Architectural Glass Market Size:

The Architectural Glass Market size is growing with a CAGR of 6.5% during the forecast period (2025-2032), and the market is projected to be valued at USD 127.28 Billion by 2032 from USD 77.36 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 82.09 Billion.

Architectural Glass Market Scope & Overview:

Architectural glass refers to glass used as a building material in modern construction and design. These glasses constitute diverse product types from the foundational float glass to high-performance insulating and laminated variants, as well as specialized toughened, decorative, and smart glass options catering to a wide range of applications. Predominantly utilized in windows and doors, building facades and curtain walls, skylights and roof glazing, interior partitions, and even structural elements like floors and stairs, these glass address varied end-use sectors including residential, commercial, and infrastructure development. The aim of these glasses is to meet the requirements of contemporary architecture regarding appearance, energy efficiency, natural light utilization, safety, and more.

How is AI Impacting the Architectural Glass Market?

AI is significantly impacting the architectural glass market, primarily through advancements in smart glass, manufacturing processes, and design optimization. AI-powered smart glass can dynamically adjust transparency and tint based on environmental conditions, enhancing energy efficiency and user comfort. In manufacturing, AI streamlines production, improves quality control, and enables greater customization. AI also aids in architectural design, facilitating the exploration of various design options and optimizing building performance. Also, AI-powered quality control systems can detect defects and inconsistencies in glass production, leading to higher product quality and reduced waste.

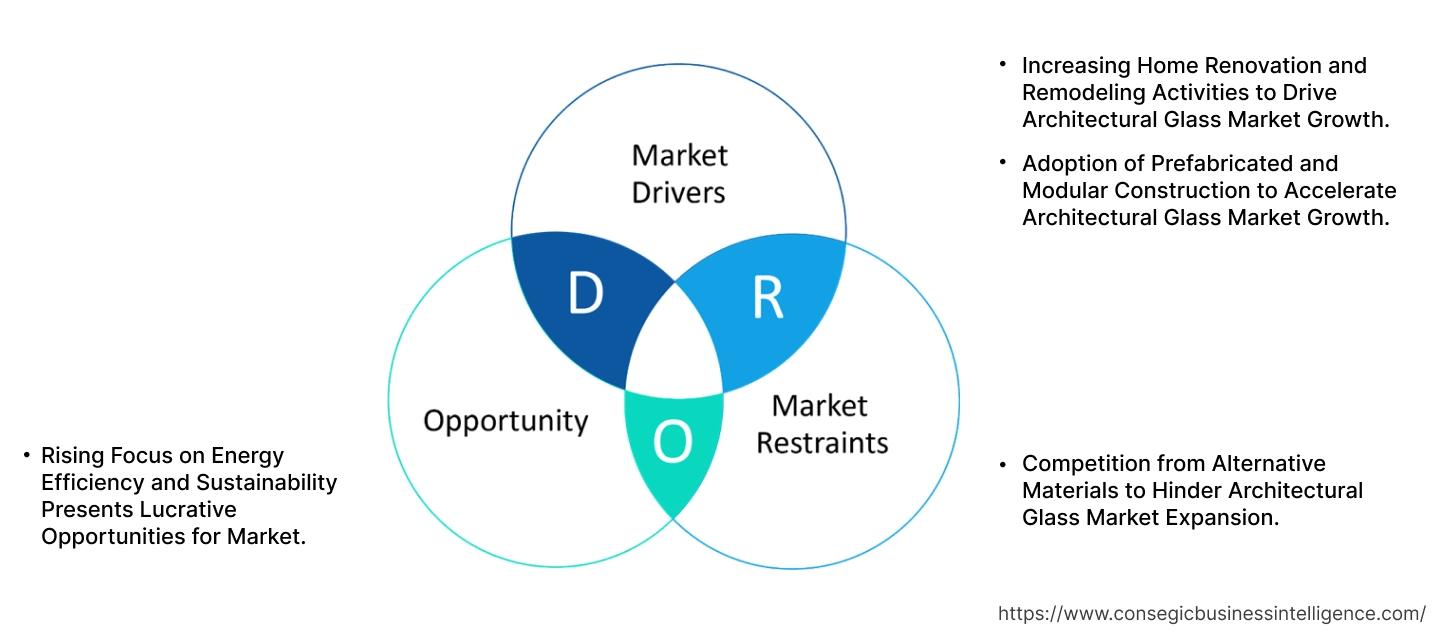

Architectural Glass Market Dynamics - (DRO) :

Key Drivers:

Increasing Home Renovation and Remodeling Activities to Drive Architectural Glass Market Growth.

