Rotavators Market Size:

Rotavators Market size is estimated to reach over USD 3.04 Billion by 2032 from a value of USD 1.96 Billion in 2024 and is projected to grow by USD 2.04 Billion in 2025, growing at a CAGR of 5.6% from 2025 to 2032.

Rotavators Market Scope & Overview:

Rotavators, also known as rotary tillers, are used for secondary cultivation, designed to break up, churn, and mix the soil to create a fine seedbed. These machines are mounted on tractors and operate through a set of rotating blades or tines attached to a horizontal shaft. As the blades turn, they pulverize the upper layer of soil, making it suitable for sowing while also helping in residue management after harvest.

Different models of rotary tillers come with varying working widths and blade setups to match different types of soil, crops, and field dimensions. Their gearboxes and drive parts are built to handle hard soil or areas with crop residue. Operators can adjust the blade spacing and rotor speed depending on how deep or shallow the mixing needs to be. Some models also have side discs or wheels to keep the working depth consistent across the field.

Rotary tillers are commonly used ahead of planting in cropping systems where precision soil conditioning and time-sensitive field turnaround are important. End-users include mechanized farms, agricultural contractors, and horticulture operations that require efficient soil preparation tools compatible with different tractor horsepower ranges.

Rotavators Market Dynamics - (DRO) :

Key Drivers:

Supportive government incentives for farm mechanization are accelerating market development.

Governments across the globe are actively promoting agricultural mechanization through financial incentives, such as subsidies and grants. These initiatives are designed to help farmers, particularly those in small and medium-scaled operations, access advanced farming tools like rotary tillers. As agricultural productivity becomes increasingly important, particularly in nations facing labor shortages and low efficiency, these subsidies play a critical role in making modern equipment affordable. By supporting the shift from manual labor to mechanized farming, these policies improve not only productivity but also the overall sustainability of farming operations.

- For instance, the Sub Mission on Agricultural Mechanization (SMAM) is a Government of India initiative under the Ministry of Agriculture and Farmers Welfare, which aims to provide farm mechanization to enhance productivity, reduce labor dependency, and improve efficiency in farming operations. This initiative provides subsidies to farmers for the purchase of various agricultural machinery and equipment, including tractors, rotavators, seeders, harvesters, and more.

Furthermore, mechanization enhances soil health, reduces operational costs, and increases crop yields. As governments continue to push for technological advancements in agriculture, the demand for equipment like rotary tillers will grow, supporting long-term rotavators market expansion in developing economies.

Key Restraints:

Operational inefficiencies caused by insufficient technical expertise are slowing the growth of the rotavators market.

The adoption of rotavators, especially in rural or underdeveloped areas, gives rise to limited availability of skilled labor to operate and maintain advanced machinery. These specialized machines require significant training for optimal operation and troubleshooting. In regions where agricultural education and technical expertise are limited, farmers may struggle to use the equipment effectively. This gap in knowledge can result in improper handling, equipment malfunction, or delayed maintenance, which impacts productivity. In many areas, there is a shortage of trained technicians who can service and repair high-tech machinery, leading to longer downtimes and increased operational costs. As a result, even though rotary tillers could substantially improve farming efficiency, their adoption may be limited in regions with insufficient technical infrastructure and support, hindering the market's growth potential, particularly in emerging markets with a less developed workforce.

Future Opportunities :

The shift toward greenhouse cultivation and organic practices is opening up attractive rotavators market opportunities.

Greenhouse and organic farming applications are increasing as awareness of sustainability grows and consumer preferences shift toward healthier food choices. This will open up significant opportunities for the adoption of precision tilling equipment, like rotary tillers. Greenhouse farming requires controlled soil conditions to maximize crop yield while minimizing exposure to pests and diseases. Organic farming, in particular, places a strong emphasis on minimal soil disruption to maintain soil health and biodiversity. Rotary tillers are ideal for these types of farming because they effectively prepare soil without overly disturbing the natural balance, which is crucial for organic practices. As the demand for organic produce continues to grow, especially in developed regions, more farmers are adopting equipment that supports sustainable farming methods. Additionally, the precision provided by rotary tillers makes them a valuable tool for greenhouse operations, where efficiency and environmental control are paramount. As both organic and greenhouse farming expand globally, the demand for specialized, eco-friendly tilling solutions will continue to drive the global rotavators market opportunities.

