Seismic Isolation Systems Market Size:

Seismic Isolation Systems Market size is estimated to reach over USD 516.21 Million by 2032 from a value of USD 402.18 Million in 2024 and is projected to grow by USD 407.76 Million in 2025, growing at a CAGR of 3.2% from 2025 to 2032.

Seismic Isolation Systems Market Scope & Overview:

Seismic isolation systems refer to engineering solutions that are designed to reduce the transmission of seismic forces from the ground to a structure during an earthquake. These systems enable a building or infrastructure to move independently from ground motion, which minimizes the effects of the seismic forces that could cause significant damage. Moreover, seismic isolation system offers several benefits including extended building service life, improved structural resilience, and reduced repair costs after seismic events among others. Additionally, these systems are typically integrated into residential, commercial, and industrial structures, including high-rise buildings, hospitals, bridges, and critical facilities, where operational continuity and safety are vital.

Key Drivers:

Rising development of earthquake-resilient infrastructure in high-risk seismic zones is propelling the seismic isolation systems market growth

Seismic isolation systems are becoming an integral element of modern structural designs, particularly, in earthquake-prone regions. As seismic activity poses significant risks to life and property, public and private sectors are constantly prioritizing investments in the development of infrastructures that can withstand ground motion without major structural damage. Moreover, urban planners and construction firms are integrating components such as lead rubber bearings, sliding pendulum isolators, and base isolators in bridges, buildings, and other related infrastructure. This enables the decoupling of structures from seismic forces, further ensuring operational continuity and occupant safety. Additionally, governments in regions with recurrent seismic activity are increasingly mandating the integration of seismic isolation technologies for protecting critical and high-value assets.

- For instance, in April 2025, the Public Works Department (PWD) of New Delhi, India issued an order to survey and retrofit all essential buildings within the city and make them earthquake-resistant. The project includes identifying critical infrastructure such as schools, hospitals, fire stations, police stations, and other essential buildings and conducting vulnerability assessments to determine the need for retrofitting or seismic upgrades.

Hence, the rising development of earthquake-resilient infrastructure for enhanced structural protection is proliferating the seismic isolation systems market size.

Key Restraints:

Integration challenges, particularly in irregular or complex building geometries, are restraining the seismic isolation systems market expansion

The integration of seismic isolation systems in buildings with asymmetric load distribution, non-uniform geometries, or complex architectural features often faces significant design and engineering challenges. Moreover, structures with mixed-use layouts or irregular footprints usually require extensive structural analysis and custom isolation strategies to ensure appropriate load transfer and even energy dissipation. The above complexities usually extend design timelines and increase project costs, which may limit its adoption among contractors and developers.

Additionally, the customized fabrication and adaptive deployment of isolators are relatively more difficult in retrofitting projects where foundation type, space, or access may be restricted as compared to new constructions. Hence, the above engineering constraints may limit the adoption of these systems, in turn hindering the seismic isolation systems market.

Future Opportunities :

Rising construction activities are expected to drive the seismic isolation systems market opportunities

Factors including rapid urbanization and increasing investments in infrastructure development projects are driving construction activities in multiple regions worldwide. As urban populations grow and infrastructure expands, the awareness of seismic risks associated with construction in earthquake-prone areas has also increased significantly. This is further driving the demand for seismic protection solutions in modern construction projects to ensure that new buildings and infrastructure can withstand potential earthquakes, thereby enhancing the safety and resilience of structures. As a result, the rising construction activities, including residential, commercial, and industrial construction, are anticipated to provide lucrative aspects for market growth.

- For instance, according to Statistics Netherlands, the total number of new construction of commercial buildings across the Netherlands reached up to 1,042 units in 2022.

Hence, the rising construction activities are expected to boost the seismic isolation systems market opportunities during the forecast period.

