duty Construction Equipment Market Size:

Heavy Duty Construction Equipment Market is estimated to reach over USD 344.33 Billion by 2032 from a value of USD 219.15 Billion in 2024 and is projected to grow by USD 229.34 Billion in 2025, growing at a CAGR of 5.2% from 2025 to 2032.

Heavy Duty Construction Equipment Market Scope & Overview:

Heavy-duty construction equipment refers to robust, high-capacity machinery specifically engineered to perform large-scale earthmoving, lifting, and structural tasks that exceed human or light-mechanical capabilities. These machines, ranging from excavators to tower cranes, utilize high-torque powerplants and advanced hydraulic systems to execute demanding operations in sectors like infrastructure, mining, and heavy industry. Further, key trends driving the demand include the rapid integration of automation and alternative fuel, which is revolutionizing productivity by enabling semi-autonomous operations and zero-emission workflows. Furthermore, technological and strategic shifts toward data-driven fleet management and the Equipment-as-a-Service model are driving the market

How is AI Transforming the Heavy Duty Construction Equipment Market?

Artificial Intelligence is revolutionizing the heavy duty construction equipment by shifting from simple data monitoring to autonomous execution and predictive foresight. Advanced machine learning algorithms now analyze thousands of sensor data points, such as hydraulic pressure and vibration, to perform machine-level predictive maintenance, virtually eliminating unplanned downtime. Additionally, safety has evolved through AI-driven vision systems that provide hazard detection. Furthermore, agentic AI is bridging the skilled labor gap by providing automated grade control and dig-to-depth assistance, allowing operators to achieve expert precision while optimizing fuel consumption and material waste.

Heavy Duty Construction Equipment MarketDynamics - (DRO) :

Key Drivers:

Increasing Infrastructure Investment in Emerging Economies Drives the Heavy Duty Construction Equipment Market Growth

Emerging economies are the primary engines of global construction equipment growth, fueled by unprecedented public capital expenditure and rapid urbanization. High-growth regions like India and Southeast Asia are witnessing massive scale-ups in transport networks. Further, the investments, ranging from China’s Belt and Road projects to new dedicated freight corridors and smart city initiatives, drive the demand for vast fleets of earthmoving and road-building machinery. Consequently, this surge is compelling manufacturers to localize production and deploy advanced, tech-enabled solutions to modernize domestic fleets and ensure timely project delivery.

- For instance, according to CFA Institute, India is expanding its highway network at an exceptional rate of nearly 34 kilometers per day, backed by a fivefold increase in capital expenditure over the last decade. For the 2025-2026 fiscal year, the government has allocated a record USD 127 billion, which is approximately 3.1% of the nation's GDP, to maintain this infrastructure momentum.

Thus, significant government investment in infrastructure and rapid urbanization contribute significantly to the heavy duty construction equipment market size.

Key Restraints :

High Capital Investment and Skilled Labor Shortages is Limiting the Market

The market for heavy-duty construction equipment faces significant hurdles due to the soaring cost of advanced machinery and a critical deficit of qualified personnel. High interest rates have amplified capital investment risks, making it difficult for mid-sized firms to finance the latest automated or electric fleets. Simultaneously, the industry is struggling with a labor gap, where the supply of skilled operators and technicians cannot keep pace with the technological complexity of modern hardware. This dual pressure forces many contractors to delay fleet renewals, ultimately slowing overall market development.

Future Opportunities :

Increasing Adoption of Electric Powered Equipment Drives the Heavy Duty Construction Equipment Market Opportunities

The increasing adoption of electric-powered heavy duty construction equipment is creating massive market opportunities by opening doors to restricted urban environments. Stringent noise ordinances in major cities now mandate zero-emission machinery, allowing electric fleets to operate 24/7 in residential areas without violating local laws. Further, beyond compliance, these machines offer a lower total cost of ownership through reduced energy expenses and the elimination of complex diesel engine maintenance. This shift is further bolstered by government subsidies and the development of mobile fast-charging hubs, which empower contractors to modernize their fleets while achieving ambitious corporate sustainability targets.

