Glucose Tolerance Test Market Size:

Glucose Tolerance Test Market size is estimated to reach over USD 64,180.45 Million by 2032 from a value of USD 31,280.70 Million in 2024 and is projected to grow by USD 33,663.71 Million in 2025, growing at a CAGR of 9.4% from 2025 to 2032.

Glucose Tolerance Test Market Scope & Overview:

A Glucose Tolerance Test (GTT) measures how a body processes sugar (glucose) over a period of time. It's primarily used to diagnose conditions including prediabetes, type 2 diabetes, and gestational diabetes by evaluating the body's insulin response and ability to clear glucose from the bloodstream. The key trends in GTT include a growing emphasis on early detection and personalized medicine and the increasing global prevalence of diabetes and prediabetes. Additionally, advancements in glucose monitoring technologies, such as continuous glucose monitors (CGMs) and point-of-care (POC) devices, are enhancing the convenience and precision of GTTs in turn driving the glucose tolerance test market size.

Glucose Tolerance Test Market Dynamics - (DRO) :

Key Drivers:

Rising Prevalence of Diabetes and Gestational Diabetes is Boosting the Market

The rising global prevalence of diabetes, encompassing both type 2 and gestational diabetes, is a primary catalyst for the increased demand for glucose tests. These tests are indispensable for accurately diagnosing conditions like impaired glucose tolerance and prediabetes, as well as gestational diabetes. Further, early and precise diagnosis through GTTs is crucial for implementing timely interventions and effective management strategies, which can significantly alter the disease's progression and mitigate long-term complications. Also, with an aging global population and rising obesity rates, the incidence of diabetes is projected to continue its upward trajectory.

- For instance, according to WHO, the global diabetes population surged from 200 million in 1990 to 830 million by 2022. This increase has been particularly pronounced in low- and middle-income nations compared to high-income countries.

Thus, the rising prevalence of diabetes and gestational diabetes coupled with growing awareness is boosting the glucose tolerance test market share.

Key Restraints:

Availability of Alternative Diagnostic Methods and Time-Consuming Nature of the Tests is Hampering the Market

The Glucose Tolerance Test (GTT) market faces significant hurdles due to the availability of alternative diagnostic methods and the time-consuming nature of the test. For instance, the Fasting Plasma Glucose (FPG) and HbA1c tests are often preferred by both patients and healthcare providers because they are simpler, less invasive, and require less time. Further, patients might also find the multi-hour duration of a GTT inconvenient, deterring compliance, especially for follow-up screenings. This convenience factor of alternatives, coupled with the logistical challenges of scheduling and conducting lengthy GTTs in busy clinical settings, can lead to lower adoption rates and restrain glucose tolerance test market share.

Future Opportunities :

Technological Advancements Drives the Glucose Tolerance Test Market Opportunities

Technological advancements are revolutionizing the GTT market by enhancing convenience, accuracy, and accessibility. The rise of continuous glucose monitors (CGMs) provides real-time glucose insights, potentially simplifying parts of the GTT or offering complementary diagnostic data. Point-of-care (POC) testing devices are making GTTs more feasible in diverse settings, reducing the need for traditional lab visits. Additionally, research into non-invasive glucose monitoring methods and the integration of GTT data with digital health platforms are creating new opportunities for personalized diabetes management and early intervention, ultimately driving the market. Moreover, the development of home-based testing kits and integration with telemedicine further drive the glucose tolerance test market size.

- For instance, UK-based Digostics offers GTT@home, which is a groundbreaking diagnostic service that simplifies diabetes screening. This new solution brings accurate OGTT directly to the patient, streamlining the entire process.

Thus, Point-of-care (POC) testing devices, home-based testing kits, and telemedicine drive the glucose tolerance test market opportunities.

Glucose Tolerance Test Market Segmental Analysis :

By Product Type:

Based on product type, the market is segmented into oral glucose tolerance test (OGTT) kits, intravenous glucose tolerance test (IVGTT) kits, standard glucose drinks, and glucose monitoring devices.

Trends in the Product Type:

- Advancements in kit formulations, such as the introduction of flavored glucose drinks, have significantly enhanced patient compliance, thereby boosting the glucose tolerance test market growth.

