Converter Modules Market Size :

Converter Modules Market size is estimated to reach over USD 18,801.21 Million by 2032 from a value of USD 11,214.39 Million in 2024 and is projected to grow by USD 11,745.95 Million in 2025, growing at a CAGR of 7.2% from 2025 to 2032.

Converter Modules Market Scope & Overview:

Converter modules are electrical devices designed to convert electricity from one form to another. It allows the current to be supplied in a precise manner with an accurate voltage to a wide range of loads. Moreover, converter module provides a range of benefits such as high temperature protection, reverse polarity protection, high power density, improved voltage and current regulation, and others. The above are primary aspects for driving its adoption in IT & telecommunication, aerospace & defense, transportation, healthcare, and other industrial sectors.

Converter Modules Market Dynamics - (DRO) :

Key Drivers :

Rising adoption in IT & telecommunication sector is propelling the converter modules market growth

Converter modules such as AC-DC converters are mainly used in servers and telecommunication infrastructures for enhancing system efficiency and improving power factor to ensure constant operations and enhanced system or device reliability. Moreover, DC-DC conversion modules are utilized in data centers for facilitating direct current voltage conversion to provide stabilized voltage for powering servers and systems to support the evolution of cloud services. These modules play a vital role in the telecommunication sector for providing a stable voltage to several communication devices that are used to offer telecommunication services including the Internet and telephone.

- For instance, in 2022, Telefonica, a Spanish multinational telecommunications company, deployed its 5G services in approximately 1,400 municipalities in Spain. Similarly, Telefonica deployed its 5G services in around 2,400 municipalities by 2023.

Thus, the growing deployment of 5G networks and rising development of 5G base stations are increasing the adoption of converter module for use in base stations, data centers, and advanced communication systems, in turn proliferating the converter modules market size.

Key Restraints :

Prevalence of stringent regulations associated with converter module is restraining the converter modules market

The manufacturers of converter module have to compulsorily comply with several stringent regulations and standards such as International Electrotechnical Commission (IEC) standard, MIL-STD (Military Standard), and others, which is among the key factors limiting the market growth.

For instance, IEC 62477-1:2022 is applicable to all power electronic converter systems, any specified accessories, and its components that are used for electronic power conversion and electronic power switching, including the medium for its monitoring, control, protection, and measurement.

Additionally, conversion modules that are designed for aerospace & defense applications must comply with MIL-STD-704, MIL-STD-1275, and MIL-STD-1399 standard. MIL-STD refers to military standard that outlines a standardized power interface between military aircraft and its equipment along with providing general guidance information on aircraft electrical operating conditions, compliance tests, power groups, and utilization equipment specifications among others. Hence, the prevalence of the aforementioned regulations and standards associated with converter module are limiting the converter modules market expansion.

Future Opportunities :

Rising adoption of electric vehicles is expected to drive the converter modules market opportunities

Factors including rising consumer preference for sustainable transportation, prevalence of stringent automotive emission regulations, along with availability of subsidies and tax rebates are leading to substantial adoption of electric vehicles (EVs). In electric vehicles, the use of motors is mainly driven by AC current while the majority of the vehicle is often powered by DC. Moreover, converter module plays a crucial role in electric vehicles for converting direct current (DC) from one voltage level to another for providing a reliable power source for in-car entertainment system and battery management system along with other EV components such as headlights, and other ancillary equipment in electric vehicles.

- For instance, according to International Energy Agency (IEA), the total sales of electric car reached around 14 million in 2023, among which China, Europe and United States accounted for 95% of the total sales.

Thus, as per the analysis, the rising adoption of electric vehicles is projected to drive the converter modules market opportunities during the forecast period.

Converter Modules Market Segmental Analysis :

By Type :

