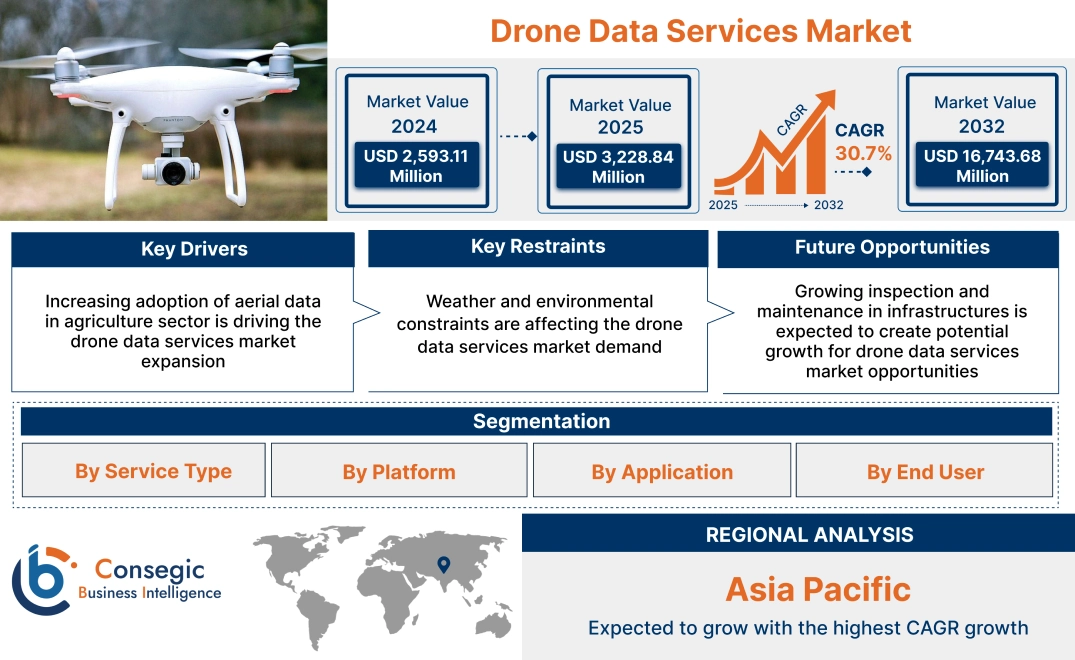

Drone Data Services Market Size:

Drone Data Services Market Size is estimated to reach over USD 16,743.68 Million by 2032 from a value of USD 2,593.11 Million in 2024 and is projected to grow by USD 3,228.84 Million in 2025, growing at a CAGR of 30.7% from 2025 to 2032.

Drone Data Services Market Scope & Overview:

Drone data services encompass the collection, processing, analysis, and delivery of information gathered by unmanned aerial vehicles (UAVs), commonly known as drones. These services include the simple capture of air images or videos and converting unprocessed data to drones into effective information in various industries. Further, the service uses air data to provide comprehensive solutions to increase efficiency, safety and decision-making in sectors such as construction, agriculture, and infrastructure.

How is AI Impacting the Drone Data Services Market?

AI is revolutionizing the drone data services market by transforming raw aerial data into actionable, automated insights. Instead of just capturing images or video, AI algorithms now process vast datasets in real time to detect patterns, identify objects, and flag anomalies autonomously. This enables services like predictive maintenance for infrastructure, real-time crop health monitoring in agriculture, and streamlined site inspections in construction. By automating the analysis and reporting process, AI drastically reduces the time and human effort required, increasing the efficiency, value, and scalability of drone services and driving significant market growth.

