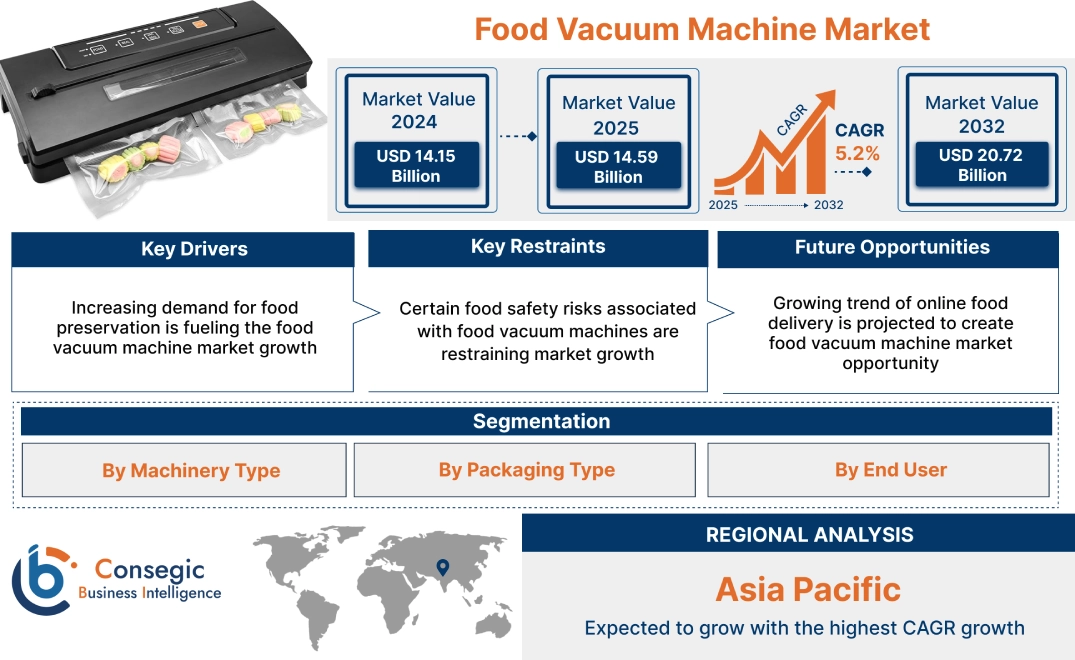

Food Vacuum Machine Market Size:

Food Vacuum Machine Market Size is estimated to reach over USD 20.72 Billion by 2032 from a value of USD 14.15 Billion in 2024 and is projected to grow by USD 14.59 Billion in 2025, growing at a CAGR of 5.2% from 2025 to 2032.

Food Vacuum Machine Market Scope & Overview:

A food vacuum machine is a device that removes air from packaging, typically specially designed bags, and then seals them. This process creates a vacuum that helps to extend the shelf life of food by inhibiting the growth of bacteria and mold, preventing freezer burn, and preserving flavor and freshness. These machines are used in both home and commercial settings to preserve a variety of food items.

