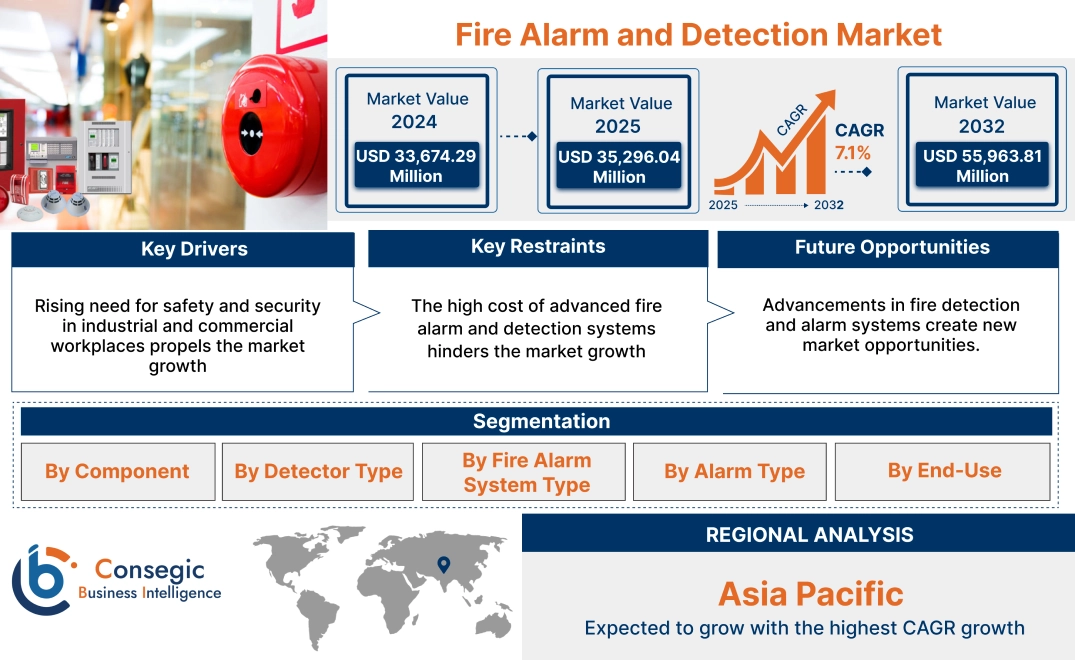

Fire Alarm and Detection Market Size:

Fire Alarm and Detection Market size is estimated to reach over USD 55,963.81 Million by 2032 from a value of USD 33,674.29 Million in 2024 and is projected to grow by USD 35,296.04 Million in 2025, growing at a CAGR of 7.1% from 2025 to 2032.

Fire Alarm and Detection Market Scope & Overview:

Fire alarm and detection systems are incorporated into buildings to detect heat, smoke, and flames to alert occupants and security or emergency forces. This helps to take appropriate actions before severe property and life damage. This comprises fire detection with sensors, initiating devices, audio and notification devices, manual call points, workstations, software for installation, management, and monitoring, along with maintenance services among others. These systems are widely installed and utilized in commercial, residential, and industrial buildings.

