Digital Panel Meter Market Introduction :

Digital Panel Meter Market size is estimated to reach over USD 5,782.25 Million by 2032 from a value of USD 3,722.48 Million in 2024 and is projected to grow by USD 3,866.84 Million in 2025, growing at a CAGR of 5.70% from 2025 to 2032.

Digital Panel Meter Market Definition & Overview:

Digital panel meters (DPM) refer to electronic devices that display electrical parameters including current, voltage, resistance, temperature, and others in digital format. Moreover, they are integrated with several features including large display, high accuracy, user-friendly interface, energy efficiency features, alarm functions, customizability, ease of installation and maintenance, and others. Their aforementioned features are key determinants for increasing its utilization in electronics & semiconductors, automotive, residential, commercial, and other sectors.

Digital Panel Meter Market Insights :

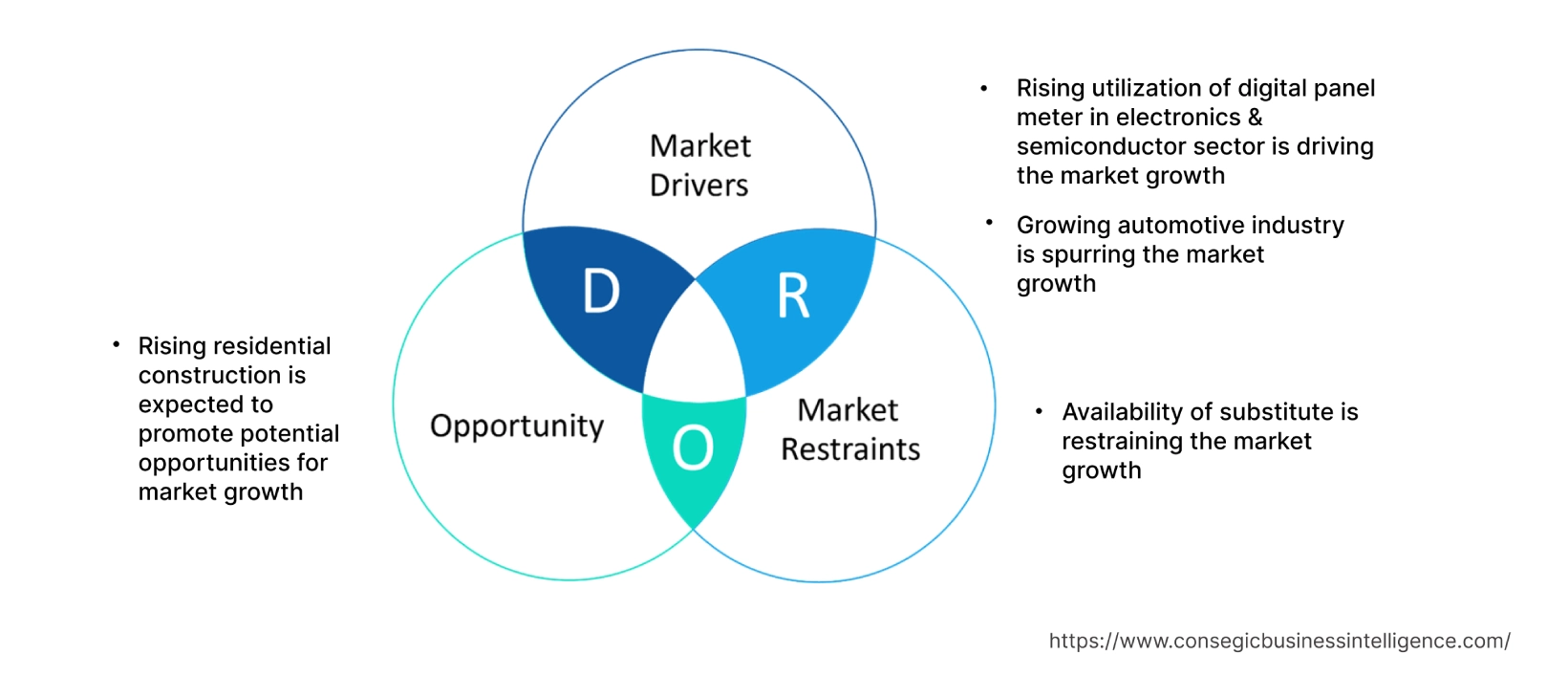

Digital Panel Meter Market Dynamics - (DRO) :