Seismic Isolation Systems Market Segmental Analysis :

By Type:

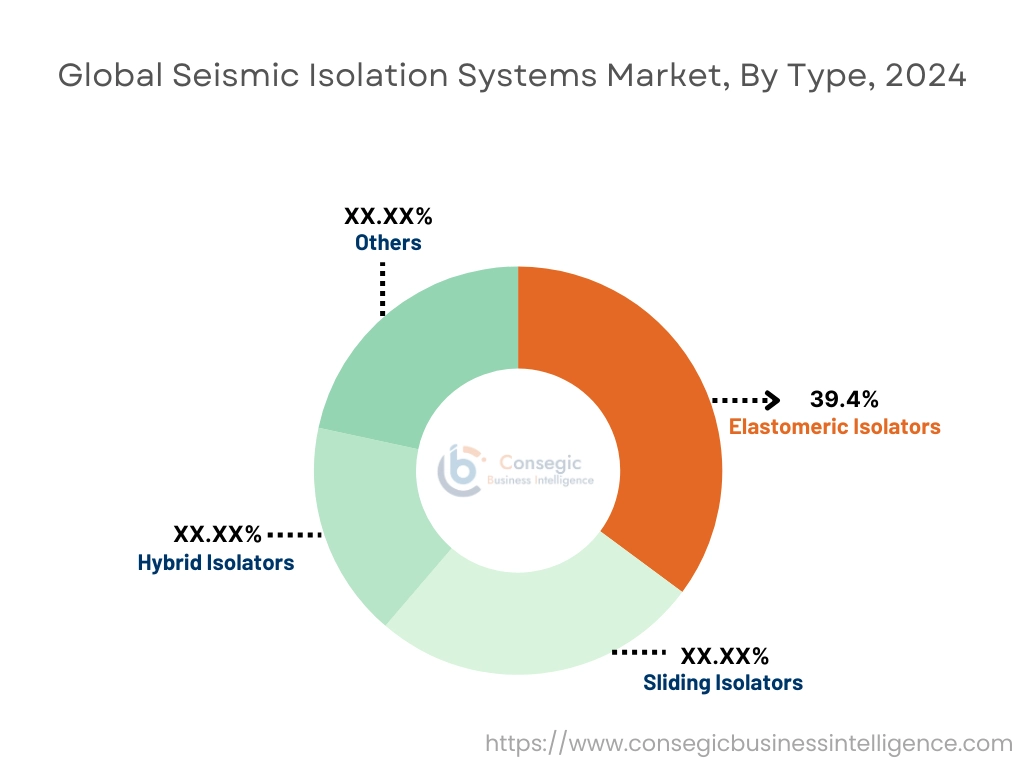

Based on type, the market is segmented into elastomeric isolators, sliding isolators, hybrid isolators, and others.

Trends in the type:

- Increasing trend in the adoption of elastomeric isolators in residential and commercial buildings to facilitate improved protection against ground shaking.

- Rising adoption of hybrid isolators in complex structures such as high-rise buildings, bridges, and critical infrastructure, due to their improved adaptability, superior performance, and the ability to offer higher protection across diverse construction projects.

The elastomeric isolators segment accounted for the largest revenue share of 39.4% in the total seismic isolation systems market share in 2024.

- Elastomeric isolators are a type of seismic isolation device that is primarily composed from layers of rubber and steel plates.

- Elastomeric isolators enable horizontal movement while providing vertical support to the structure above.

- Moreover, elastomeric isolators are capable of absorbing and dissipating the energy generated during an earthquake, thereby reducing the forces transmitted to the building structure.

- In addition, the elastomeric segment growth is mainly driven due to its improved flexibility, vertical load-bearing capacity, and others.

- Therefore, according to the analysis, the aforementioned factors are driving the market.

The hybrid isolators segment is anticipated to register the fastest CAGR growth during the forecast period.

- Hybrid isolators refer to an advanced type of seismic isolation system that combines different materials and mechanisms to attain improved performance.

- Hybrid isolators integrate the benefits of elastomeric isolators and sliding isolators, providing higher flexibility and improved damping capacity for structures situated in high-risk seismic zones.

- Moreover, hybrid isolators offer superior performance under both horizontal and vertical forces, increased adaptability, and reduced structural damage, making them ideal for integration in buildings with variable structural designs.

- Additionally, hybrid isolators are primarily used in more complex structures such as high-rise buildings, bridges, and critical infrastructure among others.