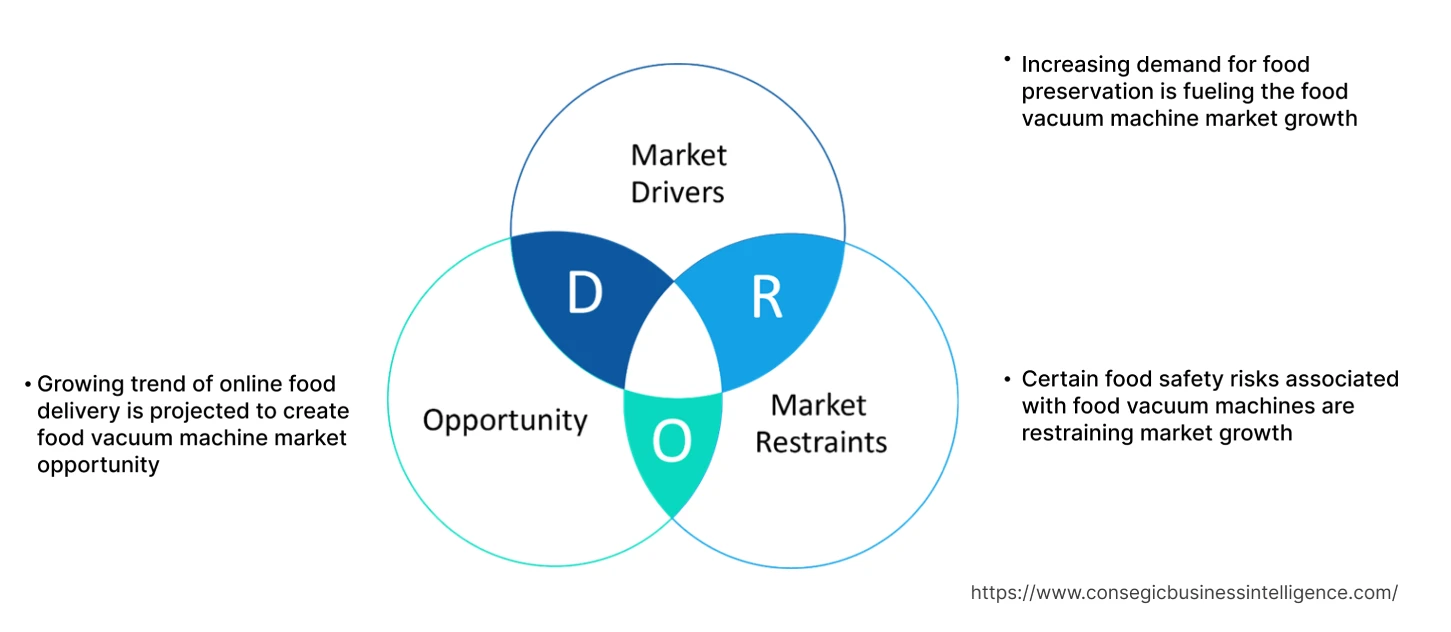

Food Vacuum Machine Market Dynamics - (DRO) :

Key Drivers:

Increasing demand for food preservation is fueling the food vacuum machine market growth

Vacuum sealing removes oxygen, which significantly prolongs the freshness and edibility of various food items, from meats and cheeses to fruits and vegetables. Additionally, vacuum sealing helps maintain the flavor, texture, and nutritional value of food, important for consumers who prioritize high-quality ingredients, thereby driving the food vacuum machine market size.

- For instance, in Feb 2024, Paxiom launched a new packaging system featuring Weighpack Systems' VerTek 2400 vertical form fill & seal machine. This system utilizes advanced vacuum packaging technology, including gas flushing and vacuum sealing, specifically designed to preserve the freshness and extend the shelf life of products like peanuts. This technology ensures maintained product quality throughout the packaging process.

Consequently, increasing need for food preservation is driving the food vacuum machine market expansion.

Key Restraints:

Certain food safety risks associated with food vacuum machines are restraining market growth

If food is contaminated before vacuum sealing, the lack of oxygen allows harmful bacteria to multiply without visible signs of spoilage, leading to foodborne illnesses. Additionally, improper cleaning of vacuum sealing equipment can lead to cross-contamination, especially when handling raw meat and other potentially hazardous foods, further hindering the global food vacuum machine market size.

Future Opportunities :

Growing trend of online food delivery is projected to create food vacuum machine market opportunity

Online food delivery services rely heavily on packaged foods and vacuum sealing is essential for maintaining the freshness and quality of these products during transit. Additionally, Ready-to-Eat (RTE) meal delivery services are booming, and vacuum sealing is crucial for preserving the taste, texture, and safety of these meals during delivery. Moreover, meal kit delivery services, which provide pre-portioned ingredients, utilize vacuum sealing to extend the shelf life of perishable items like meat and vegetables. Further, the growing trend towards online grocery delivery is also significantly boosting food vacuum machine market demand.

- For instance, Grocery shopping habits in U.S. saw a significant shift between November 2021 and 2022, with both in-store pickup and home delivery options gaining popularity. In-store pickup orders increased from 30% to 37% of consumers, while same-day delivery platforms saw a 13% rise, and grocery subscriptions experienced a 22% growth in consumer usage.