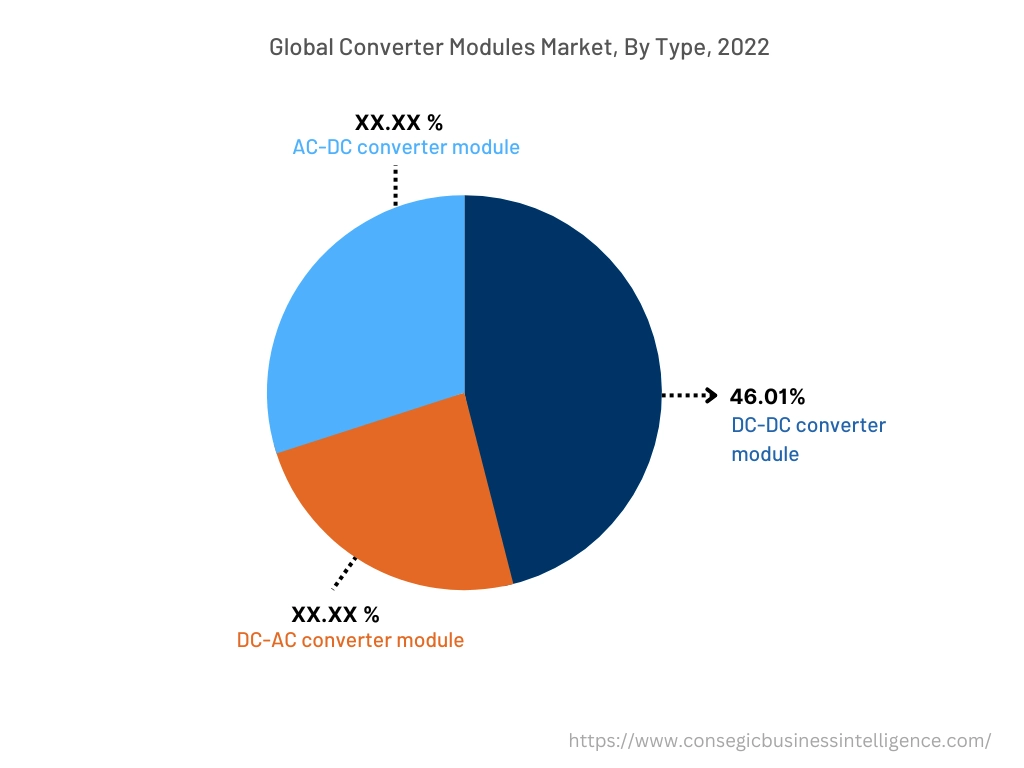

Based on type, the market is segmented into DC-DC converter module, DC-AC converter module, AC-DC converter module, and others.

DC-DC converters refer to modules that convert direct current (DC) from one voltage level to another. They are used in several applications including power supply for electronic devices, battery management systems, and others. DC-AC converters are used for converting direct current into alternating current (AC). This is essential for applications that require AC power from DC sources. Meanwhile, AC-DC converters are used for converting alternating current into direct current. They are mainly used to supply DC power from AC sources, such as wall outlets.

Trends in the type:

- Rising trend in adoption of DC-DC conversion modules in IT & telecommunication, automotive, aerospace & defense, and other sectors, attributing to its reliable voltage regulation, flexibility in voltage rails configuration, and other related characteristics.

- Increasing trend in adoption of AC-DC conversion modules in medical, military, and telecommunication sector, due to its several benefits including compact design, high energy efficiency, cost-effectiveness, and others.

DC-DC converter module segment accounted for the largest revenue share of 46.05% in the total converter modules market share in 2024.

DC-DC conversion modules utilize DC voltage as input and produce a regulated voltage output for target devices. DC-DC conversion modules can convert direct current from the power source from one voltage level to another based on the requirements of the target device or equipment being supplied. Moreover, DC-DC converters provide a range of benefits including reliable voltage regulation, flexibility in voltage rails configuration, safer operation, and reinforced safety isolation barrier including patient contact and patient vicinity applications among others.

- For instance, in February 2023, P-DUKE Technology Co. Ltd launched its new MPK06 series DC-DC converters that are mainly designed for medical applications. The DC-DC converter series provide several features such as 8mm clearance and insulation distance, 6-Watt output power, and complete protection functionalities.

According to the converter modules market analysis, the rising innovations associated with DC-DC conversion modules are driving the converter modules market trends.

AC-DC converter module segment is anticipated to register substantial CAGR growth during the forecast period

AC-DC conversion modules are designed to transform alternating current (AC) input to direct current (DC) output. Moreover, AC-DC converters offer numerous benefits such as compact design, ease of installation, high energy efficiency, cost-effectiveness, and others. The aforementioned benefits of AC-DC converter modules are further increasing its application in medical, military, and telecommunication equipment among others.

- For instance, Vicor Corporation offers AC-DC converter module in its product offerings, which can deliver regulated voltage in a power tablet configuration. The AC-DC converter offers an isolated and regulated DC output with improved fault protection and integrated filtering for redundant operation.

Hence, the increasing advancements related to AC-DC conversion modules are projected to drive the converter modules industry during the forecast period.

By Sales Channel :

Based on sales channel, the market is segmented into direct sales and distributor sales.

