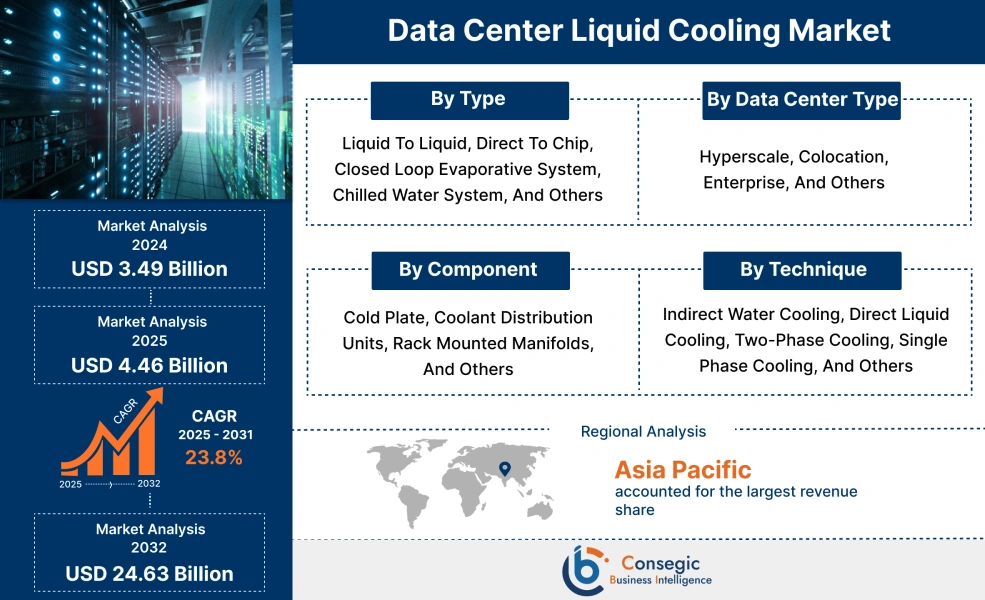

Data Center Liquid Cooling Market Size:

Data Center Liquid Cooling Market size is estimated to reach over USD 24.63 Billion by 2032 from a value of USD 3.49 Billion in 2024 and is projected to grow by USD 4.46 Billion in 2025, growing at a CAGR of 23.8% from 2025 to 2032.

Data Center Liquid Cooling Market Scope & Overview:

Liquid cooling in data centers refers to a technology that utilizes liquid to absorb heat and dissipate it away from electronic components. The key benefits of liquid cooling techniques include their higher heat-carrying capacity and excellent thermal conductivity, with direct contact with heat-generating components. Moreover, liquid cooling techniques are available in various types including liquid-to-liquid cooling, direct-to-chip cooling, immersion cooling, and others. Further, advanced technologies in liquid cooling systems such as smart cooling systems, predictive cooling, and others are driving the global data center liquid cooling market size.

How is AI Transforming the Data Center Liquid Cooling Market?

The integration of AI is considerably transforming the data center liquid cooling market. AI plays a crucial role in optimizing liquid cooling systems used in data centers for facilitating predictive analysis, dynamic adjustments, and enhanced thermal management. AI-powered solutions can analyze data from sensors to understand thermal loads and cooling mechanisms, which enables real-time adjustments to airflow and coolant flow, thereby preventing overheating and optimizing energy consumption. This leads to improved performance, increased reliability, and reduced operational costs in AI-driven data centers. Consequently, the above factors are anticipated to drive the market growth in the upcoming years.