Home renovation and remodeling refer to the process of making improvements or upgrades to an existing residential property for various reasons, including enhancing functionality, increasing property value, updating aesthetics and others. Rising property values have encouraged homeowners to invest in their existing properties. This is leading to a growing requirement for architectural glass to improve aesthetics and functions for several applications, both internally (partitions, shower enclosures, decorative elements) and externally (windows, doors, facades).

- For instance, according to the Renovation Nation Report provided by Money Co UK, it is stated that over 77% of UK homeowners spent money on changing or improving their properties in 2021. The average UK homeowner spent an average of USD 1,593.19 on home renovations.

Thus, considerable consumer spending on home renovation and remodeling is supporting the growing requirement for glass in building and construction.

Adoption of Prefabricated and Modular Construction to Accelerate Architectural Glass Market Growth.

Prefabrication and modular construction involve building components or entire modules in a controlled factory environment and then transporting them to the construction site for assembly. These approaches are gaining popularity due to their efficiency, cost-effectiveness, and sustainability benefits. Integrating glass directly into building modules during off-site manufacturing creates a consistent need for glazing solutions. The controlled factory environment ensures precise installation and reduced waste. Additionally, government support encourages the adoption of prefabricated and modular construction.

- For instance, the Canadian government's 2024 Federal Budget introduced a new Homebuilding Technology and Innovation Fund aimed at accelerating the adoption of innovative housing technologies and materials in the country's homebuilding sector. This includes a focus on modular and prefabricated homes.

As a result, as per analysis, the increasing acceptance and adoption of prefabricated and modular construction across various building types signifies a consistent and expanding market for the glass used in architecture.

Key Restraints:

Competition from Alternative Materials to Hinder Architectural Glass Market Expansion.

The growth of the market for architectural glass faces hindrance due to the widespread availability and established use of substitute materials. Polycarbonates and acrylics offer superior impact resistance and lighter weight, making them suitable for safety glazing and skylights. Aluminum provides strength and corrosion resistance in facade and window frame construction, potentially reducing the need for extensive glass areas. Wood and composites offer insulation and aesthetic versatility for frames. Advanced polymers and films mimic glass transparency with added flexibility or lower cost, competing with specialized glass coatings. Opaque cladding materials like metal and stone are preferred for cost, insulation, or aesthetic reasons in facades. Emerging transparent materials also pose a competitive future threat. This abundance of readily available and competitively priced substitutes creates a competitive landscape. As a result, the above-mentioned factors are limiting the architectural glass market expansion.

Future Opportunities :

Rising Focus on Energy Efficiency and Sustainability Presents Lucrative Opportunities for Market.

Stricter building energy codes and the growing adoption of green building certifications such as LEED across several countries are mandating the use of high-performance glass solutions, including low-emissivity (Low-E) coatings and insulated glazing units (IGUs), to minimize energy consumption in buildings. This regulatory push is complemented by a rising global awareness of environmental impact and the economic benefits of reduced energy costs, making energy-efficient glass an increasingly attractive investment for building owners and occupants. Continuous technological advancements in glass coatings are further enhancing the ability of glass to contribute to sustainability goals.

- For instance, in 2024, Vitro Architectural Glass introduced Sungate ThermL glass. This new low-e coating is designed for the inner surface of a standard one-inch IGU. When combined with Vitro's Solarban® solar control low-e glass on the second surface of the IGU, Sungate ThermL significantly reduces heat transfer and substantially improves U-values.

Hence, as per market analysis, preference for energy efficiency is expected to create architectural glass market opportunities.

Architectural Glass Market Segmental Analysis :

By Product Type:

Based on product type, the market is categorized into float glass, insulation, laminated glass, wired glass, toughened glass, decorative glass, and others.

Trends in Product Type:

- The growing need for advanced glass products in building is propelling an increased demand for float glass with exceptional clarity and minimal distortion.

- Adoption of triple and quadruple glazing is rising to enhance both thermal and acoustic insulation performance.

The float glass segment accounted for the largest market share in 2024.