Key Drivers :

Rising utilization in electronics & semiconductor sector Boosts the Market Progress

Digital panel meters are primarily used in the electronics & semiconductor sector, particularly in electronic appliances including refrigerators, ovens, and washing machines for displaying several settings and parameters such as remaining time and energy consumption. Their integration in electronic appliances enables users to monitor and control power usage. They are employed in semiconductor industry during its manufacturing for monitoring of water flow at a wet station during silicon wafer washing and cleaning. Their utilization during semiconductor manufacturing for displaying flow rates helps operators in detecting deviations that may generate issues in the system.

Factors including the rising demand for semiconductors from multiple industries, rising investments in expansion of semiconductor manufacturing facilities, and increasing penetration of smart and energy-efficient consumer appliances with advanced features are vital prospects driving the growth of the electronics & semiconductor sector.

For instance, according to the Association of German Banks, the electronics sector in Germany witnessed a considerable growth in 2021. The production and nominal sales of electronics sector witnessed a rise of 10% in 2021 as compared to 2020.

Additionally, in June 2023, Micron Technology Inc. invested approximately USD 825 million in the development of a new semiconductor assembly and test facility in India in order to address the rising demand for semiconductors from domestic and international markets. Analysis of market trends concludes that the proliferation of electronics & semiconductor sector is increasing the adoption of the panel meters for aforementioned applications, in turn driving the expansion of the market.

Growing automotive sector Fuels the Market Development

Digital panel meters are used in the automotive sector for displaying critical information including fuel level, speed, and engine temperature among others, for providing drivers with real-time data for efficient and safe vehicle operation. They are also used by automobile manufacturers for testing engine output along with monitoring and displaying temperatures to observe abnormal conditions such as pre-ignition.

Factors including advancements in autonomous driving systems, increasing production of automobiles, and rising demand for enhanced automobile safety solutions are driving the proliferation of the automotive sector.

According to the International Organization of Motor Vehicle Manufacturers, the total automotive production across the world reached 85.01 million in 2022, depicting an increase of 6% in contrast to 80.14 million in 2021.

Additionally, according to the European Automobile Manufacturers Association, the total passenger car production in the Europe Union reached 10.9 million in 2022, depicting an incline of 8.3% as compared to 2021. Analysis of market trends concludes that the rising automobile production is increasing the utilization of the panel meter for displaying crucial vehicle parameters including fuel level, speed, engine temperature and others, in turn proliferating the digital panel meter market demand.

Key Restraints :

Availability of substitutes Restrains the Market Development

The primary substitute of digital panel meters includes analog panel meters. Comparatively, the substitutes have similar performance, and applications, with respect to digital meters, which is a key factor restricting the market proliferation.

For instance, analog panel meters act as an ideal alternative to digital meters for measuring parameters including pressure, temperature, flow, speed, voltage, and current among others and further displaying values on a dial with a moving needle or pointer. Similarly, analog panel meters are also used as an alternative to digital meters in residential, commercial, and industrial applications.

Moreover, analog panel meter offers a range of benefits including ability to measure fluctuations and continuous variations, higher durability, longer shelf-life, along with being relatively economical as compared to digital meters. Analysis of market trends concludes that the availability of substitutes for digital meters is limiting the expansion of the market.

Future Opportunities :

Rising residential construction Opens New Doors

The rising residential construction is expected to present potential opportunities for the proliferation of the digital panel meter market. Digital panel meters are often used in residential sectors for monitoring current flow, voltage levels, and power consumption to ensure safe building operations while preventing electrical hazards. They are also used for tracking electricity usage in residential buildings, which further helps users in managing energy consumption and making informed decisions for reducing energy costs. They are utilized in HVAC systems installed in residential buildings for measuring and displaying variables including airflow, temperature, and pressure.