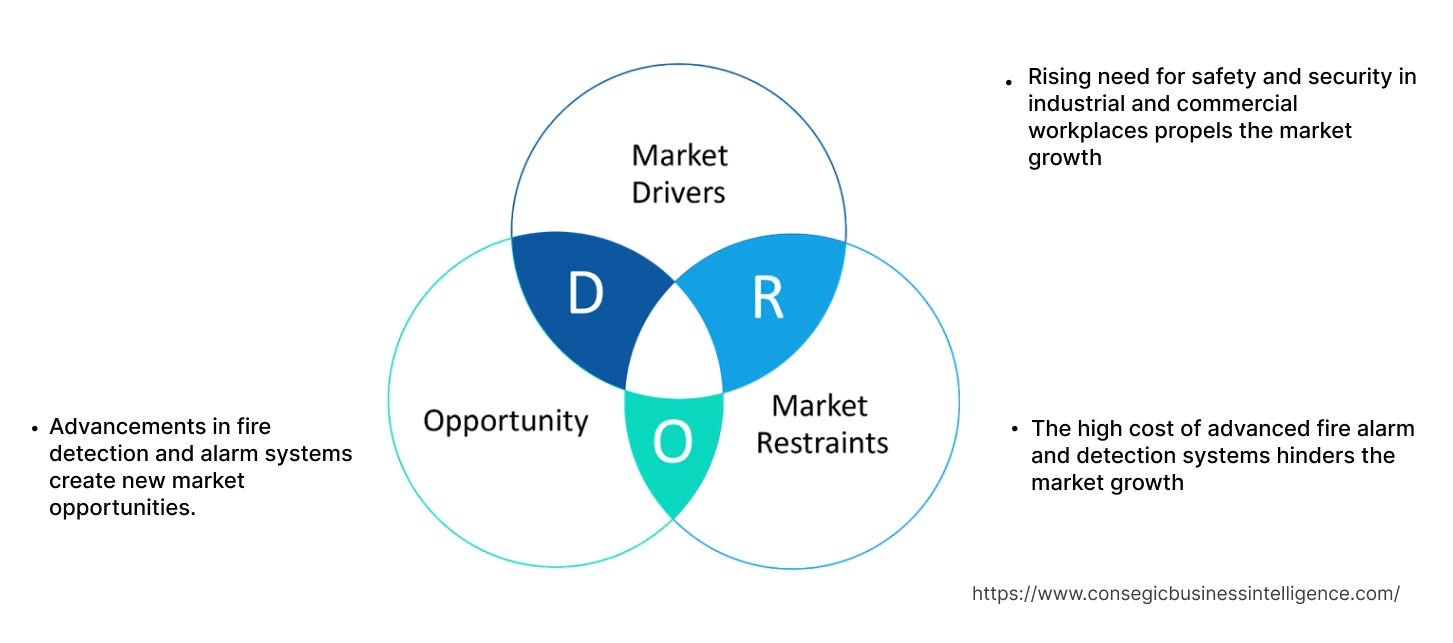

Fire Alarm and Detection Market Dynamics - (DRO) :

Key Drivers:

Rising need for safety and security in industrial and commercial workplaces propels the market growth

The wide expansion of industries such as manufacturing, oil and gas, logistics, and commercial places such as malls, airports, and corporates among others, require fire safety systems. Moreover, governments and regulatory bodies worldwide are also enforcing strict fire safety standards in industrial and commercial workplaces. Thus, the increased awareness about fire hazards and the potential loss of life and property are pushing these workplaces to adopt fire detection and alarm systems. These systems help in the detection of the earliest signs of fire, giving adequate time to evacuate and rescue occupants in case of emergencies.

- For instance, in August 2022, Honeywell HBT launched a Morley MAx fire detection and alarm system. This system comprises a control panel with user-friendly features and it is ideal for application in commercial spaces among others.

Thus, as per the market analysis, the aforementioned factors are driving the fire alarm and detection market growth.

Key Restraints:

The high cost of advanced fire alarm and detection systems hinders the market growth

Large buildings or complexes need more advanced fire detection and alarm systems to ensure early detection, source detection, and notifying emergency forces of a potential fire.

Moreover, fire alarms and detectors for such projects are costly due to several factors such as significant installation cost, labor, maintenance, testing, system types and integration complexity, equipment quality, and advanced sensors, and technologies, among others. Thus, the market analysis shows that the high cost associated with advanced fire alarm and detection systems is limiting the fire alarm and detection market demand.

Future Opportunities :

Advancements in fire detection and alarm systems create new market opportunities.

There are several technological advancements in the fire detection and alarm system including remote monitoring and control, integrated systems, cloud-based fire alarm systems, smart fire alarm systems, and others. In remote monitoring and control, a central location monitors all the systems, allowing better management and control. Integrated systems include the interconnection of building systems with fire detection and alarm systems for quicker response and communication. Cloud systems give remote access to data by storing it in the cloud, and assist in real-time decision-making.

- For instance, in September 2024, Johnson Controls announced the launch of cloud-based data hosting infrastructure. It gives remote access to data of fire alarm control panels.

These new advancements ensure quicker response times, minimal false alarms, fewer maintenance costs, and improved safety. Thus, the aforementioned factors are projected to drive fire alarm and detection market opportunities.