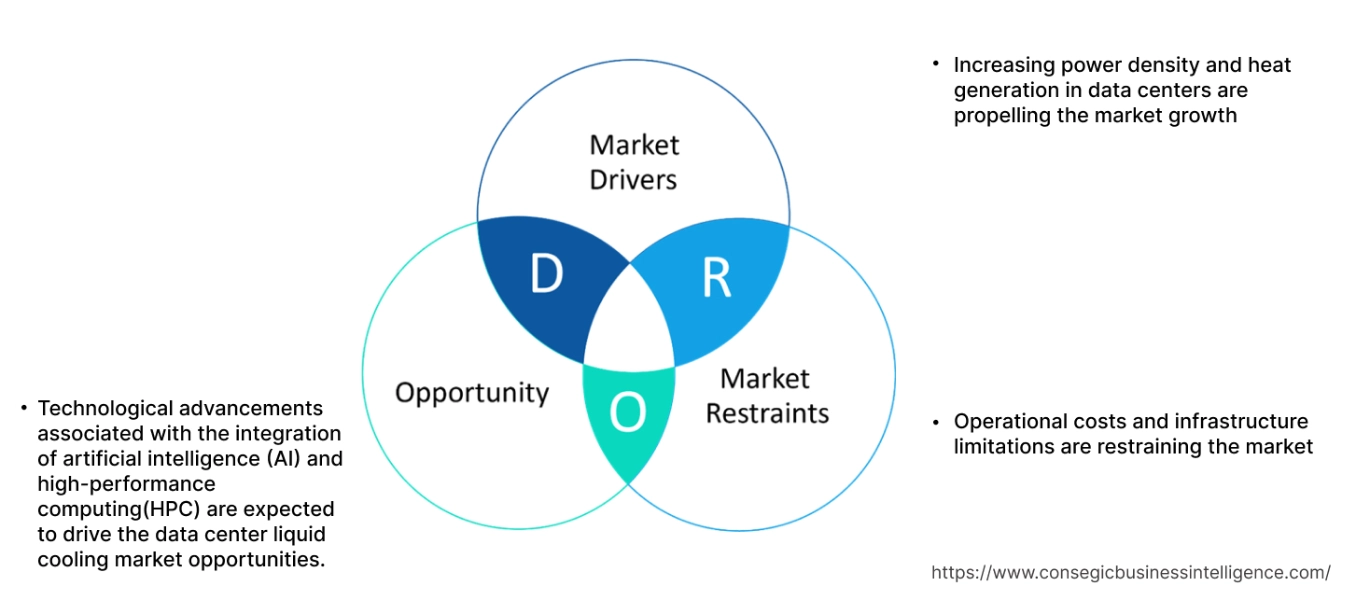

Data Center Liquid Cooling Market Dynamics - (DRO) :

Key Drivers:

Increasing power density and heat generation in data centers are propelling the market growth

The rising utilization of cloud computing, artificial intelligence, blockchain, and others require high-performance processing units like graphic processing units, tensor processing units, and others, which generate ample amounts of heat. Moreover, these heat loads generated by high-performance processing units in data centers require liquid cooling techniques to absorb and transfer heat from critical components. Thus, various liquid cooling techniques like indirect water cooling, direct liquid cooling, single-phase liquid cooling, and others are used by data centers to minimize energy consumption, thereby ensuring sustainability.

- For instance, in June 2025, Vertiv Group Corporation announced the expansion of the CoolChip family with the launch of CoolChip 70, 100, and 600 CDU. Moreover, the Vertiv Coochip family of liquid cooling solutions offers visibility, reliability, and enhanced performance with end-to-end portfolio of advanced thermal management for customer scaling.

Thus, the increasing adoption of liquid cooling solutions in data centers is propelling the data center liquid cooling market expansion

Key Restraints:

Operational costs and infrastructure limitations are restraining the market

Liquid cooling systems are more expensive to install than traditional air-based systems as they are constructed of cold plates, heat sinks, immersion cooling systems, and others. Moreover, implementing liquid cooling systems in data centers requires a lot of redesigning of existing data center infrastructure, which involves installing new piping, modifying racks, and others.

Additionally, liquid cooling systems require regular maintenance by skilled technicians, which can be costly and time-consuming. Therefore, operational costs and infrastructure limitations are hindering the data center liquid cooling market size.

Future Opportunities :

Technological advancements associated with the integration of artificial intelligence (AI) and high-performance computing(HPC) are expected to drive the data center liquid cooling market opportunities.

Technological advancements like direct-to-chip cooling, immersion cooling, and improved heat exchangers enhance data center’s performance by improving energy efficiency and reducing operating costs. Moreover, AI-driven cooling automation offers various benefits to data centers including AI-optimized smart cooling, advanced coolants, and hybrid cooling models to reduce energy use and enhance system reliability.