Hence, based on the analysis, growing trend of online food delivery is expected to create food vacuum machine market opportunities.

Food Vacuum Machine Market Segmental Analysis :

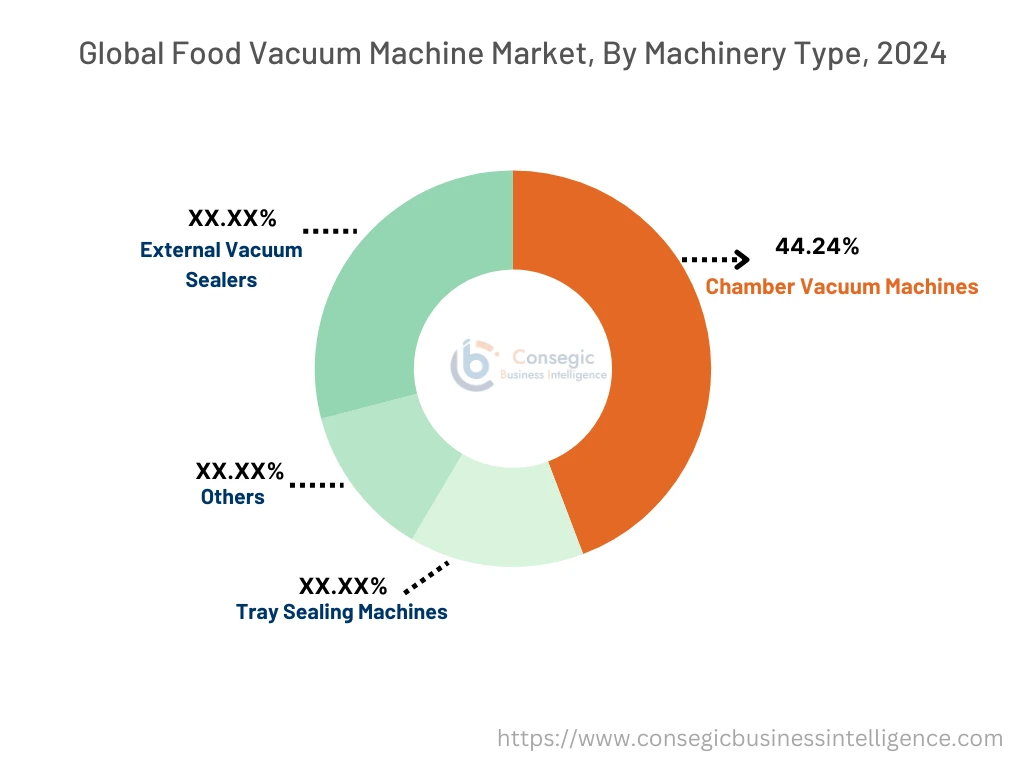

By Machinery Type:

Based on the Machinery Type, the market is categorized into External Vacuum Sealers, Chamber Vacuum Machines, Tray Sealing Machines, and Others.

Trends in the Machinery Type:

- Growing trend towards the adoption of tray sealing machines for packaging pre-portioned meals and ready-to-eat products in trays.

- Integration of modified atmosphere packaging (MAP) capabilities in tray sealing machines for extended shelf life.

Chamber Vacuum Machines accounted for the largest revenue share of 44.24% in 2024.

- Chamber vacuum machines offer superior vacuum sealing and handle liquids and a wider range of food products, thereby driving food vacuum machine market.

- Additionally, chamber vacuum machines provide a more consistent and reliable seal, crucial for maintaining product quality and extending shelf life in commercial settings.

- These machines are built with robust materials like stainless steel, ensuring durability and longevity, further boosting the food vacuum machine market trend.

- For instance, Henkelman introduced the Polar Double Chamber vacuum machine, designed to maximize efficiency in commercial packaging. This system minimizes downtime, enabling faster packaging of large product volumes. It allows users to save up to 10 custom vacuum programs and features a "soft air" option, which ensures delicate products and bags remain undamaged during the vacuum sealing process.

- Thus, as per the food vacuum machine market analysis, the aforementioned factors are driving the chamber vacuum machines segment.

