Electro Hydraulic Servo Valve Market Size:

Electro Hydraulic Servo Valve Market size is estimated to reach over USD 5.73 Billion by 2032 from a value of USD 4.43 Billion in 2024 and is projected to grow by USD 4.50 Billion in 2025, growing at a CAGR of 3.3% from 2025 to 2032.

Electro Hydraulic Servo Valve Market Scope & Overview:

An electro hydraulic servo valve is a precision control component used to regulate the flow and pressure of hydraulic fluid based on electronic input signals. It plays a key role in closed-loop control systems where accurate positioning, speed, or force is required. These valves convert low-power electrical signals into precise mechanical movements, which control the hydraulic actuator or motor in real time.

The typical structure includes torque motors, flapper-nozzle assemblies, spool valves, and feedback mechanisms. Depending on the design, some models integrate onboard electronics for signal processing, while others rely on external controllers. They are used in systems where high responsiveness and fine-tuned hydraulic performance are necessary. The valves are compatible with single-stage or two-stage configurations and can be customized for specific load and flow conditions.

Electro hydraulic servo valve systems are critical to operations where consistent motion control under variable loads is essential. End-users include aerospace system integrators, industrial automation specialists, and testing equipment manufacturers who require reliable and precise fluid control in dynamic applications.

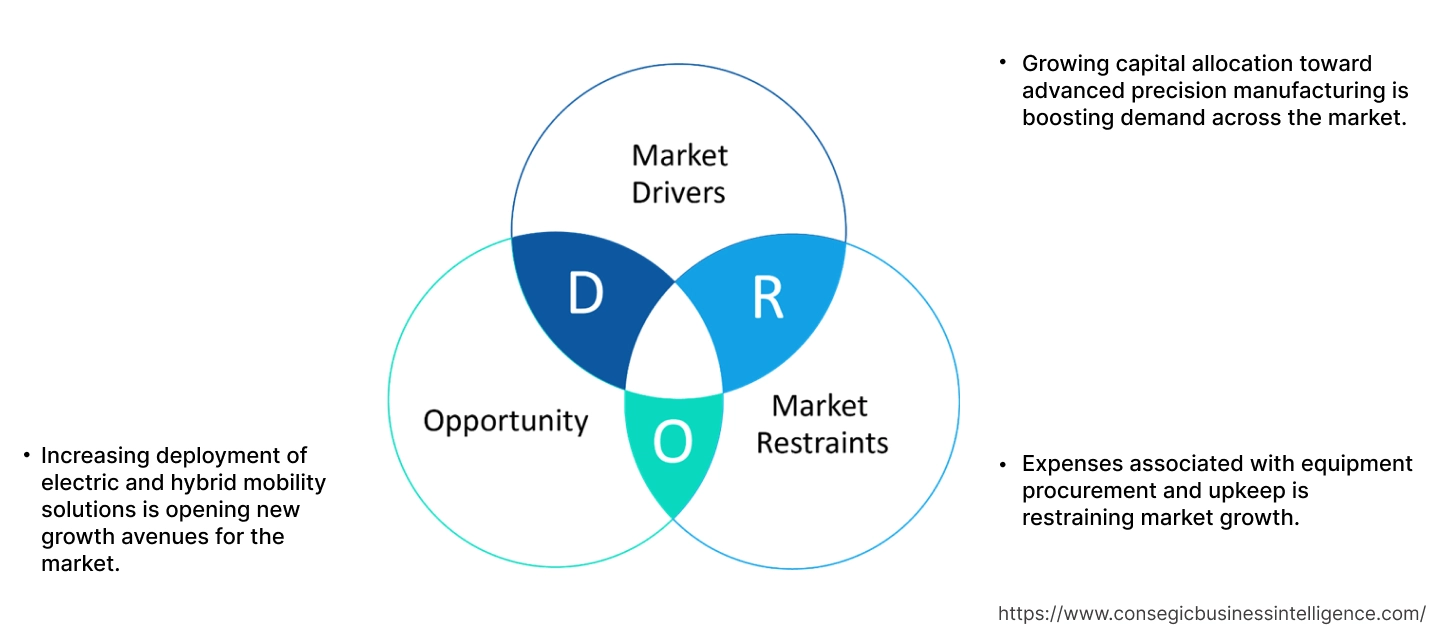

Electro Hydraulic Servo Valve Market Dynamics - (DRO) :

Key Drivers:

Growing capital allocation toward advanced precision manufacturing is boosting demand across the market.