Float glass, manufactured through the Pilkington process to achieve a flat and smooth surface, serves as the key material in architectural glazing. Its key properties include high optical clarity, smooth surfaces, versatility for further processing, good chemical inertness, and moderate strength. In architecture, float glass serves as the base for windows, facades, interior partitions, mirrors, furniture, displays, solar panels, and greenhouses among others.

Architects and designers increasingly demand larger, clearer panes of float glass for modern aesthetics and maximized daylighting. The demand for float glass is primarily driven by its dominant use in construction, its role as the base material for value-added glass products, its cost-effectiveness for standard glazing, its processing versatility, and the continuous repair and replacement market. As per the analysis, owing to the cost effectives, the float glass segment dominates the architectural glass market demand.

The insulating glass segment is expected to grow at the fastest CAGR over the forecast period.

Insulating glass comprise of two or more glass panes separated by a gas-filled space. These glasses excel in thermal and sound insulation for windows, facades, and doors, significantly reducing energy consumption. There's a growing global consciousness regarding the environmental impact of buildings. These glasses contribute to more sustainable construction by lowering carbon emissions associated with energy use, which further creates potential for the segment.

- For instance, the Swiss Glas Trosch Group, in collaboration with US materials specialist Corning, is introducing thin triple insulating glass in 2025. This new product provides a significant reduction in carbon footprint and enhanced energy efficiency for buildings.

Hence, owing to the above-mentioned factors, the others segment is expected to grow at the fastest rate over the future years.

By Application:

Based on application, the market is categorized into windows & doors, building facades & curtain walls, skylights & roof glazing, partitions & interior walls, floors & stairs, and others.

Trends in the Application:

- Growing demand for larger windows for expansive views and increased natural light is trend driving demand for bigger glass panes.

- Adoption of unitized and prefabricated systems in building facades and curtain walls is rising as it offers faster installation, better quality control, and improved energy performance.

The windows & doors segment accounted for the largest architectural glass market share in 2024.

Architectural glass plays a vital role in windows and doors, serving multiple functions from allowing daylight and views to providing thermal and sound insulation, security, and safety. It includes insulated glass units, low-E glass, tempered glass for safety, laminated glass for security and sound reduction, and decorative glass options. A growing focus on natural light and well-being, coupled with modern architectural preferences for larger, visually appealing windows are the factors fueling the segment revenue.

- For instance, in 2024, Alpen launched its new Zenith Sliding Glass Door series developed to offer customers a larger door option with improved ease of operation, enhanced energy efficiency, and the structural strength.

Home renovation and replacement activities also contribute significantly. Consequently, the windows & doors segment functions as the principal determinant of dynamics within the broader market.

The building facades & curtain walls segment is expected to grow at the fastest CAGR over the forecast period.

Building facades & curtain walls segment involves the use of glass as the exterior skin of commercial and high-rise buildings. Curtain walls are non-structural external walls containing large expanses of glass, often with sophisticated glazing systems for energy efficiency, structural integrity, and aesthetic appeal. Facades also incorporate various types of glass for cladding and visual impact.

The segment revenue is driven by increasing preference for energy-efficient building envelopes and modern architectural designs emphasizing glass exteriors. Moreover, adoption of unitized and prefabricated facade systems is also accelerating growth in this segment. Hence, owing to the above-mentioned analysis, the building facades & curtain walls segment is expected to grow at the fastest rate over the future years, creating architectural glass market opportunities.