External Vacuum Sealers are predicted to register the fastest CAGR during the forecast period.

- Increased awareness of sous vide cooking, meal prepping, and bulk food storage is driving the need for external vacuum sealers.

- Additionally, compared to chamber vacuum machines, external vacuum sealers are significantly more affordable.

- Moreover, external vacuum sealers are smaller and more compact than chamber machines, ideal for light commercial spaces and home kitchens with limited space.

- Manufacturers are continuously improving external vacuum sealers with features like moisture sensors, adjustable sealing levels, and compatibility with various bag types.

- For instance, Wedderburn launched the WFV12BXS7 external vacuum sealer, a stainless steel, bench-top model designed for light commercial use. This machine offers a balance of size and capacity, featuring user-friendly automatic and manual controls, an LCD display, an external filter, and adjustable sealing time, all within a durable, stainless-steel construction.

- In conclusion, the above-mentioned factors are contributing significantly in spurring the market.

By Packaging Type:

Trends in the Packaging Type:

- Development of recyclable and compostable rigid packaging materials, and integration of modified atmosphere packaging (MAP) capabilities.

- Development of thinner and more sustainable semi-rigid materials, and improved sealing technologies to prevent leaks.

Flexible Packaging accounted for the largest revenue share in 2024 and is also projected to witness the fastest growth.

- Flexible packaging, encompassing vacuum bags and pouches, conform to a wide variety of food shapes and sizes, suitable for food products, from meats and seafood to prepared meals and snacks, thereby driving the food vacuum machine market demand.

- Compared to rigid or semi-rigid packaging, flexible packaging requires less material, leading to lower production and transportation costs

- High-barrier flexible films, used in vacuum packaging, effectively prevent oxygen and moisture from entering, significantly extending the shelf life of food products.

- The flexible packaging industry is focused on developing sustainable solutions, including recyclable and biodegradable films.

- Thus, as per the food vacuum machine market analysis, the aforementioned factors are driving flexible packaging segment.

By End User:

Based on the End User, the market is categorized into Residential, Commercial and Industrial.

Trends in the End User:

- Restaurants, supermarkets, and small food businesses prioritize chamber vacuum machines for their high-volume capabilities and consistent performance.

- The growth of ready-to-eat meals and meal kit services is driving the need for tray sealing machines and efficient packaging solutions.

Industrial accounted for the largest revenue share in the market in 2024.

- Food processing plants and large-scale manufacturers rely on automated chamber vacuum machines and tray sealing systems for high-throughput production.

- Industrial users demand advanced technologies, such as MAP and skin packaging, to optimize shelf life and product presentation.

- For instance, Henkelman launched the Titaan series, fully automated single and double chamber vacuum machines designed for efficient, high-volume packaging. These machines feature an automatic outfeed conveyor belt, an ACS operating panel, and an emergency stop for enhanced safety and ergonomics.

- In conclusion, the aforementioned factors are contributing to the growth of global food vacuum machine market expansion.

Household is predicted to register the fastest CAGR during the forecast period.

- Home users are increasingly aware of the benefits of vacuum sealing for food preservation, waste reduction, and sous vide cooking.

- Growing trend of meal prepping and bulk food storage is driving the adoption of vacuum sealers in households.

- Further, online retail platforms are a significant channel for residential vacuum sealer sales.

- Moreover, the development of compact machines is also contributing their adoption in apartment living or smaller kitchens.

- For instance, in Apr 2023, Newell Brands released a new compact FoodSaver vacuum sealer, designed for space-conscious consumers. This model, the Space Saving Vacuum Sealer, offers the same sealing power as larger FoodSaver units while occupying 30% less space. It's designed for versatile storage, fitting either upright or in a drawer, ideal for smaller kitchens and apartments.

- Subsequently, as per the market analysis, the aforementioned factors are collectively responsible in accelerating the market during the forecast period.

