Gaming Laptop Market Size:

Gaming Laptop Market size is estimated to reach over USD 18,158.74 Million by 2032 from a value of USD 12,783.20 Million in 2024 and is projected to grow by USD 13,134.23 Million in 2025, growing at a CAGR of 4.8% from 2025 to 2032.

Gaming Laptop Market Scope & Overview:

Gaming laptop is specifically designed for gaming purposes with higher processors and graphic cards. These laptops provide higher resolution, super quality visuals with higher frame rates. These laptops include advanced cooling systems enabling long duration usage. Apart from gaming, these laptops are used in 3D modelling, video editing, graphic designing, programming and machine learning algorithms. Moreover, they offer a range of benefits including portability, high performance, connectivity, and quality displays.

Gaming Laptop Market Insights:

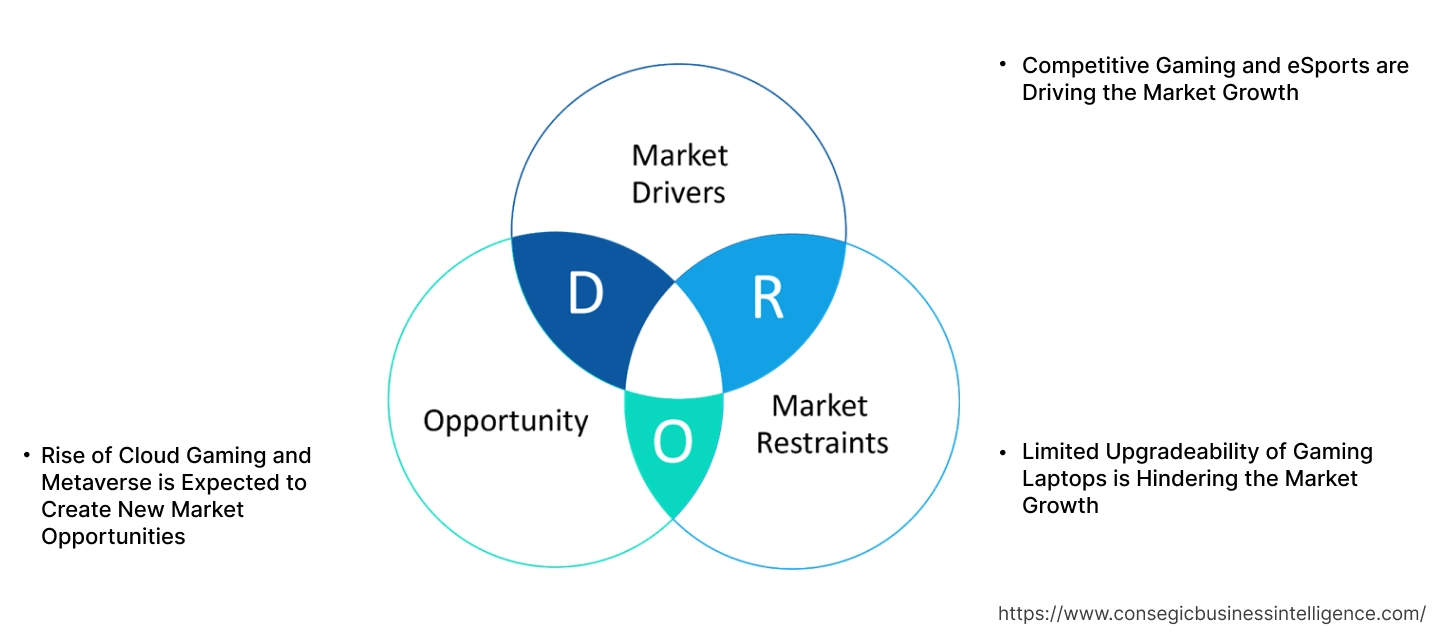

Gaming Laptop Market Dynamics - (DRO) :

Key Drivers:

Competitive Gaming and eSports are Driving the Market Growth

Competitive gaming and esports involve organized video game competitions where individuals or teams play for spectators, prizes, or money. It's an evolution of video gaming, taking the hobby and turning it into a profession. Esports are often characterized by large-scale tournaments and leagues, with professional players and teams competing for recognition and financial rewards.