Fire Alarm and Detection Market Segmental Analysis :

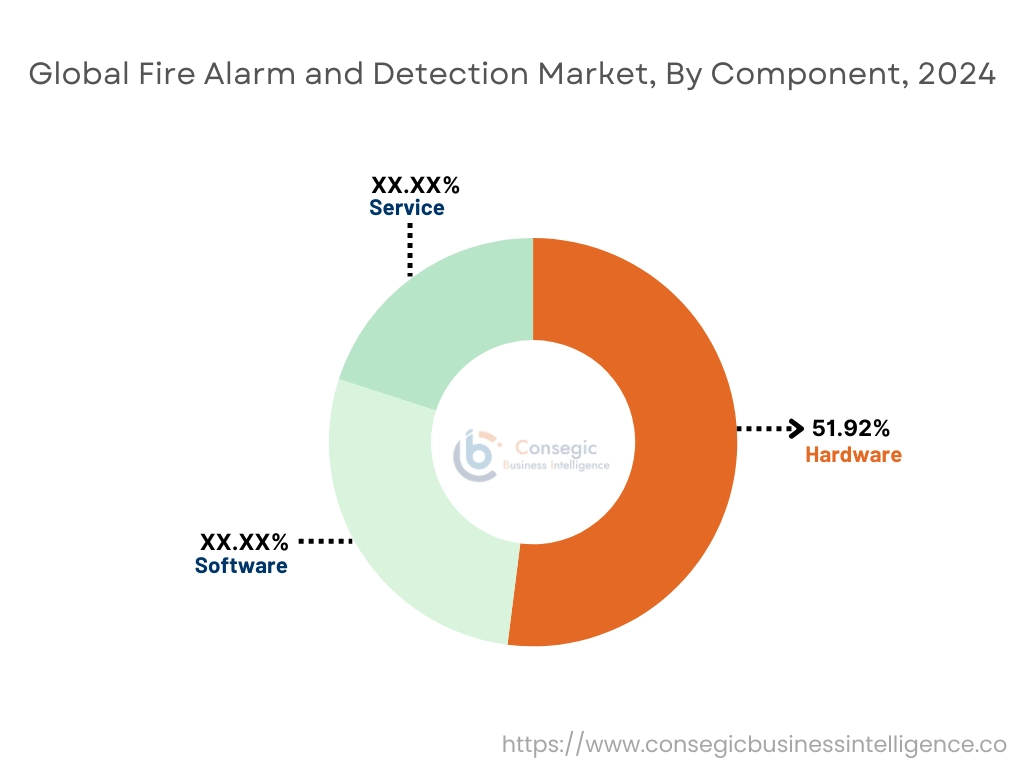

By Component:

Based on the component, the market is segmented into hardware, software, and services.

Trends in the Component:

- Rising adoption of inspection, testing, and maintenance services for fire alarm & detection systems is boosting the market.

- Rising trends towards the adoption of design, installation, and project management in commercial and industrial places are contributing to the market growth.

The hardware segment accounted for the largest revenue share of 51.92% in the market in 2024.

- The hardware segment includes devices such as control units, sensors and initiating devices, notification and audio devices, networks, and workstations among others.

- Control units detect the source of a fire or any other system event. They are easy to install and configure.

- Moreover, sensors use various techniques to detect any irregularities or signs of fire and smoke in the environment. The initiating devices are the components that send signals from the sensor to control units.

- The notification and audio devices are used to alert occupants to evacuate safely. These devices produce the loud, audible sound of bells or chimes.

- The network and workstations link all the fire system devices together to allow for control, management, and configuration. This enables a controlled environment and allows information from each panel or device to be centralized and managed from a dedicated station.

- For instance, Honeywell HBT offers Morley-IAS STX and SMX UL listed addressable control panels. These control panels are programmed using a mobile app, reducing the commissioning time significantly.

- Thus, the aforementioned applications of hardware in fire alarm & detection systems are driving the fire alarm and detection market growth.

The software segment is expected to register the fastest CAGR during the forecast period.

- The software in fire alarm & detection systems has various types such as hazard detection software, system configuration software, and graphic software, among others.

- The software is designed for improved fire alarm system design, remote configuration and control of systems, control panel programming, site monitoring, and analyzing data.

- For instance, Eaton offers site monitor software for fire systems. It enables PC administration and information on event status, event history, and device properties. It also supports multi-user operations.

- Thus, the analysis of the segment shows that the aforementioned advantages of software are accelerating the fire alarm and detection market trends.

By Detector Type:

Based on the detector type, the market is segmented into heat detectors, smoke detectors, carbon monoxide detectors, multi-sensor detectors, manual call points, and others.