- Thus, the above benefits are expected to increase the adoption of hybrid isolators, in turn driving the market during the forecast period.

By Material:

Based on material, the market is segmented into rubber, steel, polymers, composite materials, and others.

Trends in the material:

- Rising trend towards adoption of rubber material in seismic isolation system, due to improved durability and flame-retardant properties improved elasticity, durability, flexibility, and dampening properties.

- Rising trend towards the integration of composite materials in seismic isolation system, due to their lightweight, high strength-to-weight ratio, design flexibility, and others.

Rubber segment accounted for the largest revenue in the overall seismic isolation systems market share in 2024.

- Rubber is a widely used material in seismic isolation system, due to its several benefits including improved elasticity, durability, flexibility, and dampening properties.

- Rubber materials, such as natural rubber and synthetic elastomers, are commonly used in elastomeric isolators and bearings.

- Moreover, the key characteristic of rubber, which includes its elasticity, enables it to deform under stress and return to its original shape. This makes it highly effective for absorbing seismic energy and facilitating horizontal movement.

- Therefore, the increasing adoption of rubber material in seismic isolation system is driving the seismic isolation systems market trends.

The composite materials segment is anticipated to register the fastest CAGR growth during the forecast period.

- Composite materials typically combine different materials, including plastics, metals, and fibers, and are designed for specific performance characteristics.

- Common composites used in seismic isolation devices include fiber-reinforced polymers (FRPs) and laminated composites among others.

- Moreover, composite materials offer several benefits including a high strength-to-weight ratio, significant weight reduction, corrosion resistance, design flexibility, and others.

- Hence, the increasing adoption of composite materials in seismic isolation devices is anticipated to boost the seismic isolation systems market growth during the forecast period.

By End-Use:

Based on the end use, the market is segmented into residential, commercial, and industrial.

Trends in the end use:

- Factors such as the rising pace of urbanization and increasing investments in commercial construction involving hotels, hospitals, offices, educational institutions, and others are driving the commercial segment.

- Factors including an increase in disposable income, growing investments in residential construction, and government policies including subsidies, tax incentives, and rebates are major prospects driving the growth of the residential sector.

Commercial segment accounted for the largest revenue share in the total market in 2024.

- This dominance is attributed to the rising adoption of seismic isolation system in commercial buildings such as offices, retail outlets, hotels, hospitals, educational institutions, and others.

- Moreover, the utilization of seismic isolators in commercial buildings helps in protecting the structure along with minimizing downtime and operational losses during events of an earthquake.

- Additionally, factors including rising awareness regarding seismic risks in urban areas and the growing need for robust and durable commercial building structures are driving the adoption of seismic isolation systems in the commercial segment.

- For instance, according to Statistics Canada, the total commercial construction permits in Canada were valued at USD 1,682,511 in January 2024, demonstrating a significant increase of 29.5% in comparison to USD 1,299,688 in December 2023.

- According to the analysis, the above factors are driving the seismic isolation systems market size.