- For instance, in May 2025, eSports revealed its full schedule for World Cup 2025. More than 2,000 players from 200 clubs will compete in 25 games.

Thus, the rising popularity of competitive gaming and esports is booting the market growth.

Key Restraints :

Limited Upgradeability of Gaming Laptops is Hindering the Market Growth

Gaming laptops often have limited upgradability, depicting it's difficult to replace components like the CPU or GPU. This leads to performance degradation over time and potentially shorter lifespans compared to desktops. Moreover, CPU and GPU are soldered onto the motherboard and not easily replaceable. There is limited space for additional storage or other hardware components. Furthermore, the display is typically fixed, and while you can use an external monitor, it reduces portability.

Thus, the aforementioned factors are limiting the market demand.

Future Opportunities :

Rise of Cloud Gaming and Metaverse is Expected to Create New Market Opportunities

Cloud gaming and the metaverse are intertwined, with cloud gaming serving as a key technology enabling metaverse experiences. Cloud gaming provides the infrastructure to render and stream virtual worlds, while the metaverse leverages cloud gaming to deliver immersive, interactive environments. This combination allows for more accessible and scalable virtual experiences, such as virtual concerts, events, and even gaming within the metaverse.

- For instance, NVIDIA offers GeForce RTX-powered cloud gaming. It offers fastest access to GFN servers.

Thus, the market analysis shows that aforementioned factors are driving the market opportunities.

Gaming Laptop Market Segmental Analysis :

By RAM:

Based on the RAM, the market is segmented into 8GB, 16GB, 32GB, and others.

Trends in the RAM:

- The 32GB RAM is primarily utilized for higher resolutions, such as 4K gaming and content creation, among others which in turn fuels the gaming laptop market trends.

The 16GB segment accounted for the largest revenue share in the year 2024.

- The 16GB RAM allows for smooth multitasking, faster game load times, and the ability to run most modern games at higher settings, which in turn is fueling the gaming laptop market share.

- Additionally, the key benefits of 16GB RAM include multitasking, enhanced gaming experience, and others.

- Further, the increasing demand for gaming laptops with advanced GPUs and increased RAM capabilities is propelling the growth of the 16 GB RAM segment.

- For instance, in May 2025, ASUS and Republic of Gamers unveiled Strix G, Zephyrus, and TUF Gaming Laptops embedded with NVIDIA GeForce RTX 5060, as well as 16GB and 32GB RAM options, which are designed to cater growing gaming industry.

- Thus, according to the gaming laptop market analysis, the increasing need for advanced GPUs with increased RAM capabilities is driving the 16GB segment.

The 32GB segment is anticipated to register the fastest CAGR during the forecast period.

- 32 GB RAM segment allows for smoother and stable performance for intensive games, running multiple applications, or streaming while gaming, among others.

- Additionally, the key benefits of 32GB RAM include smoother performance, reduced lag, and improved responsiveness, among others.

- Further, the growing popularity of eSports and professional gaming tournaments is propelling the need for 32GB RAM, which in turn is fueling the gaming laptop market share.

- Therefore, according to the gaming laptop market analysis, the rising adoption by professional gamers and content creators is anticipated to boost the growth of the market during the forecast period.

By Refresh Rate:

Based on the refresh rate, the market is segregated into 60Hz, 120Hz, 144Hz, 240Hz, and 360Hz.

Trends in the Refresh Rate:

- The trend towards continuous innovation in GPU and CPU technology is propelling the adoption of 120 Hz refresh rate.

- The increasing trend towards need for portable and compact laptops is driving the demand for 240Hz refresh rates.

120Hz segment accounted for the largest revenue share in the year 2024.

- The 120 Hz segment is mainly compatible with mid-range GPUs, which in turn drive affordability and improved performance, among others.

- Additionally, the key benefits of 120 Hz refresh rate include smoother motion, reduced motion blur, faster response times, and an overall enhanced user experience.