Direct sales channels and distributor sales channels are two distinctive methods used by companies to market and sell their conversion modules to consumers or other businesses. Direct sales channels involve selling products directly from the manufacturer or seller to the end consumer without any intermediaries. Direct sales approach can include various methods, such as online sales through company websites or company-owned retail stores. Meanwhile, distributor sales channels involve selling products through intermediaries or distributors. Distributors purchase products in bulk from manufacturers and then resell them to retailers, wholesalers, or other businesses. Distributor sales channel enables wider reach in broad geographical markets.

Trends in the sales channel:

- Factors including higher product quality, availability of excellent support and warranty, and reliable shipping and return policies are among the key prospects propelling the direct sales channel segment.

- Factors including higher flexibility, higher accessibility to a broad range of products, and expanded reach are vital aspects driving the distributor sales channel segment.

Direct sales segment accounted for a significant revenue in the overall market in 2024.

In direct sales channel, conversion modules are sold directly to customers through company outlets. Moreover, the direct sales channel also include online mode, wherein the manufacturers sell conversion modules through its own company websites. Further, purchasing conversion modules from direct sales channel offers various benefits such as competitive pricing, higher product quality, faster response time, higher return on investments, and others, which are vital aspects for increasing the purchase of conversion modules from direct sales channel.

- For instance, Renesas Electronics Corporation is a conversion module manufacturer that offers a range of conversion modules for direct purchase through the company website.

Hence, the increasing availability of conversion modules in direct sales channel is driving the converter modules market growth.

Distributor sales segment is anticipated to register substantial CAGR growth during the forecast period.

The distributor sales channel includes indirect distribution of conversion modules, wherein the conversion modules are purchased from several regional distributors operating in multiple regions worldwide. Moreover, distributor sales channel provides a range of benefits such as extended market reach, increased cost efficiency, reduced capital expenditure, and others. The aforementioned benefits of distributor sales channel are increasing its adoption for distribution of conversion modules.

- For instance, Mouser Electronics Inc., DigiKey Corporation, Arrow Electronics Inc., and others are few of the distributors of conversion modules.

Hence, the increasing availability of conversion modules in distributor sales channel is expected to drive the market during the forecast period.

By End-User :

Based on the end-user, the market is segmented into IT & telecommunication, healthcare, transportation, aerospace & defense, and others.

Conversion modules are vital components in several industries including IT & telecommunications, healthcare, aerospace & defense, and other sectors, for supporting essential power conversion functions. In IT & telecommunication sector, conversion modules are used in power supply units, network devices, and other telecom equipment. In healthcare sector, conversion modules are used in medical devices, such as ultrasound equipment, MRI machines, and other devices, where reliable power conversion is critical. Additionally, conversion modules are used in aerospace & defense systems including avionics systems, flight control systems, and others.

Trends in the end-user:

- Factors including the rising deployment of 5G infrastructure, increasing development of data centers, and growing demand for high-speed communication and cloud services are key trends driving the IT & telecommunication segment.

- Factors including growing commercial flight activities, rising aircraft production, and increasing investments in development of defense vehicles are driving the growth of the aerospace & defense segment.

IT & telecommunication segment accounted for the largest revenue share in the overall converter modules market share in 2024.

Conversion modules are mainly used in servers and telecommunication infrastructures for enhancing system efficiency and improving power factor to ensure constant operations and enhanced system or device reliability. Moreover, conversion modules are often used in data centers for facilitating direct current voltage conversion to provide stabilized voltage for powering data center servers and systems.

- For instance, according to VIAVI Solutions Inc., approximately 2,497 cities worldwide have deployed commercial 5G networks across 92 countries as of 2022.

According to the analysis, the growing IT & telecommunication sector and rising deployment of 5G network are driving the adoption of conversion modules, in turn propelling the market.

Aerospace & defense segment is anticipated to register substantial CAGR growth during the forecast period.

Conversion modules are often used in aerospace & defense sector for providing efficient power distribution, improved power system performance, and enhanced connectivity from several unregulated power sources to the point of load. Moreover, conversion modules provide a stabilized and reliable power for aircraft power systems including displays, processors, along with communication and navigation electronics. The aforementioned features of converter modules are driving its utilization in the aerospace & defense sector.

- For instance, Airbus, an aircraft manufacturer, delivered 735 commercial aircraft in 2023, witnessing an incline of approximately 11% in comparison to 661 deliverables in 2022.

Thus, the rising aircraft production is projected to drive the converter modules market size during the forecast period.