- For instance, in June 2025, Shell launched direct liquid-to-cooling fluids to enhance performance and efficiency in data centers and meet the growing demand for HPC and AI.

Therefore, increasing technological advancements associated with the integration of artificial intelligence and high-performance computing are projected to boost the data center liquid cooling market opportunities during the forecast period.

Data Center Liquid Cooling Market Segmental Analysis :

By Type:

Based on type, the market is segmented into liquid to liquid, direct to chip, closed loop evaporative system, chilled water system, and others.

Trends in the type:

- There is a rising trend towards the adoption of liquid to liquid cooling solutions in data centers, due to its improved energy efficient cooling technologies.

- Increasing trend in the adoption of direct to chip cooling systems in data centers, due to growing reliance on cloud computing and big data analytics, is driving the data center liquid cooling market.

Liquid to liquid segment accounted for the largest revenue in the overall data center liquid cooling market share in 2024.

- Liquid to liquid cooling system utilizes liquid coolant to transfer heat from server racks, typically from electronic components to a centralized heat exchanger, which is a part of liquid-based cooling loop.

- Moreover, the liquid cooling loop is generally a gravity-assisted thermosyphon, which relies on the principle of buoyancy, driven by temperature difference to circulate a heat transfer.

- Additionally, liquid cooling systems are used in various types of data centers such as hyperscale, enterprises, colocations, and others to improve efficiency and reduce energy consumption.

- For instance, Icetope’s liquid cooling equipment significantly reduces energy consumption, offering up to a 40% reduction, thereby ensuring enhanced flexibility in designing IT solutions.

- Hence, rising advancements associated with liquid cooling solutions in data centers are driving the market growth.

Direct to chip segment is anticipated to register substantial CAGR growth during the forecast period.

- Direct to chip cooling is a thermal management technique, which involves circulating liquid coolant directly over the heat-generating components of chips.

- Moreover, direct to chip cooling technique is widely used in data centers to manage the high heat generated by modern servers and other hardware.

- Additionally, this advanced form of cooling technology offers several key benefits like higher computational density, enhanced cooling efficiency, and higher performance, in turn ensuring optimal performance.

- For instance, in July 2024, Microsoft unveiled its data center community pledge by showcasing its direct to chip liquid cooling technology optimized for the new generation of their data centers.

- Hence, increasing advancements related to direct to chip cooling solutions for data centers are projected to drive the market during the forecast period.

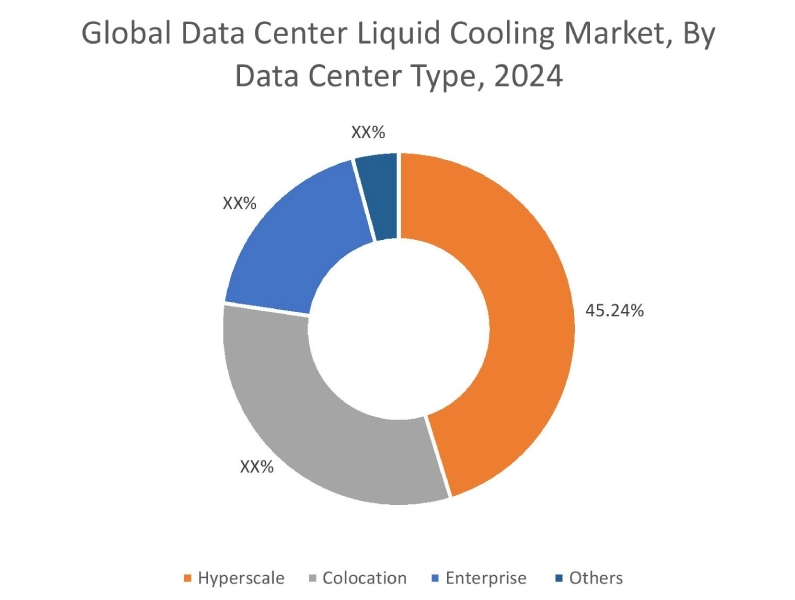

By Data Center Type:

Based on data center type, the market is segmented into hyperscale, colocation, enterprise, and others.

Trends in data center type:

- Rising trend in the adoption of liquid coolers in hyperscale data centers, driven by their superior cooling capabilities.

