Fintech As A Service Market Size:

Fintech As A Service Market size is estimated to reach over USD 1,439.57 Billion by 2032 from a value of USD 354.57 Billion in 2024 and is projected to grow by USD 416.28 Billion in 2025, growing at a CAGR of 16.78% from 2025 to 2032.

Fintech As A Service Market Scope & Overview:

Fintech as a Service (FaaS) refers to the financial technologies provided as services to customers by offering financial products or services through software. Also, the services enable businesses to embed financial services, such as payments, compliance, and virtual accounts, into their existing platforms through API-based infrastructure. Additionally, the key advantages including enhanced customer experience, scalability, convenience, and increased transparency, among others are driving the fintech as a service market growth. Further, the digital transformation is paving the way for fintech as a service market demand. Furthermore, the rising need to navigate complex regulatory environments is driving the fintech as a service industry.

Impact of AI on Fintech As A Service Market:

AI is driving major advancements in the Fintech as a Service (FaaS) market by improving efficiency, security, and customer experience. It helps automate financial processes like risk assessment, fraud detection, and credit scoring, making them faster and more accurate. AI also enables personalized financial services by analyzing user behavior and preferences. In payment processing and lending platforms, AI ensures smoother operations and better decision-making. It also strengthens cybersecurity by detecting unusual patterns and preventing threats in real time. As fintech solutions become more data-driven and customer-focused, AI is essential in helping service providers offer smarter, more scalable, and secure financial tools, accelerating the overall growth of the FaaS market.

Fintech As A Service Market Dynamics - (DRO) :

Key Drivers:

Surging Adoption of Digital Financial Solutions is Boosting Market Growth for Fintech As A Service

The increasing demand for digital banking and financial services due to growing digital technologies is paving the way for fintech as a service market growth. Additionally, the primary factors such as rapid digitization, changing customer preferences, and increasing support of investors and regulators are boosting the fintech as a service market demand. Further, the proliferation of mobile apps, e-payment systems, and others is driving the market progress.

- For instance, in August 2023, The Indian government aims to contribute USD 2 million to the Africa Digital Financial Inclusion Facility for the progress of digital financial solutions and accelerate financial inclusion in Africa.

Therefore, the increasing demand for digital banking and financial services is driving the adoption of FinTech services, in turn, proliferating the development of the market.

Key Restraints :

Increased Risk of Fraud and Data Privacy Concerns is Restraining the Market Growth

FaaS relies on integrating with third-party providers, creating potential exposure to exploitation of customers' data, including financial and personal information, in turn hindering the fintech as a service market expansion. Additionally, the rising cyber criminals due to expanding digital payment methods is restraining the market progress. Further, the speed and irreversibility of instant payments due to a lack of awareness and knowledge are attracting cyber criminals, which in turn is hindering the market evolution.

Therefore, the increasing cyber fraud and data privacy concerns are hindering the fintech as a service market expansion.

Future Opportunities :

Technological Advancement is Expected to Promote Potential Opportunities for Market Growth

The businesses are leveraging advanced technologies such as web3 technology, blockchain, artificial intelligence (AI), and others for the strategic development of business, which in turn is paving the way for fintech as a service market opportunities. Further, the technologies enhance fraud detection, personalize financial advice, and automate tasks such as customer service through chatbots is driving the market progress.

- For instance, in December 2024, Future Fintech Group Inc. expanded the company's blockchain business division for development as well as the execution of its strategic growth plan. Additionally, the division aims to leverage technologies such as web3 technology, blockchain, artificial intelligence (AI), and others for a strategic growth plan.

Hence, the rising adoption of advanced technologies is anticipated to increase the utilization of services, in turn promoting prospects for fintech as a service market opportunities during the forecast period.

