Defense Tactical Computers Size:

Defense Tactical Computers Market Size is estimated to reach over USD 8.94 Billion by 2032 from a value of USD 5.21 Billion in 2024 and is projected to grow by USD 5.48 Billion in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Defense Tactical Computers Scope & Overview:

Defense tactical computers are also referred to as tactical computers or military tactical computers, which represent a critical component within military applications. These specialized computing systems are purpose-built to meet the demanding requirements of military operations, providing essential computing power, ruggedness, and functionality tailored to the battlefield environment. By offering robust and reliable computing solutions, these computers significantly enhance the capabilities of military forces across various defense systems and missions.

How is AI Transforming the Defense Tactical Computers?

AI is significantly reshaping the defense tactical computers market by enhancing decision-making, situational awareness, and operational efficiency. These computers, essential in modern defense operations, are now integrated with AI to process vast amounts of battlefield data in real time. AI algorithms analyze sensor inputs, satellite imagery, and communication feeds to provide faster, more accurate insights, improving mission planning and threat detection. Additionally, AI strengthens cybersecurity by identifying and neutralizing potential cyber threats before they compromise systems. It also supports autonomous operations and predictive maintenance of defense equipment. As defense strategies increasingly rely on speed and precision, AI-powered tactical computers are becoming critical to modern military effectiveness globally.

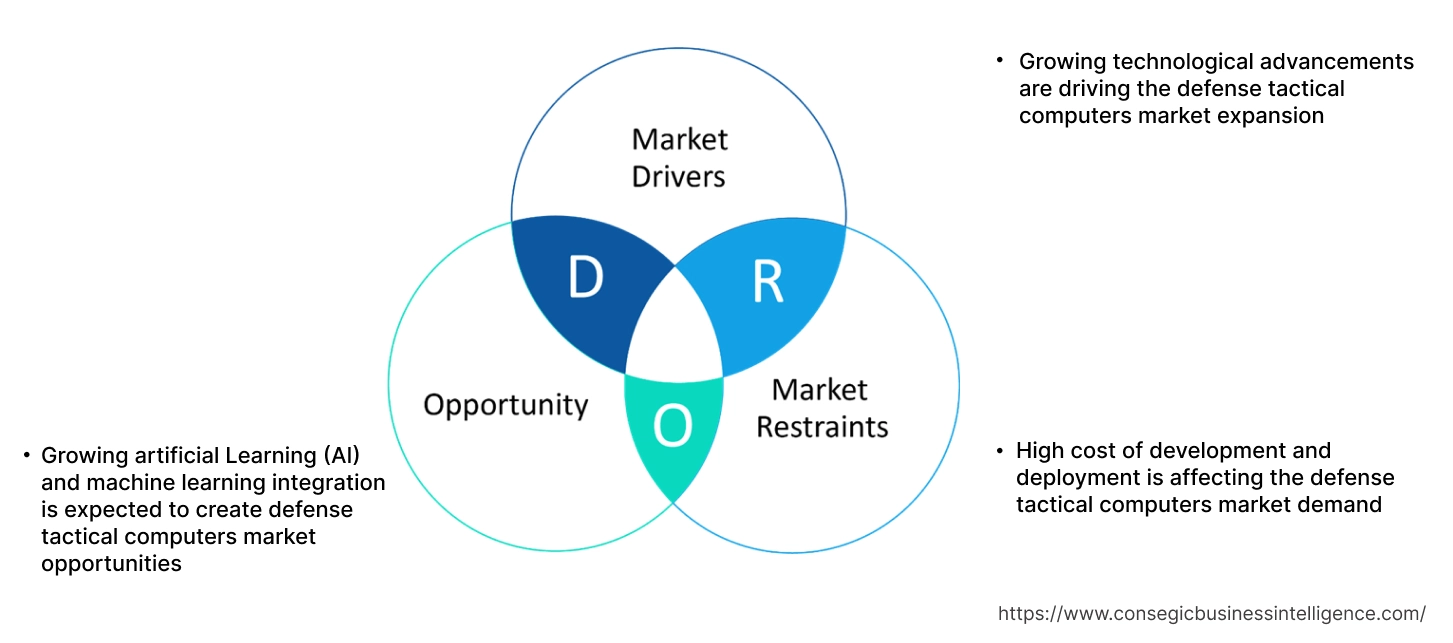

Defense Tactical Computers Dynamics - (DRO) :