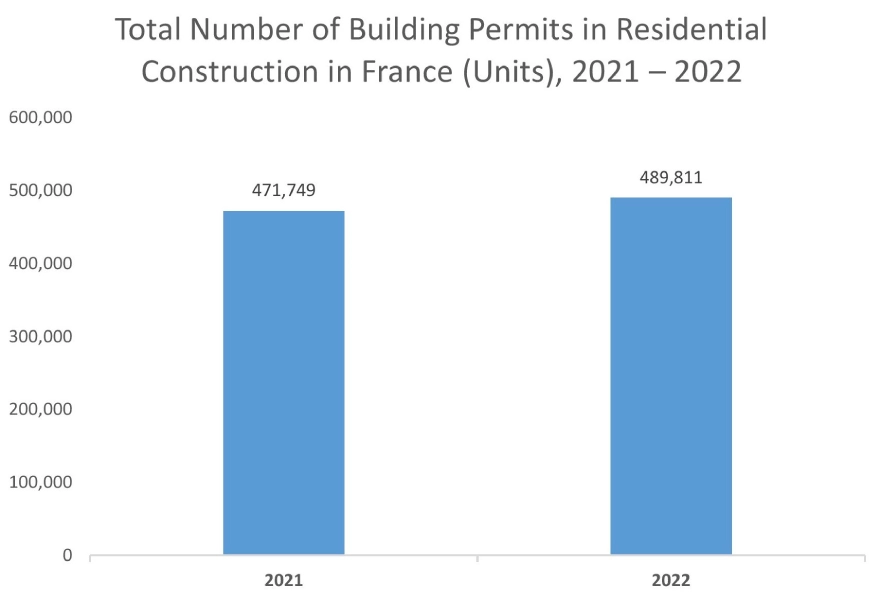

The residential segment is anticipated to register the fastest CAGR during the forecast period.

- Seismic isolation devices are being increasingly integrated into residential buildings including single-family dwellings, multi-family dwellings, and others.

- Moreover, high-rise apartment complexes and condominiums often utilize seismic isolation system to protect the building against seismic activities, in turn ensuring occupant safety and minimizing the damage during earthquakes.

- For instance, according to the European Construction Industry Federation, the total number of building permits for residential construction in France reached up to 489,811 units in 2022, witnessing an increase of 3.83% as compared to 471,749 units in 2021.

- According to the market analysis, the rising residential construction is expected to drive the demand for seismic isolation system, in turn propelling the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