Fintech As A Service Market Segmental Analysis :

By Type:

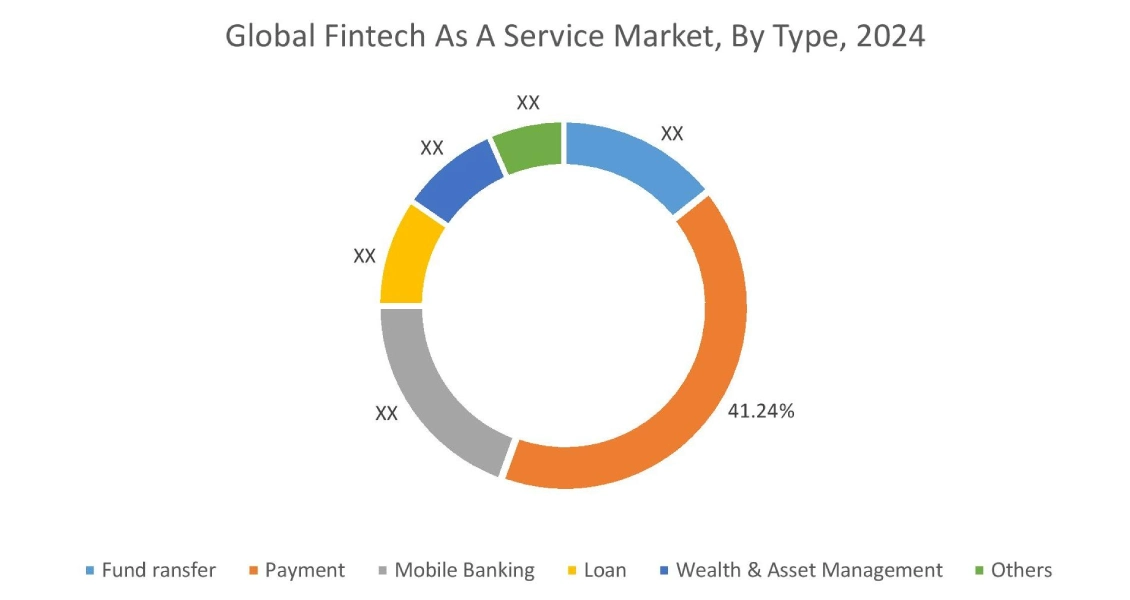

Based on the type, the market is segmented into fund transfer, payment, mobile banking, loan, wealth & asset management, and others.

Trends in the Type:

- The integration of mobile banking with other digital services is driving the fintech as a service market trends.

- The rising adoption of buy now pay later (BNPL) platforms is driving the demand for the payment segment, which in turn is boosting the fintech as a service market trends.

Payment accounted for the largest revenue share of 41.24% in the year 2024.

- The proliferation of UPI, digital wallets, POS, and other payment solutions is driving the fintech as a service market share.

- Additionally, the expanding e-commerce industry and digital checkout system are fueling the need for a payment gateway, which in turn boosts the fintech as a service market size.

- Further, the government initiatives to promote a cashless economy and innovations in cross-border payment are boosting the market progress.

- For instance, in May 2025, BharatPe launched Resilient Payments Private Limitedwith the authorization of the Reserve Bank of India as an Online Payment Aggregator. The company aims to provide operational discipline, uphold transparency, and stay aligned with regulatory expectations.

- Thus, according to the fintech as a service market analysis, the proliferation of UPI, digital wallets, POS, and other payment solutions is driving the market progress.

Mobile Banking is anticipated to register the fastest CAGR during the forecast period.

- The banks are focusing on providing robust security measures to build customer trust, which in turn is boosting the adoption of mobile banking.

- Additionally, advantages of mobile banking including enhanced financial management, improved customer support, security, and cost-effectiveness, are driving the fintech as a service market share.

- Further, mobile banking eliminates the need to visit a physical bank, in turn providing convenience and accessibility to customers is boosting the fintech as a service market size.

- Therefore, as per the market analysis, the aforementioned factors are anticipated to boost the market during the forecast period.

By Technology:

Based on the technology, the market is segmented into artificial intelligence (AI), blockchain, application programming interface (API), robotic process automation (RPA), and others.

Trends in the Technology:

- The proliferation of DeFi 2.0, which offers capital efficiency, risk reduction, and interoperability features, is driving the need for blockchain technology.

- The rising adoption of AI-powered credit scoring integrated into various platforms is boosting the need for robotic process automation (RPA).