- Technological advancements, particularly the emergence of smartphone-integrated monitoring devices, are expected to drive the glucose tolerance test market forward within the broader glucose monitoring devices sector.

Oral glucose tolerance test (OGTT) kits segment accounted for the largest revenue share in the year 2024.

- Increasing use of OGTT kits to diagnose diabetes and gestational diabetes due to their noninvasive nature and ease of administration.

- Further, the OGIT kits are a preferred choice in hospitals, diagnostic laboratories, and specialty clinics for routine glucose tests.

- Furthermore, the growing prevalence of type 2 diabetes and gestational diabetes globally has driven the demand for OGTT kits.

- Thus, as per glucose tolerance test market analysis, the noninvasive nature, ease of administration, and growing prevalence of type 2 diabetes are driving the market.

Glucose monitoring devices segment is anticipated to register the fastest CAGR during the forecast period.

- Glucose monitoring devices, such as continuous glucose monitoring (CGM) systems, are seeing wider adoption for tracking blood glucose levels in real-time.

- The devices offer accurate and convenient results, making them excellent tools for both diagnosing conditions and managing them on an ongoing basis.

- Increased awareness regarding the necessity of regular glucose monitoring in at-risk individuals is fueling the growth of this segment's adoption.

- For instance, in June 2024, Prevounce Health, a key provider of remote care management solutions, launched its first remote blood glucose monitoring device, the Pylo GL1-LTE. This clinically validated blood glucose meter ensures reliable data transmission across the U.S. by connecting to multiple cellular networks.

- Thus, based on analysis, real-time monitoring, accurate and convenient results, and increased awareness are driving the market.

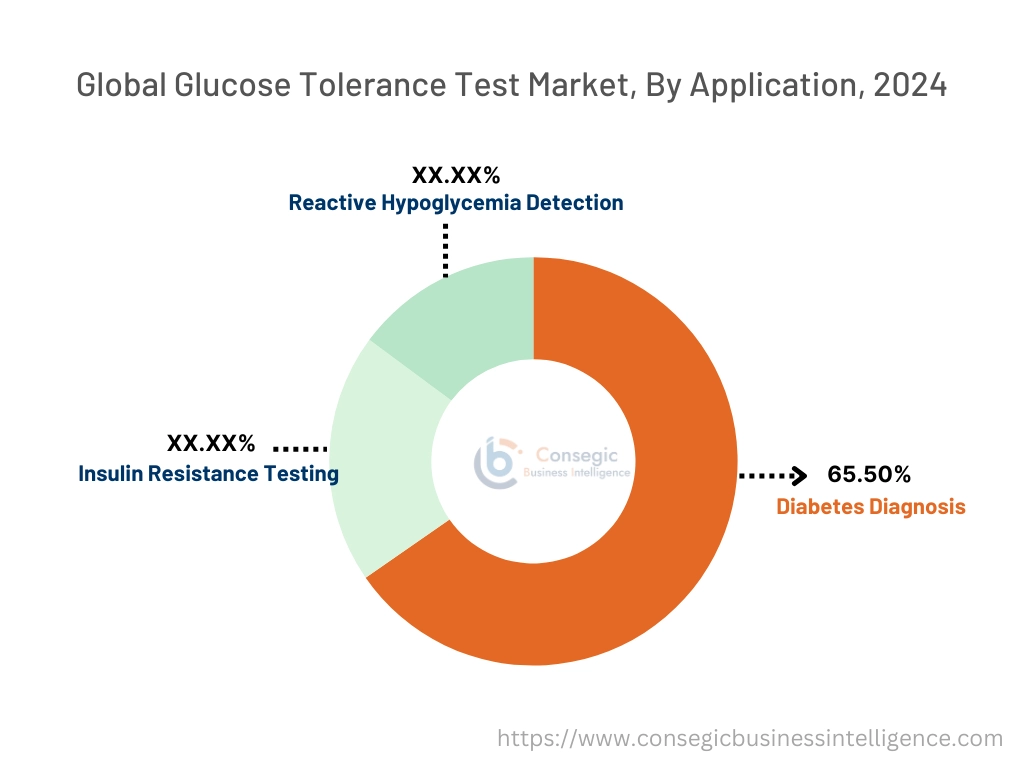

By Application:

Based on application, the market is segmented into diabetes diagnosis (type 1 diabetes, type 2 diabetes, gestational diabetes), insulin resistance testing, and reactive hypoglycemia detection.