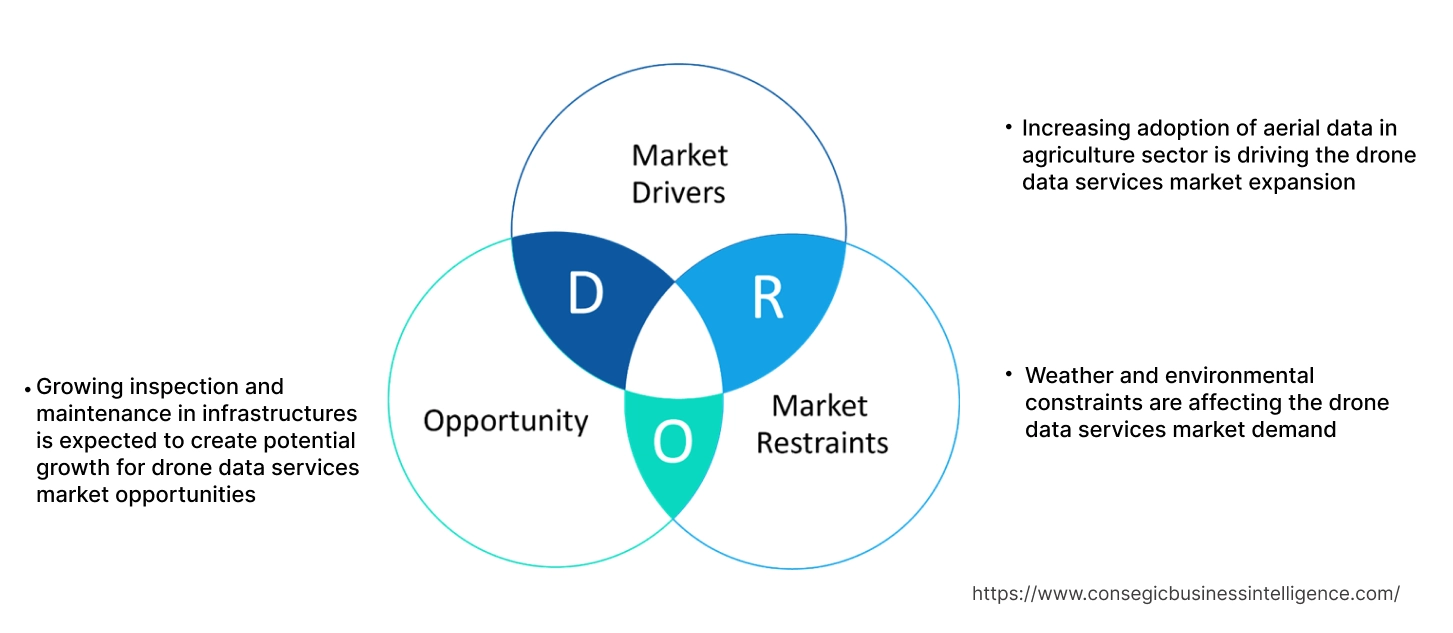

Drone Data Services Market Dynamics - (DRO) :

Key Drivers:

Increasing adoption of aerial data in agriculture sector is driving the drone data services market expansion

Companies across various sectors are enabling the value of real-time and high-resolution data with drone-based data collection services. Aerial data, captured through advanced sensors on drones, provides organizations with insights that are more accurate and efficient. Drones offer real-time aerial views of construction sites, enabling project managers to track progress, monitor safety, and ensure adherence to timelines. Further, drones in the agriculture sector enable farmers to reduce synthetic inputs and employ targeted spraying methods that minimize chemical usage. Further, in agriculture, drones provide farmers with detailed images of crop health, enabling them to make timely decisions regarding irrigation, fertilization, and pest control.

- For instance, in February 2023, XAG announced the partnership with Farmlno, to bring autonomous agricultural drones to Thailand. The partnership will lead to the launch of autonomous drones with intelligent control systems. The drones are fully autonomous and powered by AI, making them highly efficient in terms of spreading and precision spraying.

Thus, according to the drone data services market analysis, the growing demand for aerial data is driving the drone data services market size and trends.