Factors including rising disposable income and increasing investments and government policies including subsidies, rebates, and tax incentives for residential construction are key prospects driving the expansion of the residential sector.

For instance, in 2022, the Government of the United Kingdom introduced a home-building fund to support new residential development in the country. The UK Government provides direct investments ranging from USD 2.5 million to USD 6.2 million to residential builders in the country. Additionally, according to the State of Nevada of the United States, the new residential building permits reached 23,406 units in Nevada in 2021, depicting an increase of approximately 19% as compared to 19,716 units in 2020.

Hence, the rise in residential construction is projected to drive the adoption of the panel meters in modern residential buildings for monitoring current flow, voltage levels, and power consumption to ensure safe building operations. Analysis of market trends concludes that rising residential construction is emerging as one of many digital panel meter market opportunities that will drive market expansion.

Digital Panel Meter Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 5,782.25 Million |

| CAGR (2025-2032) | 5.70% |

| By Type | Temperature and Process Panel Meters, Flow Rate Totalizer, Multi-Input Indicators and Scanners |

| By End-User | Electronics & Semiconductor, Automotive, Residential, Commercial, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Murata Manufacturing Co. Ltd., Precision Digital Corporation, OMRON Corporation, Red Lion, Zhejiang Chint Instrument & Meter Co. Ltd, Lascar Electronics, Carlo Gavazzi, Phoenix Contact, PR Electronics, Jewell Instruments, Laurel Electronics Inc., |

Digital Panel Meter Market Segmental Analysis :

Based on the Type :

Based on the type, the market is bifurcated into temperature and process panel meters, flow rate totalizer, multi-input indicators and scanners. In 2024, the temperature and process panel meters segment accounted for the highest digital panel meter market share. Temperature and process panel meters are instruments designed for monitoring and displaying of process variables including temperature, pressure, and others. Temperature and process panel meters typically accept inputs from temperature sensors including thermocouples and resistance temperature detectors (RTDs) along with a wide range of current and DC voltage inputs for covering any typical process application. Moreover, temperature and process panel meters offer several benefits including set points options for process variables, adjustable displays, on/off control, alarm functions, and integration of additional channels to enable meters to obtain and interpret multiple signals from various sources. The above benefits of temperature and process panel meters are primary determinants for increasing its utilization in electronics & semiconductors, automotive, and other sectors.

For instance, Precision Digital Corporation is a digital panel manufacturer that offers a range of temperature and process panel meters in its PD765 series of digital panel meters. The temperature and process panel meters are designed for industrial applications including electronics, semiconductors, and others. Analysis of market trends concludes that the rising availability of temperature and process panel meters, particularly for industrial applications is driving the growth of the segment.

The flow rate totalizer segment is anticipated to register the fastest CAGR growth during the forecast period. A flow rate totalizer is an instrument that is designed to condition the electrical signal generated by the flowmeter for scaling the resultant flow information into a flow rate and flow total display in measurement units required by the end user. Moreover, the primary benefits of flow rate totalizer include high reliability and lower cost for flow measurement. Additionally, flow rate totalizers are often used in chemicals, water treatment, and other related industries.

For instance, in June 2023, Fluidwell introduced its upgraded F018 flow rate digital totalizer with pulse input retransmission for redundancy and improved calibration purposes. Therefore, the rising advancements associated with flow rate totalizers is among the vital factors expected to drive the digital panel meter market growth during the forecast period.