Key Drivers:

Growing technological advancements are driving the defense tactical computers market expansion

As military operations become increasingly complex and dynamic, there is a growing need for advanced computing solutions tailored to the unique needs of modern warfare. Military tactical computers play a crucial role in meeting these requirements, offering state-of-the-art computing capabilities to support critical defense systems and missions. Further, technological advancements are propelling the evolution of defense computers, enabling the development of more sophisticated and versatile computing solutions. The adoption of advanced technologies such as artificial intelligence, machine learning, and high-performance computing is facilitating the creation of next-generation tactical computing systems with enhanced capabilities.

- For instance, in September 2024, the U.S. government awarded Intelup to USD 3 billion through the CHIPS Act for their Secure Enclave program. This initiative aims to boost the secure production of advanced semiconductors within the United States, specifically for government use. It will strengthen the U.S. chip supply chain and improve the reliability of American technology systems through the development of secure and advanced technological solutions.

Thus, according to the defense tactical computers market analysis, the growing technological advancements are driving the defense tactical computers market size and trends.

Key Restraints:

High cost of development and deployment is affecting the defense tactical computers market demand

Developing advanced rugged defense tactical systems that meet stringent military standards and can withstand harsh environmental conditions requires significant investment in research and development. Additionally, the complex and rapidly evolving nature of military technology presents a constant challenge for companies to stay ahead of the competition and meet the ever-changing needs of defense organizations. Furthermore, the increasing prevalence of cyber threats poses a significant risk, as the failure to adequately protect tactical systems from cyber-attacks can have severe consequences for military operations and national security. Thus, the aforementioned factors would further impact the defense tactical computers market size.

Future Opportunities :

Growing artificial Learning (AI) and machine learning integration is expected to create defense tactical computers market opportunities

By incorporating AI algorithms and machine learning models into defense tactical computers, defense forces can enhance their decision-making processes, improve operational efficiency, and adapt to evolving threats in real-time. These technologies enable tactical computers to analyze vast amounts of data, identify patterns, and predict potential threats, empowering military personnel with actionable insights to respond effectively to dynamic battlefield scenarios.

Further, AI and machine learning integration in defense computers opens up new prospects for innovation and development. It enables the creation of autonomous systems capable of autonomous decision-making and adaptive responses, reducing the cognitive burden on human operators and enhancing overall mission effectiveness. By leveraging AI-driven analytics, defense forces can optimize resource allocation, streamline logistics, and enhance situational awareness, thereby strengthening their operational capabilities and ensuring mission success in increasingly complex and challenging environments.

- For instance, Mercury'srugged edge servers are designed for tactical computers, speeding up demanding tasks like artificial intelligence (AI), cybersecurity, signals intelligence (SIGINT), and C4ISR at the tactical edge. These servers undergo rigorous testing and certification to significantly reduce noise transmitted through the air and structures.

Thus, based on the above defense tactical computers market analysis, the growing artificial Learning (AI) and machine learning integration are expected to drive the defense tactical computers market opportunities.

Defense Tactical Computers Segmental Analysis :

By Type:

Based on type, the market is segmented into vehicle-mounted, handheld, and wearable.

Trends in the type:

- As cyber warfare becomes a more prevalent and sophisticated threat, the demand for secure, rugged systems that can resist unauthorized access and cyber-attacks is growing. This has led to increased investments in the development and deployment of such systems, particularly in defense and homeland security applications.

- The integration of artificial intelligence and machine learning in military applications is driving the need for advanced defense tactical systems.

- Thus, based on the above analysis, these factors are driving the defense tactical computers market demand and trends.

The vehicle-mounted segment accounted for the largest revenue share in the year 2024.

- Vehicle-mounted defense computers are ruggedized computing systems specifically designed for use in military vehicles. These computers are engineered to withstand harsh environmental conditions such as extreme temperatures, shock, vibration, dust, and water, ensuring reliable operation in demanding tactical situations.

- The increased global defense spending enables investments in advanced military technologies, including sophisticated vehicle-mounted computers.