Key Restraints:

Weather and environmental constraints are affecting the drone data services market demand

Weather and environmental constraints significantly impact drone operations, posing challenges for industries that rely on aerial data collection. Adverse weather conditions, such as high winds, rain, snow, and fog, severely limit drone functionality and safety. Drones, particularly those used for large-scale commercial applications, are equipped with lightweight materials and may not be designed to withstand harsh weather conditions. High winds can affect the stability and control of drones, making it difficult to maintain precise flight paths. Additionally, rain and snow can damage drones sensitive equipment, such as cameras and sensors, potentially compromising the quality of the data being collected.

Further, low temperatures can reduce battery efficiency, leading to shorter flight times, while high temperatures may cause overheating of internal components. The performance of GPS and sensors used for navigation can also be compromised in areas with poor satellite coverage or in dense urban environments. Drones may struggle to maintain reliable positioning in such conditions, leading to potential safety risks and difficulties in accurately mapping or inspecting areas. These aforementioned factors hamper the drone data services market size.

Future Opportunities :

Growing inspection and maintenance in infrastructures is expected to create potential growth for drone data services market opportunities

The use of drones in infrastructure inspection enhances the speed and efficiency of maintenance activities. By providing inspectors with real-time data and imagery, drones facilitate rapid decision-making and streamline the prioritization of maintenance tasks. The proactive approach helps prevent potential failures or accidents, minimizing downtime and associated costs. Additionally, drones access hazardous locations with ease, enabling comprehensive inspections of structures that are dangerous to assess manually. By automating repetitive tasks and reducing the need for specialized equipment and manpower, drones help lower operational expenses and optimize resource utilization. The data collected by drones during inspections can be utilized for predictive maintenance purposes, enabling asset managers to forecast maintenance needs accurately and allocate resources efficiently.

- For instance, in August 2021, The Indian state of Tamil Nadu announced plans to employ drones in combatting illicit mining of minerals by conducting surveys and monitoring activities across approximately 1,700 quarries. The drone survey initiative is expected to require an annual investment of approximately USD 3.3 million.

Thus, based on the above factors, the growing inspection and monitoring in infrastructures is expected to play a crucial role in shaping the future of the drone data services market opportunities.

Drone Data Services Market Segmental Analysis :