- Further, the increasingly fast-paced activities, such as gaming and video editing, and reducing eye strain, are propelling the adoption of 120Hz refresh rates.

- Thus, as per the market analysis, increasing fast-paced activities, as well as affordability and improved performance, are driving the adoption of the 120Hz refresh rate segment.

The 360Hz segment is anticipated to register the fastest CAGR during the forecast period.

- The growing popularity of esports and game streaming has fueled demand for 360 Hz segment, which in turn fuels the gaming laptop market size.

- Additionally, the key benefits of adopting a 360Hz refresh rate include reduced latency, improved responsiveness, and minimized motion blur, among others.

- Further, the rising demand for higher refresh rates for smooth functioning of games, which in turn provides a competitive edge in fast-paced games, drives the gaming laptop market size.

- For instance, in January 2020, ASUS Republic of Gamers launched ROG Zephyrus G14 and ROG Swift 360Hz, both are gaming laptops designed to provide a high-performance 4K HDR gaming experience.

- Therefore, as per the market analysis, the rising demand for higher refresh rates for smooth functioning of games is anticipated to boost the market during the forecast period.

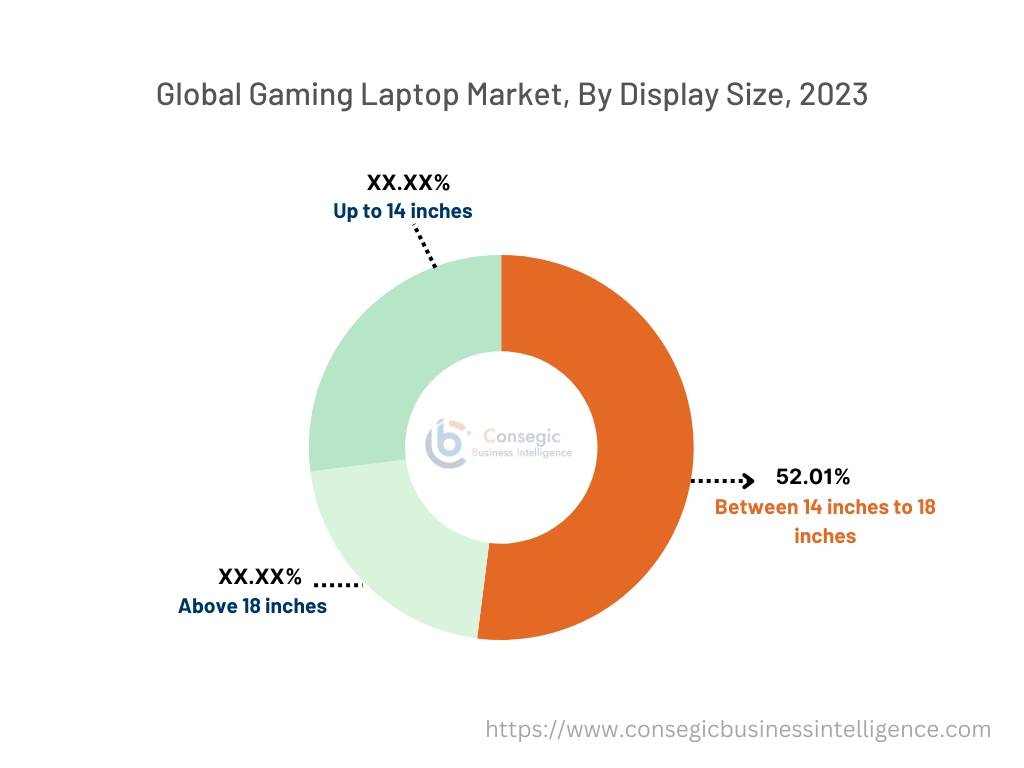

By Display Size:

Based on the display size, the market is segregated into up to 14 inches, between 14 inches to 18 inches, and above 18 inches.

Trends in the Display Size:

- The trend towards gamers prioritizing immersive experiences and powerful performance is propelling the adoption of above 18 inches display size.

- The trend towards miniaturization of various electronic components is propelling the need for portable and compact gaming laptops, which in turn is fueling the need for up to 14 inches display size.