- The rapid advancements in processor technology, memory, display technology, and communication systems drive the development of more capable and efficient defense computers.

- For instance, Leonardo DRS’s military vehicle-mounted computers, Mounted Family of Computer Systems (MFoCS) II, are advanced-generation computers, which are designed for the U.S. Army. This vehicle-mounted defense computer is built to handle several software programs at the same time without slowing down. Additionally, it is designed with enough processing power and flexibility to keep up with new and more demanding software in the future.

- Thus, based on the above analysis, these factors are further driving the defense tactical computers market growth.

The wearable segment is anticipated to register the fastest CAGR during the forecast period.

- Wearable tactical computers represent the cutting edge of military technology, providing soldiers with hands-free access to critical information and computing capabilities.

- These wearable devices, such as smart glasses or head-mounted displays, integrate advanced computing, communication, and sensor technologies to deliver enhanced situational awareness and augmented reality functionalities.

- Wearable tactical computers enable soldiers to receive real-time updates, navigate unfamiliar terrain, and coordinate with teammates without being overloaded by handheld devices, thereby improving their agility and effectiveness in the field.

- Thus, based on the above analysis, these factors are expected to drive the defense tactical computers market share during the forecast period.

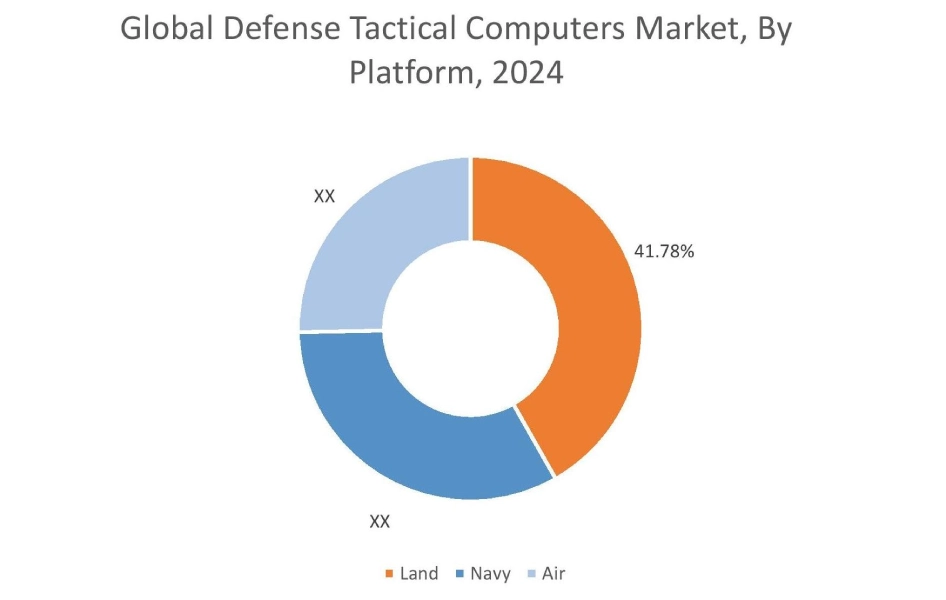

By Platform:

Based on the platform, the market is segmented into land, navy, and air.

Trends in the platform:

- The increasing focus on enhancing land, air, and naval capabilities, including surveillance, communication, and combat systems, is driving the segment growth.

- The development of advanced maritime technologies, such as autonomous underwater vehicles (AUVs) and integrated combat systems, is further contributing to the market growth and share.

The land segment accounted for the largest revenue share of 41.78% in the year 2024.

- Land-based platforms include various ground vehicles, such as unmanned ground vehicles (UGVs), tanks, and armored personnel carriers, which require robust and reliable defense systems to operate effectively in harsh and challenging environments.

- The increasing need for advanced land systems with enhanced situational awareness, communication, and targeting capabilities is driving the adoption of defense tactical systems in this segment.

- The innovations in autonomous technologies and the integration of artificial intelligence are further enhancing the capabilities of land-based platforms.

- For instance, Bharat Electronics Limited’s rugged tactical computers are designed with sunlight sunlight-readable LCD and a high-capacity storage device, which is integrated in a compact mechanical housing with LAN ports and USB.

- Thus, these factors would further supplement the defense tactical computers marketshare and trends.