Trends in the Application:

- The growing global prevalence of diabetes, fueled by lifestyle changes and an aging population, has significantly driven the demand for diagnostic solutions.

- Growing innovations in testing methodologies and the increasing embrace of personalized healthcare strategies are contributing to this segment's growth.

Diabetes diagnosis segment accounted for the largest revenue share of 65.50% in 2024.

- There's a rising focus on diagnosing diabetes, including prediabetes and gestational diabetes, earlier to enable timely interventions and prevent or delay severe complications.

- There's a concerning rise in type 2 diabetes among younger individuals, including adolescents and children, driven by lifestyle factors.

- Furthermore, integration with predictive analytics and AI is driving the market

- Thus, as per glucose tolerance test market analysis, emphasis on early detection, prevalence in younger demographics, and technological integrations drive the market.

Insulin resistance testing segment is anticipated to register the fastest CAGR during the forecast period.

- Insulin resistance testing is becoming increasingly important as a preventive measure for addressing both prediabetes and metabolic syndrome.

- Growing awareness regarding the early detection of insulin resistance, aimed at preventing its progression to type 2 diabetes, is a key driver.

- Increasing focus on preventive care and wellness programs worldwide is anticipated to significantly increase the use of insulin resistance testing.

- Thus, based on analysis, the aforementioned factors are expected to drive the market growth during the forecast period.

By Distribution Channel:

Based on distribution channels, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

Trends in the Distribution Channel:

- Growing digital literacy and supportive regulations by governments for online pharmacy operations are enhancing the glucose tolerance test market expansion.

Hospital pharmacies segment accounted for the largest revenue share in 2024.

- The growing number of hospital admissions due to diabetes and its associated complications has increased the demand for glucose testing products within this healthcare setting.

- The rising presence of specialized testing solutions and diligent monitoring by healthcare professionals are key factors contributing to market growth.

- Increasing collaboration between hospitals and diagnostic kit manufacturers to streamline supply chains is boosting the market.

- Thus, based on analysis, the aforementioned factors are driving the glucose tolerance test market expansion.

Online pharmacies segment is anticipated to register the fastest CAGR during the forecast period.

- Online pharmacies are gaining traction due to their convenience, competitive pricing, and availability of a wide range of products.

- Rising adoption of e-commerce platforms for purchasing diagnostic kits and glucose monitoring devices is driving the glucose tolerance test market growth in this segment.

- The COVID-19 pandemic accelerated the shift toward online pharmacy usage, a trend that continues to expand post-pandemic.

- For instance, Amazon offers Pharmacy with an aim to simplify access to essential medications in India. Through its marketplace model, it connects customers with licensed sellers, offering a vast selection of prescription drugs, over-the-counter medicines, medical devices, and healthcare products with the convenience of home delivery.

- Thus, based on analysis, convenience, competitive pricing, and the growing trend of digitalization drives the glucose tolerance test market trends.

By End-Use:

Based on end-use, the market is segmented into hospitals, diagnostic laboratories, specialty clinics, and home care settings.

Trends in the End-Use:

- Growing collaboration between laboratories and healthcare providers to deliver precise and timely results has boosted the glucose tolerance test market demand.

- The growth of telemedicine services and the availability of home delivery for diagnostic kits are anticipated to drive the market.

The diagnostic laboratories segment accounted for the largest revenue share in 2024.

- Diagnostic laboratories are the main locations for performing glucose tests, largely because of their advanced infrastructure and the presence of skilled technicians.

- The rising incidence of diabetes and the heightened importance placed on early diagnosis have fueled the demand for glucose tests in laboratories in turn driving the market.

- Rising investments in laboratory automation and advanced diagnostic equipment are supporting the dominance of this segment.

- Thus, based on analysis, factors including rising investments, rising incidence of diabetes, and others are driving the market.

The home care settings segment is anticipated to register the fastest CAGR during the forecast period.

- The rising emphasis on patient-centric care and self-monitoring is driving the glucose tolerance test market trends.

- Increased awareness among high-risk populations regarding proactive diabetes management is fueling growth in this segment.