Trends in the Detector Type:

- Rising adoption of carbon monoxide (CO) detectors to continuously monitor CO levels is driving the market.

- Rising trend in adoption of accessible emergency devices called manual call points, which enable individuals to manually trigger alarms during emergencies.

The smoke detectors segment accounted for the largest revenue in the fire alarm and detection market share in 2024.

- Smoke detectors include photoelectric (light scattering), ionization, and beam (light obstructing) detectors.

- Photoelectric smoke detectors use light projected through a chamber to detect smoke, as the light will be scattered if it strikes smoke. This reflected light is then detected by a photocell. These detectors are fast reactors making them ideal for use in residential, commercial, and industrial buildings.

- Ionization smoke detectors work by measuring ion levels in the environment. This is ideal for fires where a lot of smoke is not generated.

- Beam smoke detectors use a light beam to detect smoke, as the smoke interferes with the light beam. The photocell checks the amount of light received and the variations in the output are used to initiate an alarm.

- For instance, Honeywell HBT offers wireless smoke detectors that are easy to install, configure, and give instant notifications.

- Thus, as per the segmental analysis, the aforementioned benefits of smoke detectors are driving their adoption, which is further propelling the fire alarm and detection market demand.

The multi-sensor detectors are the fastest growing segment during the forecast period.

- Multi-sensor detectors combine independent sensors such as optical and temperature detection into one.

- These detectors have enhanced accuracy, faster response, minimal false alarms, and better performance, and are integrated in various systems.

- For instance, Notifier by Honeywell International offers 851 series multi-criteria/multi-sensor detectors. These detectors use multiple sensors to detect environmental conditions.

- Thus, the aforementioned factors show that the multi-sensor detectors are expected to boost the fire alarm and detection market trends.

By Fire Alarm System Type:

Based on the fire alarm system type, the market is segmented into conventional, addressable, intelligent, and wireless.

Trends in the Fire Alarm System Type:

- Rising adoption of IoT networks and building management systems due to their real-time monitoring and centralized control is boosting the market demand.

- Rising trend towards integration of wireless systems due to its easier installation and scalability.

The addressable fire alarm system accounted for the largest revenue in the fire alarm and detection market share in 2024.

- An addressable fire alarm system uniquely identifies each connected device, allowing precise monitoring and control.

- These systems also enable faster fault detection, easy maintenance, reduced false alarms, targeted alerts, and enhanced performance of the overall system.

- These systems also assist in diagnosing component malfunction due to their self-monitoring capabilities for faster repair.

- For instance, Ravel Electronics Pvt. Ltd offers a range of addressable fire alarm systems. These systems are available in two types loop and single loop.

- Thus, the segmental analysis shows that the rising advancements associated with addressable fire alarm systems are boosting the market demand.

The intelligent fire alarm system is expected to register the fastest CAGR during the forecast period.

- Intelligent fire alarm systems use advanced sensors, data analytics, and network connectivity to enhance fire detection.

- These systems continuously monitor environmental conditions, analyze patterns with algorithms, and integrate with building systems.

- This provides early warnings, reduces false alarms, and facilitates efficient emergency communication.

- For instance, Notofire Pvt. Ltd. offers an intelligent fire alarm control panel NF5109 with a printer. In this system, 1020 devices can be connected to 255 devices in each loop.

- Thus, the segmental analysis depicts that the rising developments related to intelligent fire alarm systems expected to boost the fire alarm and detection market size.

By Alarm Type:

Based on alarm type, the market is trifurcated into visual, audible, and manual.

Trends in the Alarm Type:

- Rising adoption of audible alarms due to intelligent voice alerts is boosting the market growth.

- Rising adoption of manual call points with digital interfaces and wireless connectivity drives the market.

The audible segment accounted for the largest revenue share in the market in the year 2024.

- Audible alarm systems emit loud sound signals to alert occupants of an emergency.

- They use horns, sirens, or bells. They are designed to be heard over ambient noise, ensuring rapid evacuation and response during emergencies.

- For instance, Spectra Fire offers a range of audible signaling devices in their product offerings.

- Thus, the above benefits of audible alarm systems are driving the fire alarm and detection market opportunities.

The manual segment is anticipated to register the fastest CAGR during the forecast period.

- Manual alarm types are devices that allow occupants to manually trigger a fire alarm in case of an emergency.