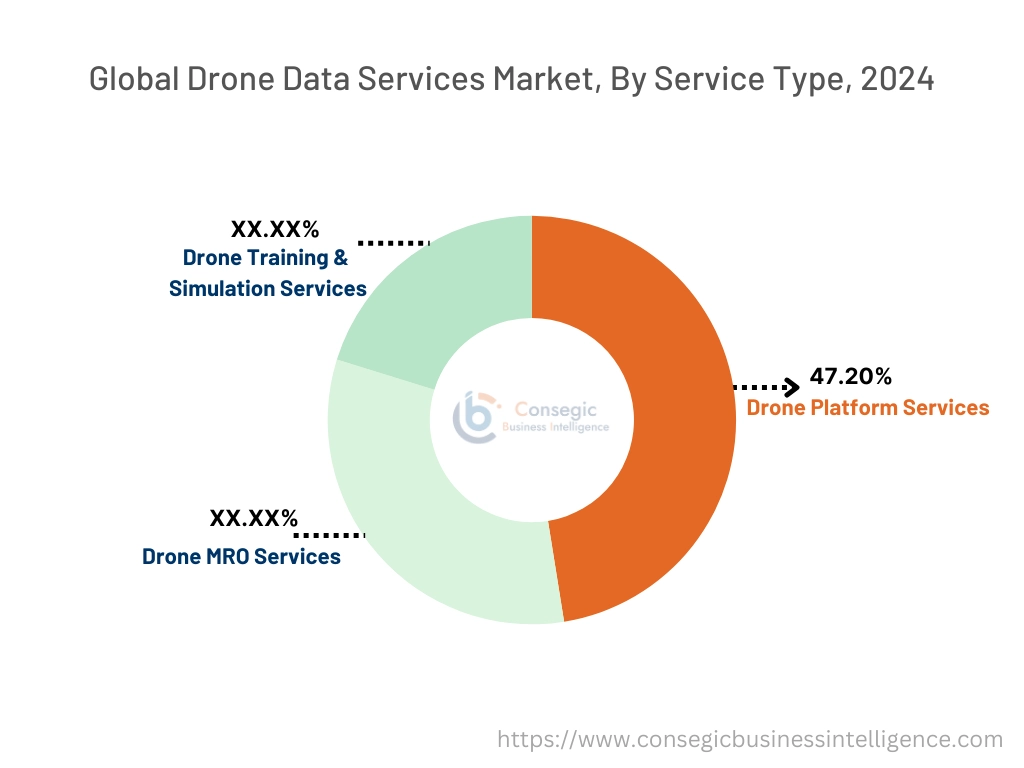

By Service Type:

Based on service type, the drone data services market is segmented into drone platform services, drone MRO services, and drone training & simulation services.

Trends in service type:

- The ongoing advancements in drone technology, such as LiDAR and multi-sensor systems enhance the accuracy of data collection. This enables drone platform and services to capture more detailed data.

- The factors and developments such as growing emphasis on visualization services would further drive the drone data services market demand during the forecast period.

The drone platform services segment accounted for the largest revenue share of 47.20% in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- The integration of AI and machine learning is enabling drones to perform increasingly complex tasks autonomously, including navigation, obstacle avoidance, and data analysis.

- IoT integration allows drones to become part of larger interconnected systems, facilitating data sharing and coordinated operations.

- For instance, the integration of drones in the IoT involves connecting unmanned aerial vehicles with sensors, connectivity, and automation to enable seamless data transfer and analysis. Drones can collect data from various sources, including cameras, sensors, GPS, and satellites, and transit in real time to centralized systems for analysis.

- These factors and developments, such as increased automation and focus on software and data analytics would further drive the future of drone data services market growth.

By Platform:

Based on platform, the market is segmented operator software and cloud-based.

Trends in platform:

- Drone service platforms are focusing on providing comprehensive data analytics and software solutions. These platforms enable users to process, analyze, and visualize drone-captured data, which generates valuable insights for decision-making.

- Drones with sensors fly from a predetermined height to collect analytical data. The drone offers services such as photographs, construction sites, evaluation, aviation photos, data capture and analysis, modelling drones and others in commercial and residential sectors.

The operator software segment accounted for the largest revenue share in the year 2024.

- Operator software refers to the software used by drone operators to control drones, monitor flight paths, and manage the data collection process. This software is essential for ensuring that drones capture accurate and high-quality data.

- Operator software includes features such as real-time flight control, route planning, and mission planning, as well as tools for data integration and post-flight analysis.

- This platform is particularly crucial for industries where precision and data quality are critical, such as surveying, environmental monitoring, and infrastructure inspection.

- The software often includes specialized applications tailored to specific industry needs, helping operators optimize flight operations and improve data accuracy.

- For instance, DroneDeploy Aerial platform enable users to capture and organize photos, generate maps and inspection reports. The platform combined with DroneDeploy Ground imagery for a holistic view of user sites and assets from every angle.

- These factors, such as growing technological advancements in drone platform services are driving the drone data services market growth.

The cloud-based segment is anticipated to register the fastest CAGR during the forecast period.

- The cloud platform allows drone operators to load large amounts of data collected during flights such as images, videos and sensors, and access, handle and analyze through the internet connection.

- Such services often provide scalability, flexibility and advanced data tests, ideal for industries such as agriculture, construction, mining, and logistics, which should effectively process and analyze large data sets.

- Cloud service also supports collaboration processes, as multiple users simultaneously access data, access and work on data to optimize decision making and increase work efficiency.