Blockchain accounted for the largest revenue share in the year 2024.

- Blockchain technology is poised to accelerate the adoption of FaaS due to enhanced efficiencies and increased security.

- Additionally, the rising adoption of blockchain technology for KYC/AML compliance due to enhanced security and integration of decentralized identifiers into banking apps is boosting the market progress.

- Further, the rising need for cross-border payments and settlements is driving the adoption of blockchain technology.

- For instance, in October 2024, DBS launched Token Servicesbased on blockchain to unlock new transaction banking capabilities and operate efficiencies for institutional clients.

- Thus, according to the fintech as a service market analysis, the rising adoption of blockchain technology for cross-border settlements and adhering to compliance is driving the market development.

Artificial Intelligence (AI) is anticipated to register the fastest CAGR during the forecast period. >

- The rising need for automation and personalization in financial services is boosting the adoption of AI.

- Additionally, the key benefits of integrating AI into FaaS include reduced operational costs, fraud prevention, and more, which in turn is boosting the market progress.

- Further, AI is revolutionizing fraud detection, customer service, and personalization among others in FaaS.

- Therefore, as per the market analysis, the rising need for automation and personalization is anticipated to boost the market during the forecast period.

By Application:

Based on the application, the market is segmented into KYC authentication, fraud management, regulatory and compliance support, and others.

Trends in the Application:

- The rising adoption of transaction monitoring platforms for fraud management applications is boosting the market trends.

- Trend towards the integration of FaaS with national identity systems is propelling the progress of KYC authentication applications.

Regulatory and Compliance Support accounted for the largest revenue share in the year 2024.

- The complex and global regulations as well as increasing digital audit trials are propelling the adoption of regulatory and compliance support applications for real-time compliance tracking and reporting automation is driving the market progress.

- Additionally, the rise in digital banking is propelling the need for regulatory and compliance support applications.

- Further, the increased exposure to regulatory requirements, sanctions, and legal actions is driving the market adoption of regulatory and compliance support.

- Thus, as per the market analysis, the complex and global regulations and increasing digital audit trials are driving the market progress.

Fraud Management is anticipated to register the fastest CAGR during the forecast period.

- The rising prevalence of digital transactions is propelling the need to protect user trust and meet compliance is driving the market progress.

- Additionally, the proliferation of e-commerce and online retail are boosting the market progress.

- Further, the integration of AI and machine learning capabilities into the fraud detection system is propelling the market progress.

- For instance, in February 2025, Mastercard partnered with Feedzai, aiming to protect consumer data and businesses from scams by leveraging Feedzai’s advanced fraud platform.

- Therefore, as per the market analysis, the integration of AI and machine learning capabilities is anticipated to boost the market during the forecast period.

By End-User:

Based on the end user, the market is segmented into banks, financial institutions, and insurance companies.

Trends in the End User:

- The rising need for API-based fintech tools and open banking regulations, which allow financial institutions to access alternative data sources, is driving the market trends.

Insurance Companies accounted for the largest revenue share in the year 2024.

- Insurance companies leverage the capability of FinTech services to leverage data insights for improved product offerings and marketing strategies.

- Additionally, the rising cybersecurity concerns are paving the way for market adoption by insurance companies to protect customers' sensitive data from hackers.

- Further, the rising adoption of advanced technologies such as Internet of Things, telematics, big data, machine learning, artificial intelligence, and distributed ledger technology, and others, is boosting the market adoption by insurance companies.

- Thus, as per the market analysis, the aforementioned factors are driving the market progress.

Financial Institutions are anticipated to register the fastest CAGR during the forecast period.

- The push for digital transformation, as well as the need to meet evolving customer requirements, is driving the market adoption by financial institutions.

- Additionally, the technological developments and the changing expectations of customers are paving the way for the need for services in financial institutions.

- Further, the proliferation of banking-as-a-platform, embedded finance, and green fintech initiatives is propelling the market adoption by financial institutions.

- Therefore, technological advancement and integration with services are anticipated to boost the market during the forecast period.