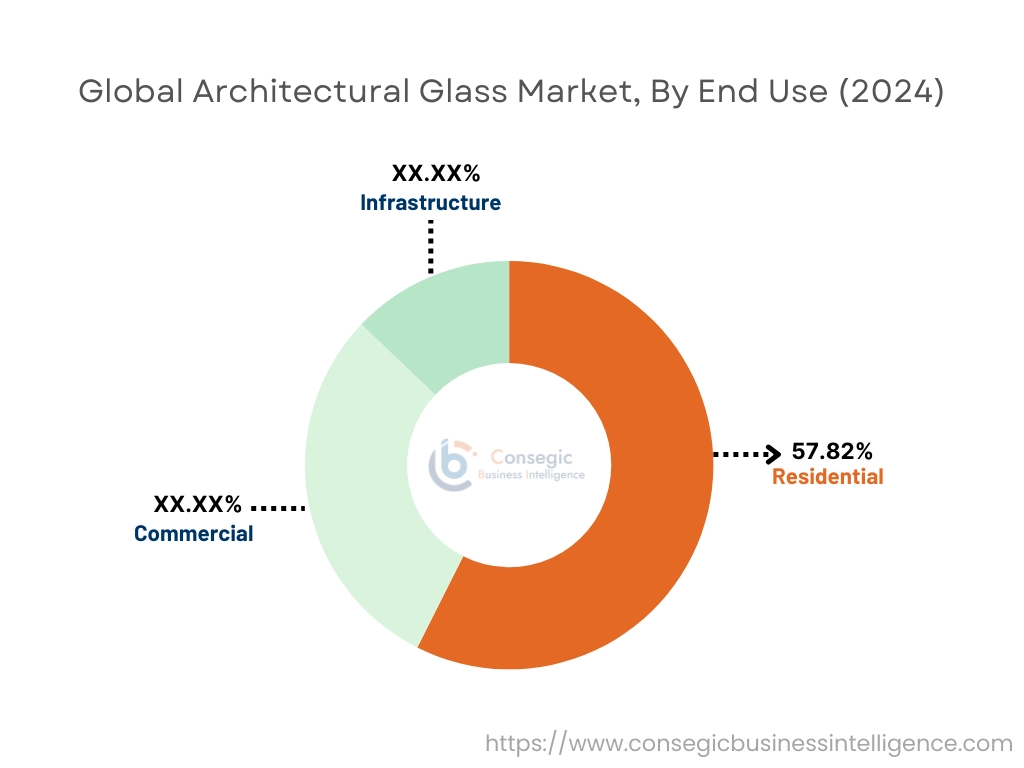

By End-Use:

The end use segment is categorized into residential, commercial, and infrastructure.

Trends in the End Use:

- Trend of using advanced glazing systems like structural glazing with solar control coatings to meet green building standards and reduce energy costs.

- Noise pollution mitigation is a trend positively impacting the use of specialized acoustic glass in transportation hubs and buildings near high-traffic areas.

The residential segment accounted for the market share of 57.82% in 2024.

Residential sector involves the use of glass in single-family homes, apartments, and other housing units. Key applications of these glasses in residential construction include windows, doors, interior partitions, balconies, balustrades, shower enclosures, and decorative elements such as mirrors and backsplashes.

The rise in this sector is driven by several factors including new housing construction, home renovation and remodeling activities, and a growing preference for aesthetics, natural light, and energy-efficient solutions.

- For instance, according to the data published by the National Association of Realtors, in 2024, it is estimated that Americans spent approximately USD 603 billion on home remodeling projects.

Thus, as per the architectural glass market analysis, the residential segment is dominating the architectural glass market trends.

The infrastructure segment is expected to grow at the fastest CAGR over the forecast period.

The infrastructure end-use segment of the architectural glass market demand is experiencing rapid expansion, fueled by substantial government investments in large-scale public projects. Airports, railway stations, and bus terminals necessitate extensive glazing for natural light, aesthetics, and passenger comfort, often requiring specialized glass types like safety, soundproof, and impact-resistant varieties.

Modern infrastructure development also prioritizes energy efficiency, driving the requirement for high-performance glass solutions. Furthermore, innovative structural glazing applications are increasingly being incorporated in advanced infrastructure designs, contributing to the segment's dynamic growth, particularly in rapidly developing economies. Hence, aforementioned factors are impacting the infrastructure end use in a positive outcome over the forecast period.