The air segment is anticipated to register the fastest CAGR during the forecast period.

- Air-based platforms require high-performance defense tactical computers for communication, surveillance, navigation, and targeting applications.

- The growing use of unmanned aerial vehicles (UAVs) for ISR and combat missions is driving the need for advanced defense systems that can operate reliably in high-altitude and extreme temperature conditions.

- Additionally, the development of next-generation fighter aircraft and the modernization of existing air fleets are contributing to the development of the segment.

- These developments in the air segment are anticipated to further drive the defense tactical computersmarket trends during the forecast period.

By Application:

Based on the application, the market is segmented into military and homeland security.

Trends in the application:

- Technological advancements drive continuous innovation in defense systems, enabling the development of more powerful, efficient, and versatile computing solutions. The evolving nature of security threats necessitates the adoption of sophisticated military systems equipped with advanced computing capabilities to effectively counter emerging challenges.

- The ongoing modernization initiatives undertaken by military forces worldwide contribute to the increasing need for defense tactical computers, as armed forces seek to equip themselves with the latest technologies to maintain operational superiority and readiness.

The military segment accounted for the largest revenue in the year 2024.

- The defense industry is the primary end-user of military tactical computers, encompassing various branches of the military, including the army, navy, air force, and special forces.

- The increasing focus on modernizing military capabilities and enhancing operational efficiency is driving the need for advanced tactical systems in this sector.

- These systems are used in a wide range of applications, including command and control, communication, surveillance, and combat, to ensure mission success in challenging environments.

- The development of next-generation military technologies and the integration of artificial intelligence are further enhancing the capabilities of defense forces, in turn driving the market growth.

- For instance, in January 2023, BEL showcased its defense products and systems at Aero India 2023. The products and systems include C4I systems, missile systems, homeland security and cyber security, airborne products & systems, outdoor display products, artificial intelligence-based products, and air defence & surveillance. The communication systems include tactical computer MK-Vl, hardware security, and rugged tablet, among others.

- Therefore, the aforementioned factors are driving the defense tactical computers market growth.

The homeland security segment is anticipated to register the fastest CAGR during the forecast period.

- Homeland security encompasses various agencies and organizations responsible for emergency response, border protection, and national security.

- The growing focus on improving homeland security facilities, including communication, cybersecurity, and surveillance, is driving the adoption of defense tactical systems.

- These systems are used in various applications, including critical infrastructure protection, disaster response, and border surveillance to ensure national security and public safety.

- The increasing dominance of cyber threats and the need for robust cybersecurity solutions are further contributing to the segment's development.

- The above factors are anticipated to further drive the defense tactical computers market trends during the forecast period.

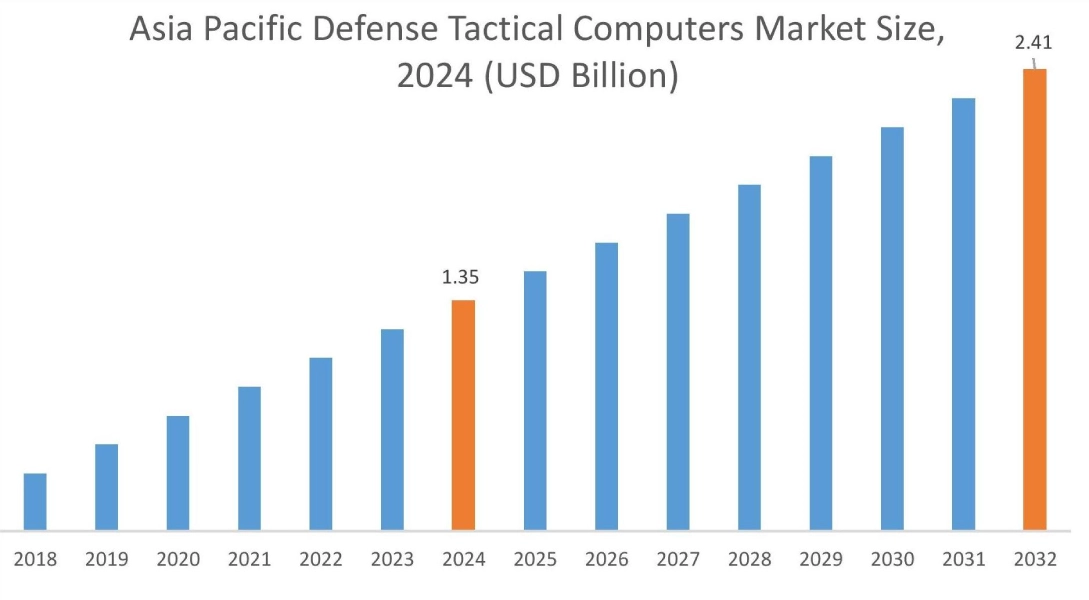

Regional Analysis:

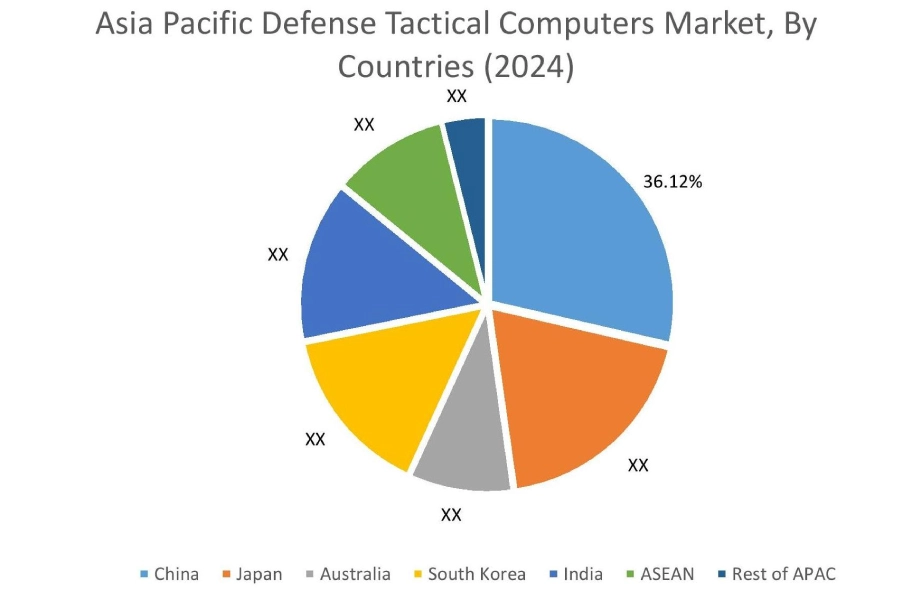

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa (MEA), and Latin America.