Rotavators Market Segmental Analysis :

By Blade Type:

Based on Blade Type, the market is categorized into L-type blades, C-type blades, and others.

The L-Type Blades segment hold the largest revenue share of the overall Rotavators Market in the year 2024.

- L-type blades are widely preferred due to their suitability for shallow tillage, effective clod breaking, and fuel efficiency across various soil types.

- These blades are ideal for preparing seedbeds, mixing manure, and weeding in row crop systems including wheat, cotton, and soybean.

- Farmers prefer L-type blades for their reduced power requirement and lower vibration, resulting in minimal stress on tractor drivetrains.

- According to the rotavators market analysis, their cost-effectiveness and compatibility with general-purpose tillage are significantly driving the market development.

The C-Type Blades segment is expected to grow at the fastest CAGR during the forecast period.

- C-type blades offer deeper soil penetration and are designed to handle more challenging soil conditions such as hardpan and compacted layers.

- These blades are increasingly used in commercial farming and large mechanized operations requiring aggressive soil inversion.

- Manufacturers are offering high-carbon and boron steel variants to enhance wear resistance and extend operational life.

- Thus, the growing interest in no-till to reduced-till conversions and high-performance cultivation through C-type blades is significantly boosting the global rotavators market trend.

By Power Source:

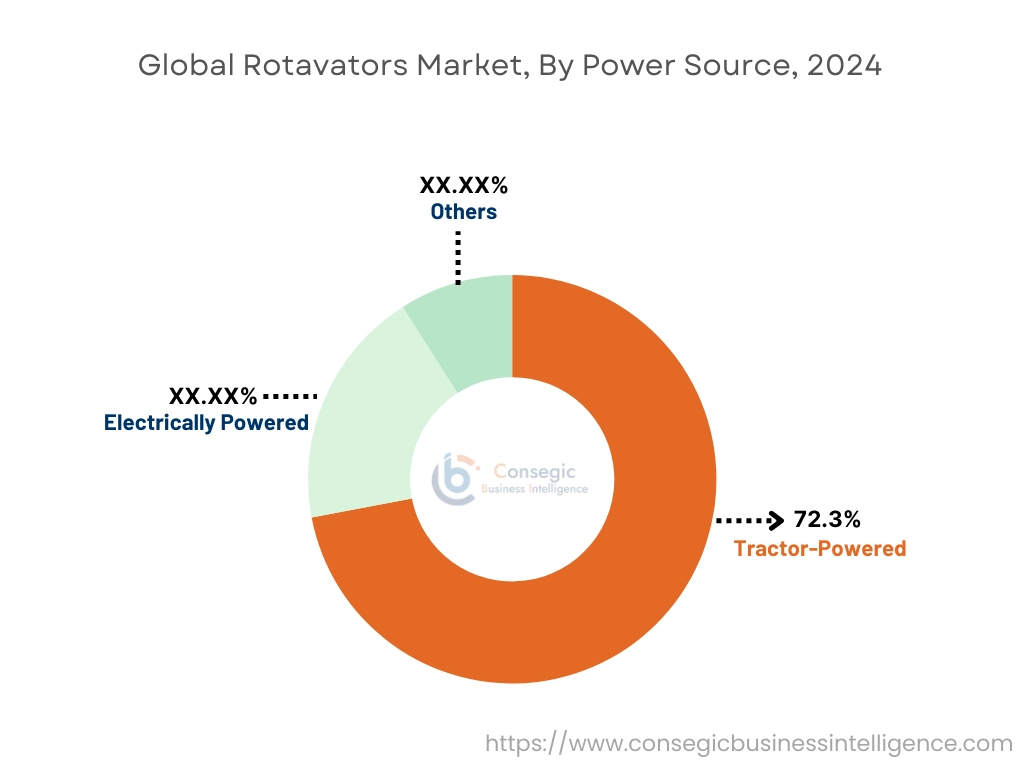

Based on Power Source, the market is categorized into Tractor-Powered, Electrically Powered, and Others.