By Region :

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

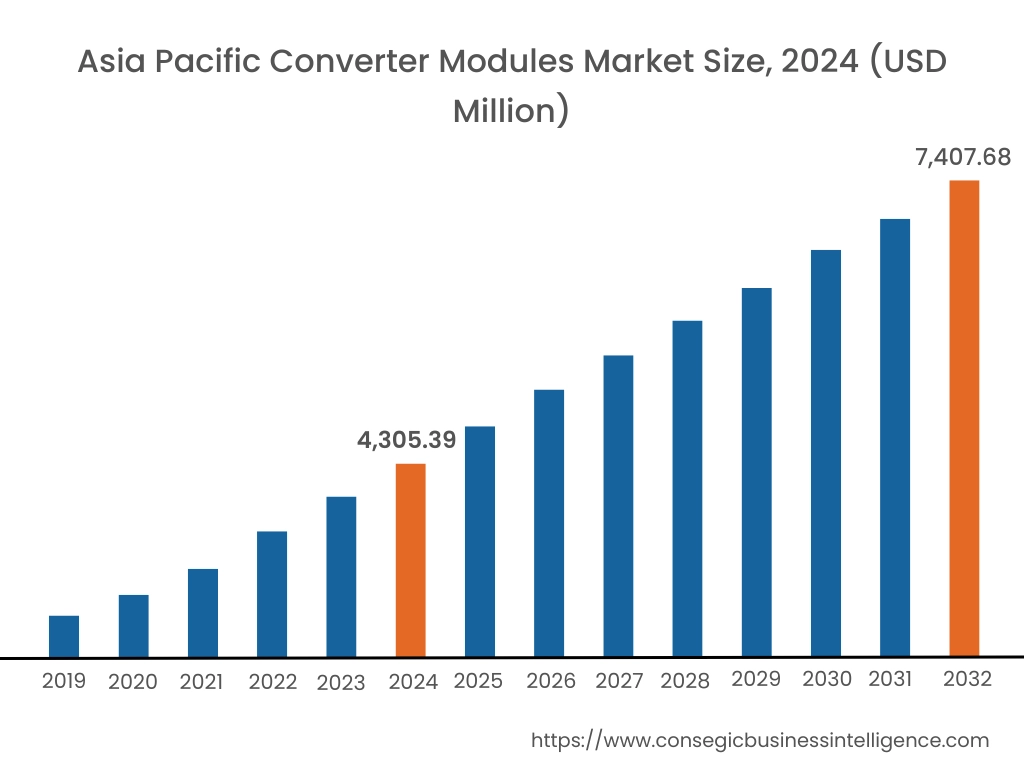

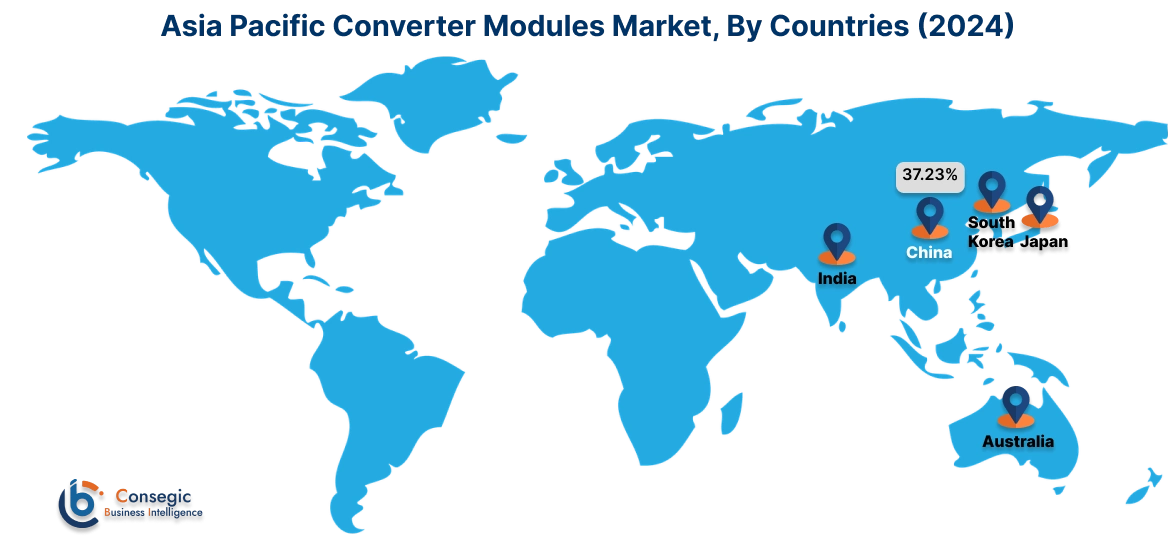

Asia Pacific region was valued at USD 4,305.39 Million in 2024. Moreover, it is projected to grow by USD 4,519.34 Million in 2025 and reach over USD 7,407.68 Million by 2032. Out of this, China accounted for the maximum revenue share of 37.23%. As per the converter modules market analysis, the adoption of conversion modules in the Asia-Pacific region is primarily driven by growing telecommunication, military & defense, and other sectors. Additionally, increasing investments in telecom base stations, specifically 5G base stations, are further accelerating the converter modules market expansion.