- Features such as reduced noise, improved temperature control, and evaporating cooling are driving the data center liquid cooling market growth.

Hyperscale segment accounted for the largest revenue share of 45.24% in the overall market share in 2024, and it is anticipated to register the fastest CAGR growth during the forecast period.

- Hyperscale data centers are significantly larger than traditional data centers, and engineered for extreme scalability.

- Moreover, liquid cooling systems in hyperscale data centers reuse water or specialized low-impact fluids to manage heat from high-density hardware.

- Additionally, liquid cooling solutions reduce maintenance needs as they often eliminate the need for fans and heat sinks, in turn reducing the overall operational and maintenance cost.

- For instance, in March 2025, Crusoe, a U.S.-based cloud provider, expanded its data center campus in Albine. Moreover, this hyperscale data center features direct-to-chip liquid cooling through a zero-water evaporation cooling system.

- Hence, the rising adoption of liquid cooling solutions in hyperscale data centers is driving the data center liquid cooling market growth.

By Component:

Based on component, the market is segmented into cold plate, coolant distribution units, rack mounted manifolds, and others.

Trends in the component:

- Rising trend in the utilization of coolant distribution units in data centers due to their enhanced push system performance is driving the market.

- Increasing adoption of rack mounted manifolds, due to their enhanced centralized management is driving the data center liquid cooling market trends.

Coolant distribution units segment accounted for the largest revenue in the overall data center liquid cooling market share in 2024.

- Coolant distribution units are central components in liquid cooling systems used to manage the distribution of coolant to various hardware components.

- In data centers, coolant distribution units maintain operating temperatures by regulating the distribution of liquid coolant.

- Moreover, coolant distribution units offer a broad range of cooling capacities to increase the overall system efficiency for high-density applications in data centers.

- Additionally, the coolant distribution unit monitors the system’s pressure, flow rate, and temperature by adjusting its parameters dynamically.

- Therefore, according to the analysis, rising advancements related to coolant distribution units for application in data centers are driving the industry.

Rack mounted manifolds segment is anticipated to register the fastest CAGR growth during the forecast period.

- Rack mounted manifold is a key component in liquid cooling systems, which acts as a distributor between cold plate loops in server and the cool and distribution unit.

- Moreover, in data centers, rack-mounted manifold often includes a combination of dry-disconnect and drip-free quick couplings designed to minimize fluid spillage and air inclusion during connection and disconnection.

- For instance, COOLIT Systems offers rack and chassis manifold made up of stainless steel, which are optimized for a manual connection at the front and back of the rack.

- Therefore, according to the analysis, the rise in adoption of rack mounted manifold in data centers is projected to drive the market during the forecast period.

By Technique:

Based on technique, the market is segmented into indirect water cooling, direct liquid cooling, two-phase cooling, single phase cooling, and others.

Trends in the technique:

- Increasing use of single phase cooling systems in data centers for increased server density is driving the data center liquid cooling market trends.

- Features such as high dissipation and low cooling energy consumption are driving the utilization of direct liquid cooling in data centers.

Single phase cooling segment accounted for the largest revenue share in the overall data center liquid cooling market in 2024.

- Single phase cooling, also called immersion cooling, utilizes dielectric liquid to directly cool electronic components without undergoing a phase change.

- Moreover, single phase cooling systems contribute to a reduction in carbon emissions, making it a viable solution towards net-zero emissions.

- For instance, PeaSoup, a U.K.-based cloud provider, provides single-phase cooling solutions for CPU and GPU-intense computer environments.

- Hence, according to data center liquid cooling market analysis, the rising adoption of single-phase cooling in data centers is driving the market.

Direct liquid cooling segment is anticipated to register the fastest CAGR growth during the forecast period.

- Direct liquid cooling, also known as direct-to-chip cooling, is a method of cooling electronic components by directly applying liquid coolant to the chip’s surface.

- Moreover, in a direct liquid cooling system, a flat, rectangular component that is made up of highly conductive material like copper is directly attached to the heat-generating components like CPU, GPU, and others.

- For instance, Gigabyte offers a direct liquid cooling system designed for high-density computers in various types of data centers.