- It consists of a break-glass or push-button mechanism that sends an immediate signal to the fire alarm control panel. This initiates building-wide alerts for faster evacuation and response.

- For instance, Bosch Security offers several manual call points. Each of them is categorized and customized as per the requirements and needs of the customer.

- Hence, the fire alarm and detection market analysis depicts that the manual segment is expected to grow at the fastest CAGR during the forecast period.

By End-Use:

Based on the end use, the market is trifurcated into residential, commercial, and industrial.

Trends in the End Use:

- Growing adoption of IoT-enabled devices in smart homes due to its benefits such as remote monitoring and real-time alerts.

- Rising installation of fire detection systems in industrial setups for faster response times.

The commercial segment accounted for the largest revenue share in the market in 2024.

- The commercial workspaces are required to have fire detection and alarm systems as these are high occupancy and high-value spaces.

- Moreover, these systems allow early detection, ensure faster response, support integration with building management solutions, enhancing the safety of the building.

- For instance, Johnson Controls offers commercial fire detection solutions. These solutions are available as audio-visual alarm notification, network, smoke, heat, and gas detection, and high-rise building evacuation alert systems.

- Thus, fire alarm and detection market analysis show that the benefits offered by these systems in commercial places are in turn driving its demand.

The residential is expected to register the fastest CAGR during the forecast period.

- The residential segment is adopting fire alarm and detection systems due to increased consumer awareness.

- These systems are tailored to protect homes and residential spaces by providing early warnings of any fire or smoke detection.

- These enable the occupants to evacuate to safer places and call for emergency forces.

- Moreover, few systems integrated with residential building systems can directly call up the emergency and rescue forces.

- Thus, the rising adoption of fire alarm systems in residential spaces is expected to boost the fire alarm and detection market size in the upcoming years.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