Regional Analysis:

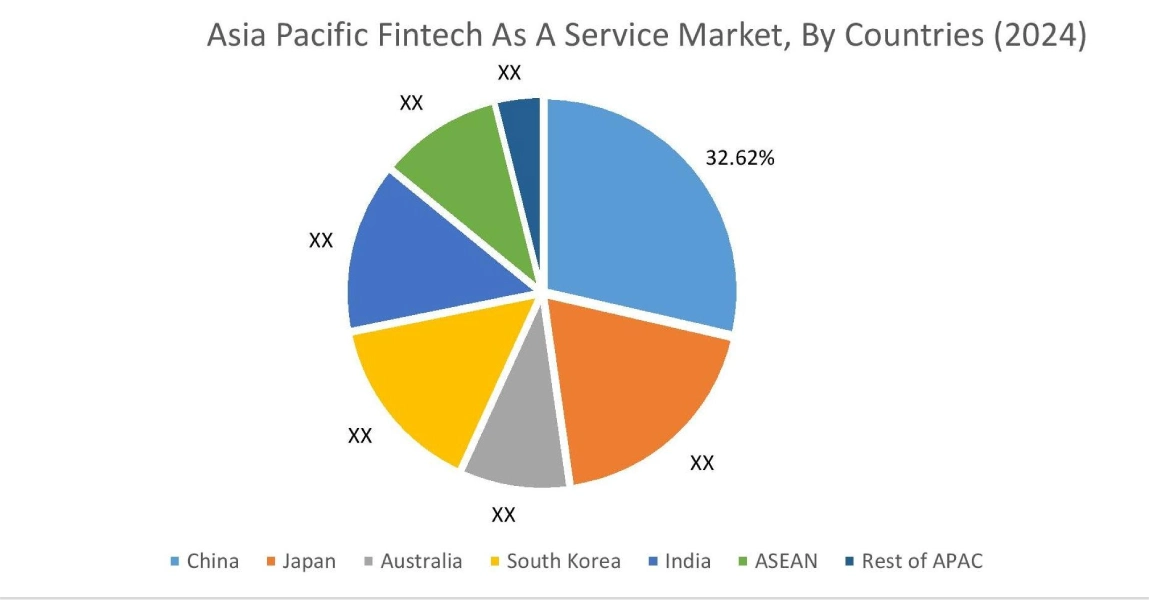

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

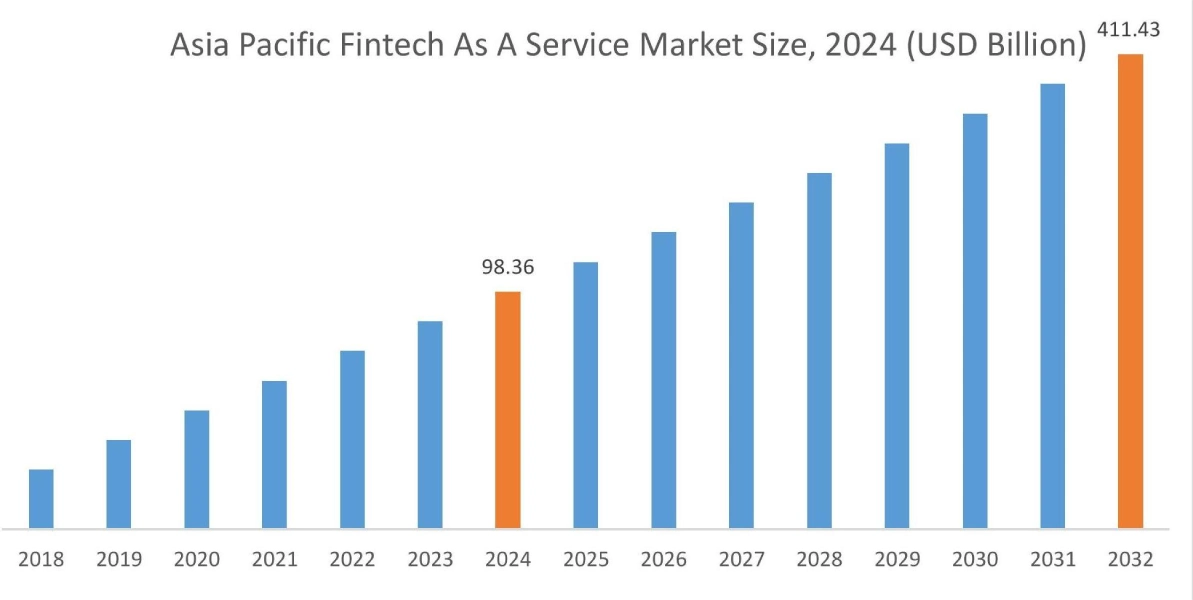

The Asia Pacific region was valued at USD 98.36 Billion in 2024. Moreover, it is projected to grow by USD 115.77 Billion in 2025 and reach over USD 411.43 Billion by 2032. Out of this, China accounted for the maximum revenue share of 32.62%. The market progress is mainly driven by increasing digital transformation across financial services. Furthermore, factors including the rising penetration of internet services, smartphone usage, and demand for streamlined financial operations are projected to drive the market progress in the Asia Pacific region during the forecast period.

- For instance, in January 2025, according to PIB India, the digital payment revolution record hit of 16.73 billion transactions in December 2024, in turn paving the way for market adoption.

North America is estimated to reach over USD 454.33 Billion by 2032 from a value of USD 110.98 Billion in 2024 and is projected to grow by USD 130.38 Billion in 2025. The North American region's rising need for high-speed internet and advanced payment systems offers lucrative growth prospects for the market. Additionally, the integration of blockchain technology as well as the adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) are driving the market progress.

- For instance, in May 2024, MoonPay integrated with PayPal to offer a seamless crypto purchasing experience for all PayPal users in the U.S. with benefits such as seamless onboarding, convenience, and speed, among others.

The regional analysis depicts that the increasing demand for digital payments is driving the market in Europe. Additionally, the key factor driving the market is the increasing digital adoption, as well as government support towards fintech development is propelling the market adoption in the Middle East and African region. Further, the widespread internet and smartphone adoption and the growing e-commerce sector are paving the way for the progress of the market in the Latin American region.

Top Key Players & Market Share Insights:

The global fintech as a service market is highly competitive with major players providing fintech as a service to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the fintech as a service industry. Key players in the fintech as a service market include-

- Rapyd Financial Network Ltd.(UK)

- Mastercard(USA)

- Revolut (UK)

- Fispan (Canada)

- Solid Financial Technologies, Inc. (USA)

- Fiserv(USA)

- FIS (USA)

- PayPal (USA)

- Nium (Singapore)

- Adyen (Netherlands)

Recent Industry Developments :

Expansions

- In January 2025, WeBank Technology Services expanded its services offering in Hong Kong. The development aims to focus on digital banking infrastructure and digital transformation to seize global prospects in digital development.

Fintech As A Service Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,439.57 Billion |

| CAGR (2025-2032) | 16.78% |

| By Type |

|

| By Technology |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the fintech as a service market? +

The fintech as a service market size is estimated to reach over USD 1,439.57 Billion by 2032 from a value of USD 354.57 Billion in 2024 and is projected to grow by USD 416.28 Billion in 2025, growing at a CAGR of 16.78% from 2025 to 2032.

Which segmentation details are covered in the fintech as a service report? +

The fintech as a service report includes specific segmentation details for type, technology, application, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the fintech as a service market, fraud management is the fastest-growing segment during the forecast period due to the integration of AI and machine learning capabilities.

Who are the major players in the fintech as a service market? +

The key participants in the fintech as a service market are Rapyd Financial Network Ltd. (UK), Mastercard (USA), Fiserv (USA), FIS (USA), PayPal (USA), Nium (Singapore), Adyen (Netherlands), Revolut (UK), Fispan (Canada), Solid Financial Technologies, Inc. (USA), and others.

What are the key trends in the fintech as a service market? +

The fintech as a service market is being shaped by several key trends including the proliferation of DeFi 2.0, as well as the rising adoption of buy now pay later (BNPL) platforms.