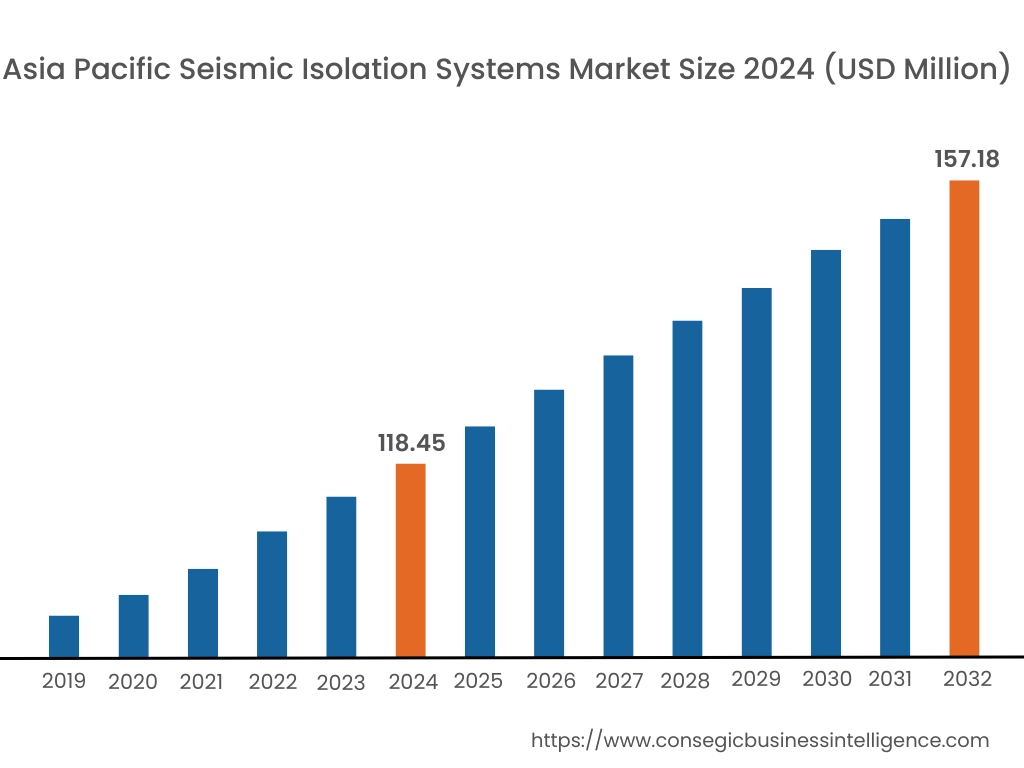

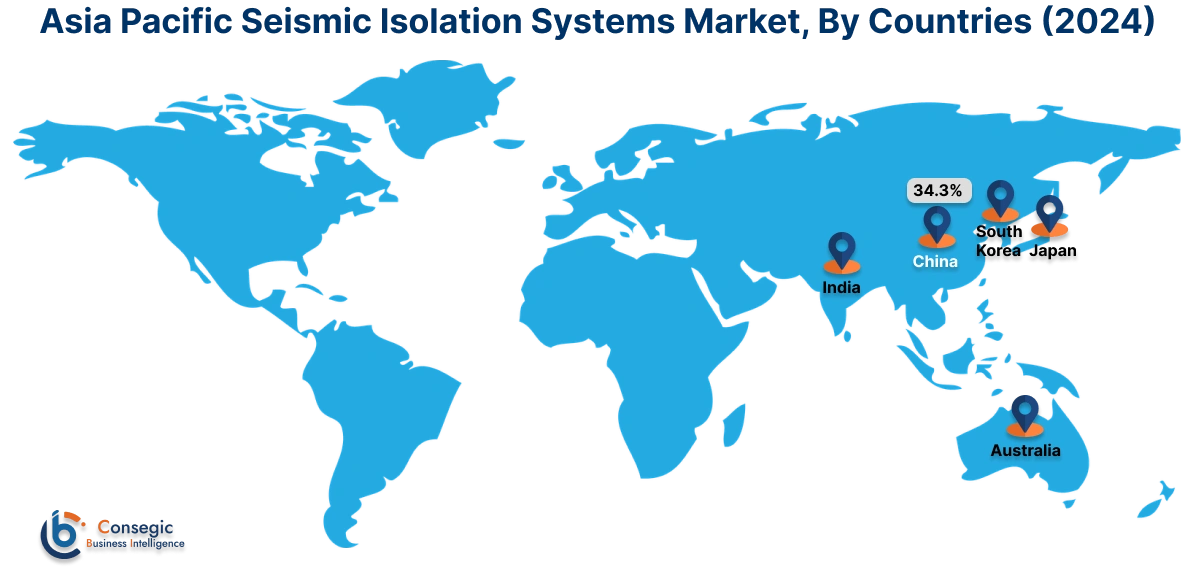

Asia Pacific region was valued at USD 118.45 Million in 2024. Moreover, it is projected to grow by USD 120.43 Million in 2025 and reach over USD 157.18 Million by 2032. Out of this, China accounted for the maximum revenue share of 34.3%. As per the seismic isolation systems market analysis, the adoption of seismic isolation system in the Asia-Pacific region is primarily driven by driven by rising development of commercial and residential spaces among others. Additionally, the rising adoption of seismic isolation system in residential and commercial spaces to ensure improved safety, particularly in high-risk seismic zones such as Japan, India, and the Southeast Asian region, is accelerating the seismic isolation systems market expansion in the Asia-Pacific region.

- For instance, according to the Building and Construction Authority of Singapore, the total construction demand including residential and commercial construction in Singapore is reached between USD 24 billion to USD 29 billion by the end of 2024. The above factors are further propelling the seismic isolation systems market trends in the Asia-Pacific region.

North America is estimated to reach over USD 167.30 Million by 2032 from a value of USD 133.41 Million in 2024 and is projected to grow by USD 135.00 Million in 2025. In North America, the growth of the seismic isolation systems industry is driven by the rising investments in residential, commercial, and industrial construction projects along with increasing integration of seismic isolation devices within buildings among others. Similarly, the prevalence of substantial number of high-rise buildings and structures along with robust safety and building codes are contributing to the seismic isolation systems market demand in North America.

In addition, the regional analysis depicts that rising construction activities and growing need for improved building safety solutions during seismic events are driving the seismic isolation systems market demand in Europe. Furthermore, as per the seismic isolation systems market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such rising pace of urbanization and increasing investments in residential and commercial construction among others.