- For instance, according to the Department of Telecommunication of India, the total deployment of 5G base stations reached nearly 464,990 base stations across India as of December 2024, representing an incline of 10.8% as compared to 419,845 base stations in January 2024. The above factors are driving the adoption of conversion modules in telecom equipment and base stations, in turn boosting the market demand in the Asia-Pacific region.

North America is estimated to reach over USD 5,264.34 Million by 2032 from a value of USD 3,144.74 Million in 2024 and is projected to grow by USD 3,293.39 Million in 2025. In North America, the growth of converter modules industry is driven by rising adoption of conversion modules in aerospace & defense, telecommunication, automotive, and other sectors. Similarly, increasing investments in aerospace & defense industry are contributing to the converter modules market demand.

- For instance, the U.S. Government allotted USD 883.7 billion budget for national defence for FY 2024, among which USD 841.4 billion was allocated for the United States Department of Defence. The above factors are projected to drive the adoption of conversion modules in defense vehicles and systems, in turn driving the converter modules market trends in North America during the forecast period.

Additionally, the regional analysis depicts that the growing telecommunication sector, increasing penetration of 5G infrastructure in several countries across Europe, rising adoption of electric vehicles, and substantial investments in healthcare sector are driving the converter modules market demand in Europe. Further, as per the market analysis, the market demand in Latin America, Middle East, and African regions is anticipated to grow at a considerable rate due to factors including growing transportation sector, along with increasing investments in telecom infrastructure and military & defense sector among others.

Recent Industry Developments :

Product Launches:

- In May 2023, TDK Corporation launched its new TDK-Lambda PYD20 series of DC-DC converters. The converters are designed for applications including industrial robotics, railroad rolling stock and trackside equipment, power generation, and scientific research equipment among others.

- In April 2023, TDK Corporation introduced its new RGC series of ruggedized non-isolated DC-DC converters. RGC series of DC-DC converters are designed for utilization in harsh environment applications including AGVs (automated guided vehicles), robotics, communications, industrial and portable battery-powered equipment, and other applications.

Top Key Players & Market Share Insights:

The global converter modules market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global converter modules market. Key players in the converter modules industry include-

- Delta Electronics Inc. (Taiwan)

- STMicroelectronics (Switzerland)

- ABB (Switzerland)

- Flex Ltd. (Sweden)

- Murata Manufacturing Co. Ltd (Japan)

- Renesas Electronics Corporation (Japan)

- RECOM Power GmbH (Austria)

- TDK Corporation (Japan)

- Vicor Corporation (U.S)

- Texas Instruments Incorporated (U.S)

Converter Modules Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2031 | USD 18,801.21 Million |

| CAGR (2023-2031) | 7.2% |

| By Type | DC-DC Converter Module, DC-AC Converter Module, and AC-DC Converter Module |

| By End-User | IT & Telecommunication, Healthcare, Transportation, Aerospace & Defense, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Delta Electronics Inc., STMicroelectronics, Renesas Electronics Corporation, Texas Instruments Incorporated, ABB Ltd., Flex Ltd., Murata Manufacturing Co. Ltd, RECOM Power GmbH, TDK Corporation, Vicor Corporation |

Key Questions Answered in the Report

What is converter modules? +

Converter modules refers to electrical devices that are designed for converting electricity from one form to another or to particular values of current and voltage for the target device.

What specific segmentation details are covered in the converter modules report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed DC-DC converter module as the dominating segment in the year 2022, owing to its increasing utilization in IT & telecommunication, aerospace & defence, automotive, and healthcare industries among others.

What specific segmentation details are covered in the converter modules market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed aerospace & defence as the fastest-growing segment during the forecast period due to rising adoption of converter modules for power conversion application to provide stable and reliable voltage to aircraft power systems.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2031? +

Europe is anticipated to register highest CAGR growth during the forecast period due to rapid pace of industrialization and growth of multiple industries such as healthcare, automotive, aerospace & defence, and others.