- For instance, in 2025, Volvo Construction Equipment upgraded its 23-ton EC230 Electric excavator, doubling the battery life of the previous model to enable a full day of operation on a single charge. This next-generation machine blends high-efficiency performance with zero-emission sustainability, offering an enhanced operator experience and improved safety features.

Thus, lower cost of ownership, urban operability, emphasis on sustainability, and advancement in battery technology drives the heavy duty construction equipment market opportunities.

Heavy Duty Construction Equipment Market Segmental Analysis :

By Machinery Type:

Based on the machinery type, the market is segmented into earthmoving equipment, material handling equipment, heavy construction vehicles, and other equipment.

Trends in the Machinery Type:

- Telematics systems use machine learning to predict hydraulic failures before they occur, minimizing downtime for high-capacity cranes, driving the heavy duty construction equipment market trends.

- Large-scale mining and infrastructure projects are deploying fully autonomous dump trucks to increase operational hours and fuel efficiency, which in turn drives the heavy duty construction equipment market size.

Earthmoving Equipment accounted for the largest revenue stake in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- There is a growing trend of excavators and dozers that are increasingly featuring semi-autonomous functions like auto-grading and dig-depth assistance, driving the heavy duty construction equipment market share.

- Further, the shift toward battery-electric mini-excavators drives the heavy duty construction equipment market expansion.

- Furthermore, real-time 3D mapping and GPS guidance are becoming standard for enhancing site preparation accuracy and reducing material waste, driving the heavy duty construction equipment market trends.

- Thus, as per analysis, widespread automation, electrification, and precision via GPS & Telematics, are driving the market.

By Power Output:

Based on the Power Output, the market is segmented into up to 100 HP, 100–400 HP, and above 400 HP.

Trends in the Power Output:

- Backhoes and wheel loaders are widely adopting operator-assist technologies like automated bucket leveling and grade control, driving the heavy duty construction equipment market demand.

- Growing use of AI in advanced engine control units (ECUs) to optimize fuel injection and engine RPM, which in turn drives the market.

Up to 100 HP accounted for the largest revenue portion in the year 2024 and is anticipated to register a significant CAGR during the forecast period.

- Increasing adoption of standardized digital interfaces, which allow small machines to automatically calibrate hydraulic settings for various smart attachments like augers and breakers.

- Further, manufacturers are prioritizing electric drivetrains that allow for 24-hour operation in residential areas, which in turn drives the heavy duty construction equipment industry.

- Furthermore, there is a rising focus on zero tail-swing and ultra-compact footprints, in turn driving the market.

- Thus, as per heavy duty construction equipment market analysis, urban maneuverability focus, digital interfaces, and noise-pollution mandates are driving the market.

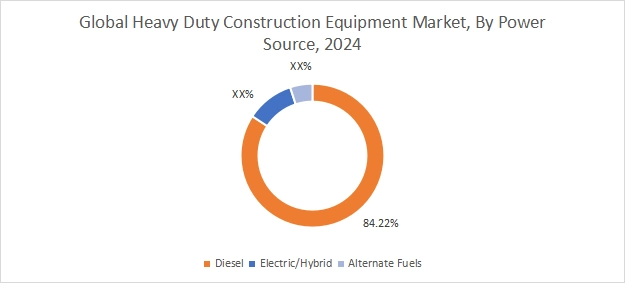

By Power Source:

Based on the power source, the market is segmented into diesel, electric/hybrid, and alternate fuels.

Trends in the Power Source:

- Heavy diesel units are increasingly featuring automated idle-reduction systems that power down the engine during operational lulls, driving the heavy duty construction equipment market demand.

- High-capacity fuel cells are being integrated into large-scale mining trucks to provide long-range and emission-free power, which in turn drives the heavy duty construction equipment market growth.

Diesel powered accounted for the largest revenue share of 84.22% in the year 2024.

- Increasing demand for diesel engines that utilize sophisticated Stage V/VI systems that reduce particulate matter and nitrogen oxides.

- Further, manufacturers are using high-pressure common rail systems and turbocharging to deliver higher torque, which in turn drives the market.