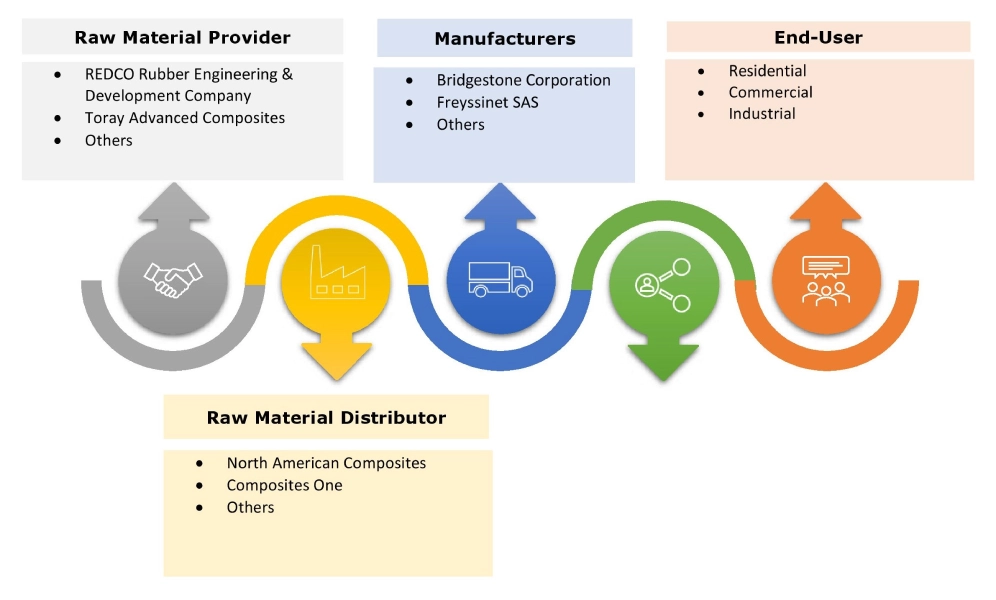

Top Key Players and Market Share Insights:

The global seismic isolation systems market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the seismic isolation systems market. Key players in the seismic isolation systems industry include-

- Bridgestone Corporation (Japan)

- Freyssinet SAS (France)

- Zhenjiang Huayu Seismic Isolation Equipment Co., Ltd. (China)

- Toyo Tire Corporation (Japan)

- OILÉS Corporation (Japan)

- Maurer SE (Germany)

- Kawakin Core-Tech Co., Ltd. (Japan)

- Dynamic Isolation Systems, Inc. (USA)

- Earthquake Protection Systems, Inc. (USA)

- Hirun International Co., Ltd. (China)

Recent Industry Developments :

Expansion:

- In March 2025, TIS, a seismic isolation system manufacturer, announced that it is expanding its presence in the Latin American region by providing its earthquake resilience technology to data centers in Chile. The company will offer advanced seismic isolators for three new data center projects located in the Santiago Metropolitan region, Chile.

Seismic Isolation Systems Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 516.21 Million |

| CAGR (2025-2032) | 3.2% |

| By Type |

|

| By Material |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Seismic Isolation Systems Market? +

Seismic Isolation Systems Market size is estimated to reach over USD 516.21 Million by 2032 from a value of USD 402.18 Million in 2024 and is projected to grow by USD 407.76 Million in 2025, growing at a CAGR of 3.2% from 2025 to 2032.

What specific segmentation details are covered in the Seismic Isolation Systems Market report? +

The Seismic Isolation Systems market report includes specific segmentation details for type, material and end-use.

What are the end-use of the Seismic Isolation Systems Market? +

The end-use of the Seismic Isolation Systems Market are residential, commercial, and industrial.

Who are the major players in the Seismic Isolation Systems Market? +

The key participants in the Seismic Isolation Systems market are Bridgestone Corporation (Japan), Freyssinet SAS (France), Maurer SE (Germany), Kawakin Core-Tech Co., Ltd. (Japan), Dynamic Isolation Systems, Inc. (USA), Earthquake Protection Systems, Inc. (USA), Hirun International Co., Ltd. (China), Zhenjiang Huayu Seismic Isolation Equipment Co., Ltd. (China), OILÉS Corporation (Japan) and Toyo Tire Corporation (Japan).