- For instance, in March 2022, Asteria Aerospace launched SkyDeck, a drone operations platform. It is a cloud-based software solution that delivers drone as a service several end use industries, such as industrial inspections, agriculture, security, and surveillance.

- These factors and developments in the cloud-based segment would further drive the drone data services market trends during the forecast period.

By Application:

Based on application, the market is segmented into aerial photography, product delivery, surveillance & inspection, data acquisition & analytics, and others.

Trends in application:

- Companies are seeking to enter the UAV software space and develop software to provide aerial imagery analysis and mapping solutions for the commercial sector.

- Governments and the companies are developing drones with certain useful loads and sensors to monitor pollution, climate change and realistic biodiversity.

The aerial photography segment accounted for the largest revenue share in the year 2024.

- As the popularity of social networks and online video platforms increases, need for high -quality visual content occurs.

- Aerial photographs are cheaper due to long battery life and improvement of drone technologies such as the best stabilization and flight management of the camera.

- For instance, Folio3 Software Inc. develops drone software that provides data and real -time analysis, aviation photos and others. Data collected in the drone chamber are handled to order an AI algorithm that interprets the data and provides full reports of panel format.

- These factors and development in the aerial photography segment would further drive the drone data services market trends during the forecast period.

The surveillance & inspection segment is anticipated to register the fastest CAGR during the forecast period.

- Drone inspections are widely used in the complex structures such as buildings and pipelines for the more efficient, cost-effective and safer inspection process, which helps to reduce. Additionally, drones are used to provide practical solutions for the inspection in an array of application areas like critical infrastructure inspection, railways, roadways and bridge inspection.

- Introduction of the advanced sensors to provide real-time data collection, in drones will save money and time along with increasing efficiency and safety for optimizing production.

- These factors, such as increase in the requirement of drone for border security across the globe would further drive the global market during the forecast period.

By End User:

Based on the end user, the drone data services market is segmented into agriculture, infrastructure, oil & gas, logistics, and others.

Trends in the end user:

- In the construction sector, drones are used more and more for on -site inspections, progress and monitoring. Developers and construction companies use drones to capture air images at high resolution to help the development, design and tracking of construction projects.

- The mining sector also uses drone data services for intelligence, polls and monitoring. The drone provides an effective way to check and map the mining area to comply with safety and environmental standards.

The agriculture segment accounted for the largest revenue in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- The agricultural sector benefits from the service of this drone to monitor crops, accurate agricultural and field sites.

- Drones with sensors and cameras can track large agricultural areas to provide real -time data on the health of agricultural crops, which helps farmers to optimize their activities, reduce their use, and increase their productivity.

- In addition, drones can analyze the soil and spray agricultural crops to increase the efficiency and stability of agricultural methods. Since the need for food production is increasing worldwide, drone technology is an important tool for ensuring sustainable agricultural and effective yield management in modern agriculture.

- For instance, in April 2024, DJI Agriculture announced the global release of drones Agras T50 and T25. The T50 offers excellent efficiency for large -scale agricultural operation, while the T25 drone is designed for greater tolerance and is suitable for small fields. Both drones are gently integrated with improved Smartfarm applications to provide reliable and comprehensive aviation management.

- These developments in the agriculture sector are anticipated to further drive the need for drone services in the global market during the forecast period.