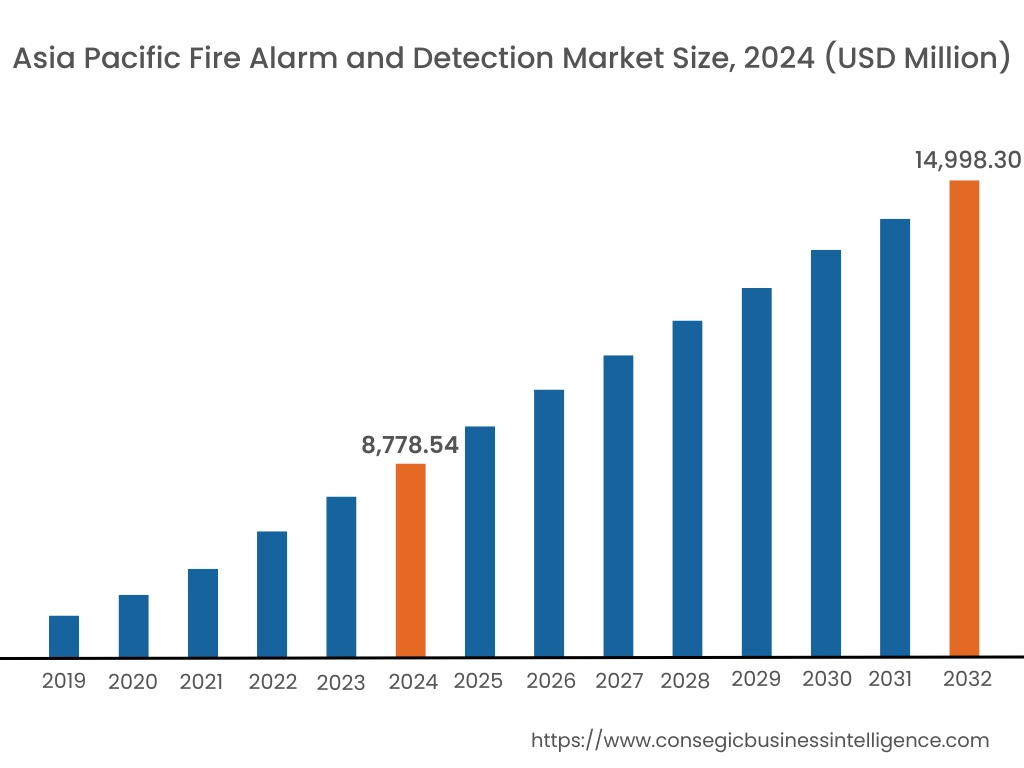

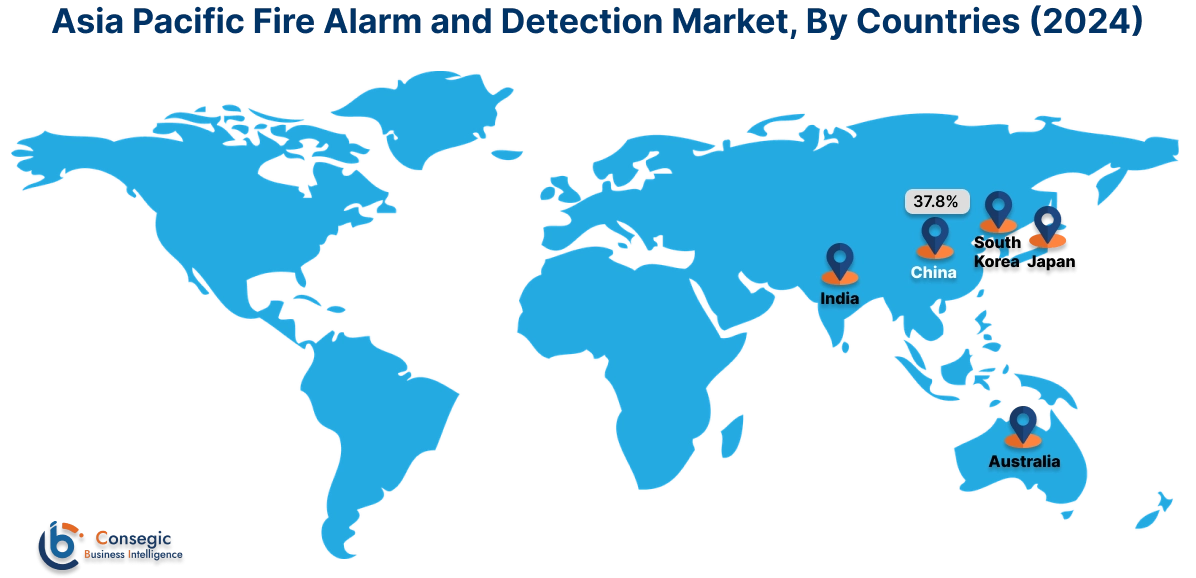

Asia Pacific region was valued at USD 8,778.54 Million in 2024. Moreover, it is projected to grow by USD 9,222.81 Million in 2025 and reach over USD 14,998.30 Million by 2032. Out of this, China accounted for the maximum revenue share of 37.8%. The fire alarm and detection market expansion in this region is booming due to industrial development, rapid urbanization, and the construction of commercial workplaces. Moreover, in this region, there is a strong emphasis on cost-effective yet reliable fire alarm solutions and systems.

- For instance, Ceasefire Industries Pvt. Ltd. offers a variety a range of alarm systems in India. These offerings include both standalone and integrated systems in a high-quality and cost-effective way.

North America is estimated to reach over USD 17,936.40 Million by 2032 from a value of USD 10,840.71 Million in 2024 and is projected to grow by USD 11,358.60 Million in 2025. The market is well established due to strict fire regulations and safety codes by the government. Moreover, the rising investments in building automation, and advanced systems for security and fire safety are driving the fire alarm and detection market expansion.

- In August 2024, Microm, a well-established company in North America, unveiled its MGC 400 series low-frequency sounders for higher fire safety in sleeping areas. It includes easily adjustable audible settings, dual power compatibility, and easy installation.

In the European region, the European safety regulations mandate regular upgrades of fire systems, in turn boosting the market. The Middle East and African region is prominently focused on its oil and gas industry, which is driving the need for fire detection and alarm systems for enhanced safety of work forces and assets. Further, the rising disposable income and increased public awareness related to fire safety in the Latin America region are contributing to the market growth.