The Tractor-Powered segment hold the largest revenue share of 72.3% in the overall Rotavators Market in the year 2024.

- Tractor-driven rotavators dominate the market due to their compatibility with widely available 30–75 HP farm tractors.

- These units are suitable for medium-to-large field dimensions and perform well in traditional as well as modern farming systems.

- Equipment leasing firms and cooperatives maintain large inventories of tractor-powered models for seasonal use in wheat, rice, and sugarcane regions.

- As per the industry analysis, their field versatility, fuel efficiency, and widespread availability, tractor-powered rotary tillers contribute to the largest revenue and significantly drive the global rotavators market expansion.

The Electrically Powered segment is expected to grow at the fastest CAGR during the forecast period.

- Electrically powered rotary tillers, often used in greenhouse, nursery, and small garden operations, are gaining popularity due to zero emissions and ease of use.

- Lightweight and compact, these units are increasingly used in urban farming setups and protected cultivation systems.

- Manufacturers are launching battery-powered models targeting precision farming and indoor agricultural infrastructure.

- Thus, growing adoption of sustainable agriculture tools, the electrically powered segment significantly boosts the global rotavators market growth.

By Application:

Based on Application, the market is categorized into Agriculture, Horticulture, and Others.

The Agriculture segment holds the largest revenue of the overall Rotavators Market share in the year 2024.

- The majority of rotary tillers are deployed for land preparation in row crop and grain systems including rice, maize, and pulses.

- Farmers use rotary tillers to reduce plow passes, saving fuel and time during pre-plant tillage.

- Seasonal crop rotation, mechanized sowing systems, and time-sensitive land preparation reinforce demand from traditional field crop farmers.

- According to the market analysis, its widespread use in food grain production, agriculture continues to be the largest application segment, significantly driving the rotavators market growth.

The Horticulture segment is expected to grow at the fastest CAGR during the forecast period.

- Horticultural operations, including vegetables, fruits, and floriculture are increasingly adopting rotavators for shallow tillage and inter-row cultivation.

- These farms benefit from smaller-width and precision-compatible models that prevent root disturbance in perennial plantations.

- Growth is especially strong in greenhouse and orchard sectors where narrow-frame and adjustable-depth rotavators are needed.

- Thus, with the high-value crops gain prominence in export-oriented and protected farming, horticulture segment is expected to grow substantially, significantly boosting the rotavators market demand.

By Sales Channel:

Based on Sales Channel, the market is categorized into OEMs (direct sales), dealers & distributors, and online platforms.

The Dealers & Distributors segment holds the largest revenue of the overall Rotavators Market share in the year 2024.

- Regional dealers and agri-machinery distributors account for the largest share of rotavator sales, especially in developing countries.

- These channels offer pre-sale advice, equipment demonstrations, and localized after-sales support that farmers rely on heavily.

- Dealer networks work closely with OEMs to manage inventory, financing solutions, and subsidy documentation for rural customers.

- Therefore, the market analysis shows that the significance of dealers & distributors in both urban and rural markets makes it the largest segment, substantially driving the rotavators market progress.

The Online Platforms segment is expected to grow at the fastest CAGR during the forecast period.

- Digital marketplaces and OEM-managed e-commerce portals are rapidly growing, especially in countries with increasing rural internet penetration.

- These platforms offer farmers the ability to compare models, view specifications, access digital brochures, and read user reviews.

- Digital platforms are gaining traction among younger farmers and agritech-savvy cooperatives looking for transparent pricing and fast turnaround.