High-end manufacturing systems are broadly used across industries like aerospace, automotive, and heavy machinery. These valves play a crucial role in ensuring the precision and reliability required for automated systems, such as robotics, automated assembly lines, and high-performance industrial machines. In industries where quality and repeatability are essential, electro hydraulic servo valves provide the necessary control to optimize production processes. As manufacturers continue to modernize their operations with advanced automation technologies, the need for more accurate and efficient hydraulic systems grows. This shift toward automation in sectors that rely on accuracy is creating significant demand for electro hydraulic servo valves, which are integral in ensuring operational efficiency and enhancing system performance. As industries embrace smarter production processes, the adoption of these high-tech valves will continue to grow, significantly propelling market progress.

Key Restraints:

Expenses associated with equipment procurement and upkeep is restraining market growth.

These valves are constructed with advanced technologies and high-quality materials, which make them expensive to produce. The initial investment required for these systems is substantial, and maintenance costs add to the overall expense. Companies with financial constraints may opt for cheaper, less advanced alternatives, reducing the overall market growth. For small and medium-scale enterprises (SMEs), particularly in emerging markets, the cost of acquiring and maintaining these valves can be prohibitive. Since electro-hydraulic valves are used in high-performance systems, they require frequent servicing and repairs to ensure optimal functionality. This increases the overall operating costs for companies, especially those with limited budgets. For many industries or businesses in developing economies, the high upfront and operational costs associated with electro-hydraulic servo valves may outweigh their benefits, restricting their adoption and limiting the market's potential.

Future Opportunities :

Increasing deployment of electric and hybrid mobility solutions is opening new growth avenues for the market.

The usage of these valves in the electric vehicle (EV) and hybrid vehicle markets presents a significant opportunity for the market. These valves play a critical role in the precise control of various systems within EVs and hybrid vehicles, including braking mechanisms, suspension systems, and energy recovery systems. As automakers invest heavily in EV technology, electro-hydraulic servo valves are becoming essential for ensuring safety, performance, and energy efficiency. In particular, these valves are used to optimize vehicle dynamics, improve comfort, and enhance the driving experience. The demand for advanced solutions to manage battery systems, regenerative braking, and suspension control is increasing, creating an opportunity for manufacturers to innovate and supply specialized valves tailored to the growing needs of the electric vehicle industry. As the market for EVs and hybrids continues to expand, the demand for electro-hydraulic valves will increase, providing significant global electro hydraulic servo valve market opportunities.

Electro Hydraulic Servo Valve Market Segmental Analysis :

By Type:

Based on Type, the market is segmented into Nozzle Flapper Servo Valve, Jet Pipe Servo Valve, and Direct Drive Servo Valve.

The Nozzle Flapper Servo Valve segment holds the largest revenue of the overall Electro Hydraulic Servo Valve Market share in the year 2024.

- Nozzle flapper valves are the most commonly used design, known for their high sensitivity, precise control, and long service history in aerospace and industrial applications.

- These valves are cost-effective and widely adopted in closed-loop hydraulic systems requiring moderate response speed and accuracy.

- Their simple yet robust design offers reliable performance in environments with moderate contamination and thermal variations.

- According to the electro hydraulic servo valve market analysis, due to their proven track record and adaptability in diverse sectors, nozzle flapper servo valves account for the largest market share, fueling the global electro hydraulic servo valve market expansion.

The Direct Drive Servo Valve segment is expected to grow at the fastest CAGR during the forecast period.

- Direct drive servo valves eliminate intermediate mechanical linkages, offering high response speed, reduced hysteresis, and lower energy loss.

- These valves are increasingly used in precision applications including robotics, injection molding, CNC machining, and advanced aerospace systems.

- Improved electronics integration and digital control capabilities enable better system diagnostics, configurability, and closed-loop control.