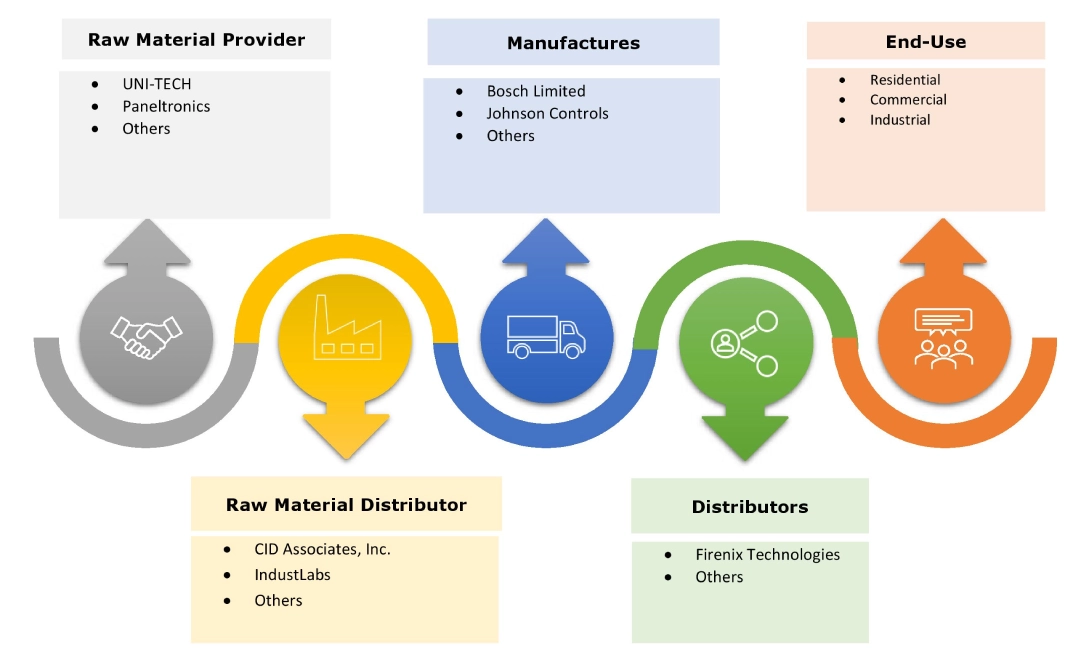

Top Key Players and Market Share Insights:

The fire alarm and detection industry is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global fire alarm and detection market. Key players in the fire alarm and detection industry include -

- Siemens (Germany)

- Bosch Limited (Germany)

- Piarc (France)

- Eaton (Ireland)

- Minimax (Germany)

- Securitas Technology (US)

- Apollo Fire Detectors Limited (UK)

- Johnson Controls (Ireland)

- Western States Fire Protection Co (US)

- Ceasefire Industries PVT LTD (India)

- Honeywell HBT (US)

- Mircom (Canada)

- Alliance Specialized Systems (Mexico)

- Schrack Seconet AG (Austria)

Recent Industry Developments :

Product Launches:

- In January 2025, LGM Products Ltd. launched addressable Exd heat detector and marine manual call point. It is the first explosive proof addressable product for the company. It is non-conductive, durable and corrosion resistant.

- In July 2024, Halma Fire India (HFI) launched fire alarm & detection system named Veiga to improve fire protection and prevention in the region. It is EN-54 and IS certified, ensuring its performance standard and capabilities.

Fire Alarm and Detection Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 55,963.81 Million |

| CAGR (2025-2032) | 7.1% |

| By Component |

|

| By Detector Type |

|

| By Fire Alarm System Type |

|

| By Alarm Type |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the fire alarm and detection market? +

Fire Alarm and Detection Market size is estimated to reach over USD 55,963.81 Million by 2032 from a value of USD 33,674.29 Million in 2024 and is projected to grow by USD 35,296.04 Million in 2025, growing at a CAGR of 7.1% from 2025 to 2032.

What are the major segments covered in the fire alarm and detection market report? +

The segments covered in the report are component, detector type, fire alarm system type, alarm type, and end use.

Which region holds the largest revenue share in 2024 in the fire alarm and detection market? +

North America holds the largest revenue share in the fire alarm and detection market in 2024.

Who are the major key players in the fire alarm and detection market? +

The major key players are Siemens (Germany), Bosch Limited (Germany), Johnson Controls (Ireland), Western States Fire Protection Co (US), Ceasefire Industries PVT LTD (India), Honeywell HBT (US), Mircom (Canada), Alliance Specialized Systems (Mexico), Schrack Seconet AG (Austria), Piarc (France), Eaton (Ireland), Minimax (Germany), Securitas Technology (US), and Apollo Fire Detectors Limited (UK).