- Furthermore, there is a rising focus on using real-time AI analytics within the engine control unit (ECU) to adjust fuel injection timing instantly, driving the market growth.

- Thus, as per heavy duty construction equipment market analysis, the aforementioned trends are expected to drive the market.

Electric/Hybrid is anticipated to register the fastest CAGR during the forecast period.

- Compact electric machines are becoming the mandatory standard for city-center projects that enforce strict noise and zero-emission requirements, which in turn drives the heavy duty construction equipment market share.

- Further, a surge in mobile "Power Bank" trailers that allow electric excavators to be fast-charged directly on-site without a grid connection, drives the market.

- For instance, in January 2025, JCB achieved a major regulatory breakthrough by securing commercial licensing from eleven European authorities for the world’s first hydrogen-powered combustion engine. JCB expects further international certifications to follow, paving the way for a global rollout of this zero-carbon technology.

- Therefore, based on analysis, exponential growth in urban fleets and adoption of fast-charging infrastructure are anticipated to boost the market during the forecast period.

By Application:

Based on the application, the market is segmented into infrastructure development, mining & quarrying, construction, oil & gas, and others.

Trends in the Application:

- Mining operations are rapidly shifting toward fully autonomous truck fleets to ensure continuous production and eliminate human error in hazardous zones, which in turn drives the heavy duty construction equipment market expansion.

- Construction machinery is now feeding real-time progress data directly into Building Information Modeling (BIM) software for instant project tracking, which subsequently propels the heavy duty construction equipment market.

Infrastructure Development accounted for the largest revenue share in the year 2024 and is anticipated to register a significant CAGR during the forecast period.

- There is a rising need for specialized boring and lifting machinery capable of navigating complex subterranean environments in high-density areas.

- Further, fleet telematics are being used to provide transparent, real-time productivity data to meet the strict reporting requirements of the government, which in turn drives the market.

- Furthermore, the global push for high-speed rail and metro networks is driving the adoption of heavy-duty rail-mounted excavators and specialized material handlers.

- Thus, based on analysis, availability of specialized boring and lifting machinery and rapid transit growth are driving the market.

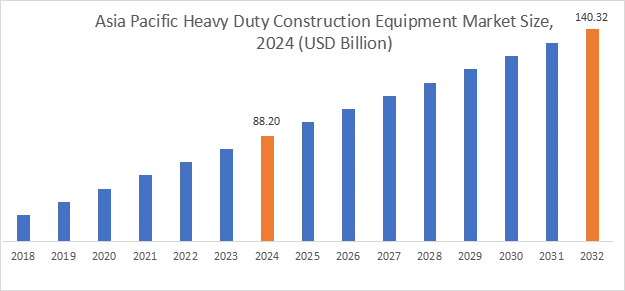

Regional Analysis:

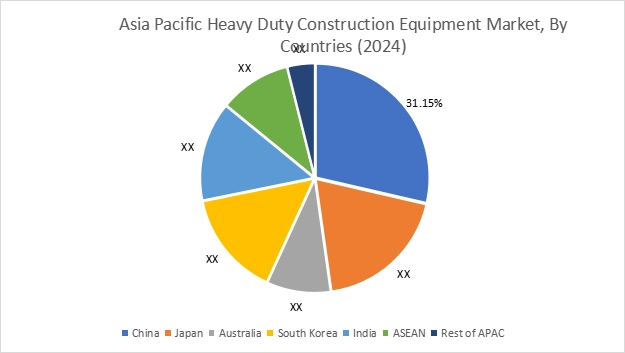

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 88.20 Billion in 2024. Moreover, it is projected to grow by USD 92.39 Billion in 2025 and reach over USD 140.32 Billion by 2032. Out of this, China accounted for the maximum revenue share of 31.15%. The market growth for Heavy Duty Construction Equipment is mainly driven by massive government investments in large-scale infrastructure projects, such as China’s Belt and Road Initiative and India’s National Infrastructure Pipeline. This momentum is further accelerated by rapid urbanization and a surge in residential and commercial construction.