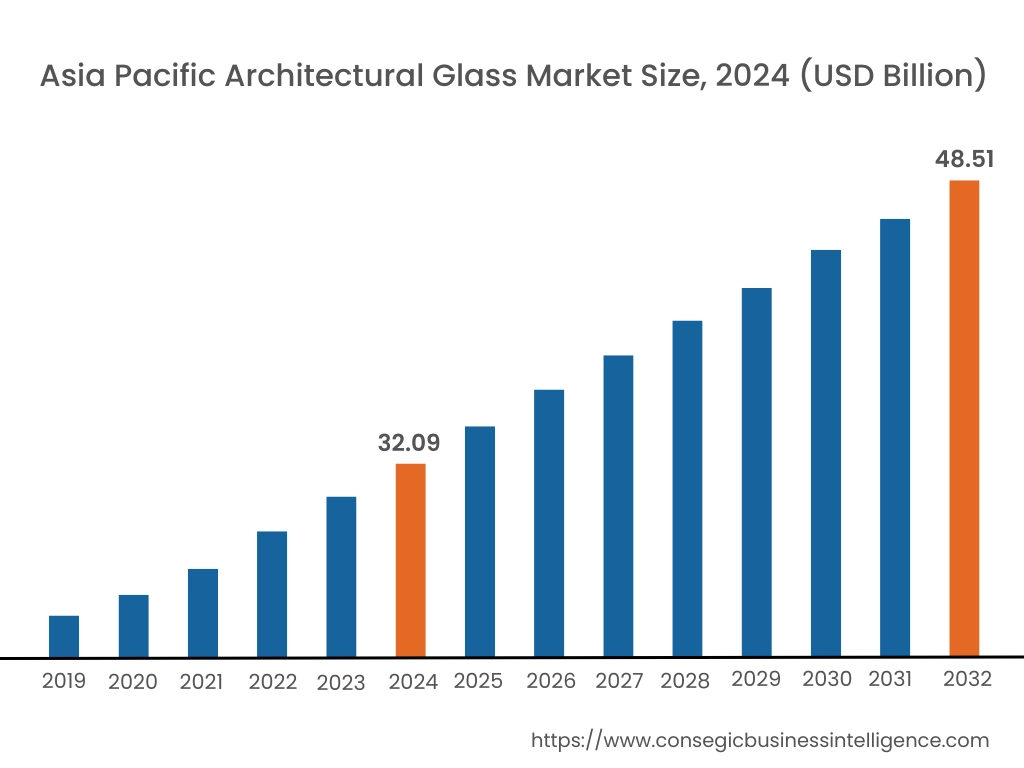

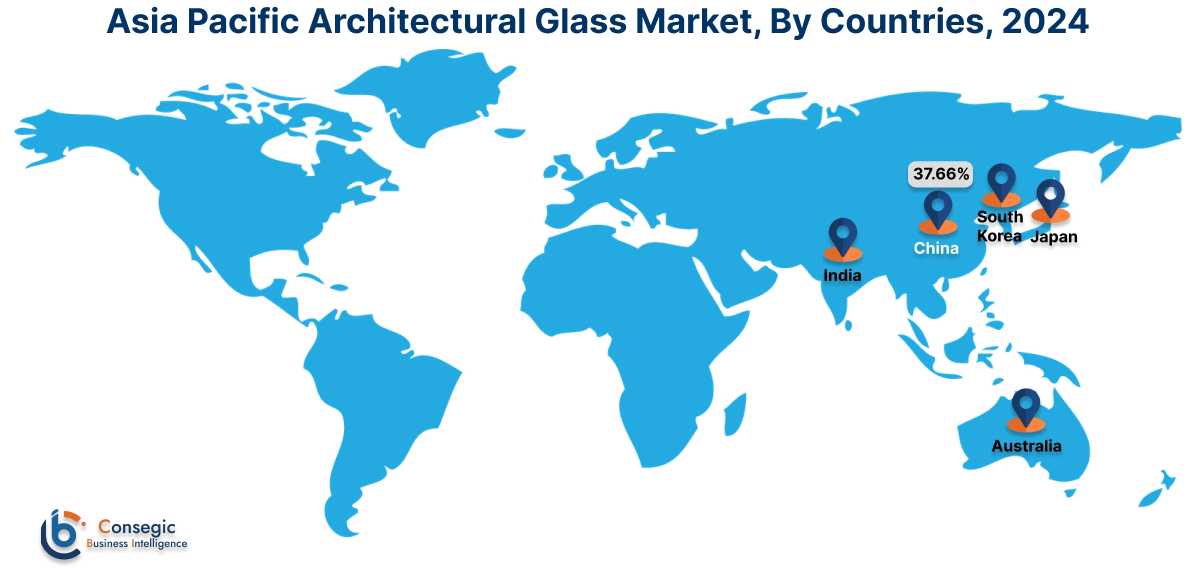

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest market share at 41.49% and was valued at USD 32.09 Billion and is expected to reach USD 48.51 Billion in 2032. In Asia Pacific, China accounted for a market share of 37.66% during the base year of 2024. Asia Pacific's influence on the market is significant due to the large-scale infrastructure development, and a growing construction sector, especially in China and India. The growing construction sector generates significant requirement for building materials including glass for various applications such as windows, facades, doors, and interior partitions. Governments are actively investing in infrastructure development and smart city projects. These initiatives often prioritize modern and energy-efficient building materials, including advanced architectural glass solutions.