Between 14-inch to 18-inch segment accounted for the largest revenue share of 52.01% in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Between 14-inch to 18-inch laptops offer comparable performance to desktop computers, due to powerful processors, dedicated graphics cards, and memory and storage solutions.

- Further, factors including changing preferences, gaming requirements, cost, high refresh rate, and others are key aspects driving the between 14-inch to 18-inch segment.

- For instance, in December 2023, MSI launched Titan 18 HX. The device features an 18 inch display with 4K/120Hz Mini LED display, positioning it as the most premium laptop display.

- Thus, as per the market analysis, the aforementioned factors are driving the between 14-inch to 18-inch segment.

By Price Range:

Based on the price range, the market is segregated into budget range, mid-range, and premium.

Trends in the Price Range:

- The trend towards increasing focus on customization is driving the adoption of the premium segment.

The premium segment accounted for the largest revenue share in the year 2024 and is expected to witness the fastest CAGR during the forecast period.

- The premium gaming laptops are integrating AI into the system for better decision making, increasing performance, and others, which in turn is driving the market progress.

- Additionally, the rising demand for mini-LED laptops on display featuring flagship specs and prices is propelling the premium segment.

- Further, factors including increasing demand for high-performance gaming laptops with advanced features and specifications for hardcore and professional gamers, are boosting the premium segment.

- Thus, as per the market analysis, the rising demand for mini-LED laptops as well as AI integration is propelling the adoption of premium laptops.

By Distribution Channel:

Based on the distribution channel, the market is segregated into online, retail stores, authorized resellers and distributors, custom PC builders, and enterprises.

Trends in the Distribution Channel:

- The trend towards formulating computer systems from scratch is driving the demand for custom PC builders.

- The trend towards need for higher specifications of laptops is propelling the custom PC builders segment.

The online segment accounted for the largest revenue share in the year 2024 and is expected to witness the fastest CAGR during the forecast period.

- Online platforms have the capability to access a global audience, expanding customer bases and sales opportunities as well as enabling data-driven decision-making.

- Additionally, the key advantages of online distribution channels include wider market reach, lower costs, 24/7 availability, and the ability to personalize customer experiences.

- Further, the proliferation of e-commerce platform that offer a wide product portfolio and analysis for customers is driving the online segment.

- Thus, as per the market analysis, enabling data-driven decision-making is driving the online platforms segment.

By End Use:

Based on the end user, the market is segregated into professional gamers, content creators, programmers, and others.

Trends in the End User:

- The trend towards rising need for high-performance laptops for editing, gaming, and others is driving the adoption by professional gamers.

- The trend towards rising adoption of models with a balance of processing power, graphics performance, and storage by programmers is driving the market development.

The professional gamers segment accounted for the largest revenue share in the year 2024 and is expected to witness the fastest CAGR during the forecast period.

- The rising need for high-end components tailored for gaming performance is driving the adoption by professional gamers.

- Further, the proliferation of AI, VR/AR experiences, and the rise in mobile gaming are driving the market adoption by professional gamers.

- For instance, in February 2024, ROG Academy launched season 9 to encourage young talent to grow and promote high standards within the game world in particular.

- Thus, as per the market analysis, the proliferation of AI, VR/AR experiences, and the rise in mobile gaming are driving the market adoption by professional gamers.