- For instance, at the Bharat Construction Equipment Expo 2025 in Greater Noida, CASE Construction India introduced seven new machines, including the 952 NX and 450 NX vibratory compactors, alongside updated backhoe loaders and a skid steer loader. Every new model adheres to the latest BS CEV V emission standards, highlighting a shift toward cleaner operations.

North America is estimated to reach over USD 86.77 Billion by 2032 from a value of USD 54.90 Billion in 2024 and is projected to grow by USD 57.47 Billion in 2025. The North American market is primarily driven by substantial federal funding from the Infrastructure Investment and Jobs Act for the modernization of aging roads, bridges, and energy grids, alongside a surge in data center construction and the widespread adoption of technologically advanced, low-emission machinery.

- For instance, in January 2025, Kubota Canada Ltd. launched three new compact machines including U17-5 zero-tail swing excavator, KX040-5 compact excavator, and the SVL97-3 compact track loader. These additions strengthen Kubota's existing construction portfolio and set the stage for further product rollouts scheduled throughout the year.

The regional trends analysis depicts stringent environmental regulations and strong funding for renewable energy and transit infrastructure modernization in Europe is driving the market. Additionally, the factors driving the market in the Middle East and African region are government-led Giga-projects and economic diversification plans. Further, investments in mining for critical minerals like lithium and copper, combined with government-backed infrastructure programs are paving the way for the progress of market in Latin America region.

Top Key Players & Market Share Insights:

The global heavy duty construction equipment market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the heavy duty construction equipment industry. Key players in the global heavy duty construction equipment market include-

- Caterpillar (U.S.)

- Komatsu (Japan)

- XCMG (China)

- Sany Group (China)

- John Deere (U.S.)

- Volvo CE (Sweden)

- Liebherr (Switzerland)

- Hitachi CM (Japan)

- Sandvik (Sweden)

- JCB (UK)

Recent Industry Developments:

Product Launch

In February 2026, Develon launched an extensive new range of electric excavators designed to match the power and reliability of its established diesel platform. This strategic expansion features a diverse lineup including mini, wheeled, and heavy crawler excavators such as the DX160WE-7K and DX250LCE-7 to meet the growing regulatory demand for zero-emission machinery in Europe.

Partnership

In March 2024, Hitachi Construction Machinery (Europe) entered an exclusive strategic partnership with software provider ShareMat to modernize fleet management for construction equipment across France. This collaboration introduces advanced telematics services designed to optimize the monitoring and operation of Hitachi machinery through high-tech digital solutions.

Heavy Duty Construction Equipment Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 (USD Billion) | USD 289.88 Billion |

| CAGR (2025-2032) | 5.2% |

| By Machinery Type |

|

| By Power Output |

|

| By Power Source |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the heavy duty construction equipment market? +

Theheavy duty construction equipment market is estimated to reach over USD 344.33 Billion by 2032 from a value of USD 219.15 Billion in 2024 and is projected to grow by USD 229.34 Billion in 2025, growing at a CAGR of 5.2% from 2025 to 2032.

What specific segmentation details are covered in the heavy duty construction equipment report? +

The heavy duty construction equipment report includes specific segmentation details for machinery type, power output, power source, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the heavy duty construction equipment market, electric/hybrid power source is the fastest-growing segment during the forecast period.

Who are the major players in the heavy duty construction equipment market? +

The key participants in the heavy duty construction equipment marketare Caterpillar (U.S.), Komatsu (Japan), XCMG (China), Sany Group (China), John Deere (U.S.), Volvo CE (Sweden), Liebherr (Switzerland), Hitachi Construction Machinery (Japan), Sandvik (Sweden), JCB (UK), and others.

What are the key trends in the heavy duty construction equipment market? +

The heavy duty construction equipment market is being shaped by several key trends including the rapid acceleration of Automation, Augmentation, and Alternative fuels which are transforming traditional worksites into connected, zero-emission hubs. Additionally, a strategic shift from asset ownership to rental-based utilization is allowing contractors to access high-tech, telematics-integrated fleets while mitigating the financial risks.