- As per the market analysis, with the end-users transitioning toward high-performance and low-maintenance servo systems, the direct drive segment is expected to grow, propelling the global electro hydraulic servo valve market opportunities.

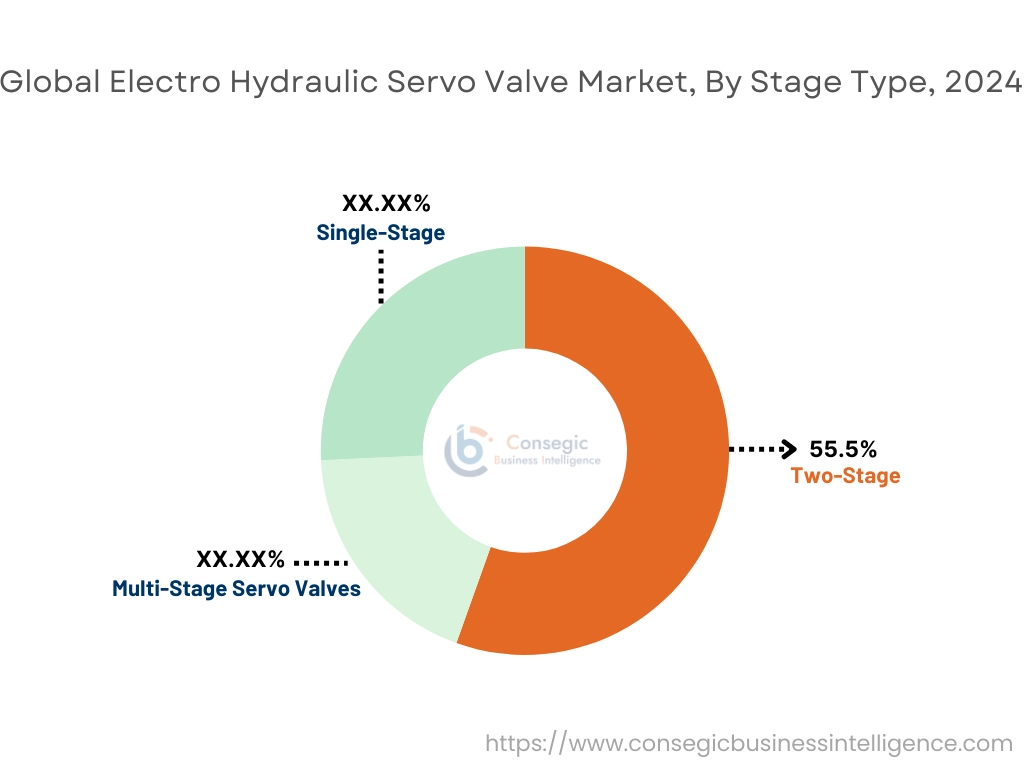

By Stage Type:

Based on Stage Type, the market is segmented into Single-Stage, Two-Stage, and Multi-Stage Servo Valves.

The Two-Stage segment holds the largest revenue of the overall Electro Hydraulic Servo Valve Market share of 55.5% in the year 2024.

- Two-stage servo valves are widely adopted in applications requiring high flow rates and dynamic force control, including aerospace, automotive testing, and metal forming.

- These systems use pilot valves to control the main spool, allowing efficient operation at higher load pressures and flow capacities.

- Their modular design and ability to deliver fine force modulation make them the preferred choice for high-precision industrial machinery.

- According to the electro hydraulic servo valve market analysis, due to their performance versatility and use in mission-critical industries, two-stage servo valves represent the largest segment, significantly fueling the electro hydraulic servo valve market growth.

The Single-Stage segment is expected to grow at the fastest CAGR during the forecast period.

- Single-stage servo valves are compact, lightweight, and suited for low-to-medium pressure applications in robotics, medical systems, and compact actuation environments.

- These valves offer a simplified mechanical configuration with lower response latency and improved energy efficiency.

- Their integration into mobile equipment, lightweight UAVs, and compact hydraulic systems is accelerating as industries miniaturize components.

- The rising trend for compact, energy-efficient designs, the single-stage segment is projected to grow, substantially driving the electro hydraulic servo valve market demand.