- According to the rotavators market analysis, online platforms segment is expected to grow substantially due to the growing e-commerce adoption in agriculture, significantly boosting the rotavators market development.

Regional Analysis:

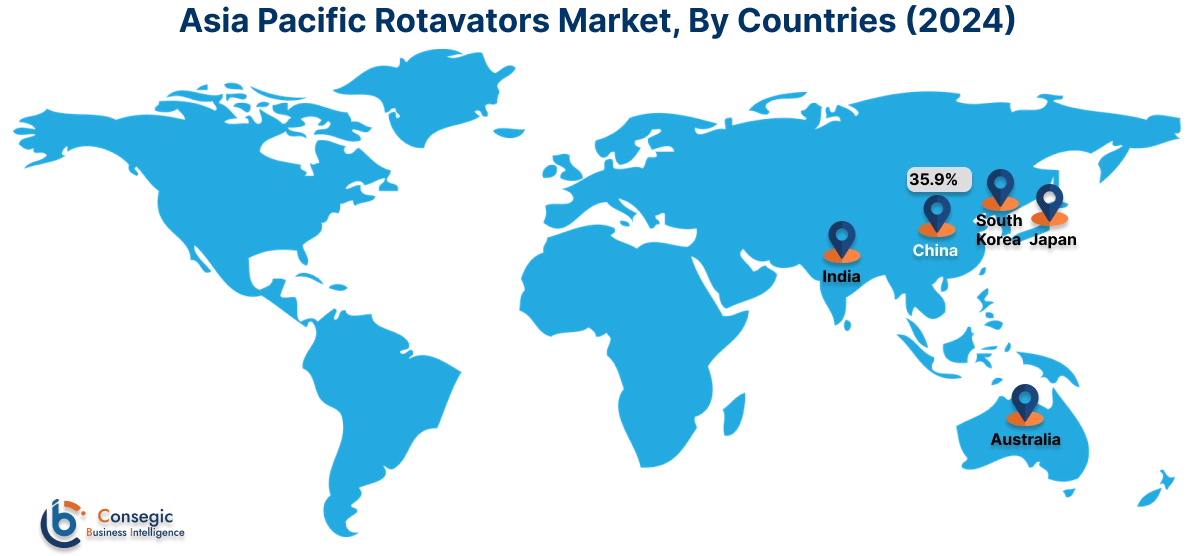

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

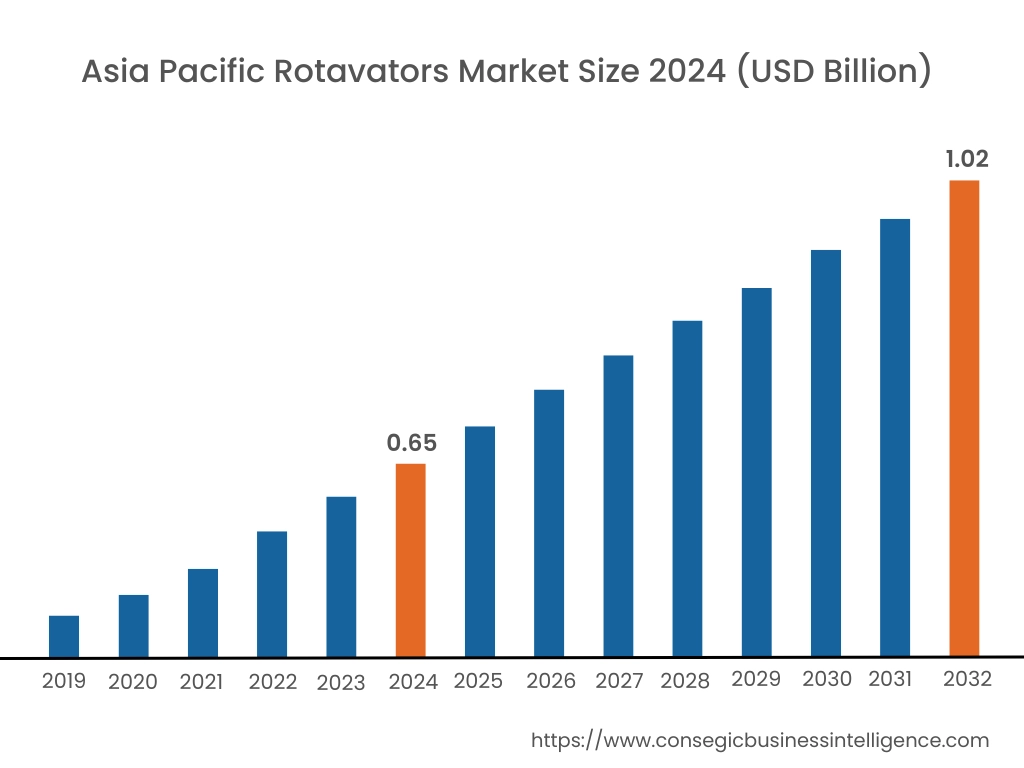

Asia Pacific region was valued at USD 0.65 Billion in 2024. Moreover, it is projected to grow by USD 0.68 Billion in 2025 and reach over USD 1.02 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.9%.

In the Asia‑Pacific region, India and China lead with low‑cost, high‑throughput rotavators designed for smallholder plots, whereas Australia and Japan are advancing premium, low‑emission models for large‑scale operations. Notable trends like the integration of solar‑powered auxiliary systems to improve fuel efficiency, while another trend centers on combining seeding and rotavating functions into single‑pass implements have significantly driven the rotavators market demand.

- For instance, Mahindra’s Dharti Mitra Rotavator is India’s first digitally enabled rotavator, enhanced with advanced features aimed at maximizing soil preparation efficiency and durability. The rotavator is equipped with boron steel blades for superior wear resistance and longevity, and its multi-speed gearbox allows for customized tillage across various soil types. Designed for deep and uniform soil mixing, it helps in creating fine seedbeds while also supporting stubble incorporation.

Furthermore, rural mechanization schemes and trade‑fair demonstrations promote technology diffusion, rapidly fueling the industry in this region.

North America is estimated to reach over USD 0.89 Billion by 2032 from a value of USD 0.58 Billion in 2024 and is projected to grow by USD 0.60 Billion in 2025.