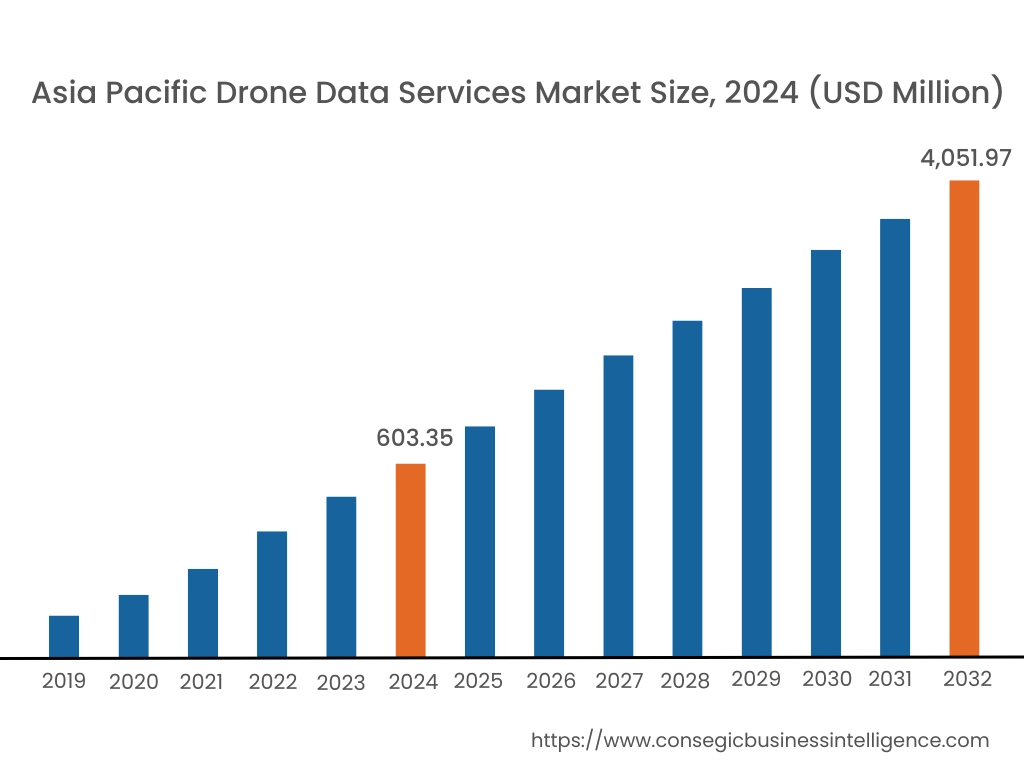

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, MEA, and Latin America.