- Technological advancements, such as smartphone-compatible monitoring devices, have enhanced the convenience of home-based glucose testing.

- Thus, awareness, self-monitoring, and technological advancements are driving the glucose tolerance test market demand.

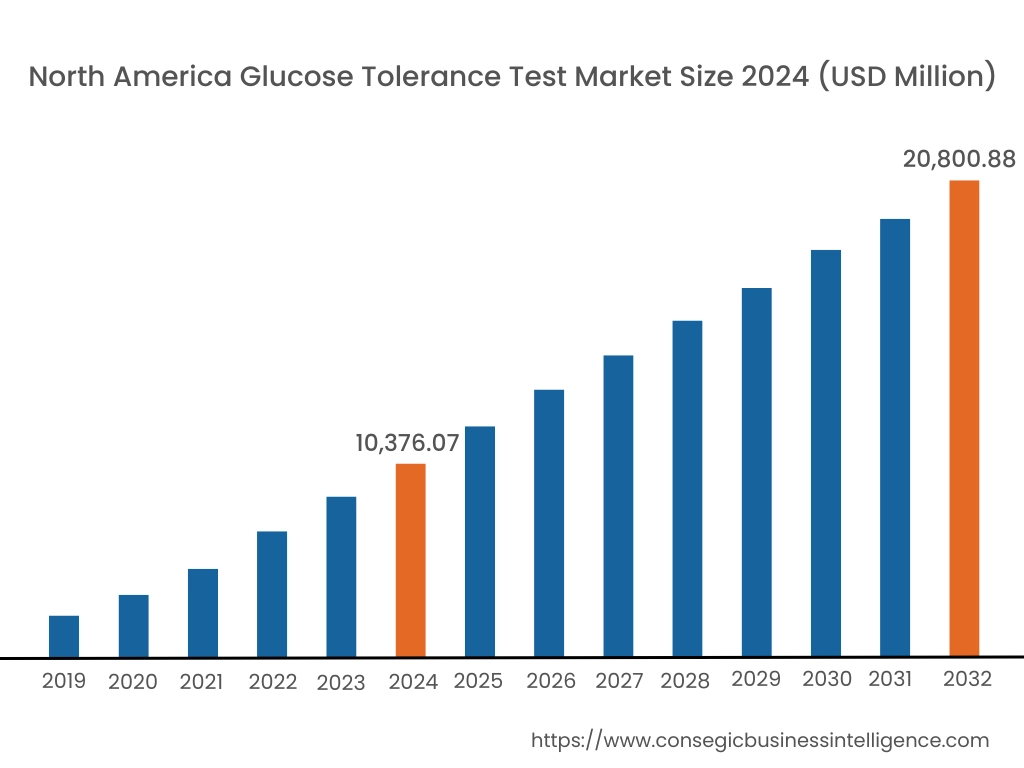

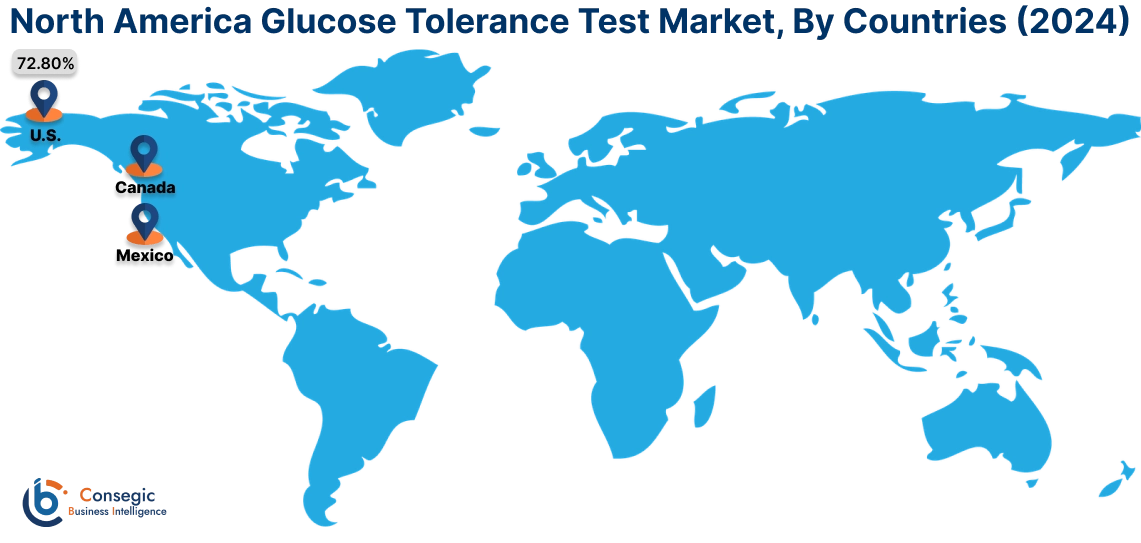

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

In 2024, North America was valued at USD 10,376.07 Million and is expected to reach USD 20,800.88 Million in 2032. In North America, the U.S. accounted for the highest share of 72.80% during the base year of 2024. The North American market is primarily driven by the high and increasing prevalence of diabetes and prediabetes, a network of well-established healthcare infrastructure, and high healthcare expenditure.

- For instance, according to the Centers for Disease Control and Prevention, in 2021, an estimated 38.4 million individuals across all age groups in the U.S. were living with diabetes, accounting for 11.6% of the total U.S. population.

In Asia Pacific, the market is experiencing the fastest progression with a CAGR of 9.9% over the forecast period. The market is mainly driven by rapidly increasing diabetes prevalence and rising health awareness. Additionally, significant improvements and developments in the glucose tolerance test industry, particularly in developing economies within the region are driving the market.

- For instance, according to the International Diabetes Federation, India is a key country within the International Diabetes Federation's (IDF) South-East Asia (SEA) region. Globally, 589 million people currently live with diabetes, with 107 million residing in the SEA Region.

The regional trends analysis depicts a robust national healthcare industry, strong public health policies, and the increasing adoption of advanced glucose monitoring technologies in Europe is driving the market. Additionally, the factors driving the market in the Middle East and African region are growing focus on improving healthcare infrastructure and public health awareness campaigns. Further, the growing obese population, alongside increasing awareness of early diagnosis is paving the way for the progress of the market in Latin America region.