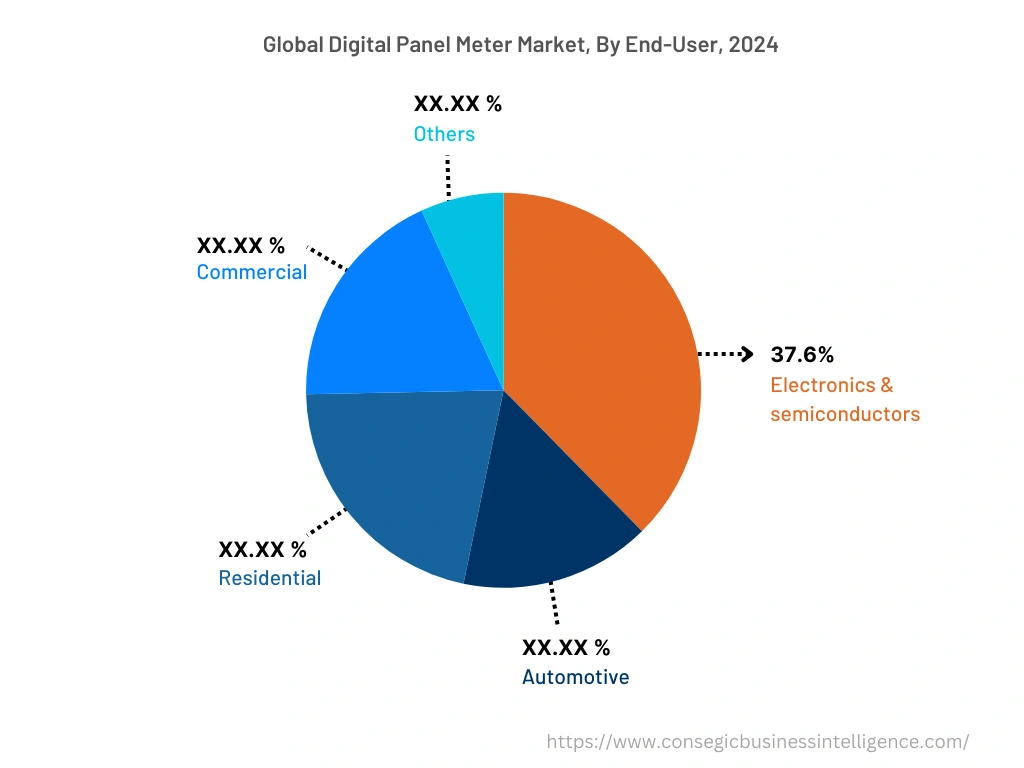

Based on the End-User :

Based on the end-user, the market is segregated into electronics & semiconductors, automotive, residential, commercial, and others. The electronics & semiconductor segment accounted for the largest revenue share of 37.6% in the year 2024. Factors including the increasing investments in expansion of semiconductor manufacturing facilities and rising penetration of smart and energy-efficient consumer appliances with advanced features are major aspects driving the growth of the electronics & semiconductor segment.

For instance, according to the Brazilian Electrical and Electronics Industry Association (ABINEE), the electrical and electronics sector in Brazil was valued at USD 42.2 billion in 2022, witnessing a rise of nearly 8% in comparison to USD 39.2 billion in 2021. Additionally, companies in the United States have announced over USD 166 billion in investments in semiconductors and electronics sector since CHIPS and Science Act became effective in August 2022.

Analysis of market trends concludes that the growing electronics & semiconductor sector is driving the adoption of the meters for displaying several settings and parameters in electronic appliances and monitoring water flow rate during silicon wafer washing and cleaning, in turn driving the proliferation of the market.

The automotive segment is expected to witness the fastest CAGR growth during the forecast period. The rise of automotive segment is driven by multiple factors including increasing automobile production, rising investments in expansion of automotive production facilities, and advancements in autonomous driving systems among others.

For instance, according to the China Association of Automobile Manufacturers, passenger car manufacturing in China reached 14.8 million units in January-August 2022, witnessing a progression of 14.7% year-over-year. The panel meters are used in the automotive sector, particularly for displaying crucial vehicle parameters including fuel level, speed, engine temperature and others to ensure safe vehicle operations. Thus, rising automotive production is projected to drive the adoption of the meters, in turn contributing the market expansion during the forecast period.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