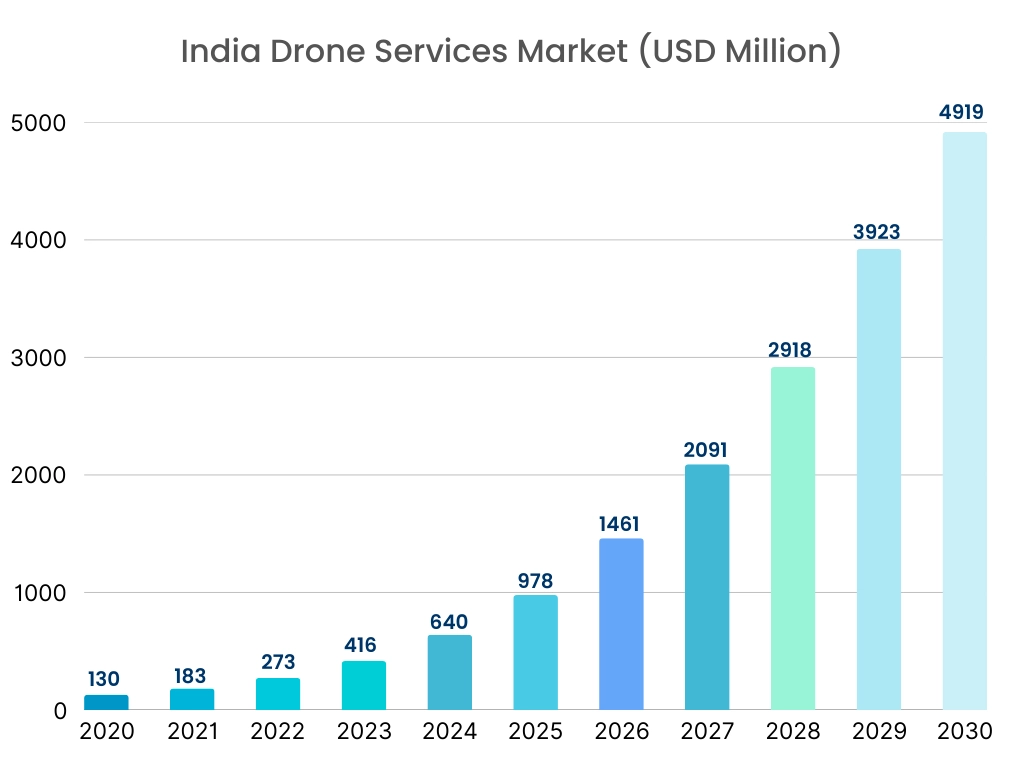

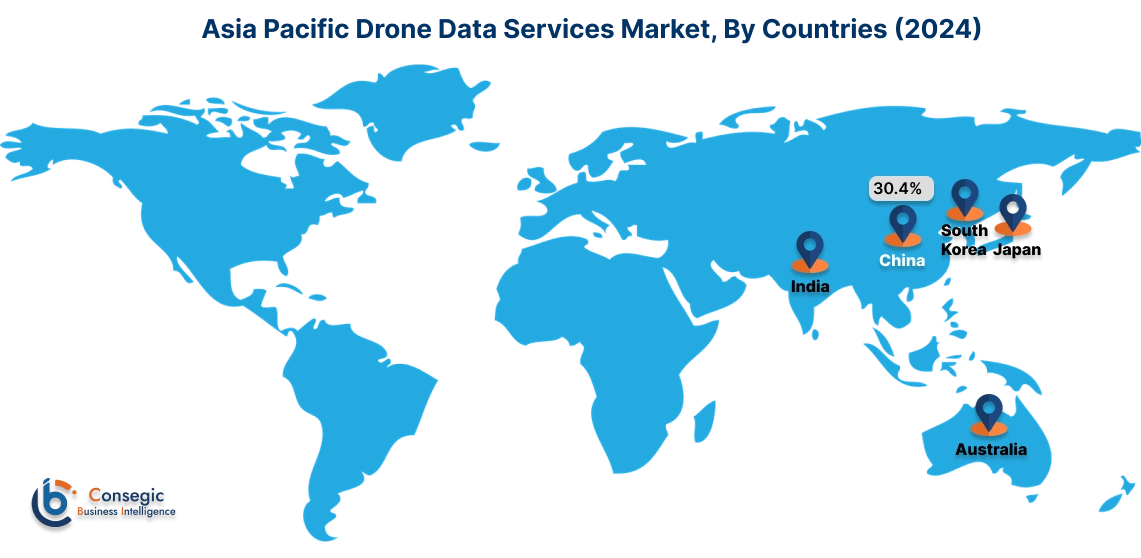

Asia Pacific drone data services market expansion is estimated to reach over USD 4,051.97 million by 2032 from a value of USD 603.35 million in 2024 and is projected to grow by USD 753.77 million in 2025. Out of this, the China market accounted for the maximum revenue split of 30.4%. Countries such as China, Japan and India have succeeded in adopting drone technologies in various sectors, such as agriculture, mining and infrastructure development. Further, the rapidly expanded industry of Chinese drones combines with large agricultural applications to promote the market in the APAC region. In addition, the need for urban planning in APAC countries increases and the development of smart cities causes the demand for services, contributing to increasing in the region's market. These factors would further drive the regional drone data services market share during the forecast period.

- For instance, in December 2024, Adani Defense and Aerospace has delivered a surveillance drones, Drishti-10 Starliner, to the Indian Navy, to boost the India’s maritime forces to mitigate piracy risks and monitor shipping lines. The Drishti 10 Starliner drone developed by ADANI Defense and Aerospace, which is a 36 -hour durability and a 450kg intellectual platform, observation and intelligence (ISR).