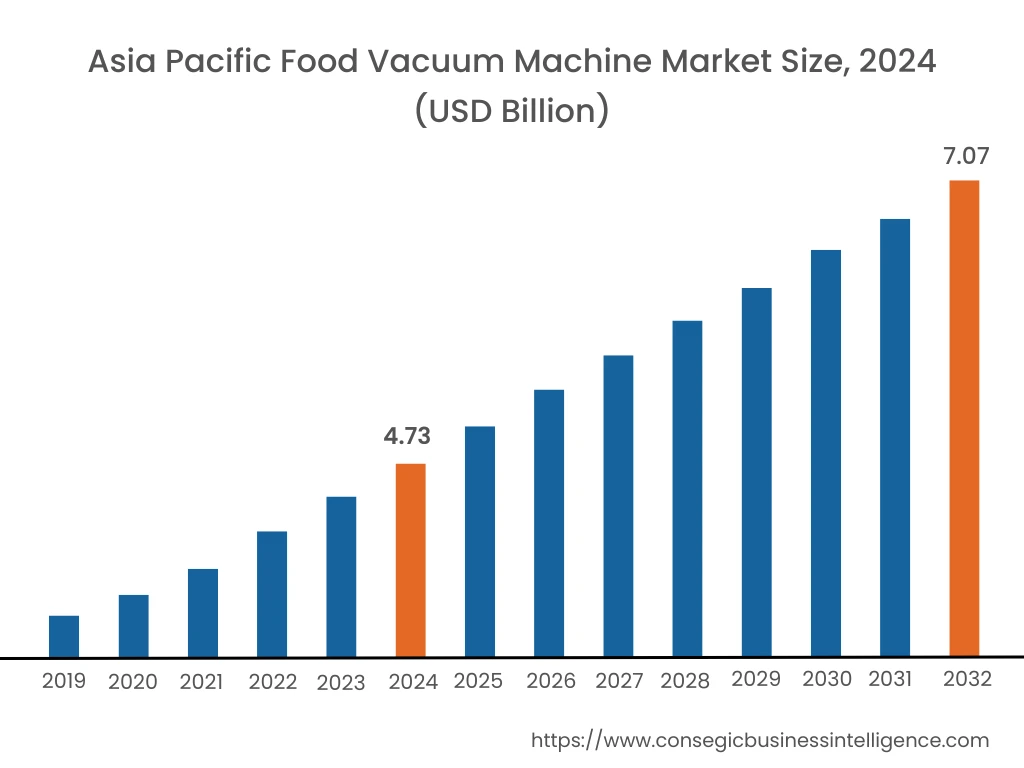

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

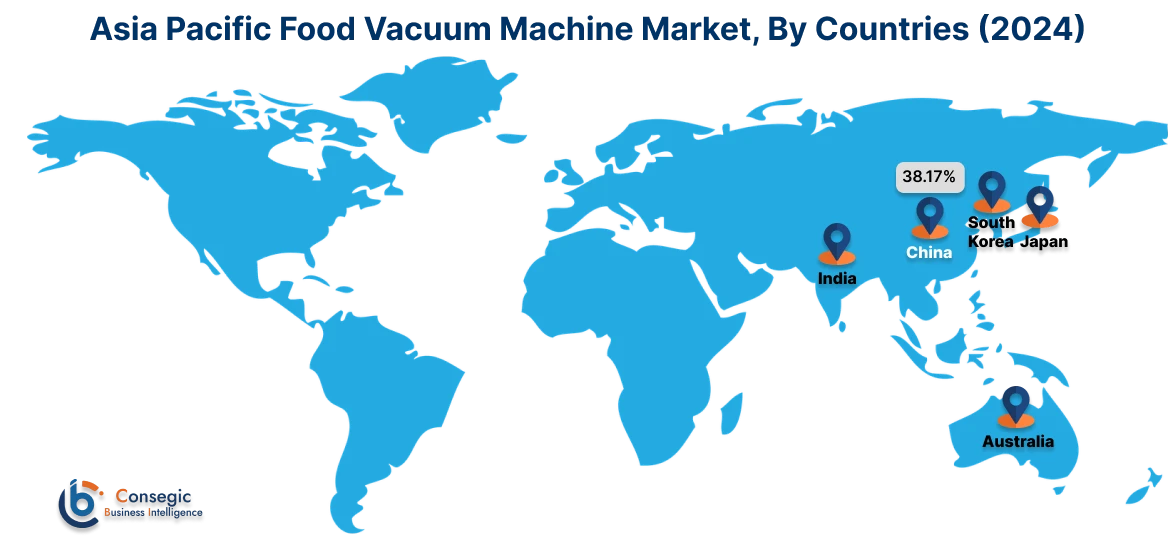

Asia Pacific was valued at USD 4.73 Billion in 2024. Moreover, it is projected to grow by USD 4.89 Billion in 2025 and reach over USD 7.07 Billion by 2032. Out of these, China accounted for the largest revenue share of 38.17% in 2024. Growing consumer awareness of food safety and hygiene in Asia Pacific countries, coupled with stricter government regulations, is driving the adoption of vacuum packaging. Additionally, the burgeoning e-commerce sector and the expansion of modern retail formats like supermarkets and hypermarkets are boosting the demand for vacuum-packaged foods, further stimulating market. Moreover, the region's expanding food processing sector is adopting advanced packaging technologies like vacuum sealing to meet the rising demand for packaged food products and comply with stringent food safety standards.

- For instance, the Indian food processing sector is projected to more than double in market size, from USD 307 billion in 2023 to USD 700 billion in 2030, driven by rising demand for processed foods, according to PHDCCI. The sector has demonstrated substantial increase, with an average annual growth rate of approximately 7.3% between 2015 and 2022, contributing significantly to India's GVA in both manufacturing (10.54%) and agriculture (11.57% in 2020-21).

North America region was valued at USD 4.02 Billion in 2024. Moreover, it is projected to grow by USD 4.15 Billion in 2025 and reach over USD 5.82 Billion by 2032. The presence of a sophisticated food industry and stringent food safety regulations drive the need for high-quality vacuum packaging to maintain product freshness and safety. Additionally, the busy lifestyles of North American consumers contribute to the increasing need for convenience foods and ready-to-eat meals, which often utilize vacuum packaging. Moreover, the expanding e-commerce sector, including online grocery sales and meal kit delivery services, relies on vacuum packaging to ensure product quality and freshness during transit, further fuels the food vacuum machine market demand.