In North America, the market is shaped by advancements in manufacturing technologies and shifting agricultural practices aimed at enhancing field efficiency and minimizing environmental footprint. Shifting trend in farm structures across the United States, Canada, and Mexico have driven the adoption of advanced technology tailored to varied soil types. Additionally the integration of GPS‑guided depth control systems that allow precise tillage have enabled sustained field performance.

- For instance, Land Pride, a division of Great Plains Ag, has continuously improved its rotary tillers by engineering a wide range of models that cater to varied soil types, tractor dimensions, and tillage needs. Their rotary tillers are equipped with heavy-duty gear-driven transmissions, reversible and replaceable tines, and adjustable skid shoes for precise working depth control. Designed for both forward and reverse tilling, these tillers offer exceptional soil mixing and residue incorporation. Land Pride has focused on enhancing durability through reinforced side panels, robust rotor assemblies, and high-quality seals and bearings, ensuring long service life with minimal maintenance.

Furthermore, the regional analysis depicts the emergence of quick‑attach implements for multi‑purpose tractors and growing partnerships between major OEMs and local cooperatives have significantly driven the rotavators market progress in this region.

Europe holds a significant position in the market, driven by its strong emphasis on sustainable practices and the adoption of advanced smart farming technologies. Dominant markets such as Germany and France are pioneering smart rotavator models featuring real‑time blade‑wear monitoring, with the United Kingdom and Italy following by piloting robotic tow‑behind units. Additionally, shifting trend towards the use of energy‑efficient driveline technologies to comply with stringent emission standards is fueling the market expansion. Furthermore, EU agricultural modernization grants are driving investment and the collaborative R&D efforts between manufacturers and farmers’ associations have significantly boosted the rotavators market in this region.