North America market is estimated to reach over USD 6,362.60 million by 2032 from a value of USD 989.96 million in 2024 and is projected to grow by USD 1,232.18 million in 2025. North America holds a dominant share in the global market, primarily due to the advanced infrastructure, high technological adoption, and substantial investment in drone services. The United States leads the region with its well-established aerospace and defense industries, as well as a growing need for drones in sectors like real estate, agriculture, and construction. Further, North America's regulatory environment is favorable, with clear guidelines provided by authorities such as Federal Aviation Administration (FAA), which has facilitated the widespread use of drones in commercial applications. The region's focus on innovation, coupled with a mature market for drones, contributes to its leading position in the global market share.

- For instance, in June 2024, Drone Delivery Canada (DDC) has signed several commercial contracts with a value of USD 417,000, to deploy drones at Edmondon International Airport (YEG). According to the contract conditions, DDC will expand the supply of specific paths in YEG through an additional drone pot in the medical clinic located in Albert's Leduc.

According to the drone data services industry, the European market has experienced significant development during the forecast period. Countries such the UK, Germany, and France are witnessing strong need for drone data services due to the growing need for precision in land surveying, infrastructure monitoring, and environmental management. Additionally, the Latin American market growth can be attributed to the introduction of drones in several applications, such as mapping, aviation surveys, and verification. Further, the agricultural sector is one of the leading adopters of drone services. Additionally, the growing need for drones in the construction sector applications, such as 2D and 3D modeling and mapping, land surveying, progress monitoring, and waste reduction, is propelling the regional market progression. Further, drones enable real-time insights, aid in workforce planning, and foster collaboration, without disrupting operations. Thus, on the above drone data services market analysis, these factors would further drive the regional market during the forecast period.

Top Key Players & Market Share Insights:

The global drone data services market is highly competitive with major players providing drone services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the drone data services industry include-

- Aerodyne Group (Malaysia)

- AgEagle Aerial Systems Inc. (U.S.)

- SenseFly (Switzerland)

- Sky Futures Ltd (U.K.)

- Terra Drone (Japan)

- Cyberhawk (U.K.)

- DroneDeploy (U.S.)

- Matternet (U.S.)

- Phoenix Drone Services LLC (U.S.)

- PrecisionHawk (U.S.)

Recent Industry Developments :

Partnership:

- In March 2023, Vodafone Group PLC announced the partnership with Dimetor, to introduce DRONET, to evaluate the risk of commercial drones in Germany. This innovative solution allows the company to provide mobile phone data to accelerate and increase the risk assessment of ground risks related to drone operation. This service makes the evaluation process faster, more effective and safer than anytime.

Drone Data Services Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 16,743.68 Million |

| CAGR (2025-2032) | 30.7% |

| By Service Type |

|

| By Platform |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Drone Data Services market? +

Drone Data Services Market Size is estimated to reach over USD 16,743.68 Million by 2032 from a value of USD 2,593.11 Million in 2024 and is projected to grow by USD 3,228.84 Million in 2025, growing at a CAGR of 30.7% from 2025 to 2032.

Which is the fastest-growing region in the Drone Data Services market? +

Asia-Pacific is the region experiencing the most rapid growth in the market. The regional growth can be attributed to the growth in commercial sector and enhancements in policy frameworks about using drones in commercial applications.

What specific segmentation details are covered in the Drone Data Services report? +

The drone data services report includes specific segmentation details for service type, platform, application, and end user, and region.

Who are the major players in the Drone Data Services market? +

The key participants in the market are Aerodyne Group (Malaysia), AgEagle Aerial Systems Inc. (U.S.), Cyberhawk (U.K.), DroneDeploy (U.S.), Matternet (U.S.), Phoenix Drone Services LLC (U.S.), PrecisionHawk (U.S.), SenseFly (Switzerland), Sky Futures Ltd (U.K.), Terra Drone (Japan), and others.