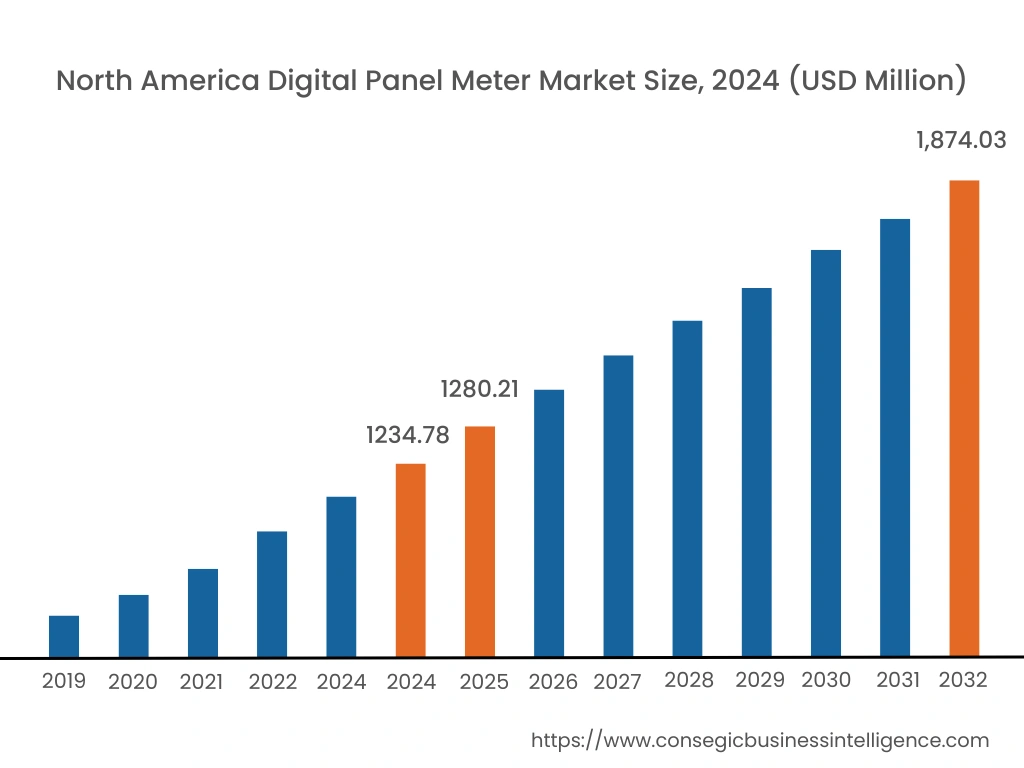

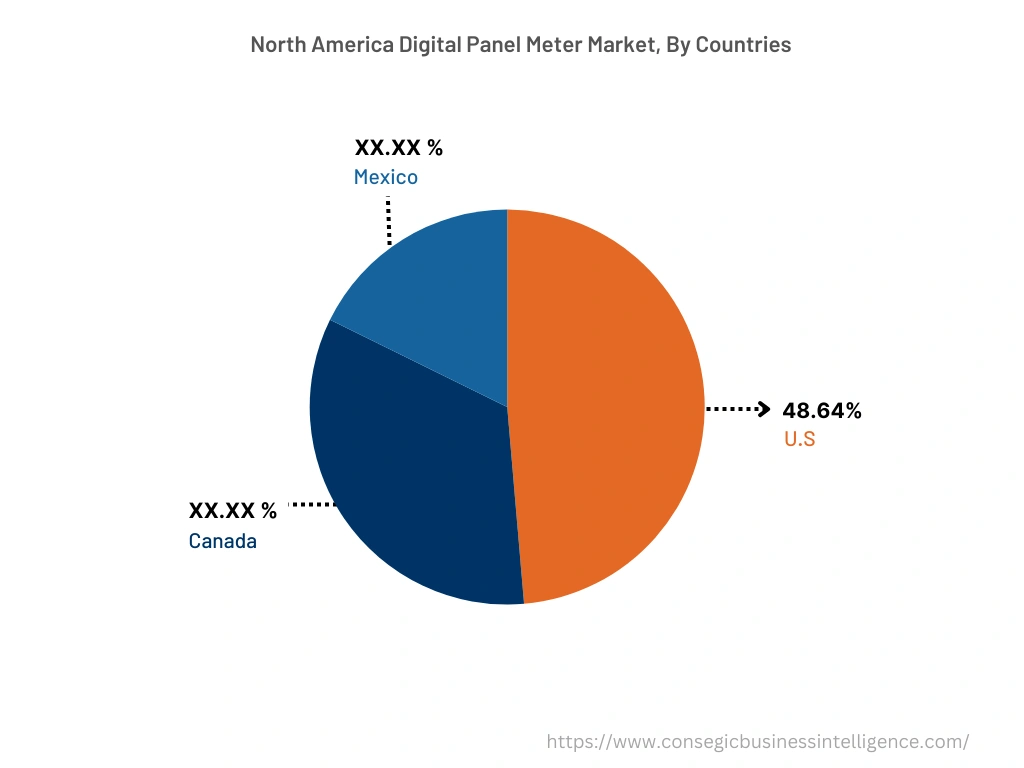

North America is estimated to reach over USD 1,874.03 Million by 2032 from a value of USD 1,234.78 Million in 2024 and is projected to grow by USD 1,280.21 Million in 2025, registering a CAGR of 5.7% during the forecast period. In addition, in the region, the U.S. accounted for the maximum revenue share of 48.64% in the same year. Analysis of digital panel meter market trends concludes that the adoption of digital panel meters in the North American region is primarily driven by its usage in electronics & semiconductors, commercial, automotive, and other sectors. Moreover, the rising utilization of DPMs in automobiles for displaying vital vehicle parameters including speed, fuel level, engine temperature, and others to ensure safe vehicle operations are among the significant factors driving the market expansion in the region.

For instance, according to the OICA (International Organization of Motor Vehicle Manufacturers), the total production of automobiles in North America reached 14.8 million in 2022, depicting an incline of approximately 10% from 13.5 million in 2021. Thus, the growing automotive sector is driving the deployment of DPMs, in turn fostering market proliferation in the North American region. Additionally, increasing investments in residential and commercial construction are expected to boost market expansion in North America during the forecast period.

Asia-Pacific is expected to register the fastest CAGR growth of 5.9% during the forecast period. The rising pace of industrialization and development is fostering market expansion in the region. Moreover, factors including the development of industrial sectors and rising government initiatives for the development of smart cities are contributing to the market expansion for DPMs in the Asia-Pacific region. For instance, the government of China launched multiple initiatives including China's 14th five-year Development Plan (2021 to 2025), National New-type Urbanization Plan, and smart cities projects with the aim of supporting the development of smart homes in the country.