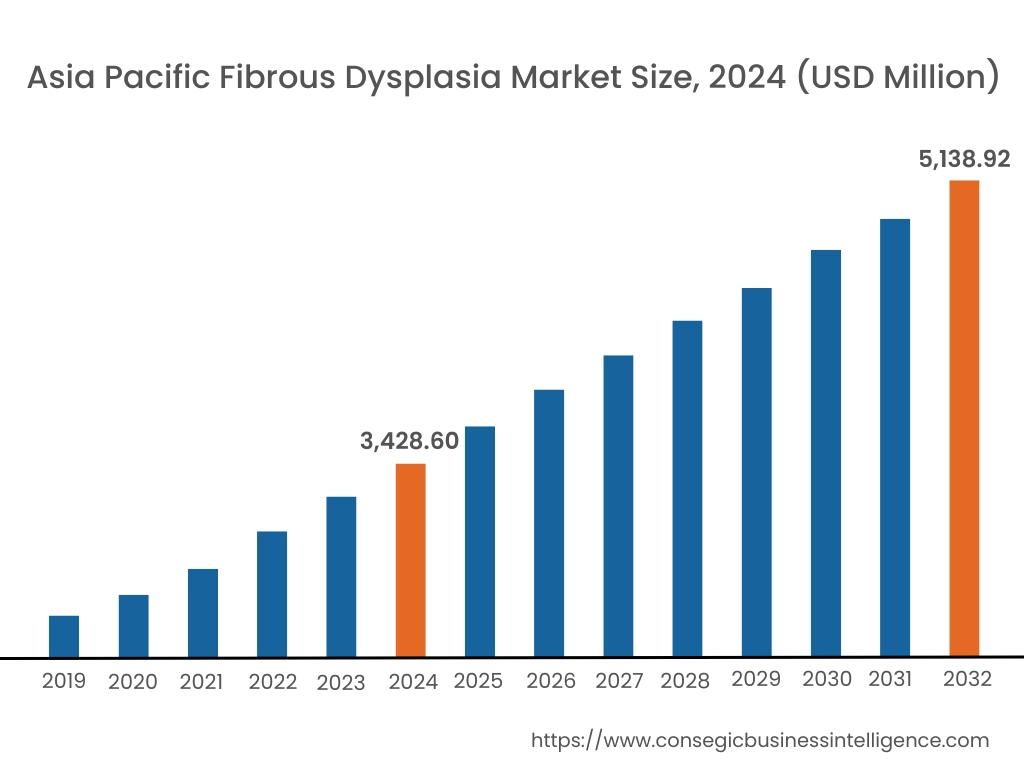

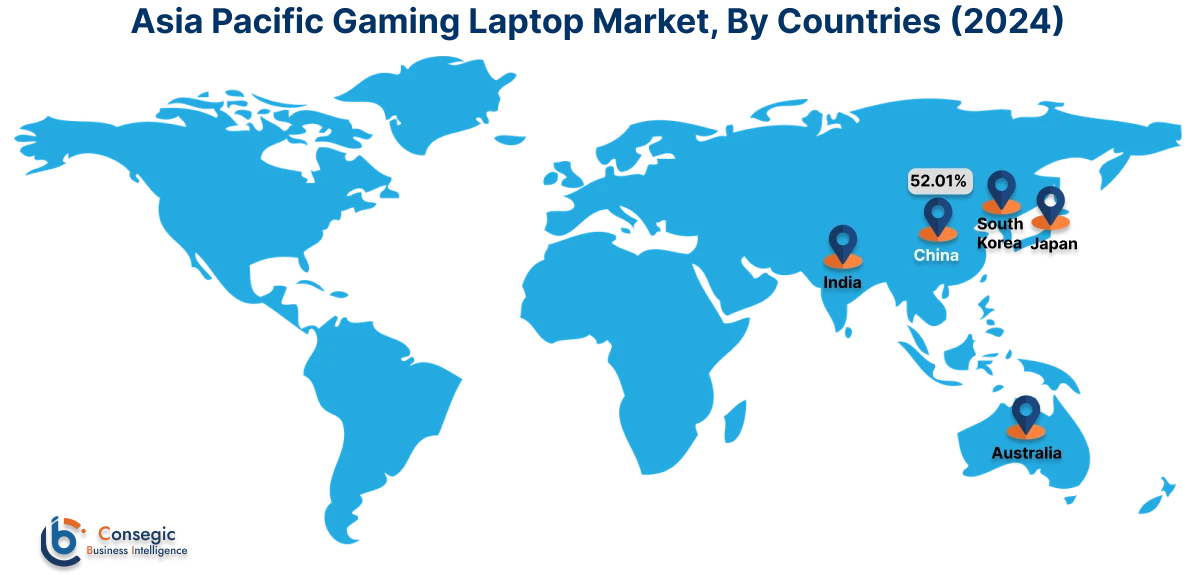

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 3,428.60 Million in 2024. Moreover, it is projected to grow by USD 3,538.93 Million in 2025 and reach over USD 5,138.92 Million by 2032. Out of this, China accounted for the maximum revenue share of 37.20%. The market is mainly driven by the proliferation of e-commerce platforms in India and other emerging economies. Furthermore, factors including smooth gameplay and efficient performance, as well as blend of power and features for gamers and multitaskers, are projected to drive the market growth in Asia Pacific region during the forecast period.