- Therefore, the increasing adoption of direct liquid cooling systems in data centers is projected to boost the market during the forecast period.

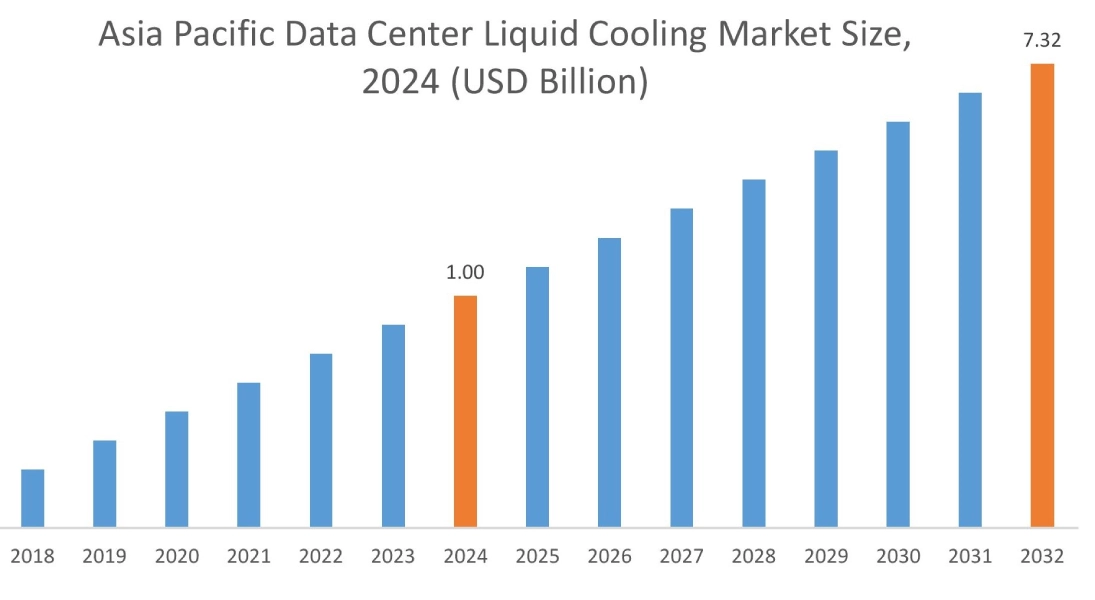

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

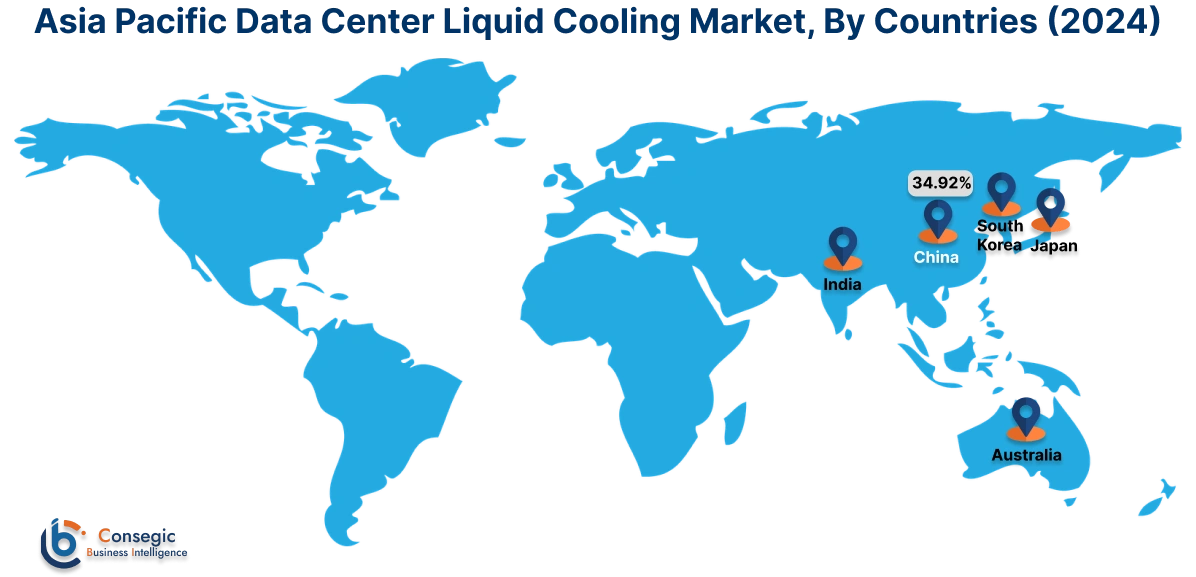

Asia Pacific region was valued at USD 1.00 Billion in 2024. Moreover, it is projected to grow by USD 1.28 Billion in 2025 and reach over USD 7.32 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.92%. As per data center liquid cooling market analysis, the adoption of data center liquid cooling in the Asia-Pacific region is primarily driven by its rising demand for high-density computing and AI applications and rapid pace of digital transformation among others. Additionally, the rising adoption of coolant distribution units in hyperscale data centers, due to their space-efficient cooling design, is further accelerating the data center liquid cooling market expansion.

- For instance, Rittal Pvt Ltd, an India based company, offers liquid cooling units for data centers to ensure effective cooling of built-in components. Moreover, the liquid cooling unit comprises of heat exchanger, which is used to dissipate heat from server racks.

North America is estimated to reach over USD 8.77 Billion by 2032 from a value of USD 1.25 Billion in 2024 and is projected to grow by USD 1.59 Billion in 2025. In North America, the adoption of data center liquid cooling is driven by advancements in technologies such as direct-to-chip liquid cooling and single-phase cooling due to various factors like scalability, focused thermal management, lower operational cost, and sustainability. Moreover, the increasing adoption of data center liquid cooling in the hyperscale and colocation data centers is contributing to the data center liquid cooling market demand.

- For instance, in June 2024, Amazon announced its plans to invest USD 10 Billion in North Carolina to expand its data center infrastructure for facilitating AI and cloud computing technologies.

Additionally, the regional analysis depicts that the rising development of data centers and increasing adoption of liquid cooling solutions in enterprise and colocation data centers, due to growing adoption of cloud computing, are driving the data center liquid cooling market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as increasing investments in data center infrastructure, rising need to improve power density of IT infrastructure, along with strong emphasis on minimizing energy consumption and lower operational costs among others.