By Application:

Based on Application, the market is segmented into Aerospace & Defense, Industrial Machinery, Oil & Gas, Automotive, and Others.

The Aerospace & Defense segment holds the largest revenue share of the overall Electro Hydraulic Servo Valve Market in the year 2024.

- Electro hydraulic servo valves are extensively used in flight control systems, missile guidance units, and aircraft actuation subsystems due to their precise force modulation.

- These valves support mission-critical operations by providing fail-safe redundancy and vibration-resistant actuation in high-G environments.

- Defense procurement programs and commercial aircraft production maintain consistent need for reliable, lightweight servo actuation systems.

- Thus, their strategic importance and regulatory alignment, aerospace & defense applications account for the largest market segment, significantly driving the electro hydraulic servo valve market trends.

The Industrial Machinery segment is expected to grow at the fastest CAGR during the forecast period.

- The rise in advanced automation, high-speed assembly systems, and smart manufacturing is driving rapid adoption of servo valves in industrial applications.

- Servo valves are used in presses, forming machines, injection molding equipment, and robotic arms for precise pressure and position control.

- Integration with industrial control systems, condition monitoring software, and predictive analytics platforms is increasing operational efficiency.

- According to the market analysis, the shifting trend of industrial automation is significantly fueling the global electro hydraulic servo valve market expansion.