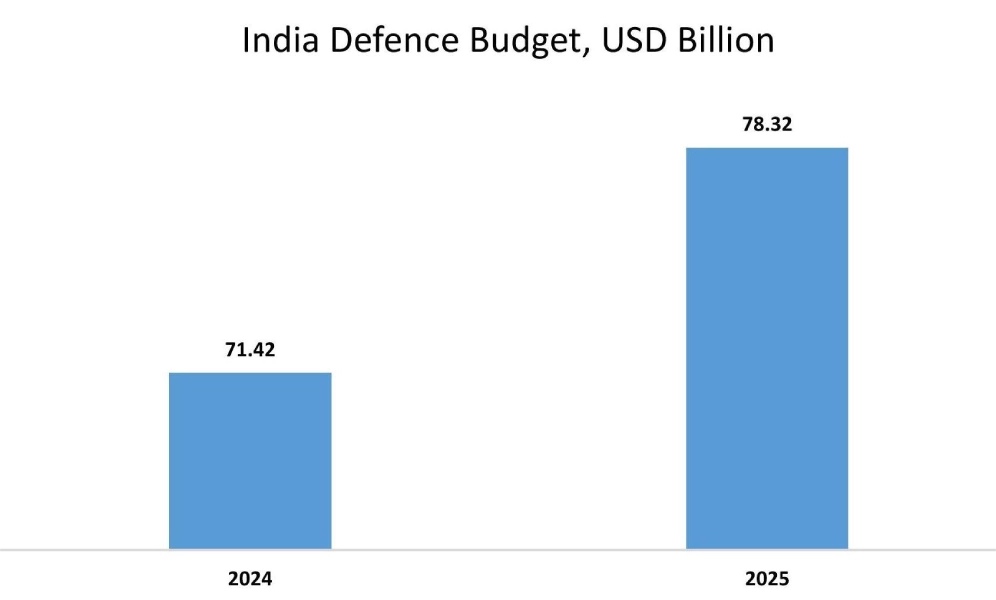

Asia Pacific defense tactical computers market expansion is estimated to reach over USD 2.41 billion by 2032 from a value of USD 1.35 billion in 2024 and is projected to grow by USD 1.43 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 36.12%. The regional growth can be attributed to the increasing defense budgets of nations such as China and India. Their strong emphasis on upgrading military infrastructure and boosting operational effectiveness is creating a significant need for advanced defense systems. Moreover, the rising number of security challenges within the region and the consequent necessity for strong defense capabilities are further propelling the regional market. The development of local defense technologies, along with greater cooperation between national and international defense firms, is also fostering innovation and development in the region. These factors would further drive the regional defense tactical computers market during the forecast period.

- For instance, in June 2024, Panasonic launched the TOUGHBOOK 40 TACTICAL, a strong laptop designed to improve connectivity within military vehicles for command-and-control operations.

The North America market is estimated to reach over USD 3.46 billion by 2032 from a value of USD 2.02 billion in 2024 and is projected to grow by USD 2.13 billion in 2025. North America is projected to remain the leading market for military tactical computers, supported by significant defense spending and the presence of major industry participants. The United States is a key driver of this growth, with substantial investments in upgrading military infrastructure and improving operational effectiveness. Further, the increasing emphasis on developing cutting-edge technologies, such as artificial intelligence and cybersecurity, is boosting the need for defense tactical systems in the region. Moreover, the region’s concentration of prominent defense contractors and technology firms provides a firm base for continued market development. These factors would further drive the market in North America.

- For instance, Elbit Systems' enhanced tactical computers (ETCs) offer advanced command and control (C2) functionalities and enable the distribution of tactical data across various operational situations. They are designed for infantry, special forces, and command personnel. These computers are implemented on diverse platforms, such as tanks, artillery, armored personnel carriers (APCs), and both wheeled and tracked combat vehicles.

According to the analysis, the defense tactical computers industry in Europe is significantly growing. The increasing emphasis on creating unified defense systems and improving the ability of different military branches to work together is boosting the need for tactical defense systems in the European region. In addition, with the increasing reliance on digital systems in military operations in Latin America, cybersecurity is becoming a critical concern. This drives the need for tactical computers with advanced cybersecurity measures to protect against evolving cyber threats, including robust encryption and secure communication protocols.

Further, there is a growing focus on enhancing the capabilities of individual soldiers through soldier modernization programs in the Middle East & Africa (MEA) region. These programs often include the adoption of advanced communication systems, wearable electronics, and improved situational awareness tools, all of which rely on rugged and portable tactical computers. These factors would further drive the regional market during the forecast period.

Top Key Players and Market Share Insights:

The global defense tactical computers market is highly competitive, with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the defense tactical computers industry include-

- Curtiss-Wright (U.S.)

- Northrop Grumman (U.S.)

- Elbit Systems (Israel)

- Cornet Technology (U.S.)

- Kontron (U.S.)

- Dynics (U.S.)

- Bharat Heavy Electricals Ltd (India)

- Leonardo (Italy)

- Thales (France)

- Saab (Sweden)

Defense Tactical Computers Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 8.94 Billion |

| CAGR (2025-2032) | 6.3% |

| By Type |

|

| By Platform |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Defense Tactical Computers Market? +

Defense Tactical Computers market size is estimated to reach over USD 8.94 Billion by 2032 from a value of USD 5.21 Billion in 2024 and is projected to grow by USD 5.48 Billion in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Which is the fastest-growing region in the Defense Tactical Computers Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Defense Tactical Computers report? +

The defense tactical computers report includes specific segmentation details for type, platform, application, and region.

Who are the major players in the Defense Tactical Computers Market? +

The key participants in the market are Curtiss-Wright (U.S.), Northrop Grumman (U.S.), Bharat Heavy Electricals Ltd (India), Leonardo (Italy), Thales (France), Saab (Sweden), Elbit Systems (Israel), Cornet Technology (U.S.), Kontron (U.S.), Dynics (U.S.), and others.