- For instance, according to IBEF, the market for e-commerce of Tier-3 cities in India expanded from 34.2% to 41.5% from 2021 to 2022, which in turn is fueling the market progress.

North America is estimated to reach over USD 6,560.75 Million by 2032 from a value of USD 4,635.76 Million in 2024 and is projected to grow by USD 4,761.58 Million in 2025. The North American region's growing popularity of gaming culture offers lucrative prospects for the market. Additionally, the rising adoption of advanced technologies such as AI and ML is driving the market development.

- For instance, in April 2024, Acer launched its new products Acer Nitro 14 and Acer Nitro 16 gaming laptops embedded with AMD Ryzen 8040 Series processors which is also embedded with Ryzen AI technology.

The regional evaluation depicts that the growing e-sports culture and an active gaming community, as well as need for high-refresh-rate displays and improved GPUs, are driving the market in Europe. Additionally, the key factor driving the market is the growing consumer electronics sector, as well as investments in gaming infrastructure are propelling the market adoption in the Middle East and African region. Further, the increasing internet penetration and an expanding young population interested in gaming are paving the way for the progress of the market in Latin America region.

Top Key Players & Market Share Insights:

The gaming laptop market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-use launches to hold a strong position in the global gaming laptop market. Key players in the gaming laptop industry include-

- Lenovo Group Limited (China)

- Razer Inc. (United States)

- HP Inc. (United States)

- ASUSTeK Computer Inc. (Asus) (Taiwan)

- Alienware Corporation (United States)

- GIGA-BYTE Technology Co., Ltd. (Taiwan)

- Dell Technologies Inc. (United States)

- Micro-Star International Co., Ltd. (MSI) (Taiwan)

- Origin PC Corporation (United States)

- Eluktronics, Inc. (United States)

- Acer Inc. (Taiwan)

Recent Industry Developments :

Product Launches:

- In June 2024, Asus launched the Asus ROG Zephyrus G14. It has AMD's Ryzen 9 8945HS processor, complemented by 16GB of RAM and an Nvidia GeForce RTX 4070 GPU. The laptop features a custom cooling system, a 14-inch OLED panel with 3K resolution, and comes pre-installed with Windows 11 Home. Additionally, it has a 73Wh battery for extended usage.

Gaming Laptop Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 18,158.74 Million |

| CAGR (2024-2031) | 4.8% |

| By RAM |

|

| By Refresh rate |

|

| By Display Size |

|

| By Price Range |

|

| By Distribution Channel |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Gaming Laptop Market Report? +

Gaming Laptop Market size is estimated to reach over USD 18,158.74 Million by 2032 from a value of USD 12,783.20 Million in 2024 and is projected to grow by USD 13,134.23 Million in 2025, growing at a CAGR of 4.8% from 2025 to 2032.

Which is the fastest-growing region in the market? +

Asia Pacific is the fastest-growing region in the market.

What segmentation does the gaming laptop market report cover? +

The report covers RAM, refresh rate, display size, price range, distribution channel, end-use, and region.

Who are the major key players in the market? +

The major key players in the market are Lenovo Group Limited (China), Razer Inc. (United States), Dell Technologies Inc. (United States), Micro-Star International Co., Ltd. (MSI) (Taiwan), Origin PC Corporation (United States), Acer Inc. (Taiwan), HP Inc. (United States), ASUSTeK Computer Inc. (Asus) (Taiwan), Alienware Corporation (United States), GIGA-BYTE Technology Co., Ltd. (Taiwan) and Eluktronics, Inc. (United States).