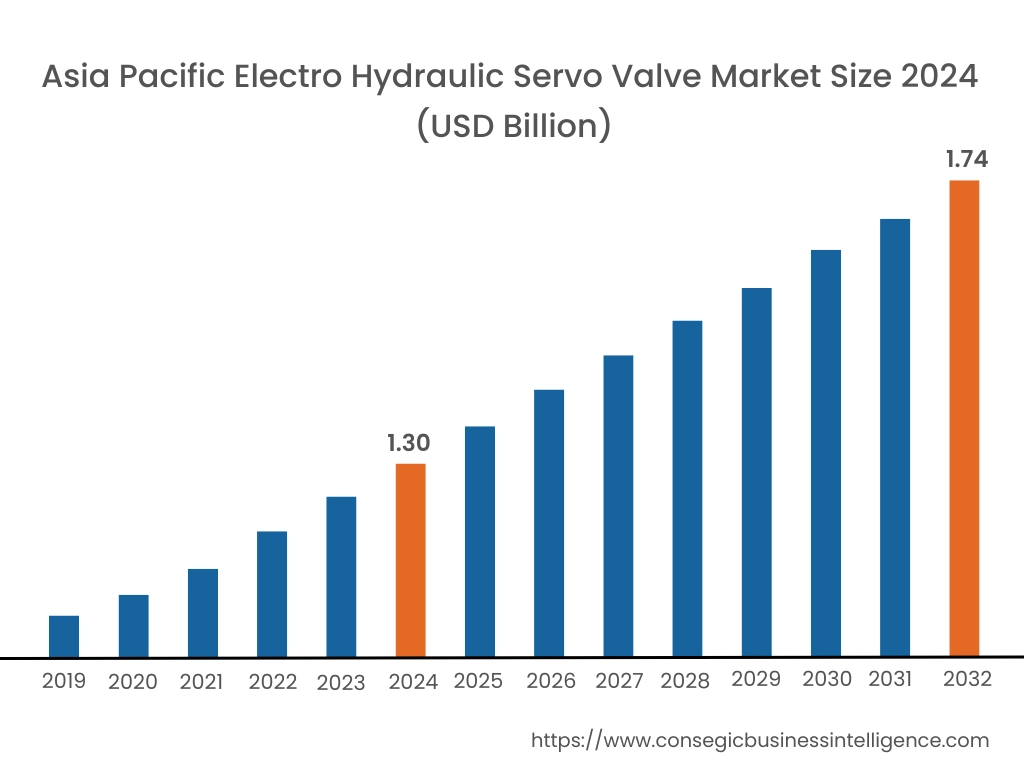

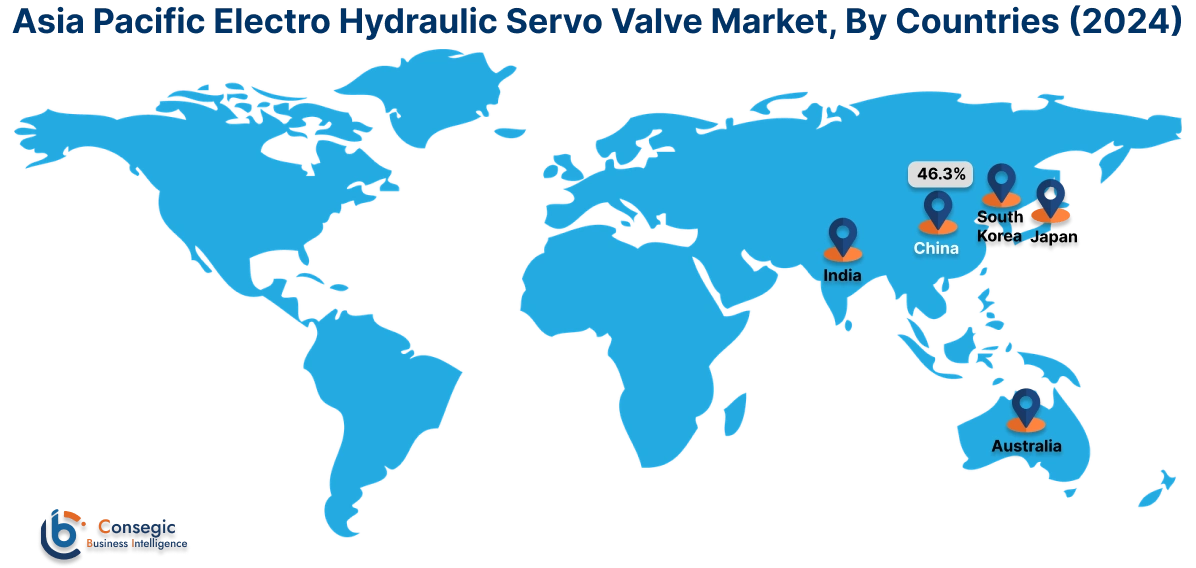

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 1.30 Billion in 2024. Moreover, it is projected to grow by USD 1.33 Billion in 2025 and reach over USD 1.74 Billion by 2032. Out of this, China accounted for the maximum revenue share of 46.3%.

Asia-Pacific’s surge in industrial automation and railway electrification projects is propelling the market. China leads with high-speed rail and heavy manufacturing upgrades, and Japan follows by integrating servo valves into precision machining centers. A notable trend involves development of compact, on-board electronics servo valves for machine-tool applications and the evolution of two-stage linear motors paired with position-feedback loops for high-speed control have boosted market growth.

- For instance, in April 2024, Aeronautical Development Agency (ADA), under the Defence Research and Development Organisation (DRDO), delivered the first batch of indigenous Leading Edge Actuators and Airbrake Control Modules to Hindustan Aeronautics Limited (HAL) for integration into the LCA Tejas Mk1A fighter aircraft. These components, developed in collaboration with the Research Centre Imarat (RCI) and the Central Manufacturing Technology Institute (CMTI) feature advanced servo-valve-based electro-hydraulic actuators and control modules and are essential for the aircraft's secondary flight control systems.

Analysis of the market showed that cross-border supply-chain collaborations support timely customization and part availability, significantly driving the electro hydraulic servo valve market demand.

North America is estimated to reach over USD 1.86 Billion by 2032 from a value of USD 1.47 Billion in 2024 and is projected to grow by USD 1.49 Billion in 2025.

North America is experiencing increased aerospace and defense modernization and industrial automation adoption that drive the market. The United States spearheads strategic military and commercial aircraft refurbishments, and Canada follows with robotics and heavy-machinery automation initiatives. Additionally, the integration of electronic feedback modules in spool valves for real-time position control, and digital bus interfaces enabling remote diagnostics and predictive maintenance propel market development. Furthermore, analysis of the market showed that defense procurement cycles and industrial mechanization programs underpin equipment upgrades and OEM-contractor collaborations are refining valve specifications to regional application requirements, substantially driving the electro hydraulic servo valve industry in this region.