Top Key Players and Market Share Insights:

The global glucose tolerance test market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the glucose tolerance test market. Key players in the glucose tolerance test industry include -

- Abbott Laboratories(United States)

- Hoffmann-La Roche AG(Switzerland)

- ARKRAY, Inc. (Japan)

- Bio-Rad Laboratories, Inc. (United States)

- Thermo Fisher Scientific Inc. (United States)

- Nova Biomedical Corporation (United States)

- Medtronic plc (Ireland)

- Danaher Corporation(United States)

- Quest Diagnostics Incorporated (United States)

- Siemens Healthineers AG (Germany)

Recent Industry Developments :

Product Launches:

- In August 2024, Austrian biosensor developer DirectSens launched XpressGT, a research-use-only (RUO) kit. This innovative eight-minute test measures 2-hydroxybutyrate (2-HB) levels in venous blood, serving as a rapid indicator for insulin resistance-related conditions such as gestational diabetes, endometriosis, and liver disease.

Glucose Tolerance Test Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 64,180.45 Million |

| CAGR (2025-2032) | 9.4% |

| By Product Type |

|

| By Application |

|

| By Distribution Channel |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Glucose Tolerance Test Market Report? +

Glucose Tolerance Test Market size is estimated to reach over USD 64,180.45 Million by 2032 from a value of USD 31,280.70 Million in 2024 and is projected to grow by USD 33,663.71 Million in 2025, growing at a CAGR of 9.4% from 2025 to 2032.

Which is the fastest-growing region in the market? +

Asia Pacific is the fastest-growing region in the market.

What segmentation does the glucose tolerance test market report cover? +

The report covers product type, application, distribution channel, end-use, and region.

Who are the major key players in the market? +

The major key players in the market are Abbott Laboratories (United States), F. Hoffmann-La Roche AG (Switzerland), Danaher Corporation (United States), Quest Diagnostics Incorporated (United States), Siemens Healthineers AG (Germany), Bio-Rad Laboratories, Inc. (United States), Thermo Fisher Scientific Inc. (United States), ARKRAY, Inc. (Japan), Nova Biomedical Corporation (United States), Medtronic plc (Ireland), and others.