The digital panel meter market analysis concluded that several factors including the rise in commercial and residential construction along with growing demand for the panel meters for monitoring current flow, voltage levels, and power consumption in residential and commercial buildings to ensure safe building operations are projected to drive the market expansion in the Asia-Pacific region during the forecast period.

Top Key Players & Market Share Insights:

The digital panel meter market is highly competitive with major players providing DPMs to the national and international markets. Analysis of market trends concludes that major companies operating in the digital panel meter industry are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in digital panel meter market. Key players in the digital panel meter market include-

- Murata Manufacturing Co. Ltd.

- Precision Digital Corporation

- PR Electronics

- Jewell Instruments

- Laurel Electronics Inc.

- OMRON Corporation

- Red Lion

- Zhejiang Chint Instrument & Meter Co. Ltd.

- Lascar Electronics

- Carlo Gavazzi

- Phoenix Contact

Recent Industry Developments :

- In April 2021, Murata Manufacturing Co. Ltd. launched its new series of DPMs that is primarily designed for laboratory and industrial current and voltage measurement applications. They offer high performance and features a bar-graph readout integrated with the digital absolute value for providing a fast response.

Key Questions Answered in the Report

What is digital panel meter? +

Digital panel meters refer to electronic devices that display electrical parameters including current, voltage, resistance, temperature, and others in digital format.

What specific segmentation details are covered in the digital panel meter report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed temperature and process panel meters as the dominating segment in the year 2024, owing to its increasing utilization in electronics & semiconductor and automotive industries among others.

What specific segmentation details are covered in the digital panel meter market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed automotive as the fastest-growing segment during the forecast period due to rising adoption of digital panel meter in automotive sector for displaying vital vehicle parameters including speed, fuel level, engine temperature, and others.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization and rising residential & commercial construction projects.