Europe’s push toward Industry 4.0 and stringent environmental regulations in manufacturing plants are accelerating the electro hydraulic servo valve market. Germany sets the pace with automotive and energy-sector automation, and the United Kingdom follows through on offshore wind and rail infrastructure projects. One significant trend emphasizes adoption of modular servo valves with ISO-standard cavities for flexible system integration, and another trend spotlights telematics-enabled valve controls that reduce unscheduled downtime. Furthermore, analysis of the market showed that EU sustainability grants and factory digitalization strategies drive product innovation, significantly boosting the electro hydraulic servo valve market in this region.

Middle East & Africa is witnessing energy-sector modernization and urban development programs that fuel the market. Saudi Arabia invests in petrochemical plant automation, the United Arab Emirates focuses on power-generation infrastructure, and South Africa upgrades mining-machinery control systems. Additionally, the use of high-reliability servo valves in offshore platform control circuits and the deployment of valve-monitoring solutions in gas-turbine test beds are some of the trends propelling market growth. Analysis of the market showed that sovereign-wealth–funded energy projects and technical training partnerships shape procurement strategies, fueling the electro hydraulic servo valve market in this region.

Latin America’s infrastructure refurbishment and resource-extraction modernization are driving the electro hydraulic servo valve market. Brazil leads with sugarcane-processing and mining-equipment automation, and Chile follows with copper-mine hoists and pump control systems. Trends focusing on retrofitting legacy hydraulic systems with digital servo valves for improved process accuracy, and integration of temperature and pressure feedback sensors for remote operation drive market progress. Furthermore, the public-private infrastructure funding and OEM-local distributor alliances support market penetration, sustainability propelling electro hydraulic servo valve market growth in this region.

Top Key Players and Market Share Insights:

The Electro Hydraulic Servo Valve Market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global Electro Hydraulic Servo Valve Market. Key players in the Electro Hydraulic Servo Valve industry include -

- Moog Inc. (USA)

- Bosch Rexroth AG (Germany)

- Woodward, Inc. (USA)

- MTS Systems Corporation (USA)

- Danfoss A/S (Denmark)

- Parker Hannifin Corporation (USA)

- Eaton Corporation plc (Ireland)

- Honeywell International Inc. (USA)

- Duplomatic MS S.p.A. (Daikin Group) (Italy)

- YUKEN KOGYO CO., LTD. (Japan)

Recent Industry Developments :

Partnerships and Collaborations:

- In June 2023, Domin Fluid Power, a UK-based innovator in hydraulic systems, adopted Renishaw's advanced RenAM 500Q Ultra metal additive manufacturing (AM) system to enhance the production of its servo hydraulic valves. This strategic move aims to meet the increasing demand for high-performance, energy-efficient hydraulic components across industries such as automotive, aerospace, and manufacturing.

Electro Hydraulic Servo Valve Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 5.73 Billion |

| CAGR (2025-2032) | 3.3% |

| By Type |

|

| By Stage Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Electro Hydraulic Servo Valve Market? +

Electro Hydraulic Servo Valve Market size is estimated to reach over USD 5.73 Billion by 2032 from a value of USD 4.43 Billion in 2024 and is projected to grow by USD 4.50 Billion in 2025, growing at a CAGR of 3.3% from 2025 to 2032.

What specific segments are covered in the Electro Hydraulic Servo Valve Market? +

The Electro Hydraulic Servo Valve Market specific segments for Type, Stage Type, Application, and Region.

Which is the fastest-growing region in the Electro Hydraulic Servo Valve Market? +

Asia pacific is the fastest growing region in the Electro Hydraulic Servo Valve Market.

What are the major players in the Electro Hydraulic Servo Valve Market? +

The key players in the Electro Hydraulic Servo Valve Market are Moog Inc. (USA), Bosch Rexroth AG (Germany), Parker Hannifin Corporation (USA), Eaton Corporation plc (Ireland), Honeywell International Inc. (USA), Duplomatic MS S.p.A. (Daikin Group) (Italy), YUKEN KOGYO CO., LTD. (Japan), Woodward, Inc. (USA), MTS Systems Corporation (USA), Danfoss A/S (Denmark), and others.