Top Key Players and Market Share Insights:

The data center liquid cooling market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the data center liquid cooling industry. Key players in the data center liquid cooling industry include-

- Vertiv Group Corporation (U.S.)

- Schneider Electric (France)

- Asperitas (Netherlands)

- Asetek Inc. (Denmark)

- Rittal Pvt Ltd (India)

- COOLIT Systems (Canada)

- Green Revolution Cooling (U.S.)

- Icetope (U.K.)

- Submer (Spain)

- Liquidstack (U.S.)

Recent Industry Developments :

Product Launch:

- In June 2025, Vertiv launched three new liquid cooling distribution units in Europe, Middle East, and Africa regions. Moreover, Vertiv Coolchip CDU 70 is an in-row, liquid to air coolant distribution unit that enables rapid and cost-effective liquid cooling solutions for data centers.

Data Center Liquid Cooling Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 24.63 Billion |

| CAGR (2025-2032) | 23.8% |

| By Type |

|

| By Data Center Type |

|

| By Component |

|

| By Technique |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the data center liquid cooling market? +

The data center liquid cooling market was valued at USD 3.49 Billion in 2024 and is projected to grow to USD 24.63 Billion by 2032.

Which is the fastest-growing region in the data center liquid cooling market? +

Asia-Pacific is the region experiencing the most rapid growth in the data center liquid cooling market.

What specific segmentation details are covered in the data center liquid cooling report? +

The data center liquid cooling report includes specific segmentation details for type, data center type, component, technique, and region.

Who are the major players in the data center liquid cooling market? +

The key participants in the data center liquid cooling market are Vertiv Group Corporation (U.S.), Schneider Electric (France), COOLIT Systems (Canada), Green Revolution Cooling (U.S.), Icetope (U.K.), Submer (Spain), Liquidstack (U.S.), Asperitas (Netherlands), Asetek Inc. (Denmark), Rittal Pvt Ltd (India) and others.