The rotavators market in the Middle East and Africa is witnessing consistent growth, largely driven by the need for dust-resistant models in arid regions like South Africa and Egypt, while in countries such as Morocco and Kenya, the preference for hopper-fed designs that handle varying residue levels is boosting adoption. Additionally, rising trend towards ruggedized gearbox assemblies to withstand extreme temperatures and the development of quick‑couple linkage systems for rapid field adjustments is propelling demand. Furthermore, government-supported agricultural resilience initiatives are encouraging equipment trials, while collaborations with international aid organizations are financing pilot programs and training sessions, collectively driving market growth.

Latin America’s leading producers in Brazil and Argentina leverage heavy‑duty rotavators for soybean and sugarcane cultivation, with emerging markets in Chile and Colombia testing lighter, precision‑tillage variants. One notable trend is the adoption of cloud-connected monitoring systems to track equipment usage, while another trend highlights the integration of maintenance services within rental and leasing contracts. Market analysis indicates that agricultural credit programs linked to sustainability initiatives are playing a significant role in driving regional market growth.

Top Key Players and Market Share Insights:

The Rotavators Market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global Rotavators Market. Key players in the Rotavators industry include -

- Maschio Gaspardo S.p.A. (Italy)

- Fieldking (Beri Udyog Pvt. Ltd.) (India)

- Alpego S.p.A. (Italy)

- KS Agrotech Pvt. Ltd. (India)

- Deccan Farm Equipment Pvt. Ltd. (India)

- Mahindra & Mahindra Ltd. (India)

- Sonalika Tractors (International Tractors Ltd.) (India)

- Shaktiman (Tirth Agro Technology Pvt. Ltd.)

- Martin Pears Engineering Ltd. (UK)

- Unlu Agrigroup (Turkey)

Recent Industry Developments :

Mergers and Acquisitions:

- In October 2023, Consolidated Equipment Group (CEG) announced the acquisitions of Pro-Dig and Dirt Dog Manufacturing. The acquisition of Dirt Dog Manufacturing, known for its U.S.-built agricultural and landscaping attachments including rotary tillers, blades, and box scrapers, enhances CEG’s product portfolio and market reach. The integration of Dirt Dog’s robust rotary tiller line further reinforces CEG’s commitment to offering durable and high-performance equipment solutions. Meanwhile, Pro-Dig brings expertise in advanced drilling and anchoring solutions. These strategic acquisitions align with CEG’s goal of expanding its manufacturing capabilities, product range, and customer base across construction, agriculture, and utility sectors.

Rotavators Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 3.04 Billion |

| CAGR (2025-2032) | 5.6% |

| By Blade Type |

|

| By Power Source |

|

| By Application |

|

| By Sales Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Rotavators Market? +

The Rotavators Market is estimated to reach over USD 3.04 Billion by 2032 from a value of USD 1.96 Billion in 2024, growing at a CAGR of 5.6%.

What specific segments are covered in the Rotavators Market? +

The Rotavators Market specific segments for Blade Type, Power Source, Application, Sales Channel, and Region.

Which is the fastest-growing region in the Rotavators Market? +

Asia pacific is the fastest growing region in the Rotavators Market.

What are the major players in the Rotavators Market? +

The key players in the Rotavators Market are Maschio Gaspardo S.p.A. (Italy), Fieldking (Beri Udyog Pvt. Ltd.) (India), Mahindra & Mahindra Ltd. (India), Sonalika Tractors (International Tractors Ltd.) (India), Shaktiman (Tirth Agro Technology Pvt. Ltd.), Martin Pears Engineering Ltd. (UK), Unlu Agrigroup (Turkey), Alpego S.p.A. (Italy), KS Agrotech Pvt. Ltd. (India), Deccan Farm Equipment Pvt. Ltd. (India), and others.