- For instance, according to the IBEF, USD 1.3 trillion is provided for Gati Shakti national master plan for infrastructure in Inda. This plan is supporting impactful reforms in the infrastructure sector. These initiatives have positively impacted on programs like the Smart Cities Mission and Housing for All.

These factors create a strong upward trajectory for the Asia Pacific market, positioning it as a key region for players.

In Europe, the architectural glass industry is experiencing the fastest growth with a CAGR of 8.7% over the forecast period. One of the key factors contributing to the region’s market revenue is the stringent energy efficiency regulations, ambitious sustainability targets like the European Green Deal, and increasing adoption of aesthetically appealing and functional glazing solutions. The region's commitment to reducing carbon emissions from buildings, which account for a significant portion of its energy consumption, necessitates the adoption of high-performance glass such as low-E coatings. Furthermore, the renovation of existing buildings and the rising popularity of green building certifications are creating a strong market for advanced glazing technologies. These factors collectively present a positive impact on the European market.

The North American market trend significantly defined by stringent energy efficiency regulations and the increasing adoption of green building certifications pushing the need for high-performance glass to reduce energy consumption in both residential and commercial buildings. Furthermore, renovation and remodeling of existing buildings is also supporting the market revenue across the region. The United States and Canada have a well-established prefabricated housing market. This also contributes significantly to the adoption of glass. Hence, as per analysis, aforementioned factors are supporting the architectural glass market share across North America.

The Latin American architectural glass market trend is driven by the region's focus on infrastructure development. The growing investments in infrastructure, particularly in countries such as Brazil, contribute significantly to this requirement for various glass applications in residential, commercial, and industrial buildings. Furthermore, the increasing disposable incomes and a growing preference for modern aesthetics are boosting the need for advanced and decorative glass options in the region. As per analysis, these aforementioned factors are contributing to the upward trajectory of the market.

The Middle East and African architectural glass market analysis is currently characterized by growing focus on infrastructure development. This has led to significant growth potential for the market in the upcoming years. Increasing investments in the construction sector, particularly large-scale institutional and commercial construction projects in countries like the UAE, Saudi Arabia, and Qatar are expected to positively influence the adoption of several glass types used in architecture.

Top Key Players and Market Share Insights:

The Global Architectural Glass Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Architectural Glass market. Key players in the Architectural Glass industry include

- AGC Inc. (Japan)

- Saint-Gobain (France)

- Xinyi Glass Holdings Limited. (China)

- Sisecam (Turkey)

- CSG HOLDING CO. LTD. (China)

- Guardian Industries Holdings (U.S.)

- Nippon Sheet Glass Co., Ltd. (Japan)

- Vitro (U.S.)

- CARDINAL GLASS INDUSTRIES, INC (U.S.)

- SCHOTT (Germany)

Recent Industry Developments :

Product Launch:

- In February 2024, Vitro launched Sungate ThermL glass, a new low-emissivity (low-e) coating specifically engineered for application on the interior surface (typically the fourth surface) of a standard one-inch insulating glass unit (IGU). This coating is designed to significantly reduce heat transfer and dramatically improve the overall U-value of the IGU when used in combination with a Solarban solar control low-e glass by Vitro on the second surface. The Sungate ThermL coating enhances the insulation performance of the IGU without altering its clear, neutral appearance.

Architectural Glass Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 127.28 Billion |

| CAGR (2025-2032) | 6.5% |

| By Product Type |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Architectural Glass market? +

In 2024, the Architectural Glass market is USD 77.36 Billion.

Which is the fastest-growing region in the Architectural Glass market? +

Europe is the fastest-growing region in the Architectural Glass market.

What specific segmentation details are covered in the Architectural Glass market? +

By Product Type, By Application and End Use segmentation details are covered in the Architectural Glass market.

Who are the major players in the Architectural Glass market? +

AGC Inc. (Japan), Saint-Gobain (France), Guardian Industries Holdings (U.S.) are some of the major players in the market.