As per the food vacuum machine market analysis, stringent food safety regulations and increasing environmental concerns are driving the adoption of food vacuum machines in Europe. Additionally, rising disposable incomes and growing consumer awareness of food preservation benefits are contributing to the food vacuum machine market in Latin America. Moreover, increasing disposable incomes and a growing focus on food safety and hygiene are boosting the need for food vacuum machines in the Middle East and Africa.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing food vacuum machine to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the food vacuum machine industry include-

- Amcor plc (Switzerland)

- MULTIVAC (Germany)

- PAC Machinery (USA)

- Hualian Machinery (China)

- Henkelman (Netherlands)

- Italian Pack (Italy)

- VALKO (Italy)

- ULMA Packaging (Spain)

- Henkovac International (Netherlands)

- Busch (Germany)

- JVR Industries, Inc. (USA)

Recent Industry Developments :

Product Launch:

- In Oct 2021, FoodSaver introduces the VS2100 and a Multi-Use Handheld Vacuum Sealer, providing new options for food preservation and waste reduction.

Food Vacuum Machine Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 20.72 Billion |

| CAGR (2025-2032) | 5.2% |

| By Machinery Type |

|

| By Packaging Type |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the food vacuum machine market? +

The food vacuum machine market size is estimated to reach over USD 20.72 Billion by 2032 from a value of USD 14.15 Billion in 2024 and is projected to grow by USD 14.59 Billion in 2025, growing at a CAGR of 5.2% from 2025 to 2032.

What specific segmentation details are covered in the food vacuum machine report? +

The food vacuum machine report includes specific segmentation details for machinery type, packaging type, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the food vacuum machine market, residential is the fastest-growing segment during the forecast period.

Who are the major players in the food vacuum machine market? +

The key participants in the food vacuum machine market are Amcor plc (Switzerland), MULTIVAC (Germany), PAC Machinery (USA), Hualian Machinery (China), Henkelman (Netherlands), Italian Pack (Italy), VALKO (Italy), ULMA Packaging (Spain), Henkovac International (Netherlands), Busch (Germany), JVR Industries, Inc. (USA), and Others.